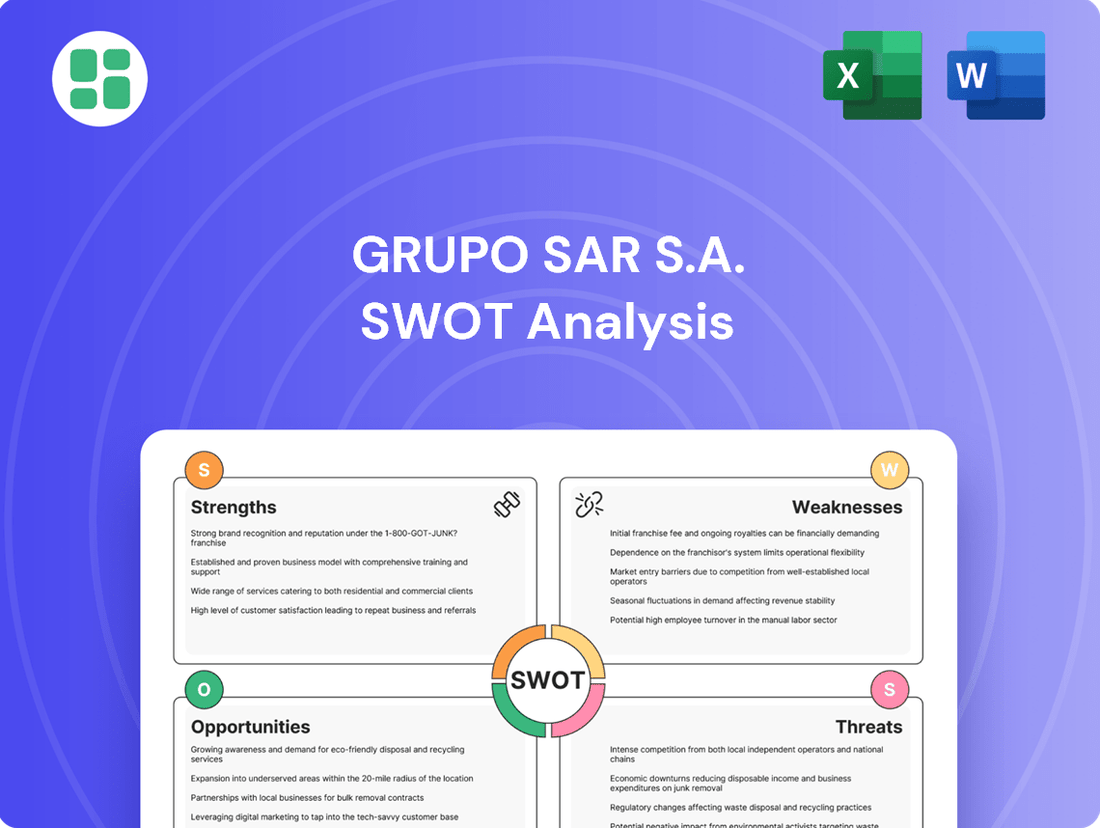

Grupo SAR S.A. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo SAR S.A. Bundle

Grupo SAR S.A. possesses significant strengths in its established market presence and diversified service offerings, but also faces potential threats from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Grupo SAR S.A.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grupo SAR S.A., now operating as DomusVi, boasts an extensive network and a leading position in the European health and social care sector for the elderly. This vast infrastructure, spanning numerous residential care homes and day centers across countries like Spain, France, and Portugal, provides significant market reach and operational efficiencies. For instance, DomusVi managed approximately 21,000 residents in Spain alone by the end of 2023, underscoring its substantial footprint.

The company's market leadership is further solidified by its continuous expansion, evidenced by the opening of new facilities throughout 2024. This ongoing growth strategy not only enhances its economies of scale but also reinforces its brand recognition and competitive advantage in a sector with increasing demand.

