GS-Hydro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS-Hydro Bundle

Navigate the complex external forces shaping GS-Hydro's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting the company's operations and strategic direction. Gain a competitive edge by leveraging these critical insights. Download the full PESTLE analysis now to unlock actionable intelligence and inform your investment or business decisions.

Political factors

Shifting global trade policies, including new tariffs or changes to existing trade agreements, directly influence GS-Hydro's operational costs. For instance, if the European Union, a key market for GS-Hydro, were to impose new tariffs on steel components sourced from outside the bloc, it could increase GS-Hydro's manufacturing expenses. In 2024, the World Trade Organization projected that tariffs could increase global trade costs by an average of 0.8% to 1.5%.

Geopolitical instability, such as ongoing conflicts or trade disputes between major economies, poses a significant risk to GS-Hydro's international projects. Disruptions to key shipping lanes, like those in the Red Sea, can lead to extended delivery times and substantial increases in freight costs, impacting project timelines and overall profitability for GS-Hydro's large-scale hydro projects.

Government subsidies and tax incentives play a crucial role in stimulating demand for GS-Hydro's piping systems, particularly within sectors like marine, offshore, and general industrial manufacturing. For instance, in 2024, many nations continued to offer significant R&D tax credits and investment grants for green technologies and infrastructure development, directly benefiting companies involved in these areas. These financial encouragements can lead to increased project investments and upgrades, translating into higher sales volumes for GS-Hydro.

Conversely, any rollback or reduction in these industrial sector subsidies, a trend observed in some regions seeking fiscal consolidation in 2025, could dampen market growth. A decrease in government financial support might lead to project deferrals or scaled-back investments, consequently impacting the demand for specialized piping solutions like those provided by GS-Hydro.

Government mandates and incentives for renewable energy are directly boosting demand for GS-Hydro's expertise. For instance, the European Union's commitment to increasing renewable energy sources, with a target of at least 42.5% by 2030, translates into significant project pipelines for hydrogen infrastructure and sustainable maritime solutions, areas where GS-Hydro operates.

Policies focused on energy efficiency and decarbonization in industrial sectors are also a key driver. Many nations are implementing stricter emissions standards, pushing industries to adopt cleaner technologies. This trend is creating new market opportunities for GS-Hydro, particularly in sectors like carbon capture utilization and storage (CCUS) and the development of green hydrogen production facilities, which saw global investment reach an estimated $100 billion in 2024.

Political Stability in Key Operating Regions

Political stability in GS-Hydro's key operating regions is a critical factor. Uncertainty or instability in areas where GS-Hydro has significant operations or a substantial client base can directly impact project timelines, strain local partnerships, and disrupt overall business continuity. For instance, geopolitical tensions in Eastern Europe, a region with significant industrial activity and potential for hydro projects, could lead to supply chain disruptions and increased operational costs for GS-Hydro in 2024-2025.

Conversely, stable political environments are crucial for fostering long-term investment and ensuring predictable market conditions. Countries with consistent governance and clear regulatory frameworks, such as Finland where GS-Hydro is headquartered and has strong market presence, tend to offer a more secure environment for capital deployment and business expansion. This stability allows for more reliable forecasting and reduces the risk premium associated with new projects.

The global political landscape in 2024-2025 presents a mixed picture for infrastructure investments. While many developed nations are prioritizing green energy transitions, which benefits companies like GS-Hydro, emerging markets may face greater political volatility. For example, recent elections in several African nations could lead to shifts in energy policy, potentially affecting GS-Hydro's project pipeline in those areas.

- Geopolitical Risk: Increased geopolitical tensions in regions like Eastern Europe and parts of Asia could disrupt supply chains and project execution for GS-Hydro.

- Regulatory Stability: Stable political environments, exemplified by Nordic countries, encourage foreign direct investment in infrastructure, benefiting GS-Hydro's long-term growth prospects.

- Policy Shifts: Potential changes in government policies regarding renewable energy and infrastructure development in emerging markets could create both opportunities and risks for GS-Hydro's operations.

Defense and Maritime Security Spending

Government budgets allocated to naval defense and maritime security directly impact the demand for GS-Hydro's high-reliability piping systems. For instance, the United States Navy's shipbuilding plan for fiscal year 2025 includes the procurement of new vessels and modernization of existing fleets, signaling potential growth for suppliers like GS-Hydro. Increased defense spending translates to more opportunities for specialized applications in military shipbuilding and infrastructure projects.

The global maritime security market is also expanding, driven by concerns over piracy, smuggling, and territorial disputes. This trend is reflected in increased investment by various nations in coast guard capabilities and naval patrols. For example, in 2024, several European nations announced plans to bolster their maritime surveillance and defense capabilities, which could lead to greater demand for robust piping solutions in patrol vessels and port facilities.

