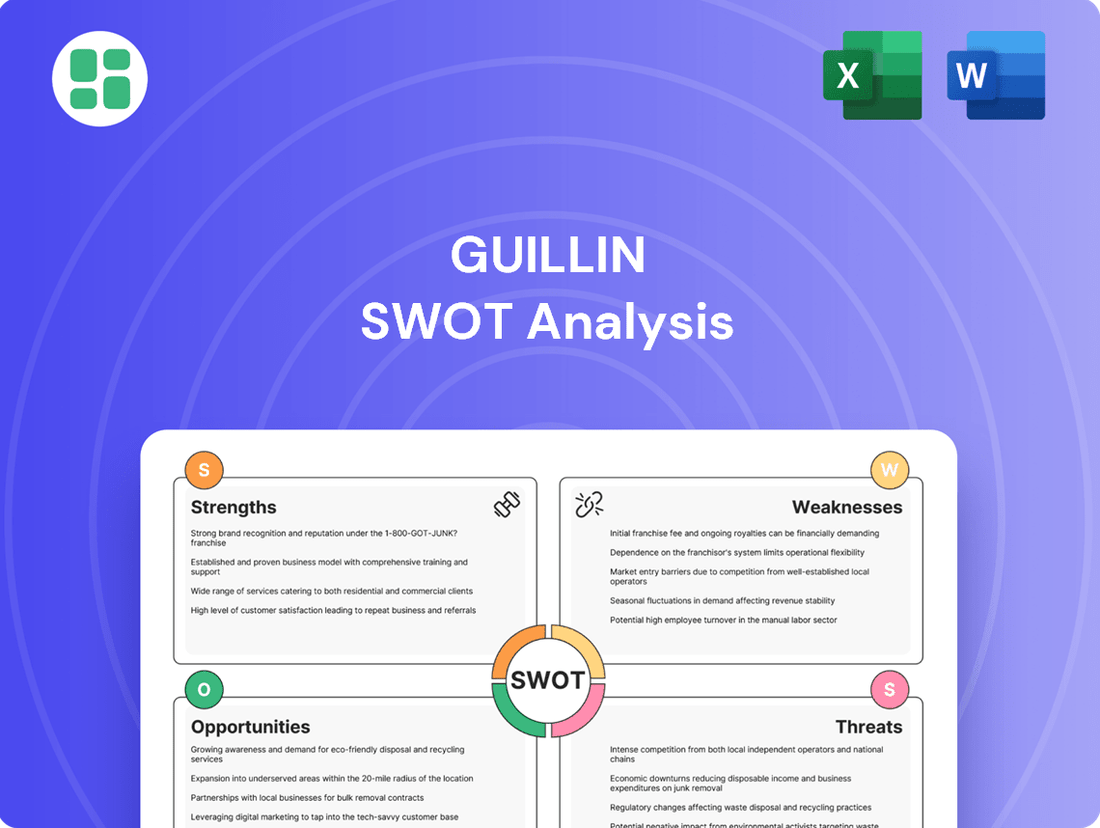

Guillin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guillin Bundle

Guilin's unique natural beauty and rich cultural heritage present significant Strengths and Opportunities for tourism growth. However, understanding the delicate balance required to leverage these assets while mitigating potential Weaknesses and Threats is crucial for sustainable development.

Want the full story behind Guilin's market position and future potential? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Groupe Guillin stands as a prominent European leader in the food packaging sector, distinguished by its exceptionally broad product portfolio. The company provides an extensive selection of solutions across plastic, paper, and cardboard materials, boasting over 25,000 product references.

This comprehensive multi-material approach enables Guillin to effectively serve a wide spectrum of clients within the food industry, from fresh produce and meat to seafood and bakery segments. Their vast product range ensures they can meet diverse and specialized packaging requirements.

Guillin's commitment to innovation and eco-design is a significant strength, evident in their continuous development of new products featuring recycled materials and reduced packaging weight. This focus not only minimizes environmental impact but also resonates with a growing consumer demand for sustainable options.

Groupe Guillin's commitment to the circular economy is a significant strength, evident in their proactive integration of recycled content, such as rPET, into their plastic packaging solutions. This focus not only reduces reliance on virgin plastics but also aligns with growing consumer and regulatory demands for sustainable practices.

