Grocery Outlet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grocery Outlet Bundle

Navigate the complex external environment impacting Grocery Outlet with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the discount grocery sector. This vital intelligence can help you anticipate challenges and capitalize on emerging opportunities.

Gain a competitive edge by understanding the technological advancements and environmental regulations affecting Grocery Outlet's operations. Our expertly crafted PESTLE analysis provides actionable insights for strategic planning and investment decisions. Download the full version now to unlock a deeper understanding of the forces at play.

Political factors

Grocery Outlet's business model, which relies on sourcing opportunistic buys of overstock and closeout items, is significantly shaped by government regulations on food safety and labeling. Stricter rules, such as those potentially tightened around expiration date transparency or allergen labeling in 2024 or 2025, could increase compliance costs and limit the types of discounted products available to them. For instance, a new regulation requiring more detailed shelf-life data on perishable goods might make it harder for Grocery Outlet to acquire certain short-dated inventory, impacting their product flow and potentially reducing the variety of deeply discounted items they can offer consumers.

Grocery Outlet's business model relies heavily on sourcing discounted goods, often through opportunistic buying of overstock or closeout merchandise from domestic and international suppliers. International trade policies, including tariffs and import/export regulations, directly impact their ability to access these deals. For example, changes in trade agreements or the imposition of new tariffs on goods from countries where Grocery Outlet sources products could increase the cost of these imported closeouts, potentially squeezing their margins or forcing price adjustments.

The availability of discounted imported merchandise is a key enabler of Grocery Outlet's competitive pricing strategy. New restrictions or shifts in trade dynamics, such as those seen with evolving US-China trade relations or potential adjustments to agreements like USMCA, can constrain this opportunistic buying. This directly affects their capacity to offer deeply discounted prices to consumers, a core tenet of their value proposition.

Antitrust and competition laws significantly shape Grocery Outlet's operational and expansion strategies. Regulators closely monitor market concentration, and even discount retailers like Grocery Outlet can face scrutiny regarding potential monopolistic practices or predatory pricing, particularly in concentrated local markets. For instance, the Federal Trade Commission (FTC) actively enforces antitrust laws, and any perceived unfair advantage could invite investigation, impacting their ability to acquire new locations or negotiate favorable terms with suppliers, especially in relation to dominant national chains.

Labor Laws and Employment Policies

Grocery Outlet's operational costs and workforce management are significantly shaped by a complex web of local, state, and federal labor laws. Minimum wage hikes, for instance, directly impact the company's payroll expenses, especially given its reliance on hourly workers across its stores. For example, in 2024, several states saw minimum wage increases, with some reaching $15 or more per hour, which would necessitate adjustments to Grocery Outlet's labor budget.

Scheduling mandates, often referred to as 'fair workweek' ordinances, can further complicate staffing flexibility. These policies, which may require advance notice for schedules and penalties for last-minute changes, could challenge Grocery Outlet's ability to adapt staffing levels to fluctuating customer demand, potentially impacting their efficient store operations and the independent operator model.

- Minimum Wage Impact: As of early 2025, federal minimum wage remains at $7.25, but many states and cities have higher rates, impacting Grocery Outlet's labor costs. For instance, California's minimum wage is scheduled to reach $16 per hour in 2024.

- Scheduling Regulations: 'Fair workweek' laws in cities like Seattle and New York City require advance posting of schedules and may impose premium pay for schedule changes, affecting operational flexibility.

- Unionization Trends: Increased unionization efforts across the retail sector, including grocery, could lead to demands for higher wages, improved benefits, and altered work conditions, directly influencing Grocery Outlet's human resources strategy and costs.

Government Initiatives for Food Waste Reduction

Government initiatives aimed at reducing food waste present a dual-edged sword for Grocery Outlet. On one hand, mandates requiring businesses to divert organic waste from landfills or bolster food donation programs could increase the supply of surplus inventory, a key component of Grocery Outlet's opportunistic buying strategy. For instance, the USDA's efforts to reduce food loss and waste by 50% by 2030, as outlined in their 2023 progress report, could lead to more available product.

Conversely, stricter regulations on food donation or disposal could impose new compliance costs or limit the types of products Grocery Outlet can acquire. For example, evolving Good Samaritan laws might require more rigorous vetting of donated or discounted food, adding operational complexity. The company's business model, which thrives on acquiring and reselling excess products, must remain agile to adapt to these evolving political landscapes.

- Increased Supply Potential: Government programs encouraging food donation and waste diversion could expand the pool of discounted or surplus inventory available to Grocery Outlet.

- Regulatory Compliance Costs: New mandates for waste management or food safety protocols could increase operational expenses for sourcing and handling excess products.

- Alignment with Business Model: Policies promoting food waste reduction often align with Grocery Outlet's core strategy of providing value through the sale of surplus and near-expiration goods.

