Grocery Outlet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grocery Outlet Bundle

Grocery Outlet navigates a retail landscape shaped by intense buyer power and the constant threat of substitute products, often from larger, more established players. Their unique discount model, however, offers a buffer against intense rivalry and can leverage supplier relationships effectively. Understanding these forces is crucial for anyone looking to grasp Grocery Outlet's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Grocery Outlet’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Grocery Outlet's business thrives on acquiring overstock and closeout items, which inherently weakens supplier bargaining power. Suppliers often view Grocery Outlet as a crucial outlet to offload excess inventory efficiently, rather than facing the costs of storage or disposal. This creates a situation where suppliers are eager to sell to Grocery Outlet, limiting their ability to dictate terms.

Grocery Outlet's unique deep-discount, opportunistic buying model means that while many retailers purchase from suppliers, only a select few can absorb the large, often non-standard batches of products that Grocery Outlet specializes in. This limited pool of similarly positioned buyers can provide Grocery Outlet with a degree of bargaining power, as suppliers looking to move such inventory may find fewer alternative outlets. For instance, in 2024, the grocery sector saw continued inventory management challenges for many CPG brands, making flexible off-price channels like Grocery Outlet increasingly attractive.

Supplier brand reputation can influence bargaining power. If Grocery Outlet wants to stock specific, popular national brands to create excitement for shoppers, those suppliers might hold some leverage. However, Grocery Outlet's business model thrives on value and a dynamic inventory, meaning they aren't heavily reliant on any single brand. This reduces the overall power of any one supplier.

Volume of Purchases

Grocery Outlet's substantial purchasing volume significantly enhances its bargaining power with suppliers. By committing to large quantities of opportunistic inventory, the company becomes a valuable outlet for manufacturers and distributors seeking to offload excess or closeout goods. This ability to absorb significant volumes allows Grocery Outlet to negotiate more favorable pricing, a core element of its discount retail strategy.

For example, in the first quarter of 2024, Grocery Outlet reported net sales of $1.1 billion, indicating a consistent demand for a high volume of products. This scale translates directly into leverage when dealing with suppliers who need to move inventory efficiently.

- High Volume Purchases: Grocery Outlet's business model relies on the acquisition of large quantities of opportunistic inventory.

- Supplier Dependence: Suppliers often view Grocery Outlet as a critical channel for managing overstock and short-dated products.

- Price Negotiation Power: The ability to buy in bulk grants Grocery Outlet considerable leverage to secure deeply discounted pricing from suppliers.

- Strategic Advantage: This volume-driven purchasing power is a key differentiator, enabling the company to offer low prices to its customers.

Supplier Dependency on Liquidation Channel

For certain suppliers, especially food manufacturers dealing with products that have a short shelf life or are seasonal, Grocery Outlet acts as a vital outlet for excess inventory. This capability helps these suppliers avoid substantial financial losses that would otherwise occur from unsold goods.

This reliance on Grocery Outlet to efficiently manage and sell off problematic or surplus inventory significantly diminishes the bargaining power these suppliers hold. They become more amenable to Grocery Outlet's terms because the alternative is a direct financial hit.

- Supplier Reliance: Many food manufacturers depend on discount retailers like Grocery Outlet to liquidate inventory, particularly perishable or seasonal items, thereby minimizing waste and financial losses.

- Reduced Negotiation Leverage: This dependency translates into less bargaining power for suppliers, as they are keen to secure an outlet for goods that might otherwise expire or become unsellable.

- Inventory Management Support: Grocery Outlet's role in managing this excess stock provides a valuable service to suppliers, further strengthening Grocery Outlet's position in negotiations.

