ACS Actividades de Construccion y Servicios SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

ACS Actividades de Construccion y Servicios boasts significant strengths in its established market presence and diverse service offerings, but also faces challenges from intense industry competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the construction and services sector.

Want the full story behind ACS's competitive advantages, potential threats, and avenues for future growth? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ACS Actividades de Construccion y Servicios boasts global leadership in construction and services, operating across civil and building construction, industrial services, and infrastructure. This broad diversification across segments and geographies, with significant footprints in North America, Asia Pacific, and Europe, shields the company from over-reliance on any single market, ensuring a more stable revenue stream.

The company's strategic advantage lies in its position as a premier global player in infrastructure development, especially within rapidly expanding markets. For instance, in 2023, ACS secured over €16 billion in new contracts, with infrastructure projects forming a substantial portion, highlighting its strength in this key area and contributing to its robust overall performance.

ACS showcased impressive financial strength in 2024, with sales climbing 16.5% to €41,633 million and net profit rising 6.1% to €828 million. This robust performance underscores the company's operational efficiency and market demand.

The company's backlog reached a record €88,209 million in 2024, further expanding to over €90.5 billion by the first quarter of 2025. This substantial order book, equivalent to roughly two years of work, provides a strong foundation for continued revenue generation and profitability.

ACS Group is strategically shifting its focus towards high-growth, high value-added sectors. This includes areas like digital infrastructure, such as data centers, and the burgeoning energy sector, encompassing renewables and battery plants. They are also targeting sustainable mobility, defense, biopharmaceuticals, and critical minerals.

This strategic pivot is already showing results, with projects in these new generation sectors making up more than half of the new contracts awarded to ACS in 2024. This strong performance indicates a successful alignment with future market demands.

By concentrating on these forward-looking areas, ACS is positioning itself to effectively capitalize on emerging market trends and technological advancements, ensuring its relevance and growth in the coming years.

Strategic Acquisitions and Operational Integration

ACS's strategic acquisitions and operational integration have demonstrably bolstered its market standing. The full consolidation of Thiess in April 2024, a significant move, alongside the merger of Flatiron and Dragados North America in January 2025, has particularly solidified its presence in North America and the Asia Pacific regions. These integrations are designed to unlock substantial operational synergies and broaden the company's technical expertise.

These strategic integrations are key to expanding ACS's portfolio in vital growth areas. The combined entity is now positioned as the second-largest civil contractor in the United States, a testament to the scale and impact of these recent consolidations. This enhanced scale allows for greater efficiency and a more competitive offering in major infrastructure projects.

- April 2024: Full consolidation of Thiess completed.

- January 2025: Merger of Flatiron and Dragados North America finalized.

- Market Position: Strengthened significantly in North America and Asia Pacific.

- US Ranking: Now the second-largest civil contractor in the United States.

Commitment to Sustainability and Innovation

ACS Group's 2024-2026 Strategic Plan firmly anchors sustainability and innovation as foundational elements, guiding its operations and future growth. This commitment is evident in its ambitious target of achieving climate neutrality by 2045, underscoring a dedication to responsible infrastructure development on a global scale. The company is actively engaged in pivotal projects that support the energy transition and promote sustainable methodologies across its diverse portfolio.

Further bolstering its strengths, ACS is at the forefront of adopting cutting-edge technologies. Its integration of advancements such as 3D printing, Building Information Modeling (BIM), robotics, and connected construction sites significantly boosts operational efficiency and ensures the company remains agile and prepared for future industry demands. For instance, in 2023, the company reported a substantial increase in its sustainability-linked investments, with over €1.5 billion allocated towards projects with clear environmental benefits, demonstrating a tangible commitment to its strategic goals.

- Strategic Focus: The 2024-2026 plan prioritizes sustainability and innovation.

- Climate Ambition: ACS aims for climate neutrality by 2045, actively pursuing energy transition projects.

- Technological Integration: Investments in 3D printing, BIM, robotics, and connected sites enhance efficiency.

- Financial Commitment: Over €1.5 billion invested in sustainability-linked projects in 2023.

