ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

ACS Actividades de Construccion y Servicios operates in a dynamic construction and services sector, facing moderate threats from new entrants and substitutes. The bargaining power of buyers and suppliers presents significant considerations for the company's profitability and strategic positioning.

The complete report reveals the real forces shaping ACS Actividades de Construccion y Servicios’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ACS Actividades de Construccion y Servicios is shaped by the concentration of key material providers. For instance, a limited number of global producers for specialized construction machinery or high-performance concrete can dictate terms.

In 2024, the global steel market, a crucial input for ACS's infrastructure projects, saw price volatility. Major steel producers, particularly those in Asia, wield significant influence due to their production capacity and control over raw material sourcing, impacting ACS's input costs.

Similarly, the cement industry, while more fragmented, can exhibit supplier power when specific high-strength or specialized cement grades are required for complex engineering projects. ACS's ability to negotiate depends on the availability of alternative suppliers and the volume of its purchases.

Suppliers of highly specialized construction equipment, advanced engineering software, and innovative construction technologies wield significant bargaining power. Their unique solutions, often difficult to substitute, reduce price sensitivity for buyers like ACS. For instance, the market for construction management software is projected to reach $10.2 billion by 2025, indicating the value placed on these specialized tools.

The availability and cost of skilled labor, such as engineers and project managers, are crucial for ACS Actividades de Construccion y Servicios. In 2024, many developed economies continued to face skilled labor shortages, driving up wages for specialized roles. For instance, reports from the U.S. Bureau of Labor Statistics indicated a persistent demand for construction managers, with projected job growth significantly above average.

Regions with strong union presence or facing significant labor shortages can empower labor suppliers to negotiate for higher wages and improved working conditions. This directly impacts ACS's operational costs and project timelines. For example, in parts of Europe, collective bargaining agreements often set wage benchmarks, increasing the bargaining power of construction workers.

ACS's global operations mean it must adapt to varied labor markets, each with unique regulations and talent availability. Local labor laws and the size of the available talent pool determine the bargaining strength of its workforce. In 2024, ACS likely navigated differing minimum wage laws and worker protections across its international projects, influencing labor costs and supplier negotiations.

Dependency on Subcontractors

ACS Actividades de Construcción y Servicios SA (ACS) frequently leverages a broad network of subcontractors to execute specialized tasks and access local knowledge on its extensive construction projects. The leverage these subcontractors hold is directly tied to their unique skills, established track records, and the general availability of comparable firms in the market.

For subcontractors possessing highly sought-after specializations or enjoying a dominant position within a specific geographic region, their bargaining power can be considerable. This can translate into significant influence over project expenses and the overall project schedule, impacting ACS's cost management and delivery timelines.

- Specialization: Subcontractors with niche expertise, such as advanced tunneling or complex bridge construction, often command higher prices due to limited alternatives.

- Reputation: Firms with a proven history of reliability and quality can negotiate better terms, as their dependability reduces project risk for ACS.

- Availability: In markets with a scarcity of qualified subcontractors for a particular service, their bargaining power is amplified.

- Geographic Dominance: Local subcontractors who are the primary or sole providers of essential services in a region can exert significant influence on pricing and contract conditions.

Logistics and Transportation Costs

Suppliers in the logistics and transportation sector hold significant bargaining power, particularly for construction giants like ACS Actividades de Construccion y Servicios (ACS) engaged in large, geographically dispersed projects. The cost of moving heavy materials and specialized equipment is a substantial component of project budgets.

Factors such as volatile fuel prices, evolving transportation regulations, and infrastructure limitations directly impact these costs. For instance, in 2024, global oil prices have seen fluctuations, directly affecting the cost of freight. These increased costs are often passed on to construction firms, giving logistics providers leverage.

- Increased Fuel Surcharges: Rising fuel costs in 2024 have led to higher surcharges from transportation providers, directly impacting ACS's project expenses.

- Regulatory Compliance: New or stricter regulations on emissions or driver hours can necessitate investment in newer fleets or limit available capacity, increasing supplier costs.