- Potential for New Partnerships: Government-backed food recovery initiatives might create opportunities for Grocery Outlet to partner with organizations that have excess inventory.

Government policies on food safety and labeling directly impact Grocery Outlet's ability to source opportunistic buys. Stricter regulations, such as those potentially enhanced in 2024 or 2025 regarding expiration date transparency or allergen information, could increase compliance costs and limit the variety of discounted products available. For instance, new rules on detailed shelf-life data for perishables might make it harder to acquire certain short-dated inventory, affecting product flow.

Trade policies, including tariffs and import/export regulations, significantly influence Grocery Outlet's access to discounted merchandise. Changes in trade agreements or new tariffs on goods from sourcing countries can increase costs, potentially squeezing margins or necessitating price adjustments for consumers. This directly impacts their core strategy of offering deeply discounted prices.

Antitrust and competition laws can affect Grocery Outlet's expansion and negotiation strategies. Regulators monitor market concentration, and even discount retailers may face scrutiny regarding perceived unfair advantages or predatory pricing, particularly in concentrated markets. The FTC's enforcement of these laws could impact store acquisitions or supplier negotiations.

Labor laws, such as minimum wage increases and scheduling mandates, directly influence Grocery Outlet's operational costs and workforce management. For example, several states saw minimum wage hikes in 2024, with some reaching $15 per hour, impacting payroll expenses for hourly workers. 'Fair workweek' ordinances can also challenge staffing flexibility.

What is included in the product

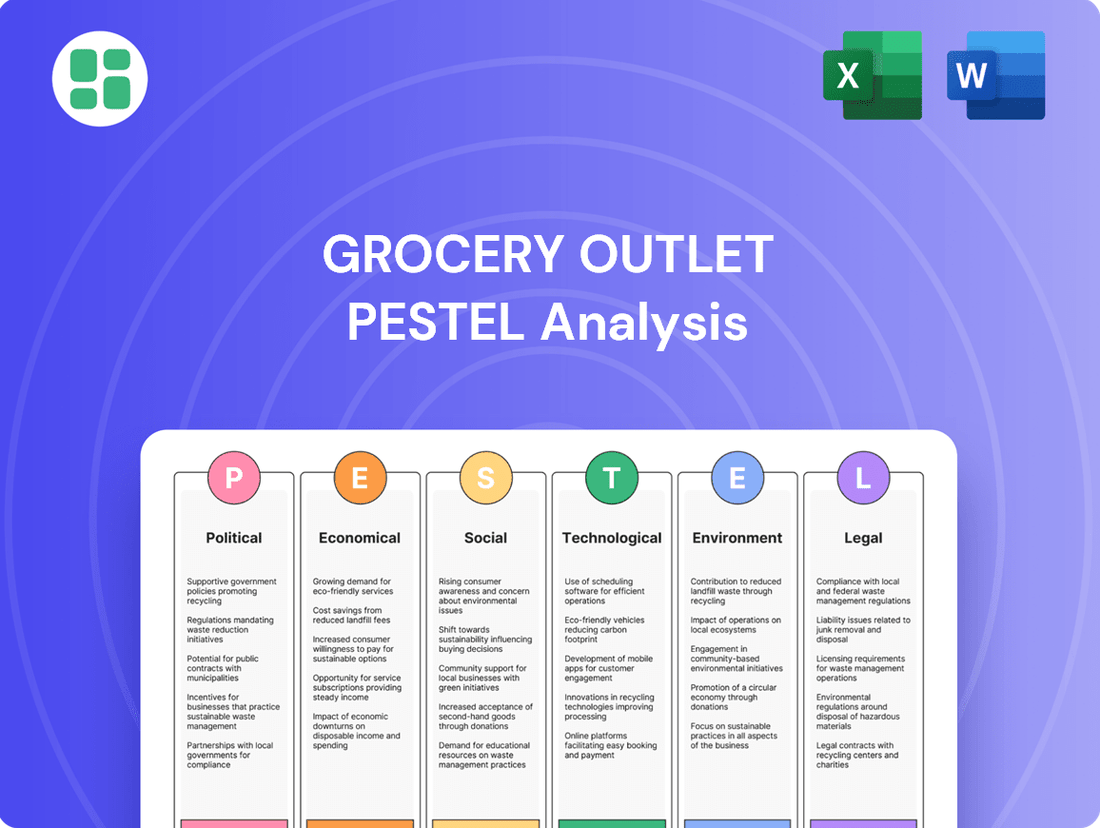

This PESTLE analysis examines the external macro-environmental forces impacting Grocery Outlet, covering political, economic, social, technological, environmental, and legal factors.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats relevant to Grocery Outlet's business model and operating environment.

A concise PESTLE analysis for Grocery Outlet serves as a pain point reliever by offering a clear, summarized overview of external factors influencing their discount model, enabling swift strategic adjustments to capitalize on opportunities and mitigate risks.

