Grupo SAR S.A. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo SAR S.A. Bundle

Grupo SAR S.A. navigates a competitive landscape shaped by significant buyer power and the constant threat of substitutes. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Grupo SAR S.A.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Grupo SAR S.A. depends on specialized medical equipment suppliers for essential items like mobility aids and monitoring systems. The bargaining power of these suppliers can be significant, particularly for advanced or proprietary technology where few substitutes exist.

The critical nature of high-quality, reliable equipment for patient care and regulatory adherence amplifies the leverage these specialized providers hold. For instance, in 2024, the global medical device market, which includes specialized equipment, was valued at an estimated $600 billion, highlighting the substantial economic footprint of these suppliers.

The availability of qualified nurses, doctors, and specialized therapists is a key factor in the bargaining power of the healthcare workforce. In 2024, Europe, and specifically Spain, continued to experience shortages in skilled elder care professionals. This scarcity allows these professionals to negotiate for higher wages and improved working conditions, directly impacting Grupo SAR S.A.'s operational expenses.

For Grupo SAR S.A.'s residential care homes, food and catering services are absolutely critical, impacting resident satisfaction and operational costs. The bargaining power of these suppliers hinges significantly on the local market's supplier landscape and the ease of finding suitable alternatives. While many local food providers might exist, catering companies specializing in the unique dietary needs of the elderly, such as low-sodium or pureed meals, can command greater influence, especially if their tailored services are in high demand.

Pharmaceutical Companies

Pharmaceutical companies, especially those holding patents for essential elderly care medications, wield considerable bargaining power. This is because the demand for these life-sustaining drugs is inelastic, meaning price increases have little impact on demand. For Grupo SAR S.A., this translates to limited ability to negotiate lower prices for critical treatments, directly affecting operational costs.

The reliance on patented drugs means that Grupo SAR S.A. often faces fixed or increasing costs for key pharmaceuticals. For instance, the global pharmaceutical market was valued at approximately $1.4 trillion in 2023, with a significant portion attributed to patented, high-value drugs. This market dynamic reinforces supplier leverage.

- High Demand for Essential Medicines: Medications for chronic conditions prevalent in elderly populations are non-discretionary purchases, granting suppliers pricing power.

- Patent Protection: Exclusive patent rights for many drugs prevent generic competition, allowing patent holders to set higher prices.

- Limited Substitutability: For specific medical needs, there may be few or no viable alternatives to patented drugs, further strengthening supplier position.

- Consolidated Supplier Base: In some therapeutic areas, a small number of pharmaceutical manufacturers may dominate, reducing Grupo SAR S.A.'s options and negotiation leverage.

Real Estate and Facilities Management Services

Grupo SAR S.A., as a provider of residential care homes and day centers, is significantly dependent on real estate for its operational facilities. Suppliers of these properties, whether landlords or construction firms involved in new builds, can wield moderate to substantial bargaining power. This is particularly true in sought-after urban locations where the availability of suitable properties is limited, driving up acquisition or rental costs. For instance, in 2024, prime commercial real estate in major European cities saw rental increases averaging 5-8%, impacting operating expenses for businesses like Grupo SAR.

Furthermore, the outsourcing of facilities management services can also introduce supplier leverage. Companies providing these specialized services may possess significant bargaining power due to their unique expertise in maintaining complex and regulated care environments. The demand for specialized maintenance, such as for medical equipment or specific environmental controls within care homes, can make it difficult to switch providers, thus enhancing their negotiating position.

- Real Estate Scarcity: Limited availability of suitable properties in desirable urban areas increases supplier bargaining power.

- Specialized Facilities Management: Expertise required for maintaining care environments grants leverage to service providers.

- Market Trends: In 2024, prime real estate rentals in key European cities rose by an average of 5-8%, indicating upward pressure on facility costs.

Grupo SAR S.A. faces significant bargaining power from suppliers of specialized medical equipment, particularly for advanced technologies with few alternatives. The critical nature of this equipment for patient care and regulatory compliance strengthens the suppliers' position. For example, the global medical device market, valued at approximately $600 billion in 2024, underscores the economic influence of these providers.

