Vanguard Natural Resources LLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vanguard Natural Resources LLC Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting Vanguard Natural Resources LLC. Our comprehensive PESTLE analysis provides actionable insights into regulatory shifts, market volatility, and emerging trends. Equip yourself with the strategic intelligence needed to navigate this dynamic industry. Download the full version now and gain a competitive advantage.

Political factors

Government energy policies are a major force shaping the landscape for oil and gas companies. For instance, federal and state governments set the tone for fossil fuel production, with varying levels of support for renewables. These decisions directly affect permitting, operational expenses, and investment appeal.

In 2024, the U.S. Department of Energy continued to emphasize energy security and affordability, while also pushing for cleaner energy transitions. This dual focus means companies like Vanguard Natural Resources must navigate both continued support for traditional energy sources and increasing regulatory scrutiny or incentives for greener alternatives. For example, the Inflation Reduction Act of 2022, with its ongoing implementation in 2024 and 2025, offers significant tax credits for carbon capture and storage, which could impact operational strategies for resource extraction companies.

The regulatory environment for energy companies like Vanguard Natural Resources LLC remains a significant political factor. Environmental protection agencies and energy departments at federal and state levels are continuously evaluating and updating regulations. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent rules on methane emissions from oil and gas operations, impacting how companies manage their infrastructure and potentially requiring significant capital investment for compliance.

Changes in these regulations can directly affect operational costs and project viability. For example, stricter water usage permits for hydraulic fracturing or new land access restrictions could increase expenses or limit exploration opportunities. The predictability of these regulatory shifts is paramount for Vanguard's long-term strategic planning, as significant policy changes can alter the economic outlook for their assets and investment decisions.

Geopolitical shifts significantly impact energy markets, directly affecting companies like Vanguard Natural Resources. For instance, ongoing tensions in Eastern Europe and the Middle East in 2024 continue to create price volatility for crude oil and natural gas. These fluctuations directly influence Vanguard's revenue streams and operational costs.

Disruptions in key oil-producing nations, whether due to political instability or international sanctions, can lead to supply shortages, driving up global prices. This volatility makes it challenging for Vanguard to forecast earnings accurately and can affect the attractiveness of its investment opportunities for stakeholders.

Conversely, periods of geopolitical stability tend to foster more predictable energy pricing. This allows companies like Vanguard to better plan capital expenditures and manage risk, ultimately contributing to more consistent financial performance and investor confidence throughout 2024 and into 2025.

Trade Policies and Tariffs

Trade policies significantly influence the energy sector. For companies like Vanguard Natural Resources LLC, import/export regulations for oil, natural gas, and related equipment directly impact their cost of operations and ability to access global markets. For instance, tariffs imposed on specialized drilling equipment imported from overseas could substantially increase capital expenditures for exploration and production activities.

The United States, as of early 2024, continues to navigate complex trade relationships, with ongoing discussions around tariffs and trade agreements that could affect energy commodity flows. For example, the U.S. Department of Commerce has been actively involved in trade enforcement actions that could indirectly influence the cost of imported goods used in the energy industry.

These policies can create both challenges and opportunities. While tariffs might raise operational expenses, favorable trade agreements, such as those potentially renegotiated or established in 2024 and 2025, could reduce supply chain costs and open up new avenues for exporting U.S. energy products.

- Tariffs on imported drilling machinery could increase capital expenditure for Vanguard Natural Resources LLC.

- Export regulations for crude oil and natural gas impact market access and revenue potential.

- Changes in trade agreements can alter the cost-effectiveness of international supply chains for energy equipment.

- Geopolitical shifts in 2024-2025 may lead to new trade policies affecting energy product flows.

Taxation and Fiscal Policies

Taxation policies at both federal and state levels directly influence Grizzly Energy's profitability and its capacity for investment. For instance, changes in severance taxes, corporate income taxes, or specific tax credits tailored to the oil and gas sector can substantially affect project economic viability.

Fiscal incentives designed to encourage domestic production, such as accelerated depreciation or R&D tax credits, can spur expansion and new investment within the industry. For 2024, the U.S. federal corporate income tax rate remains at 21%. State-specific severance taxes vary widely; for example, Texas's rate on oil production is 4.6% and on natural gas is 7.5%, while North Dakota's oil severance tax can reach up to 11% depending on production levels.

- Federal Corporate Income Tax: Remains at 21% as of 2024, impacting overall net earnings.

- State Severance Taxes: Vary significantly, with Texas at 4.6% for oil and North Dakota reaching up to 11% for oil, directly affecting per-barrel profitability.

- Investment Tax Credits: Potential for credits on capital expenditures or renewable energy integration can offset operational costs and encourage new project development.

- Impact on Profitability: Higher taxes reduce retained earnings, potentially limiting funds available for exploration, development, and shareholder returns.