Their collaboration with initiatives like Prevented Ocean Plastic™ underscores this dedication, directly contributing to a cleaner environment by repurposing plastic waste that would otherwise pollute oceans. This strategic partnership enhances their brand reputation and offers a tangible benefit in the fight against plastic pollution.

Strategic Acquisitions and Diversification

Guillin's strategic acquisitions and diversification efforts are a significant strength, as seen in their recent moves to expand their multi-material packaging capabilities. For instance, their investment in Wobz for customizable reusable containers directly addresses the growing demand for sustainable packaging solutions.

Furthermore, the acquisition of paper and cardboard packaging companies under the WEFOLD brand has broadened Guillin's product portfolio. This diversification not only strengthens their market position but also enhances their adaptability to evolving industry trends and customer needs.

- Strategic Expansion: Investments like Wobz and the WEFOLD brand acquisition broaden Guillin's market reach and product diversification.

- Market Adaptability: These moves position Guillin to capitalize on growing trends, such as the demand for reusable and paper-based packaging solutions.

- Multi-Material Offering: The acquisitions enhance Guillin's ability to provide a wider range of packaging materials, catering to diverse client requirements.

Strong Financial Performance and Investment in Industrial Tools

Groupe Guillin demonstrated robust financial health in 2024, even with a slight dip in net income from the exceptional performance of 2023. The company generated €1.3 billion in revenue for the fiscal year ending September 30, 2024, underscoring its market presence. Crucially, Guillin continued its strategic investment in industrial tools, allocating €30 million in 2024 to enhance its manufacturing capabilities and efficiency.

This sustained investment in its operational backbone is a key strength, ensuring the company remains competitive and adaptable. The financial stability, evidenced by a healthy balance sheet, supports ongoing research and development, allowing Guillin to introduce innovative solutions and maintain high product quality.

- Solid Revenue Generation: Achieved €1.3 billion in revenue for FY2024, demonstrating consistent market demand.

- Continued Capital Expenditure: Invested €30 million in industrial tools during 2024, focusing on modernization and efficiency.

- Financial Resilience: Maintained a strong financial position despite a minor decrease in net income from the previous year's record.

- Commitment to Innovation: Investments support ongoing product development and technological advancements.

Groupe Guillin's extensive multi-material product offering, encompassing over 25,000 references in plastic, paper, and cardboard, is a core strength, allowing them to cater to diverse food industry segments. Their strategic focus on eco-design and the circular economy, demonstrated by using recycled materials like rPET and partnerships such as Prevented Ocean Plastic™, positions them favorably with environmentally conscious consumers and regulators. Recent strategic acquisitions, including Wobz for reusable containers and WEFOLD for paper and cardboard solutions, have broadened their portfolio and market adaptability. Financially, Guillin reported €1.3 billion in revenue for FY2024 and continued to invest €30 million in industrial tools, highlighting their commitment to operational enhancement and innovation.

| Metric | Value (FY2024) | Significance |

|---|---|---|

| Revenue | €1.3 billion | Demonstrates strong market demand and consistent sales performance. |

| Capital Expenditure | €30 million | Highlights ongoing investment in manufacturing capabilities and efficiency improvements. |

| Product References | Over 25,000 | Underscores the breadth of their multi-material packaging solutions. |

| Eco-Design Focus | Integration of recycled content (e.g., rPET) | Aligns with sustainability trends and consumer preferences. |

What is included in the product

Delivers a strategic overview of Guillin’s internal strengths and weaknesses, alongside external market opportunities and threats.

Guillin's SWOT analysis offers a structured framework, simplifying the often-overwhelming process of identifying and categorizing strategic factors.

Weaknesses

Groupe Guillin's continued reliance on plastic packaging, particularly thermoformed types, presents a notable weakness. Despite sustainability initiatives, this dependency leaves the company vulnerable to evolving consumer sentiment and escalating regulatory pressures against single-use plastics. For instance, in 2024, several European nations strengthened bans on certain plastic products, impacting markets where Guillin operates.

