GS-Hydro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS-Hydro Bundle

GS-Hydro operates within a competitive landscape shaped by moderate supplier power and a significant threat from substitute products, particularly in the specialized piping solutions market. While buyer power is present, it's somewhat mitigated by GS-Hydro's unique technological expertise. The intensity of rivalry is notable, demanding continuous innovation and efficiency.

The complete report reveals the real forces shaping GS-Hydro’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for GS-Hydro's specialized non-welded flanged connection systems can be moderate to high. This leverage stems from the potential for proprietary components or the need for niche manufacturing capabilities. For example, suppliers of high-pressure hydraulic components or unique sealing materials may hold significant sway due to their specialized offerings and limited alternative sources.

GS-Hydro faces significant supplier bargaining power due to high switching costs. If GS-Hydro has deeply integrated a supplier's specialized components into its core product designs and manufacturing workflows, moving to an alternative supplier becomes an extremely costly and time-consuming endeavor. This involves substantial expenses for re-engineering products, obtaining new certifications, and conducting rigorous testing phases, all of which strengthen the supplier's leverage.

GS-Hydro's commitment to leak-free and reliable fluid transfer systems hinges on the quality of its components. Suppliers of high-precision parts crucial for high-pressure hydraulics, especially those enabling smart hydraulics and IoT integration, wield significant influence. For instance, the hydraulic industry's focus on advanced filtration means suppliers offering superior filtration components can command higher prices.

Potential for Forward Integration by Suppliers

Suppliers of highly specialized, critical components for non-welded piping solutions possess a latent threat of forward integration. If a supplier were to establish its own complete piping solution offerings, GS-Hydro would face direct competition from its own supply chain, potentially disrupting its established business model.

This possibility, however remote, exerts pressure on GS-Hydro’s supplier negotiations, as the company aims to prevent its suppliers from becoming direct rivals. The expanding global market for fluid transfer systems, projected to reach over $200 billion by 2028, could indeed provide the necessary incentive for such strategic moves by suppliers.

- Supplier Forward Integration Risk: Suppliers of specialized components could potentially offer complete non-welded piping solutions, directly competing with GS-Hydro.

- Market Growth Incentive: The robust growth in the fluid transfer systems market, estimated at a CAGR of 5.5% from 2023 to 2028, could encourage supplier integration.

- Negotiation Leverage: The mere threat of forward integration by suppliers can influence GS-Hydro's bargaining power in its supply chain relationships.

Importance of GS-Hydro to Supplier Revenue

The significance of GS-Hydro's business to its suppliers directly influences their bargaining power. If GS-Hydro constitutes a substantial portion of a supplier's revenue, that supplier is likely more inclined to offer favorable pricing and terms to retain GS-Hydro as a customer. For instance, a supplier heavily reliant on GS-Hydro's orders might be more flexible on delivery schedules or material specifications.

Conversely, if GS-Hydro represents only a minor segment of a supplier's overall sales, the supplier may possess greater leverage. In a market where fluid transfer systems are experiencing growth, such as the projected 5.7% CAGR for the global industrial fluid handling systems market through 2030, a supplier might feel less pressure to compromise on terms, especially if they have other significant clients or a robust order book.

- Supplier Dependence: A supplier whose revenue is heavily dependent on GS-Hydro will have less bargaining power.

- Market Dynamics: In a growing market, suppliers with diversified client bases may exert more influence.

- GS-Hydro's Share: The percentage of a supplier's total sales that GS-Hydro accounts for is a key determinant.

- Competitive Landscape: The availability of alternative suppliers for GS-Hydro can also shift the balance of power.

The bargaining power of suppliers for GS-Hydro is influenced by the concentration of suppliers in the market. If there are few suppliers for critical components, their collective power increases. For example, if only a handful of manufacturers produce the specialized high-pressure seals essential for GS-Hydro's systems, these suppliers can dictate terms.

The availability of substitute components also plays a crucial role. If readily available, less specialized alternatives exist, GS-Hydro can switch suppliers more easily, reducing supplier leverage. However, for GS-Hydro's demanding applications, such substitutes are often not viable, thereby enhancing supplier power.

