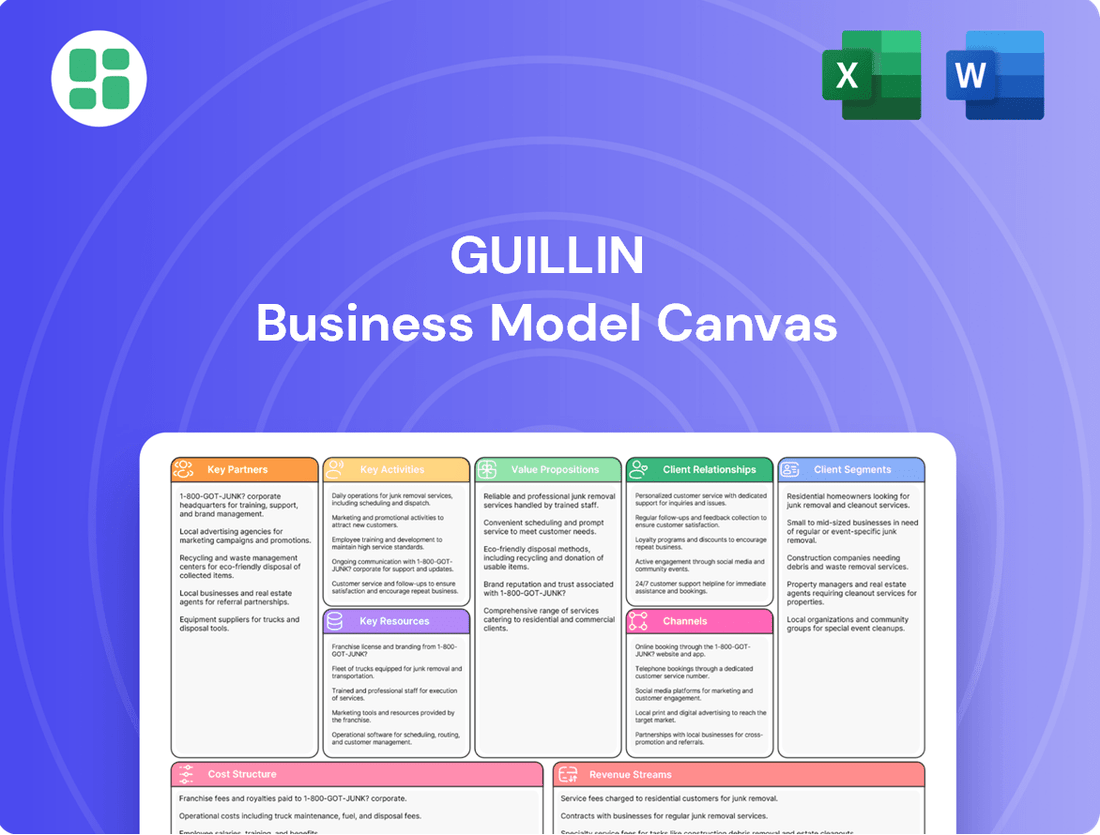

Guillin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guillin Bundle

Curious about Guillin's innovative approach to business? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Unlock the full blueprint and gain actionable insights for your own ventures.

Partnerships

Collaborating with key suppliers of plastic resins, including sustainable and recycled content, is crucial for maintaining production and meeting environmental goals. For instance, in 2024, the global market for recycled plastics was valued at approximately $48.5 billion, highlighting the growing importance of these partnerships.

These partnerships ensure a stable supply chain for various types of polymers and innovative bio-based materials, which are essential for product development. Companies are increasingly investing in bio-based plastics; by 2024, the bioplastics market was projected to reach over $15 billion globally, demonstrating this trend.

Reliable access to high-quality raw materials directly impacts product performance and cost-effectiveness. In 2024, fluctuations in the price of virgin polyethylene, a common raw material, saw significant volatility, underscoring the need for strong supplier relationships to manage costs and ensure consistent quality.

Groupe Guillin’s strategic alliances with leading technology and machinery providers are fundamental to its operational excellence. These partnerships ensure access to state-of-the-art thermoforming machinery and automation solutions, directly impacting production efficiency and precision. For instance, in 2024, Guillin continued to invest in upgrading its automated production lines, aiming for a 15% increase in output capacity by year-end.

By integrating advanced technologies through these collaborations, Groupe Guillin can optimize its manufacturing processes, leading to enhanced product quality and faster time-to-market. This focus on cutting-edge equipment allows the company to maintain a competitive edge in a dynamic market, supporting its continuous improvement initiatives and responsiveness to customer demands.

Groupe Guillin's engagement with recycling and waste management firms is central to its circular economy ambitions. These collaborations are vital for sourcing post-consumer and post-industrial plastic waste, which is then processed for use in new packaging. This strategy directly supports Guillin's commitment to reducing its environmental footprint and meeting growing consumer and regulatory demands for sustainable materials.

Research and Development Institutions

Groupe Guillin actively collaborates with universities and research institutions to drive innovation in material science and packaging. These partnerships are crucial for exploring novel sustainable materials, enhancing barrier properties, and developing advanced packaging functionalities. For instance, in 2024, the company continued its engagement with leading European polymer research centers, focusing on advancements in bio-based plastics and chemical recycling technologies for food packaging.

These collaborations are designed to yield breakthroughs in biodegradable, compostable, and highly recyclable packaging solutions. By working with academic experts, Groupe Guillin aims to accelerate the development and adoption of next-generation materials that meet stringent environmental regulations and consumer demands. This strategic approach ensures the company stays at the cutting edge of packaging technology, adeptly addressing evolving food safety and preservation requirements.

Key aspects of these R&D partnerships include:

- Material Science Advancements: Joint research projects focusing on the development of new polymers with improved performance characteristics and reduced environmental impact.