Pharmaceutical suppliers, especially those holding patents for essential elderly care medications, also exert considerable leverage. The inelastic demand for these life-sustaining drugs means price increases do not significantly deter purchases, limiting Grupo SAR S.A.'s ability to negotiate. The global pharmaceutical market, around $1.4 trillion in 2023, highlights the substantial revenue and pricing power of patented drug manufacturers.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Grupo SAR S.A. |

|---|---|---|

| Specialized Medical Equipment | Proprietary technology, few substitutes, criticality for patient care | Higher equipment costs, potential supply chain vulnerabilities |

| Pharmaceuticals (Patented) | Patent protection, inelastic demand, limited substitutability | Increased medication expenses, reduced cost control |

| Real Estate | Limited availability in desirable locations, specialized facility needs | Higher rental or acquisition costs for care homes |

What is included in the product

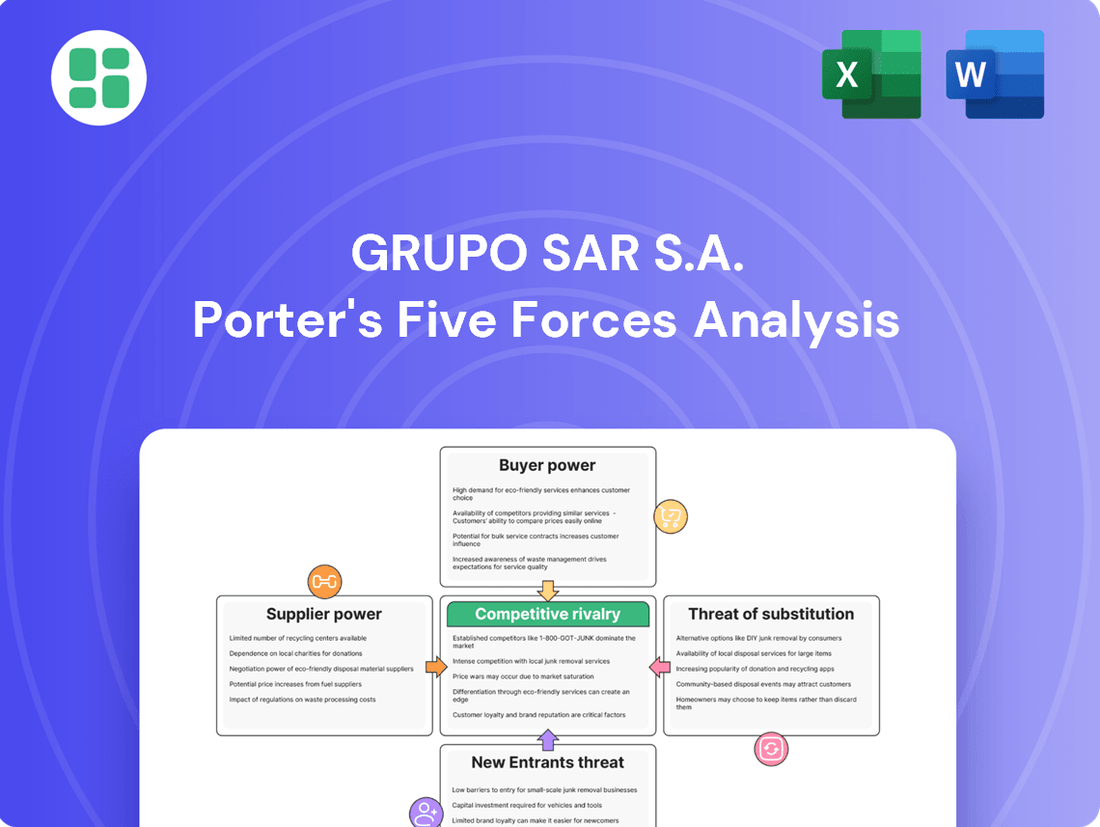

This Porter's Five Forces analysis for Grupo SAR S.A. dissects the competitive intensity within its industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Uncover critical competitive advantages and vulnerabilities with a dynamic, interactive Porter's Five Forces model for Grupo SAR S.A., enabling proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of individual elderly clients and their families is typically moderate. This stems from the deeply personal and emotional nature of care services, where perceived quality and trust are paramount. Families often prioritize continuity of care, making the disruption and administrative hassle of switching providers a significant deterrent, thus creating a moderate switching cost.