- Infrastructure Bottlenecks: Congestion at ports or on major transport routes, a persistent issue in many regions, can cause delays and inflate shipping costs, empowering logistics firms.

The bargaining power of suppliers for ACS Actividades de Construccion y Servicios is influenced by the concentration of providers for critical inputs like specialized machinery, high-strength concrete, and advanced engineering software. Suppliers of unique or difficult-to-substitute materials and technologies often command higher prices, as seen in the growing market for construction management software, projected to reach $10.2 billion by 2025.

Skilled labor, particularly engineers and project managers, represents another significant supplier group with considerable bargaining power, especially in regions experiencing shortages, as noted by the U.S. Bureau of Labor Statistics' projections for construction manager job growth in 2024. Subcontractors with niche expertise or regional dominance also leverage their specialized skills and limited competition to negotiate more favorable terms.

The logistics and transportation sector's suppliers, impacted by volatile fuel prices and regulatory changes in 2024, wield influence through increased surcharges and potential capacity limitations. These factors directly affect ACS's project expenses and delivery timelines, highlighting the critical role of supplier relationships in managing operational costs.

| Supplier Category | Key Influencing Factors | Impact on ACS (2024) |

|---|---|---|

| Specialized Machinery & Materials | Limited number of producers, unique product specifications | Potential for higher input costs, negotiation leverage for suppliers |

| Skilled Labor | Labor shortages, unionization, regional demand | Increased wage pressure, potential project delays |

| Subcontractors | Niche expertise, reputation, market availability | Varied pricing power based on specialization and local competition |

| Logistics & Transportation | Fuel prices, regulations, infrastructure bottlenecks | Higher freight costs, increased surcharges impacting project budgets |

