ACS Actividades de Construccion y Servicios PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

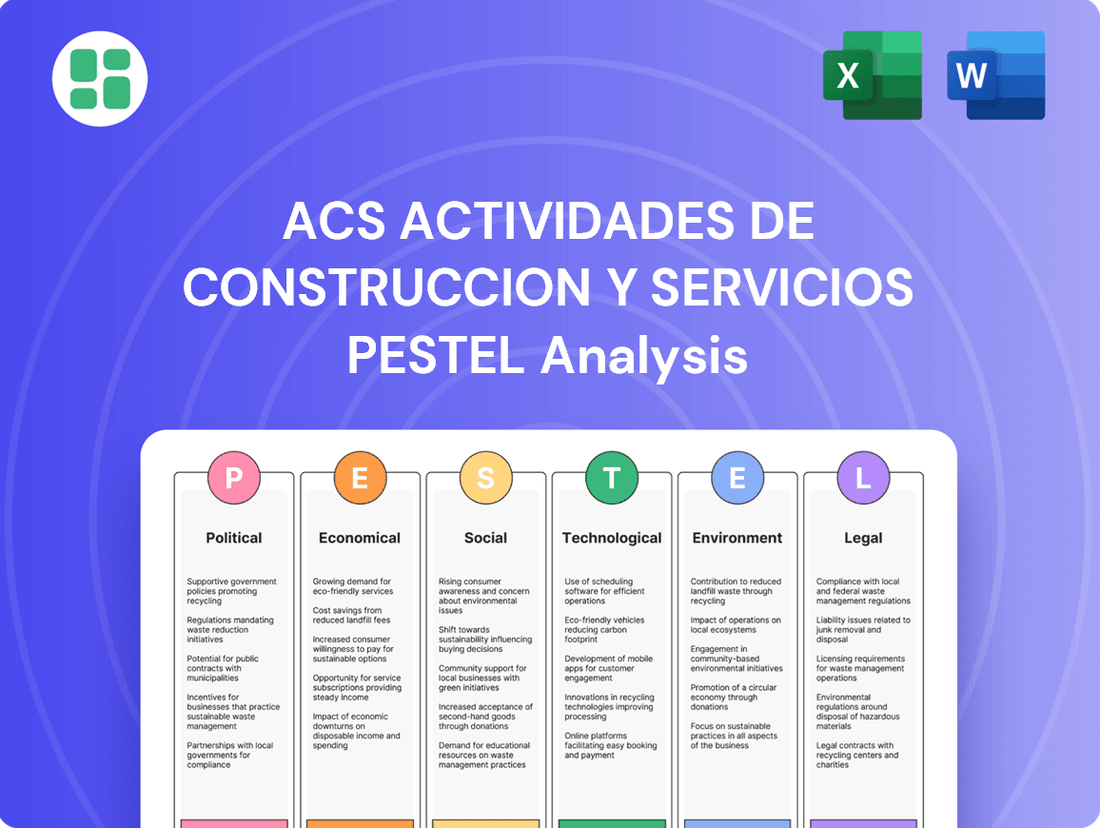

Unlock the strategic advantages for ACS Actividades de Construccion y Servicios by understanding the intricate web of political, economic, social, technological, legal, and environmental factors impacting its operations. Our expertly crafted PESTLE analysis provides a clear roadmap of these external forces, empowering you to anticipate challenges and seize opportunities. Invest in comprehensive market intelligence; download the full PESTLE analysis now to gain a decisive edge.

Political factors

Government infrastructure spending is a massive driver for ACS Group, a company deeply involved in building major projects like highways and railways. When governments invest more in infrastructure, it directly translates to more projects for ACS to bid on and complete, creating a steady stream of work. For instance, the European Union's NextGenerationEU recovery fund, with significant allocations for infrastructure development, is a key opportunity.

In 2024, many countries are continuing or increasing their infrastructure budgets to boost economic growth and address aging systems. This trend is particularly evident in Spain, ACS's home market, where the government's National Recovery, Transformation and Resilience Plan prioritizes transport and sustainable mobility projects. These initiatives are crucial for ACS's revenue pipeline and future growth prospects.

Changes in national and international construction regulations significantly impact ACS Group's operational costs and project feasibility. For instance, new environmental regulations in Europe, such as those related to sustainable building materials and carbon emissions, can necessitate costly upgrades to existing infrastructure and construction methods. These shifts require ACS to invest in new technologies and training, potentially extending project timelines and increasing compliance expenses across its global operations.

ACS Group's extensive international presence means it's exposed to political shifts and global tensions. For instance, ongoing conflicts or sudden governmental changes in regions where ACS operates, such as Latin America or the Middle East, can halt construction projects, disrupt material sourcing, and endanger personnel and property. While ACS strategically diversifies its operations across many countries to lessen the impact of localized instability, maintaining a constant awareness of these evolving geopolitical landscapes is crucial.