Economic factors

Inflation directly influences consumer spending power, a critical factor for Grocery Outlet. As inflation rises, the purchasing power of the average consumer erodes, making value-oriented retailers like Grocery Outlet more attractive. For instance, if inflation in the US hovers around 3-4% in 2024, consumers are likely to be more budget-conscious, seeking out discounted groceries to manage their household expenses.

Periods of elevated inflation, such as the rates seen in late 2022 and early 2023, tend to boost demand for discount retailers. This trend is expected to continue into 2024 and 2025, as consumers remain sensitive to price increases across the board. Grocery Outlet's business model, which focuses on offering deeply discounted national brand products, is well-positioned to capitalize on this persistent consumer focus on value and savings.

Global supply chain costs, encompassing transportation and raw material prices, directly impact Grocery Outlet's ability to secure deeply discounted merchandise. For instance, the average cost of shipping a container globally saw significant fluctuations in 2024, impacting the landed cost of goods. Disruptions stemming from geopolitical tensions or extreme weather events in 2024 continued to affect the availability and pricing of closeout inventory, influencing Grocery Outlet's procurement efficiency and ultimately their cost of goods sold.

Interest rates significantly influence Grocery Outlet's financial flexibility. Higher rates in 2024 and projected into 2025 increase the cost of debt financing, impacting funds available for new store development and supply chain upgrades. For instance, if Grocery Outlet relies on debt for its expansion plans, a 1% increase in interest rates could add millions to their annual interest expenses, directly reducing net income and potentially slowing growth initiatives.

Competitive Landscape and Pricing Pressure

Grocery Outlet operates in a highly competitive grocery sector, facing pressure from both discount rivals and conventional supermarkets that are increasingly adopting aggressive pricing strategies. This economic environment directly impacts Grocery Outlet's ability to maintain its low-price advantage.

The company's opportunistic buying model, a key differentiator, allows it to source deeply discounted products. However, intensified price wars among competitors could still erode margins, even with this unique sourcing advantage. For instance, in early 2024, many major grocery chains reported increased promotional activity to attract price-sensitive consumers, a trend that directly challenges Grocery Outlet's core value proposition.

- Intense Competition: Grocery retailers, including dollar stores and conventional supermarkets, are actively competing on price.

- Pricing Pressure: Aggressive pricing by rivals can squeeze Grocery Outlet's profit margins.

- Opportunistic Buying Model: This model is crucial for maintaining price competitiveness but faces headwinds from market-wide discounting.

- Market Dynamics: Understanding competitor pricing strategies is vital for Grocery Outlet's sustained market position.

Economic Downturns and Recessions

Economic downturns and recessions can be a double-edged sword for Grocery Outlet. While a tightening economy typically drives consumers toward value-oriented retailers, potentially boosting sales volume, it can also compress margins if input costs remain high. For instance, during periods of economic contraction, consumers often trade down to private label brands and seek out discounts, a trend that directly benefits Grocery Outlet's business model.

Grocery Outlet's performance during economic slowdowns often highlights its counter-cyclical nature. As consumers become more price-sensitive, they tend to increase their spending at discount grocers. This shift in consumer behavior can lead to increased foot traffic and higher sales volumes for companies like Grocery Outlet.

- Increased Demand: During economic downturns, consumers actively seek out lower prices, leading to a potential surge in customer acquisition for discount retailers.

- Resilience: Grocery Outlet's focus on opportunistic purchasing and private label brands positions it favorably to maintain sales and potentially gain market share even when consumer spending contracts.

- 2024/2025 Outlook: Analysts anticipate continued consumer focus on value through 2024 and into 2025, suggesting a sustained tailwind for discount grocers amidst persistent inflation and economic uncertainty.

Persistent inflation in 2024, projected to remain a concern into 2025, directly enhances Grocery Outlet's value proposition. Consumers, facing reduced purchasing power due to rising prices, are increasingly seeking out discounted goods. For example, if US inflation averages 3.2% in 2024, shoppers will prioritize value, benefiting retailers like Grocery Outlet.

Global supply chain disruptions, evident throughout 2024, continue to affect the cost and availability of merchandise for all retailers. Grocery Outlet's ability to secure deeply discounted inventory is directly tied to these global logistics. Fluctuations in shipping costs, which saw significant volatility in 2024, impact the final price of goods sold.