What is included in the product

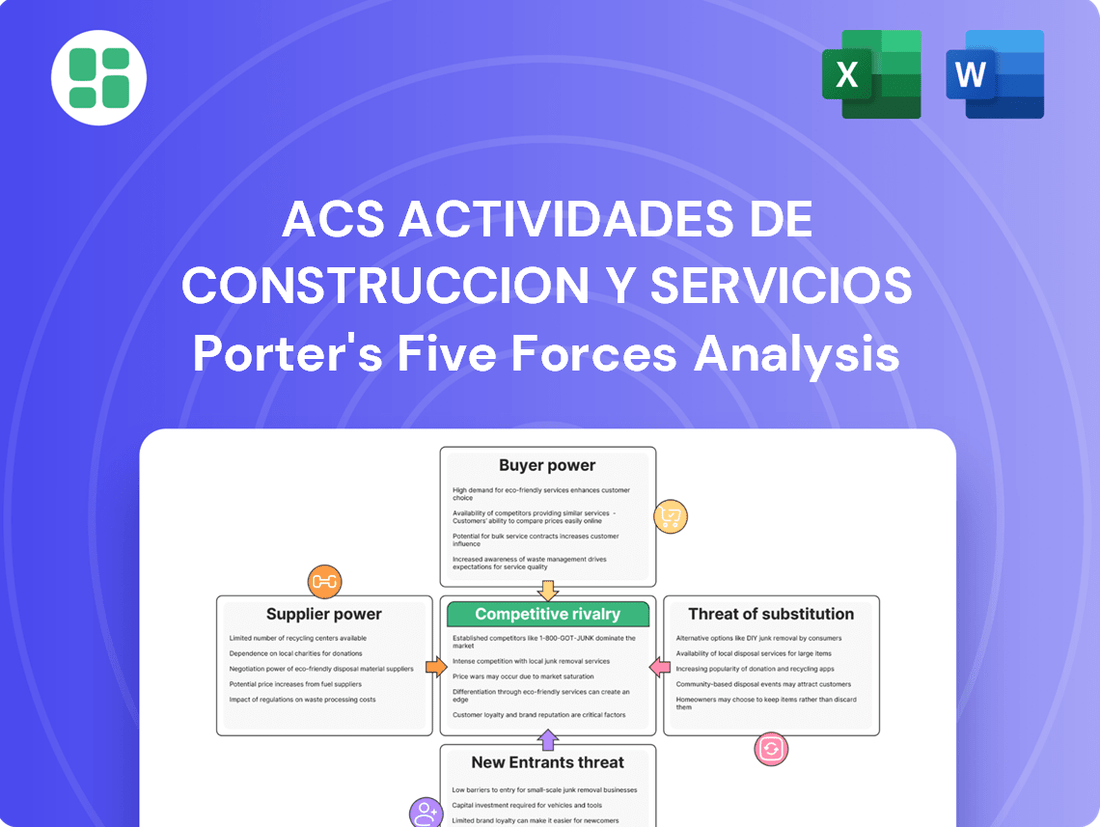

This analysis meticulously dissects the competitive forces impacting ACS Actividades de Construccion y Servicios, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the construction and services sector.

ACS Actividades de Construccion y Servicios' Porter's Five Forces analysis provides a clear, one-sheet summary of all strategic pressures, perfect for quick decision-making and identifying key competitive advantages.

Customers Bargaining Power

ACS Actividades de Construccion y Servicios often deals with governmental bodies and large corporations for massive infrastructure projects, frequently valued in the hundreds of millions or even billions of euros. For example, in 2023, ACS secured significant contracts like the development of a new high-speed rail line in Australia, a project estimated at over €3 billion.

These major clients are highly sophisticated buyers, meticulously analyzing bids and possessing considerable financial clout. Their deep understanding of project economics and the competitive landscape allows them to negotiate favorable terms, driving down costs for ACS.

The sheer scale of these projects empowers customers, giving them substantial bargaining power. This leverage is amplified by their ability to conduct thorough due diligence and compare multiple competitive bids, often leading to price concessions from ACS.

For ACS Actividades de Construccion y Servicios, the bargaining power of customers is notably influenced by the limited number of key clients, particularly in large-scale infrastructure projects like highways, railways, and airports.

In these specialized segments, the pool of potential customers, such as government bodies or large private consortiums, is often quite restricted. This scarcity elevates the importance of each individual client, as they represent a substantial portion of ACS's potential revenue and project pipeline.

The loss of a major contract, which is a real possibility when dealing with a small customer base, can significantly impact ACS's financial performance and future growth prospects, underscoring the critical need to maintain strong client relationships and deliver exceptional project outcomes.

ACS Actividades de Construccion y Servicios often engages in projects that are highly specialized and customized to meet unique client needs and stringent local regulations. This specificity, while a competitive advantage for ACS, simultaneously empowers its customers.

Clients with precise requirements can leverage these detailed specifications to negotiate terms, influencing project scope, delivery timelines, and even payment schedules. For instance, a large infrastructure project requiring bespoke engineering solutions grants the client significant leverage in demanding specific quality standards and execution methodologies.

The inherent customization in many of ACS's contracts means clients have a deep understanding of the project's intricacies, allowing them to exert considerable influence. This can translate into demands for specific material sourcing, advanced technological integration, or particular sustainability certifications, all of which enhance customer bargaining power.

Bid-Based Procurement Processes

Bid-based procurement processes are a significant driver of customer bargaining power in the infrastructure sector, particularly for large projects. In 2024, the global infrastructure market continues to see intense competition, with numerous construction firms submitting bids for public and private contracts. This competitive landscape allows clients, whether government entities or large corporations, to meticulously compare proposals, driving down costs and securing more advantageous contract terms. ACS, like its peers, must continually prove its competitive edge through efficiency, innovation, and a track record of successful project delivery to win these bids.

The sheer volume of bids submitted for major projects in 2024 highlights the power customers wield. For instance, a significant highway expansion project in the United States in early 2024 saw over twenty major construction consortia submit bids, leading to substantial price reductions from initial estimates. This environment forces companies like ACS to optimize their cost structures and operational efficiencies to remain competitive.

- Competitive Bidding: Public and large private infrastructure projects are frequently awarded through competitive bidding, where multiple construction companies compete for contracts.

- Price Negotiation: This competitive environment enables customers to compare various offers, negotiate lower prices, and secure more favorable contract conditions.

