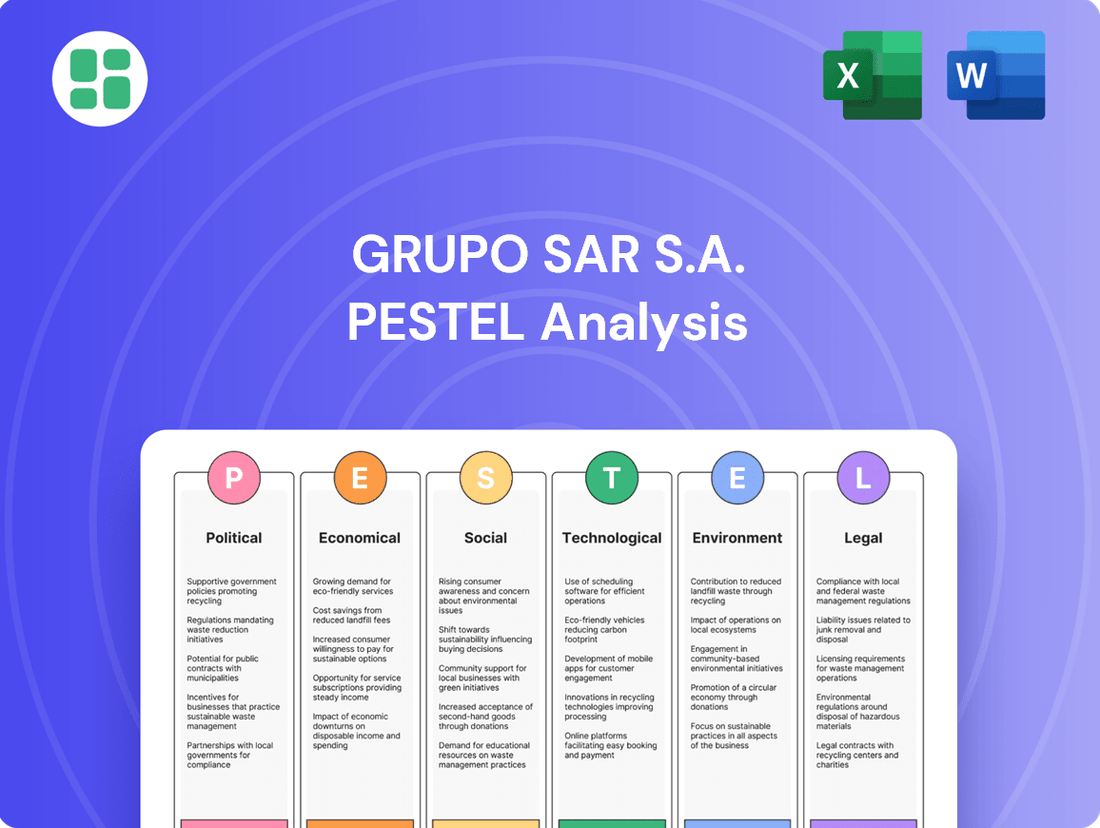

Grupo SAR S.A. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo SAR S.A. Bundle

Grupo SAR S.A. operates within a dynamic external environment shaped by significant political, economic, and technological shifts. Understanding these forces is crucial for strategic planning and identifying potential opportunities or threats. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights. Download the full version to gain a competitive edge and make informed decisions for Grupo SAR S.A.'s future.

Political factors

The Spanish government is prioritizing its aging demographic through policies promoting active aging and improved social care. The National Strategy for a new model of care in the community 2024-2030 is a key initiative, aiming to shift towards personalized, community-based support systems.

This strategy intends to decrease reliance on institutional care, allowing elderly individuals to remain in their communities with dignity. This focus on community care aligns with a broader European trend, as Spain's population aged 65 and over is projected to reach 30% by 2050, up from approximately 20% in 2023.

Public funding is a major driver in Spain's elderly care sector, with the government actively boosting investments to enhance service accessibility and affordability. In 2023, national spending on long-term care saw a substantial increase over 2020 figures, reflecting a commitment to expand beneficiary reach and elevate service standards.

This financial backing is indispensable for both public entities and private operators in the elderly care space, including major players like DomusVi. Such subsidies directly influence the operational capacity and growth potential of companies like Grupo SAR S.A. by reducing the financial burden on end-users and supporting infrastructure development.