Public-Private Partnership (PPP) Frameworks

The structure and prevalence of Public-Private Partnership (PPP) frameworks are highly significant for ACS Group, given its frequent involvement in these collaborations. Clear and supportive PPP policies, which ensure equitable risk distribution and appealing financial returns, are vital for attracting private investment in infrastructure projects. For instance, Spain, a key market for ACS, has been actively refining its PPP legislation to streamline project approvals and enhance investor confidence.

Robust regulatory environments for PPPs directly translate into expanded investment prospects. As of early 2024, many European nations, including those where ACS operates, are focusing on standardizing PPP procurement processes to reduce transaction costs and improve project delivery timelines. This trend is expected to continue, with governments seeking to leverage private capital for essential infrastructure upgrades.

- Spain's PPP framework continues to evolve, aiming for greater transparency and efficiency in project bidding and execution.

- European Union initiatives are promoting harmonized PPP guidelines to facilitate cross-border infrastructure investment.

- Increased government spending on infrastructure in 2024-2025, particularly in renewable energy and digital networks, is creating new PPP opportunities.

Trade Policies and Protectionism

Evolving trade policies, including tariffs and local content requirements, directly impact ACS Group's material sourcing and operational strategies. For instance, the European Union's ongoing review of its trade agreements and potential retaliatory tariffs in response to global trade disputes can affect the cost of imported components for ACS's infrastructure projects.

Protectionist measures in key markets, such as increased tariffs on steel or construction equipment, could significantly raise costs for imported materials, thereby reducing project profitability. In 2024, several countries have implemented or are considering new trade barriers, impacting global supply chains and potentially increasing the cost of raw materials for construction by an estimated 5-10% depending on the specific goods and tariffs applied.

ACS must adeptly navigate these complexities to maintain cost efficiency and ensure continued market access for its global operations. The company's ability to adapt its procurement strategies and explore alternative sourcing options will be crucial in mitigating the financial impact of these trade policy shifts.

- Tariff Impact: Potential for increased costs on imported construction materials and equipment due to trade disputes and protectionist policies.

- Local Content Rules: Evolving regulations requiring a higher percentage of locally sourced materials or labor can necessitate adjustments to supply chain management.

- Market Access: Trade barriers could limit ACS's ability to bid on or profitably execute projects in certain international markets.

Government infrastructure spending remains a primary growth engine for ACS, with increased budgets in 2024-2025 across Europe, particularly in Spain through its National Recovery Plan. The EU's NextGenerationEU fund further bolsters this, directing substantial capital towards transport and sustainable mobility, directly benefiting ACS's project pipeline.

Regulatory shifts, especially environmental mandates in Europe, necessitate significant investment in new technologies and sustainable practices, potentially increasing compliance costs and project timelines for ACS. Geopolitical instability in regions where ACS operates, such as Latin America, poses risks of project disruption and supply chain interruptions, requiring careful strategic management.

The framework and efficiency of Public-Private Partnerships (PPPs) are critical for ACS, with Spain and other European nations actively refining their PPP legislation to streamline processes and attract private investment. Harmonized EU guidelines are also emerging to facilitate cross-border infrastructure projects, enhancing investment prospects.

Trade policies, including tariffs and local content rules, directly influence ACS's material costs and market access. Protectionist measures in 2024 could raise raw material costs by an estimated 5-10%, impacting project profitability and requiring adaptive procurement strategies.

| Political Factor | Impact on ACS | 2024-2025 Data/Trend |

|---|---|---|

| Government Infrastructure Spending | Increased project opportunities and revenue | EU NextGenerationEU fund (significant allocations); Spain's National Recovery Plan (prioritizing transport) |

| Regulatory Environment (Environmental) | Increased compliance costs, need for new technologies | Stricter EU environmental regulations on sustainable building and emissions |

| Geopolitical Stability | Risk of project disruption and supply chain issues | Ongoing conflicts/governmental changes in Latin America and Middle East |

| Public-Private Partnership (PPP) Frameworks | Expanded investment prospects, streamlined project execution | Spain refining PPP legislation; EU promoting harmonized PPP guidelines |

| Trade Policies (Tariffs, Local Content) | Increased material costs, potential market access limitations | Estimated 5-10% rise in raw material costs due to protectionist measures in 2024 |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the macro-environmental forces impacting ACS Actividades de Construccion y Servicios, dissecting their influence across political, economic, social, technological, environmental, and legal landscapes.

It provides actionable insights for strategic decision-making by highlighting potential threats and opportunities arising from these external factors, tailored to ACS's operational context.

The ACS Actividades de Construccion y Servicios PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of complex data overload.

Economic factors

ACS Actividades de Construccion y Servicios's fortunes are intrinsically linked to the pace of global economic expansion. As economies grow, there's a natural uptick in the need for new infrastructure, from roads and bridges to energy facilities, directly benefiting ACS's core business. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% for 2024, a slight moderation from previous years but still indicative of a generally expanding economic landscape that supports construction demand.