- Defense Budgets: Global defense spending reached an estimated $2.44 trillion in 2024, with a significant portion allocated to naval modernization and maritime security initiatives.

- Naval Procurement: Major naval powers are investing in new aircraft carriers, submarines, and destroyers, all of which require advanced piping systems.

- Maritime Security Investments: Countries are enhancing their coast guard fleets and port security infrastructure, creating a steady demand for reliable maritime components.

Government policies on infrastructure development and green energy are pivotal for GS-Hydro. Nations pushing for renewable energy targets, like the EU's 42.5% by 2030 goal, directly fuel demand for hydrogen and sustainable maritime projects. Similarly, energy efficiency mandates and decarbonization efforts, with global CCUS investment reaching an estimated $100 billion in 2024, create new market avenues.

Conversely, shifts in industrial subsidies or a slowdown in government spending on infrastructure, particularly in emerging markets facing political volatility, could impact GS-Hydro's growth. The United States Navy's fiscal year 2025 shipbuilding plans, however, highlight sustained demand for specialized piping in defense sectors, with global defense spending at $2.44 trillion in 2024.

| Political Factor | Impact on GS-Hydro | 2024-2025 Data/Trend |

|---|---|---|

| Renewable Energy Policies | Increased demand for hydrogen and sustainable maritime solutions. | EU target: 42.5% renewable energy by 2030. |

| Decarbonization Mandates | Opportunities in CCUS and green hydrogen infrastructure. | Global CCUS investment estimated at $100 billion in 2024. |

| Infrastructure Spending | Potential impact from shifts in government budgets and emerging market volatility. | Emerging markets may see policy shifts post-elections. |

| Defense Budgets | Growth in demand for specialized piping in naval applications. | Global defense spending ~$2.44 trillion in 2024; US Navy FY25 plans. |

What is included in the product

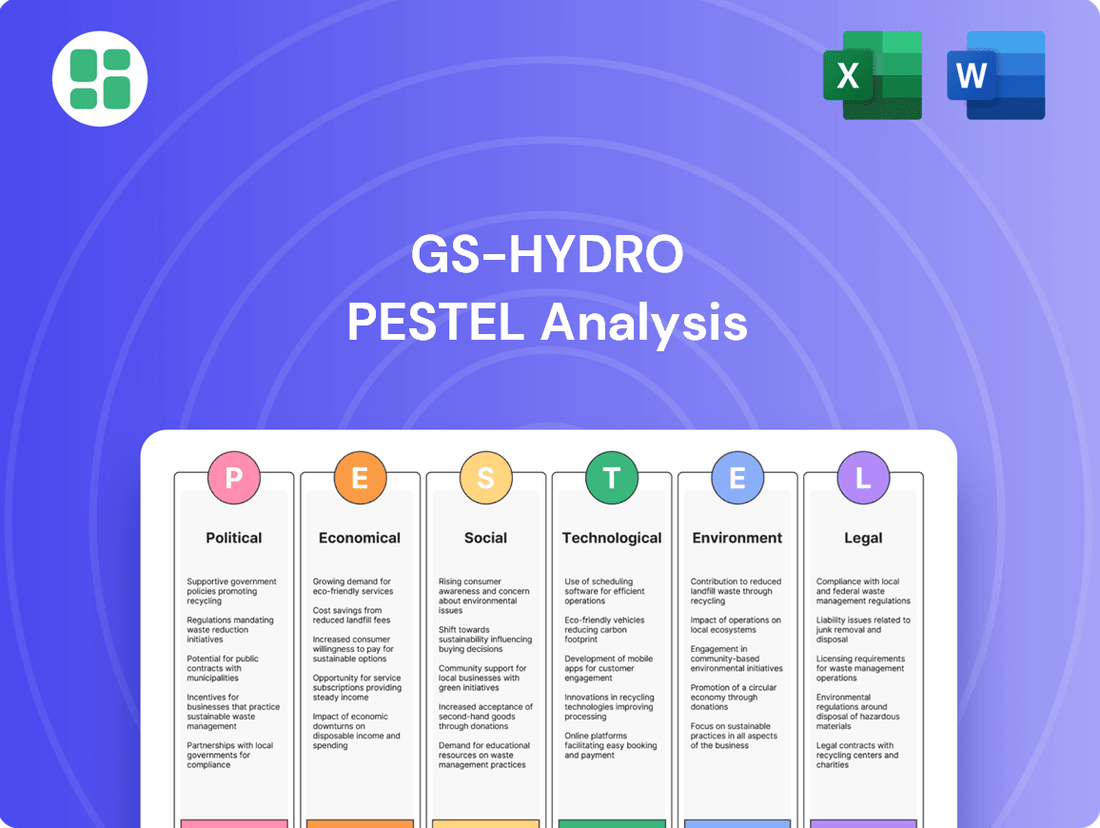

This GS-Hydro PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by detailing specific threats and opportunities relevant to GS-Hydro's operational context and strategic objectives.