However, this power is evolving. Greater transparency in service quality metrics and pricing structures, readily available through online platforms and consumer reviews, empowers clients. In 2024, the proliferation of diverse care models, from in-home assistance to specialized facilities, means families have more options than ever before, potentially increasing their leverage if providers do not meet expectations.

In Spain's elderly care sector, public funding bodies and insurers wield considerable influence. In 2024, the government's increased investment and subsidies solidified the public service segment's dominance, meaning these entities significantly impact costs.

Their substantial bargaining power allows them to dictate pricing, service quality, and the very nature of care provided through their reimbursement structures and contractual terms.

Customers today possess unprecedented access to information, thanks to digital platforms. This allows them to easily compare care quality, read reviews, and scrutinize pricing across various healthcare providers. For instance, in 2024, platforms like Doctoralia and Top Doctors saw significant user growth, indicating a strong trend towards informed healthcare consumerism.

This heightened transparency directly empowers customers, increasing their bargaining power. When patients can readily compare options and understand the value proposition of different providers, they are more likely to choose services that offer the best combination of quality and cost. This competitive pressure incentivizes providers, including those within Grupo SAR S.A.'s network, to enhance their service offerings and pricing structures.

Demand for Personalized Care

Customers are increasingly seeking personalized healthcare solutions, a trend that significantly boosts their bargaining power. This demand for tailored programs means clients can more easily switch to providers offering bespoke services, compelling companies like Grupo SAR S.A. to adapt. For instance, in 2024, surveys indicated that over 60% of patients expressed a preference for healthcare providers who offered personalized treatment plans.

This growing emphasis on individualized care translates directly into greater leverage for customers. They can now more effectively negotiate terms or select providers who demonstrate a strong capacity for customization. Grupo SAR S.A., like others in the sector, must therefore invest in flexible service models to meet these evolving expectations and retain its client base.

- Increased Patient Expectations: A significant portion of patients now expect healthcare services to be adapted to their unique medical histories and lifestyle needs.

- Provider Differentiation: Companies offering personalized care plans gain a competitive edge, as customers are willing to pay a premium or switch providers for this customization.

- Data-Driven Personalization: The ability to leverage patient data to create tailored care pathways is becoming a key differentiator in the market.

- Impact on Pricing: The demand for personalized services can influence pricing strategies, as customized plans may command different rates than standardized offerings.

Availability of Alternative Care Options

The increasing availability of alternative care options significantly bolsters customer bargaining power for Grupo SAR S.A. Services like home care, assisted living technology, and day centers offer consumers more choices, diminishing their reliance on traditional residential care homes. This shift allows customers to seek out services that better align with their personal preferences and financial capacities.

For instance, the home healthcare market in Mexico, a key operational area for Grupo SAR S.A., has seen substantial growth. Estimates suggest the Mexican home healthcare market was valued at approximately USD 2.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of over 7% through 2028. This expansion provides a direct counterpoint to residential care facilities.

- Increased Choice: Customers can now choose between residential care, home-based support, or community-based day programs.

- Reduced Dependency: The proliferation of alternatives lessens the captive audience for traditional care homes.

- Price Sensitivity: Customers can compare pricing and service quality across a wider range of providers, exerting downward pressure on prices.

- Service Customization: Alternative options often allow for more tailored care plans, forcing residential providers to adapt and offer more flexible packages.

The bargaining power of customers within the elderly care sector, particularly for Grupo SAR S.A., is notably influenced by increased transparency and the proliferation of alternative care models. In 2024, readily available online information and reviews empower individuals to compare services, while the growing availability of home care and specialized facilities means clients have more options, potentially driving down prices and demanding greater service customization.

Public funding bodies and insurers in Spain, a key market for Grupo SAR S.A., exert significant bargaining power. Their substantial influence, particularly with increased government investment in 2024, allows them to dictate pricing and service standards through reimbursement structures, impacting the overall cost dynamics for care providers.

Customers' ability to access information and compare providers has intensified. In 2024, platforms facilitating such comparisons saw significant user growth, indicating a trend towards informed decision-making. This heightened transparency pressures providers to enhance service quality and optimize pricing to remain competitive.