The global market for industrial fluid handling systems is expected to reach approximately $300 billion by 2029, growing at a CAGR of around 5.8%. This growth signifies increasing demand, which can empower suppliers if they possess unique capabilities or are key to meeting this demand.

| Factor | Impact on GS-Hydro | Example/Data Point |

|---|---|---|

| Supplier Concentration | Moderate to High | Few suppliers for high-pressure hydraulic seals. |

| Availability of Substitutes | Low | Specialized components for leak-free systems are hard to substitute. |

| Switching Costs | High | Re-engineering and certification for new components are costly. |

| Supplier Importance to GS-Hydro | Variable | Depends on GS-Hydro's share of supplier's revenue. |

| Market Growth | Potential for Increased Supplier Power | Fluid handling market growth may incentivize supplier leverage. |

What is included in the product

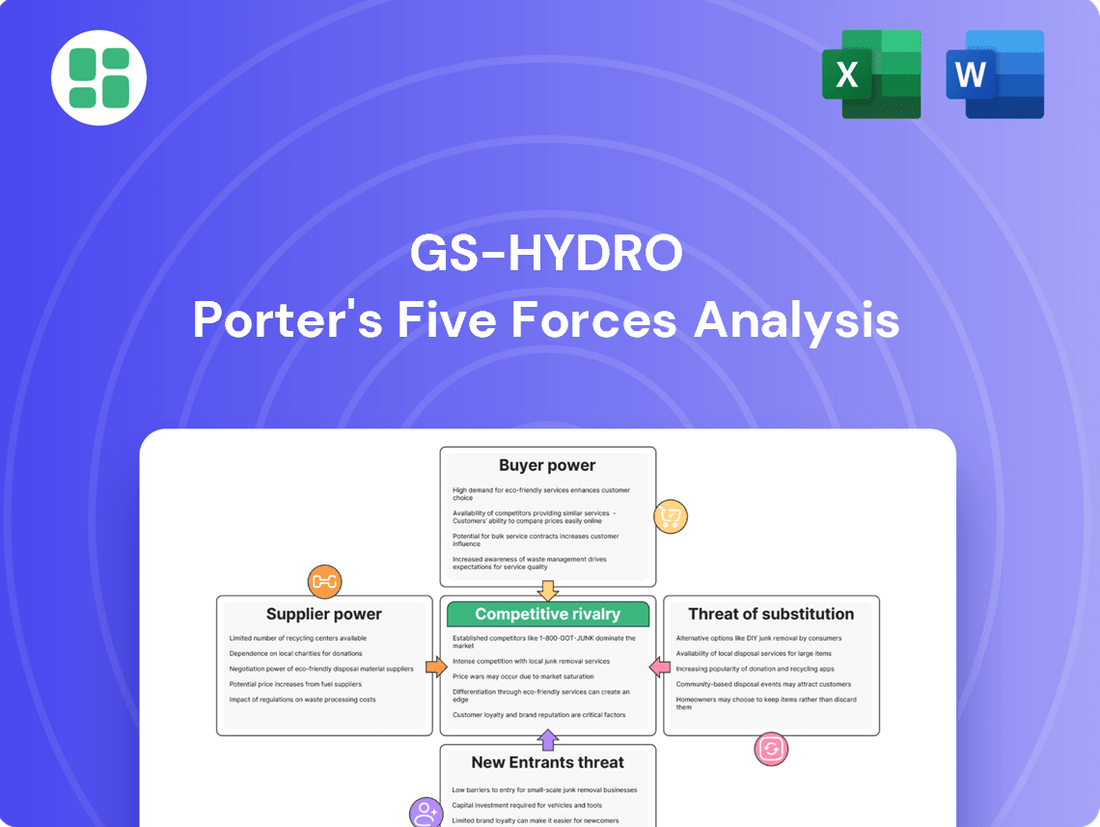

This analysis dissects the competitive forces impacting GS-Hydro, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its profitability.

Effortlessly identify and address competitive threats with a visual breakdown of each force, making strategic planning more intuitive.

Customers Bargaining Power

GS-Hydro's customer base is concentrated within large industrial sectors like marine, offshore, and general industry. These sectors typically involve massive projects, meaning customers often procure in significant volumes.