The GS-Hydro PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of wading through lengthy reports.

Visually segmented by PESTEL categories, the GS-Hydro PESTLE Analysis allows for quick interpretation at a glance, relieving the pain of deciphering complex market dynamics.

Economic factors

Global economic performance directly impacts capital expenditure in GS-Hydro's key markets like marine, offshore, and industrial sectors. A slowdown in global GDP growth, which the IMF projected at 3.2% for 2024, can cause project delays and cancellations, directly affecting demand for GS-Hydro's piping solutions. Conversely, robust economic expansion fuels new investments and upgrades, boosting opportunities.

The cost of key materials like steel, stainless steel, and specialized seals, essential for GS-Hydro's flanged connection systems, is highly susceptible to global commodity market swings. For instance, steel prices saw considerable volatility in early 2024, with benchmarks like the Shanghai rebar futures experiencing fluctuations driven by demand signals and production levels in major economies. This volatility directly impacts GS-Hydro's cost of goods sold.

Significant increases in these raw material prices can directly squeeze profit margins for GS-Hydro. If the company cannot pass these increased costs onto its customers through effective pricing strategies or mitigate them through robust supply chain optimization, profitability will be negatively affected. For example, a 10% increase in stainless steel costs, a common input, could reduce gross margins by a noticeable percentage if not managed.

Currency exchange rate movements are a critical consideration for GS-Hydro, given its probable international operations. Fluctuations can significantly affect the cost of raw materials and components sourced from abroad, as well as the value of revenue earned from exports. For instance, a strengthening Euro against a key trading partner's currency could make GS-Hydro's products more expensive for overseas buyers, potentially dampening sales volume.

Conversely, a weaker Euro might boost export competitiveness but could also increase the cost of imported machinery or essential parts. The overall profitability is also impacted when converting earnings from foreign subsidiaries back into Euros. For example, if GS-Hydro has substantial operations in the United States, a significant depreciation of the US Dollar against the Euro in 2024 or 2025 would reduce the Euro-denominated value of those profits.

Effective financial hedging strategies are therefore essential to mitigate these currency risks. This might involve forward contracts or options to lock in exchange rates for future transactions, thereby providing greater certainty over costs and revenues. The Bank for International Settlements reported that foreign exchange market turnover averaged $7.5 trillion per day in April 2022, highlighting the sheer scale and volatility of currency markets that companies like GS-Hydro must navigate.

Interest Rate Environment

The prevailing interest rate environment significantly impacts GS-Hydro's business by influencing the cost of capital for its clients. Higher rates, such as the Federal Reserve's target range of 5.25%-5.50% as of early 2024, make borrowing more expensive, potentially slowing down large infrastructure and industrial projects that are key demand drivers for GS-Hydro's piping solutions.

Conversely, periods of lower interest rates, which might be anticipated in a disinflationary environment in late 2024 or 2025, typically encourage investment. This can lead to an uptick in new project initiations, thereby increasing the demand for GS-Hydro's products and services.

- Impact on Client Investment: Higher borrowing costs can deter clients from undertaking capital-intensive projects requiring extensive piping systems.

- Stimulation of Demand: Lower interest rates generally encourage investment and project development, boosting demand for GS-Hydro's offerings.

- Project Financing: The ability of GS-Hydro's clients to secure favorable financing directly correlates with the health of their project pipelines.

- Economic Sensitivity: GS-Hydro's revenue is thus sensitive to shifts in monetary policy and the resulting interest rate fluctuations.

Competition and Pricing Pressures

The fluid transfer systems market is highly competitive, with both established players offering welded solutions and emerging companies focusing on non-welded technologies. This intense rivalry often translates into significant pricing pressures. For instance, in the global industrial piping market, which includes fluid transfer systems, average profit margins can range from 5% to 15%, depending on the segment and innovation level.

GS-Hydro faces the challenge of justifying its premium for non-welded technology. Competitors offering lower-cost welded alternatives can erode market share if GS-Hydro's value proposition – such as faster installation, reduced leak potential, and higher system integrity – is not clearly communicated and demonstrably superior.

Market analysis from 2024 indicates that while the demand for advanced, leak-free systems is growing, cost remains a primary driver for many customers. This dynamic forces companies like GS-Hydro to balance innovation investment with competitive pricing strategies.

- Competitive Landscape: The fluid transfer systems market includes both welded and non-welded solutions, intensifying competition.

- Pricing Pressures: Intense rivalry often leads to downward pressure on pricing for fluid transfer systems.

- Value Proposition: GS-Hydro must continuously highlight the benefits of its non-welded technology to maintain market share and profitability.