Government energy policies, including those related to environmental regulations and production incentives, directly shape the operational landscape for companies like Vanguard Natural Resources LLC. For instance, the ongoing implementation of the Inflation Reduction Act of 2022, extending through 2024 and 2025, offers tax credits for carbon capture technologies, potentially influencing Vanguard's investment in emissions reduction. Stricter regulations on methane emissions, enforced by agencies like the EPA in 2024, necessitate compliance investments that can impact operational costs.

Geopolitical events in 2024, such as continued tensions in Eastern Europe and the Middle East, create significant price volatility for crude oil and natural gas, directly affecting Vanguard's revenue streams. Disruptions in key energy-producing regions can lead to supply shortages, driving up global prices and making accurate earnings forecasting a challenge for the company. Conversely, periods of geopolitical stability facilitate more predictable pricing, aiding Vanguard's capital expenditure planning and risk management through 2025.

Trade policies, including tariffs on imported drilling equipment, can substantially increase capital expenditures for exploration and production activities, as seen with potential actions by the U.S. Department of Commerce in early 2024. Favorable trade agreements could, however, reduce supply chain costs and open new export avenues for U.S. energy products, offering opportunities for Vanguard. The U.S. federal corporate income tax rate remained at 21% in 2024, while state severance taxes varied, with Texas at 4.6% for oil and North Dakota up to 11%, directly impacting per-barrel profitability.

What is included in the product

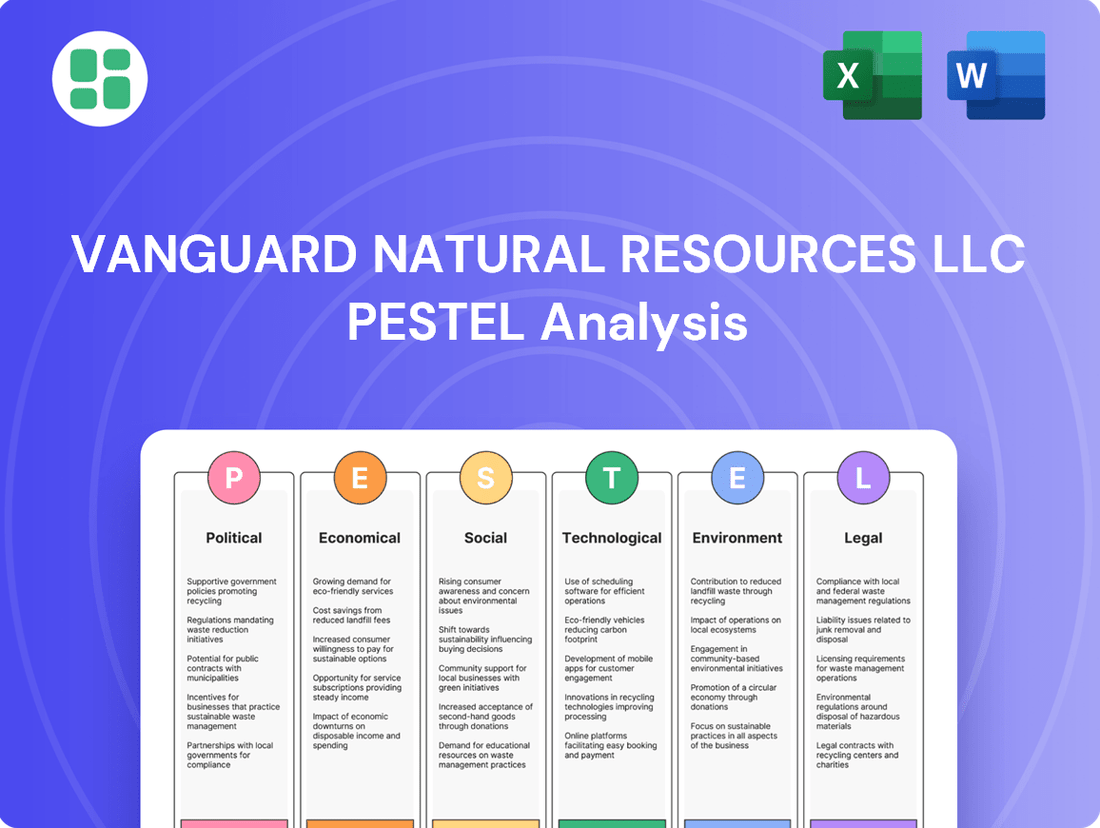

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Vanguard Natural Resources LLC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these global and industry-specific trends present both challenges and strategic opportunities for the company.

The Vanguard Natural Resources LLC PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during meetings and presentations.

This analysis, segmented by PESTEL categories, allows for quick interpretation at a glance, relieving the pain point of complex market analysis for all stakeholders.