Major players such as large shipbuilders or offshore platform operators wield considerable purchasing power. Their substantial orders enable them to negotiate favorable pricing, request tailored solutions, and secure extended service contracts from suppliers like GS-Hydro.

The marine hydraulic pumps market, for instance, saw robust demand in 2024, driven by increased shipbuilding and repair activities. This trend presents significant opportunities for large customers to leverage their project scale in negotiations.

While switching from traditional welded systems to GS-Hydro's non-welded solutions might involve initial adjustments, the long-term advantages are compelling. These include faster installation, reduced labor, and improved reliability, all of which can outweigh the perceived switching hurdles.

Cost comparisons from 2024 data reveal that non-welded systems can slash installation time by 35-45% compared to welded alternatives. This significant reduction in labor and flushing requirements directly translates into lower overall project costs, making the transition more financially attractive for customers.

Customers can readily turn to traditional welded piping systems, which are widely recognized and typically come with a lower initial price tag. For instance, a 'Price Comparison of Seamless Pipe and Welded Pipe' study from 2024 highlighted that welded pipes are 40-60% cheaper than seamless options, making them a popular choice due to their cost-effectiveness.

This abundance of alternatives, even if they don't match GS-Hydro's performance or reliability in every scenario, significantly boosts customer leverage. Knowing they have other functional choices empowers customers to negotiate better terms or seek out competitors if GS-Hydro's offerings become too expensive or inflexible.

Customer Price Sensitivity

In capital-intensive sectors such as marine and offshore, customers exhibit significant price sensitivity, particularly when undertaking large infrastructure projects. Piping systems, for instance, can represent a substantial portion of the overall investment. This pressure compels companies like GS-Hydro to focus on competitive pricing strategies, as clients can readily explore less expensive alternatives, such as traditional welded pipes.

The global piping and fittings market is a vast arena, valued in the hundreds of billions of dollars, underscoring the critical importance of cost efficiency in procurement decisions. For example, the market was projected to reach approximately $280 billion by 2024, highlighting the sheer scale where even small price differences can lead to substantial savings for buyers.

- Customer Price Sensitivity: High in capital-intensive marine and offshore industries.

- Competitive Pressure: Forces GS-Hydro to maintain competitive pricing.

- Alternative Solutions: Customers can leverage cost advantages of welded pipes.

- Market Scale: The piping and fittings market is a multi-billion dollar industry where cost efficiency is paramount.

Customer Knowledge and Information Asymmetry

Customers in GS-Hydro's target industries are often highly knowledgeable about piping systems, possessing significant technical expertise. This allows them to thoroughly assess various solutions and engage in more effective price and quality negotiations. In 2024, the emphasis on enhanced safety and reliability standards within the hydraulic sector, coupled with a growing demand for customized solutions, further amplifies customer bargaining power.

The reduction of information asymmetry is a key driver here. Sophisticated buyers can readily access competitive market data, enabling them to compare offerings and press for favorable terms. This informed position means customers are less reliant on supplier-provided information, strengthening their negotiating stance.

- Informed Buyers: Customers possess deep technical knowledge of piping systems.

- Market Transparency: Access to competitive market information reduces information asymmetry.

- Demand for Customization: Industry trends highlight customer desire for tailored solutions.

- Focus on Standards: Increased emphasis on safety and reliability standards empowers informed customer demands.

GS-Hydro's customers often operate in capital-intensive industries where price sensitivity is high, especially for large projects. The significant volume of their purchases gives them considerable leverage to negotiate favorable terms and pricing. This is further amplified by the availability of alternative solutions, such as traditional welded piping systems, which are typically less expensive upfront, contributing to strong customer bargaining power.

| Factor | Impact on GS-Hydro | Supporting Data (2024) |

|---|---|---|

| Customer Concentration & Volume | High leverage for major clients | Large industrial sectors (marine, offshore) procure in significant volumes. |

| Price Sensitivity | Pressure on GS-Hydro's pricing | Welded pipes 40-60% cheaper than seamless options. |

| Availability of Alternatives | Weakens GS-Hydro's position | Global piping and fittings market valued around $280 billion in 2024. |

| Customer Knowledge | Facilitates informed negotiation | Technical expertise allows for thorough assessment and price comparison. |

Same Document Delivered

GS-Hydro Porter's Five Forces Analysis

This preview showcases the comprehensive GS-Hydro Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering no surprises and full usability. You are looking at the actual, ready-to-use analysis, ensuring you get the complete strategic insights you need without any placeholders or modifications.