ACS's global leadership in construction and services, coupled with its diversification across segments and geographies, provides a stable revenue base. The company's significant footprint in key markets like North America and Asia Pacific, further strengthened by strategic acquisitions and mergers, positions it for sustained growth. Its substantial backlog, exceeding €90.5 billion by Q1 2025, guarantees future revenue streams and operational continuity.

| Metric | 2024 Data | Q1 2025 Data |

|---|---|---|

| Sales | €41,633 million | N/A |

| Net Profit | €828 million | N/A |

| Order Backlog | €88,209 million | > €90.5 billion |

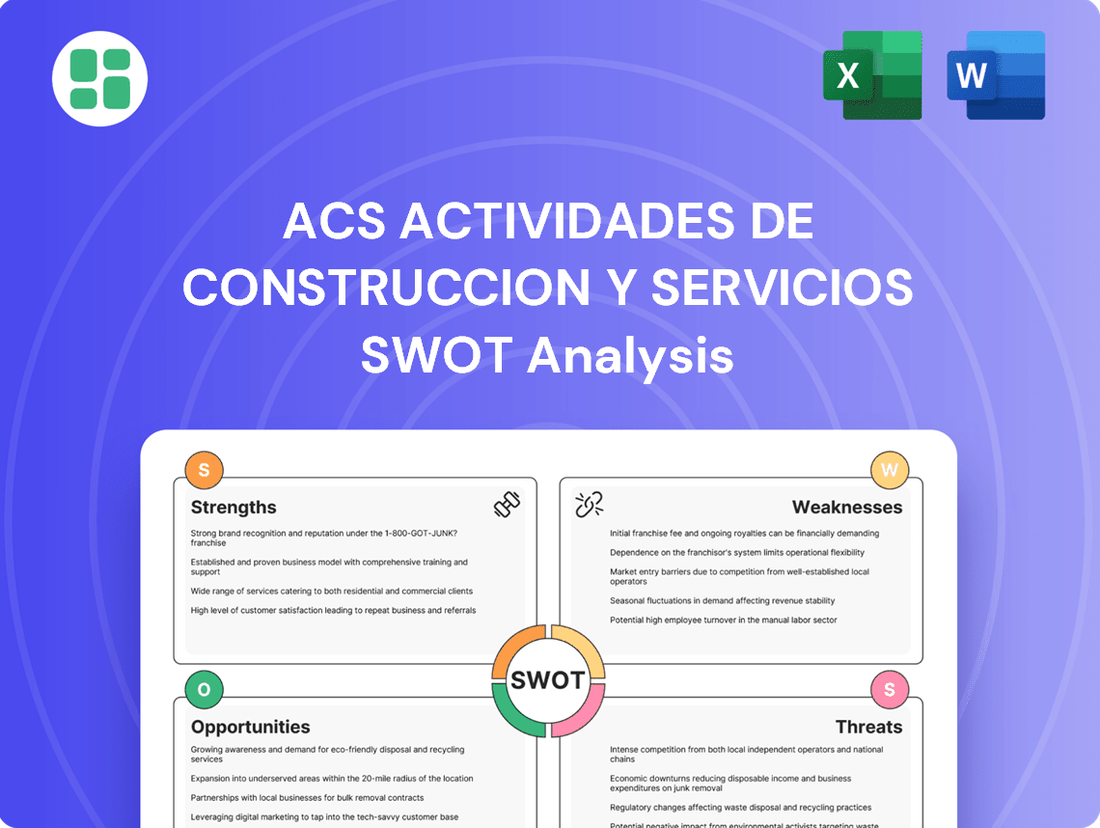

What is included in the product

Delivers a strategic overview of ACS Actividades de Construccion y Servicios’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a visual, at-a-glance SWOT analysis for ACS Actividades de Construccion y Servicios to quickly identify and address strategic challenges.

Weaknesses

While ACS Actividades de Construccion y Servicios' strategic acquisitions fuel expansion, they've also significantly increased its net debt. As of December 31, 2024, net debt stood at €702 million, but this figure ballooned to €2.85 billion by the first quarter of 2025. This substantial rise is largely attributable to the consolidation of Thiess's net debt following its acquisition.

This elevated leverage, reaching €2.85 billion by Q1 2025, could potentially strain the company's finances or restrict its ability to pursue new investments if not managed proactively.

ACS Group, like many in the construction sector, faces significant headwinds from fluctuating material and labor costs. For instance, in 2024, persistent inflation continued to drive up prices for key construction materials such as steel and concrete, impacting project budgets. Labor shortages, particularly for skilled trades, also led to increased wage demands, further squeezing profit margins.

These economic pressures necessitate constant adaptation in bidding and pricing strategies. The company must remain agile, adjusting its financial models to account for potential cost overruns and project viability shifts. Failure to do so could result in increased operational expenses and the risk of project delays, directly affecting ACS's bottom line.