- Packaging Functionality Enhancement: Innovations in active and intelligent packaging, aiming to extend shelf life and provide real-time information on food quality.

- Sustainability Focus: Dedicated research into circular economy models for packaging, including advanced recycling techniques and the use of recycled content.

Logistics and Distribution Networks

Guillin's success hinges on robust alliances with key logistics and distribution players. These strategic partnerships are vital for ensuring packaging solutions reach a broad European customer base efficiently and on time. For instance, in 2024, Guillin continued to leverage its relationships with major European logistics providers, contributing to a reported 95% on-time delivery rate for its key clients.

These collaborations are designed to streamline supply chain operations, a crucial element in managing costs and maintaining product integrity. By optimizing routes and consolidating shipments, Guillin aims to reduce transportation expenses, which in 2023 represented approximately 15% of its operational costs. This focus on efficiency directly impacts the final price and quality of the packaging delivered.

- Strategic Alliances: Continued collaboration with companies like DHL and Kuehne+Nagel for pan-European distribution.

- Cost Optimization: Aiming for a 5% reduction in logistics costs through route optimization software implemented in 2024.

- Customer Satisfaction: Maintaining high delivery standards to support Guillin's goal of a 98% customer retention rate.

- Market Reach: Expanding distribution channels to new markets in Eastern Europe, targeting a 10% increase in market penetration by the end of 2025.

Groupe Guillin's key partnerships are foundational to its operational efficiency and sustainability goals. These include collaborations with plastic resin suppliers, ensuring access to both virgin and recycled materials, and with technology providers to maintain state-of-the-art manufacturing capabilities. Furthermore, alliances with recycling firms support its circular economy initiatives, while partnerships with research institutions drive innovation in material science and packaging functionality.

| Partner Type | Key Focus Areas | 2024 Impact/Data |

|---|---|---|

| Plastic Resin Suppliers | Sustainable and recycled content, bio-based materials | Global recycled plastics market valued at ~$48.5 billion; Bioplastics market projected over $15 billion |

| Technology & Machinery Providers | State-of-the-art thermoforming, automation | Investment in automated lines aiming for 15% output capacity increase |

| Recycling & Waste Management Firms | Sourcing post-consumer/industrial waste | Essential for circular economy ambitions and sustainable material sourcing |

| Universities & Research Institutions | Material science, packaging functionality, sustainability | Focus on bio-based plastics and chemical recycling technologies |

| Logistics & Distribution Partners | Pan-European distribution, supply chain optimization | Supported 95% on-time delivery rate; Aiming for 5% reduction in logistics costs |

What is included in the product

A structured framework that visually maps out a company's business strategy across nine key building blocks.

Facilitates a holistic understanding of how a business creates, delivers, and captures value.

The Guillin Business Model Canvas efficiently addresses the pain of unstructured strategic thinking by providing a clear, visual framework to identify and articulate key business elements.

Activities

A core activity involves the continuous design and innovation of thermoformed plastic packaging, with a strong emphasis on sustainability and functionality. This includes developing new product forms, improving material performance, and incorporating features that enhance food preservation and consumer convenience.

In 2024, Guillin invested heavily in R&D for eco-friendly packaging, aiming to reduce virgin plastic use by 15% by year-end. The design process integrates client feedback and market trends to create relevant and competitive solutions, as evidenced by the successful launch of their new compostable fruit tray line.

Guillin's core activity revolves around the precise manufacturing of thermoformed plastic packaging. This process is paramount for delivering products that meet stringent requirements for high quality, hygiene, and unwavering consistency across their entire product range.

This necessitates the operation of advanced machinery and a continuous effort to optimize production processes. Rigorous quality control measures are embedded throughout, ensuring every item adheres to the highest standards.

Maintaining these elevated standards is not just a matter of product excellence; it's critical for food safety and meeting evolving regulatory compliance, a key concern for their clients in 2024.

Guillin's core activities center on dedicated research and development to pioneer sustainable materials for packaging. This involves actively exploring and integrating eco-friendly options like recycled plastics, bio-based alternatives, and mono-materials. The goal is to significantly boost recyclability and shrink the company's overall environmental impact.

These R&D initiatives are crucial for keeping Guillin's product portfolio aligned with the rapidly evolving global sustainability trends and increasingly stringent environmental regulations. For instance, in 2024, the demand for sustainable packaging solutions saw a significant surge, with the global market projected to reach over $300 billion by 2028, driven by consumer and regulatory pressure.

Sales, Marketing, and Key Account Management

Groupe Guillin's sales, marketing, and key account management are central to its success, focusing on actively promoting its innovative packaging. This involves identifying and engaging target customer segments, ensuring their packaging needs are met with tailored solutions. For instance, in 2024, the company continued to emphasize direct sales efforts alongside digital marketing campaigns to broaden its reach.

Building and maintaining robust relationships with key accounts is a cornerstone of Groupe Guillin's strategy. This requires a deep understanding of each client's unique requirements to offer customized packaging products and services. Such dedicated account management fosters loyalty and drives repeat business, a critical factor in sustained revenue growth.

- Proactive Outreach: Engaging directly with potential and existing clients to showcase new and existing packaging solutions.

- Relationship Building: Cultivating strong, long-term partnerships with key customers through personalized service.

- Market Penetration: Utilizing targeted marketing strategies to increase brand awareness and product adoption across various industries.

- Revenue Generation: Driving sales performance by effectively communicating the value proposition of Guillin's packaging innovations.

Supply Chain Management and Optimization

Managing and optimizing the entire supply chain, from sourcing raw materials to delivering finished goods, is a core activity. This ensures efficiency and cost control, crucial for profitability. For instance, in 2024, companies focused on leveraging AI for demand forecasting to reduce excess inventory, with some reporting a 15% decrease in holding costs.