The demand for personalized healthcare is a significant factor increasing customer leverage. Surveys in 2024 showed a strong preference for tailored treatment plans, compelling companies like Grupo SAR S.A. to invest in flexible service models to meet these evolving client expectations and retain their customer base.

| Factor | Impact on Grupo SAR S.A. | 2024 Data/Trend |

| Information Transparency | Increases customer leverage; enables easier comparison of quality and price. | Significant user growth on healthcare comparison platforms. |

| Alternative Care Options | Reduces customer dependency on traditional facilities; allows for greater choice. | Growth in home healthcare market, e.g., Mexico valued at ~USD 2.5 billion in 2023. |

| Personalization Demand | Drives need for flexible service models; customers may switch for tailored care. | Over 60% of patients prefer providers with personalized treatment plans. |

| Public Funding & Insurers | Dictate pricing and service standards through reimbursement. | Increased government investment in public services impacting cost structures. |

Full Version Awaits

Grupo SAR S.A. Porter's Five Forces Analysis

This preview displays the complete Grupo SAR S.A. Porter's Five Forces Analysis, offering a thorough examination of competitive forces impacting the company. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry attractiveness and strategic positioning. No placeholders or sample content; what you see is precisely what you'll download and utilize.

Rivalry Among Competitors

The Spanish elderly care sector is notably fragmented, featuring a blend of public, private, and non-profit entities. This diverse mix includes major players like DomusVi, which operates under the former Grupo SAR S.A. umbrella, alongside a multitude of smaller, localized, and independent providers.

This widespread presence of various operators intensifies competition as each entity vies for market share and service contracts. In 2024, the Spanish elderly care market continued to see this dynamic, with established groups like DomusVi navigating a landscape populated by numerous regional and independent facilities, all seeking to attract residents and secure funding.

Spain's demographic landscape is shifting dramatically, with its population aging at a significant pace. This trend directly fuels an increasing demand for elderly care services across the nation.

The market for these services is substantial and growing, projected to expand from an estimated USD 7.89 billion in 2024 to USD 11.89 billion by 2030. This robust market expansion offers a considerable opportunity for various companies to thrive, potentially softening the intensity of competitive rivalry as there is ample room for growth for all participants.

In the competitive landscape for senior living, Grupo SAR S.A. likely faces rivals who heavily emphasize service differentiation. This often translates into personalized care programs, specialized offerings like memory care for Alzheimer's patients, and a focus on enhancing the overall quality of life for residents. For instance, in 2024, the demand for specialized memory care units continued to grow, with many facilities investing in advanced training for staff and tailored therapeutic activities.

Providers are actively differentiating themselves through a range of factors beyond just the basic cost. This includes the quality of amenities, such as spacious private rooms, well-maintained common areas, and diverse recreational facilities. Furthermore, a critical differentiator is the staff-to-resident ratio, as a higher ratio generally indicates more individualized attention and care, a key factor for families making decisions. The integration of technology, from smart home features for resident safety to digital platforms for family communication, also plays a significant role in creating competitive advantages.

High Exit Barriers

The elder care industry, especially residential care, demands considerable capital for real estate and specialized facilities. For instance, the average cost to build a new 100-bed nursing home in the US can range from $20 million to $30 million, a substantial upfront investment.

These high fixed costs and the unique nature of the assets mean that exiting the market is difficult and expensive. Companies are often compelled to continue operating and competing, even in less favorable economic conditions, to recoup their investments.

This situation naturally leads to sustained, intense competition among existing players. The difficulty in exiting the market reinforces the competitive rivalry as firms are locked into the industry, driving a constant effort to maintain market share and operational efficiency.

- Significant Capital Investment: Residential elder care facilities require substantial upfront capital, often in the tens of millions of dollars for construction and specialized equipment.

- Specialized Assets: The infrastructure is highly specialized for elder care, making it difficult to repurpose or sell for other uses, thus increasing exit costs.

- Reinforced Rivalry: High exit barriers encourage existing companies to remain and compete vigorously, as abandoning the market would mean significant unrecouped costs.