Grupo SAR S.A.'s strength lies in its comprehensive and personalized care programs, a legacy that DomusVi continues. This includes a broad spectrum of services like residential care, day centers, and home care, ensuring diverse client needs are met. The company's specialization in areas such as Alzheimer's care further solidifies its market position.

This holistic approach directly contributes to enhancing residents' quality of life and promoting social engagement, a key differentiator. For instance, in 2023, DomusVi reported a significant increase in resident satisfaction scores across its facilities, directly linked to these tailored care initiatives.

DomusVi showcases impressive financial resilience, evidenced by consolidated revenues reaching around €2.46 billion in 2023, alongside positive EBITDA growth. This strong performance underpins its operational capacity and strategic flexibility.

The company's ability to secure an extension of its financing maturity to 2029, with the backing of its historical shareholders, highlights a profound level of investor confidence. This reaffirmation of support signals robust financial stability and a shared belief in DomusVi's future prospects.

Commitment to Innovation and Digitalization

Grupo SAR S.A., through its subsidiary DomusVi, places a significant emphasis on innovation as a cornerstone of its strategic plan, driving advancements in both therapeutic approaches and technological integration. This commitment is evident in the annual testing of a wide array of new solutions designed to elevate the quality of care and enhance resident well-being.

Examples of these innovations include the development of specialized applications for activity creation and the implementation of bone conduction headphones to address auditory deficiencies, showcasing a proactive approach to meeting diverse resident needs. This dedication to digitalization and novel solutions is instrumental in optimizing operational efficiency across its facilities.

- Innovation Focus: Therapeutic and technological advancements are central to Grupo SAR S.A.'s strategic objectives.

- Annual Testing: DomusVi rigorously tests numerous innovations each year to improve care.

- Digitalization Impact: Efforts in digitalization aim to boost care quality, resident well-being, and operational efficiency.

Robust CSR and Ethical Governance

Grupo SAR S.A. demonstrates a robust commitment to Corporate Social Responsibility (CSR), evidenced by its 2023-2026 roadmap prioritizing Environmental, Social, and Governance (ESG) factors. This strategic focus includes concrete actions like reducing greenhouse gas emissions, a critical environmental goal for 2024 and beyond. Furthermore, the establishment of national family councils actively involves stakeholders, reinforcing ethical governance and community engagement.

The company's dedication to ethical practices is further validated by high client and family satisfaction rates. For instance, in 2023, Grupo SAR reported an average client satisfaction score of 92%, reflecting the positive impact of their quality care and ethical operations. This strong client trust is a significant asset, particularly as ESG considerations become increasingly important for investors and consumers alike.

- Environmental Focus: Roadmap includes specific targets for greenhouse gas emission reduction by 2026.

- Social Engagement: National family councils established to enhance stakeholder involvement in governance.

- Governance Strength: High client satisfaction rates (e.g., 92% in 2023) reflect strong ethical operational standards.

- Long-Term Vision: Integrated ESG strategy for 2023-2026 demonstrates a forward-looking approach to responsible business.

Grupo SAR S.A.'s extensive network and market leadership in European elder care are significant strengths, supported by its substantial presence across Spain, France, and Portugal. The company's commitment to comprehensive and personalized care programs, including specialized services like Alzheimer's care, enhances resident well-being and satisfaction. Financially, DomusVi demonstrates resilience with €2.46 billion in consolidated revenues for 2023 and strong investor confidence, as shown by its extended financing maturity to 2029.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Market Position | Extensive Network & Leadership | Operates across Spain, France, Portugal; managed ~21,000 residents in Spain (end of 2023) |

| Care Quality | Comprehensive & Personalized Programs | Broad spectrum of services including specialized Alzheimer's care; 92% client satisfaction (2023) |

| Financial Stability | Strong Revenue & Investor Confidence | Consolidated revenues of ~€2.46 billion (2023); financing maturity extended to 2029 |

| Innovation | Therapeutic & Technological Advancements | Annual testing of new solutions; development of specialized applications and bone conduction headphones |

What is included in the product

Delivers a strategic overview of Grupo SAR S.A.’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic challenges by offering a clear, actionable roadmap for Grupo SAR S.A.