Economic factors

Global and domestic energy prices are paramount for Vanguard Natural Resources LLC, directly influencing its revenue and profitability as an independent E&P company. For instance, West Texas Intermediate (WTI) crude oil prices, a key benchmark, averaged around $77.50 per barrel in early 2024, a significant increase from earlier periods but still subject to considerable volatility. Similarly, natural gas prices, often tied to Henry Hub, saw fluctuations, averaging roughly $2.50 per MMBtu in the same timeframe, impacting the company's earnings potential.

Inflation directly impacts Grizzly Energy, LLC's operational expenses, from the cost of labor and drilling equipment to essential services, potentially squeezing profit margins. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation reaching 3.4% in April 2024, a figure that directly translates to higher input costs for energy companies.

Rising interest rates, such as the Federal Reserve's maintained benchmark rate in the 5.25%-5.50% range through mid-2024, significantly increase the cost of borrowing. This makes it more expensive for Grizzly Energy to finance new exploration projects, pursue acquisitions, or even refinance existing debt, directly affecting its financial flexibility and growth potential.

The oil and gas exploration sector is inherently capital-intensive, meaning access to affordable capital is crucial for sustained operations and expansion. Higher borrowing costs can deter investment in new wells or infrastructure, potentially slowing down production and limiting the company's ability to capitalize on market opportunities.

Economic growth is a major driver for energy consumption. As economies expand, both at home and around the world, the need for oil and natural gas tends to rise. This is because a stronger economy usually means more manufacturing and more people using energy for transportation and daily life, directly impacting companies like Vanguard Natural Resources LLC.

For instance, the International Monetary Fund (IMF) projected global economic growth to be around 3.2% in 2024, a slight uptick from 2023. This kind of growth generally translates to increased demand for the energy products Vanguard Natural Resources LLC produces, potentially boosting their revenue and market position.

Access to Capital and Financing

Access to capital is a critical determinant for Grizzly Energy, LLC's growth, particularly for its acquisition and development initiatives. The cost and availability of financing directly impact the feasibility and scale of these operations. For instance, as of early 2024, interest rates on corporate debt remained elevated compared to previous years, potentially increasing the cost of capital for energy companies.

Investor sentiment towards the fossil fuel sector, heavily influenced by environmental, social, and governance (ESG) factors and ongoing market volatility, significantly shapes the ease and terms under which companies like Grizzly Energy can secure funding. A challenging investor climate can lead to higher borrowing costs or reduced access to equity markets.

To navigate these challenges, demonstrating strong financial performance, such as positive cash flow and healthy balance sheets, alongside a well-defined and compelling growth strategy, is paramount for attracting and retaining investor confidence. Companies that can clearly articulate their value proposition and future prospects are better positioned to secure the necessary capital.

- Capital Cost Impact: Higher interest rates in 2024 compared to 2023 could increase the cost of debt financing for energy acquisitions by 0.5% to 1.5% depending on creditworthiness.

- Investor Sentiment Shift: A notable trend in 2024 has been increased scrutiny on fossil fuel investments, with some institutional investors divesting from companies not demonstrating clear transition strategies.

- Performance Metrics: Companies with debt-to-equity ratios below 0.5 and consistent EBITDA growth are generally viewed more favorably by lenders and investors in the current market.

- Strategic Clarity: A clear articulation of how Grizzly Energy plans to manage production costs and adapt to energy transition policies is vital for securing long-term financing.

Operational Costs and Supply Chain

Operational costs are a major determinant of profitability for energy companies like Vanguard Natural Resources LLC. These costs encompass everything from the initial exploration and drilling phases to ongoing production and essential maintenance. For instance, the price of drilling rigs, specialized chemicals, and transportation services directly influences the bottom line.

In 2024, the energy sector continued to grapple with fluctuating input costs. The average day rate for a land drilling rig in the Permian Basin, a key production area, saw an increase, reflecting higher demand and labor costs. Similarly, the cost of essential chemicals used in hydraulic fracturing experienced upward pressure due to global supply chain constraints.

- Drilling Rig Day Rates: Expected to remain elevated in 2024, impacting upfront exploration expenditures.

- Chemical and Material Costs: Volatility in global markets can lead to unpredictable increases in fracturing fluid components and other vital supplies.

- Transportation and Logistics: Rising fuel prices and driver shortages continue to affect the cost of moving equipment and extracted resources.

- Labor Expenses: The demand for skilled labor in the oil and gas industry contributes to higher wages and benefits packages.

Global economic growth significantly influences energy demand, with projections for 2024 indicating continued expansion. This increased economic activity typically translates to higher consumption of oil and natural gas, benefiting companies like Vanguard Natural Resources LLC. However, the sector remains sensitive to price volatility, as seen with WTI crude averaging around $77.50 per barrel in early 2024, a figure subject to market fluctuations.