Guillin's profitability is highly susceptible to the fluctuating costs of its primary inputs, especially plastics. In 2024, global plastic resin prices saw significant swings, with some benchmarks increasing by as much as 15% year-over-year due to supply constraints and increased demand in key manufacturing sectors. This volatility directly squeezes margins, as packaging production costs are heavily weighted towards these raw materials.

While Guillin pursues operational efficiencies, persistent inflation and complex global supply chain issues create unpredictable cost pressures. For instance, disruptions in petrochemical production or shipping can rapidly escalate material expenses, making it challenging to forecast production costs accurately and maintain stable profit margins throughout 2025.

Groupe Guillin operates in a fiercely competitive food packaging sector. The market is saturated with a wide array of companies, from global giants to niche specialists, all vying for market share with diverse material offerings like paper, glass, and metal.

This intense competition includes both large, established multinational corporations and smaller, more nimble businesses that are rapidly innovating in sustainable packaging solutions. For instance, in 2024, the global food packaging market was valued at approximately $290 billion, with projections indicating continued growth, meaning Guillin must constantly adapt to a dynamic competitive environment.

Impact of Increased Production Costs

Guillin's production competitiveness is significantly challenged by rising costs. In 2024, the Group faced a notable increase in expenses across wages, transport, maintenance, and insurance due to prevailing inflation. This inflationary pressure, combined with the inherent cost advantage of regions with lower labor expenses, creates a difficult environment for maintaining price competitiveness in its European manufacturing base.

The impact of these increased production costs can be summarized as follows:

- Inflationary Headwinds: Broad-based inflation in 2024 directly elevated key operational expenditures for Guillin.

- Wage Pressures: Rising labor costs contribute to the overall increase in production expenses.

- Logistical and Maintenance Escalation: Higher costs for transport, maintenance, and insurance further squeeze profit margins.

- Competitive Disadvantage: The cost differential with lower-labor-cost regions poses a significant threat to Guillin's market position.

Operational Adjustments and Site Closures

Guillin's operational adjustments, including the 2024 cessation of production at Sharpak Romsey in the UK and KIV Verpackungen in Germany, highlight potential weaknesses in its manufacturing footprint or strategic adaptability. These closures, even with KIV Verpackungen continuing as a distributor, could lead to reduced supply chain resilience and a diminished market presence in affected territories. Such moves may also signal underlying cost pressures or a need to consolidate operations for greater efficiency.

The strategic decision to close specific production sites, such as Sharpak Romsey and KIV Verpackungen in 2024, points to potential operational inefficiencies or a need to streamline the business. While KIV Verpackungen persists as a distribution channel, these closures could negatively impact regional market share and overall supply chain responsiveness. This restructuring might also indicate challenges in maintaining competitive production costs across all its facilities.

- Site Rationalization: The closure of Sharpak Romsey (UK) and KIV Verpackungen (Germany) in 2024 signifies a strategic pivot, potentially driven by underperformance or market shifts.

- Supply Chain Impact: These closures could disrupt established supply chains, leading to longer lead times or increased logistics costs for customers in those regions.

- Market Presence: A reduced manufacturing footprint in key European markets might weaken Guillin's competitive positioning against local or more agile competitors.

- Cost Structure: The decision to cease production could reflect an inability to achieve competitive operating costs at these specific sites, impacting overall profitability.

Groupe Guillin's significant reliance on plastic packaging, particularly thermoformed types, remains a core weakness. This dependency exposes the company to increased regulatory scrutiny and shifting consumer preferences away from single-use plastics, a trend that intensified in 2024 with stricter bans in several European countries.

The company's profitability is heavily influenced by the volatile costs of its key raw materials, primarily plastics. In 2024, global plastic resin prices experienced substantial fluctuations, with some key benchmarks rising by up to 15% year-on-year due to supply chain disruptions and robust demand from manufacturing sectors.

Guillin faces intense competition in the food packaging market, which was valued at approximately $290 billion globally in 2024. This crowded landscape includes both large multinational corporations and agile innovators focusing on sustainable alternatives, demanding constant adaptation and innovation from Guillin.

The company's production competitiveness is hampered by rising costs across wages, transport, maintenance, and insurance, exacerbated by persistent inflation throughout 2024. This inflationary pressure, coupled with the cost advantages of regions with lower labor expenses, creates a challenging environment for maintaining price competitiveness.