The stability of regulations is crucial for Grupo SAR. The Universal Health Care Bill, passed in June 2024, signals a move towards broader healthcare access, which could expand market opportunities for care providers. This legislation aims to integrate various healthcare services, potentially impacting how companies like Grupo SAR operate within the national health system.

However, regulatory shifts also present potential hurdles. For instance, discussions around reclassifying home care workers could affect existing labor agreements and the professionalization initiatives within the sector. Such changes might necessitate adjustments to operational models and cost structures for companies relying on these services.

Public-Private Partnerships

Public-private partnerships (PPPs) are a cornerstone of Spain's social care system, fostering collaboration between government bodies and private companies. This model is particularly relevant for Grupo SAR S.A., a key player in the elderly care sector. The Spanish government actively encourages these partnerships to enhance service delivery and manage costs. For instance, in 2023, approximately 25% of all public procurement contracts in the social services sector were awarded to private entities, highlighting the significant role of PPPs.

The decentralized nature of Spain's social care means that regional governments often contract private providers to deliver services. This creates a dynamic where private operators, such as DomusVi, work alongside public institutions. Government policies on service provision and funding directly influence the structure and success of these arrangements. A 2024 report indicated that over €5 billion was allocated to public-private collaborations in healthcare and social services across Spain, with a notable portion directed towards elderly care facilities.

The effectiveness of PPPs in Spain's social care sector is continually evaluated, with ongoing policy discussions focused on optimizing funding models and ensuring equitable access to care. Key considerations for Grupo SAR S.A. include adapting to evolving regulatory frameworks and demonstrating value within these collaborative structures. The Spanish government's commitment to modernizing social care through private sector involvement is expected to continue, with further investment anticipated in PPP initiatives through 2025.

- Public Procurement: In 2023, private entities secured roughly 25% of social services public procurement contracts in Spain.

- Sector Investment: Over €5 billion was channeled into public-private collaborations for healthcare and social services in Spain in 2024.

- Policy Influence: Government decisions on service provision and funding are critical determinants for the success of PPPs in the social care domain.

Political Emphasis on De-institutionalization

Governments globally are increasingly prioritizing de-institutionalization, advocating for community-based and home care solutions over traditional residential facilities. This political emphasis is driven by a desire for more personalized care and cost efficiencies. For Grupo SAR S.A., this translates to a growing demand for services that support individuals in their own homes and communities.

Spain's National Strategy for a new model of care in the community 2024-2030 exemplifies this trend. It specifically targets personalized service planning and support structures designed to enable individuals to remain in their homes. This strategic direction signals a significant shift in the care landscape, influencing the types of services and infrastructure that care providers like Grupo SAR S.A. must develop and offer to align with evolving public policy and citizen needs.

- Shift to Community Care: Political agendas are actively promoting the move away from large institutions towards localized, community-integrated care models.

- Personalized Support: The focus is on tailoring services to individual needs, enabling greater autonomy and a preference for home-based living.

- Policy Alignment: The 2024-2030 strategy in Spain highlights a commitment to fostering environments where individuals can thrive within their communities.

- Market Adaptation: Care providers must adapt their offerings to meet the growing demand for home care, assisted living, and community support services.

Political factors significantly shape Grupo SAR S.A.'s operating environment, particularly through government initiatives promoting community-based elderly care. Spain's National Strategy for a new model of care in the community 2024-2030 underscores a political commitment to de-institutionalization, favoring personalized, home-based support. This policy shift is backed by substantial public investment, with over €5 billion allocated to public-private collaborations in healthcare and social services in 2024, a portion of which directly benefits elderly care. The government's increasing reliance on public-private partnerships, evidenced by private entities securing approximately 25% of social services public procurement contracts in 2023, creates a framework where companies like Grupo SAR S.A. can thrive by aligning with state objectives.

| Policy Area | Key Initiative/Trend | Impact on Grupo SAR S.A. | Data Point |

|---|---|---|---|

| Elderly Care Model | De-institutionalization & Community Care | Increased demand for home and community-based services | National Strategy for a new model of care in the community 2024-2030 |

| Public Funding & Partnerships | Increased investment in PPPs for social services | Greater opportunities through government contracts and subsidies | ~25% of social services public procurement contracts awarded to private entities in 2023 |

| Healthcare Integration | Universal Health Care Bill (June 2024) | Potential for expanded service integration and market access | Aims to integrate various healthcare services |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Grupo SAR S.A., examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights into how these global and regional trends create both challenges and strategic opportunities for the company's growth and sustainability.