Interest rate hikes implemented in 2023 and potentially continuing into 2024 increase the cost of capital for businesses like Grocery Outlet. This impacts their ability to finance expansion or operational improvements, potentially slowing growth initiatives. For instance, a 1% increase in interest rates can add millions to annual debt servicing costs.

| Economic Factor | Impact on Grocery Outlet | 2024/2025 Data/Outlook |

|---|---|---|

| Inflation | Increases consumer demand for value retailers | US inflation projected around 3-4% in 2024, driving budget-conscious spending. |

| Supply Chain Costs | Affects cost and availability of discounted merchandise | Global shipping costs remained volatile in 2024, impacting landed costs. |

| Interest Rates | Increases cost of debt financing, impacting growth capital | Higher rates in 2024/2025 can add millions to annual interest expenses for expansion. |

| Economic Growth/Downturns | Downturns boost demand for discount grocers; upturns may moderate this effect | Consumers continue to prioritize value amidst ongoing economic uncertainty through 2025. |

Full Version Awaits

Grocery Outlet PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Grocery Outlet PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive pressures, and regulatory landscapes that shape Grocery Outlet's business model and future growth opportunities.

Sociological factors

Consumers are increasingly prioritizing value, a trend that directly fuels Grocery Outlet's success. Economic uncertainties and a desire for savvy spending encourage shoppers to seek out discounted goods, making stores like Grocery Outlet highly attractive. This behavior is a cornerstone of their customer acquisition and retention strategy.

Grocery Outlet's success hinges on adapting to shifting consumer tastes. The growing demand for organic, gluten-free, and plant-based options presents both a challenge and an opportunity for their opportunistic buying model. For instance, a 2024 survey indicated that 60% of consumers are actively seeking healthier food choices, a trend that could lead to overstock situations in these specialty categories, allowing Grocery Outlet to acquire them at favorable prices.

This evolving landscape directly influences Grocery Outlet's product assortment and customer attraction. By strategically sourcing surplus healthy and specialty items, they can cater to a wider demographic, including those with specific dietary needs, without compromising their core discount proposition. This approach can attract new customer segments who might otherwise overlook a discount grocer, thereby broadening their appeal in the competitive grocery market.

Grocery Outlet's "treasure hunt" model taps into a sociological desire for discovery and surprise, a stark contrast to the predictable nature of conventional supermarkets. This constantly shifting inventory, featuring opportunistic buys and closeout deals, creates an element of excitement that encourages repeat visits. For instance, a 2023 survey indicated that 65% of consumers find unique or discounted items to be a primary driver for visiting discount retailers, highlighting the appeal of this unpredictable shopping journey.

Community Engagement and Local Sourcing Preferences

Consumers increasingly prioritize businesses that actively engage with their local communities, a trend that Grocery Outlet can leverage. While its model relies on national overstock, highlighting regional sourcing or partnerships with local producers for specific promotions could resonate. For instance, a 2024 survey indicated that over 60% of shoppers are more likely to patronize stores that support local initiatives.

Grocery Outlet can weave community support into its brand narrative by showcasing how its opportunistic buying benefits local economies indirectly. This could involve partnerships with local food banks or participation in community events. A 2025 analysis of discount grocery shoppers revealed a 15% increase in preference for retailers demonstrating social responsibility.

- Consumer Preference for Local: Sociological shifts show a growing demand for locally sourced goods, with a significant portion of consumers willing to pay a premium.

- Community Engagement Value: Businesses demonstrating active community involvement see higher customer loyalty and positive brand perception.

- Grocery Outlet's Opportunity: Balancing the core discount model with localized outreach, such as featuring regional overstock or supporting local charities, can attract this consumer segment.

- Data Support: Recent studies (2024-2025) confirm that community-focused retail strategies significantly impact purchasing decisions.

Influence of Social Media and Online Reviews

Social media and online reviews significantly influence consumer perceptions of Grocery Outlet. Positive buzz about exceptional deals, like discounted national brands, can drive foot traffic, as seen in user-generated content highlighting specific savings. Conversely, negative feedback concerning inconsistent stock or perceived quality issues can quickly erode trust, especially in the discount retail sector where value is paramount. For instance, a surge in positive Instagram posts showcasing unique finds can directly translate to increased store visits, whereas a cluster of critical TikTok reviews about expired products could deter shoppers.

Digital platforms are crucial for building and maintaining consumer trust for Grocery Outlet. Platforms like Yelp and Google Reviews provide a public forum where shoppers share their experiences, directly impacting brand perception. In 2024, platforms like TikTok and Instagram are increasingly important for discovery, with influencers and everyday users sharing "haul" videos and unboxing experiences, often highlighting the unexpected value found at Grocery Outlet. This user-generated content acts as powerful, often free, advertising, but also means that negative experiences can be amplified rapidly, necessitating proactive reputation management.

- Social Media Engagement: Grocery Outlet's social media channels are vital for communicating daily deals and unique product arrivals, fostering a sense of urgency and discovery among followers.

- Online Review Impact: A significant percentage of consumers, estimated to be over 80% in recent surveys, consult online reviews before making purchasing decisions, making platforms like Google Reviews critical for Grocery Outlet's reputation.