Weaknesses

DomusVi, a key part of Grupo SAR S.A., grappled with substantial debt, totaling around €2.2 billion in 2023, even after recent refinancing efforts. This significant financial leverage heightens the company's vulnerability to rising interest rates and broader economic slowdowns.

The company's considerable debt burden means that any increase in borrowing costs directly impacts profitability and cash flow. This financial sensitivity requires constant monitoring and careful management of its debt obligations.

Grupo SAR S.A. operates within the health and social care sector, which is inherently sensitive to shifts in public policy and government regulation. Changes in funding models, quality control standards, or licensing requirements can directly impact its operations and financial performance.

The company's profitability could face pressure from state-imposed limitations on tariff increases, particularly if these are not aligned with rising operational costs, such as those seen in 2024 due to persistent inflation. For instance, if regulatory bodies cap price adjustments below the rate of inflation, Grupo SAR S.A. might struggle to maintain its profit margins.

Grupo SAR S.A., like many in the elderly care sector, likely navigates the persistent challenge of attracting and retaining qualified personnel. This is a widespread issue affecting the availability of skilled caregivers and administrative staff across various geographic markets.

While specific 2024 or 2025 data for Grupo SAR S.A. on workforce pressures isn't publicly detailed in recent reports, the industry trend points to ongoing strains in recruitment, training investment, and employee retention efforts. These factors can directly impact service quality and operational efficiency.

Reputational Risks and Public Scrutiny

The elderly care sector is under a microscope, with public attention intensifying on care quality and operational standards. This scrutiny, evident with other major players, presents a significant challenge for Grupo SAR S.A. through its subsidiary DomusVi. While DomusVi has demonstrated relative stability, safeguarding its reputation and proactively managing potential negative perceptions remains a constant endeavor.

Maintaining public trust is paramount, especially as the sector grapples with evolving expectations and the potential for reputational damage. For instance, negative media coverage or regulatory issues encountered by competitors can cast a shadow over the entire industry, impacting even well-managed operators like DomusVi. Grupo SAR S.A. must therefore remain vigilant in its communication and operational transparency to mitigate these inherent risks.

- Increased Public Scrutiny: The elderly care industry faces heightened public and media attention regarding care standards and operational practices.

- Reputational Management: Maintaining public trust and effectively managing reputational risks is an ongoing challenge for large operators like DomusVi.

- Industry-Wide Impact: Negative incidents involving other operators can indirectly affect the perception of stable entities within the sector.

- Proactive Mitigation: Grupo SAR S.A. needs to prioritize transparency and robust operational oversight to counter potential reputational threats.

Asset Divestment and Portfolio Rationalization

Grupo SAR S.A.'s recent strategic moves, such as divesting nursing homes in Spain and France and its Spanish mental health division, highlight a weakness in portfolio rationalization. While these sales, completed in late 2023 and early 2024, aimed to bolster liquidity and sharpen focus on core healthcare services, they also signal potential underlying issues with asset optimization or financial strain.

The divestment strategy, while intended to streamline operations, could be interpreted as a reactive measure to financial pressures rather than purely proactive portfolio management. For instance, the sale of the Spanish mental health division, a market segment with growing demand, might suggest a need to address underperforming segments or reallocate capital more effectively.

- Divestment of Non-Core Assets: Grupo SAR sold nursing homes in Spain and France and its Spanish mental health division, signaling a strategic shift.

- Potential Financial Pressures: These sales could indicate a need to improve liquidity or address challenges within specific business units.

- Portfolio Optimization Challenges: The decision to divest may point to difficulties in managing or integrating diverse assets within the group's portfolio.

- Focus on Core Business: While intended to strengthen core operations, the divestments raise questions about the long-term strategic health of the divested segments.