Rivalry Among Competitors

The fluid transfer system market, a sector valued at over $21 billion in 2024, is characterized by a substantial number of competitors. This landscape includes a wide array of companies, from large, established manufacturers to smaller, specialized firms, all vying for market share.

These players offer diverse solutions, ranging from conventional welded pipe systems to a variety of non-welded technologies. This broad spectrum of offerings means that GS-Hydro faces competition not only from direct rivals in the non-welded connection space but also from providers of alternative fluid transfer methods.

The sheer diversity in company size and technological approach intensifies the competitive environment. GS-Hydro's unique non-welded flanged connection system must therefore continuously demonstrate its advantages and differentiate itself to succeed against this multifaceted competitive force.

The fluid transfer system market is seeing robust expansion, with projections indicating it will reach $22.68 billion by 2025, growing at a compound annual growth rate of 7.7%. This healthy industry growth can temper direct competitive rivalry by allowing companies to expand their operations without necessarily stealing market share from existing players.

However, this attractive growth also acts as a magnet for new investments and entrants. As the market expands, the potential for increased competition intensifies as companies strive to capture a larger segment of this growing opportunity.

The global hydraulics market is also on an upward trajectory, expected to grow at a CAGR of 3.4% between 2025 and 2032. While growth generally eases immediate competitive pressures, the underlying expansion in demand for fluid transfer solutions means players must remain vigilant and innovative to secure their positions.

GS-Hydro's competitive edge is sharpened by its unique non-welded, leak-free flanged connection system. This innovation directly tackles the industry's reliance on traditional welding, offering substantial benefits like faster installation and lower costs. For instance, the company highlights that its system can reduce installation time by up to 50% in certain applications.

This strong product differentiation allows GS-Hydro to sidestep intense price competition by emphasizing superior value, safety, and operational efficiency. As the hydraulic industry increasingly prioritizes these attributes, GS-Hydro's focus on a reliable, high-performance solution positions it favorably against rivals who may compete primarily on price.

High Exit Barriers

The specialized nature of industrial piping and fluid transfer systems, demanding substantial capital for manufacturing, engineering talent, and robust supply chains, results in high exit barriers. This means companies are more inclined to persevere through competitive cycles rather than withdraw.

Consequently, this environment fosters sustained rivalry as firms are locked into the market. The global piping and fittings market, projected to approach $500 billion by 2034, underscores the immense infrastructure and ongoing investment that makes exiting such an undertaking.

- Specialized Assets: High investment in unique manufacturing equipment and proprietary technologies.

- Skilled Workforce: Reliance on highly trained engineers and technicians with specific industry knowledge.

- Supply Chain Integration: Deeply embedded relationships with suppliers and distributors are difficult to replicate.

- Market Commitment: Companies are committed to long-term projects and infrastructure development.

Strategic Stakes and Market Share Objectives

Competitors in the fluid transfer and hydraulic systems market, including specialized non-welded providers and larger diversified engineering firms, possess significant strategic stakes in market share. This often fuels aggressive tactics like competitive pricing and ongoing advancements in flange technology.

These players are driven by objectives to either capture or defend their positions, leading to actions such as strategic alliances and product differentiation. For instance, in 2024, the global industrial hydraulics market was valued at approximately $30 billion, showcasing substantial financial incentives for market share gains.

- Market Share Drive: Competitors actively seek to increase their slice of the pie in the fluid transfer sector.

- Innovation Focus: Continuous improvement in technologies like flange systems is a key battleground.

- Strategic Partnerships: Collaborations are common as companies aim to bolster their market presence and offerings.

- Aggressive Tactics: Pricing strategies and product development are often employed to outmaneuver rivals.