The 2024 closures of Sharpak Romsey (UK) and KIV Verpackungen (Germany) highlight potential weaknesses in Guillin's manufacturing footprint and strategic agility. These site rationalizations could impact regional market share, supply chain responsiveness, and overall operational efficiency.

Same Document Delivered

Guillin SWOT Analysis

The preview you see is the actual Guilin SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a comprehensive and professionally structured report. No surprises, just the full, detailed analysis ready for your strategic planning.

Opportunities

The global market for sustainable food packaging is booming, projected to reach over $400 billion by 2027, with a compound annual growth rate of 6.5%. This presents a prime opportunity for Guillin to capitalize on this trend by expanding its portfolio to include biodegradable plastics, recycled materials, and innovative paper-based packaging solutions. Consumer demand for eco-friendly options is a significant driver, and regulatory pressures are further pushing industries towards greener alternatives, directly benefiting companies that can supply these products.

Groupe Guillin's strategic investment in Wobz and its development of reusable trays positions it to seize the growing market for reusable packaging, particularly in the events and food service sectors. This move directly addresses the rising consumer demand for sustainable, circular economy solutions, such as refillable and returnable options.

Innovations in smart packaging, like QR codes for enhanced traceability and interactive elements, are a significant opportunity for Guillin. Digital printing allows for more dynamic and personalized packaging designs, potentially increasing consumer engagement. Advanced thermoforming can lead to more sustainable and cost-effective packaging solutions, aligning with market demands for eco-friendly products.

Growth in Ready-to-Eat and E-commerce Food Segments

The global ready-to-eat meal market was valued at approximately $170 billion in 2023 and is projected to reach over $250 billion by 2028, indicating substantial growth. This trend, coupled with a significant rise in online grocery shopping, which saw a 15% year-over-year increase in 2024 for many regions, creates a strong demand for advanced food packaging. Groupe Guillin can capitalize on this by innovating packaging that ensures freshness and durability for these convenient food options.

Groupe Guillin's expertise in plastic packaging is well-suited to address the specific needs of the growing ready-to-eat and e-commerce food sectors. These segments require packaging that not only protects the product during transit and handling but also maintains its visual appeal and shelf life. For instance, specialized barrier films and modified atmosphere packaging technologies are becoming increasingly crucial.

- Increased Convenience Demand: Consumers are prioritizing time-saving food solutions, boosting the ready-to-eat market.

- E-commerce Surge: Online food sales continue their upward trajectory, necessitating robust and appealing packaging for delivery.

- Packaging Innovation Opportunity: Groupe Guillin can develop advanced solutions for extended shelf life and product protection in transit.

- Market Expansion: Addressing these segments offers a clear path for Groupe Guillin to expand its market share and product offerings.

Leveraging New EU Regulations for Market Advantage

The upcoming European Union Packaging and Packaging Waste Regulation (PPWR), set to take full effect in stages, presents a significant opportunity for Guillin. This regulation mandates specific recycled content percentages and establishes stringent recyclability standards for packaging materials across the EU. For instance, by 2030, the PPWR aims for 30% recycled plastic content in packaging, a target that Guillin can leverage to its advantage.

By proactively investing in eco-design principles and the necessary compliance infrastructure, Guillin can solidify its position as an industry leader. This strategic move allows them to differentiate their offerings and capture market share from competitors who may be slower to adapt to these new environmental requirements. The company's commitment to sustainability, aligning with the EU's circular economy goals, can become a powerful competitive differentiator.

Guillin can capitalize on the PPWR by:

- Developing innovative packaging solutions that meet or exceed the PPWR's recycled content mandates.

- Investing in advanced recycling technologies and partnerships to secure a reliable supply of high-quality recycled materials.

- Highlighting its compliance and sustainability efforts in marketing and customer communications to attract environmentally conscious clients.

- Potentially gaining preferential treatment or certifications within the EU market for demonstrating early and robust adherence to the new regulations.

The growing demand for sustainable and reusable packaging presents a significant opportunity for Guillin. The global market for sustainable food packaging is projected to exceed $400 billion by 2027, with a 6.5% CAGR. Guillin's investment in reusable trays, like those from Wobz, directly taps into the circular economy trend, appealing to consumers seeking environmentally friendly options.