Regulatory Landscape and Public Sector Influence

The competitive landscape for Grupo SAR S.A. is shaped by Spain's varied regulatory environment, which differs across autonomous communities, directly influencing how companies operate and compete. This patchwork of regulations can create uneven playing fields and compliance challenges.

The public sector's growing involvement and investment in elderly care is a significant factor. For instance, in 2024, many Spanish regions increased their budgets for social services, including elder care, aiming to improve accessibility and quality. This public sector push can set new industry standards for quality and pricing, potentially intensifying competition for private entities like Grupo SAR that rely on public subsidies or seek to secure public contracts.

- Regulatory Variation: Spain's autonomous communities have distinct regulations for healthcare and social services, impacting operational requirements and market entry for elder care providers.

- Public Sector Investment: Increased public funding in elder care, observed in 2024 budget allocations across various regions, aims to expand services and can influence private sector participation and pricing strategies.

- Contract Competition: Private providers, including Grupo SAR, often compete for public contracts and subsidies, where quality benchmarks and cost-effectiveness are key determinants of success.

Grupo SAR S.A., now operating as DomusVi, faces intense competition in Spain's fragmented elderly care market. Numerous regional and independent providers vie for residents and contracts, amplified by a growing demand fueled by Spain's aging population. In 2024, this dynamic persisted, with established players like DomusVi navigating a crowded field.

Service differentiation, encompassing personalized care, specialized units like memory care, and enhanced quality of life, is a key battleground. Factors such as amenities, staff-to-resident ratios, and technological integration are crucial differentiators for providers in 2024. The market is expected to grow from an estimated USD 7.89 billion in 2024 to USD 11.89 billion by 2030, suggesting ample room for growth but also sustained competitive pressure.

High capital investment and specialized assets create significant barriers to exiting the Spanish elder care market. This lock-in effect compels existing firms to remain and compete vigorously to recoup their substantial investments, thereby reinforcing ongoing rivalry. The difficulty in exiting the market means companies are often committed to operating and competing, even during less favorable economic conditions.

Spain's varied regulatory landscape across autonomous communities creates uneven playing fields, while increased public sector investment in elderly care, seen in 2024 budget allocations, sets higher industry standards and intensifies competition for private entities seeking public contracts.

| Competitor Type | Key Differentiators (2024 Focus) | Market Share Indicator |

|---|---|---|

| Major Groups (e.g., DomusVi) | Scale, brand recognition, integrated services, specialized care units | Significant, often leading in specific regions |

| Regional Providers | Local presence, community ties, tailored services for regional needs | Moderate to significant within their operating areas |

| Independent Facilities | Niche services, personalized attention, specific care philosophies | Smaller, often localized impact |

| Public/Non-Profit Entities | Accessibility, affordability, social mission focus | Varies by region and funding levels |

SSubstitutes Threaten

Home care services pose a considerable threat as a substitute for residential care. Many seniors opt to remain in their familiar surroundings, receiving support at home. This preference is underscored by the Spanish home healthcare market's robust growth, projected to increase from USD 10,186.5 million in 2024 to USD 16,222.6 million by 2030.

This substantial market expansion highlights a clear shift towards in-home care solutions. Consequently, Grupo SAR S.A. must recognize that this growing demand for home-based assistance can divert potential clients from its residential facilities, impacting occupancy rates and revenue.

Historically, family members have been the primary caregivers for the elderly in Spain. While societal shifts and smaller family sizes are impacting this, informal caregiving remains a significant substitute, particularly for less intensive needs. This directly reduces the demand for formal institutional services, impacting providers like Grupo SAR S.A.

Technological advancements are creating compelling alternatives to traditional assisted living. Smart home systems, for instance, offer features like voice-activated controls and automated lighting, enhancing convenience and safety for seniors. Wearable health monitoring devices, such as smartwatches with fall detection, provide real-time health data and alerts, offering peace of mind. Telemedicine platforms further enable remote consultations, reducing the need for in-person visits.

These innovations directly substitute for certain services provided by assisted living facilities. By enabling remote monitoring and providing medication reminders, these technologies empower seniors to live independently for longer. This shift is significant, as the global smart home market was projected to reach over $150 billion in 2024, indicating a strong consumer interest in these solutions.