A robust global economy translates into increased capital expenditure by both governments and private entities. This investment surge fuels demand for the large-scale construction and industrial services that ACS specializes in. In 2023, global infrastructure spending saw continued investment, with many nations prioritizing projects to address climate change and improve connectivity, providing a favorable environment for companies like ACS.

However, the company remains sensitive to economic downturns. A global recession or significant slowdown can lead to a contraction in construction budgets, resulting in project postponements or outright cancellations. For example, during periods of high inflation and rising interest rates, as seen in parts of 2023 and extending into 2024, some infrastructure projects faced scrutiny and potential delays, impacting revenue streams for construction firms.

Interest rates significantly influence ACS Group's ability to secure financing for its extensive construction and infrastructure projects. For instance, as of early 2024, central banks in major economies like the Eurozone and the United States have maintained relatively stable, albeit cautious, interest rate policies, which generally supports project viability.

When interest rates are low, as they were in recent years leading up to 2023, the cost of borrowing for both ACS and its clients decreases. This makes large capital-intensive projects, such as new highways or renewable energy facilities, more attractive, potentially boosting ACS's order book. Conversely, a rise in interest rates, which has been a trend in some regions during 2023 and early 2024, can increase borrowing expenses for ACS and make potential clients more hesitant to commit to new, long-term investments.

Inflationary pressures continue to be a significant concern for ACS Group, directly impacting the cost of essential construction materials. For instance, the Producer Price Index (PPI) for construction materials in the US saw a notable increase, with some categories experiencing double-digit percentage rises year-over-year through late 2024 and into early 2025. This trend directly translates to higher input costs for projects undertaken by ACS, potentially squeezing profit margins, especially on long-term, fixed-price contracts where price adjustments are difficult.

The volatility in prices for key commodities such as steel, cement, and lumber presents a substantial challenge. Reports from early 2025 indicated that global steel prices, influenced by energy costs and supply chain disruptions, remained elevated compared to pre-pandemic levels. Similarly, cement and concrete prices have seen upward adjustments due to increased energy expenses and transportation costs. These unpredictable hikes can lead to unforeseen cost overruns, impacting the financial viability of projects and requiring ACS to implement robust risk mitigation strategies.

To navigate these economic headwinds, ACS Group's focus on sophisticated supply chain management and strategic hedging becomes paramount. By securing favorable long-term contracts with suppliers and utilizing financial instruments to hedge against price volatility, the company aims to insulate its projects from the most severe impacts of rising material costs. This proactive approach is essential for maintaining profitability and ensuring project completion within budget in the current economic climate.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant consideration for ACS Group, given its extensive global footprint across North America, Europe, and the Asia Pacific region. As of early 2024, major currency pairs like EUR/USD and USD/JPY have experienced notable volatility, impacting the translated value of ACS's international earnings and expenditures.

These shifts directly affect the consolidated financial statements, altering the reported profitability and asset valuations when converted to ACS's primary reporting currency. For instance, a strengthening US dollar against the Euro could reduce the reported value of ACS's European revenues. Conversely, a weakening dollar could inflate it.

To mitigate these risks, ACS likely employs sophisticated financial management and hedging strategies. These might include forward contracts or currency options to lock in exchange rates for future transactions, thereby providing greater certainty in financial planning and performance reporting.

- Global Operations Exposure: ACS Group's presence in North America, Europe, and Asia Pacific inherently exposes it to diverse currency markets.

- Impact on Financial Reporting: Fluctuations in exchange rates, such as the EUR/USD or USD/JPY, can significantly alter the reported value of international revenues and expenses when consolidated.

- Need for Hedging: Effective financial management necessitates the implementation of hedging strategies to neutralize the adverse effects of currency volatility on profitability and asset values.

- 2024 Currency Trends: Early 2024 saw continued volatility in major currency pairs, underscoring the ongoing importance of currency risk management for multinational corporations like ACS.

Labor Market Conditions and Wage Pressures

Labor market conditions significantly impact ACS Group's operational expenses, particularly concerning skilled labor shortages and wage inflation. A tight labor market, especially in construction and industrial services, can drive up labor costs and potentially cause project timelines to slip. For instance, in the EU, construction sector unemployment rates have remained low, hovering around 5-6% in late 2024, indicating persistent demand for skilled workers.

To counter these challenges, ACS must prioritize robust training and retention programs to ensure a consistently skilled workforce. Wage pressures are a direct consequence of this demand; in many European countries, average construction wages saw an increase of 3-5% in 2024 compared to the previous year, reflecting the competitive landscape for talent.

- Skilled labor shortages in construction and industrial services directly increase ACS Group's operational costs.

- Wage inflation, with average construction wages rising 3-5% in the EU during 2024, impacts profitability.

- Project delays are a risk stemming from the inability to secure sufficient skilled labor.

- Investment in **training and retention strategies** is crucial for maintaining workforce capability and mitigating cost increases.