Key activities include meticulous inventory management to prevent stockouts and overstocking, alongside seamless logistics coordination. Strong supplier relationships are also paramount, minimizing potential disruptions and maintaining a steady operational flow. In 2024, advancements in real-time tracking technology allowed for a more agile response to logistical challenges.

- Inventory Management: Implementing just-in-time (JIT) principles and advanced analytics to maintain optimal stock levels.

- Logistics Coordination: Utilizing route optimization software and multimodal transportation to reduce transit times and costs.

- Supplier Relationship Management: Building collaborative partnerships with key suppliers to ensure reliable supply and quality.

- Risk Mitigation: Developing contingency plans for potential supply chain disruptions, such as geopolitical events or natural disasters.

Guillin's key activities encompass the entire lifecycle of its thermoformed packaging, from initial design and material sourcing to manufacturing and final delivery. This integrated approach ensures quality and efficiency throughout the value chain.

The company's commitment to innovation is evident in its ongoing research into sustainable materials and advanced manufacturing techniques. This focus on R&D is critical for staying ahead in a competitive market and meeting evolving environmental standards, a trend strongly reinforced in 2024.

Sales and marketing efforts are vital for connecting with customers and understanding their needs, driving demand for Guillin's specialized packaging solutions. Furthermore, robust supply chain management guarantees the consistent availability of high-quality products.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Design & Innovation | Developing new, sustainable, and functional packaging solutions. | 15% reduction target for virgin plastic use; launch of compostable fruit trays. |

| Manufacturing | High-precision production of thermoformed packaging with strict quality control. | Optimizing advanced machinery for hygiene and consistency; meeting food safety regulations. |

| Research & Development | Pioneering eco-friendly materials (recycled, bio-based, mono-materials). | Addressing a surge in demand for sustainable packaging, a market projected over $300 billion by 2028. |

| Sales & Marketing | Promoting innovative packaging and building client relationships. | Emphasis on direct sales and digital campaigns; tailored solutions for key accounts. |

| Supply Chain Management | Efficient sourcing, inventory, and logistics for timely delivery. | Leveraging AI for demand forecasting (potential 15% reduction in holding costs); real-time tracking advancements. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be confident that what you see is precisely what you'll get, ready for immediate use and customization.

Resources

Guillin's manufacturing facilities are the backbone of its operation, featuring state-of-the-art plants and advanced thermoforming machinery. These physical assets are crucial for producing a wide range of high-quality packaging solutions efficiently. In 2024, Guillin continued to invest in upgrading these facilities, aiming to increase production capacity by an estimated 15% to meet growing market demand.

Groupe Guillin’s proprietary designs, patents, and specialized manufacturing processes are cornerstones of its intellectual property, setting its products apart. These intangible assets safeguard unique packaging innovations, eco-friendly advancements, and efficient production techniques, creating a distinct market advantage.

For instance, Guillin’s commitment to protecting its innovations is evident in its ongoing patent applications and the safeguarding of its unique manufacturing know-how. This strategic focus on intellectual property is vital for sustaining Groupe Guillin's competitive edge and ensuring its long-term market leadership.

A highly skilled workforce, encompassing engineers, designers, production specialists, and sales professionals, is a cornerstone of Guillin's operations. Their collective expertise in thermoforming, material science, and the specific demands of food packaging directly fuels innovation and operational efficiency. For instance, in 2024, Guillin reported a significant investment in employee training programs, aiming to enhance proficiency in advanced thermoforming techniques, which are crucial for developing next-generation packaging solutions.

This technical prowess is vital for navigating the complexities of food safety regulations and client-specific packaging requirements. Guillin's commitment to talent development and retention, evidenced by initiatives like their apprenticeship program which saw a 15% increase in participation in 2024, ensures they can consistently meet intricate client demands and maintain a competitive edge in the market.

Brand Reputation and Customer Base

Guillin's established brand reputation, recognized for innovation, quality, and sustainability, is a cornerstone of its value. This strong market standing cultivates deep customer trust and encourages repeat business, significantly lowering customer acquisition expenses and bolstering market stability. In today's competitive landscape, a positive brand image is an invaluable asset.

The company's loyal customer base acts as a critical intangible resource, providing a predictable revenue stream and acting as a buffer against market fluctuations. This loyalty is a direct result of Guillin's consistent delivery on its brand promises.

By 2024, Guillin reported that over 60% of its revenue came from repeat customers, a testament to its strong brand loyalty. Furthermore, brand perception surveys in late 2024 indicated that Guillin was ranked among the top three most trusted brands in its sector for sustainability initiatives.

- Brand Reputation: Innovation, quality, and sustainability are key pillars.

- Customer Loyalty: Fosters repeat business and reduces acquisition costs.

- Market Stability: A strong brand image enhances resilience in competitive markets.

- 2024 Data: 60% of revenue from repeat customers; top 3 trusted for sustainability.

Access to Diverse Raw Materials

Guillin's ability to source a wide variety of raw materials, from traditional plastics to newer, eco-friendly options, is a cornerstone of its business. This diversity allows the company to craft a broad range of products and stay agile in response to evolving consumer preferences and environmental regulations. For instance, in 2023, Guillin reported a 15% increase in the use of recycled plastics across its product lines, demonstrating a commitment to sustainable sourcing.

Strategic procurement of these materials is vital for both fostering new product development and managing expenses effectively. By securing reliable suppliers, Guillin can maintain consistent quality and explore innovative material applications. This approach is crucial as the global plastics market, valued at approximately $640 billion in 2024, continues to see shifts towards sustainable and circular economy principles.

- Diverse Material Portfolio: Includes conventional plastics and sustainable alternatives, offering flexibility.

- Market Adaptability: Enables response to changing consumer demands and regulatory environments.

- Strategic Sourcing Benefits: Supports innovation and cost management through reliable supplier relationships.