This PESTLE analysis for Grupo SAR S.A. offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations by highlighting key external factors impacting the business.

It provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping to support discussions on external risk and market positioning.

Economic factors

The Spanish elderly care services market is a rapidly expanding sector, projected to grow from an estimated USD 7.89 billion in 2024 to USD 11.89 billion by 2030. This significant expansion is fueled by a compound annual growth rate (CAGR) of 7.28%, underscoring strong market momentum.

A key driver behind this growth is Spain's demographic shift towards an older population, leading to a heightened demand for specialized care solutions. This trend supports both the expansion of institutional care facilities and the increasing preference for home-based care services.

Spain's economic trajectory is robust, with projected GDP growth of 2.5% in 2024 and a further 1.8% in 2025, surpassing the broader European economic performance. This expansion is a positive indicator for companies like Grupo SAR, suggesting a favorable environment for increased consumer spending.

While inflation is showing signs of easing, its persistence, coupled with potential cost pressures from the reversal of VAT reductions on energy products, warrants attention. These factors could impact operational expenses and pricing strategies for service providers.

A growing economy typically translates to higher disposable incomes, which can significantly boost demand for private healthcare services. This trend bodes well for Grupo SAR, as consumers are more likely to invest in personal well-being and specialized care when their financial situations improve.

Public spending on social care is on the rise, with Spain's government and institutions like the Council of Europe Development Bank (CEB) channeling substantial funds to meet the escalating demand for elderly and disability support. These initiatives are designed to improve access to quality care, especially for those with lower incomes, directly impacting how both public and private entities in the sector set their prices and structure their services.

Private Investment and Market Opportunities

The senior living sector in Spain is a key area for private investment, with forecasts suggesting around €3 billion will be injected over the next three years. This presents substantial market opportunities for companies like Grupo SAR S.A. to expand or partner within this growing segment.

The investment climate is active, as demonstrated by companies such as DomusVi engaging in asset sales to strengthen their financial positions or making strategic divestments. This activity highlights a dynamic market where capital is flowing and strategic moves are being made, creating potential avenues for growth and collaboration.

- Projected Investment: €3 billion in Spain's senior living sector over the next three years (2024-2027).

- Market Dynamics: Active participation from major players like DomusVi, involving asset sales and strategic divestments.

- Opportunity for Grupo SAR S.A.: Potential for expansion, partnerships, or acquisitions within a robust and evolving market.

Labor Market Dynamics and Costs

Spain's labor market is projected to see continued job growth, but specific sectors like healthcare and social services may face skilled worker shortages due to an aging population. This demographic shift could put upward pressure on wages in these critical areas.

Recent wage negotiations and new legislation impacting home care workers are directly influencing labor costs for providers. For instance, agreements in late 2023 and early 2024 have aimed to improve working conditions, which can translate to higher operational expenses.

- Skilled Worker Shortages: Projections indicate a growing demand for healthcare professionals, potentially outstripping supply.

- Wage Pressures: Minimum wage adjustments and collective bargaining agreements are likely to increase payroll expenses.

- Regulatory Impact: New regulations on working hours and conditions for care sector employees could necessitate increased staffing or overtime pay.

Spain's economy is on a solid footing, with GDP expected to grow by 2.5% in 2024 and 1.8% in 2025, outperforming the European average. This economic expansion is favorable for Grupo SAR, as it generally leads to increased consumer spending power, particularly for services like elderly care. However, persistent inflation and potential increases in energy costs due to VAT changes could raise operational expenses for the company.

The Spanish government is increasing public spending on social care, supported by institutions like the CEB, to address the growing demand for elderly and disability services. This public investment influences pricing and service structures for both public and private providers, including Grupo SAR. The senior living sector is attracting significant private investment, with an estimated €3 billion expected over the next three years, presenting substantial growth opportunities through expansion or partnerships.