Economic growth directly fuels demand for ACS's infrastructure services, with global expansion projected to remain positive, albeit at a moderated pace in 2024. Increased capital expenditure by governments and private entities, particularly in areas like climate change mitigation and connectivity, supports large-scale projects. However, economic downturns or recessions can lead to budget contractions and project delays, impacting ACS's revenue streams.

Interest rates significantly influence project financing costs for ACS and its clients. While major central banks maintained cautious policies in early 2024, rising rates in certain regions during 2023-2024 increase borrowing expenses and can make new investments less attractive. Inflationary pressures, especially in material costs like steel and cement, are also a major concern, with elevated prices persisting into early 2025 due to energy and supply chain issues.

Currency exchange rate volatility, as seen in major pairs like EUR/USD in early 2024, impacts ACS's consolidated financial reporting of international earnings. Labor market conditions, characterized by low unemployment and wage inflation in the EU construction sector (estimated 3-5% wage increase in 2024), also raise operational costs and pose risks of project delays if skilled labor is insufficient.

| Economic Factor | 2024/2025 Trend/Data | Impact on ACS |

|---|---|---|

| Global GDP Growth | Projected ~3.2% for 2024 (IMF) | Supports demand for infrastructure projects |

| Interest Rates (Major Economies) | Cautiously stable in early 2024; rising trends in some regions 2023-2024 | Increases financing costs, potentially dampens investment |

| Construction Material Prices (e.g., Steel) | Elevated into early 2025, influenced by energy/supply chains | Increases project costs, squeezes margins |

| EU Construction Unemployment Rate | Low, ~5-6% in late 2024 | Indicates demand for skilled labor, potential for wage inflation |

| EU Construction Wage Inflation | Estimated 3-5% increase in 2024 | Increases operational expenses |

Same Document Delivered

ACS Actividades de Construccion y Servicios PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ACS Actividades de Construccion y Servicios delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping ACS's strategic landscape.

Sociological factors

Global population growth is a significant driver for ACS. The United Nations projects the world population to reach 8.5 billion by 2030, up from an estimated 8.1 billion in 2024. This continued expansion directly translates into a greater need for housing, infrastructure, and public services, areas where ACS operates extensively.

Urbanization trends further amplify this demand. By 2050, it's estimated that 68% of the world's population will live in urban areas, a substantial increase from 57% in 2023. This concentration of people in cities necessitates significant investment in new construction, transportation systems, and utilities, creating sustained opportunities for ACS’s core business segments.

Public perception significantly impacts ACS Group's infrastructure ventures. For instance, in 2024, a major high-speed rail project in Spain, where ACS is a key player, faced considerable public debate regarding its environmental impact and land acquisition, highlighting the need for transparent communication and community buy-in.

Positive public sentiment, often cultivated through proactive community engagement and clear communication of social benefits, is crucial for securing project approvals and maintaining a social license to operate. ACS's commitment to sustainability and local job creation, as demonstrated in its 2025 ESG report, aims to bolster this positive perception.

Conversely, negative public opinion can create substantial hurdles, leading to protests, regulatory delays, and even outright project cancellations. The ongoing discussions around urban development projects in 2024 and 2025 often involve public scrutiny of noise pollution and traffic disruption, underscoring the financial and operational risks associated with public opposition.

Societal expectations for diversity and inclusion are significantly shaping corporate behavior, including that of ACS Group. As of early 2024, many large corporations, including those in the construction sector, are reporting increased focus on ESG (Environmental, Social, and Governance) metrics, with diversity and inclusion being a key component. For instance, a significant percentage of Fortune 500 companies have publicly stated goals for gender and ethnic diversity in leadership roles.

ACS Group's commitment to robust diversity and inclusion initiatives can directly bolster its reputation. Companies with strong D&I programs often see a measurable improvement in employee engagement and retention. Data from various studies in 2024 indicate that organizations with higher levels of diversity are more likely to outperform their less diverse peers financially, with some reporting up to 30% higher profitability.

Furthermore, embracing diversity and inclusion helps ACS Group attract a wider range of talent and fosters a more innovative work environment. This adaptability is crucial for meeting the evolving demands of clients and stakeholders who increasingly prioritize ethical and socially responsible business practices. By aligning with these societal shifts, ACS Group can enhance its competitive edge in the global market.

Health and Safety Standards and Public Expectations

Health and safety standards are critical in construction and industrial services, with public expectations for worker well-being continually increasing. ACS Group must not only meet but surpass these rigorous standards to safeguard its employees, preserve its reputation, and prevent expensive legal issues and project delays stemming from accidents. In 2023, the construction industry globally reported a lost-time injury frequency rate (LTIFR) of approximately 3.5 per million hours worked, highlighting the ongoing challenges.

Adherence to evolving safety regulations and anticipating public sentiment are key for ACS. Failure to do so can lead to significant financial penalties, such as fines that can reach millions of euros for major violations, and can also severely damage brand perception, impacting future contract bids. For instance, a major safety lapse in 2024 on a large infrastructure project in Europe resulted in a six-month suspension and a €5 million fine for the contracting company.