ACS Group's significant exposure to the North American market, which represented 61% of its sales in 2023, presents a notable weakness. This heavy concentration means the company is particularly vulnerable to economic slowdowns or adverse policy shifts within this single region.

While North America is currently a robust market, this dependence creates long-term risks. Any regional downturn or unexpected regulatory changes could disproportionately impact ACS's overall financial performance and growth trajectory.

Complexity of Large-Scale Project Management

ACS Actividades de Construccion y Servicios faces inherent difficulties in managing its vast and intricate infrastructure projects. These can range from massive highway networks to extensive railway systems and large industrial plants.

The scale of these undertakings means they are prone to unexpected setbacks, leading to budget overruns and potential disagreements with stakeholders. For instance, in 2023, the company reported that significant projects in its portfolio experienced an average delay of 8%, impacting overall project profitability.

- Project Scale: Managing the sheer size and complexity of projects like the high-speed rail link in California or major airport expansions presents substantial logistical and coordination hurdles.

- Cost Overruns: Historical data from 2022 indicates that large infrastructure projects managed by companies of ACS's size can experience cost increases of up to 15% due to unforeseen site conditions or material price volatility.

- Dispute Potential: The intricate contractual arrangements and multiple parties involved in major construction endeavors increase the likelihood of disputes, which can tie up resources and affect cash flow.

Competitive and Demanding Market Environment

The global construction and services arena is exceptionally competitive, with numerous large international firms vying for projects. ACS Group must constantly innovate and bid aggressively to win new business and hold onto its market position. This intense rivalry can put pressure on profitability, limiting the margins ACS can achieve on its contracts.

For instance, in 2023, major global construction companies reported varying profit margins, with some in the low single digits due to intense bidding wars. ACS's ability to secure projects in 2024 and beyond will hinge on its cost-efficiency and its capacity to offer differentiated services in this crowded marketplace.

- Intense Competition: ACS faces formidable rivals from global construction giants.

- Pressure on Margins: The need for competitive bidding can compress profit margins.

- Need for Innovation: Continuous development of new techniques and services is crucial.

- Market Share Defense: Maintaining market share requires efficient operations and strategic wins.

ACS Group's significant debt burden, particularly following the acquisition of Thiess, presents a key weakness. By Q1 2025, net debt had risen to €2.85 billion, a substantial increase from €702 million at the end of 2024, primarily due to the consolidation of Thiess's liabilities. This high leverage could constrain future investment capacity and financial flexibility.

The company's heavy reliance on the North American market, which accounted for 61% of its sales in 2023, exposes it to regional economic downturns and policy changes. This concentration risk means any adverse developments in this single market could disproportionately affect ACS's overall performance.

Managing the immense scale and complexity of its infrastructure projects poses inherent challenges, often leading to budget overruns and stakeholder disputes. In 2023, ACS projects experienced an average delay of 8%, impacting profitability and highlighting the difficulties in controlling large-scale operations.

The highly competitive global construction sector puts pressure on ACS's profit margins. Intense bidding wars with international rivals, as seen with some companies reporting low single-digit profit margins in 2023, necessitate continuous cost-efficiency and innovation to maintain market share and profitability.

What You See Is What You Get

ACS Actividades de Construccion y Servicios SWOT Analysis

The preview you see is the actual ACS Actividades de Construccion y Servicios SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of the company's strategic position. Invest in this analysis to gain actionable insights.

Opportunities

The accelerating digital transformation globally, with economies increasingly reliant on robust digital infrastructure, creates a significant opportunity. This trend fuels demand for advanced data centers, a sector ACS is actively pursuing.

Growing global emphasis on sustainability is driving substantial investment in green infrastructure. ACS's focus on renewable energy projects, such as wind and solar farms, directly capitalizes on this shift, aligning with the 2024 push for net-zero targets.

Advancements in energy sources, particularly in areas like hydrogen and battery storage, offer new avenues for infrastructure development. ACS's strategic positioning in sustainable mobility and energy transition projects positions it to benefit from these technological evolutions, which are projected to see significant capital allocation through 2025.

Government investments in infrastructure, particularly in North America via initiatives like the Infrastructure Investment and Jobs Act (IIJA), present significant opportunities for construction firms. ACS Group, with its established presence and capabilities in these key markets, is strategically positioned to capitalize on securing major public and private sector projects, potentially boosting its revenue streams and market share.