- Cost Sensitivity: Customer purchasing decisions are often heavily influenced by cost, requiring a strong justification for premium pricing.

Global economic trends directly influence GS-Hydro's demand. A projected 2.7% global GDP growth for 2025, according to World Bank estimates, suggests a moderately positive environment for capital expenditures in GS-Hydro's target sectors. However, regional economic disparities and potential slowdowns in key markets like Europe could temper growth opportunities.

Commodity prices, particularly for steel and stainless steel, remain a critical cost factor. Anticipated stabilization in steel prices during 2025, following the volatility seen in 2024, could offer some cost predictability for GS-Hydro. Yet, geopolitical events or supply chain disruptions could still trigger price spikes.

Currency fluctuations present ongoing risks. For instance, if the Euro weakens significantly against the US Dollar in 2025, it would benefit GS-Hydro's export competitiveness but increase the cost of imported components. Companies like GS-Hydro must employ robust hedging strategies to manage this volatility, which affects the conversion of foreign earnings and the cost of international sourcing.

Interest rates, while potentially easing in some regions in 2025, continue to impact client investment decisions. Higher borrowing costs can still deter large-scale projects, affecting the pipeline for GS-Hydro's piping solutions. Conversely, any significant rate cuts could stimulate project financing and demand.

| Economic Factor | 2024 Projection/Data | 2025 Outlook | Impact on GS-Hydro | Mitigation Strategy |

| Global GDP Growth | IMF: 3.2% (2024) | World Bank: 2.7% (2025) | Moderate demand, potential regional variations | Diversify market presence |

| Steel Prices | Volatile, some stabilization | Anticipated stabilization | Cost of goods sold impact | Long-term supply contracts, hedging |

| Currency Exchange Rates (EUR/USD) | Fluctuating | Potential weakening of EUR | Export competitiveness vs. import costs | Financial hedging instruments |

| Interest Rates (e.g., US Fed Funds Rate) | 5.25%-5.50% (early 2024) | Potential easing | Client project financing costs | Focus on value proposition beyond cost |

What You See Is What You Get

GS-Hydro PESTLE Analysis

The GS-Hydro PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at GS-Hydro's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of political, economic, social, technological, legal, and environmental factors impacting GS-Hydro.

Sociological factors

The increasing global focus on workforce safety, particularly in demanding sectors like offshore oil and gas, directly benefits GS-Hydro. As industries prioritize reducing workplace accidents, especially those linked to hazardous processes like welding, GS-Hydro's non-welded pipe connection technology offers a significant advantage. This societal shift toward safer construction and maintenance practices creates a favorable environment for their solutions.

For instance, the International Labour Organization (ILO) reported in 2024 that occupational accidents and diseases cause millions of fatalities annually, underscoring the critical need for enhanced safety measures. GS-Hydro's systems, by eliminating the need for hot work, inherently mitigate risks associated with fire, explosions, and burns, aligning perfectly with this growing societal and regulatory demand for inherently safer operations.

The diminishing availability of highly skilled welding technicians in several key markets presents a significant sociological shift. This scarcity, particularly noted in regions experiencing an aging workforce and fewer new entrants into trades, makes alternative connection methods more appealing. For instance, a 2024 report indicated a projected shortfall of over 400,000 skilled tradespeople in the US by 2028, with welding being a critical area of concern.

GS-Hydro's non-welded pipe connection systems directly address this challenge. By offering solutions that require less specialized welding expertise, the company can position itself as a cost-effective and efficient alternative for clients facing labor shortages and rising technician wages. This can translate into reduced project timelines and overall installation expenses, a compelling proposition in the current economic climate.

Globally, a significant portion of industrial and marine infrastructure is aging, creating a substantial demand for effective repair and maintenance. For instance, the American Society of Civil Engineers' 2021 report card estimated that the U.S. infrastructure needs $2.59 trillion in investment over the next decade, highlighting the scale of this challenge.

GS-Hydro's innovative, quick-installation, leak-free pipe systems are particularly advantageous for retrofitting and upgrading these aging assets. These solutions directly address the societal imperative to extend infrastructure lifespan and ensure continued operational reliability.

Corporate Social Responsibility (CSR) Demands

Societal and investor pressure for robust Corporate Social Responsibility (CSR) is escalating, directly impacting client acquisition. Companies are increasingly scrutinized for their environmental stewardship and ethical labor standards. GS-Hydro's core technology, which inherently minimizes emissions and waste in welding processes, positions it favorably to meet these evolving demands.

The global push for sustainability is tangible. For instance, in 2024, a significant majority of consumers indicated they would switch brands if a competitor offered a more sustainable option. Investors are also channeling capital towards ESG (Environmental, Social, and Governance) compliant firms, with ESG funds reaching trillions of dollars in assets under management globally by early 2025. This trend directly influences how businesses choose their technology partners.