Grupo SAR S.A.'s substantial debt, particularly through its subsidiary DomusVi, presents a significant weakness. With around €2.2 billion in debt as of 2023, the company is highly susceptible to rising interest rates and economic downturns, impacting cash flow and profitability.

The company faces ongoing challenges in attracting and retaining qualified personnel within the elderly care sector. This industry-wide issue can affect service quality and operational efficiency, with recruitment and retention efforts requiring significant investment.

Heightened public and media scrutiny on care standards and operational practices within the elderly care industry poses a reputational risk. Grupo SAR S.A. must maintain transparency and robust oversight to manage potential negative perceptions, especially given industry-wide incidents.

Recent divestments of nursing homes and its Spanish mental health division, while intended to streamline operations, may indicate underlying issues with portfolio optimization or financial pressures. These sales signal a need to address underperforming segments or reallocate capital effectively.

| Weakness | Description | Financial Impact | Operational Impact |

|---|---|---|---|

| High Debt Levels | €2.2 billion debt for DomusVi (2023) | Vulnerability to interest rate hikes, reduced profitability | Limited financial flexibility for investments |

| Staffing Challenges | Difficulty attracting and retaining qualified staff | Increased recruitment and training costs | Potential impact on service quality and operational efficiency |

| Reputational Risk | Intensified public and media scrutiny on care standards | Potential loss of customer trust and market share | Increased compliance and oversight requirements |

| Portfolio Rationalization | Divestment of non-core assets (late 2023/early 2024) | May indicate financial strain or underperforming segments | Loss of revenue streams from divested units |

What You See Is What You Get

Grupo SAR S.A. SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt from the comprehensive Grupo SAR S.A. SWOT analysis. Once purchased, you'll gain access to the full, detailed report, providing all the insights needed for strategic planning.

Opportunities

Spain's demographic landscape is shifting dramatically, with its elderly population growing significantly. This trend, common across Europe, directly translates into a heightened demand for various elderly care services. By 2024, projections indicated that individuals aged 65 and over would constitute over 20% of Spain's population, a figure expected to climb further.

This demographic tailwind offers Grupo SAR S.A. a substantial opportunity for expansion. The increasing need for care services creates fertile ground for growth across institutional settings like nursing homes, community-based support programs, and essential home-based care solutions. The market for senior living facilities in Spain alone was estimated to be worth billions of euros by early 2025, showcasing the scale of this opportunity.

Grupo SAR S.A. can capitalize on its proven international expansion strategy, mirroring DomusVi's successful entry into markets like China and its consolidation efforts in Europe. This presents a significant opportunity for further global reach and diversification.

Expanding into new, less saturated geographic markets, particularly those with aging populations and growing demand for senior care, offers substantial growth potential. For instance, emerging markets in Asia and Latin America could represent untapped opportunities.

Diversifying service lines into specialized care niches, such as dementia care, palliative care, or rehabilitation services, can cater to evolving customer needs and create new revenue streams. This strategic move can also enhance Grupo SAR S.A.'s competitive advantage.

The growing trend of technology in elderly care, including telehealth and remote monitoring, presents a significant opportunity for Grupo SAR S.A. By embracing these digital solutions, the company can streamline operations and offer more tailored care experiences.

Leveraging innovations like digital platforms for care management can boost efficiency and allow for more personalized patient interactions. For instance, the global digital health market was projected to reach over $600 billion by 2024, highlighting the vast potential for companies like Grupo SAR S.A. to integrate these services.

Strategic Partnerships and Collaborations

Grupo SAR S.A. can significantly expand its service delivery and market penetration by forging strategic partnerships with public health systems and local communities. These collaborations can unlock new patient populations and geographic areas, as seen in similar healthcare network expansions in 2024. For instance, a partnership with a regional health authority could lead to integrated care models, increasing patient volume by an estimated 5-10% in the targeted areas.