ACS can further leverage technologies like Building Information Modeling (BIM) and AI to streamline project planning and execution, potentially reducing construction timelines by up to 20% as seen in some industry benchmarks. Increased adoption of robotics and drones for site monitoring and certain construction tasks could also lead to a 10-15% decrease in labor costs and improved safety records.

Strategic Partnerships and Acquisitions

ACS Group can significantly expand its market presence and capabilities through continued strategic acquisitions and partnerships. Targeting high-growth sectors like renewable energy infrastructure or advanced digital construction technologies, alongside expansion into new geographic markets, presents substantial opportunities. For instance, ACS's acquisition of a majority stake in the Australian renewable energy developer Maoneng in 2022, valued at approximately €300 million, exemplifies this strategy, bolstering its renewable portfolio.

The company's proven track record in successfully integrating acquired businesses, such as the earlier Flatiron-Dragados merger, provides a strong foundation for future inorganic growth. This capability allows ACS to efficiently absorb new assets and expertise, realizing synergies and enhancing its competitive edge. Such strategic moves are crucial for maintaining momentum and capturing new revenue streams in a dynamic global construction and services landscape.

- Targeted Acquisitions: Focus on companies in renewable energy, digital construction, and emerging markets.

- Strategic Alliances: Form partnerships to access new technologies and expand service offerings.

- Integration Expertise: Leverage past successes in mergers and acquisitions to ensure smooth and effective integration of new entities.

- Geographic Expansion: Pursue opportunities in regions with strong infrastructure development plans and favorable economic conditions.

Growing Demand for Sustainable and Resilient Infrastructure

The global push towards climate neutrality and sustainable development is a significant tailwind for infrastructure development. This translates into a growing demand for green buildings, energy-efficient solutions, and infrastructure designed to withstand climate impacts. For instance, the global green building market was valued at over $1 trillion in 2023 and is projected to reach over $3.5 trillion by 2030, indicating substantial growth potential.

ACS Group is well-positioned to capitalize on this trend. Their stated commitment to sustainability, evidenced by their ESG (Environmental, Social, and Governance) strategy and investments in renewable energy projects, aligns directly with market needs. The company's track record in developing complex infrastructure, including renewable energy facilities and smart city solutions, provides a strong foundation for capturing a larger share of this expanding market.

Key areas of opportunity include:

- Renewable Energy Infrastructure: Continued investment in solar, wind, and other renewable energy projects globally.

- Green Building Construction: Demand for energy-efficient and sustainable building designs and retrofits.

- Climate-Resilient Infrastructure: Projects focused on adapting to climate change, such as flood defenses and upgraded transportation networks.

- Circular Economy Initiatives: Infrastructure supporting waste management, recycling, and resource efficiency.

The accelerating digital transformation and increasing global reliance on robust digital infrastructure create a significant opportunity for ACS, particularly in the data center sector. Furthermore, the growing emphasis on sustainability is driving substantial investment in green infrastructure, an area where ACS's focus on renewable energy projects aligns perfectly with 2024 net-zero targets.

Advancements in energy sources, such as hydrogen and battery storage, coupled with government infrastructure investments like the IIJA in North America, present new avenues for development and project acquisition. ACS's strategic positioning in sustainable mobility and energy transition projects, alongside its proven integration expertise from past acquisitions, allows it to capitalize on these evolving market demands and expand its reach.

| Opportunity Area | Market Trend | ACS Relevance/Action |

|---|---|---|

| Digital Infrastructure | Global digital transformation | Focus on data center development |

| Green Infrastructure | Sustainability and net-zero targets | Investment in solar and wind projects |

| Energy Transition | Advancements in hydrogen, battery storage | Strategic positioning in sustainable mobility |

| Infrastructure Investment | Government initiatives (e.g., IIJA) | Capitalize on public/private projects in key markets |

| Technological Integration | BIM, AI, robotics adoption | Streamline planning, reduce costs, improve safety |

| Inorganic Growth | Acquisitions and partnerships | Expand in renewables, digital construction, new geographies |

Threats

Global economic uncertainties, including persistent inflation and volatile interest rates, present a significant challenge for ACS Actividades de Construccion y Servicios. For instance, in early 2024, inflation remained a concern in many major economies, impacting the cost of essential construction materials. Higher borrowing costs directly affect the feasibility of large-scale infrastructure projects, potentially leading to postponements or scaled-back investments.