Day Centers and Community Programs

Day centers and community programs present a significant threat of substitution for Grupo SAR S.A.'s residential care services. These alternatives offer social engagement, structured activities, and daytime support, enabling seniors to maintain independence at home. For individuals not requiring constant supervision, these options are often more cost-effective and less disruptive than full-time care facilities.

The appeal of these substitutes is growing. In 2024, the demand for home-based care and community support services is projected to increase as individuals and families seek flexible and affordable solutions. This trend directly impacts the market share of traditional residential care providers.

- Cost Savings: Day centers typically cost significantly less per month than full-time residential care, making them an attractive option for budget-conscious families.

- Social Engagement: These programs provide vital social interaction and activities, combating loneliness and improving mental well-being without the need for permanent relocation.

- Flexibility: They offer a flexible care solution, catering to varying needs and allowing seniors to remain in their familiar home environment for longer periods.

Lower-Cost, Less Comprehensive Alternatives

For clients with tighter budgets, the threat of substitutes is significant. Less comprehensive or lower-cost alternatives, such as independent living communities with fewer included services or even shared housing arrangements, can serve as viable substitutes for the full-spectrum care offered by Grupo SAR S.A.

These options, while not providing the same level of medical and social support, appeal to a segment of the elderly population prioritizing affordability. For instance, in 2024, the average monthly cost for assisted living in the US ranged from $3,500 to $6,000, making more basic alternatives attractive to those with limited financial resources.

- Independent Living Communities: Offer housing and social activities but typically lack extensive medical care.

- Shared Living Arrangements: Provide a more economical housing solution, often with less formal support services.

- Home Care Services: While potentially costly, certain home care packages might be tailored to specific needs, offering a substitute for residential care.

- Family Caregiving: Informal care provided by family members remains a significant substitute, especially in regions with strong familial support networks.

The threat of substitutes for Grupo SAR S.A. is substantial, driven by evolving senior care preferences and technological advancements. Home care services, community day centers, and even informal family caregiving offer more flexible and often more affordable alternatives to residential facilities. These substitutes allow seniors to maintain independence longer, directly impacting demand for traditional assisted living.

Technological innovations further bolster the substitute threat. Smart home systems and wearable health monitors empower seniors to manage their well-being at home, reducing the perceived need for constant on-site care. Telemedicine platforms also facilitate remote medical consultations, diminishing the necessity for in-person facility visits.

The financial aspect is a key driver for substitute adoption. Lower-cost options like independent living communities or shared housing arrangements appeal to budget-conscious individuals. For example, the significant cost difference between full-time residential care and more basic alternatives makes these substitutes highly attractive in 2024.

| Substitute Type | Key Features | Impact on Grupo SAR S.A. |

|---|---|---|

| Home Care Services | In-home assistance, familiar environment | Diverts clients seeking personalized, home-based support. Spanish home healthcare market projected to grow from USD 10,186.5 million in 2024. |

| Day Centers & Community Programs | Social engagement, daytime activities | Reduces demand for full-time residential care by offering social interaction and support. |

| Technology (Smart Homes, Wearables) | Enhanced safety, remote monitoring, convenience | Enables longer independent living, lessening the need for assisted living facilities. Global smart home market exceeding $150 billion in 2024. |

| Cost-Effective Housing | Independent living, shared housing | Appeals to budget-conscious seniors; US assisted living costs averaging $3,500-$6,000 monthly in 2024. |

Entrants Threaten

The elder care sector, especially residential care homes, demands significant upfront capital. This includes costs for acquiring or building facilities, purchasing specialized equipment, and ensuring adherence to stringent quality and safety standards. For instance, establishing a new, modern nursing home in 2024 could easily involve multi-million dollar investments, making it a substantial hurdle for aspiring operators.

Operating within Spain's health and social care sector presents significant challenges for potential new entrants due to a complex web of regulations. These rules, which can vary by region, dictate everything from staff qualifications to facility standards, acting as a substantial barrier to entry.

Compliance with these stringent requirements, such as those mandated by the Spanish Ministry of Health, necessitates considerable investment in training, infrastructure, and administrative processes. For instance, adhering to specific staff-to-patient ratios or obtaining necessary accreditations can be costly and time-consuming, deterring new businesses from entering the market.