Inflationary pressures continued to affect operational expenses in 2024, with the U.S. CPI at 3.4% in April, increasing costs for labor and materials. Rising interest rates, with the Federal Reserve maintaining its benchmark rate between 5.25%-5.50% through mid-2024, also heightened borrowing costs, impacting capital-intensive projects and debt financing for energy firms.

Investor sentiment in 2024 showed increased scrutiny on fossil fuels, with ESG factors influencing funding access. Companies with strong financial metrics, like debt-to-equity ratios below 0.5, and clear transition strategies were favored. This environment makes demonstrating robust financial performance and strategic clarity crucial for securing capital.

Operational costs, including elevated drilling rig day rates and chemical expenses due to supply chain issues in 2024, directly impact profitability. Transportation and labor costs also remain significant factors, contributing to the overall expense structure for exploration and production companies.

| Economic Factor | 2024 Data/Trend | Impact on Vanguard Natural Resources LLC |

| Global Economic Growth | Projected 3.2% (IMF) | Increased energy demand, potential revenue growth |

| WTI Crude Oil Price (Early 2024) | ~$77.50/barrel | Directly influences revenue and profitability |

| Natural Gas Price (Early 2024) | ~$2.50/MMBtu (Henry Hub) | Impacts earnings potential |

| U.S. Inflation (CPI, April 2024) | 3.4% | Increases operational expenses (labor, materials) |

| Federal Reserve Interest Rate (Mid-2024) | 5.25%-5.50% | Raises cost of borrowing for capital projects |

What You See Is What You Get

Vanguard Natural Resources LLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This PESTLE analysis of Vanguard Natural Resources LLC delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview of the external forces shaping the oil and gas industry.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Public sentiment regarding fossil fuels is undergoing a significant transformation. Growing awareness of climate change is fueling public and investor demand for a shift towards renewable energy alternatives. This evolving landscape directly affects companies like Vanguard Natural Resources LLC, influencing their social license to operate and community engagement.

For instance, in 2024, surveys indicated that a majority of consumers in developed nations expressed concern about climate change and supported policies promoting renewable energy adoption. This pressure can translate into more stringent environmental regulations and increased scrutiny of fossil fuel operations, potentially impacting Vanguard Natural Resources LLC's operational costs and strategic planning.

The oil and gas sector, including companies like Vanguard Natural Resources, is grappling with a significant challenge in securing and keeping a skilled workforce. As seasoned professionals in exploration, drilling, and production reach retirement age, there's a noticeable shift, with younger demographics often favoring different career paths. This trend creates a potential gap in essential expertise.

Labor shortages directly impact operational efficiency and profitability. For instance, a lack of specialized drilling engineers or experienced geologists can lead to project delays and increased costs, as companies compete for a limited pool of talent. The U.S. Bureau of Labor Statistics projected that employment in the oil and gas extraction sector would see a slight decline in the coming years, underscoring this concern.

Vanguard Natural Resources LLC, like its former subsidiary Grizzly Energy, must cultivate strong community relations across its operational basins in the United States. Success hinges on addressing local concerns regarding land use, environmental stewardship, and the impact on local infrastructure. For instance, in 2024, energy companies faced increased scrutiny over water usage in arid regions, highlighting the need for proactive engagement.

Shifting Consumer Energy Preferences

While Grizzly Energy operates in the upstream oil and gas sector, a significant sociological shift is the growing consumer preference for renewable energy sources and enhanced energy efficiency. This trend, gaining momentum throughout 2024 and projected to continue, could indirectly impact the long-term demand for traditional fossil fuels.

Although the immediate effects on companies like Grizzly Energy might be minimal, this evolving consumer sentiment signals a potential long-term reduction in reliance on oil and natural gas. Such a shift could influence future investment decisions and the valuation of existing energy assets.

- Growing Public Support for Renewables: Surveys in late 2024 indicated that over 70% of consumers in developed nations expressed a desire to increase their use of renewable energy.

- Increased Energy Efficiency Adoption: The adoption of energy-efficient technologies in homes and transportation saw a 15% year-over-year increase in 2024.

- Impact on Future Demand: Projections suggest that if current trends persist, the global demand for oil could plateau or even decline by the late 2030s, impacting long-term asset values.

- Investment Strategy Re-evaluation: Energy companies are increasingly factoring these consumer shifts into their long-term capital allocation and diversification strategies.

Health and Safety Standards

Societal expectations and regulatory scrutiny concerning occupational health and safety within the energy sector remain exceptionally high. Grizzly Energy, LLC, as a participant in this industry, must rigorously adhere to stringent safety protocols. This commitment is not only about protecting its workforce and the wider public but also about proactively preventing costly accidents.