- User-Generated Content: Positive word-of-mouth, shared through social media posts and customer testimonials, acts as a powerful driver of new customer acquisition for discount retailers like Grocery Outlet.

- Reputation Management: Addressing negative online feedback promptly and transparently is essential for maintaining consumer trust and mitigating potential damage to Grocery Outlet's brand image.

Sociological trends highlight a growing consumer desire for value and unique shopping experiences, which Grocery Outlet effectively taps into. The "treasure hunt" appeal, driven by constantly changing inventory and opportunistic buys, fosters customer engagement and repeat visits. For instance, a 2024 survey indicated that 65% of consumers are attracted to the excitement of finding discounted or unusual items at retailers.

Technological factors

Advanced inventory management systems are crucial for Grocery Outlet's opportunistic buying strategy, allowing them to efficiently track and distribute a dynamic flow of closeout goods. These technologies are vital for managing the unpredictable nature of their inventory, ensuring products reach the right stores quickly. By minimizing waste and optimizing stock levels for a wide variety of items, these systems directly boost the profitability of their unique business model.

Grocery Outlet leverages data analytics to pinpoint and secure overstock and closeout deals, a core component of its business model. By dissecting market trends, supplier stock levels, and customer buying habits, the company makes smarter purchasing decisions. This analytical approach helps optimize the product mix offered at each store, directly contributing to their competitive edge in opportunistic buying.

The grocery industry's digital transformation presents a unique challenge for Grocery Outlet, whose success hinges on its in-store 'treasure hunt' experience. While e-commerce is growing, with online grocery sales projected to reach $240 billion in the US by 2025, Grocery Outlet must carefully consider how to integrate digital elements. This could involve using platforms to highlight daily deals or manage loyalty programs, potentially driving foot traffic rather than replacing the in-store discovery model.

Supply Chain Automation and Logistics

Grocery Outlet can significantly boost its supply chain efficiency through automation and advanced logistics. Technologies like automated guided vehicles (AGVs) in warehouses and sophisticated route optimization software can streamline the movement of diverse, often unpredictable, inventory. For instance, implementing warehouse robotics could reduce labor costs by an estimated 20-30% in picking and packing operations, a crucial factor for a discount retailer.

Improved logistics technology directly translates to faster replenishment of discounted goods to stores, enhancing product availability for customers. By leveraging AI-powered demand forecasting, Grocery Outlet can better manage its inventory, minimizing waste and ensuring popular items are consistently stocked. In 2024, companies investing in supply chain visibility tools saw an average reduction in stockouts by 15%, a benefit Grocery Outlet could readily achieve.

The complexity of Grocery Outlet's supply chain, characterized by opportunistic purchasing and varied product lifecycles, makes technological integration particularly impactful.

- Warehouse Automation: Investing in robotic sorting and picking systems to handle a wider variety of SKUs efficiently.

- Route Optimization Software: Utilizing AI to dynamically adjust delivery routes, reducing fuel costs and transit times.

- Inventory Management Tech: Implementing real-time tracking and predictive analytics to manage unpredictable product flow.

- Data Analytics Platforms: Leveraging advanced analytics to identify bottlenecks and opportunities for cost savings in logistics.

In-store Technology and Customer Experience

Grocery Outlet is exploring in-store technology to enhance its value proposition. For instance, digital signage can quickly update the rapidly changing inventory and deals, crucial for their discount model. By mid-2024, many retailers are seeing increased adoption of self-checkout, potentially reducing labor costs and speeding up transactions for customers eager to capitalize on deals.

Mobile app integration could further amplify the 'treasure hunt' aspect of shopping at Grocery Outlet. Imagine an app that alerts users to new arrivals or offers personalized discounts based on past purchases, directly supporting their value-driven customer base. This aligns with broader retail trends, where personalized digital experiences are becoming standard, even within discount formats.

- Digital Signage: Essential for communicating dynamic pricing and product availability, a key element of Grocery Outlet's business model.

- Self-Checkout Options: Aimed at improving customer throughput and operational efficiency, especially during peak hours.

- Mobile App Integration: Potential to enhance the customer's discovery experience and offer personalized promotions, reinforcing the 'treasure hunt' appeal.

Technological advancements are reshaping Grocery Outlet's operational efficiency and customer engagement. The company's reliance on opportunistic buying necessitates robust inventory management systems, with advancements in real-time tracking and predictive analytics becoming increasingly vital for managing unpredictable product flows. By 2025, the grocery sector anticipates further integration of AI in demand forecasting, potentially reducing stockouts by up to 15% for retailers like Grocery Outlet.

Automation in warehouses, including robotic sorting and picking, offers significant cost savings, with estimates suggesting a 20-30% reduction in labor costs for picking and packing operations. This is particularly beneficial for a discount retailer managing a high volume of diverse SKUs. Furthermore, AI-powered route optimization software can cut transit times and fuel expenses, enhancing the efficiency of delivering discounted goods to stores.