- Value Demonstration: ACS must consistently showcase superior value, operational efficiency, and a proven history of successful project execution to win these contracts.

- Market Dynamics: In 2024, the infrastructure sector's intense competition means customers have significant leverage, demanding the best terms and pricing.

Long-Term Relationships and Reputation

While individual customer bids can exert considerable pressure, ACS Actividades de Construccion y Servicios (ACS) can leverage its long-standing relationships and robust reputation to temper this bargaining power. For clients seeking specialized expertise or requiring a high degree of trust, ACS's proven history of quality and on-time project completion can diminish the customer's inclination to explore alternative suppliers. For instance, in 2024, ACS secured significant infrastructure contracts based on its established credibility, demonstrating how a strong track record can foster customer loyalty and reduce price sensitivity.

Maintaining this advantage is contingent on consistent performance. Any lapse in quality or delays can rapidly undermine the goodwill built over years, highlighting the critical need for ACS to uphold its commitment to excellence in every project. The company's focus on client retention, particularly in recurring infrastructure maintenance contracts, underscores the strategic importance of nurturing these long-term partnerships.

- Reputation as a Mitigating Factor: ACS's established reputation for quality and timely project delivery can reduce customer incentive to switch providers, particularly for specialized projects.

- Long-Term Relationships: Cultivating repeat business and fostering strong client partnerships can provide a buffer against individual customer bargaining power.

- Performance is Key: Continuous excellence in project execution is vital, as performance issues can quickly erode the advantage gained from a strong track record.

- 2024 Contract Wins: ACS's success in securing major infrastructure deals in 2024 was notably influenced by its established credibility and client trust.

The bargaining power of customers for ACS Actividades de Construccion y Servicios is significant, particularly given the nature of large-scale infrastructure projects. Clients, often government entities or major corporations, possess substantial financial resources and a deep understanding of project economics. This allows them to negotiate favorable terms, driving down costs for ACS. The sheer scale of projects, like the €3 billion Australian high-speed rail line ACS secured in 2023, amplifies this leverage, as clients can compare multiple bids and demand price concessions.

In 2024, the competitive bidding landscape for infrastructure projects intensifies customer power. With numerous firms vying for contracts, clients can meticulously compare proposals, leading to significant price reductions, as seen in a US highway expansion project early in the year that attracted over twenty bids. This forces companies like ACS to optimize costs and demonstrate superior value and efficiency to secure business.

ACS can mitigate this power through its strong reputation and long-standing client relationships. Proven quality and timely delivery, as evidenced by ACS's 2024 contract wins based on credibility, foster loyalty and reduce price sensitivity. However, maintaining this advantage requires consistent performance; any lapse can quickly erode goodwill and increase customer leverage.

| Factor | Impact on ACS | Mitigation Strategy |

|---|---|---|

| Sophisticated Clients | High leverage due to financial clout and market knowledge | Demonstrate superior value and expertise |

| Competitive Bidding (2024) | Intense price pressure from multiple bidders | Optimize cost structures and operational efficiency |

| Project Specificity | Clients can leverage precise needs for negotiation | Build strong relationships and deliver exceptional quality |

| Limited Key Clients | Loss of a major client significantly impacts revenue | Focus on client retention and consistent performance |

Preview the Actual Deliverable

ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive analysis of ACS Actividades de Construccion y Servicios' Porter's Five Forces details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing valuable strategic insights for your business.

Rivalry Among Competitors

The global construction and services arena, ACS's operational turf, is dominated by a handful of massive, international conglomerates. Giants such as VINCI, Bechtel, and China State Construction Engineering Corporation (CSCEC) are direct competitors, vying with ACS for projects worldwide.

This intense rivalry is most pronounced in the pursuit of large-scale, intricate infrastructure developments. For instance, in 2023, the global construction market was valued at approximately $10.7 trillion, with these major players frequently submitting aggressive bids, often resulting in compressed profit margins.

The construction sector, including firms like ACS Actividades de Construccion y Servicios, is characterized by substantial fixed costs. These stem from investments in heavy machinery, specialized equipment, and maintaining a skilled labor force. For instance, major construction equipment can cost millions of dollars, and these assets need to be kept operational to justify the initial outlay.