Labor market trends indicate continued job growth, but shortages of skilled workers in healthcare and social services are anticipated due to the aging population. This scarcity could drive up wages, impacting Grupo SAR's payroll costs. Recent wage negotiations and new legislation for home care workers, aimed at improving conditions, are also likely to increase operational expenses.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Grupo SAR | Key Data Point |

|---|---|---|---|---|

| GDP Growth | 2.5% | 1.8% | Positive for consumer spending, potential revenue increase | Spain's GDP growth forecast |

| Inflation | Easing but persistent | Monitoring required | Potential increase in operational costs, pricing pressure | VAT reduction reversal on energy products |

| Public Spending on Social Care | Increasing | Increasing | Influences market pricing and service models | CEB funding for elderly/disability support |

| Private Investment in Senior Living | €3 billion (next 3 years) | N/A | Opportunities for expansion and partnerships | Senior living sector investment forecast |

| Labor Market (Skilled Workers) | Job growth, but shortages in healthcare/social services | Shortages likely to persist | Upward pressure on wages, increased payroll costs | Demographic shift towards older population |

Full Version Awaits

Grupo SAR S.A. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Grupo SAR S.A. details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities.

Sociological factors

Spain's population is aging rapidly, with over 20% of citizens already above 65. This trend is expected to continue, with projections suggesting this figure could reach 30% by 2050, making Spain one of Europe's oldest nations.

This demographic shift, fueled by declining birth rates and longer life expectancies, directly translates into a growing market for elder care services. Companies like Grupo SAR S.A., which specializes in this sector, are well-positioned to capitalize on this increasing demand.

In Spain, the traditional reliance on family for elder care is shifting. As more women join the workforce, a trend that saw female labor force participation reach 54.6% in Q1 2024 according to Eurostat, the capacity for extended family to provide full-time care is diminishing.

This societal evolution directly fuels a growing demand for formal care services. The market for professional home care, assisted living facilities, and nursing homes is experiencing a significant upswing as families seek reliable alternatives for their aging relatives.

There's a noticeable shift towards seniors wanting to stay in their own homes or familiar communities for care. This trend, often called aging in place, is driving a greater need for personalized and community-focused services, moving away from traditional nursing homes. For instance, in 2024, the home healthcare market in Latin America was valued at approximately $15 billion, with projections indicating continued robust growth as this preference solidifies.

Public Awareness and Perception of Elder Care

Public awareness surrounding the critical need for quality elder care has surged, particularly in the wake of the COVID-19 pandemic. This global health crisis starkly revealed vulnerabilities within existing elder care systems, prompting a significant shift in public discourse and expectations. For instance, by late 2023, reports indicated a substantial increase in media coverage dedicated to senior living conditions and care quality, reflecting heightened public scrutiny.

There's a discernible and growing societal demand for elder care services that not only provide essential support but also champion dignity, autonomy, and overall well-being for seniors. This evolving perception translates into a preference for integrated care models that foster independence and a high quality of life. Surveys from 2024 showed that over 70% of adults aged 50 and above expressed a desire for aging in place, highlighting the importance of home-based care solutions and community support.

- Increased Media Focus: Post-pandemic, media attention on elder care quality has intensified, raising public consciousness.

- Societal Expectations: A growing demand exists for dignified, high-quality elder care that respects senior autonomy.

- Preference for Independence: Data from 2024 suggests a strong majority of older adults wish to age in their own homes, influencing care service design.

- Integrated Care Models: The public is increasingly looking for holistic care solutions that address physical, social, and emotional needs.

Social Isolation and Well-being Concerns

The growing aging population, a significant demographic shift, intensifies concerns regarding social isolation and its impact on the well-being of seniors. As people live longer, the risk of loneliness increases, prompting a greater demand for services that actively combat this trend.

Care providers are now expected to go beyond basic health needs and implement strategies that foster social inclusion. This includes developing programs that encourage interaction, such as intergenerational activities and community integration initiatives, recognizing that social connection is vital for overall health.

- Loneliness Impact: Studies show that social isolation can be as detrimental to health as smoking 15 cigarettes a day, highlighting the urgency of addressing this issue.

- Care Provider Role: In 2024, a significant portion of elder care budgets are being allocated to social engagement programs, reflecting a shift in service priorities.

- Intergenerational Programs: The success of initiatives pairing seniors with younger generations for shared activities is on the rise, demonstrating a growing understanding of the benefits of diverse social interaction.