The fluid transfer system market is highly competitive, featuring numerous players from large manufacturers to niche specialists. GS-Hydro's non-welded flanged connection system faces rivals offering both similar technologies and traditional welded solutions, creating a complex competitive landscape.

While industry growth, projected at 7.7% CAGR through 2025, can temper direct rivalry by expanding the overall market, it also attracts new entrants. This dynamic necessitates continuous innovation and differentiation, as demonstrated by GS-Hydro's 50% potential installation time reduction.

High exit barriers, due to specialized assets and skilled labor, mean competitors remain entrenched, fostering sustained rivalry. The global piping and fittings market, nearing $500 billion by 2034, highlights the significant commitment and investment that deters companies from leaving.

Competitors actively pursue market share through aggressive pricing and technological advancements, with the global industrial hydraulics market valued at approximately $30 billion in 2024. Strategic alliances and product differentiation are common tactics employed to gain an edge.

| Competitive Factor | Description | Impact on GS-Hydro | Example/Data Point |

| Number of Competitors | Numerous, ranging from large corporations to smaller, specialized firms. | Intensifies rivalry, requiring strong differentiation. | Fluid transfer system market valued over $21 billion in 2024. |

| Product/Technology Diversity | Offers include welded and non-welded systems, including GS-Hydro's unique flanged connections. | Forces GS-Hydro to highlight its specific advantages over alternatives. | GS-Hydro's system can reduce installation time by up to 50%. |

| Market Growth | Projected 7.7% CAGR through 2025 for fluid transfer systems. | Can ease rivalry by expanding market, but also attracts new entrants. | Global hydraulics market expected to grow at 3.4% CAGR (2025-2032). |

| Exit Barriers | High due to specialized assets, skilled workforce, and supply chain integration. | Leads to sustained rivalry as firms are committed to the market. | Global piping and fittings market approaching $500 billion by 2034. |

| Strategic Objectives | Competitors aim to capture or defend market share through various tactics. | Drives aggressive strategies like pricing and innovation. | Global industrial hydraulics market valued at ~$30 billion in 2024. |

SSubstitutes Threaten

Traditional welded piping systems represent the most significant threat of substitutes for GS-Hydro's non-welded solutions. These systems are deeply entrenched in many industries, offering a familiar and widely adopted alternative.

While GS-Hydro highlights benefits such as faster installation and superior leak prevention, the upfront cost of welded pipes can be considerably lower, often 40-60% less than seamless pipe alternatives. This cost advantage is a powerful draw, especially for projects where initial capital outlay is the primary concern.

This cost-effectiveness directly challenges GS-Hydro's value proposition, as it provides a compelling reason for customers to opt for traditional methods, even if long-term operational savings are less pronounced. The market for industrial piping is vast, and a substantial portion continues to favor the lower initial investment of welded systems.

Beyond traditional welding, alternative non-welded connection technologies pose a significant threat. These include quick-connect flanges and grooved piping systems, which can replace welded joints in various industrial applications.

For example, INTLEF Group's recent introduction of an 'Innovative Quick-Connect Flange' demonstrates this threat. This new technology is designed to drastically cut installation times, claiming a 75-90% reduction compared to conventional methods. This directly challenges existing non-welded solutions, including those offered by companies like GS-Hydro.

Customer acceptance of non-welded pipe connections, like those offered by GS-Hydro, faces a hurdle of industry inertia. Many sectors are accustomed to traditional welding methods, and shifting this mindset requires substantial effort in education and proving the long-term advantages of newer technologies. This resistance can slow the adoption of potentially superior alternatives.

Despite the push for innovation, as highlighted in 'Flange Manufacturer Trends in 2025' which points to increased demand for stringent quality and advanced production, the broad acceptance of non-welded solutions hinges on industry-wide buy-in. Evolving standards and consistent demonstrations of reliability are crucial for overcoming the ingrained preference for welding.

Price-Performance Trade-off Considerations

Customers constantly weigh the price versus performance of different piping options. For instance, while GS-Hydro's non-welded systems boast enhanced reliability and quicker setup, their higher upfront material costs compared to traditional welded systems can be a barrier for some.