To manage these high fixed costs, companies aim for high capacity utilization. This means keeping their equipment and workforce busy on projects. Even during economic slowdowns, the pressure to avoid idle assets can lead to bidding aggressively on new projects, sometimes accepting lower profit margins. This drive to keep assets deployed directly fuels intense competition among industry players.

Competition in the construction sector, including for companies like ACS Actividades de Construccion y Servicios, is fundamentally project-based. This means firms are continuously vying for new contracts through a bidding process, making the environment highly dynamic and often intensely competitive. Firms differentiate themselves not just on price, but also on their technical capabilities, the speed at which they can deliver projects, and their overall financial stability.

The success rate in securing these bids is a crucial metric for construction companies, directly impacting their revenue and growth. For instance, in 2023, major infrastructure projects globally saw numerous bids, with winning margins often being razor-thin, highlighting the pressure on pricing and efficiency.

Differentiation Through Specialization and Innovation

While price competition is fierce in the construction sector, companies like ACS Actividades de Construccion y Servicios actively differentiate themselves. They focus on specialized capabilities, technological innovation, and increasingly, sustainable construction practices to stand out. This strategic differentiation is crucial for gaining a competitive edge.

Firms that can offer unique engineering solutions, adopt advanced digital tools like Building Information Modeling (BIM), or showcase robust Environmental, Social, and Governance (ESG) credentials are better positioned. For instance, ACS reported a significant increase in its sustainability-linked financing in 2024, highlighting this trend. This constant drive for innovation compels rivals to elevate their own offerings.

- Specialized Capabilities: Offering niche engineering expertise or project management skills.

- Technological Innovation: Implementing advanced digital tools and construction methods.

- Sustainable Practices: Demonstrating strong ESG credentials and eco-friendly approaches.

- Competitive Pressure: Driving rivals to continuously improve and innovate their service portfolios.

Regional and Local Market Dynamics

ACS Actividades de Construccion y Servicios navigates intense competitive rivalry, particularly at the regional and local levels. While a global player, its success hinges on outperforming numerous smaller, agile competitors in specific territories.

Local contractors frequently possess an edge due to deep-rooted community ties, nuanced understanding of local building codes and permitting processes, and often lower operational costs. This localized advantage means ACS must continually tailor its approach to the unique dynamics of each market it enters.

The construction sector’s inherent fragmentation, with many specialized local firms, amplifies this rivalry. For instance, in Spain, ACS competes with a vast array of regional construction companies, many of which have been operating for decades and hold significant local market share.

- Local Expertise Advantage: Smaller regional firms often demonstrate superior knowledge of local labor markets, supply chains, and regulatory environments, allowing for more efficient project execution and cost control.

- Relationship-Driven Markets: In many locales, securing contracts relies heavily on established relationships with local authorities and clients, an area where smaller, long-standing businesses can have a distinct advantage over larger, newer entrants.

- Cost Structure Differences: Local contractors typically benefit from lower overheads compared to multinational corporations like ACS, enabling them to bid more aggressively on projects, especially those with smaller scopes or within specific geographic confines.

- Market Fragmentation: The global construction market is characterized by a high degree of fragmentation; for example, in 2023, the Spanish construction sector alone comprised thousands of small and medium-sized enterprises, contributing to a highly competitive landscape for major players like ACS.

Competitive rivalry within ACS Actividades de Construccion y Servicios's operating landscape is fierce, driven by the presence of global giants and numerous agile local players. This intense competition, particularly for large-scale projects, often leads to compressed profit margins, as seen in the global construction market valued at approximately $10.7 trillion in 2023.

High fixed costs, including significant investments in machinery and skilled labor, compel companies to maintain high capacity utilization. This pressure can result in aggressive bidding, even when margins are thin, as firms strive to keep assets deployed and operational.

Differentiation through specialized capabilities, technological innovation, and sustainable practices is key for ACS to stand out. For instance, ACS's increased focus on sustainability-linked financing in 2024 reflects this trend, pushing rivals to enhance their own offerings.