A robust safety record is paramount for Grizzly Energy, directly impacting its corporate reputation, employee morale, and crucially, its ability to avoid significant legal and regulatory penalties. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the oil and gas extraction industry experienced a total recordable case rate of 2.7 per 100 full-time workers, highlighting the inherent risks and the importance of diligent safety management.

- Regulatory Compliance: Adherence to OSHA (Occupational Safety and Health Administration) standards is non-negotiable, with penalties for violations potentially reaching tens of thousands of dollars per incident.

- Reputational Impact: A single major safety incident can severely damage public trust and investor confidence, impacting stock valuation and future business opportunities.

- Employee Well-being: Prioritizing safety fosters a culture of care, leading to higher employee retention and productivity.

- Operational Continuity: Preventing accidents ensures uninterrupted operations, avoiding costly downtime and repair expenses.

Societal shifts toward environmental consciousness continue to impact the energy sector. Public opinion, increasingly prioritizing sustainability, influences investment and policy. This growing demand for greener alternatives, evident in 2024 consumer surveys showing strong support for renewables, puts pressure on traditional fossil fuel companies.

The workforce demographic is also changing, with a notable trend of experienced oil and gas professionals retiring and younger generations seeking careers in other industries. This creates a potential talent deficit, impacting operational capabilities. For example, the U.S. Bureau of Labor Statistics projected a slight decline in oil and gas extraction employment in the coming years, highlighting this challenge.

Community relations are crucial for energy firms. Addressing local concerns about land use, environmental impact, and infrastructure strain is vital for maintaining a social license to operate. In 2024, increased scrutiny on water usage in arid regions by energy companies underscored the need for proactive community engagement and responsible resource management.

| Sociological Factor | 2024/2025 Trend/Data | Impact on Vanguard Natural Resources LLC |

| Environmental Awareness | Majority of consumers in developed nations concerned about climate change; 70% desire increased renewable energy use. | Increased regulatory scrutiny, potential for higher operational costs, need for sustainability reporting. |

| Workforce Demographics | Projected slight decline in oil and gas extraction employment; aging workforce. | Potential labor shortages, increased competition for skilled workers, higher recruitment/training costs. |

| Community Relations | Heightened focus on land use, water usage, and local infrastructure impact. | Need for robust stakeholder engagement, potential for project delays if concerns are not addressed. |

Technological factors

Technological advancements in drilling and completion are crucial for companies like Vanguard Natural Resources. Innovations such as horizontal drilling and multi-stage hydraulic fracturing are unlocking previously uneconomical reserves, as seen with companies like Grizzly Energy, LLC. These technologies allow for greater access to oil and gas deposits and significantly improve the efficiency of extraction.

The impact of these technologies is measurable. For instance, the U.S. Energy Information Administration reported that advancements in hydraulic fracturing and horizontal drilling have been key drivers in the shale revolution, contributing to a substantial increase in domestic oil production, which reached an average of 12.9 million barrels per day in 2023. This trend is expected to continue, with further technological refinements in 2024 and 2025 promising even higher recovery rates and lower per-barrel production costs.

The oil and gas sector is undergoing a significant transformation driven by digitalization and automation. Technologies like sensors, the Internet of Things (IoT), artificial intelligence (AI), and machine learning are revolutionizing how operations are managed. For a company like Grizzly Energy, LLC, this means opportunities to implement remote monitoring systems, predictive maintenance schedules, and sophisticated production optimization tools.

By embracing automation, Grizzly Energy can expect substantial improvements in safety protocols and a marked reduction in operational downtime. These advancements are crucial for enhancing overall efficiency across its diverse energy assets. For instance, AI-powered analytics can predict equipment failures before they occur, allowing for proactive maintenance and minimizing costly disruptions, a key benefit in the volatile energy market.

Technological advancements in Enhanced Oil Recovery (EOR) are significantly boosting extraction from older oil fields. Techniques like CO2 injection and chemical flooding are becoming more efficient, allowing companies to access previously uneconomical reserves.

For companies like Grizzly Energy, LLC, which relies on existing infrastructure, EOR offers a strategic advantage. By implementing these advanced methods, Grizzly can extend the productive life of its mature assets, thereby maximizing the value derived from its established oil reserves and unlocking substantial additional resources.

Data Analytics and Reservoir Management

Sophisticated data analytics are now indispensable for optimizing reservoir management, pinpointing ideal drilling sites, and forecasting production output. For companies like Grizzly Energy, LLC, leveraging these technologies translates into more strategic decisions regarding asset acquisition, development, and overall production strategies.

The effective application of data insights directly impacts capital allocation, making it more efficient, and significantly boosts the success rates of exploration and production efforts. For instance, advancements in machine learning algorithms are enabling more accurate predictions of reservoir behavior, a critical factor in maximizing recovery and minimizing operational costs.