- Rising Public Scrutiny: Increased media and social media attention on workplace accidents puts companies like ACS under greater public scrutiny.

- Regulatory Compliance: Staying ahead of and complying with evolving health and safety legislation, such as updated EU directives on construction site safety, is essential.

- Reputational Risk: A single major safety incident can tarnish a company's reputation, affecting its ability to attract talent and secure new projects.

- Operational Continuity: Robust safety protocols minimize the risk of work stoppages, ensuring project timelines and financial performance remain on track.

Changing Consumer Demands for Sustainable and Smart Infrastructure

Societal awareness regarding sustainability is profoundly reshaping infrastructure demands. Consumers and clients are increasingly prioritizing eco-friendly materials, energy efficiency, and smart technologies in new builds and renovations. This shift directly impacts project design, construction methods, and the overall lifecycle of infrastructure, pushing companies like ACS to innovate.

For instance, a 2024 report indicated that over 60% of global consumers are willing to pay more for products and services from companies committed to positive social and environmental impact. This trend translates directly to infrastructure projects, where demand for green buildings, smart grids, and resilient urban solutions is escalating. ACS Group must therefore embed these evolving preferences into its strategic planning and project execution to maintain its competitive edge and align with prevailing societal values.

- Growing Demand for Green Building: By 2025, it's projected that the global green building market will reach over $370 billion, reflecting a significant demand for sustainable construction practices.

- Smart City Integration: Investments in smart city infrastructure, focusing on IoT, data analytics, and efficient resource management, are expected to exceed $700 billion globally by 2028, highlighting a clear trend towards technologically advanced facilities.

- Client Expectations: Surveys in 2024 show that over 70% of corporate clients now consider sustainability credentials a key factor in selecting construction partners.

- Energy Efficiency Mandates: Many governments are implementing stricter energy efficiency standards for new constructions, driving the need for advanced, low-carbon solutions in the sector.

Societal expectations for diversity and inclusion are significantly shaping corporate behavior, including that of ACS Group. Companies with strong D&I programs often see a measurable improvement in employee engagement and retention, with organizations exhibiting higher diversity levels potentially outperforming less diverse peers financially by up to 30% as reported in 2024 studies. Embracing diversity also helps ACS attract a wider talent pool and fosters innovation, crucial for meeting evolving client demands for ethical business practices.

Technological factors

The construction industry's embrace of Building Information Modeling (BIM) is accelerating, with global BIM market size projected to reach $12.7 billion by 2027, up from $6.5 billion in 2022, demonstrating its growing importance for companies like ACS. Digital twins, a further evolution, are also gaining traction, offering dynamic virtual replicas of physical assets for enhanced operational insights and predictive maintenance.

Technological advancements in automation and robotics are reshaping the construction industry. We're seeing automated bricklaying systems and drone surveying becoming more common, offering significant efficiency gains.

ACS Group can harness these innovations to boost site safety, improve accuracy, address labor scarcity, and ultimately increase project output. For instance, companies adopting robotic systems have reported productivity increases of up to 30% in specific tasks.

Implementing these technologies necessitates strategic investment in cutting-edge equipment and comprehensive training programs for ACS's existing workforce to ensure they can operate and maintain these new systems effectively.

Innovation in sustainable construction technologies and materials is paramount for ACS Group to achieve its environmental objectives and satisfy evolving client expectations. This involves the research, development, and implementation of materials like low-carbon concrete and the increased utilization of recycled aggregates, alongside the adoption of advanced energy-efficient building systems.

Embracing these advancements not only aligns with ACS Group's commitment to sustainability but also positions the company favorably in a market increasingly prioritizing eco-friendly solutions. For instance, the global green building materials market was valued at approximately $265.6 billion in 2023 and is projected to grow significantly, offering substantial opportunities for companies like ACS that invest in these areas.

Data Analytics and AI for Project Management and Efficiency

The construction industry, including ACS Group, is increasingly leveraging data analytics and Artificial Intelligence (AI) to revolutionize project management and boost operational efficiency. These technologies are instrumental in enhancing predictive analysis, allowing for more accurate forecasting of project timelines, resource needs, and potential challenges.

ACS can deploy AI for sophisticated applications such as optimized scheduling, which dynamically adjusts plans based on real-time data, and more precise cost estimation, minimizing budget overruns. Furthermore, AI-driven risk assessment tools can identify potential project disruptions early on, enabling proactive mitigation strategies. This integration leads to demonstrably improved project outcomes and a significant reduction in material waste.

- Enhanced Predictive Capabilities: AI algorithms can analyze historical project data to predict potential delays or cost overruns with greater accuracy, as seen in pilot projects where AI reduced schedule deviations by up to 15% in 2024.

- Optimized Resource Allocation: By processing vast datasets, AI can ensure optimal deployment of labor, equipment, and materials, contributing to efficiency gains reported by industry leaders to be in the range of 10-20% in operational cost savings.