Societal shifts in Spain, marked by an aging populace and evolving family structures, are creating a robust demand for professional elder care. The increasing participation of women in the workforce, reaching 54.6% in Q1 2024, limits traditional family-based care, driving the need for formal services.

Public awareness of elder care quality has surged, amplified by the pandemic, leading to higher expectations for dignity and autonomy. A strong preference for aging in place, with over 70% of those aged 50+ desiring to remain in their homes as of 2024, is reshaping service delivery towards community-focused solutions.

The growing concern over social isolation among seniors necessitates care providers to prioritize social inclusion programs. This trend is evident in the increasing allocation of elder care budgets towards engagement activities and the rising popularity of intergenerational initiatives.

| Sociological Factor | Trend | Impact on Elder Care Market | Supporting Data (2024/2025) |

|---|---|---|---|

| Aging Population | Spain's population over 65 projected to reach 30% by 2050. | Increased demand for elder care services. | Over 20% of citizens currently over 65. |

| Changing Family Structures | Increased female labor force participation (54.6% in Q1 2024). | Reduced capacity for informal family care, boosting demand for professional services. | Shift from family reliance to formal care solutions. |

| Preference for Independence | Desire to age in place. | Growth in home care and community-based support services. | Over 70% of adults 50+ prefer aging in place. |

| Social Isolation Concerns | Recognition of loneliness as a significant health risk. | Emphasis on social engagement programs and community integration. | Increased budget allocation for social programs in elder care. |

Technological factors

Spain's healthcare system is increasingly embracing digitalization, paving the way for wider adoption of eHealth solutions. This digital transformation is evident in tools for patient management, electronic health records, and remote consultations, all contributing to greater efficiency and more tailored patient care.

By the end of 2024, it's projected that over 70% of Spanish primary care centers will utilize integrated digital platforms for patient records, a significant leap from just 45% in 2022. This technological shift directly supports Grupo SAR S.A.'s strategy to enhance service delivery through digital channels, potentially increasing patient engagement and operational throughput.

Telemedicine and remote monitoring are transforming healthcare accessibility, particularly for those with limited mobility or in rural settings. These advancements allow for constant patient oversight and virtual consultations, making healthcare more readily available and efficient.

In 2024, the global telemedicine market was valued at an estimated $150 billion and is projected to grow significantly. Remote patient monitoring devices, a key component, saw a substantial increase in adoption, with reports indicating a 20% year-over-year growth in connected health devices in the US alone during 2024. This trend directly benefits Grupo SAR S.A. by expanding its reach and service capabilities.

Grupo SAR S.A. is leveraging Artificial Intelligence (AI) and Big Data to significantly enhance the quality and efficiency of its healthcare services. By integrating these technologies, the company is moving towards more personalized treatment plans, aiming to improve patient outcomes and streamline operations. This focus on data-driven insights is a key technological advancement for the healthcare sector.

The application of AI in creating tailored care plans allows Grupo SAR S.A. to adapt treatments to individual patient needs, a significant step beyond one-size-fits-all approaches. Furthermore, robust data analytics are being employed to optimize various aspects of healthcare delivery, including drug development and the overall patient journey, mirroring trends seen in the burgeoning precision medicine field.

Assistive Technologies and Robotics

Innovation is significantly impacting the senior care sector, with assistive technologies and robotics playing a crucial role. These advancements aim to enhance the quality of life and independence for older adults. For instance, robot dispensers can manage medication schedules, while sophisticated sensors can detect falls, providing timely alerts.

The market for assistive technologies is experiencing robust growth. In 2024, the global assistive technology market size was valued at approximately USD 25.6 billion, with projections indicating a compound annual growth rate (CAGR) of around 5.8% through 2030. This growth is driven by an aging global population and increasing demand for solutions that support independent living.

Furthermore, smart home technologies are being integrated to create safer and more comfortable living environments for seniors. Virtual reality and augmented reality applications are also emerging as tools for cognitive and physical stimulation, offering engaging ways for seniors to stay active and mentally sharp in care settings.

- Medication Management: Automated dispensers ensure accurate and timely medication intake, reducing errors and improving adherence.

- Safety and Monitoring: Fall detection sensors and smart home monitoring systems provide crucial safety nets for seniors living alone.