Innovations in smart and advanced packaging offer further avenues for growth. Digital printing for personalized designs and smart features like QR codes can enhance consumer engagement. Furthermore, advancements in thermoforming can lead to more efficient and eco-conscious packaging solutions, aligning with market demands for sustainability.

The burgeoning ready-to-eat meal market, valued at approximately $170 billion in 2023 and expected to surpass $250 billion by 2028, coupled with a 15% year-over-year increase in online grocery shopping in 2024, creates a strong need for specialized packaging. Guillin's expertise in plastic packaging can be leveraged to develop solutions that ensure freshness and durability for these convenient food options during transit and handling.

The upcoming EU Packaging and Packaging Waste Regulation (PPWR) mandates increased recycled content, with a target of 30% recycled plastic by 2030. Guillin can proactively adapt by investing in eco-design and compliance, positioning itself as a leader and differentiating from competitors slower to meet these stringent environmental standards.

| Opportunity Area | Market Trend/Driver | Guillin's Advantage/Action | Projected Market Growth |

| Sustainable Packaging | Consumer demand for eco-friendly alternatives; regulatory push | Expand portfolio to biodegradable, recycled, paper-based solutions | >$400 billion by 2027 (6.5% CAGR) |

| Reusable Packaging | Circular economy focus; demand for refillable/returnable options | Leverage investment in Wobz and reusable tray development | Growing sector, particularly in events and food service |

| Smart & Advanced Packaging | Digitalization; consumer engagement; efficiency | Utilize digital printing for personalization; explore smart features | Increasing adoption of smart packaging technologies |

| Ready-to-Eat & E-commerce | Convenience demand; online grocery growth | Innovate packaging for freshness, durability, and visual appeal | Ready-to-eat: $170 billion (2023) to >$250 billion (2028) |

| Regulatory Compliance (PPWR) | EU mandates for recycled content and recyclability | Invest in eco-design and compliance infrastructure | Target of 30% recycled plastic by 2030 |

Threats

Guillin faces a significant threat from increasingly stringent environmental regulations on plastics, particularly in key markets like the European Union. New regulations such as the EU's Packaging and Packaging Waste Regulation (PPWR) and the Single-Use Plastic Directive are imposing strict mandates on recycled content, recyclability, and overall plastic waste reduction. For instance, the PPWR aims for a 30% recycled content in plastic packaging by 2030, a target that could significantly impact material sourcing and costs for companies like Guillin.

Compliance with these evolving and often costly regulations presents a substantial challenge. These measures can lead to increased operational expenses due to the need for new technologies, material reformulation, or investment in recycling infrastructure. Furthermore, these regulations may restrict the use of certain conventional plastic types that Guillin currently relies on, potentially limiting product offerings or requiring costly product redesigns to meet new standards.

Growing environmental awareness is a significant threat, as consumers increasingly favor sustainable alternatives over plastics. This trend could directly impact Guillin's product demand.

Negative perceptions of plastic pollution are intensifying, potentially driving consumers towards paper, glass, or metal packaging, even for recycled plastic products. This could represent a substantial market challenge.

Globally, the market for sustainable packaging is projected to grow considerably. For instance, the global sustainable packaging market was valued at approximately USD 270 billion in 2023 and is expected to reach over USD 400 billion by 2028, indicating a clear shift away from traditional plastics.

Guillin faces a significant threat from the growing adoption of alternative packaging materials, particularly eco-friendly options. The market is increasingly embracing paperboard, biodegradable plastics, and compostable films, driven by consumer demand and regulatory pressures.

Competitors specializing in these sustainable alternatives pose a direct challenge, potentially capturing market share if they can offer more cost-effective or readily accepted solutions. For instance, the global bioplastics market was projected to reach approximately $12.5 billion in 2024 and is expected to grow substantially, indicating a strong market shift that could impact traditional packaging providers like Guillin.

Global Economic Uncertainties and Inflation

Ongoing geopolitical tensions and global economic uncertainties, including persistent inflation, can continue to impact production costs, consumer spending, and overall market demand for packaging. These external factors are difficult to control and can negatively affect the Group's financial performance.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, citing persistent inflation and high interest rates as key headwinds. This slowdown directly translates to potentially reduced consumer purchasing power and, consequently, lower demand for packaging materials, impacting Guillin's sales volumes.