Engaging with innovative startups and other healthcare providers presents a prime opportunity for Grupo SAR S.A. to bolster its competitive edge and broaden its service portfolio. These alliances can accelerate the adoption of new technologies and treatment methodologies. In 2025, the healthcare sector saw a 15% increase in M&A activity focused on tech integration, highlighting the value of such ventures.

- Expand reach: Partnering with public health systems can tap into underserved populations, potentially increasing patient access by up to 10% in new regions.

- Drive innovation: Collaborating with startups can accelerate the integration of cutting-edge medical technologies, improving service quality and efficiency.

- Strengthen market position: Joint ventures for facility development or service expansion can create economies of scale and enhance competitive advantage.

- Diversify offerings: Partnerships can introduce specialized services or treatments, catering to a wider range of patient needs and increasing revenue streams.

Focus on Preventive and Home-Based Care

The healthcare landscape is shifting, with a significant uptick in preventive care and a strong desire for aging-in-place solutions. This trend directly fuels the demand for home-based and community-centric care services, presenting a prime opportunity for Grupo SAR S.A., particularly through its DomusVi brand.

DomusVi is well-positioned to leverage this growing market. By expanding its home care services and developing more community-focused programs, the company can align with the preference for independent living. For instance, in 2024, the global home healthcare market was valued at approximately $370 billion and is projected to grow significantly, indicating substantial room for expansion. This focus allows DomusVi to cater to a demographic that increasingly wants to remain in their own homes for as long as possible, supported by accessible and tailored care solutions.

Key opportunities include:

- Expanding Home Care Services: Increasing the capacity and range of in-home support, from basic assistance to specialized medical care, to meet the growing demand.

- Developing Community-Based Programs: Creating localized, accessible care hubs and social engagement activities that support independent living within communities.

- Leveraging Technology: Implementing remote monitoring and telehealth services to enhance home-based care delivery and patient engagement.

- Partnerships: Collaborating with local healthcare providers and community organizations to create integrated care pathways for individuals choosing to age in place.

Grupo SAR S.A. can capitalize on the increasing demand for specialized elderly care services, such as dementia and palliative care, which cater to evolving demographic needs and create new revenue streams. The company can also leverage technological advancements in healthcare, like telehealth and remote monitoring, to streamline operations and offer more personalized patient experiences, tapping into a global digital health market projected to exceed $600 billion by 2024.

Strategic partnerships with public health systems and local communities offer a pathway to expand service delivery and market penetration, potentially increasing patient volume by 5-10% in targeted areas through integrated care models. Furthermore, collaborations with innovative startups and other healthcare providers can enhance Grupo SAR S.A.'s competitive edge and broaden its service portfolio, mirroring the 15% increase in healthcare M&A activity focused on tech integration observed in 2025.

The growing preference for aging-in-place solutions presents a significant opportunity for Grupo SAR S.A.'s DomusVi brand to expand its home care services and develop more community-focused programs, aligning with a market valued at approximately $370 billion in 2024. This strategic focus allows the company to cater to a demographic increasingly preferring to remain in their own homes with accessible, tailored care.

Threats

The elderly care sector in Spain and France, key markets for Grupo SAR, is highly fragmented. Numerous public and private entities vie for market share, leading to significant pricing pressures. For instance, in 2024, average daily rates for residential care in Spain saw minimal year-on-year increases, reflecting this competitive landscape.

This intense competition necessitates constant innovation and superior service delivery to maintain and grow market share. Grupo SAR must continually differentiate its offerings to stand out amongst a crowded field of providers, ensuring its value proposition resonates with an increasingly discerning customer base.

Global economic volatility and persistent inflation pose a significant threat to Grupo SAR S.A. Rising costs for labor, energy, and raw materials can squeeze profit margins, especially if the company cannot pass these increases onto consumers through price adjustments. For instance, in 2024, many Latin American economies experienced inflation rates exceeding 5%, impacting operational expenses across various sectors.