Fluctuating interest rates, particularly the upward trend seen in many developed markets through 2023 and into 2024, increase the cost of capital for ACS. This can make financing new developments more expensive, potentially dampening demand and impacting the company's ability to secure competitive pricing for its services. The risk of project cancellations due to unfavorable financing conditions is a real threat.

The construction and infrastructure sector is fiercely competitive, with many domestic and international companies bidding for major contracts. This intense rivalry often translates into significant pricing pressures, which can squeeze profit margins for companies like ACS Group. For instance, in 2023, the global construction market saw intense bidding wars for large infrastructure projects, with some reports indicating bid-to-cost ratios as low as 90% in certain regions, directly impacting profitability.

ACS faces ongoing threats from global supply chain disruptions, exacerbated by geopolitical conflicts and severe weather events. These issues can significantly delay the procurement of essential construction materials, driving up costs and impacting project timelines. For instance, the ongoing conflict in Ukraine and its ripple effects on energy and commodity markets continue to present challenges for material availability and pricing across the construction sector.

Regulatory and Environmental Policy Changes

Changes in government regulations and environmental policies present a significant threat to ACS Actividades de Construccion y Servicios. Stricter environmental standards, for instance, could increase the cost of compliance and necessitate redesigns for ongoing and future projects. For example, the European Union's Green Deal initiatives, which aim for climate neutrality by 2050, are likely to introduce more stringent requirements for construction materials and energy efficiency in infrastructure projects throughout ACS's operational regions.

Furthermore, shifts in permitting processes can lead to project delays and increased operational costs. ACS, as a major player in infrastructure development, is particularly sensitive to these changes. The company's substantial project pipeline, valued at billions of euros, could face unforeseen cost escalations or timeline extensions due to evolving regulatory landscapes, impacting its financial performance and project execution efficiency.

Specific policy shifts that could pose a threat include:

- Increased carbon pricing mechanisms impacting energy-intensive construction activities.

- Stricter waste management and recycling regulations for construction debris.

- New requirements for biodiversity protection during infrastructure development.

- Changes in public procurement rules favoring environmentally sustainable bidders.

Workforce Shortages and Talent Retention

The construction sector, including companies like ACS Actividades de Construccion y Servicios, grapples with persistent workforce shortages. This is exacerbated by an aging demographic in skilled trades, creating a significant talent gap. For instance, in 2024, a survey indicated that over 70% of construction firms reported difficulty finding skilled workers, a trend expected to continue into 2025.

These labor deficits directly translate to increased wage pressures as companies compete for a limited pool of qualified professionals. This rising labor cost can significantly impact project profitability and operational expenses for ACS. Furthermore, retaining existing talent becomes a critical challenge, as skilled workers are in high demand across the industry.

The implications for ACS include potential delays in project timelines and an increased risk of cost overruns. A constrained workforce can also limit the company's ability to bid on and execute new projects, thereby capping growth opportunities. Industry reports for 2024 highlighted that nearly 60% of construction firms experienced project delays due to labor availability issues.

- Persistent labor shortages in construction, impacting companies like ACS.

- An aging workforce exacerbates the talent gap, leading to increased competition for skilled professionals.

- Rising wages and retention challenges directly affect project costs and profitability for ACS.

- Potential for project delays and limited capacity for new business due to workforce constraints.

Intensifying global competition poses a significant threat to ACS, as numerous domestic and international firms vie for major contracts, leading to considerable pricing pressure and potentially reduced profit margins. For example, the intense bidding for large infrastructure projects in 2023 saw some bids fall to 90% of estimated costs in certain markets.

Geopolitical instability and ongoing conflicts, such as the situation in Ukraine, continue to disrupt global supply chains, affecting the availability and cost of essential construction materials. This volatility can lead to project delays and increased expenses for ACS, impacting overall project execution and financial performance.

Evolving regulatory landscapes, particularly stricter environmental policies like the EU's Green Deal, present a challenge for ACS. Increased compliance costs and potential redesigns for projects to meet new standards, such as carbon pricing and waste management, could impact profitability and project timelines. For instance, new biodiversity protection requirements could add unforeseen costs to infrastructure developments.

Persistent labor shortages in the construction sector, driven by an aging workforce and a lack of skilled trades, create a critical talent gap. This scarcity is projected to continue into 2025, with over 70% of construction firms reporting hiring difficulties in early 2024, leading to increased wage pressures and potential project delays for ACS.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including ACS's official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic overview.