This often leads to a careful balancing act for buyers, weighing initial expenditure against the long-term advantages of reduced maintenance needs, less operational downtime, and improved safety protocols. The perceived value proposition of GS-Hydro's solutions, therefore, must clearly demonstrate a compelling return on investment over the system's lifecycle.

- Price Sensitivity: In sectors where cost is paramount, such as certain segments of the construction industry, the initial price difference can be a significant deterrent, even with long-term savings.

- Total Cost of Ownership (TCO): Buyers are increasingly scrutinizing the TCO, factoring in installation labor, maintenance, potential leaks, and system lifespan.

- Performance Justification: GS-Hydro's challenge is to clearly articulate how its system's performance benefits, like faster assembly time which can reduce labor costs by up to 30% in some projects, offset the higher initial material expense.

- Market Segmentation: The acceptance of higher initial costs is often linked to the specific industry and application, with high-stakes environments like offshore oil and gas or sensitive industrial processes being more receptive to premium solutions.

Emerging Fluid Transfer and Sealing Technologies

The fluid transfer and sealing technology landscape is evolving rapidly, driven by digital transformation and stringent safety and compliance standards. Innovations in advanced polymers and composite materials for flange construction, alongside new gasket solutions, are creating potential substitutes. For instance, the global market for advanced polymers used in industrial applications was projected to reach over $70 billion in 2024, indicating significant investment in these material sciences.

These technological advancements could introduce substitute products that offer compelling advantages in cost-effectiveness, enhanced performance, or reduced environmental impact. For example, the development of self-healing seals could significantly lower maintenance costs and downtime, posing a direct threat to traditional sealing methods. GS-Hydro must therefore maintain a proactive approach to innovation to counter these emerging threats.

- Advancements in composite materials for flanges are reducing weight and corrosion issues.

- New gasket materials offer improved sealing integrity and longer service life.

- Digitalization in fluid transfer systems could lead to integrated, smart solutions that bypass traditional components.

- The drive for sustainability is pushing the development of eco-friendly fluid transfer and sealing technologies.

Traditional welded piping systems remain the most significant substitute threat for GS-Hydro's non-welded solutions due to their lower upfront costs, often 40-60% less than seamless pipe alternatives. While GS-Hydro emphasizes faster installation and leak prevention, the initial price advantage of welded pipes is a strong draw for cost-sensitive projects. This cost-effectiveness directly challenges GS-Hydro's value proposition, as many customers prioritize immediate capital outlay over potential long-term operational savings.

| Substitute Type | Key Advantage | Potential Impact on GS-Hydro | Example/Data Point |

|---|---|---|---|

| Traditional Welded Piping | Lower upfront cost | Deters adoption of higher-cost non-welded systems | Up to 60% cheaper initial material cost |

| Alternative Non-Welded Systems | Faster installation, ease of use | Competes directly with GS-Hydro's installation benefits | INTLEF Group's quick-connect flanges claim 75-90% faster installation |

| Advanced Materials & Sealing | Potential for improved performance/cost | Could offer superior alternatives to current non-welded tech | Global advanced polymer market projected over $70 billion in 2024 |

Entrants Threaten

Entering the specialized non-welded piping system market, particularly for demanding sectors like marine and offshore, necessitates significant capital. This includes substantial investment in research and development, state-of-the-art manufacturing facilities, specialized machinery, and robust inventory management. These high upfront costs create a formidable barrier for any new players looking to enter the industry.

GS-Hydro's proprietary flanged connection system, a result of extensive R&D and deep engineering expertise, presents a significant barrier to new entrants. This technology ensures leak-free and reliable performance, a standard that is difficult and costly for newcomers to replicate.

Developing comparable, robust non-welded solutions or acquiring existing technologies would require substantial investment from potential competitors. The market trend, as indicated by 'Flange Manufacturer Trends in 2025,' emphasizes the critical need for precision machining and advanced material testing, underscoring the high technical threshold for entry.

Established customer relationships and a strong reputation are major barriers for new entrants in the fluid transfer systems market, especially in sectors like marine and offshore where reliability is non-negotiable. GS-Hydro has cultivated a reputation for dependable, leak-free systems, a trust that new competitors must painstakingly build.