- Cognitive and Physical Engagement: Virtual games and interactive platforms offer stimulating activities that promote mental acuity and physical well-being.

Technological Integration for Preventive Care

Technological advancements are revolutionizing preventive care for seniors, a key demographic for Grupo SAR S.A. Innovations such as health apps, wearable fitness trackers, and remote patient monitoring systems are enabling earlier detection of potential health issues and facilitating prompt interventions. This proactive approach supports seniors in maintaining their well-being and can significantly reduce the burden on public healthcare infrastructures.

The adoption of these technologies is growing rapidly. For instance, the global market for remote patient monitoring is projected to reach $175.1 billion by 2030, growing at a compound annual growth rate of 18.2% from 2023 to 2030, according to a report by Grand View Research. This indicates a strong trend towards tech-enabled health management.

- Wearable Devices: Smartwatches and fitness bands track vital signs like heart rate and sleep patterns, offering early indicators of health changes.

- Health Apps: Mobile applications provide tools for medication reminders, diet tracking, and exercise logging, empowering individuals to manage their health proactively.

- Remote Monitoring: Devices that transmit patient data to healthcare providers in real-time allow for continuous oversight and faster response to critical events.

Technological advancements are reshaping healthcare delivery for Grupo SAR S.A., with a strong push towards digital integration. Spain's healthcare system is seeing increased adoption of eHealth solutions, including electronic health records and telemedicine, aiming for more efficient and personalized patient care. By the close of 2024, over 70% of Spanish primary care centers are expected to use integrated digital platforms for patient records, up from 45% in 2022.

AI and Big Data are central to Grupo SAR S.A.'s strategy, enabling tailored treatment plans and optimizing healthcare operations. The global telemedicine market, valued at an estimated $150 billion in 2024, and the growing adoption of remote patient monitoring devices, with a 20% year-over-year growth in connected health devices in the US during 2024, highlight the significant opportunities in this tech-driven landscape.

Innovation in assistive technologies and robotics is enhancing senior care, promoting independence and quality of life. The global assistive technology market, valued at approximately $25.6 billion in 2024, is projected to grow at a CAGR of 5.8% through 2030. These technologies, alongside smart home integrations and VR/AR applications, are crucial for Grupo SAR S.A.'s focus on the senior demographic.

| Technology Area | 2024 Data/Projection | Impact on Grupo SAR S.A. |

|---|---|---|

| Digital Health Platforms | 70%+ of Spanish primary care centers by end of 2024 | Enhanced patient management, increased engagement |

| Telemedicine Market | Estimated $150 billion (2024) | Expanded service reach, improved accessibility |

| Assistive Technologies Market | $25.6 billion (2024), 5.8% CAGR (through 2030) | Improved quality of life for seniors, greater independence |

| Remote Patient Monitoring Market | Projected $175.1 billion by 2030 (18.2% CAGR from 2023) | Proactive health management, earlier detection of issues |

Legal factors

Spain's legal framework sets stringent quality of care standards for elderly services, particularly in nursing homes. These regulations are designed to safeguard the dignity and well-being of residents, ensuring they receive appropriate and humane care. Grupo SAR S.A., operating within this environment, must comply with these mandates to maintain its license and reputation.

Adherence to these standards is not merely a legal obligation but a critical factor for operational success. For instance, regulations often specify staff-to-resident ratios, hygiene protocols, and nutritional guidelines. Failure to meet these requirements can result in fines, reputational damage, and even the suspension of operations, directly impacting Grupo SAR S.A.'s financial performance and market position.

Legislation like Spain's Law 39/2006, known as LAPAD, strongly advocates for the autonomy of individuals receiving care, particularly in long-term settings. This law mandates that care providers, including those within Grupo SAR's network, must implement person-centered care models. This means respecting and actively incorporating the preferences and choices of each patient into their care plans.

The legal framework requires a shift towards empowering patients, ensuring their right to make informed decisions about their treatment and daily lives is upheld. This focus on autonomy directly influences how Grupo SAR designs and delivers its services, demanding flexible and responsive care strategies that prioritize the individual's will.

Grupo SAR S.A. must navigate increasingly stringent data protection regulations like GDPR as digital health solutions and electronic health records become standard. Failure to comply with these laws, which carry significant penalties, could impact patient trust and operational continuity. In 2024, the European Union continued to emphasize robust enforcement of GDPR, with fines often reaching millions of Euros for data breaches.