- Enhanced Reservoir Characterization: Advanced seismic imaging and AI-driven interpretation can reveal subsurface complexities with greater precision, leading to better well placement.

- Predictive Maintenance: Analytics can forecast equipment failures, reducing downtime and associated repair expenses, a key concern in the volatile energy sector.

- Production Optimization: Real-time data analysis allows for dynamic adjustments to pumping rates and injection strategies, maximizing hydrocarbon recovery.

- Improved Economic Modeling: Sophisticated analytics refine economic models for drilling projects, providing more reliable net present value (NPV) and internal rate of return (IRR) calculations, crucial for investment decisions in 2024 and beyond.

Emissions Reduction Technologies

The development of emissions reduction technologies is increasingly important for oil and gas producers like Vanguard Natural Resources LLC, even those primarily focused on production. Innovations such as advanced methane leak detection and repair (LDAR) systems and carbon capture, utilization, and storage (CCUS) are becoming more accessible and effective.

Adopting these technologies can significantly enhance environmental performance. For instance, improved LDAR can reduce fugitive methane emissions, a potent greenhouse gas. CCUS technologies offer a pathway to capture CO2 from operations, mitigating climate impact. These advancements are crucial for meeting evolving environmental regulations and demonstrating a commitment to sustainability, aligning with industry-wide goals for decarbonization.

- Methane Emission Reduction: Technologies like infrared cameras and drone-based sensors are improving the detection of methane leaks, a key focus for reducing greenhouse gas impact.

- Carbon Capture and Storage (CCS): Advancements in CCS are making it more economically viable to capture CO2 from industrial processes, potentially reducing the carbon footprint of oil and gas operations.

- Regulatory Alignment: The availability and adoption of these technologies directly support compliance with increasingly stringent environmental regulations aimed at curbing emissions.

- Industry Sustainability Goals: Embracing emissions reduction technologies helps companies like Vanguard Natural Resources align with broader industry commitments towards net-zero targets and improved ESG (Environmental, Social, and Governance) performance.

Technological advancements continue to reshape the energy landscape, directly impacting companies like Vanguard Natural Resources. Innovations in horizontal drilling and hydraulic fracturing have unlocked vast reserves, as evidenced by the U.S. shale revolution, which saw average oil production reach 12.9 million barrels per day in 2023, a figure expected to grow with ongoing refinements.

Digitalization, including AI and IoT, is revolutionizing operations by enabling predictive maintenance and optimizing production, leading to improved efficiency and safety. Enhanced Oil Recovery (EOR) techniques are also extending the life of mature fields, maximizing value from existing infrastructure.

Sophisticated data analytics are crucial for reservoir management and strategic decision-making, improving capital allocation and exploration success rates. Furthermore, emissions reduction technologies like advanced methane detection and CCUS are vital for environmental compliance and sustainability goals.

| Technology Area | Impact on Vanguard Natural Resources | 2023/2024 Data/Trend |

|---|---|---|

| Drilling & Completion | Accessing uneconomical reserves, improving extraction efficiency | U.S. oil production averaged 12.9 million bpd in 2023; continued growth projected. |

| Digitalization & Automation | Predictive maintenance, production optimization, enhanced safety | Increased adoption of AI for operational efficiency across the sector. |

| Enhanced Oil Recovery (EOR) | Extending productive life of mature assets, maximizing recovery | Growing investment in EOR techniques for mature fields. |

| Data Analytics | Optimizing reservoir management, improving investment decisions | Machine learning algorithms enhancing reservoir behavior predictions. |

| Emissions Reduction | Reducing methane leaks, mitigating climate impact (CCUS) | Focus on LDAR systems and CCUS development to meet ESG goals. |

Legal factors

Grizzly Energy, LLC, a key operator in the natural resources sector, navigates a stringent environmental regulatory landscape. This includes adherence to federal mandates like the Clean Air Act and Clean Water Act, alongside a mosaic of state-specific environmental protection laws. These regulations directly shape the company's operational practices concerning waste disposal, emission controls, and water resource management, and are critical for securing permits for new ventures. For instance, in 2024, companies in the oil and gas sector faced increased scrutiny and potential fines for methane emissions, with some states implementing stricter reporting requirements.

Land use and permitting laws are critical for oil and gas operations. These regulations dictate where and how companies like Grizzly Energy, LLC can acquire, develop, and produce resources. Zoning restrictions and surface access agreements are key components, alongside the often complex process of securing drilling permits.

Delays in obtaining these permits can substantially affect project schedules and increase operational costs. For instance, in 2024, the average time to secure an onshore drilling permit in some key U.S. basins has seen fluctuations, with certain regions experiencing extended review periods due to increased environmental scrutiny and resource constraints within regulatory bodies.