Grocery Outlet's bargaining power with suppliers is considerably strong due to its business model of purchasing opportunistic inventory, such as overstock and closeouts. This dynamic limits suppliers' ability to dictate terms, as they often rely on Grocery Outlet to efficiently offload excess goods and avoid disposal costs. In 2024, the grocery industry continued to face inventory challenges, making off-price channels like Grocery Outlet particularly attractive to suppliers needing to move surplus stock.

| Factor | Grocery Outlet's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Opportunistic Buying | Buys large volumes of overstock and closeouts. | Weakens supplier power; suppliers need outlets for excess. |

| High Purchase Volume | Consistent large-scale purchasing. | Strengthens Grocery Outlet's negotiation leverage for better pricing. |

| Supplier Dependence | Suppliers view GO as a key channel for inventory liquidation. | Reduces supplier ability to demand higher prices or stricter terms. |

| Limited Alternative Buyers | Fewer retailers can absorb GO's specific bulk purchases. | Increases GO's relative power with suppliers of such inventory. |

What is included in the product

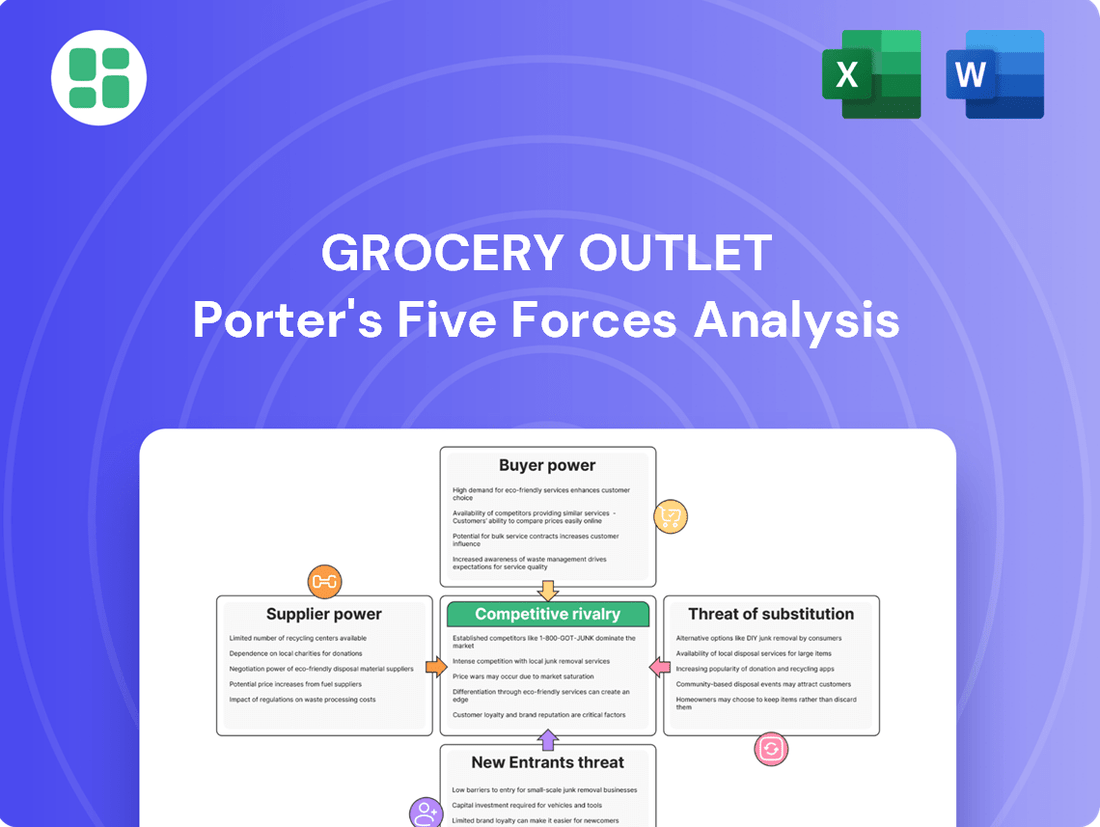

This analysis of Grocery Outlet's competitive landscape examines the intensity of rivalry, the bargaining power of suppliers and buyers, the threat of new entrants, and the impact of substitute products.

Instantly identify and mitigate competitive threats with a comprehensive, easy-to-understand visual of Grocery Outlet's Porter's Five Forces.

Gain actionable insights into supplier power and buyer bargaining by clearly mapping out industry dynamics, enabling more strategic sourcing and pricing.

Customers Bargaining Power

Grocery Outlet's customer base is largely comprised of bargain-minded shoppers, a segment that exhibits significant price sensitivity, particularly in the current economic climate with persistent inflation. These consumers are actively engaged in comparing prices across various grocery stores to secure the best possible deals.

This heightened price sensitivity directly translates into increased bargaining power for customers. If they perceive that Grocery Outlet is not offering competitive value, they can readily switch to alternative retailers that better meet their price expectations.