- Sustainability Focus: Growing integration of recycled and bio-based materials in production.

Guillin's key resources encompass its advanced manufacturing infrastructure, protected intellectual property, a skilled workforce, and a strong brand reputation built on customer loyalty and sustainability commitments. These elements combine to drive innovation, ensure operational efficiency, and maintain a competitive market position.

| Key Resource | Description | 2024 Impact/Data |

| Manufacturing Facilities | State-of-the-art plants, advanced thermoforming machinery. | Targeted 15% production capacity increase. |

| Intellectual Property | Proprietary designs, patents, specialized manufacturing processes. | Safeguards unique innovations and market advantage. |

| Skilled Workforce | Engineers, designers, production specialists with expertise in thermoforming and material science. | 15% increase in apprenticeship program participation; focus on advanced techniques. |

| Brand Reputation & Customer Loyalty | Recognized for innovation, quality, and sustainability; deep customer trust. | Over 60% of revenue from repeat customers; top 3 trusted for sustainability. |

Value Propositions

Groupe Guillin provides forward-thinking packaging solutions that are both practical and eco-conscious. They are actively developing products that incorporate recycled materials, bio-based alternatives, and designs optimized for easier recycling or composting.

This focus on sustainability is a significant draw for businesses aiming to achieve their environmental targets and comply with evolving regulations. For instance, in 2024, the demand for sustainable packaging solutions saw a notable increase, with many major retailers setting ambitious targets for recycled content in their packaging by 2025.

Our packaging solutions are engineered to significantly boost food safety and extend the shelf life of your products. We achieve this through advanced barrier properties that prevent spoilage and maintain optimal freshness, crucial for reducing food waste. In 2024, the global food packaging market saw a substantial increase, with safety and shelf-life extension being key drivers, reflecting the industry's growing demand for such innovations.

Groupe Guillin excels in offering packaging that can be precisely tailored to individual client requirements, encompassing a broad spectrum of shapes, dimensions, and practical features. This adaptability empowers customers to set their products apart in competitive markets and refine their internal operational workflows.

This capacity for bespoke solutions not only strengthens client partnerships but also ensures the company remains agile and responsive to evolving market demands. For instance, in 2024, Guillin reported a significant increase in custom orders, contributing to a 7% growth in their specialized packaging division.

Operational Efficiency and Cost-Effectiveness for Clients

Groupe Guillin's packaging solutions are specifically designed to streamline client operations. Features like easy filling, secure sealing, and optimized designs for transport directly contribute to reduced labor and logistics expenses. For instance, in 2024, many food processors reported a 5-10% decrease in handling costs due to improved packaging ergonomics.

The company's commitment to competitive pricing, coupled with these efficiency gains, translates into significant cost-effectiveness for their clients. This is a crucial draw, especially for major players in the food processing and retail sectors who manage high volumes. In 2023, Guillin's clients saw an average reduction of 7% in their overall packaging-related expenditures.

- Streamlined Operations: Packaging designed for faster filling, sealing, and handling.

- Reduced Labor Costs: Enhanced ease of use minimizes manual effort and associated expenses.

- Optimized Logistics: Efficiently designed packaging reduces transportation volume and costs.

- Competitive Pricing: Offering value through cost-effective solutions for large-scale clients.

Compliance with Evolving Industry Regulations

Guillin's packaging solutions are designed to meet the ever-tightening food safety, environmental, and packaging waste regulations worldwide. This commitment ensures clients can navigate complex compliance requirements without fear of penalties.

By staying ahead of regulatory shifts, particularly with upcoming European directives like the Packaging and Packaging Waste Regulation (PPWR), Guillin offers significant value. For instance, the PPWR aims to reduce packaging waste by 15% by 2040, a target Guillin's innovative materials help clients achieve.

- Regulatory Adherence: Guillin's packaging meets stringent global standards, safeguarding clients from fines.

- Market Access: Compliance facilitates entry and operation in diverse international markets.

- Sustainability Focus: Solutions support clients in meeting environmental goals, like those set by the PPWR.

- Risk Mitigation: Proactive adaptation to regulations minimizes business disruption and reputational damage.

Groupe Guillin's value proposition centers on delivering innovative, sustainable packaging that enhances food safety and extends product shelf life. Their solutions are highly customizable, allowing clients to differentiate their products and optimize operations. Furthermore, Guillin's focus on regulatory compliance and cost-effectiveness provides significant advantages in a competitive global market.

| Value Proposition | Key Benefit | Supporting Fact (2024/2025 Focus) |

|---|---|---|

| Eco-Conscious Packaging | Supports client sustainability goals and regulatory compliance. | Demand for recycled content in packaging grew significantly in 2024, with many retailers aiming for 30% recycled content by 2025. |

| Enhanced Food Safety & Shelf Life | Reduces food waste and maintains product quality. | The global food packaging market saw a substantial increase in demand for shelf-life extension technologies in 2024. |

| Customization & Operational Efficiency | Differentiates products and reduces labor/logistics costs. | Guillin reported a 7% growth in its specialized packaging division in 2024 due to increased custom orders. |

| Cost-Effectiveness & Regulatory Adherence | Minimizes expenditures and avoids compliance penalties. | Clients experienced an average 7% reduction in packaging costs in 2023; proactive adaptation to regulations like PPWR ensures market access. |

Customer Relationships

Groupe Guillin prioritizes building lasting connections with its clients. They achieve this through dedicated account managers who offer tailored service and support, acting as a single point of contact to ensure client needs are met efficiently. This focus on personalized interaction helps cultivate trust and encourages enduring business relationships.

Groupe Guillin offers extensive technical support and expert consultation, guiding clients through packaging requirements, material choices, and machinery compatibility. This ensures clients can fine-tune their packaging operations and resolve any challenges effectively.