- Growing Consumer Preference: Over 70% of consumers in a 2024 survey stated that CSR initiatives influence their purchasing decisions.

- Investor Focus on ESG: The global ESG investment market is projected to exceed $50 trillion by 2025, highlighting a strong financial incentive for CSR alignment.

- Regulatory Tailwinds: Anticipated stricter environmental regulations in key markets by 2025 will further elevate the importance of emission-reducing technologies.

- GS-Hydro's Alignment: The company's welding solutions contribute to reduced carbon footprints and material waste, directly addressing these CSR expectations.

Shifting Demographics and Automation

Demographic shifts are reshaping the global workforce, presenting both challenges and opportunities for companies like GS-Hydro. In many developed nations, an aging population is leading to a shrinking pool of available labor, particularly for physically demanding roles. Conversely, younger generations entering the workforce are often more tech-savvy and may prefer roles that leverage automation and offer less strenuous tasks. This trend aligns well with GS-Hydro's focus on advanced hydraulic solutions that can streamline installation processes.

The increasing demand for efficiency and the desire for less physically taxing work environments are key drivers. For instance, a significant portion of the workforce in countries like Japan and Germany is over 65, impacting labor availability for traditional construction and infrastructure projects. GS-Hydro's technologies, which can reduce manual labor requirements and improve installation speed, are therefore well-positioned to meet this evolving workforce dynamic.

- Aging Workforce: In 2024, over 20% of the population in the EU is projected to be aged 65 or over, impacting labor availability for physically intensive tasks.

- Tech-Savvy Youth: Younger workforces often seek roles that incorporate technology and reduce manual exertion, aligning with automated installation solutions.

- Efficiency Demand: Societal pressure for faster project completion and reduced on-site labor costs favors advanced, automated installation methods.

- Worker Preferences: A growing preference for safer and less physically demanding jobs makes technologies that automate or simplify complex tasks more attractive to potential employees.

Societal expectations for enhanced safety are paramount, especially in industries like offshore oil and gas. GS-Hydro's non-welded technology directly addresses this by eliminating risks associated with hot work, a significant factor given that millions suffer from occupational accidents annually, as highlighted by the ILO in 2024.

The scarcity of skilled welders, a trend amplified by an aging workforce, makes GS-Hydro's less specialized connection methods highly attractive. A projected shortfall of over 400,000 skilled tradespeople in the US by 2028, with welding being a key concern, underscores this demand.

Aging infrastructure globally necessitates efficient repair and maintenance solutions. GS-Hydro's quick-installation systems are ideal for retrofitting, aligning with the societal imperative to extend infrastructure lifespan, as evidenced by the $2.59 trillion investment need for U.S. infrastructure over the next decade.

Growing pressure for Corporate Social Responsibility (CSR) and sustainability favors GS-Hydro. With ESG investments projected to exceed $50 trillion by 2025 and over 70% of consumers influenced by CSR in 2024, the company's emission-reducing technology offers a competitive edge.

Technological factors

Innovations in material science are directly impacting GS-Hydro's core offerings. New materials for seals and flanges can boost the performance and lifespan of their non-welded piping systems. For instance, advancements in corrosion-resistant alloys are crucial for industries operating in harsh environments, potentially extending the operational life of GS-Hydro's solutions by an estimated 15-20% in challenging marine or chemical processing applications.

The increasing integration of digital technologies like IoT sensors and predictive analytics is transforming fluid transfer systems. GS-Hydro can leverage these advancements for real-time monitoring and proactive issue detection, significantly enhancing system performance and client value.

By implementing digital twin capabilities, GS-Hydro can offer clients advanced simulation and optimization for their fluid transfer operations. This technological leap allows for more efficient resource management and reduced downtime, a crucial benefit in demanding industrial environments.

Increased automation in manufacturing and assembly processes is a significant technological driver for GS-Hydro. Embracing robotics and advanced machinery for piping component fabrication and module assembly can lead to substantial efficiency gains. For instance, a report by the International Federation of Robotics indicated that the global industrial robot market is projected to reach $73.1 billion by 2025, showcasing a strong trend towards automation across industries.

This technological shift directly translates to reduced production costs for GS-Hydro by minimizing labor expenses and material waste. Furthermore, automated systems ensure a higher degree of precision and consistency in product quality, which is crucial for critical applications in sectors like shipbuilding and offshore energy. The ability to scale production rapidly while maintaining stringent quality standards is a key advantage, enabling GS-Hydro to better respond to fluctuating market demands.

Development of New Fluid Applications

Emerging technologies like hydrogen transportation and advanced cooling systems are creating significant new avenues for specialized fluid transfer solutions. GS-Hydro's expertise in leak-free and high-pressure fluid handling positions them well to capitalize on these evolving market demands.