Grocery Outlet's 'treasure hunt' shopping experience, characterized by its constantly changing inventory and surprising 'WOW!' deals, significantly diminishes the customers' ability to directly compare prices on specific items. This unique model taps into consumers' desire for discovery, often leading to impulse buys and building loyalty around the excitement of finding unexpected bargains.

The availability of substitutes significantly amplifies customer bargaining power for Grocery Outlet. Shoppers can easily pivot to traditional supermarkets, other discount chains like Aldi and Lidl, warehouse clubs, or online grocery platforms if Grocery Outlet's prices or product selection aren't appealing. This wide array of alternatives means customers are not locked into a single provider, giving them leverage to seek better deals elsewhere.

Low Switching Costs

The bargaining power of customers for Grocery Outlet is significantly influenced by low switching costs. It costs very little for a shopper to move from Grocery Outlet to a competitor, mainly just the effort of traveling to a different store or adjusting their shopping habits. This means customers can easily shift their loyalty if they perceive better prices or a more convenient shopping experience elsewhere.

This low friction in switching empowers customers, as they can readily explore alternatives. For instance, if a competitor offers a compelling weekly sale or a more extensive selection, customers can quickly pivot their spending. This dynamic puts pressure on Grocery Outlet to maintain competitive pricing and a satisfactory customer experience to retain its shopper base.

- Low Switching Costs: Customers face minimal financial or practical barriers when changing grocery providers.

- Ease of Comparison: Shoppers can easily compare prices and product offerings between Grocery Outlet and other retailers.

- Customer Retention Challenge: Grocery Outlet must continually offer value to prevent customers from easily moving to competitors.

Information Availability

Customers today have unprecedented access to information, thanks to digital tools and online resources. This means they can easily compare prices and promotions across numerous grocery retailers with just a few clicks. In 2024, the prevalence of price comparison websites and apps significantly amplified this trend, allowing shoppers to pinpoint the most advantageous deals instantly.

This heightened transparency directly translates into increased customer bargaining power. Armed with readily available data on what competitors are offering, consumers are empowered to make more informed purchasing decisions. They can readily identify and exploit discrepancies in pricing, pushing retailers to remain competitive or risk losing business.

- Information Accessibility: Digital platforms provide easy price and promotion comparisons.

- Informed Decisions: Customers can quickly identify the best deals available.

- Enhanced Bargaining Power: Increased transparency empowers consumers to negotiate or seek better value.

- Retailer Pressure: Retailers must remain competitive to retain price-sensitive customers.

Grocery Outlet's customers possess considerable bargaining power due to low switching costs and the ease of price comparison, especially in 2024's inflationary environment. The widespread availability of price comparison tools means shoppers can quickly identify better deals elsewhere, forcing Grocery Outlet to maintain competitive pricing and a compelling value proposition to retain its customer base.

| Factor | Impact on Grocery Outlet | Customer Action |

|---|---|---|

| Low Switching Costs | Customers can easily shift to competitors without significant effort or financial penalty. | Shop at alternative discount grocers or traditional supermarkets if prices are lower. |

| Price Transparency (2024) | Digital tools and apps allow for instant price comparisons across the market. | Leverage information to demand lower prices or seek out the best available deals. |

| Availability of Substitutes | Numerous alternative grocery options exist, from dollar stores to online retailers. | Choose retailers that offer better selection, quality, or perceived value for money. |

Preview the Actual Deliverable

Grocery Outlet Porter's Five Forces Analysis

This preview showcases the complete Grocery Outlet Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your business insights.

Rivalry Among Competitors

The grocery landscape is incredibly fragmented, with a wide variety of store types vying for customer dollars. This includes everything from your typical supermarket and massive hypermarkets to specialized organic stores and the ever-growing online grocery sector. Grocery Outlet isn't just up against other deep discounters; it's also competing for household budgets against these numerous other formats.

The grocery industry, particularly the discount segment, is characterized by fierce price competition. Grocery Outlet's model thrives on offering significant discounts on national brands, a strategy that directly taps into this price sensitivity. However, this intense environment means they are constantly up against rivals like Aldi and Lidl, who also compete aggressively on price, often with their own private label offerings.