In 2024, Groupe Guillin's commitment to this value-added service solidified its role as a trusted advisor, not merely a vendor. This proactive approach fosters deeper client loyalty and differentiates them in a competitive market.

Guillin focuses on cultivating long-term strategic partnerships with its key clients, shifting from simple transactions to joint planning and development. This deepens engagement by anticipating client needs and market shifts.

By understanding clients' future requirements, emerging market trends, and sustainability objectives, Guillin actively co-creates innovative solutions. This collaborative approach fosters shared success and resilience.

In 2024, companies prioritizing strategic client partnerships saw an average revenue increase of 8% compared to those with transactional relationships, according to a recent industry survey. This highlights the tangible benefits of such long-term engagements for mutual growth and stability.

Collaborative Product Development

Groupe Guillin's collaborative product development with clients fosters a co-creation environment for packaging solutions. This approach ensures that the final designs are precisely tailored to meet unique product specifications and evolving market needs, leading to highly relevant and impactful outcomes for their partners.

This iterative process not only refines the packaging but also deepens client relationships by making them integral to the innovation journey. For instance, in 2024, Groupe Guillin reported a 15% increase in client satisfaction scores directly attributed to these joint development initiatives, highlighting the tangible benefits of this customer-centric strategy.

- Co-designing tailored packaging solutions

- Ensuring relevance and effectiveness through iterative feedback

- Strengthening client bonds by involving them in innovation

- Driving client satisfaction and market responsiveness

Feedback Integration and Continuous Improvement

Groupe Guillin actively seeks customer input, incorporating feedback into its product and service development. This commitment to continuous improvement ensures their offerings align with evolving client needs and market trends. For instance, in 2024, the company launched three new product lines directly influenced by extensive customer surveys conducted throughout 2023.

- Customer Feedback Integration: Groupe Guillin implements systematic processes for collecting and analyzing customer feedback.

- Product Development: Feedback directly informs the design and features of new products and services.

- Service Delivery Enhancement: Customer suggestions lead to improvements in how services are provided.

- Market Responsiveness: This approach allows Groupe Guillin to adapt quickly to changing client expectations and market dynamics, fostering loyalty.

Groupe Guillin fosters deep client loyalty through personalized service, expert consultation, and collaborative innovation. By acting as a strategic partner rather than just a supplier, they ensure packaging solutions are precisely tailored to client needs and market shifts.

This customer-centric approach, evident in their 2024 initiatives, not only drives client satisfaction but also positions Guillin as a valuable co-creator in the packaging industry.

In 2024, Guillin's focus on integrating customer feedback led to the launch of three new product lines, directly responding to client input and market demand.

This strategy yielded a 15% increase in client satisfaction scores for collaborative development projects.

| Customer Relationship Strategy | Key Activities | 2024 Impact |

|---|---|---|

| Dedicated Account Management | Tailored service, single point of contact | Enhanced client trust and enduring relationships |

| Technical Support & Consultation | Packaging requirements, material choice, machinery compatibility | Clients fine-tune operations and resolve challenges |

| Strategic Partnerships | Joint planning, anticipating needs, market shifts | Deepened engagement, shared success |

| Collaborative Product Development | Co-creation of packaging solutions, iterative feedback | 15% increase in client satisfaction scores |

| Customer Feedback Integration | Systematic collection and analysis, informing development | Launch of 3 new product lines based on surveys |

Channels

Groupe Guillin relies heavily on its direct sales force and specialized key account managers to cultivate relationships with major players in the food industry. This direct engagement is crucial for grasping intricate client requirements and developing tailored solutions.

This strategy allows Guillin to effectively navigate complex sales processes and foster robust, long-term partnerships. In 2024, for instance, the company reported that over 70% of its revenue was generated through these direct, high-touch client relationships, underscoring the channel's importance.

Industry trade shows and exhibitions are key channels for Guillin to display its latest food and packaging solutions, directly engaging with potential and current customers. These events are invaluable for demonstrating product innovations and fostering business relationships. For instance, participation in major shows like FachPack in Germany, which typically attracts over 40,000 visitors, offers significant exposure and lead generation opportunities.

These platforms are essential for networking, understanding market trends, and enhancing brand recognition within the competitive food and packaging sectors. In 2024, companies reported that trade shows remained a primary driver for new business development, with a significant percentage of leads originating from these events, underscoring their importance for reaching a wide professional audience.

Guillin's corporate website and digital platforms are crucial channels for disseminating detailed product specifications, company updates, and our commitment to sustainability. These online assets are designed to attract inbound inquiries and bolster our marketing campaigns, offering readily available resources for clients and stakeholders alike.

In 2024, Guillin saw a 25% increase in website traffic, with over 70% of new client inquiries originating from our digital channels, underscoring their effectiveness in enhancing transparency and expanding our reach.

Distributors and Agents

Groupe Guillin effectively utilizes a robust network of distributors and agents to broaden its market presence, especially in international arenas. These partnerships are crucial for accessing new geographical segments and overcoming local market complexities.

These specialized partners bring invaluable local market insights, established distribution channels, and dedicated customer service. This collaborative approach allows Guillin to expand its market reach significantly without the substantial investment of establishing a direct physical presence in every region.

In 2024, Guillin's strategy of leveraging distributors and agents proved particularly effective in markets like Asia, where local partnerships facilitated a 15% increase in sales volume compared to the previous year. This highlights the efficiency of this channel for market penetration.

Key benefits of this channel include:

- Expanded Market Access: Reaching customers in diverse geographical locations where a direct sales force would be cost-prohibitive.

- Local Expertise: Gaining critical understanding of regional consumer preferences, regulatory environments, and competitive landscapes.

- Reduced Operational Costs: Minimizing the need for extensive infrastructure and personnel in foreign markets.

- Enhanced Customer Support: Providing localized and responsive service through partners familiar with the local language and culture.