- Improved Risk Management: AI tools can identify subtle patterns indicative of risk, allowing for preemptive action. For instance, AI-powered site monitoring in 2024 helped identify safety hazards 25% faster than traditional methods.

- Streamlined Decision-Making: Real-time data analysis powered by AI provides project managers with actionable insights, enabling faster and more informed decisions that drive project success and profitability.

Cybersecurity Risks and Data Protection in Digital Operations

As ACS Group's reliance on digital platforms grows, cybersecurity becomes paramount. Protecting sensitive project data, intellectual property, and operational systems from cyber threats is crucial for business continuity and client trust. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial implications of inadequate protection.

Maintaining robust data protection measures is essential for ACS to comply with evolving data privacy regulations, such as GDPR and similar frameworks worldwide. Failure to do so can result in significant fines and reputational damage. The construction sector, in particular, faces unique challenges due to the vast amounts of data generated across diverse projects.

- Cybersecurity Investment: ACS must continuously invest in advanced security technologies and employee training to mitigate evolving cyber threats.

- Data Privacy Compliance: Strict adherence to data protection laws is non-negotiable to avoid legal repercussions and maintain customer confidence.

- Risk Mitigation: Implementing comprehensive risk management strategies for digital operations is vital to safeguard against operational disruptions and financial losses.

Technological advancements are fundamentally reshaping the construction sector. Building Information Modeling (BIM) adoption is accelerating, with its market expected to reach $12.7 billion by 2027. Automation, including robotic systems, is boosting productivity by up to 30% in specific tasks, addressing labor shortages and improving accuracy. AI and data analytics are enhancing project management through predictive capabilities, optimizing resource allocation, and improving risk management, with AI reducing schedule deviations by 15% in 2024 pilot projects.

| Technology | Impact on Construction | 2024/2025 Data/Projections |

|---|---|---|

| BIM | Improved design, planning, and collaboration | Global BIM market projected to reach $12.7 billion by 2027 |

| Automation & Robotics | Increased efficiency, accuracy, and safety | Productivity gains of up to 30% in specific tasks |

| AI & Data Analytics | Enhanced prediction, optimization, and risk management | AI reduced schedule deviations by up to 15% in 2024 pilot projects |

| Sustainable Tech | Reduced environmental impact, cost savings | Green building materials market valued at ~$265.6 billion in 2023 |

Legal factors

ACS Group navigates a dynamic legal environment, with construction and environmental regulations posing significant operational considerations. In 2024, for instance, the European Union continued to emphasize stricter emissions standards for construction machinery, impacting operational costs and equipment upgrades. Failure to adhere to these, along with waste disposal and land use mandates across its global operations, can lead to substantial penalties and project delays, as seen in past cases where non-compliance resulted in millions of euros in fines for industry peers.

Labor laws and employment regulations differ considerably across the many countries where ACS Group operates, directly influencing its human resource strategies and operational costs. For instance, in Spain, a key market for ACS, minimum wage laws and collective bargaining agreements set by powerful construction unions significantly shape employment terms. Failure to comply with these can lead to substantial fines and operational disruptions.

Adherence to local wage laws, working conditions, union agreements, and stringent health and safety mandates is not just a legal requirement but a critical component of maintaining a stable workforce and avoiding costly disputes. In 2024, for example, European Union directives on worker safety continue to evolve, requiring ongoing investment in compliance and training for ACS’s global workforce, which numbered over 200,000 employees in recent reports.

Any shifts in these labor regulations, such as increases in minimum wages or new mandates on employee benefits, can directly impact ACS Group's labor costs. For example, a proposed increase in the minimum wage in a major operating region could necessitate adjustments to employment policies and potentially affect project profitability if not adequately factored into bidding processes.

Contractual laws are the bedrock of ACS Group's operations, dictating everything from project agreements to subcontractor relationships. Navigating international contract law, including nuanced force majeure clauses and liability stipulations, is critical for risk mitigation. For instance, in 2023, ACS reported that its international projects involved adhering to diverse legal frameworks, with a significant portion subject to common law and civil law jurisdictions, each with distinct dispute resolution protocols.

Effective dispute resolution mechanisms are paramount for ACS. The group relies on a combination of negotiation, mediation, and arbitration to resolve contractual disagreements efficiently. In 2024, ACS's legal strategy emphasizes proactive contract management and early dispute intervention to minimize project delays and financial repercussions, a stance reinforced by its consistent track record of successfully resolving over 90% of its contractual disputes outside of prolonged litigation.

Anti-Corruption and Compliance Regulations

ACS Group, operating globally, must navigate a complex web of anti-corruption and compliance regulations. This includes adhering to stringent international laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, alongside country-specific compliance mandates. For instance, in 2023, companies globally faced increased scrutiny, with significant fines levied for compliance breaches, underscoring the critical need for robust internal frameworks.