Major players like Aldi and Sprouts Farmers Market are aggressively expanding their store footprints, particularly in the value and specialty grocery segments. Aldi, for instance, has been on a significant expansion spree, aiming to open hundreds of new stores across the United States. This growth directly intensifies competition for Grocery Outlet, as these rivals capture market share and customer attention in both new and existing territories.

Unique Business Model as a Differentiator

Grocery Outlet's opportunistic buying strategy sets it apart from traditional supermarkets. This model, where they purchase surplus or close-to-expiration inventory from manufacturers, creates a unique 'treasure hunt' shopping experience for consumers. This differentiation helps them avoid direct competition on consistent product offerings.

While their business model mitigates some direct rivalry, the fundamental competition for consumer spending on groceries is intense. In 2023, Grocery Outlet reported net sales of $4.1 billion, a testament to their ability to capture a share of the grocery market despite the competitive landscape.

- Opportunistic Buying: Secures deals on overstock, close-dated, or discontinued items.

- 'Treasure Hunt' Experience: Offers a constantly changing inventory, encouraging frequent visits.

- Mitigated Direct Competition: Less emphasis on matching every item from traditional grocers.

- Underlying Budget Battle: Still competes directly for the consumer's overall grocery spending.

Impact of Private Label Growth

The competitive rivalry for Grocery Outlet intensifies as both traditional and discount grocers significantly expand their private label product lines. These store-brand offerings directly challenge the national brands that Grocery Outlet typically features at discounted prices. For instance, in 2024, major grocery chains continued to invest heavily in private label development, aiming to capture a larger share of consumer spending by offering value-oriented alternatives.

This trend is further fueled by a growing consumer preference for private labels, largely driven by a persistent search for value, especially in the current economic climate. As consumers increasingly seek affordable options, the proliferation of these private label goods introduces a significant competitive pressure, providing readily available and often lower-priced substitutes for the merchandise Grocery Outlet is known for.

- Private Label Expansion: Major grocery retailers are actively increasing their private label assortments.

- Consumer Value Focus: Shoppers are prioritizing affordability, boosting private label demand.

- Direct Competition: Private labels compete directly with national brands offered by Grocery Outlet.

- Market Share Impact: This trend can erode market share for retailers reliant on national brand discounts.

The grocery market is intensely competitive, with Grocery Outlet facing rivals across various formats, from traditional supermarkets to online grocers. While its opportunistic buying model offers differentiation, the fundamental battle for consumer dollars remains fierce. Major players like Aldi and Sprouts are expanding, intensifying this rivalry.

| Competitor Type | Key Strategy | Impact on Grocery Outlet |

|---|---|---|

| Deep Discounters (e.g., Aldi, Lidl) | Aggressive pricing, private labels | Direct price competition, potential erosion of value proposition |

| Traditional Supermarkets | Broad assortment, loyalty programs, expanding private labels | Competition for overall grocery spend, private labels challenge national brand discounts |

| Specialty/Organic Grocers (e.g., Sprouts) | Niche offerings, quality focus | Competition for specific consumer segments, less direct but still impacts wallet share |

| Online Grocers | Convenience, delivery options | Alternative shopping channel, competes on convenience and sometimes price |

SSubstitutes Threaten

The most direct substitute for Grocery Outlet's deep discount model is the traditional supermarket. These stores offer a wider selection of brands and products, often with more consistent inventory availability and a greater emphasis on shopper convenience and a more pleasant in-store experience. For instance, in 2024, the average American household spent approximately $5,700 annually on groceries, a significant portion of which flowed to conventional supermarkets.

The growing popularity of online grocery delivery services presents a significant threat of substitutes for Grocery Outlet. Consumers increasingly value the convenience of having groceries delivered directly to their homes, a stark contrast to Grocery Outlet's discount, in-store model. This shift is driven by time-saving benefits and the ease of online ordering, directly challenging traditional brick-and-mortar grocery shopping.

The e-commerce grocery market has seen substantial growth. For instance, in 2024, online grocery sales in the U.S. are projected to reach over $200 billion, demonstrating a clear consumer preference for this alternative. This expansion means consumers have readily available substitutes that offer a different value proposition, potentially drawing away customers who might otherwise shop at Grocery Outlet for value.