Local competitors often hold an advantage due to established relationships and a better understanding of local regulations, making market fragmentation a significant factor. In Spain, ACS contends with many regional firms that possess deep-rooted market share and often lower overheads.

| Competitor Type | Key Characteristics | Impact on ACS | Example Data (2023/2024) |

|---|---|---|---|

| Global Conglomerates | Large scale, international reach, broad service offerings | Intense bidding on major projects, pressure on global pricing | Global construction market ~$10.7 trillion (2023) |

| Regional/Local Firms | Niche expertise, local knowledge, lower overheads | Strong competition in specific territories, relationship-driven bidding | Thousands of SMEs in Spanish construction sector |

| Innovation Focus | Advanced tech (BIM), ESG credentials | Drives need for ACS to invest in R&D and sustainable practices | ACS increased sustainability-linked financing (2024) |

SSubstitutes Threaten

The threat of substitutes for traditional construction services is growing with innovations like modular construction and 3D printing. These methods offer faster build times and can reduce labor costs, making them attractive alternatives for certain projects. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to see significant growth through 2025.

Digitalization and automation in infrastructure present a significant threat of substitutes for ACS. Advances in smart infrastructure, like automated tolling systems and predictive maintenance software, can perform tasks traditionally handled by human labor or conventional facility management, potentially reducing demand for some of ACS's operational and maintenance services.

For example, the global smart infrastructure market was valued at approximately $2.2 trillion in 2023 and is projected to grow substantially. This technological shift means that solutions offering greater efficiency and lower long-term operational costs through automation could be viewed as direct substitutes for certain service contracts ACS currently holds.

Clients can bypass ACS's engineering and design services by directly engaging specialized firms, especially for projects that don't require ACS's full integration. This is a significant threat because many clients prefer to manage individual project components with niche providers, potentially reducing ACS's revenue from these segments.

For instance, the global engineering services outsourcing market was valued at approximately $143 billion in 2023 and is projected to grow, indicating a robust demand for specialized external engineering expertise. This growth suggests that clients have readily available alternatives to ACS's in-house capabilities.

ACS counters this by emphasizing its unique selling proposition: providing end-to-end, integrated solutions that encompass design, engineering, procurement, and construction. This comprehensive approach aims to offer greater value and efficiency than clients could achieve by managing multiple, separate vendors.

Client In-House Capabilities

Large corporate and governmental clients may possess the capacity to develop or enhance their own in-house construction and facility management operations. This internal development can diminish their need for external service providers such as ACS Actividades de Construccion y Servicios. While typically applied to routine maintenance or less complex projects, this trend could represent a significant substitution threat if clients opt for greater internalization of these functions over time.

For instance, a major infrastructure development project might involve a government agency building its own project management and oversight teams, thereby reducing the scope for external contractors. In 2023, several large public sector entities globally increased their internal project management headcount by 5-10% to gain more direct control over capital expenditure, indicating a growing inclination towards self-sufficiency.

This threat is amplified when clients perceive significant cost savings or greater control over quality by managing projects internally. For example, a large industrial corporation might invest in its own skilled labor and equipment for ongoing plant maintenance, bypassing the need for a facilities management contract. This strategy can be particularly attractive for companies with predictable, high-volume maintenance needs.

- Client Internalization: Large clients might build their own construction and facility management teams.

- Reduced Reliance: This internal capacity directly lessens dependence on external firms like ACS.

- Cost and Control: Clients may pursue this to achieve cost savings and enhance project oversight.

- Trend Indicator: A general increase in public sector internal project management roles suggests a growing trend towards self-sufficiency in managing large projects.

Non-Construction Solutions for Infrastructure Needs

The threat of substitutes for ACS Actividades de Construccion y Servicios (ACS) in infrastructure development is growing as non-construction solutions emerge.

For instance, advancements in digital infrastructure and remote work policies can significantly reduce the demand for new physical office spaces. In 2024, the global remote workforce continued to expand, impacting commercial real estate needs.