Maintaining strong internal controls, fostering an ethical corporate culture, and implementing rigorous due diligence processes are paramount for ACS. These measures are essential to proactively prevent bribery, fraud, and other illicit activities. A 2024 report by Transparency International highlighted that companies with well-established compliance programs are significantly less likely to face penalties, with an average reduction in fines by up to 50% in cases of proven violations.

- Global Reach, Local Laws: ACS must comply with both international anti-corruption statutes and the specific regulations of every country in which it operates.

- Ethical Imperative: Robust internal controls and a commitment to ethical practices are crucial for preventing financial misconduct and protecting the company's reputation.

- Financial Ramifications: Non-compliance can lead to substantial fines and legal penalties, impacting financial performance and shareholder value.

- Reputational Safeguard: Adherence to anti-corruption laws is vital for maintaining trust with stakeholders, including clients, investors, and the public.

International Trade Laws and Agreements

International trade laws and agreements significantly shape ACS Group's global operations, impacting the flow of materials, services, and workforce across different countries. For instance, the European Union’s single market facilitates seamless trade among member states, a key advantage for ACS's infrastructure projects within the EU.

Shifts in these regulations, such as new tariffs or sanctions, can directly affect ACS's supply chain efficiency and the cost-effectiveness of its international projects. The World Trade Organization (WTO) agreements, for example, set broad guidelines that influence how ACS negotiates contracts and manages logistics in its diverse markets.

ACS's exposure to various trade regimes means it must constantly monitor and adapt to evolving international trade landscapes.

- Impact of WTO Agreements: ACS must navigate WTO rules impacting procurement and service provision, ensuring compliance in its international bids.

- EU Trade Facilitation: The EU's open borders and harmonized regulations allow ACS to move equipment and personnel efficiently for projects across member nations.

- Supply Chain Vulnerabilities: Trade disputes or sanctions, like those affecting certain raw material imports, can disrupt ACS's project timelines and increase costs.

- Cross-Border Labor Mobility: Agreements governing the movement of skilled labor are crucial for ACS's ability to staff large-scale international construction projects.

ACS Group operates under a stringent regulatory framework, with legal compliance being paramount to its global operations. In 2024, the company continued to prioritize adherence to environmental protection laws, including those concerning waste management and emissions, which are increasingly being enforced across its international project sites. Failure to comply with these regulations, as demonstrated by industry-wide penalties in recent years, can result in significant financial liabilities and operational disruptions.

Labor laws and safety regulations are critical considerations for ACS, given its large global workforce. In 2024, the company focused on aligning its practices with evolving EU directives on worker safety and health, which often set benchmarks for other regions. For instance, maintaining compliance with local wage agreements and collective bargaining stipulations, particularly in key markets like Spain, is essential for avoiding labor disputes and ensuring project continuity. These legal obligations directly influence operational costs and human resource management strategies.

Contractual law forms the backbone of ACS's project execution and stakeholder relationships. The company's international presence necessitates navigating diverse legal systems, from common law to civil law jurisdictions, each with distinct dispute resolution mechanisms. In 2023, ACS highlighted its commitment to robust contract management, aiming to mitigate risks and ensure efficient project delivery through proactive legal engagement and alternative dispute resolution methods, which have historically proven effective in resolving over 90% of its contractual disagreements.

ACS Group's global operations are significantly influenced by international trade laws and agreements, such as those governed by the World Trade Organization. These frameworks impact supply chain logistics, material sourcing, and cross-border labor mobility, crucial for large-scale infrastructure projects. The facilitation of trade within the European Union's single market, for example, allows for more efficient deployment of resources. However, potential trade disputes or sanctions can introduce vulnerabilities, affecting project timelines and cost-effectiveness.

Environmental factors

Global climate change policies, like the European Union's Fit for 55 package targeting a 55% net greenhouse gas emission reduction by 2030, directly impact ACS Group. These regulations push for greener construction methods and materials, influencing project selection and operational costs.

National carbon emission targets, such as Spain's commitment to reduce emissions by at least 20% compared to 1990 levels by 2030, create both challenges and opportunities for ACS. The company must adapt its practices to comply with these targets, potentially investing in low-carbon technologies and sustainable infrastructure projects.

Growing concerns over resource scarcity, particularly for materials like cement and steel, directly impact ACS Group's project costs and timelines. For instance, global steel prices saw significant volatility in late 2023 and early 2024, with some benchmarks fluctuating by over 15% within months, directly affecting construction input expenses.

Increasingly stringent waste management regulations worldwide, such as the EU's Circular Economy Action Plan aiming to reduce construction and demolition waste by 30% by 2030, compel ACS to invest in advanced recycling technologies and sustainable material sourcing. This regulatory push is fostering innovation in how ACS manages its waste streams, pushing towards circular economy principles.

Environmental regulations safeguarding biodiversity and dictating responsible land use are paramount for ACS Group, especially given its extensive involvement in large-scale infrastructure development. Failure to comply can significantly hinder project progression and incur substantial penalties.

