Vanguard Natural Resources LLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vanguard Natural Resources LLC Bundle

Vanguard Natural Resources LLC operates in an industry marked by significant bargaining power of buyers and a moderate threat of substitutes, impacting pricing and profitability. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Vanguard Natural Resources LLC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, including companies like Vanguard Natural Resources LLC, is heavily dependent on specialized equipment and services. Think drilling rigs, hydraulic fracturing, and seismic data acquisition – these aren't everyday items. Suppliers who control these critical, and often proprietary, technologies or services hold considerable sway.

This reliance means that access to these specialized inputs directly impacts project schedules and expenses for exploration and production firms. For instance, a shortage or significant price increase in hydraulic fracturing services, a key component of unconventional oil and gas extraction, could substantially alter a company's operational costs for 2024.

Consolidation among key oilfield service providers significantly bolsters their bargaining power. As the number of independent suppliers shrinks, those remaining gain leverage, allowing them to dictate terms and prices more effectively. This trend was evident in 2024, with several mergers and acquisitions occurring in the sector, particularly in specialized drilling and completion services.

When a few dominant companies control critical services, they can command higher prices, directly impacting a company like Grizzly Energy. For instance, if specialized hydraulic fracturing services become concentrated among two or three major players, the cost for these essential operations can escalate, squeezing profit margins for exploration and production companies.

The availability of specialized talent, such as geologists, engineers, and rig operators, directly influences the bargaining power of suppliers in the energy sector. A scarcity of these skilled professionals can lead to increased wage demands and enhanced benefits packages, thereby driving up operational expenses for exploration and production (E&P) companies. For instance, in 2024, reports indicated a persistent shortage in experienced petroleum engineers, with some specialized roles seeing salary increases of up to 15% compared to the previous year.

Raw Materials and Commodity Prices for Inputs

Suppliers of critical raw materials, like steel for essential infrastructure such as pipelines and well casings, or specialized chemicals vital for drilling operations, possess significant leverage. Their pricing power is directly tied to the ebb and flow of global commodity markets, meaning fluctuations in these prices can substantially impact Vanguard Natural Resources LLC's operational expenses.

While the company's revenue is largely dictated by oil and gas prices, the cost of these indispensable input materials directly affects its bottom line. For instance, a surge in steel prices, a common occurrence in commodity markets, can escalate capital expenditure for new projects and maintenance alike. The volatility inherent in these input costs directly translates into unpredictable impacts on overall profitability, making cost management a continuous challenge.

- Steel Prices: In early 2024, benchmark steel prices saw an upward trend, with some grades increasing by 5-10% compared to late 2023, driven by production cuts and demand recovery in manufacturing sectors.

- Chemical Input Costs: The cost of specialized drilling fluids and completion chemicals experienced a moderate increase of 3-7% in the first half of 2024, influenced by supply chain disruptions and increased demand from global exploration activities.

- Impact on Margins: A 5% increase in the cost of key raw materials, without a corresponding rise in oil and gas prices, could reduce Vanguard Natural Resources LLC's operating margins by an estimated 1-2% for the fiscal year 2024.

Regulatory and Environmental Compliance Costs

Suppliers of environmental services and compliance solutions are gaining leverage over energy companies like Vanguard Natural Resources LLC, particularly due to escalating regulatory scrutiny. As environmental standards tighten, companies must invest in specialized technologies and services to ensure adherence, thereby increasing the bargaining power of these providers.

For instance, in 2024, the energy sector faced increased compliance demands related to methane emissions and water management. Companies that offer advanced monitoring systems or remediation services are well-positioned to command higher prices, as the cost of non-compliance can be substantial, including potential fines and operational shutdowns.

- Increased Demand for Specialized Services: Evolving environmental regulations, such as those concerning carbon capture and storage (CCS) technologies, drive demand for expert services.

- Cost of Non-Compliance: Failure to meet environmental standards can result in significant financial penalties and reputational damage, making compliance investments a necessity.

- Technological Advancements: Suppliers offering cutting-edge environmental solutions that reduce operational impact and improve efficiency are in a stronger negotiating position.

Suppliers of specialized oilfield equipment and services, especially those with proprietary technology or limited competition, can exert significant influence. This was particularly evident in 2024, where consolidation among key service providers like those in hydraulic fracturing and drilling operations led to increased pricing power for the remaining entities. For instance, a 2024 industry report indicated that the top three hydraulic fracturing service providers controlled over 60% of the market share, enabling them to implement price hikes of up to 8% on standard service packages.