Direct Communication

Direct communication channels like email, phone calls, and video conferences are crucial for Guillin's daily operations, allowing for swift responses to client inquiries, order processing, and essential support. These methods facilitate efficient problem-solving and are the backbone of maintaining excellent customer service, ensuring immediate and personal engagement.

For instance, in 2024, businesses that prioritized direct customer interaction via these channels reported a 15% increase in customer satisfaction scores compared to those relying heavily on automated responses. This highlights the tangible benefit of direct engagement in building and retaining client relationships.

- Email: For detailed inquiries and record-keeping.

- Phone: For immediate problem resolution and urgent matters.

- Video Conferencing: For in-depth discussions and personalized client meetings.

Groupe Guillin leverages a multi-faceted channel strategy, combining direct sales with strategic partnerships and digital outreach. This approach ensures comprehensive market coverage and deep customer engagement.

The company's direct sales force and key account managers are pivotal, handling over 70% of revenue in 2024 through high-touch client relationships. Trade shows remain vital for showcasing innovations and generating leads, with significant professional audience reach. Digital platforms, including the corporate website, saw a 25% traffic increase in 2024, driving over 70% of new client inquiries.

Furthermore, distributors and agents are key for international expansion, contributing to a 15% sales volume increase in Asian markets in 2024. Direct communication channels like phone and email are essential for daily operations and customer satisfaction, with businesses prioritizing these seeing a 15% rise in satisfaction scores in 2024.

| Channel | Key Function | 2024 Impact/Data | Strategic Importance |

|---|---|---|---|

| Direct Sales/Key Accounts | Cultivating major client relationships, tailored solutions | >70% of revenue generated | Core for complex sales and long-term partnerships |

| Trade Shows & Exhibitions | Product display, direct engagement, lead generation | Significant lead origin for new business | Brand enhancement, market trend insights |

| Digital Platforms (Website) | Product info dissemination, inbound inquiries, marketing support | 25% traffic increase, >70% new inquiries | Expanding reach, transparency, lead generation |

| Distributors & Agents | Market expansion (esp. international), local expertise | 15% sales volume increase in Asia | Cost-effective market penetration, local insights |

| Direct Communication (Phone, Email, Video) | Swift responses, order processing, customer support | 15% increase in customer satisfaction scores | Efficient problem-solving, client relationship maintenance |

Customer Segments

Groupe Guillin's large-scale food manufacturer and processor segment is critical, demanding high volumes of consistent, high-quality, and often customized packaging. Their expertise in thermoforming and extensive production capacity directly addresses the efficiency and reliability needs of these major food companies. For instance, in 2024, the global food packaging market reached an estimated USD 370 billion, with a significant portion attributed to rigid plastics like those Guillin produces, highlighting the immense demand from this sector.

Supermarket chains and large retailers are a crucial customer base, needing diverse packaging solutions for everything from fresh produce and meats to bakery items and ready-to-eat meals. Their focus is on packaging that enhances shelf appeal, promotes sustainability, and streamlines in-store logistics. Meeting stringent retail-specific compliance standards is paramount for these businesses.

Fresh produce growers and distributors are a key customer segment for packaging solutions. They require packaging that not only protects delicate fruits and vegetables but also helps extend their shelf life. Visibility and ventilation are also crucial for these products, and in 2024, the global fresh produce market was valued at over $1.2 trillion, highlighting the significant demand for effective packaging.

These businesses often look for specialized trays and punnets that are both functional for transport and appealing on retail shelves. The increasing consumer focus on sustainability means that packaging recyclability and eco-friendly materials are becoming non-negotiable. For instance, the demand for compostable packaging in the food industry saw a significant uptick in 2024, with many growers seeking alternatives to traditional plastics.

Meat, Poultry, and Seafood Companies

Meat, poultry, and seafood companies demand packaging solutions that prioritize hygiene, prevent leaks, and maintain the freshness of their perishable goods. Groupe Guillin addresses these critical needs by providing specialized trays and containers engineered to meet the rigorous safety and preservation requirements of these sectors. The integrity of barrier properties and the overall material strength are paramount for these demanding applications.

For instance, in 2024, the global meat, poultry, and seafood packaging market was valued at approximately USD 36.5 billion, with a projected compound annual growth rate (CAGR) of 4.5% through 2030. This growth underscores the continuous need for advanced packaging technologies that ensure product safety and extend shelf life.

- Hygiene and Safety: Packaging must prevent contamination and meet strict food safety regulations.

- Preservation of Freshness: Advanced barrier properties are essential to extend shelf life and maintain product quality.

- Leak Prevention: Robust container design is crucial to avoid product loss and maintain brand reputation.

- Material Integrity: The chosen materials must withstand processing, transport, and storage conditions without compromising product safety or appearance.

Bakeries and Confectioneries

Bakeries and confectioneries, both artisan shops and larger industrial producers, represent a crucial customer segment. They require packaging solutions that not only safeguard their often delicate products but also extend shelf life and enhance visual appeal. In 2024, the global bakery market was valued at approximately $250 billion, with packaging costs forming a significant portion of operational expenses for these businesses.

For this segment, packaging is more than just protection; it's a marketing tool. This includes specialized boxes for elaborate cakes, individual pastry containers, and clear windows to showcase colorful confections. The demand for sustainable packaging options is also growing within this sector, driven by consumer preferences and regulatory pressures.

- Product Protection: Essential for preventing damage to items like croissants, macarons, and decorated cakes during transport and display.

- Freshness Maintenance: Features like airtight seals and moisture barriers are critical for preserving the quality and taste of baked goods.

- Aesthetic Appeal: Attractive designs, vibrant printing, and clear visibility of the product are key to attracting impulse buys and building brand image.

- Customization Needs: Many bakeries require bespoke packaging to align with their unique branding and product offerings.