For instance, in 2024, the European Union continued to strengthen its Natura 2000 network, impacting land development across member states. ACS must meticulously conduct environmental impact assessments (EIAs) and implement robust mitigation strategies, such as habitat restoration or wildlife corridor creation, to secure necessary permits and avert legal challenges and reputational damage.

Renewable Energy Integration in Projects

The global push for renewable energy is a significant environmental factor impacting ACS Actividades de Construccion y Servicios. By 2023, renewable energy sources accounted for approximately 30% of global electricity generation, a figure expected to climb substantially. This trend necessitates ACS's strategic integration of renewables into its construction and infrastructure development, creating new avenues for growth.

ACS can capitalize on this by not only incorporating renewable energy solutions into its building projects but also by actively participating in the development of new renewable energy facilities. This strategic alignment with global sustainability goals is crucial for market expansion and long-term viability.

- Growing Renewable Energy Share: Renewables represented about 30% of global electricity generation in 2023, with projections indicating continued rapid growth.

- Market Opportunities: Integration of solar, wind, and other renewable technologies into ACS projects opens new revenue streams and market segments.

- Sustainability Alignment: Adhering to global sustainability trends by developing and implementing renewable energy solutions enhances ACS's corporate image and competitive positioning.

Stakeholder Pressure for Sustainable Practices and ESG Reporting

Investors, clients, and the public are increasingly demanding that companies like ACS Group demonstrate strong Environmental, Social, and Governance (ESG) performance. This translates into significant pressure for transparent and detailed ESG reporting, influencing how ACS Group operates and is perceived in the market. For instance, in 2024, a significant portion of global institutional investors indicated they would divest from companies with poor ESG ratings, highlighting the financial implications of sustainability efforts.

Meeting these expectations is no longer optional; it's a critical factor for attracting investment and maintaining a favorable brand image. ACS Group's commitment to sustainable practices and clear communication about its environmental footprint, social impact, and governance frameworks directly impacts its ability to secure capital and build trust with stakeholders. The company's 2023 sustainability report, for example, detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a figure scrutinized by many financial analysts.

- Investor Scrutiny: A growing number of investment funds, particularly those focused on sustainable investing, are actively screening companies based on their ESG credentials.

- Client Demands: Major corporate clients are increasingly incorporating ESG requirements into their procurement processes, favoring suppliers with proven sustainability commitments.

- Public Perception: Negative publicity surrounding environmental or social issues can rapidly damage a company's reputation and affect consumer loyalty and employee recruitment.

- Regulatory Trends: Anticipation of stricter environmental regulations and mandatory ESG disclosure requirements further incentivizes proactive reporting and sustainable operational changes.

Global environmental policies, like the EU's Fit for 55 aiming for a 55% net greenhouse gas reduction by 2030, directly influence ACS Group by promoting greener construction and materials, impacting project choices and costs.

National emission targets, such as Spain's goal for a 20% reduction by 2030, require ACS to adapt, potentially investing in low-carbon technologies and sustainable infrastructure, creating both compliance challenges and growth opportunities.

Resource scarcity, particularly for materials like cement and steel, affects ACS's project expenses and timelines, with global steel prices experiencing over 15% volatility in late 2023 and early 2024.

Stricter waste management regulations, such as the EU's Circular Economy Action Plan targeting a 30% reduction in construction waste by 2030, push ACS to invest in recycling and sustainable sourcing, fostering innovation in waste management.

| Environmental Factor | Impact on ACS | Relevant Data/Trend |

|---|---|---|

| Climate Change Policies | Drives adoption of sustainable construction methods and materials. | EU's Fit for 55: 55% net GHG reduction target by 2030. |

| National Emission Targets | Requires adaptation to comply with reduction goals, fostering investment in green tech. | Spain's target: 20% GHG reduction vs. 1990 levels by 2030. |

| Resource Scarcity | Increases project costs and impacts timelines due to material price volatility. | Global steel prices fluctuated over 15% in late 2023/early 2024. |

| Waste Management Regulations | Mandates investment in recycling and sustainable sourcing, promoting circular economy principles. | EU Circular Economy Action Plan: 30% reduction in C&D waste by 2030. |

| Biodiversity & Land Use | Requires meticulous EIAs and mitigation strategies for infrastructure projects. | EU Natura 2000 network expansion in 2024 impacts land development. |

| Renewable Energy Growth | Opens opportunities for ACS in developing and integrating renewable energy solutions. | Renewables accounted for ~30% of global electricity generation in 2023. |

| ESG Demands | Pressures ACS for transparent reporting and strong sustainability performance to attract investment. | Significant investor divestment from companies with poor ESG ratings in 2024. |

PESTLE Analysis Data Sources

Our ACS Actividades de Construccion y Servicios PESTLE Analysis is built on a robust foundation of data from official Spanish government agencies, key European Union economic and environmental reports, and leading industry publications. We integrate insights from national statistics institutes, construction sector associations, and relevant EU regulatory bodies to ensure comprehensive and accurate analysis.