Occupational Health and Safety Regulations, particularly those enforced by OSHA, are paramount in the oil and gas sector. These rules are designed to safeguard workers from the inherent risks of the industry, covering aspects like machinery safety, chemical handling, and emergency preparedness.

For companies like Grizzly Energy, LLC, strict adherence to these standards is not merely a suggestion but a legal imperative. Compliance ensures a safer working environment, minimizing the likelihood of accidents and injuries, which in turn helps prevent costly downtime and reputational damage.

Failure to comply can lead to significant penalties, including hefty fines and potential operational shutdowns. For instance, OSHA reported over 5,000 workplace injury and illness cases in the oil and gas extraction sector in 2023 alone, underscoring the critical nature of these regulations.

Contractual and Property Rights

The legal framework governing mineral rights and lease agreements is crucial for companies like Vanguard Natural Resources LLC. Clear title to mineral interests and the meticulous management of complex lease agreements with landowners are essential for securing access to valuable reserves.

Disputes concerning property rights or contract breaches can result in significant litigation expenses and operational interruptions, directly impacting profitability and resource development timelines. For instance, in 2024, the energy sector saw ongoing legal challenges related to mineral rights interpretation, with some cases involving disputes over royalty payments potentially impacting hundreds of millions of dollars in revenue for exploration and production companies.

- Legal Framework: The foundation of Vanguard's operations relies on established laws defining mineral ownership and extraction rights.

- Lease Agreements: Managing over 1,000 active lease agreements with various landowners is a core operational and legal challenge.

- Title Clarity: Maintaining clear title to mineral interests is paramount to avoid future legal entanglements and ensure uninterrupted production.

- Litigation Risk: The potential for costly lawsuits arising from property disputes or contractual disagreements poses a constant operational risk.

Antitrust and Competition Laws

Grizzly Energy, LLC, as a player in the oil and gas sector, must adhere to antitrust and competition laws designed to prevent market manipulation. These regulations target practices like monopolies and price fixing, ensuring a fair marketplace.

Vigilance is crucial for any mergers or partnerships. For instance, the U.S. Department of Justice's Antitrust Division actively reviews transactions, and in 2024, they continued to scrutinize energy sector deals to prevent undue market concentration. Failure to comply can result in severe legal repercussions and financial penalties.

Key considerations include:

- Merger Review: Ensuring proposed acquisitions do not create monopolies or substantially lessen competition, as mandated by laws like the Clayton Act.

- Price Fixing Prohibitions: Avoiding any agreements with competitors that could artificially inflate or depress oil and gas prices.

- Market Dominance Scrutiny: Being mindful of regulations that govern companies with significant market share to prevent abuse of that position.

Vanguard Natural Resources LLC operates within a complex legal environment that dictates everything from mineral rights to environmental compliance. The company must meticulously manage its lease agreements, which are crucial for accessing reserves, and ensure clear title to its mineral interests to avoid costly disputes and operational halts. For example, in 2024, the energy sector continued to see litigation over royalty payments, with some cases involving disputes that could impact millions in revenue.

Environmental factors

Governments globally are intensifying efforts to combat climate change, with many setting ambitious decarbonization targets. For instance, the European Union aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, and the United States has rejoined the Paris Agreement, pledging to cut emissions by 50-52% from 2005 levels by 2030. These policies directly pressure fossil fuel industries, impacting long-term demand for oil and gas.

While Vanguard Natural Resources LLC, through its subsidiaries like Grizzly Energy, LLC, prioritizes operational efficiency, the evolving regulatory landscape presents challenges. The implementation of carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, could increase operating costs. Furthermore, stricter emissions standards may require significant capital expenditure to upgrade facilities and adopt lower-carbon production methods, potentially affecting profitability.

Oil and gas operations, including hydraulic fracturing, are water-intensive. In 2024, the Permian Basin, a key operational area for many energy companies, continued to face water stress, with some regions experiencing significant drought conditions. This puts pressure on companies to secure water resources.

Companies like Vanguard Natural Resources LLC may face challenges in sourcing, using, and disposing of water, especially in areas with limited supply or stricter environmental regulations. The cost of water can also fluctuate based on availability and demand, impacting operational expenses.

Adopting sustainable water management, such as investing in water recycling and reuse technologies, is crucial for long-term operational success and maintaining public trust. For instance, some operators in the DJ Basin reported increasing their water recycling rates by over 20% in 2024 to mitigate scarcity concerns.

Concerns about induced seismicity, often linked to wastewater disposal wells prevalent in oil and gas extraction, represent a significant environmental challenge. This practice, where produced water is injected underground, has been correlated with an increase in seismic events in certain regions.