For instance, the global hydrogen market is projected to reach USD 256.37 billion by 2030, with a compound annual growth rate of 33.1% from 2023 to 2030, according to Grand View Research. This expansion necessitates robust and secure fluid transfer systems, a core competency for GS-Hydro.

- Hydrogen Transportation: Growing demand for safe and efficient hydrogen pipelines and refueling infrastructure.

- Carbon Capture: Need for reliable systems to transport CO2 from capture sites to storage or utilization facilities.

- Advanced Cooling: Increased adoption of liquid cooling for data centers and high-performance computing, requiring specialized fluid circuits.

Additive Manufacturing (3D Printing)

The increasing adoption of additive manufacturing, or 3D printing, presents significant opportunities for GS-Hydro. This technology allows for the creation of highly complex and customized components, which can lead to greater design flexibility and potentially faster lead times for specialized parts. For instance, the global 3D printing market was valued at approximately $19.8 billion in 2023 and is projected to grow substantially, reaching an estimated $70.7 billion by 2030, according to Grand View Research. This growth indicates a maturing technology capable of producing functional parts, not just prototypes.

GS-Hydro can leverage additive manufacturing to reduce costs associated with producing niche or intricate system elements that are not typically welded. The ability to print directly from digital designs minimizes material waste and eliminates the need for traditional tooling, which can be a significant cost driver for low-volume production. Furthermore, advancements in materials science are expanding the range of printable alloys, including those suitable for demanding industrial applications, making 3D printing a viable option for producing critical system components.

- Design Flexibility: Additive manufacturing enables the creation of intricate geometries previously impossible with subtractive methods, allowing for optimized system designs.

- Cost Reduction: For specialized, low-volume components, 3D printing can bypass expensive tooling and reduce material waste, leading to lower production costs.

- Faster Prototyping & Production: The ability to rapidly iterate designs and produce parts directly from CAD files significantly shortens lead times from concept to finished component.

- Material Innovation: Ongoing developments in printable metals and alloys are expanding the application of additive manufacturing to high-performance, critical system parts.

Technological advancements are reshaping fluid transfer systems, with innovations in material science enhancing GS-Hydro's non-welded piping solutions. Digital integration, including IoT and predictive analytics, offers real-time monitoring and proactive maintenance, boosting system efficiency. Emerging technologies like hydrogen transportation and advanced cooling systems present new growth avenues for specialized fluid transfer expertise.

| Technology Area | Impact on GS-Hydro | Market Projection/Data |

|---|---|---|

| Material Science | Improved performance and lifespan of piping systems with new alloys. | Corrosion-resistant alloys can extend operational life by 15-20% in harsh environments. |

| Digitalization (IoT, AI) | Real-time monitoring, predictive maintenance, enhanced system performance. | Digital twin capabilities offer advanced simulation and optimization. |

| Emerging Energy Tech | Opportunities in hydrogen transportation and carbon capture systems. | Global hydrogen market projected to reach USD 256.37 billion by 2030 (CAGR 33.1%). |

| Additive Manufacturing | Creation of complex, customized components with reduced waste. | Global 3D printing market expected to reach $70.7 billion by 2030. |

Legal factors

GS-Hydro's success hinges on adherence to a complex web of international standards and certifications. For instance, in the marine and offshore sectors, compliance with ISO 9001 for quality management, API standards for pipeline components, and classification society approvals from DNV or ABS are not just recommendations but prerequisites for market entry. These certifications, often renewed through rigorous audits, directly impact GS-Hydro's ability to secure contracts with major shipbuilders and offshore operators who demand proven reliability and safety.

Strict health and safety regulations, especially those targeting hot work and hazardous materials in industrial settings, naturally benefit GS-Hydro's non-welded solutions. These regulations are paramount for ensuring operational compliance and significantly reducing potential liabilities for companies like GS-Hydro and its clients.

In 2024, the global industrial safety market was valued at approximately $60 billion, with a projected compound annual growth rate of 7.5% through 2030, indicating a strong and growing emphasis on compliance. GS-Hydro's offerings directly address these evolving safety standards, positioning them favorably within this expanding market.

Environmental protection laws are tightening globally, focusing on preventing fluid leaks and minimizing contamination from industrial operations. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits on pollutants, impacting sectors that utilize hydraulic systems. GS-Hydro's commitment to leak-free technology directly addresses these concerns, enabling clients to meet and exceed regulatory requirements, thereby avoiding potential fines that could amount to millions for non-compliance.

Intellectual Property Rights and Patents

Intellectual property, particularly patents protecting GS-Hydro's innovative flanged connection technology, is a cornerstone of its competitive advantage. These patents prevent rivals from easily copying its core offerings, a crucial element in the specialized industrial equipment market. Enforcing these rights through legal channels is a continuous and necessary activity to safeguard its market position and revenue streams.