For consumers seeking a more curated or unique grocery experience, farmers' markets and specialty food stores present a viable alternative. These venues often focus on locally sourced produce or niche gourmet items, appealing to shoppers who prioritize freshness, origin, or specific culinary interests over broad selection and price. In 2024, the demand for local and artisanal food products continued to grow, with the U.S. farmers' market sector seeing steady consumer engagement, indicating a persistent threat to conventional grocers like Grocery Outlet for a segment of the market.

Dollar Stores and Mass Merchandisers

The threat of substitutes from dollar stores and mass merchandisers like Walmart and Target is significant for Grocery Outlet. These retailers are increasingly stocking a wider array of food and grocery items, including discounted staples and their own private label brands, directly competing for the same budget-conscious consumer.

These mass merchandisers and dollar stores present a compelling alternative for consumers prioritizing price and convenience on everyday essentials. For instance, Walmart's grocery sales in 2023 reached approximately $174 billion, showcasing its immense reach and appeal in the food sector.

- Increased Competition: Walmart, Dollar General, and Target are expanding their grocery offerings, directly challenging Grocery Outlet's market share.

- Price Sensitivity: Budget-conscious consumers may opt for these larger retailers due to perceived better value and the ability to consolidate shopping trips.

- Convenience Factor: The one-stop-shop appeal of mass merchandisers makes them an attractive substitute for consumers seeking to purchase groceries alongside other household items.

Home Meal Solutions and Restaurants

The threat of substitutes for Grocery Outlet is significant, extending beyond traditional grocery competitors. Consumers can opt for home meal kit services like HelloFresh or Blue Apron, or simply choose takeout and dining out at restaurants. This presents a direct challenge to grocery sales.

The economic climate plays a crucial role here. As of early 2024, many consumers are more budget-conscious, which can influence their choices between cooking at home and dining out. For instance, while dining out can be perceived as a convenience, the rising costs associated with it might push some consumers back towards grocery shopping for home preparation, especially if they can find value at retailers like Grocery Outlet.

- Home Meal Kits: Services offer pre-portioned ingredients and recipes, directly competing with the need to purchase raw ingredients from a grocery store.

- Takeout and Delivery: The convenience of ready-to-eat meals from local restaurants or delivery platforms bypasses the grocery shopping process entirely.

- Dining Out: Restaurants provide a complete dining experience, from food preparation to service, offering an alternative to home cooking.

- Cost Sensitivity: In 2023, the average cost of a restaurant meal saw an increase, potentially making grocery store purchases for home cooking a more attractive option for cost-conscious consumers.

The threat of substitutes for Grocery Outlet is multifaceted, encompassing traditional supermarkets, online grocery services, farmers' markets, specialty stores, dollar stores, mass merchandisers, and even meal kits and dining out. Each of these substitutes offers a distinct value proposition, from convenience and wider selection to unique product offerings or complete meal solutions.

For instance, while Grocery Outlet thrives on deep discounts, consumers might still gravitate towards conventional supermarkets for brand variety and a more curated shopping experience. In 2024, the average American household's annual grocery spend of approximately $5,700 highlights the significant market share held by these traditional players.

The burgeoning online grocery sector, projected to exceed $200 billion in U.S. sales in 2024, presents a formidable substitute due to its inherent convenience. Similarly, mass merchandisers like Walmart, which reported around $174 billion in grocery sales in 2023, offer a compelling one-stop-shop alternative for budget-conscious shoppers.

| Substitute Category | Key Differentiators | 2023/2024 Relevance |

|---|---|---|

| Traditional Supermarkets | Brand variety, consistent inventory, shopping experience | Annual household spend ~$5,700 (2024) |

| Online Grocery Services | Convenience, home delivery | Projected U.S. sales >$200 billion (2024) |

| Mass Merchandisers (e.g., Walmart) | Price, convenience, one-stop-shop | Walmart grocery sales ~$174 billion (2023) |

| Dollar Stores | Price, accessibility for essentials | Increasing grocery offerings |

| Farmers' Markets/Specialty Stores | Local sourcing, unique products, freshness | Steady consumer engagement |

| Meal Kits/Dining Out | Convenience, complete meal solutions | Rising restaurant costs may shift preference |

Entrants Threaten

The grocery retail sector demands a significant capital outlay, forming a formidable barrier for potential new entrants. Establishing a new chain, especially one with physical stores, necessitates substantial investment in real estate acquisition or leasing, store construction and outfitting, initial inventory stocking, and the development of a robust distribution network. For instance, the average cost to build out a new supermarket can range from $2 million to $10 million or more, depending on size and location, making it a daunting prospect for new players.