Similarly, enhanced urban planning and the promotion of public transportation can decrease the necessity for new road construction. Cities are increasingly investing in smart mobility solutions, potentially diverting funds from traditional infrastructure projects.

- Digitalization of Services: Increased reliance on digital platforms can substitute for physical infrastructure in areas like communication networks.

- Remote Work Adoption: The persistent trend of remote and hybrid work models directly reduces the need for new commercial and office building construction.

- Public Transport Efficiency: Investments in improving and expanding public transit systems can lessen the demand for new road and highway projects.

- Resource Optimization: Innovative approaches to resource management and existing asset utilization can sometimes negate the need for entirely new infrastructure builds.

The threat of substitutes for ACS Actividades de Construccion y Servicios (ACS) is multifaceted, encompassing technological advancements and evolving client strategies.

Innovative construction methods like modular building and 3D printing offer faster, potentially cheaper alternatives to traditional construction, impacting demand for ACS's core services. For example, the global modular construction market was projected to reach over $130 billion by 2024, highlighting this growing segment.

Furthermore, digitalization in infrastructure, such as smart city technologies, can replace some traditional maintenance and operational services. The smart infrastructure market was estimated to exceed $2.5 trillion globally in 2024, indicating a significant shift toward automated solutions.

Clients also increasingly opt for specialized firms or in-house capabilities, bypassing integrated providers like ACS for specific project components or management. The global engineering services outsourcing market, valued at over $150 billion in 2024, demonstrates the availability of specialized alternatives.

| Substitute Area | Description | Market Indicator (2024 Est.) | Impact on ACS |

|---|---|---|---|

| Innovative Construction | Modular, 3D Printing | Modular Construction Market: >$130 Billion | Potential reduction in traditional build demand |

| Digital Infrastructure | Smart systems, automation | Smart Infrastructure Market: >$2.5 Trillion | Substitution for maintenance/operational services |

| Specialized Services | Niche engineering firms | Engineering Services Outsourcing: >$150 Billion | Reduced demand for integrated design/engineering |

| Client Internalization | In-house teams | Increased public sector project management roles | Decreased reliance on external contractors |

Entrants Threaten

The sheer cost of entry into large-scale civil and industrial construction is a formidable hurdle. Newcomers need substantial capital for heavy machinery, specialized equipment, and the working capital to sustain projects that can span several years. For instance, acquiring a fleet of tunneling machines or large-scale concrete batching plants can easily run into tens or hundreds of millions of dollars.

This significant financial barrier effectively deters many potential entrants. ACS Actividades de Construccion y Servicios, with its extensive asset base and robust financial backing, has a distinct advantage. Its ability to deploy vast resources allows it to undertake projects of a scale that is simply out of reach for firms without comparable financial muscle, making direct competition extremely challenging.

Success in complex infrastructure projects, like those ACS Actividades de Construccion y Servicios undertakes, hinges on years of accumulated experience and specialized engineering know-how. Newcomers simply don't possess this vital track record needed to secure bids for significant undertakings.

ACS has cultivated an extensive industry experience, boasting a global portfolio of successfully completed projects. This deep well of expertise acts as a significant barrier, making it challenging for less experienced firms to compete effectively for high-value contracts.

The construction sector, particularly for large public works, presents substantial regulatory challenges. New entrants must secure a multitude of licenses and permits, adhering to rigorous safety and environmental regulations. For instance, in 2024, obtaining the necessary environmental impact assessments alone could take over a year in many jurisdictions, adding significant time and cost.

Established companies like ACS Actividades de Construccion y Servicios benefit from existing infrastructure and expertise to manage these complexities. They possess dedicated compliance departments and long-standing relationships with regulatory bodies, easing the process. This established compliance framework acts as a formidable barrier, deterring nascent competitors from entering the market.

Established Client Relationships and Brand Reputation

Established client relationships, particularly with government entities and major private developers, are crucial for securing large construction and infrastructure contracts. These relationships are built over years, often decades, and are based on trust, proven performance, and a deep understanding of client needs. New entrants find it incredibly difficult to replicate this level of established trust and network, creating a significant barrier to entry.