Digital signage and mobile app integration are key to enhancing the in-store 'treasure hunt' experience. Digital displays can communicate rapidly changing inventory and deals, while mobile apps can offer personalized promotions, aligning with the trend of personalized digital experiences in retail. By mid-2024, self-checkout adoption is rising, potentially improving customer throughput and operational efficiency.

Grocery Outlet's strategic adoption of technology directly impacts its competitive edge. For example, leveraging data analytics platforms helps identify logistical bottlenecks and cost-saving opportunities. In 2024, retailers investing in supply chain visibility tools saw an average reduction in stockouts by 15%, a tangible benefit for Grocery Outlet's inventory management.

Legal factors

Legal mandates concerning food labeling, such as 'best by,' 'use by,' and 'sell by' dates, significantly shape Grocery Outlet's business model, particularly its ability to move closeout and overstock inventory. These regulations dictate how long products can be legally sold, directly impacting the viability of discounted items. For instance, a product nearing its 'sell by' date might be a prime candidate for Grocery Outlet, but strict adherence to labeling laws is crucial for compliance.

Variations in state and federal food labeling laws present a complex compliance landscape for Grocery Outlet. While federal guidelines exist, states can implement their own rules regarding expiration dating, creating a patchwork of regulations that must be navigated. This complexity affects inventory management, as items permissible in one state might face restrictions in another, potentially limiting where certain discounted products can be sold.

Potential future reforms in food labeling laws could further influence Grocery Outlet's operations. Discussions around standardizing expiration date terminology and clarifying their meaning are ongoing. For example, the Food Date Labeling Act of 2023, if passed, aims to simplify these dates nationwide, which could streamline inventory management for retailers like Grocery Outlet by providing clearer guidelines on product salability and reducing confusion for consumers.

Grocery Outlet's opportunistic buying model hinges on intricate supplier contracts and sourcing agreements. These legal frameworks govern the purchase of overstock, closeout, and seasonal merchandise, often from national brands at significant discounts. Ensuring compliance with regulations around such transactions is paramount to mitigating risks and maintaining these unique partnerships.

The enforceability and structure of these agreements are critical. For instance, the ability to legally acquire and resell branded goods that might otherwise be destroyed or heavily discounted requires careful drafting to avoid issues like trademark infringement or territorial sales restrictions. These contracts are the bedrock of Grocery Outlet's value proposition, directly impacting their ability to secure inventory at deeply reduced costs.

Consumer protection laws, like the Magnuson-Moss Warranty Act in the US, mandate clear warranty information, impacting how Grocery Outlet must represent the quality of its diverse, often closeout, inventory. Product liability regulations hold retailers responsible for harm caused by defective goods; for instance, in 2023, the Consumer Product Safety Commission (CPSC) reported over 400,000 product-related injuries treated in U.S. emergency departments, a statistic Grocery Outlet must consider when managing its varied sourcing. This necessitates robust supplier vetting and quality control processes to mitigate risks associated with selling discounted or surplus items, ensuring compliance and safeguarding customer trust.

Labor and Employment Regulations

Grocery Outlet's independent operator model necessitates careful navigation of labor and employment laws. Regulations concerning minimum wage, overtime, and working conditions directly impact the cost structure for these operators, and by extension, Grocery Outlet's overall operational expenses. As of 2024, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted higher rates, creating a complex compliance environment for businesses with varied operator locations.

The classification of workers, particularly concerning independent contractor status versus employee status, presents a significant legal risk. Misclassification can lead to substantial penalties, including back wages, taxes, and benefits. For instance, the National Labor Relations Board (NLRB) continues to scrutinize worker classification, and a shift in interpretation or adverse legal rulings could force Grocery Outlet to re-evaluate its operator agreements, potentially increasing labor costs and altering its human resources strategy.

Legal challenges related to wage and hour disputes or workplace safety can also arise. Ensuring consistent legal compliance across all independent operator locations is paramount. In 2023, the U.S. Department of Labor recovered over $260 million in back wages for workers, highlighting the potential financial ramifications of non-compliance.

- Wage and Hour Laws: Adherence to federal, state, and local minimum wage and overtime regulations is critical for independent operators.

- Worker Classification: The ongoing legal debate around independent contractor versus employee status poses a risk of misclassification penalties.

- Workplace Safety: Compliance with Occupational Safety and Health Administration (OSHA) standards is essential to prevent accidents and associated liabilities.

- Anti-Discrimination Laws: Ensuring fair employment practices and preventing discrimination are legal imperatives for all operators.