The hydraulics market, as highlighted by industry analyses, places a premium on safety and reliability, making it difficult for newcomers to displace established players like GS-Hydro. Building this level of trust and proving a track record takes considerable time and investment, acting as a significant deterrent.

Economies of Scale and Experience Curve Advantages

Existing players in the fluid transfer system market, such as GS-Hydro, leverage significant economies of scale in their operations. This includes bulk purchasing of raw materials, optimized manufacturing processes, and efficient distribution networks, all of which contribute to lower per-unit costs that are challenging for new entrants to achieve.

The experience curve is another formidable barrier. GS-Hydro's decades of accumulated knowledge in designing, fabricating, installing, and maintaining complex fluid transfer systems translate into greater efficiency, fewer errors, and higher quality. This deep-seated expertise allows them to offer superior service and potentially lower prices than a newcomer could initially provide.

The fluid transfer system market is projected for continued growth, with some estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years. This expansion indicates that established companies are already benefiting from scaling their operations, further solidifying their cost advantages and making it harder for new competitors to break in.

- Economies of Scale: Lower procurement costs due to larger order volumes.

- Experience Curve: Reduced production costs and improved quality through accumulated learning.

- Market Growth: Expansion in the fluid transfer system market (e.g., projected CAGR >5%) favors established players' scaling efforts.

- Barriers to Entry: New entrants face significant hurdles in matching the cost efficiencies and operational expertise of incumbents.

Stringent Regulatory Requirements and Certifications

The marine, offshore, and industrial sectors are heavily regulated, demanding strict adherence to safety standards and quality certifications for piping systems. New companies entering these markets must invest significant time and capital to understand and comply with these complex regulatory frameworks and secure necessary approvals. This rigorous compliance process, including obtaining certifications like ISO 9001 or specific maritime classification society approvals, acts as a substantial barrier to entry.

For instance, in 2024, the International Maritime Organization (IMO) continued to emphasize stricter environmental regulations, such as those related to ballast water management and emissions, which directly impact piping system design and material choices. Companies seeking to supply these sectors must demonstrate robust quality management systems and often undergo extensive audits by classification societies. This creates a high hurdle for newcomers, favoring established players with proven track records and existing certifications.

- Regulatory Complexity: Navigating diverse international and national safety and environmental regulations for piping systems.

- Certification Costs: Acquiring certifications from bodies like DNV, Lloyd's Register, or ABS requires substantial financial investment and time.

- Industry Standards: Meeting stringent quality and performance standards, such as those set by ASME or API, is mandatory.

- Compliance Burden: The ongoing cost and effort to maintain compliance with evolving regulations and standards deter new entrants.

The threat of new entrants into the specialized non-welded piping system market, particularly for critical sectors like marine and offshore, remains relatively low. Significant capital investment is required for R&D, advanced manufacturing, and specialized machinery, creating a substantial financial barrier. GS-Hydro's proprietary flanged connection system, backed by extensive R&D and engineering expertise, is difficult and costly for newcomers to replicate, ensuring leak-free performance.

Established customer relationships and a strong reputation for reliability, particularly in safety-conscious industries, are major deterrents. New competitors must invest considerable time and resources to build trust and prove their track record, a process that can take years. For example, in 2024, the demand for precision machining and advanced material testing in flange manufacturing, as noted in industry trends, highlights the high technical threshold for entry.

Regulatory hurdles and the need for stringent certifications from bodies like DNV or Lloyd's Register also pose significant challenges. Compliance with evolving safety and environmental standards, such as IMO regulations introduced in 2024, demands substantial investment and time, favoring established players with proven compliance histories.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and machinery. | Significant financial hurdle. |

| Proprietary Technology | GS-Hydro's unique, leak-free flanged connection system. | Difficult and costly to replicate. |

| Brand Reputation & Customer Loyalty | Established trust in reliability and performance. | Requires extensive time and investment to build. |

| Regulatory Compliance | Adherence to strict safety, quality, and environmental standards (e.g., IMO 2024). | Demands significant time, capital, and expertise for certifications. |

Porter's Five Forces Analysis Data Sources

Our GS-Hydro Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company annual filings, and expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive pressures.