The threat of new entrants is significantly lowered by the intricate supply chain required for Grocery Outlet's opportunistic buying strategy. Replicating this model necessitates building a sophisticated and agile network capable of sourcing, negotiating, and distributing a constantly shifting inventory. This complexity, coupled with the need to establish deep supplier relationships, presents a substantial barrier to entry for potential competitors.

Grocery Outlet benefits from deeply entrenched relationships with national brand suppliers, built over years of sourcing overstock and closeout inventory. These long-standing partnerships are critical for securing the unique, deeply discounted merchandise that defines Grocery Outlet's value proposition.

Newcomers face a significant hurdle in replicating this supplier network. Establishing trust and securing consistent access to distressed goods at the necessary price points would be a formidable challenge, requiring substantial time and effort to cultivate comparable supplier goodwill and agreements.

Brand Recognition and Customer Loyalty

Grocery Outlet has built a strong brand around its 'extreme value' and unique 'treasure hunt' shopping experience, which cultivates significant customer loyalty. This established brand recognition acts as a substantial barrier for new competitors. For instance, in 2024, Grocery Outlet continued to emphasize its value proposition, which resonates with a broad consumer base seeking savings.

New entrants would face the daunting task of matching Grocery Outlet's brand equity, requiring considerable investment in marketing and a sustained effort to build a comparable level of customer trust and repeat business. This brand loyalty means that even with competitive pricing, a new player would struggle to draw customers away from a familiar and trusted source of value.

- Brand Identity: Grocery Outlet's 'extreme value' and 'treasure hunt' model fosters deep customer loyalty.

- Marketing Investment: New entrants need substantial capital for marketing to build comparable brand awareness.

- Customer Acquisition: Attracting and retaining customers requires time and consistent delivery of value.

- Competitive Advantage: Existing brand loyalty presents a significant hurdle for potential new grocery retailers.

Regulatory Hurdles and Local Permits

The grocery sector faces significant regulatory scrutiny. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce stringent standards for food safety and labeling, requiring new entrants to invest heavily in compliance measures.

Securing the necessary local permits for new store openings is another substantial barrier. This process can be time-consuming and costly, often involving multiple local and state agencies. For example, obtaining a business license and zoning approval in a major metropolitan area could take several months and incur thousands of dollars in fees, deterring smaller or less capitalized competitors.

- Health and Safety Regulations: Compliance with FDA and USDA guidelines is mandatory, impacting product sourcing, storage, and handling.

- Permitting Processes: Local zoning laws, building permits, and health department approvals can significantly delay store openings.

- Licensing Requirements: Obtaining a liquor license or specific permits for selling certain products adds another layer of complexity and cost.

The threat of new entrants in the grocery retail sector, particularly for a value-focused model like Grocery Outlet, is moderately low. Significant capital investment is required for store build-outs, inventory, and distribution networks, with average supermarket construction costs ranging from $2 million to $10 million. Grocery Outlet's unique sourcing model, relying on opportunistic buying and deep supplier relationships, creates a complex supply chain barrier that is difficult for newcomers to replicate. Established brand loyalty, cultivated through a consistent 'extreme value' proposition, further deters new players. For instance, in 2024, the emphasis on value continued to resonate strongly with consumers, solidifying existing brand advantages.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for store construction, inventory, and distribution. | Significant hurdle for less capitalized entrants. |

| Supply Chain Complexity | Replicating opportunistic sourcing and supplier relationships is challenging. | Deters entrants without established networks. |

| Brand Loyalty | 'Extreme value' and 'treasure hunt' experience fosters strong customer preference. | Makes customer acquisition difficult for new brands. |

| Regulatory Compliance | Adherence to food safety and labeling standards (e.g., FDA in 2024) requires investment. | Adds to the cost and time for market entry. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grocery Outlet leverages data from company investor relations pages, competitor press releases, and industry-specific market share reports to capture the competitive landscape.