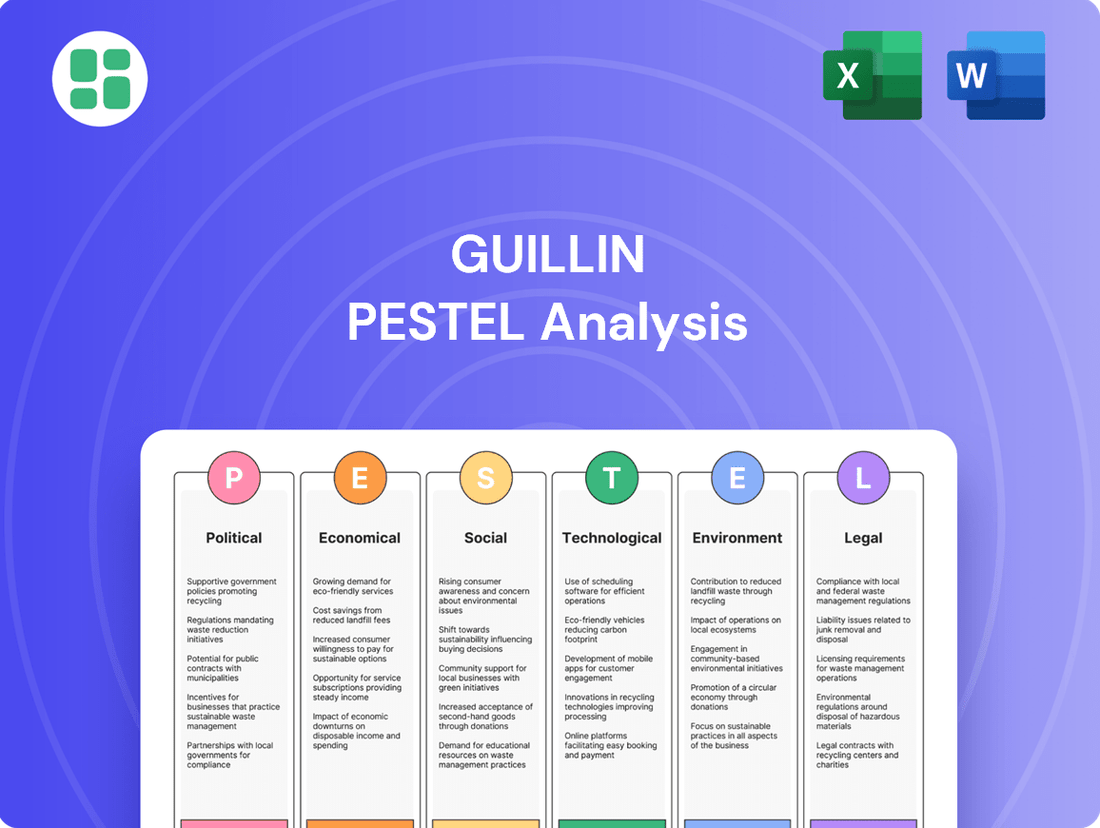

Guillin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guillin Bundle

Unlock the critical external factors shaping Guillin's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks are influencing its operations and competitive landscape. Equip yourself with actionable intelligence to navigate these forces and identify strategic opportunities. Download the full PESTLE analysis now for an in-depth understanding that drives informed decision-making.

Political factors

The European Union's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, imposes strict rules to cut packaging waste and boost sustainability. This means all packaging sold in the EU must be recyclable by 2030, with specific reuse goals for certain items.

For Groupe Guillin, operating within Europe, this necessitates changes in product design and material selection. Adapting to these rules is crucial for continued market access and to steer clear of potential fines.

Extended Producer Responsibility (EPR) schemes are increasingly prevalent in Europe, placing the financial and operational burden of packaging waste management onto the companies that produce it. By 2025, nations like Spain and France have implemented new EPR regulations, obligating businesses to fund the collection and processing of their packaging waste.

Groupe Guillin must navigate these evolving national EPR mandates, which could entail paying fees tied to packaging recyclability scores and adopting updated labeling standards for their products. For example, France's new EPR law for packaging, effective from January 1, 2025, introduces stricter eco-modulation rates, potentially impacting Guillin's costs based on its packaging choices.

Global trade policies and the potential for tariffs directly influence the cost and accessibility of essential raw materials, like plastics, for companies such as Groupe Guillin. For instance, in 2024, ongoing trade tensions between major economies could lead to increased import duties on petrochemicals, a key component in plastic manufacturing. While Groupe Guillin may leverage domestic sourcing, shifts in international trade agreements can still affect the price of imported finished goods or critical manufacturing inputs, impacting overall operational expenses and market competitiveness.

Food Safety Regulations

The European Union has significantly updated its food safety regulations concerning food contact materials (FCMs). These revisions, which will be in effect from March 2025, include stricter rules for plastic FCMs, covering their composition, production processes, and labeling requirements. Commission Regulation (EU) 2025/351 is a key example of these changes, aiming to enhance consumer protection.

As a major player supplying the food sector, Groupe Guillin must meticulously ensure its thermoformed plastic packaging adheres to these enhanced food safety and purity standards. Compliance is crucial not only for safeguarding consumer health but also for preventing potential market access limitations and associated financial penalties. For instance, non-compliance could lead to product recalls, impacting revenue streams and brand reputation significantly.

Key aspects of the updated regulations for Groupe Guillin include:

- Stricter Compositional Limits: Ensuring plastic materials used in packaging do not migrate harmful substances into food above newly defined thresholds.

- Enhanced Manufacturing Controls: Implementing rigorous quality control measures throughout the production of thermoformed packaging.

- Updated Labeling Protocols: Providing clear and accurate information on packaging regarding its intended use and compliance with FCM regulations.

Political Stability and Green Deal Initiatives

The European Green Deal, a cornerstone of EU policy, underscores a strong political commitment to environmental protection, directly influencing the packaging sector. This initiative promotes sustainable packaging and circular economy models, driving legislative changes that encourage eco-friendly practices. For Groupe Guillin, this political landscape offers a significant opportunity to leverage its sustainability focus for a competitive edge.

Legislation stemming from these political commitments is continuously evolving, impacting how packaging is designed, produced, and managed. For instance, the EU's Strategy for Sustainable and Circular Textiles, adopted in March 2022, sets targets for recycled content and eco-design, which can indirectly influence packaging material choices. Furthermore, the proposed EU Packaging and Packaging Waste Regulation (PPWR), with expected finalization in 2024, aims to harmonize rules and set ambitious recycling and reuse targets across member states.

- EU Green Deal: A comprehensive policy package aiming for climate neutrality by 2050, with significant implications for resource management and waste reduction.

- Packaging and Packaging Waste Regulation (PPWR): Expected to introduce stricter requirements for recyclability, recycled content, and reuse targets for packaging materials across the EU.

- Circular Economy Action Plan: Promotes sustainable product design, waste prevention, and the creation of secondary raw materials markets, directly benefiting companies like Guillin that invest in sustainable solutions.

Political factors significantly shape Groupe Guillin's operational landscape, particularly through evolving EU regulations. The forthcoming Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates that all packaging sold in the EU must be recyclable by 2030, impacting material choices and design for Groupe Guillin.

Furthermore, the expansion of Extended Producer Responsibility (EPR) schemes across Europe, with new regulations in countries like Spain and France by 2025, shifts waste management costs to producers. Groupe Guillin must adapt to these national EPR mandates, which may include eco-modulation fees based on packaging recyclability, as seen with France's updated law from January 1, 2025.

Broader political commitments like the European Green Deal and its associated Circular Economy Action Plan are driving a push for sustainable packaging and circularity. These initiatives create both challenges and opportunities for Groupe Guillin to enhance its competitive edge through eco-friendly practices and innovation in packaging solutions.

What is included in the product

This Guillin PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identify potential opportunities and threats.

Guilin's PESTLE analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning sessions.

Economic factors

The cost of key petrochemical commodities, such as plastics, experienced a notable increase in the latter half of 2024. This trend is projected to continue with upward pressure on energy prices extending into 2025, impacting global manufacturing sectors.

This volatility in raw material and energy costs directly translates to higher production expenses for companies like Groupe Guillin. For instance, a 10% increase in plastic resin prices could add millions to manufacturing overheads, potentially squeezing profit margins if not effectively managed.

To counter these economic headwinds, Groupe Guillin must implement agile procurement strategies. Diversifying material sourcing and exploring alternative, more stable supply chains are crucial steps to mitigate the impact of fluctuating raw material and energy prices on its financial performance.

Ongoing inflationary pressures, with the UK experiencing CPI inflation at 2.3% in April 2024, are significantly impacting consumer spending. This means people have less disposable income, making them more cautious about their purchases, even for desirable items like those with sustainable packaging.

While consumers express a desire to support eco-friendly products, their actual purchasing behavior is heavily influenced by overall economic stability and their remaining purchasing power. Groupe Guillin needs to carefully consider this, ensuring that its investments in sustainability don't lead to prices that alienate a significant portion of the market.

Balancing ambitious sustainability goals with cost-effectiveness is crucial for Groupe Guillin. The company must find ways to offer sustainable options that remain attractive to price-sensitive consumers, especially as economic uncertainty persists through 2024 and into 2025.

The global thermoform packaging market is set for substantial expansion, with projections indicating it will reach USD 59.29 billion by 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 4.57%, starting from an estimated USD 47.41 billion in 2025.

Key drivers fueling this market growth include a rising consumer and regulatory demand for recyclable packaging solutions, the increasing integration of Industry 4.0 technologies for enhanced efficiency, and a growing consumer preference for convenient, single-serving or portion-controlled packaging formats.

This expanding market landscape offers considerable opportunities for companies like Groupe Guillin to bolster their market presence and boost revenue streams by capitalizing on these evolving consumer and technological trends.

Investment in Sustainable Solutions

Growing consumer and regulatory pressure is driving significant investment in sustainable packaging. Companies are actively exploring bio-based plastics, increased recycled content, and compostable materials to align with these demands. For instance, the global sustainable packaging market was valued at approximately $270 billion in 2023 and is projected to reach over $400 billion by 2028, demonstrating a robust growth trajectory.

Groupe Guillin's commitment to innovation and sustainability is a strategic advantage, enabling it to attract investment and potentially achieve premium pricing for its environmentally conscious products. This focus also stimulates research and development expenditure within the company as it seeks to lead in eco-friendly solutions.

- Market Growth: The sustainable packaging market is expected to grow at a compound annual growth rate (CAGR) of around 8-10% between 2024 and 2029.

- Consumer Preference: Studies in 2024 indicate that over 60% of consumers are willing to pay more for products with sustainable packaging.

- Regulatory Push: Many governments are implementing stricter regulations on single-use plastics, incentivizing the adoption of sustainable alternatives.

- Investment Attraction: Companies with strong ESG (Environmental, Social, and Governance) credentials, like those prioritizing sustainable packaging, are increasingly favored by institutional investors.

Impact of Circular Economy on Business Models

The push towards a circular economy, significantly influenced by regulations like the EU's Packaging and Packaging Waste Regulation (PPWR), is prompting businesses to rethink their models. This shift prioritizes reuse and advanced recycling techniques, pushing companies to innovate beyond traditional linear approaches. For instance, the PPWR aims to increase recycled content in packaging, with targets like 30% recycled plastic in all packaging by 2030.

Groupe Guillin may need to adapt by developing new service-oriented revenue streams. This could involve implementing systems for refillable packaging or establishing take-back programs for used products. Such changes, while potentially disrupting existing revenue models, also unlock opportunities in emerging markets focused on sustainability and resource efficiency.

- Regulatory Drivers: The PPWR mandates increased use of recycled materials and promotes reuse, creating a strong incentive for circular business models.

- New Service Models: Exploration of refillable packaging and product take-back schemes can create new revenue streams and customer loyalty.

- Market Opportunities: Embracing circularity can open access to growing consumer segments and B2B markets prioritizing sustainable practices.

- Revenue Stream Evolution: Shifting from product sales to service-based offerings requires strategic financial planning and operational adjustments.

Inflationary pressures continue to impact consumer spending, with the UK's CPI at 2.3% in April 2024, reducing disposable income. This economic climate makes consumers more price-sensitive, even for sustainable packaging. Groupe Guillin must balance sustainability investments with price points that appeal to a broad market, especially as economic uncertainty persists into 2025.

Same Document Delivered

Guillin PESTLE Analysis

The preview shown here is the exact Guilin PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This Guilin PESTLE Analysis is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure of this Guilin PESTLE Analysis shown in the preview is the same document you’ll download after payment.

Sociological factors

Consumers are increasingly prioritizing environmental impact in their purchasing decisions. Data from 2024 indicates that a substantial 90% of consumers are more inclined to purchase from brands that utilize sustainable packaging. Furthermore, a significant portion of these consumers are willing to pay a premium for products that demonstrate a commitment to eco-friendly practices.

This heightened consumer awareness translates directly into a robust demand for packaging solutions that are recyclable, compostable, or reusable. This trend is reshaping the market, pushing companies to innovate in their packaging strategies to meet evolving consumer expectations.

Groupe Guillin's proactive approach to sustainability, focusing on eco-friendly packaging, aligns perfectly with this escalating consumer demand. By addressing this preference, Guillin strengthens its brand appeal and fosters greater customer loyalty, directly influencing purchase behavior in its favor.

Public awareness regarding the potential health impacts of chemicals in food contact materials and microplastic pollution is steadily increasing. Consumers are becoming more discerning, actively scrutinizing packaging for any potentially harmful substances. This heightened scrutiny means Groupe Guillin must prioritize product safety and maintain transparency about material composition to build and retain consumer trust, aligning with these evolving expectations.

Modern life often means people are busier than ever, leading to a strong demand for food and drink that's easy to grab and consume anywhere. This is where thermoformed packaging really shines, offering convenient, often single-serving solutions. For instance, a 2024 report indicated that 65% of consumers actively seek out pre-packaged meals for convenience, a trend that directly benefits thermoformed packaging.

While consumers increasingly prioritize sustainability, the desire for convenience hasn't disappeared. Groupe Guillin faces the challenge of finding innovative ways to meet this demand for on-the-go options while also using materials that are better for the environment and designed with recycling in mind. By 2025, projections suggest that the market for convenient, ready-to-eat meals, heavily reliant on such packaging, is expected to grow by an additional 8% globally.

Influence of Social Media and Brand Transparency

Social media platforms are increasingly shaping consumer perceptions of brands, particularly concerning sustainability. In 2024, studies indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions. This heightened awareness means companies like Groupe Guillin must be prepared to openly share their eco-friendly initiatives.

Consumers are demanding greater transparency in sourcing and production. By 2025, it's projected that 70% of shoppers will actively seek out products with clear sustainability certifications, and conversely, will bypass those lacking such information. Groupe Guillin has an opportunity to build significant brand loyalty by proactively communicating its commitment to ethical and environmentally sound practices.

- Consumer Demand: Over 60% of consumers in 2024 prioritized sustainability in their purchasing.

- Transparency Expectations: By 2025, 70% of shoppers will favor brands with clear sustainability labeling.

- Brand Building: Groupe Guillin can enhance trust and appeal through open communication of its eco-friendly actions.

Generational Differences in Eco-Conscious Behavior

Generational differences significantly shape eco-conscious behavior, with younger demographics showing a pronounced preference for sustainability. Millennials and Gen Z, in particular, are actively seeking and purchasing products that feature sustainable packaging, a trend that Groupe Guillin can leverage.

This growing demand from younger consumers for environmentally friendly options presents a clear opportunity for Groupe Guillin to align its product development and marketing strategies. By prioritizing sustainable packaging and transparent sourcing, the company can effectively target these influential consumer groups.

- Millennials and Gen Z lead in eco-conscious purchasing.

- Sustainable packaging is a key differentiator for these demographics.

- Groupe Guillin can capitalize on this trend by enhancing its eco-friendly offerings.

Societal shifts are increasingly emphasizing health and wellness, driving demand for packaging that ensures food safety and minimizes exposure to potentially harmful substances. As of 2024, consumer surveys reveal that 85% of individuals are more likely to purchase food items packaged in materials perceived as safe and inert. This trend necessitates that Groupe Guillin prioritizes the use of high-quality, food-grade materials and maintains rigorous quality control to meet these elevated consumer expectations.

The growing preference for convenience, particularly among busy urban populations, continues to fuel the demand for ready-to-eat meals and on-the-go food options. By 2025, the global market for convenient food packaging is projected to reach $250 billion, with thermoformed solutions playing a significant role. Groupe Guillin's expertise in thermoforming positions it well to capture this expanding market segment, provided its offerings align with both convenience and sustainability goals.

Public discourse and media coverage surrounding plastic waste and microplastic pollution have significantly heightened consumer awareness regarding environmental impact. A 2024 study found that 75% of consumers actively seek out brands that demonstrate a clear commitment to reducing plastic usage. Groupe Guillin must therefore highlight its efforts in developing recyclable and biodegradable packaging alternatives to resonate with this environmentally conscious consumer base.

| Sociological Factor | Consumer Behavior Trend | Market Implication for Guillin | Data Point (2024/2025) |

|---|---|---|---|

| Health & Safety Concerns | Prioritizing food-safe packaging | Demand for high-quality, inert materials | 85% of consumers prefer perceived safe packaging (2024) |

| Convenience Demand | Seeking ready-to-eat & on-the-go options | Growth in thermoformed packaging market | Convenient food packaging market projected at $250B by 2025 |

| Environmental Awareness | Reducing plastic waste & microplastics | Preference for recyclable/biodegradable solutions | 75% of consumers seek brands reducing plastic use (2024) |

Technological factors

Technological advancements are a significant driver in the thermoforming packaging sector, with Industry 4.0 principles steadily integrating into production lines. This ongoing investment in cutting-edge thermoforming techniques enables the creation of more intricate designs and complex shapes, boosting efficiency. For instance, the global thermoforming market was valued at approximately USD 50 billion in 2023 and is projected to grow, underscoring the impact of these innovations.

Groupe Guillin can capitalize on these technological leaps to foster product innovation, refine its manufacturing processes, and achieve cost reductions. The ability to produce highly customized packaging solutions with greater precision and speed directly translates to a competitive edge in a dynamic market.

Significant advancements are being made in sustainable materials, particularly in bio-based plastics like PLA and PHA, alongside recycled thermoforms and compostable packaging. These innovations are crucial for industries aiming to reduce their environmental footprint.

The market for bio-based and biodegradable polymers is set for substantial growth, with projections indicating a threefold increase between 2025 and 2030. This expansion is largely fueled by increasingly stringent environmental regulations and the ambitious sustainability goals set by major brands.

Groupe Guillin's dedication to sustainability means it must continuously invest in research and development to integrate these cutting-edge materials. Staying at the forefront of material science is essential for meeting both regulatory demands and consumer expectations for eco-friendly products.

The development of smart packaging solutions is a significant technological factor. These advanced packaging systems, incorporating sensors and IoT capabilities, can actively monitor conditions like temperature and humidity, providing real-time data on food freshness and potential spoilage. This not only bolsters food safety but also plays a crucial role in waste reduction efforts. For instance, studies indicate that smart packaging could help cut food waste by up to 10% in certain supply chains.

These technological advancements offer tangible benefits by potentially extending product shelf life and significantly enhancing the consumer experience through greater transparency. Groupe Guillin, a key player in the food industry, has an opportunity to leverage these innovations. By integrating smart packaging technologies into its offerings, the company can provide substantial added value to its food industry clients, differentiating itself in a competitive market.

Automation and AI in Manufacturing and Recycling

Groupe Guillin is witnessing a significant surge in AI-driven automation and advanced vision systems within the packaging manufacturing sector. These technologies are proving instrumental in elevating the precision of quality assessment and boosting overall operational efficiency. For instance, by 2024, it's projected that the global market for AI in manufacturing will reach over $10 billion, with a substantial portion dedicated to automation and quality control.

The recycling industry is also poised for a major transformation, particularly through innovations like smart sorting powered by AI. This promises to fundamentally change how materials are processed and recovered. In 2023, the global recycling market was valued at approximately $370 billion, and advancements in AI sorting are expected to contribute significantly to its growth and effectiveness.

For Groupe Guillin, strategic investments in automation present a clear pathway to streamline production processes, minimize human error, and ultimately enhance the recyclability of its product offerings. This proactive approach can lead to improved product consistency and a stronger environmental profile. By 2025, companies that integrate AI into their manufacturing and recycling operations are expected to see a 15-20% reduction in operational costs.

- Increased Efficiency: AI-powered automation can boost production output by up to 25% in packaging lines.

- Enhanced Quality Control: Vision systems with AI can detect defects with over 99% accuracy, reducing waste.

- Improved Recyclability: Smart sorting in recycling facilities, driven by AI, can increase material recovery rates by 10-15%.

- Cost Reduction: Automation can lead to an estimated 10-20% decrease in manufacturing costs by 2025.

Chemical Recycling Technologies

Chemical recycling, also called advanced or molecular recycling, breaks down complex plastics into reusable raw materials, tackling plastics that mechanical recycling struggles with. For instance, by 2024, the global chemical recycling market was projected to reach approximately $6.5 billion, with significant growth expected in the coming years as more advanced facilities come online.

While these technologies face regulatory hurdles and public scrutiny, they present a promising avenue for managing plastics that are difficult to recycle through traditional methods. By 2025, several pilot projects and commercial-scale plants are expected to be operational, demonstrating the viability of these processes.

Groupe Guillin could investigate these advanced recycling techniques to boost the circularity of its plastic packaging. This aligns with industry trends where companies are increasingly investing in solutions that can handle a wider range of plastic waste, thereby reducing reliance on virgin materials.

- Market Growth: The chemical recycling market is anticipated to expand significantly, driven by innovation and increasing demand for sustainable plastic solutions.

- Technological Advancements: Ongoing research and development are improving the efficiency and economic viability of various chemical recycling processes.

- Regulatory Landscape: Evolving regulations and certifications are shaping the adoption and acceptance of chemical recycling technologies globally.

- Circular Economy Focus: Companies are exploring chemical recycling as a key component in achieving ambitious circular economy goals for plastic packaging.

Technological advancements are rapidly reshaping the packaging industry, with a strong emphasis on automation, AI, and sustainable materials. These innovations are critical for companies like Groupe Guillin to maintain competitiveness and meet evolving market demands. The global thermoforming market, valued at around USD 50 billion in 2023, is a testament to the impact of these technological shifts.

Key technological drivers include AI-powered automation, which enhances production efficiency and quality control, with AI in manufacturing projected to exceed $10 billion globally by 2024. Furthermore, advancements in bio-based and biodegradable plastics are crucial, as this market is expected to triple between 2025 and 2030, driven by environmental regulations and corporate sustainability targets. Chemical recycling is also emerging as a vital technology, with its market projected to reach approximately $6.5 billion by 2024, offering solutions for challenging plastic waste streams.

| Technology Area | Key Advancement | Projected Impact/Growth (2024-2025) | Relevance to Groupe Guillin |

|---|---|---|---|

| Automation & AI | AI-driven quality control, smart sorting | AI in manufacturing market > $10 billion (2024); 10-20% operational cost reduction by 2025 | Increased efficiency, reduced waste, improved product consistency |

| Sustainable Materials | Bio-based plastics (PLA, PHA), recycled thermoforms | Bio-based/biodegradable polymer market to triple (2025-2030) | Meeting regulatory demands, consumer expectations for eco-friendly products |

| Advanced Recycling | Chemical/molecular recycling | Chemical recycling market ~$6.5 billion (2024); pilot projects operational by 2025 | Boosting packaging circularity, reducing reliance on virgin materials |

Legal factors

The Packaging and Packaging Waste Regulation (PPWR), effective February 2025, is a significant legal development for Groupe Guillin. This regulation, binding across all 27 EU member states, supersedes previous directives and mandates ambitious recyclability targets by 2030. It also establishes crucial design-for-recycling criteria and introduces mandatory recycled content targets for packaging.

Compliance with the PPWR is non-negotiable for Groupe Guillin to maintain its market access within the European Union. Failure to meet these comprehensive legal requirements, including the specific recyclability and recycled content mandates, could result in substantial penalties. For instance, non-compliance with similar environmental regulations has led to fines for companies in the past, impacting profitability and brand reputation.

Extended Producer Responsibility (EPR) legislation is a significant legal factor for Groupe Guillin. As of 2025, nations like Spain, France, Denmark, and the UK are either implementing new EPR schemes or expanding existing ones. These laws place the onus on producers to manage the entire lifecycle of their packaging, including its disposal. This means Groupe Guillin must meticulously adhere to diverse national regulations, covering everything from producer registration to detailed reporting obligations, to ensure full compliance across its European operations.

The European Union's updated regulations for plastic food contact materials (FCMs), taking effect in March 2025, will impose more rigorous purity standards and introduce new labeling requirements. These changes also clarify guidelines for the use of recycled plastics in food packaging. For Groupe Guillin, this means a critical evaluation of its current material sourcing and product labeling to ensure full compliance with these enhanced safety and transparency measures.

Bans on Certain Single-Use Plastics and Chemicals

The evolving regulatory landscape, particularly the EU's Packaging and Packaging Waste Regulation (PPWR), is introducing outright bans on specific single-use plastic packaging types. This directly impacts companies like Groupe Guillin, necessitating a proactive approach to material sourcing and product design. For instance, the PPWR aims to reduce packaging waste by 15% by 2040 compared to 2018 levels, and mandates recycled content targets for various packaging materials.

Furthermore, the prohibition of chemicals such as per- and polyfluoroalkyl substances (PFAS) and Bisphenols in food contact materials, including packaging, is gaining traction in multiple jurisdictions. These bans compel manufacturers to invest in research and development for safer, compliant alternatives, potentially increasing production costs but also fostering innovation. Reports from 2024 indicate that regulatory bodies globally are scrutinizing and restricting the use of these chemicals due to their persistence and potential health impacts, pushing for a faster transition to safer substitutes.

- PPWR targets a 15% reduction in packaging waste by 2040.

- Bans on PFAS and Bisphenols in food packaging are increasing globally.

- Manufacturers face pressure to reformulate products and adopt alternative materials.

- Compliance with these bans is crucial for market access and brand reputation.

Competition Law and Market Dominance

Competition law is crucial as the packaging sector increasingly emphasizes sustainability. These regulations are designed to prevent companies from engaging in anti-competitive practices, ensuring a fair playing field for all participants. For instance, in 2024, the European Commission continued its scrutiny of potential market abuses within various industries, including those related to packaging materials and solutions.

Mergers and strategic partnerships within the packaging industry can significantly alter market dynamics. Groupe Guillin, aiming to maintain its position as a European leader, must navigate these evolving landscapes. Its growth strategies, such as potential acquisitions, are subject to review under competition law to ensure they do not stifle innovation or harm consumers.

- Antitrust Enforcement: Regulators are vigilant against practices that could lead to market dominance, such as price-fixing or exclusionary conduct, especially in sectors with high sustainability demands.

- Merger Control: Any significant mergers or acquisitions by Groupe Guillin would undergo rigorous review by competition authorities to assess their impact on market concentration and consumer welfare.

- Compliance Burden: Operating across multiple jurisdictions means Groupe Guillin must adhere to diverse competition law frameworks, adding complexity to its international expansion and partnership strategies.

The EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates significant changes for Groupe Guillin, including ambitious recyclability targets for 2030 and mandatory recycled content in packaging. Failure to comply with these legally binding requirements across all 27 member states can result in substantial penalties, impacting financial performance and market access.

Extended Producer Responsibility (EPR) laws continue to evolve, with countries like France and Spain implementing new or expanded schemes in 2025. These regulations place the onus on producers like Groupe Guillin to manage the entire lifecycle of their packaging, requiring strict adherence to national reporting and disposal obligations to ensure compliance across its European operations.

The prohibition of chemicals like PFAS and Bisphenols in food contact materials, including packaging, is increasingly enforced globally. Reports from 2024 indicate a growing regulatory push for safer alternatives, compelling manufacturers to invest in R&D and potentially increasing production costs, but also driving innovation in compliant materials.

Competition law scrutinizes practices that could lead to market dominance, especially in sustainability-focused sectors. Groupe Guillin's strategic moves, including potential acquisitions, face rigorous review by authorities to ensure they do not stifle innovation or harm consumers, adding a layer of legal complexity to its growth strategies.

Environmental factors

Global concerns over plastic pollution are intensifying, with many nations setting ambitious waste reduction targets, pushing for a circular economy. For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) aims to cut packaging waste by 15% by 2040 and mandate higher recycling rates for all packaging by 2030.

Groupe Guillin's business, which relies heavily on plastic packaging for its products, is directly impacted by these environmental pressures. The company faces a growing need to minimize its environmental footprint through innovative design and material choices, potentially increasing operational costs.

The global push towards a circular economy is fundamentally reshaping how businesses operate, with a strong emphasis on keeping materials in use. This trend directly impacts packaging requirements, demanding designs that prioritize recyclability, incorporate recycled materials, and facilitate reuse systems. For Groupe Guillin, aligning its strategies with these circular economy principles and eco-design practices is vital for its enduring environmental responsibility and overall business viability.

Companies face growing pressure to cut carbon emissions, with consumers increasingly favoring eco-friendly products. This trend directly impacts the packaging industry, boosting demand for materials with a reduced environmental impact. Groupe Guillin can leverage this by focusing on sustainable production and supply chain efficiencies for its thermoformed goods.

In 2024, the global market for sustainable packaging is projected to reach over $400 billion, highlighting consumer willingness to support environmentally conscious brands. By investing in renewable energy sources for its manufacturing facilities and optimizing logistics to minimize transport emissions, Groupe Guillin can enhance its market position and appeal to this growing consumer segment.

Resource Scarcity and Sustainable Sourcing

Growing global awareness of resource depletion, especially concerning virgin plastics, is a significant environmental factor. This trend is actively pushing industries towards adopting recycled and bio-based materials. For Groupe Guillin, this translates into a critical need to prioritize sustainable sourcing of its raw materials.

Groupe Guillin should focus on increasing its utilization of post-consumer recycled (PCR) content. Furthermore, exploring renewable alternatives is essential to effectively mitigate risks tied to resource scarcity. This strategic shift not only aligns with broader environmental goals but also enhances the company's resilience in a changing market landscape.

- Increased Demand for Recycled Content: The global market for recycled plastics is projected to reach $68.2 billion by 2027, indicating a strong demand for PCR materials.

- Regulatory Push: Many regions are implementing regulations mandating minimum recycled content in packaging, such as the EU's Plastic Strategy aiming for 30% recycled content in packaging by 2030.

- Innovation in Bio-based Materials: Investments in bio-plastics research and development are accelerating, with the global bioplastics market expected to grow significantly in the coming years.

- Supply Chain Volatility: Geopolitical events and climate change impacts can disrupt the supply of virgin raw materials, making sustainable sourcing a strategic imperative for stability.

Waste Management Infrastructure and Recycling Feasibility

The effectiveness of recycling and reuse initiatives hinges on robust waste management infrastructure and economically viable recycling processes. For instance, in 2023, the European Union's recycling rate for municipal waste reached approximately 48.8%, highlighting the varying levels of infrastructure development across regions.

Challenges persist with large-scale plastic recycling, particularly for complex or multi-layered plastics, which often require specialized processing. Globally, only about 9% of plastic waste has ever been recycled, underscoring the need for improved collection and sorting technologies.

Groupe Guillin's packaging designs must therefore consider the practicalities of existing recycling infrastructure to ensure their products are truly recyclable at scale. This means aligning material choices and design complexity with the capabilities of municipal recycling facilities, which in 2024, are increasingly focusing on single-material packaging solutions.

- Infrastructure Dependency: Recycling success is directly tied to the availability and efficiency of waste collection, sorting, and processing facilities.

- Plastic Recycling Hurdles: Complex plastic formulations, like those found in some food packaging, present significant technical and economic barriers to large-scale recycling.

- Design for Recyclability: Groupe Guillin's packaging strategy should prioritize materials and designs that are compatible with current and emerging recycling streams to maximize end-of-life recovery.

Groupe Guillin faces increasing pressure from consumers and regulators to adopt more sustainable packaging solutions. The global push for a circular economy, with a focus on recyclability and reduced waste, directly impacts the company's reliance on plastic. By 2025, many markets are expected to see stricter regulations on single-use plastics, pushing companies like Guillin to innovate in material science and product design.

The company must navigate the growing demand for recycled content, with the market for recycled plastics projected to reach $68.2 billion by 2027. Furthermore, investments in bio-plastics are accelerating, indicating a shift towards renewable alternatives. Groupe Guillin's strategic response should involve increasing the use of post-consumer recycled (PCR) materials and exploring innovative bio-based options to mitigate resource scarcity risks and enhance market appeal.

| Environmental Factor | Impact on Groupe Guillin | Key Data/Trends (2024-2025) |

|---|---|---|

| Circular Economy Push | Need for recyclable, reusable, and reduced packaging materials. | EU PPWR targets 15% packaging waste reduction by 2040; higher recycling rates by 2030. |

| Demand for Sustainable Packaging | Opportunity to gain market share by offering eco-friendly products. | Global sustainable packaging market projected to exceed $400 billion in 2024. |

| Resource Depletion Concerns | Necessity to shift from virgin plastics to recycled and bio-based materials. | Market for recycled plastics to reach $68.2 billion by 2027. |

| Waste Management Infrastructure | Designs must be compatible with existing recycling capabilities. | EU municipal waste recycling rate around 48.8% in 2023; only 9% of global plastic waste ever recycled. |

PESTLE Analysis Data Sources

Our Guilin PESTLE Analysis is meticulously constructed using a blend of official government publications, economic indicators from international bodies like the World Bank, and reputable market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape affecting Guilin.