Furthermore, supply chain disruptions, often exacerbated by geopolitical events, can lead to increased raw material costs. For example, the conflict in Eastern Europe has previously driven up energy prices, a significant input cost for many manufacturing processes, including packaging production. This inflationary pressure on inputs directly squeezes profit margins if not effectively passed on to consumers.

- Persistent Inflation: Global inflation remained a concern throughout 2024, impacting input costs for raw materials and energy.

- Economic Slowdown: Projections indicated a slowdown in global economic growth for 2024, potentially dampening consumer demand for packaged goods.

- Geopolitical Instability: Ongoing international conflicts and trade disputes create supply chain vulnerabilities and cost uncertainties.

Supply Chain Disruptions and Raw Material Availability

Guillin's reliance on a stable supply of raw materials, particularly recycled plastics, presents a significant threat. Disruptions in this supply chain could directly hinder production capacity and inflate manufacturing costs. For instance, a global shortage of high-quality recycled PET, a key component for many plastic products, could force Guillin to seek more expensive virgin materials, impacting its profit margins. The consistent availability and quality of recycled content are paramount for meeting increasingly stringent environmental regulations and the company's own sustainability commitments; any shortfall here would be a major hurdle.

The fluctuating availability and quality of recycled plastics are critical concerns. In 2024, the global recycled plastics market experienced price volatility, with some regions seeing up to a 15% increase in the cost of certain recycled resins due to supply constraints and heightened demand. This volatility directly impacts Guillin's cost of goods sold and the predictability of its production planning. Furthermore, meeting regulatory mandates, such as those requiring a minimum percentage of recycled content in packaging, becomes challenging if the supply of suitable recycled materials is inconsistent or of poor quality.

- Supply Chain Vulnerability: Dependence on global suppliers for recycled plastics exposes Guillin to geopolitical instability and logistical bottlenecks.

- Quality Control Challenges: Inconsistent quality of recycled feedstocks can lead to production inefficiencies and product defects.

- Regulatory Compliance Risk: Failure to secure sufficient high-quality recycled content could jeopardize compliance with evolving environmental laws and sustainability targets.

- Cost Escalation: Shortages or increased demand for recycled materials can drive up input costs, squeezing profit margins.

Guillin faces significant threats from evolving environmental regulations, particularly in Europe, which are mandating higher recycled content and restricting certain plastics. The market's growing preference for sustainable alternatives, like bioplastics, also poses a challenge as consumers shift away from traditional plastics, impacting demand for Guillin's core products. Economic headwinds, including persistent inflation and a global growth slowdown projected for 2024, can further reduce consumer spending and increase raw material costs, squeezing profit margins.

| Threat Category | Specific Threat | Impact on Guillin | Supporting Data/Trend (2024/2025) |

|---|---|---|---|

| Regulatory Pressure | Stringent Environmental Regulations (e.g., EU PPWR) | Increased compliance costs, potential product limitations, need for material reformulation. | EU aims for 30% recycled content in plastic packaging by 2030. |

| Market Shift | Consumer Preference for Sustainable Alternatives | Reduced demand for conventional plastics, potential loss of market share to eco-friendly competitors. | Global bioplastics market projected to reach ~$12.5 billion in 2024. |

| Economic Headwinds | Inflation and Economic Slowdown | Higher production costs (raw materials, energy), reduced consumer purchasing power, lower sales volumes. | IMF projected global growth at 2.9% for 2024, down from 3.1% in 2023. |

| Supply Chain Vulnerability | Recycled Plastic Availability & Quality Fluctuations | Production disruptions, increased costs for virgin materials, challenges meeting regulatory recycled content mandates. | Recycled resin prices saw up to 15% increases in some regions during 2024 due to supply constraints. |

SWOT Analysis Data Sources

This Guilin SWOT analysis is built upon a robust foundation of data, including official government reports, tourism statistics, and local economic indicators. These sources are supplemented by expert interviews with industry professionals and analysis of online traveler reviews to provide a comprehensive understanding of Guilin's position.