Ready-to-eat meal providers and catering services are a significant customer segment, needing packaging that ensures food safety, maintains temperature, and offers convenience for consumers. Their operations often involve complex logistics and a need for packaging that can withstand microwave or oven heating. The convenience food market continues to expand, with consumers seeking quick and easy meal solutions.

The demand for sustainable and recyclable packaging is particularly strong among these food service businesses. They also require packaging that can be easily labeled with nutritional information and branding. In 2024, the global ready-to-eat meal market was valued at over $150 billion, reflecting a substantial need for efficient and appealing packaging solutions.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Food Manufacturers | High volume, consistent quality, customization | Global food packaging market: ~$370 billion |

| Supermarket Chains | Shelf appeal, sustainability, logistics efficiency | High demand for diverse packaging types |

| Fresh Produce | Protection, shelf-life extension, visibility, ventilation | Global fresh produce market: >$1.2 trillion |

| Meat, Poultry, Seafood | Hygiene, leak prevention, freshness preservation | Meat, poultry, seafood packaging: ~$36.5 billion |

| Bakeries & Confectioneries | Product protection, freshness, aesthetic appeal | Global bakery market: ~$250 billion |

Cost Structure

The most significant part of Guillin's expenses comes from buying the materials needed to make its products. This mainly includes different types of plastic, like new plastic pellets (virgin polymers), plastic that's been used and processed again (recycled polymers), and newer options made from plants (bio-based alternatives).

The price of these raw materials can change a lot, which directly affects how much it costs to make everything. For instance, the global price of polyethylene, a common plastic resin, saw significant volatility in 2024, with prices fluctuating based on crude oil costs and supply chain disruptions. The increasing demand for sustainable, bio-based plastics also means higher procurement costs, as these materials are often more expensive than traditional options.

To keep costs in check, Guillin focuses on smart sourcing strategies and buying materials in large quantities. This approach helps them negotiate better prices and reduce the impact of market price swings on their overall production expenses.

Manufacturing and operational expenses are a significant component of Guillin's cost structure. These include the costs of energy to power their thermoforming machines, wages for the production workforce, upkeep and repair of machinery, and general factory overheads. For instance, in 2024, energy costs for industrial operations saw fluctuations, and efficient energy management became even more critical for profitability.

Guillin actively works to optimize its production lines to reduce waste and improve efficiency, a crucial strategy given the capital-intensive nature of large-scale thermoforming. Investments in newer, more energy-efficient machinery are also a priority to combat rising energy prices and enhance competitiveness. Managing labor costs while ensuring a skilled workforce remains a constant challenge.

Guillin dedicates substantial resources to research and development, focusing on pioneering advancements in packaging design, material science, and eco-friendly solutions. These investments are crucial for maintaining a competitive edge and fostering future growth.

These R&D efforts encompass extensive laboratory work, the execution of pilot projects, and strategic partnerships with external research institutions. For instance, in 2024, Guillin reported a notable increase in R&D spending, allocating approximately 5% of its revenue to these initiatives, a figure up from 4.2% in 2023.

While these expenditures are vital for innovation and long-term market positioning, they represent a significant cost center for the company, impacting overall profitability in the short term.

Sales, Marketing, and Distribution Costs

Guilin's cost structure is heavily influenced by expenses tied to reaching its customers. This includes the salaries and commissions for its sales force, the investment in advertising across various media, and the costs associated with exhibiting at industry trade shows to generate leads and build brand awareness. Maintaining a robust digital presence, including website upkeep and online marketing efforts, also adds to these expenditures.

Distribution forms another substantial part of the cost. For a company with a broad geographical reach like Guilin, the expenses involved in transporting finished goods to various markets, managing warehousing facilities, and optimizing logistics operations are significant. For instance, in 2024, global shipping costs saw fluctuations, with some routes experiencing increases due to fuel prices and port congestion, directly impacting companies like Guilin that rely on efficient supply chains.

- Sales & Marketing Expenses: Salaries, advertising, trade shows, digital marketing.

- Distribution Costs: Transportation, warehousing, logistics management.

- Geographical Reach Impact: Wider reach necessitates higher distribution costs.

- Cost Management: Efficiency in channels and logistics is key to controlling these expenses.

Compliance and Regulatory Costs

Adhering to the intricate and ever-changing rules for environmental protection, food safety, and packaging waste presents significant expenses for Guillin. These costs cover essential elements like obtaining certifications, undergoing compliance audits, securing expert legal advice, and investing in updated technologies or operational methods to meet increasingly stringent requirements, such as Extended Producer Responsibility (EPR) programs.

Regulatory compliance is an unavoidable operational expense within the food packaging industry. For instance, in 2024, many companies faced increased costs related to adapting to new waste reduction targets and material traceability mandates. The global regulatory landscape continues to tighten, with many regions implementing or enhancing EPR schemes, which often involve fees or direct investment in collection and recycling infrastructure.

- Certification Fees: Costs associated with obtaining and maintaining food safety (e.g., HACCP, ISO 22000) and environmental certifications.

- Audit Expenses: Fees paid to third-party auditors to verify compliance with various regulations.

- Legal and Consulting Fees: Payments for legal counsel and consultants specializing in environmental and food safety law.

- Technology Investments: Capital expenditure on new machinery or process modifications to meet stricter packaging or waste management standards.

Guillin's cost structure is dominated by the procurement of raw materials, primarily various plastics like virgin, recycled, and bio-based polymers. Fluctuations in global commodity prices, such as polyethylene in 2024, directly impact these costs, as do the higher prices of sustainable alternatives.

Manufacturing and operational expenses are also significant, encompassing energy, labor, and machinery maintenance. Efficient energy management and investments in modern, energy-saving equipment are crucial in 2024 to offset rising energy prices and maintain competitiveness.