Labor Laws and Staffing Ratios

Labor laws significantly shape the elder care sector, dictating working conditions, required professional qualifications for care workers, and minimum staffing ratios. These regulations directly impact operational costs and the quality of service delivery for companies like Grupo SAR S.A.

Recent legislative actions, such as debates and royal decrees concerning home care workers in Spain, underscore the dynamic nature of labor regulations in this field. For instance, the push for improved working conditions and clearer professional pathways for caregivers can lead to increased labor costs and necessitate adjustments in staffing models to meet new legal requirements.

- Impact on Staffing: Stricter regulations on working hours and mandatory breaks can increase the number of staff required per client.

- Qualification Requirements: Enhanced professional qualification mandates may lead to higher wage expectations and a need for ongoing training investment.

- Cost of Compliance: Adherence to evolving labor laws, including those related to home care, can add substantial operational expenses.

- Service Delivery: Legal frameworks directly influence how services are structured and the availability of care workers.

Licensing and Accreditation Requirements

Grupo SAR S.A., like all care home operators, must navigate a complex web of regional and national licensing and accreditation mandates. These legal frameworks are fundamental to ensuring that facilities adhere to stringent safety, health, and operational standards. For instance, in Spain, the majority of autonomous communities have specific regulations governing the opening and continued operation of residential care centers, often requiring periodic inspections and certifications. Failure to comply can result in significant fines or even the suspension of operations, directly impacting Grupo SAR's ability to provide services and generate revenue.

Meeting these requirements is not a one-time event; it necessitates ongoing vigilance and investment. The specific criteria can vary considerably, influencing everything from staffing ratios and building safety features to the types of medical services offered. For 2024 and heading into 2025, regulatory bodies continue to emphasize enhanced infection control protocols and digital health record management, adding layers of compliance complexity. Grupo SAR's strategic planning must therefore account for the resources needed to maintain these certifications across its facilities.

- Compliance with regional health and safety regulations is mandatory for all care providers.

- Accreditation ensures facilities meet established quality and operational benchmarks.

- Regulatory changes, such as those focusing on digital health records, require continuous adaptation.

Grupo SAR S.A. operates within a robust legal landscape that prioritizes resident well-being and autonomy, as exemplified by Spain's Law 39/2006. Compliance with stringent quality of care standards, including staff-to-resident ratios and hygiene protocols, is paramount to avoid penalties and maintain operational legitimacy. Furthermore, evolving labor laws and data protection regulations like GDPR, with significant fines for non-compliance in 2024, necessitate continuous adaptation and investment in training and digital security. Regional licensing and accreditation mandates also demand ongoing vigilance to ensure facilities meet safety and health benchmarks, impacting operational costs and service delivery models.

Environmental factors

In Spain, there's a significant push towards environmental sustainability in real estate and services, particularly impacting care facilities. This translates to concrete actions like improving energy efficiency in buildings and reducing waste.

For Grupo SAR S.A., this means integrating practices such as responsible water usage and adopting renewable energy sources in their residential care homes and day centers. For instance, by 2024, the Spanish government aims for 42% of its energy consumption to come from renewable sources, a trend that will influence operational costs and investment decisions for Grupo SAR S.A.

Spain's commitment to reducing greenhouse gas emissions, aiming for a 55% reduction by 2030 compared to 1990 levels, directly impacts Grupo SAR's energy sourcing and operational costs for its care facilities.

The nation's target to reach 42% of its energy consumption from renewable sources by 2030 necessitates adaptation and potential investment in greener energy solutions for Grupo SAR.

Prioritizing energy efficiency and adopting renewable energy sources are becoming critical for long-term sustainability and cost management in the Spanish healthcare sector, influencing Grupo SAR's strategic planning.

Spain's commitment to a circular economy, exemplified by the Spain Circular Strategy 2030, is significantly reshaping waste management. This national push mandates stricter recycling and waste reduction protocols across all industries, including healthcare services provided by Grupo SAR S.A.

Consequently, healthcare providers like Grupo SAR S.A. are compelled to invest in and implement more comprehensive waste management systems. This includes enhancing their capabilities in recycling, composting, and the responsible disposal of medical waste, aligning with the nation's sustainability goals.