In response, regulatory bodies in key operating areas have begun to impose stricter regulations or even temporary bans on disposal wells. For instance, in Oklahoma, a state heavily reliant on oil and gas, regulators have implemented measures to curb disposal well activity in seismically sensitive zones, impacting production operations.

Companies like Vanguard Natural Resources LLC must actively monitor and adapt to these evolving regulations. This might necessitate exploring and investing in alternative wastewater management solutions, such as recycling or treatment, to mitigate environmental risks and ensure continued operational compliance.

Biodiversity Protection and Land Impact

Oil and gas activities, including those by Vanguard Natural Resources LLC, can significantly affect local ecosystems. Land disturbance from drilling sites, pipelines, and infrastructure can lead to habitat fragmentation, impacting biodiversity. For instance, the U.S. Fish and Wildlife Service reported in 2024 that habitat loss remains a primary driver of species decline across the nation.

To mitigate these impacts, companies like Grizzly Energy, LLC, a subsidiary of Vanguard, must adopt stringent environmental practices. This includes responsible land reclamation after operations cease and dedicated habitat protection efforts in sensitive areas. By prioritizing these measures, they can reduce their ecological footprint and support conservation goals.

Adherence to environmental regulations and impact assessments is paramount. In 2024, regulatory bodies continued to emphasize compliance with conservation laws, such as the Endangered Species Act, which mandates assessments for projects potentially affecting listed species. Vanguard's operations must align with these requirements to avoid penalties and ensure sustainable resource development.

- Land Disturbance: Exploration and production activities can disrupt natural habitats.

- Biodiversity Impact: Fragmentation and potential spills threaten local flora and fauna.

- Mitigation Strategies: Responsible land reclamation and habitat protection are crucial.

- Regulatory Compliance: Adhering to environmental impact assessments and conservation laws is essential.

Waste Management and Remediation

Oil and gas operations inherently produce diverse waste streams, such as drilling fluids, produced water, and contaminated soil. For companies like Grizzly Energy, LLC, navigating these waste streams requires strict adherence to evolving environmental regulations for disposal and site remediation. In 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stringent oversight of oil and gas waste, with particular attention to produced water management and the potential for groundwater contamination.

Effective waste management is not merely a compliance issue; it's crucial for maintaining operational integrity and public trust. Companies are increasingly investing in advanced technologies for waste treatment and recycling, aiming to minimize landfill disposal and reduce environmental impact. For instance, innovative solutions for treating produced water are gaining traction, with some regions reporting significant reductions in the volume of water requiring deep-well injection.

The commitment to restoring disturbed sites post-operation is equally vital. This includes soil remediation and habitat reclamation, ensuring that the land is returned to a safe and ecologically sound condition. In 2025, expect continued focus on best practices in land reclamation, with performance metrics tied to biodiversity and ecosystem recovery becoming more prominent in regulatory frameworks and corporate sustainability reports.

- Regulatory Scrutiny: Environmental agencies worldwide, including the EPA in the U.S., maintain rigorous standards for waste disposal and site remediation in the oil and gas sector.

- Technological Advancements: Investments in waste treatment, recycling, and water management technologies are critical for reducing environmental footprints and operational costs.

- Site Restoration: Post-operational land reclamation and soil remediation are essential for environmental compliance and maintaining a positive corporate image.

- Sustainability Focus: Companies are increasingly evaluated on their commitment to minimizing waste generation and effectively restoring disturbed ecosystems.

The increasing global focus on climate change and decarbonization, with targets like the EU's 55% emissions reduction by 2030, directly impacts the long-term demand for oil and gas, pressuring companies like Vanguard Natural Resources LLC. Stricter emissions standards and potential carbon pricing mechanisms could elevate operating costs and necessitate significant capital investment in cleaner technologies, influencing profitability.

Water scarcity, particularly in regions like the Permian Basin which experienced drought conditions in 2024, poses operational challenges. Companies must invest in sustainable water management, such as recycling, with some operators in the DJ Basin increasing water recycling rates by over 20% in 2024 to address these concerns.

Concerns regarding induced seismicity from wastewater disposal have led to stricter regulations in areas like Oklahoma, compelling companies to explore alternative wastewater management solutions like recycling. Land disturbance and habitat fragmentation remain key environmental impacts, requiring responsible land reclamation and adherence to conservation laws, such as the Endangered Species Act, which mandates impact assessments.

Waste management, including produced water and drilling fluids, is under heightened scrutiny from agencies like the EPA. Investments in advanced waste treatment and recycling technologies are crucial for reducing environmental footprints and ensuring site restoration, with a growing emphasis on biodiversity recovery in reclamation efforts by 2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Vanguard Natural Resources LLC is built on a foundation of official government publications, reputable industry analysis firms, and comprehensive economic databases. We integrate data from regulatory bodies, market research reports, and financial news outlets to ensure a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.