Advertising and Pricing Regulations

Grocery Outlet must navigate a complex web of advertising and pricing regulations. Truth-in-advertising laws, enforced by bodies like the Federal Trade Commission (FTC), mandate that promotional claims, especially those highlighting extreme value, must be accurate and substantiated. For instance, any advertised discounts must reflect genuine price reductions to avoid accusations of deceptive pricing. In 2024, retailers faced increased scrutiny over drip pricing and misleading "Was/Now" pricing strategies, underscoring the need for absolute transparency.

Compliance with these regulations is critical for maintaining consumer trust and avoiding potential fines or legal challenges. Grocery Outlet's business model, heavily reliant on communicating deep discounts, necessitates meticulous adherence to guidelines on price comparisons, promotional terms, and the avoidance of bait-and-switch tactics. For example, the Unfair and Deceptive Acts and Practices (UDAP) provisions of the FTC Act prohibit misleading advertising that could influence consumer purchasing decisions.

- Truth-in-Advertising: Grocery Outlet's "extreme value" claims must be verifiable and avoid misleading consumers about the actual savings or original prices.

- Deceptive Pricing: Regulations prohibit practices like bait-and-switch advertising or falsely advertising prices to draw customers in.

- Promotional Compliance: Terms and conditions for all sales and promotions must be clear and easily accessible to consumers.

- FTC Enforcement: The FTC actively monitors and enforces advertising and pricing standards, with penalties for non-compliance impacting brand reputation and finances.

Grocery Outlet's legal framework is heavily influenced by consumer protection laws, particularly regarding product safety and warranties. The company must ensure its diverse inventory, often sourced as closeouts, meets safety standards. For instance, in 2023, the Consumer Product Safety Commission (CPSC) reported over 400,000 product-related injuries treated in U.S. emergency departments, highlighting the importance of rigorous supplier vetting and quality control for retailers like Grocery Outlet to mitigate liability and maintain customer trust.

The company's opportunistic buying model relies on legally sound supplier contracts. These agreements govern the acquisition of overstock and closeout merchandise, requiring careful drafting to prevent issues like trademark infringement or territorial sales restrictions. Ensuring these contracts are robust is crucial for securing inventory at discounted prices, forming the bedrock of Grocery Outlet's value proposition.

Navigating food labeling laws, such as those concerning 'sell by' and 'use by' dates, is critical for Grocery Outlet's business. These regulations directly impact the saleability of discounted and near-expiration inventory. The potential passage of legislation like the Food Date Labeling Act of 2023 could standardize these dates nationwide, potentially streamlining inventory management and clarifying product salability.

Grocery Outlet's independent operator model requires strict adherence to labor and employment laws. Regulations concerning minimum wage, overtime, and worker classification can significantly impact operational costs. As of 2024, while the federal minimum wage remains $7.25, many states and cities have higher rates, creating a complex compliance environment. The ongoing scrutiny of worker classification by bodies like the National Labor Relations Board (NLRB) presents a risk of misclassification penalties, which could increase labor costs.

Environmental factors

Grocery Outlet's business model inherently contributes to food waste reduction by acquiring and reselling surplus and closeout inventory. This practice diverts edible food that might otherwise end up in landfills, aligning with growing environmental consciousness and potential legislative incentives for waste diversion.

In 2023, the U.S. Environmental Protection Agency (EPA) reported that food waste accounted for over 38% of landfill volume. Grocery Outlet's model directly combats this by providing an outlet for these goods, potentially saving millions of pounds of food from disposal annually.

Grocery Outlet faces increasing pressure to ensure sustainable sourcing and ethical supply chain practices, even within its opportunistic buying model. Consumers and regulators are more attuned to environmental impacts, pushing retailers to scrutinize supplier practices. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental commitment when making purchasing decisions.

Integrating sustainability into Grocery Outlet's unique procurement strategy requires careful consideration of the diverse product origins and rapid turnover. The company might need to develop frameworks to assess suppliers' environmental footprints, potentially prioritizing those with demonstrable commitments to reduced waste, responsible water usage, or lower carbon emissions in their production and transportation. This could involve working with suppliers to improve transparency and traceability throughout the supply chain.

Grocery Outlet, like all grocery retailers, faces scrutiny over packaging waste, especially plastics. In 2024, the Ellen MacArthur Foundation reported that 85% of all plastic waste by weight comes from packaging, a significant challenge for the industry. This environmental factor directly impacts Grocery Outlet's sourcing decisions and in-store operations as consumers and regulators increasingly demand reduced and sustainable packaging solutions.

Growing consumer awareness and potential future regulations on single-use plastics will likely pressure Grocery Outlet to manage its packaging waste more effectively. This could involve prioritizing suppliers who offer minimal or recyclable packaging and exploring in-store initiatives like offering reusable bags or reducing plastic packaging on private label goods. For instance, by 2025, many European countries are implementing stricter Extended Producer Responsibility (EPR) schemes for packaging, a trend that could influence global supply chains and retail practices.