GS-Hydro's strategy likely involves a proactive approach to patent filing and monitoring. For instance, the global patent landscape is dynamic; in 2023, the World Intellectual Property Organization (WIPO) reported a record 3.4 million patent applications filed worldwide, highlighting the intense innovation and the need for robust IP protection. GS-Hydro's ability to secure and defend its patents directly impacts its ability to command premium pricing and maintain market share.

- Patent Portfolio Strength: GS-Hydro's defensive and offensive patent strategy is key to preventing infringement and potentially licensing its technology.

- Enforcement Costs: Legal battles to enforce patents can be substantial, requiring careful budgeting and risk assessment.

- Global IP Laws: Navigating and complying with varying intellectual property laws across different operating regions is a significant legal challenge.

Contract Law and Liability

The legal landscape for GS-Hydro is heavily influenced by contract law, directly shaping its relationships with clients and suppliers. This includes the enforceability of agreements, the terms of service, and the precise definitions of deliverables and payment schedules. For instance, a breach of contract could lead to significant financial penalties or project delays, impacting revenue streams. In 2024, the global average cost of resolving a commercial dispute through litigation was estimated at $150,000, highlighting the financial implications of contract disputes.

Product liability and warranty claims represent another critical legal consideration for GS-Hydro. Ensuring that its hydraulic systems meet stringent safety and performance standards is paramount to avoid costly recalls, lawsuits, and damage to its reputation. A failure in a critical component could result in significant damages, leading to substantial compensation claims. In the industrial equipment sector, product liability claims can range from tens of thousands to millions of dollars depending on the severity of the failure and its consequences.

Effectively managing these legal factors is key to GS-Hydro's risk mitigation strategy. This involves meticulous contract drafting, robust quality control processes, and clear communication channels to prevent misunderstandings. Proactive legal counsel and adherence to regulatory compliance frameworks are essential for navigating potential liabilities and ensuring smooth dispute resolution, thereby safeguarding the company's financial health and operational continuity.

- Contractual Obligations: GS-Hydro must adhere to all terms within client and supplier agreements, covering aspects like delivery timelines, performance specifications, and payment terms.

- Product Liability: The company faces legal responsibility for any defects in its hydraulic systems that could cause harm or damage to users or third parties.

- Warranty Claims: GS-Hydro is legally bound by the warranties it provides, which guarantee the quality and performance of its products for a specified period.

- Dispute Resolution: Understanding and implementing effective mechanisms for resolving contractual disagreements and liability claims is crucial for minimizing financial and reputational damage.

GS-Hydro's operations are significantly shaped by evolving environmental regulations, particularly those aimed at preventing fluid leaks and minimizing industrial contamination. For example, the European Union's stringent Industrial Emissions Directive (IED) impacts sectors reliant on hydraulic systems by setting strict pollutant limits. GS-Hydro's leak-free technology directly aids clients in meeting these requirements, helping them avoid substantial fines for non-compliance.

The company's intellectual property, especially patents for its unique flanged connection technology, forms a critical competitive edge. These patents deter rivals from replicating its core products, which is vital in the specialized industrial equipment market. Protecting these rights through legal action is an ongoing necessity to maintain market standing and revenue.

In 2023, the World Intellectual Property Organization (WIPO) reported a record 3.4 million global patent applications, underscoring the intense innovation and the need for robust IP protection. GS-Hydro's ability to secure and defend its patents directly influences its pricing power and market share.

| Legal Factor | Impact on GS-Hydro | 2024/2025 Relevance |

|---|---|---|

| Environmental Compliance | Adherence to regulations on fluid leaks and emissions. | Growing focus on sustainability and reduced environmental impact. |

| Intellectual Property Rights | Protection of patented technologies, preventing replication. | Crucial for maintaining competitive advantage and market exclusivity. |

| Contract Law | Governs client and supplier agreements, defining obligations. | Ensures clarity in deliverables, payment, and project execution. |

| Product Liability | Responsibility for defects in hydraulic systems. | Mitigation through rigorous quality control to avoid lawsuits and recalls. |

Environmental factors

Growing environmental awareness and stricter regulations are driving a significant demand for leak-free fluid transfer systems across industries. This push aims to mitigate the environmental impact of spills from hydraulic fluids, oils, and other hazardous materials. For instance, the European Union's Industrial Emissions Directive continues to tighten controls on fluid containment, influencing system design choices.

GS-Hydro's core offering of non-welded technology directly aligns with this market need. Their advanced connection methods provide inherent leak resistance, offering a superior alternative to traditional welded systems that can be prone to micro-fractures and subsequent leaks over time. This technological advantage positions GS-Hydro favorably in a market increasingly prioritizing environmental safety and compliance.