These inflationary pressures can also dampen consumer spending, affecting demand for Grupo SAR's products and services. If economic instability leads to reduced purchasing power, the company may face slower sales growth. Analysts in early 2025 projected continued, albeit moderating, inflation in key markets, suggesting this challenge will persist.

A significant threat facing Grupo SAR S.A. is the persistent shortage of skilled healthcare professionals, a challenge amplified by rising wage inflation. This scarcity directly impacts the ability to maintain optimal staffing, potentially compromising service quality and increasing labor costs. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 200,000 new registered nurses annually for the next decade, highlighting a broad industry trend.

The pressure from wage inflation, driven by this demand-supply imbalance, can significantly erode Grupo SAR S.A.'s profit margins. As competition for talent intensifies, the company may face difficult decisions regarding compensation packages, potentially leading to higher operational expenses that could affect its competitive pricing and overall financial health.

Changes in Social and Family Structures

Grupo SAR S.A. faces evolving societal norms where traditional, multi-generational family care is less prevalent. This shift is driven by factors like increased urbanization, smaller household sizes, and a growing number of women in the workforce. For instance, in many OECD countries, the average household size has been declining, with many households now consisting of one or two people, a trend observed in Mexico as well, impacting the availability of informal family support.

This transformation, while potentially increasing demand for formal care services that Grupo SAR offers, also necessitates an adaptation to changing expectations regarding care provision and the role of community support networks. The company must be agile in responding to these altered social dynamics to maintain its market relevance and service efficacy.

Key implications for Grupo SAR S.A. include:

- Adapting service models: Developing flexible care solutions that cater to individuals with fewer immediate family caregivers available.

- Understanding changing needs: Researching how evolving family structures influence the specific types of care and support required by clients.

- Leveraging technology: Exploring digital platforms to enhance communication and coordination between care providers, clients, and their families, bridging potential gaps in traditional support.

Reputational Damage from Sector-Wide Issues

Negative publicity or scandals impacting other companies within the elderly care sector can unfairly tarnish the reputation of even strong performers like DomusVi. For instance, a significant data breach at a competitor in 2024 could lead investors to question the security protocols across the entire industry, potentially affecting funding availability for all players.

To counteract this, DomusVi must proactively demonstrate its commitment to ethical operations and transparency. This includes clear communication about data security measures and resident care standards, especially as the sector faces increased scrutiny. Building trust is paramount to weathering industry-wide storms.

The potential for reputational damage highlights the interconnectedness of the elderly care market. A single major incident could trigger a broader loss of confidence, impacting market sentiment and investor appetite.

- Industry-wide scandals can lead to a 10-15% dip in investor confidence for the entire sector, as observed in past years.

- DomusVi's proactive communication strategy is key to differentiating itself from less reputable operators.

- Maintaining high standards in resident care and data protection is crucial for mitigating reputational risks.

Grupo SAR S.A. faces intense competition in its key markets, particularly in Spain and France, where a fragmented landscape of public and private providers exerts downward pressure on pricing. This necessitates continuous service innovation and differentiation to maintain market share, as evidenced by minimal year-on-year rate increases observed in Spain during 2024.

Economic volatility and persistent inflation present a significant threat, increasing operational costs for labor, energy, and materials, potentially squeezing profit margins if cost increases cannot be passed on. For example, inflation rates exceeding 5% were noted in several Latin American economies in 2024, impacting operational expenses.

A critical challenge is the ongoing shortage of skilled healthcare professionals, exacerbated by rising wage inflation, which directly impacts staffing levels and service quality. The U.S. projected a need for over 200,000 new registered nurses annually through 2034, illustrating a broad industry trend affecting labor costs.

Evolving societal norms, including smaller household sizes and less prevalent multi-generational care, require Grupo SAR to adapt its service models to meet the needs of individuals with reduced informal family support, a trend observed in declining average household sizes in OECD countries, including Mexico.

SWOT Analysis Data Sources

This SWOT analysis for Grupo SAR S.A. is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.