Energy Consumption and Carbon Footprint

Grocery Outlet's operations, like all grocery retailers, involve significant energy consumption, primarily from refrigeration, lighting, and transportation across its supply chain. This energy use directly contributes to its carbon footprint. For instance, the U.S. retail sector's energy consumption in 2022 was substantial, with refrigeration alone accounting for a significant portion of a typical supermarket's energy bill. Implementing energy-efficient refrigeration systems, LED lighting upgrades, and optimizing delivery routes are key strategies for reducing environmental impact and improving operational sustainability.

Focusing on energy management can yield tangible benefits for Grocery Outlet. By investing in energy-efficient technologies and practices, the company can lower operating costs and reduce its greenhouse gas emissions. For example, a 2024 report indicated that supermarkets adopting advanced energy management systems saw an average reduction of 15% in their energy expenditure.

- Refrigeration Efficiency: Upgrading to modern, energy-efficient refrigeration units can significantly cut electricity usage, a major operational cost for grocery stores.

- LED Lighting Conversion: Replacing traditional lighting with LED technology offers substantial energy savings and a longer lifespan, reducing both energy bills and maintenance frequency.

- Supply Chain Optimization: Streamlining logistics and transportation routes minimizes fuel consumption and associated carbon emissions, enhancing the sustainability of the entire supply chain.

- Renewable Energy Adoption: Exploring options for sourcing electricity from renewable sources, such as solar or wind power, can further decarbonize operations.

Climate Change Impacts on Food Production

Climate change poses significant risks to food production, directly impacting Grocery Outlet's supply chain. Extreme weather events like droughts and floods, which have become more frequent and intense, can devastate crop yields and disrupt livestock production. For instance, the U.S. experienced widespread drought conditions in 2023, impacting corn and soybean harvests. This scarcity can lead to higher wholesale prices for food items, affecting the volume and variety of surplus goods available to Grocery Outlet.

Resource scarcity, another facet of climate change, also threatens agricultural stability. Water shortages, particularly in key agricultural regions, can limit planting seasons and reduce overall output. Furthermore, rising global temperatures can alter growing seasons and necessitate shifts in crop types, potentially making traditional food items less available or more expensive. These long-term environmental shifts create volatility in the food market, influencing Grocery Outlet's ability to source diverse and affordable overstock.

- Increased Volatility: Climate change-induced weather extremes are projected to cause greater year-to-year fluctuations in agricultural output globally.

- Supply Chain Disruptions: Events such as the 2023 California atmospheric rivers caused billions in agricultural damage, highlighting the vulnerability of food supply chains.

- Price Inflation: Reduced yields and increased production costs due to climate impacts contribute to higher food prices, affecting the affordability of goods for both consumers and discount retailers.

- Shifting Agricultural Landscapes: Changes in temperature and precipitation patterns may render certain regions less suitable for current crop production, necessitating adaptation and potentially altering the availability of specific food categories.

Grocery Outlet's unique model of selling surplus and closeout food directly addresses the environmental issue of food waste, a significant contributor to landfill volume. By diverting edible food that might otherwise be discarded, the company aligns with growing consumer demand for sustainable practices and potentially benefits from future waste reduction incentives.

The company faces increasing pressure regarding packaging waste, particularly plastics, as consumers and regulators push for more sustainable solutions. This environmental factor influences sourcing decisions, with a growing expectation for minimal or recyclable packaging, impacting the company's operational choices and supplier relationships.

Energy consumption for refrigeration and transportation is a key environmental consideration for Grocery Outlet, directly impacting its carbon footprint. Implementing energy-efficient technologies and optimizing logistics are crucial for reducing operational costs and environmental impact, with potential for significant energy expenditure reductions.

Climate change poses a direct threat to Grocery Outlet's supply chain through increased weather volatility and resource scarcity, impacting food production and price stability. Extreme weather events can devastate crop yields, leading to higher wholesale prices and affecting the availability of diverse and affordable overstock for the company.

| Environmental Factor | Impact on Grocery Outlet | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Food Waste Reduction | Core business model directly combats waste. | US landfill volume: Over 38% food waste (EPA 2023). |

| Packaging Waste | Pressure for reduced/sustainable packaging. | 85% of plastic waste by weight is packaging (Ellen MacArthur Foundation 2024). |

| Energy Consumption | Significant operational cost and carbon footprint. | Retail sector energy use substantial; refrigeration a major component (US data 2022). |

| Climate Change & Supply Chain | Volatility in food production and pricing. | US drought conditions impacted harvests (2023); extreme weather events cause agricultural damage (e.g., California atmospheric rivers 2023). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grocery Outlet is grounded in data from U.S. Census Bureau, Bureau of Labor Statistics, and USDA reports, alongside market research from Nielsen and Statista. This ensures a comprehensive understanding of economic, social, and political factors affecting the grocery sector.