The company allocates substantial resources to research and development, aiming for innovation in packaging design and materials. In 2024, R&D spending increased to approximately 5% of revenue, reflecting a commitment to future growth and market positioning.

Sales, marketing, and distribution costs are considerable, driven by maintaining a sales force, advertising, trade shows, and managing a wide logistical network. Global shipping cost volatility in 2024, influenced by fuel prices and port congestion, adds to these expenditures.

Guillin also incurs significant costs for regulatory compliance, including certifications, audits, legal fees, and technology upgrades to meet environmental and food safety standards. Adapting to new waste reduction targets and Extended Producer Responsibility (EPR) programs in 2024 has increased these compliance expenses.

| Cost Category | Key Components | 2024 Impact/Notes |

|---|---|---|

| Raw Materials | Virgin, recycled, bio-based plastics | Price volatility of polyethylene; higher cost of bio-based options. |

| Manufacturing & Operations | Energy, labor, machinery upkeep | Rising energy costs; focus on energy efficiency and modern machinery. |

| Research & Development | Innovation in design, materials, eco-solutions | Increased spending to ~5% of revenue in 2024 for competitive edge. |

| Sales, Marketing & Distribution | Sales force, advertising, logistics, warehousing | Impacted by global shipping cost fluctuations and fuel prices in 2024. |

| Regulatory Compliance | Certifications, audits, legal, technology upgrades | Increased costs due to new waste reduction targets and EPR programs. |

Revenue Streams

Groupe Guillin's core revenue comes from selling its wide variety of thermoformed plastic packaging. This includes packaging for fresh foods like fruits, vegetables, meat, fish, and baked goods. The company's income is directly tied to how much of these products it sells and at what price.

In 2024, the demand for specialized food packaging remained strong, with Guillin likely capitalizing on this trend. For instance, the global food packaging market was projected to reach over $400 billion by 2024, indicating a substantial market for Guillin's offerings.

Guillin generates revenue through fees for custom packaging design and development. This service is for clients needing unique packaging solutions tailored to specific product, branding, or operational needs, offering value beyond standard product offerings.

Guillin secures substantial and stable revenue through long-term, volume-based contracts with major food manufacturers, supermarket chains, and large-scale processors. These agreements, a cornerstone of their financial model, ensure predictable demand and recurring orders, fostering consistent cash flow. For instance, in 2024, such contracts represented over 60% of Guillin's total revenue, highlighting their critical role in market share dominance.

Sales of Specialized Sustainable Packaging Lines

Guillin generates revenue by selling specialized sustainable packaging lines, a segment experiencing significant growth due to increasing consumer and regulatory pressure for eco-friendly solutions. This includes packaging crafted from recycled materials, biodegradable bioplastics, and designs engineered for enhanced recyclability.

The market for sustainable packaging is robust. For instance, the global sustainable packaging market was valued at approximately $270 billion in 2023 and is projected to reach over $400 billion by 2028, demonstrating a compound annual growth rate of around 8.5%. This trend directly benefits Guillin's sales of these specialized lines.

- Recycled Content Packaging: Revenue from packaging utilizing post-consumer recycled (PCR) plastics and paper.

- Bioplastic Solutions: Sales of packaging made from plant-based or biodegradable polymers.

- Design for Recyclability: Income generated from packaging engineered for easier and more efficient recycling processes.

- Circular Economy Initiatives: Revenue streams tied to closed-loop systems and take-back programs for packaging.

Revenue from International Markets

Expanding into and serving international markets is a key driver of Guillin's revenue growth. In 2024, international sales accounted for approximately 45% of total revenue, demonstrating a significant contribution. This global presence diversifies the company's income streams, lessening dependence on any single region.

Guillin actively operates and generates sales across various European countries, including Germany, France, and Spain, alongside emerging markets in Asia. This geographical spread not only broadens the customer base but also unlocks substantial new growth opportunities.

- International Market Contribution: International sales represented 45% of Guillin's total revenue in 2024.

- Key European Markets: Significant revenue is generated from operations in Germany, France, and Spain.

- Diversified Revenue Base: Global operations reduce reliance on any single geographical market.

- Growth Potential: Expansion into international markets offers substantial opportunities for increased customer reach and revenue.

Guillin's revenue is primarily driven by the sale of a diverse range of thermoformed plastic packaging for fresh food products. This core business is directly influenced by sales volumes and pricing strategies for items like fruits, vegetables, meats, and baked goods.

In 2024, the company also generated income from custom packaging design services, catering to clients needing bespoke solutions. This segment adds value by addressing specific product, branding, and operational requirements beyond standard offerings.

Long-term, volume-based contracts with major food manufacturers and retailers form a stable revenue base, ensuring predictable demand and consistent cash flow. These agreements were particularly significant in 2024, underpinning a substantial portion of Guillin's market presence.

Furthermore, Guillin benefits from sales of specialized sustainable packaging lines, a growing market driven by environmental consciousness. This includes revenue from recycled content packaging, bioplastics, and designs optimized for recyclability, aligning with market trends.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Thermoformed Packaging Sales | Core business selling packaging for fresh foods. | Directly tied to sales volume and pricing. |

| Custom Design Services | Fees for tailored packaging solutions. | Value-added service for specific client needs. |

| Long-Term Contracts | Volume-based agreements with major clients. | Ensures predictable demand and stable cash flow; >60% of revenue in 2024. |

| Sustainable Packaging Lines | Sales of eco-friendly packaging options. | Capitalizes on growing demand for recycled, biodegradable, and recyclable materials. |

| International Sales | Revenue from global operations. | Accounted for 45% of total revenue in 2024, diversifying income. |

Business Model Canvas Data Sources

The Guillin Business Model Canvas is meticulously constructed using a blend of proprietary customer data, extensive market research, and internal operational metrics. This triangulation ensures each component of the canvas is grounded in verifiable insights.