In the sensitive elderly care sector, building a strong reputation and earning trust is crucial. Newcomers face a significant hurdle, needing to invest substantial time and resources to establish credibility with clients and their families. This slow and challenging process inherently favors established providers, such as Grupo SAR S.A. (now operating as DomusVi), who have already cultivated these essential relationships.

Access to Skilled Workforce

The elder care sector in Europe, including for Grupo SAR S.A., faces a significant hurdle with a shortage of qualified healthcare professionals. New companies entering this market would struggle to attract and retain the necessary talent. This scarcity drives up recruitment and training expenses, acting as a substantial barrier to entry.

For instance, in 2023, several European countries reported critical shortages in nursing and specialized care roles, with some estimates suggesting a deficit of over one million healthcare workers by 2030 across the EU. This situation directly impacts new entrants' ability to scale operations and provide consistent, high-quality care, mirroring challenges faced by established players.

- Talent Scarcity: A widespread deficit of skilled healthcare professionals in Europe's elder care market.

- Increased Costs: New entrants face higher recruitment and training expenses due to this shortage.

- Competitive Disadvantage: Difficulty in attracting and retaining staff can hinder a new company's ability to compete effectively.

Economies of Scale and Experience Curve

Established companies like Grupo SAR S.A. leverage significant economies of scale, particularly in purchasing, administration, and operational efficiencies across their extensive network. This allows them to command lower per-unit costs for raw materials and manufacturing.

New entrants would face substantial hurdles in matching these cost advantages. For instance, in 2024, the construction materials sector, where Grupo SAR operates, saw significant price volatility for key inputs like cement and steel, making it harder for smaller, unscaled players to secure favorable pricing.

- Economies of Scale: Grupo SAR's established infrastructure and high production volumes in 2024 allowed it to negotiate bulk discounts on raw materials, reducing its cost base compared to new market entrants.

- Experience Curve: Years of operational experience have refined Grupo SAR's processes, leading to greater efficiency and lower labor costs per unit, a learning curve advantage that new competitors would need considerable time and investment to replicate.

- Capital Requirements: The substantial capital needed to build comparable production facilities and achieve similar economies of scale acts as a significant barrier, deterring potential new entrants in the current market climate.

The threat of new entrants for Grupo SAR S.A. (now DomusVi) is moderate, primarily due to high capital requirements for establishing facilities and the complex regulatory landscape in Spain's elder care sector. Significant upfront investment in infrastructure and compliance with stringent standards, which can easily run into millions of euros in 2024, deters many potential competitors. Furthermore, the established reputation and trust that DomusVi has built over years present a considerable challenge for newcomers seeking to gain market share.

The shortage of qualified healthcare professionals across Europe, a trend continuing into 2024, also acts as a substantial barrier. New entrants would face higher recruitment and training costs, struggling to attract and retain the necessary talent to compete effectively. This talent scarcity, projected to worsen with estimates of over a million healthcare worker deficits by 2030 in the EU, gives established players with existing workforces a distinct advantage.

Economies of scale achieved by DomusVi, particularly in purchasing and operational efficiencies, create a cost advantage that new entrants would find difficult to match. For example, in 2024, price volatility in construction materials impacted smaller players more severely, hindering their ability to secure favorable input costs compared to large, established entities like DomusVi.

| Barrier to Entry | Impact on New Entrants | Grupo SAR S.A. (DomusVi) Advantage |

|---|---|---|

| High Capital Requirements | Significant upfront investment needed for facilities and equipment. | Existing infrastructure and scale reduce per-unit costs. |

| Regulatory Complexity | Navigating varied regional health and social care regulations is challenging and costly. | Established compliance processes and expertise. |

| Talent Scarcity | Difficulty in attracting and retaining qualified healthcare staff. | Existing workforce and established recruitment channels. |

| Reputation and Trust | Building credibility with clients and families takes considerable time and effort. | Long-standing customer relationships and brand loyalty. |

| Economies of Scale | Inability to achieve comparable cost efficiencies in purchasing and operations. | Bulk purchasing power and streamlined administrative functions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grupo SAR S.A. is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the company and its key competitors. We also incorporate insights from reputable industry research reports and market intelligence databases to capture current market trends and competitive landscapes.