GS-Hydro's innovative approach to pipe joining, by eliminating traditional welding, directly addresses the environmental imperative to reduce emissions and waste. This method significantly cuts down on the release of harmful fumes and gases typically associated with welding, contributing to cleaner industrial air quality. For instance, the welding industry globally generates millions of tons of slag annually, a byproduct GS-Hydro's process avoids entirely.

Optimizing raw material usage and reducing scrap are key environmental considerations for GS-Hydro. By designing systems that maximize material efficiency and employing prefabrication, GS-Hydro can significantly lessen its environmental footprint compared to traditional welding processes. This focus on resource efficiency aligns with growing industry demands for sustainable manufacturing practices.

Circular Economy Principles

GS-Hydro's non-welded piping systems align well with circular economy principles by facilitating easy disassembly, reuse, and recycling of components. This design significantly lowers the environmental footprint across the entire product lifecycle, presenting a more sustainable option for extensive infrastructure development.

The emphasis on reusability and reduced waste makes these systems attractive for projects with long-term sustainability goals. For instance, the European Union's Circular Economy Action Plan, updated in 2024, aims to boost sustainable product design and reduce waste, creating a favorable market for solutions like GS-Hydro's.

- Reduced Waste: Non-welded systems minimize material waste during installation and decommissioning compared to traditional welded pipes.

- Extended Lifespan: Components can be readily replaced or relocated, extending the usable life of the infrastructure.

- Resource Efficiency: Facilitates the recovery and reuse of valuable materials, supporting a more resource-efficient economy.

- Lower Carbon Footprint: By reducing manufacturing and disposal impacts, these systems contribute to lower overall carbon emissions.

Compliance with ESG Reporting

The increasing demand for Environmental, Social, and Governance (ESG) reporting by investors and regulators is a significant environmental factor. Companies are actively seeking suppliers who demonstrate robust environmental performance to bolster their own ESG credentials. For instance, the global sustainable investing market reached an estimated $35.3 trillion in 2024, highlighting this investor shift.

GS-Hydro's advanced piping system technologies offer a tangible solution for clients aiming to enhance their ESG metrics. By mitigating environmental risks inherent in traditional piping, such as leaks and material waste, GS-Hydro directly contributes to a client's reduced environmental footprint. This alignment with sustainability goals is becoming a key differentiator in supplier selection.

Specifically, GS-Hydro's prefabrication and advanced welding techniques can lead to significant material savings and reduced on-site waste. For example, a 2024 report indicated that the construction industry's waste generation accounts for over 30% of landfill volume, making waste reduction a critical ESG concern. GS-Hydro's approach directly addresses this by minimizing scrap and rework.

- Investor Demand: Over 80% of institutional investors consider ESG factors in their investment decisions as of early 2025.

- Regulatory Push: Many jurisdictions are introducing mandatory ESG disclosure requirements for publicly traded companies.

- Risk Mitigation: GS-Hydro's solutions help clients avoid environmental fines and reputational damage associated with piping system failures.

- Efficiency Gains: Reduced material waste and improved system longevity contribute to a lower carbon footprint throughout the project lifecycle.

The increasing global focus on sustainability and environmental protection directly benefits GS-Hydro's leak-free piping solutions. Stricter regulations, like the EU's updated Circular Economy Action Plan from 2024, mandate reduced waste and promote product longevity, areas where GS-Hydro excels. This trend is further amplified by investor demand for ESG-compliant businesses, with over 80% of institutional investors considering these factors as of early 2025.

| Environmental Factor | GS-Hydro's Advantage | Market Impact (2024-2025 Data) |

|---|---|---|

| Regulatory Compliance | Non-welded technology inherently reduces leak risks, aiding compliance with environmental directives. | EU Industrial Emissions Directive continues to tighten controls; European Union's Circular Economy Action Plan (2024) emphasizes sustainable design. |

| Waste Reduction | Eliminates welding byproducts (slag, fumes) and minimizes scrap during installation and decommissioning. | Construction industry waste accounts for over 30% of landfill volume; GS-Hydro's process avoids millions of tons of slag globally. |

| Resource Efficiency & Circularity | Facilitates easy disassembly, reuse, and recycling of components, aligning with circular economy principles. | Global sustainable investing market reached $35.3 trillion in 2024, driving demand for lifecycle-efficient solutions. |

| ESG Performance | Directly improves clients' ESG metrics by mitigating environmental risks and reducing carbon footprint. | Over 80% of institutional investors consider ESG factors; many jurisdictions introducing mandatory ESG disclosure. |

PESTLE Analysis Data Sources

Our GS-Hydro PESTLE Analysis is meticulously constructed using data from reputable sources including international financial institutions, governmental environmental agencies, and leading technology research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape.