Grocery Outlet SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grocery Outlet Bundle

Grocery Outlet's unique bargain model presents significant strengths in value-driven markets, but also faces challenges in supply chain consistency and brand perception. Understanding these internal capabilities and external pressures is crucial for anyone looking to invest or strategize in the discount retail space.

Want the full story behind Grocery Outlet's competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market research.

Strengths

Grocery Outlet's opportunistic sourcing model is a significant strength, allowing them to buy surplus, closeout, and seasonal items from major brands at deeply discounted prices. This is how they can offer savings of up to 40-70% compared to conventional supermarkets, a major draw for budget-savvy consumers.

This unique buying approach not only benefits customers but also plays a role in sustainability by rescuing products that might otherwise go to waste. For instance, in 2023, Grocery Outlet continued to leverage this model to bring value to its customers, with net sales reaching $4.1 billion, underscoring the effectiveness of their low-price strategy.

Grocery Outlet's 'treasure hunt' shopping experience, driven by its constantly changing inventory from opportunistic buying, sets it apart from traditional supermarkets. This dynamic model transforms grocery shopping into an engaging discovery process.

Customers are motivated to visit frequently, eager to uncover new and exciting deals, which directly fuels customer engagement and builds loyalty. This unique approach fosters a sense of excitement and anticipation with every visit.

Grocery Outlet's independent operator (IO) model is a significant strength, allowing local families to run stores with considerable autonomy. This fosters deep community ties and enables product assortments that resonate with local tastes.

This entrepreneurial structure offers remarkable flexibility and efficiency, driving scalability without the substantial capital investment typically associated with traditional franchise systems. The company's growth is evident, with 49 new IOs joining the network in 2024, underscoring the model's attractiveness and effectiveness in expanding the business.

Strategic Expansion and Market Penetration

Grocery Outlet is aggressively expanding its footprint, a key strength that bolsters its market penetration. The acquisition of United Grocery Outlet (UGO) significantly contributed to this, adding 40 stores in the Southeastern United States.

The company's strategic growth plan targets the opening of 55-60 new stores throughout 2024, aiming to capture new customer bases and enhance its presence in underserved regions. By the end of fiscal 2024, Grocery Outlet operated 533 stores across 16 states, demonstrating a clear commitment to scaling its operations.

- Aggressive Store Openings: Targeting 55-60 new stores in 2024.

- Acquisition of UGO: Added 40 stores in the Southeast.

- Expanded Geographic Reach: Operating 533 stores across 16 states by end of fiscal 2024.

- Market Penetration Strategy: Focus on underserved areas to reach new customers.

Enhanced Digital and Private Label Initiatives

Grocery Outlet is actively enhancing its digital presence, notably through a new personalization app. This initiative has already demonstrated success, with app transactions showing larger basket sizes, which is a key driver for increasing customer loyalty and encouraging more frequent visits.

The company's strategic focus on its private label program is also a significant strength. In 2024 alone, Grocery Outlet introduced over 180 new private label stock keeping units (SKUs). This expansion is designed to bolster profitability, encourage larger customer purchases, and consistently deliver value, a core tenet of the brand.

- Digital Investment: Grocery Outlet's app personalization is driving higher average basket sizes.

- Private Label Growth: Over 180 new private label SKUs launched in 2024 to boost profitability and customer value.

- Customer Loyalty: Enhanced digital tools and private label offerings aim to increase customer retention and spending.

Grocery Outlet's opportunistic sourcing model is a significant strength, allowing them to buy surplus, closeout, and seasonal items from major brands at deeply discounted prices. This is how they can offer savings of up to 40-70% compared to conventional supermarkets, a major draw for budget-savvy consumers. This unique buying approach not only benefits customers but also plays a role in sustainability by rescuing products that might otherwise go to waste. For instance, in 2023, Grocery Outlet continued to leverage this model to bring value to its customers, with net sales reaching $4.1 billion, underscoring the effectiveness of their low-price strategy.

Grocery Outlet's 'treasure hunt' shopping experience, driven by its constantly changing inventory from opportunistic buying, sets it apart from traditional supermarkets. This dynamic model transforms grocery shopping into an engaging discovery process. Customers are motivated to visit frequently, eager to uncover new and exciting deals, which directly fuels customer engagement and builds loyalty. This unique approach fosters a sense of excitement and anticipation with every visit.

Grocery Outlet's independent operator (IO) model is a significant strength, allowing local families to run stores with considerable autonomy. This fosters deep community ties and enables product assortments that resonate with local tastes. This entrepreneurial structure offers remarkable flexibility and efficiency, driving scalability without the substantial capital investment typically associated with traditional franchise systems. The company's growth is evident, with 49 new IOs joining the network in 2024, underscoring the model's attractiveness and effectiveness in expanding the business.

Grocery Outlet is aggressively expanding its footprint, a key strength that bolsters its market penetration. The acquisition of United Grocery Outlet (UGO) significantly contributed to this, adding 40 stores in the Southeastern United States. The company's strategic growth plan targets the opening of 55-60 new stores throughout 2024, aiming to capture new customer bases and enhance its presence in underserved regions. By the end of fiscal 2024, Grocery Outlet operated 533 stores across 16 states, demonstrating a clear commitment to scaling its operations.

Grocery Outlet is actively enhancing its digital presence, notably through a new personalization app. This initiative has already demonstrated success, with app transactions showing larger basket sizes, which is a key driver for increasing customer loyalty and encouraging more frequent visits. The company's strategic focus on its private label program is also a significant strength. In 2024 alone, Grocery Outlet introduced over 180 new private label stock keeping units (SKUs). This expansion is designed to bolster profitability, encourage larger customer purchases, and consistently deliver value, a core tenet of the brand.

| Key Strength | Description | Supporting Data (2023-2024) |

| Opportunistic Sourcing | Acquiring discounted surplus and closeout items from major brands. | Net sales of $4.1 billion in 2023; savings of 40-70% for consumers. |

| 'Treasure Hunt' Experience | Dynamic inventory creates engaging shopping and repeat visits. | Fosters customer engagement and loyalty through constant discovery. |

| Independent Operator (IO) Model | Local operators with autonomy, fostering community ties and flexibility. | 49 new IOs joined in 2024; scalable growth without high franchise investment. |

| Aggressive Expansion | Strategic store growth and acquisitions to increase market penetration. | Acquired UGO (40 stores); targeting 55-60 new stores in 2024; 533 stores across 16 states by end of FY24. |

| Digital & Private Label Focus | Personalization app driving larger baskets; expanding private label SKUs. | App transactions show larger baskets; over 180 new private label SKUs in 2024. |

What is included in the product

Delivers a strategic overview of Grocery Outlet’s internal and external business factors, highlighting its unique value proposition and competitive landscape.

Offers a clear view of Grocery Outlet's competitive advantages and areas for improvement, simplifying strategic decision-making.

Weaknesses

Grocery Outlet's opportunistic buying strategy, while cost-effective, leads to a highly variable inventory. This inconsistency means customers might not always find their preferred brands or specific staple items, a significant drawback for those prioritizing predictable shopping trips. For instance, during the first quarter of 2024, while net sales increased by 7.3% year-over-year to $1.06 billion, the dynamic nature of their product sourcing means that the exact assortment of goods available week-to-week can differ substantially.

This 'treasure hunt' experience, a key differentiator, can alienate shoppers accustomed to the reliable stock of traditional supermarkets. Unlike competitors who maintain a more stable product mix, Grocery Outlet's reliance on closeout deals results in a less predictable assortment. This makes it challenging for consumers seeking a consistent supply of everyday necessities, potentially limiting repeat visits for those who value certainty in their grocery purchases.

Grocery Outlet experienced considerable operational hurdles during its technology platform upgrades, which spanned late 2023 and early 2024. These disruptions directly affected key performance indicators, including gross margins, which saw a negative impact. The company reported that these system issues led to reduced product variety available to customers.

The implementation of new systems created significant challenges in inventory management and data visibility for Grocery Outlet. This lack of clear data and control over inventory resulted in increased commission support being offered to store operators to mitigate the impact of these inefficiencies. Resolving these lingering system inefficiencies remains an ongoing priority for the company.

Grocery Outlet's reliance on discount shoppers, while beneficial during inflationary periods, presents a significant weakness. A substantial portion of its customer base is highly price-sensitive, making the company vulnerable to changes in consumer spending patterns, especially during economic upturns or periods of recovery. For instance, if disposable incomes rise broadly, some of these value-seeking customers might shift to slightly higher-priced, perceived-quality alternatives.

This economic sensitivity means that even a severe recession, which might seem to favor discount retailers, could still negatively impact Grocery Outlet if overall consumer spending significantly declines. While the company's model is designed to capture market share when consumers are tightening their belts, a deep economic downturn can shrink the total pie, affecting everyone. This was a concern in late 2023 and early 2024 as some analysts debated the sustainability of consumer spending resilience amidst persistent inflation.

Perception of Product Quality and Brand Image

Grocery Outlet's positioning as a 'bargain market' can inadvertently create a perception that its name-brand products might be of lower quality or less fresh, simply due to the closeout model. This perception, while not always reflective of reality, can be a significant hurdle in attracting consumers who prioritize guaranteed quality over price alone.

The company faces an ongoing challenge in consistently shaping consumer perception to overcome the association of discount pricing with compromised product standards. For instance, while Grocery Outlet reported net sales of $4.7 billion for the fiscal year 2023, a significant portion of its customer base may still be influenced by the 'you get what you pay for' mentality.

- Perception Gap: Consumers may associate bargain prices with lower quality, even when dealing with reputable brands.

- Brand Image Challenge: Overcoming the 'discount' stigma requires continuous effort to highlight product quality and value.

- Market Reach Limitation: This perception can limit Grocery Outlet's appeal to a broader demographic seeking consistent, high-end product assurance.

Slower Comparable Store Sales Growth and Profitability Pressures

Grocery Outlet has experienced a slowdown in comparable store sales growth. For the first quarter of 2024, comparable store sales increased by a modest 0.5%, a deceleration from previous periods.

Profitability is facing pressure from several fronts. Gross margins were impacted by operational inefficiencies and a strategic shift back towards value pricing, which can compress margins. This was evident in the first quarter of 2024, where gross margin decreased to 24.5% from 25.7% in the prior year's quarter.

Several factors are contributing to reduced profitability, even as net sales grow. These include:

- Increased Inventory Shrinkage: Higher rates of inventory loss, reported at 2.2% of sales in Q1 2024, directly reduce profitability.

- Elevated SG&A Expenses: Selling, general, and administrative costs rose, partly due to investments in store operations and infrastructure, impacting the bottom line.

- Pressure on Adjusted EBITDA: Consequently, adjusted EBITDA saw a decline, falling to $51.1 million in Q1 2024, down from $68.8 million in Q1 2023, highlighting the profitability challenges.

Grocery Outlet's reliance on opportunistic buying creates an inconsistent product assortment, meaning customers may not always find their preferred brands or staples, impacting shopping predictability. This variability can alienate shoppers accustomed to the stable inventory of traditional supermarkets, potentially limiting repeat visits for those who value certainty in their grocery purchases.

The company's positioning as a 'bargain market' can lead to a perception that its products might be of lower quality or less fresh, a significant hurdle in attracting consumers who prioritize guaranteed quality over price alone. This perception gap requires continuous effort to highlight product quality and value, potentially limiting market reach to a broader demographic.

Profitability is facing pressure from increased inventory shrinkage, which was reported at 2.2% of sales in Q1 2024, directly reducing margins. Additionally, elevated selling, general, and administrative expenses, partly due to investments in store operations, further impacted the bottom line, leading to a decline in adjusted EBITDA to $51.1 million in Q1 2024 from $68.8 million in Q1 2023.

Same Document Delivered

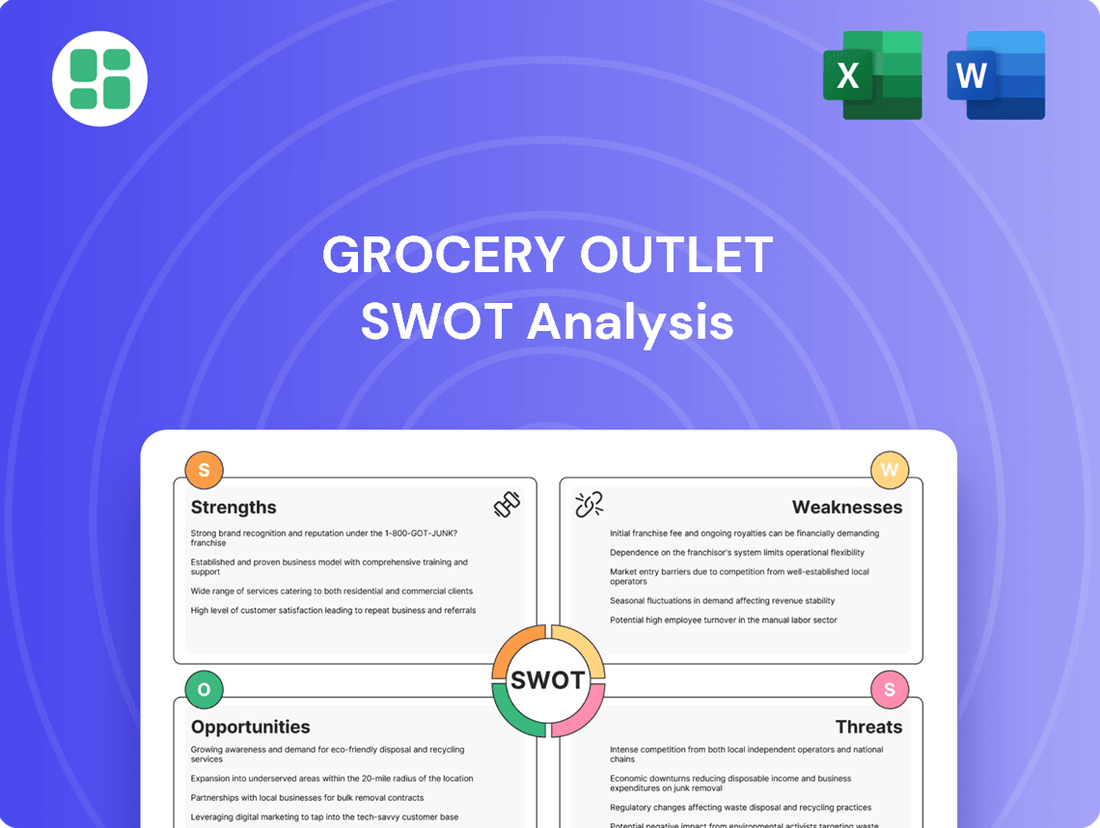

Grocery Outlet SWOT Analysis

This is the actual Grocery Outlet SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

Opportunities

Grocery Outlet has a prime chance to grow by entering markets that are currently overlooked or have limited access to its value-driven grocery model. This includes expanding into new regions and neighboring areas where the company can effectively build its brand recognition.

The company's strategic move to acquire United Grocery Outlet and its commitment to opening many new locations underscore a deliberate effort to broaden its reach. This expansion is particularly focused on extending its presence beyond its established West Coast stronghold and into the Southeastern United States.

Consumers are increasingly seeking value in their grocery purchases, a trend amplified by persistent inflation. In 2024, the average US household's grocery bill saw a notable increase, driving shoppers to seek out more affordable options. This heightened price sensitivity creates a significant opportunity for retailers like Grocery Outlet, whose core business model is built on offering deep discounts.

Grocery Outlet's ability to provide extreme value directly addresses this growing consumer demand for budget-friendly, yet quality, food. As shoppers actively prioritize savings, the company is well-positioned to attract and retain a larger customer base, potentially expanding its market share in the competitive grocery landscape throughout 2024 and into 2025.

Grocery Outlet has a prime opportunity to boost its digital presence by further investing in its mobile app and online ordering systems. This focus on digital platforms, including partnerships with services like Instacart, can significantly improve customer convenience and deepen engagement.

By expanding personalized digital promotions and deals, Grocery Outlet can encourage larger purchases and more frequent visits, aligning with contemporary consumer shopping behaviors. For instance, in Q1 2024, the company reported a 7.7% increase in comparable store sales, demonstrating a growing customer base that could be further captured through enhanced digital offerings.

Expansion of Private Label Offerings

Grocery Outlet's expanding private label program, featuring brands like Simply Go, Go Home, Haven, Go Paw, and Pamper, presents a significant growth avenue. These in-house brands offer customers value and consistency, often at lower price points than national competitors. This strategy can boost profit margins for Grocery Outlet and foster stronger customer loyalty by providing unique, affordable options.

The company's focus on private labels allows it to control product quality and sourcing, potentially leading to better cost efficiencies. As of early 2024, Grocery Outlet has been actively promoting these offerings, aiming to capture a larger portion of consumer spending on everyday essentials. This expansion is crucial for differentiating the brand and enhancing its competitive edge in the discount grocery sector.

- Increased Profitability: Private label products typically yield higher gross margins compared to national brands, directly impacting the company's bottom line.

- Enhanced Customer Loyalty: Offering exclusive, value-driven private label items encourages repeat business and builds a stronger connection with the customer base.

- Competitive Differentiation: A robust private label strategy sets Grocery Outlet apart from competitors, providing unique product assortments that cannot be found elsewhere.

- Value Proposition: These affordable alternatives to national brands reinforce Grocery Outlet's core mission of delivering exceptional value to its shoppers.

Leveraging ESG and Sustainability Initiatives

Grocery Outlet's discount model naturally minimizes food waste, a significant ESG benefit that can be amplified. By actively tracking and publicizing their waste reduction metrics, they can appeal to a growing segment of environmentally aware shoppers and investors. For example, in 2023, the company reported a 10% reduction in food waste across its operations, a figure that can be a powerful marketing tool.

Further strengthening their ESG profile involves showcasing community involvement and support for their independent operators. This dual focus on local impact and ethical business practices can significantly boost brand loyalty and attract capital from ESG-focused funds. In 2024, Grocery Outlet plans to increase its local sourcing by 15%, further embedding sustainability into its supply chain.

Key opportunities include:

- Quantifying and communicating food waste reduction achievements to consumers and investors.

- Highlighting community support programs and the economic benefits for independent operators.

- Developing partnerships with organizations focused on sustainability and food security.

- Securing ESG certifications to validate and enhance brand credibility.

Grocery Outlet is well-positioned to capitalize on the increasing consumer demand for value, especially with persistent inflation impacting household budgets. The company's expansion into new markets, particularly the Southeast, and its focus on enhancing its digital presence through its app and partnerships, like Instacart, offer significant growth potential. Furthermore, the expansion of its private label brands, such as Simply Go and Go Home, provides opportunities for increased profitability and customer loyalty by offering unique, affordable products.

The company's commitment to sustainability, evidenced by its efforts to reduce food waste and increase community involvement, aligns with growing consumer and investor preferences for ESG-conscious businesses. This focus can enhance brand loyalty and attract capital from ESG-focused funds, further solidifying its market position.

| Opportunity Area | Key Initiatives | Potential Impact |

|---|---|---|

| Market Expansion | Entry into new, underserved regions (e.g., Southeast) | Increased market share and brand awareness |

| Digital Enhancement | Investment in mobile app, online ordering, Instacart partnerships | Improved customer convenience, engagement, and sales |

| Private Label Growth | Expansion of brands like Simply Go, Go Home | Higher profit margins, customer loyalty, competitive differentiation |

| ESG Focus | Food waste reduction, community support, local sourcing | Enhanced brand reputation, customer/investor appeal |

Threats

The grocery sector is fiercely competitive, with giants like Walmart and traditional grocers intensifying their focus on value and private label brands. This makes the threat from other discount retailers particularly potent for Grocery Outlet.

Retailers such as Aldi and Lidl are expanding rapidly, directly challenging Grocery Outlet's core customer base with their own low-price strategies. In 2024, the discount grocery segment continued to see significant growth, with players like Aldi reporting strong sales figures, putting pressure on smaller competitors to maintain market share and pricing flexibility.

Grocery Outlet's reliance on opportunistic buying, a core strength, also exposes it to significant threats from widespread supply chain disruptions and ongoing inflation. These factors can directly affect the availability of discounted products and increase the cost of acquiring inventory. For instance, while specific data for Grocery Outlet's Q4 2023 inventory costs isn't public, the broader retail sector experienced significant supply chain challenges throughout 2023, with many companies reporting increased freight and logistics expenses.

Persistent inflationary pressures pose a risk to Grocery Outlet's business model by potentially reducing the pool of deeply discounted goods available for opportunistic purchase. Furthermore, rising operational costs, from labor to energy, could squeeze profit margins, even if the company can secure inventory at favorable prices. In 2023, the U.S. Consumer Price Index (CPI) averaged 4.1% year-over-year, indicating a sustained inflationary environment that impacts all retailers, including those focused on value.

A robust economic recovery could diminish the appeal of deep discounts, a core element of Grocery Outlet's strategy. As consumer confidence rises, shoppers might shift their focus towards convenience and brand familiarity, potentially impacting Grocery Outlet's customer base. For instance, if inflation continues to ease and disposable incomes increase, consumers may be less inclined to seek out the extreme value propositions that Grocery Outlet offers.

Challenges with Independent Operator Model and Growth Pace

While Grocery Outlet's independent operator (IO) model fosters local engagement, maintaining strong IO relationships and ensuring consistent operational standards across its diverse store base presents ongoing challenges. The company's expansion strategy, aiming for continued store growth, must carefully balance recruitment pace with operator quality to avoid diluting performance.

Overly aggressive expansion targets could strain resources and compromise the vetting process for new IOs, potentially impacting profitability. For instance, if the company aims to open 50 new stores in 2025 but faces difficulties in sourcing and training qualified operators, this could lead to underperforming locations.

- Maintaining IO Relationships: Ensuring alignment on brand standards and operational execution with a decentralized operator base requires continuous effort and clear communication.

- Operational Consistency: Achieving uniform customer experience and product availability across all independently operated stores is a key challenge.

- Operator Recruitment Pace: Balancing the desire for rapid growth with the need for thorough selection and training of new independent operators is critical for sustained success.

Technological and Operational Execution Risks

Grocery Outlet faces significant threats from its ongoing SAP system transition. Glitches and inefficiencies stemming from this implementation can directly impact operations. For instance, poor data visibility can hinder accurate forecasting and stocking, potentially leading to stockouts or excess inventory, which directly affects sales and profitability.

The slow system speeds and inventory management problems identified during this transition pose a direct operational risk. These issues can slow down crucial processes like receiving, stocking, and checkout, negatively impacting the customer experience and increasing operational costs. In 2023, similar large-scale system implementations in the retail sector have often seen initial dips in productivity and increased error rates, a trend Grocery Outlet must actively mitigate.

These technological and operational execution challenges threaten Grocery Outlet's ability to scale effectively and maintain profitability. Reduced product variety due to inventory issues or financial headwinds from system-related inefficiencies can erode market share. The company's success in navigating these operational hurdles is critical for its future growth trajectory.

Key aspects of these threats include:

- Data visibility issues: Hindering accurate inventory management and sales forecasting.

- System speed and performance: Slowdowns impacting operational efficiency and customer service.

- Inventory management failures: Leading to stockouts, reduced product variety, and lost sales opportunities.

Grocery Outlet faces intense competition from established players like Walmart and rapidly expanding discounters such as Aldi and Lidl, which are aggressively targeting its value-conscious customer base. The ongoing inflationary environment, with U.S. CPI averaging 4.1% year-over-year in 2023, also threatens to reduce the availability of deeply discounted goods and increase operational costs, potentially squeezing profit margins.

The company's reliance on opportunistic buying makes it vulnerable to supply chain disruptions and rising inventory acquisition costs, as seen across the retail sector in 2023. Furthermore, a strong economic recovery could lessen consumer demand for extreme discounts, impacting Grocery Outlet's core appeal.

Challenges in maintaining consistent operational standards and relationships with its independent operators, coupled with the risks associated with rapid expansion, pose significant threats. The ongoing SAP system transition introduces operational risks, including data visibility issues and inventory management failures, which could hinder efficiency and customer experience.

| Threat Category | Specific Threat | Impact on Grocery Outlet | Data Point/Example |

|---|---|---|---|

| Competition | Intensified Discount Sector | Loss of market share, pricing pressure | Aldi's continued strong sales growth in 2024 |

| Economic Factors | Inflation and Supply Chain Issues | Reduced product availability, increased costs | U.S. CPI averaged 4.1% YoY in 2023 |

| Operational Model | Independent Operator Management | Inconsistent standards, expansion strain | Risk of underperforming locations with rapid, unvetted growth |

| Technology Implementation | SAP System Transition | Operational inefficiencies, inventory issues | Potential for stockouts or excess inventory due to data visibility problems |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and accurate assessment of Grocery Outlet's strategic position.