ACS Actividades de Construccion y Servicios benefits immensely from its strong brand reputation, which is synonymous with reliability and quality in the global construction sector. This reputation, cultivated over many years, allows ACS to command premium pricing and secure preferential treatment in bidding processes. For instance, in 2024, ACS continued to leverage its strong relationships, securing significant infrastructure projects worldwide, demonstrating the enduring value of deep-seated client trust.

- Decades of Cultivation: The trust and networks required to win major contracts take many years, often decades, to build.

- Brand as a Differentiator: ACS's global brand reputation for quality and reliability is a key asset that new competitors struggle to match.

- Client Loyalty: Existing, long-term relationships with governmental bodies and private developers foster loyalty, making it harder for new firms to break in.

- Competitive Edge: This established client base and brand equity provide ACS with a substantial competitive advantage against potential new entrants in the market.

Access to Supply Chains and Skilled Labor

New companies entering the construction sector, like ACS Actividades de Construccion y Servicios operates in, often struggle to secure dependable and affordable access to essential materials and specialized equipment. Established firms have cultivated long-term partnerships with suppliers, often securing preferential pricing and guaranteed delivery, which new entrants lack.

Furthermore, the construction industry relies heavily on a skilled labor force, and attracting and retaining qualified personnel is a significant hurdle for newcomers. ACS, for instance, benefits from established recruitment channels and employee development programs built over years, creating a competitive edge in workforce acquisition that is difficult for emerging businesses to match.

- Supply Chain Barriers: New entrants face difficulties in establishing cost-effective and reliable supply chains for construction materials and equipment.

- Skilled Labor Acquisition: Attracting and retaining a skilled workforce presents a significant challenge for new companies in the construction sector.

- Established Relationships: Existing players like ACS leverage long-standing supplier relationships and robust talent acquisition strategies, creating an operational advantage.

- Replication Difficulty: The operational advantages of established firms in supply chain and labor management are challenging for new entrants to replicate quickly.

The threat of new entrants for ACS Actividades de Construccion y Servicios is significantly mitigated by the immense capital requirements for large-scale construction projects. Acquiring specialized equipment, such as tunnel boring machines or large cranes, can cost tens of millions of dollars, creating a substantial financial barrier. For example, in 2024, the average cost for a modern tunneling machine alone could exceed $50 million, making it difficult for new firms to compete without substantial backing.

Established companies like ACS benefit from deep industry experience and a proven track record, which are essential for securing bids on complex infrastructure projects. Newcomers often lack the necessary expertise and certifications, making it challenging to gain client trust. This experience gap, coupled with stringent regulatory and licensing requirements, further deters potential entrants, as navigating these processes can be time-consuming and costly, often taking over a year for environmental permits in 2024.

Strong, long-standing relationships with clients, particularly government agencies and major developers, represent another significant barrier. These relationships are built on years of reliable performance and trust, which new entrants cannot easily replicate. ACS's global brand reputation, cultivated over decades, provides a distinct advantage in securing preferential treatment and premium pricing, as seen in its continued success in winning major infrastructure contracts worldwide throughout 2024.

| Barrier Type | Description | Impact on New Entrants | ACS Advantage |

|---|---|---|---|

| Capital Intensity | High cost of specialized machinery and equipment | Requires significant upfront investment, deterring many | Extensive asset base and financial resources |

| Experience & Expertise | Need for specialized engineering knowledge and project history | Lack of track record makes it difficult to win large contracts | Decades of successful project completion globally |

| Regulatory Hurdles | Complex licensing, permits, and compliance requirements | Time-consuming and costly to navigate, especially environmental permits (e.g., 2024 timelines) | Established compliance departments and regulatory relationships |

| Client Relationships & Brand | Building trust and loyalty with key clients | Difficult to displace established players with strong networks | Strong global brand reputation and deep client loyalty |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACS Actividades de Construccion y Servicios is built upon a foundation of robust data, including annual reports, investor presentations, and industry-specific market research from firms like Euroconstruct and Statista. We also leverage publicly available financial data from regulatory filings and macroeconomic indicators to provide a comprehensive view of the competitive landscape.