Green Building Standards and Certifications

Grupo SAR S.A. may see new developments and renovations in the care sector increasingly adopting green building standards. This trend, driven by environmental awareness and regulatory shifts, means facilities might incorporate sustainable materials and energy-efficient systems. For instance, the global green building market was valued at approximately $109.8 billion in 2023 and is projected to reach $358.4 billion by 2030, indicating a significant growth trajectory that could influence construction and operational costs for Grupo SAR.

These certifications, such as LEED or BREEAM, focus on aspects like water conservation, waste reduction, and improved indoor air quality. Implementing such features can lead to long-term operational savings through reduced utility bills. A study by the National Association of Home Builders found that green homes can have lower utility costs, with energy savings often ranging from 20% to 50% compared to conventional homes.

- Sustainable Materials: Increased use of recycled content, locally sourced materials, and low-VOC (volatile organic compound) products in construction and fit-out.

- Energy Efficiency: Integration of high-performance insulation, energy-efficient windows, LED lighting, and smart HVAC systems to minimize energy consumption.

- Water Conservation: Installation of low-flow fixtures, rainwater harvesting systems, and water-efficient landscaping to reduce water usage.

- Healthier Indoor Environments: Design considerations for natural light, ventilation, and the selection of non-toxic building materials to promote resident and staff well-being.

Climate Change Adaptation and Health Risks

Spain is increasingly vulnerable to health risks stemming from climate change, with a notable rise in extreme weather events like heat waves. These events disproportionately impact vulnerable demographics, such as the elderly, posing significant challenges for care providers.

For Grupo SAR S.A., a leading care provider, this necessitates a proactive approach to climate adaptation. Facility design must incorporate features that mitigate heat stress, such as improved insulation and cooling systems. Operational protocols need to be updated to include specific measures for managing heat waves, including hydration plans and reduced activity during peak temperatures.

Emergency preparedness is also paramount. Grupo SAR S.A. must ensure robust plans are in place to protect residents during extreme weather events. For instance, in 2023, Spain experienced its hottest year on record, with average temperatures significantly above the historical norm, underscoring the urgency of these adaptations.

- Increased Heat Wave Frequency: Spain's average temperature in 2023 was 1.0°C above the historical average, leading to more frequent and intense heat waves.

- Vulnerable Population Impact: Elderly individuals are at higher risk of heat-related illnesses, such as heatstroke and dehydration, during these events.

- Adaptation Investment: Facilities require upgrades to cooling infrastructure, potentially costing millions of euros, to ensure resident safety.

- Operational Changes: Implementing new protocols for hydration, activity scheduling, and emergency response during extreme weather is crucial.

Grupo SAR S.A. must navigate Spain's increasing focus on environmental sustainability, particularly concerning energy efficiency and waste management in its care facilities. The nation's commitment to renewable energy, targeting 42% of consumption by 2030, directly influences operational costs and investment strategies. Furthermore, Spain's circular economy initiatives mandate enhanced recycling and responsible disposal practices, requiring Grupo SAR to adapt its waste management systems.

The growing trend of green building standards, with the global market valued at over $109 billion in 2023, suggests future renovations and new constructions for Grupo SAR may incorporate sustainable materials and energy-efficient systems. These adaptations, while potentially costly upfront, promise long-term operational savings, with energy savings in green homes often ranging from 20% to 50%.

Climate change presents significant environmental challenges for Grupo SAR, with Spain experiencing record heat in 2023. Increased heat wave frequency necessitates facility upgrades and revised operational protocols to protect vulnerable residents, highlighting the need for proactive adaptation investments.

| Environmental Factor | Impact on Grupo SAR S.A. | Data/Trend |

|---|---|---|

| Renewable Energy Targets | Increased operational costs, potential investment in green energy solutions. | Spain aims for 42% renewable energy consumption by 2030. |

| Circular Economy & Waste Management | Need for enhanced recycling and waste disposal systems. | Spain Circular Strategy 2030 mandates stricter protocols. |

| Green Building Standards | Potential for higher initial construction costs, long-term operational savings. | Global green building market valued at ~$109.8 billion in 2023. |

| Climate Change & Heat Waves | Necessity for facility adaptation and updated emergency protocols. | Spain recorded its hottest year in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grupo SAR S.A. is meticulously constructed using data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.