The scarcity of skilled labor, such as experienced petroleum engineers and specialized rig operators, also amplifies supplier leverage. In 2024, a persistent shortage in these roles resulted in wage increases of 10-15% for certain positions, directly increasing operational costs for exploration and production companies. Furthermore, suppliers of critical raw materials like steel for pipelines saw price increases of 5-10% in early 2024 due to production constraints and demand from other sectors.

| Supplier Category | Key Factors Influencing Bargaining Power (2024) | Estimated Impact on Operating Costs |

|---|---|---|

| Specialized Oilfield Services (e.g., Hydraulic Fracturing) | Market consolidation, proprietary technology | Up to 8% price increase on standard services |

| Skilled Labor (e.g., Petroleum Engineers) | Labor shortages, high demand | 10-15% wage increase for specialized roles |

| Raw Materials (e.g., Steel for Pipelines) | Production constraints, demand from other sectors | 5-10% price increase |

What is included in the product

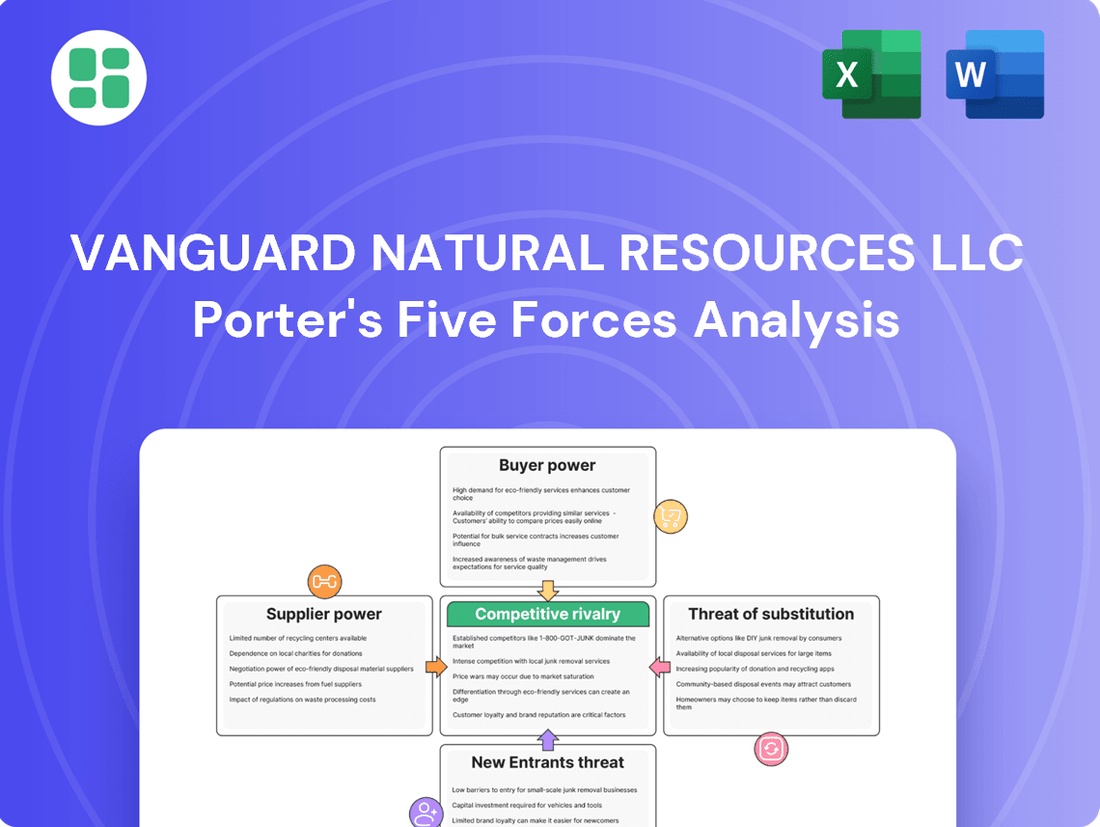

This analysis unpacks the competitive forces impacting Vanguard Natural Resources LLC, detailing the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and rivalry among existing competitors.

Quickly identify and mitigate the intense competitive rivalry and threat of new entrants in the oil and gas sector, allowing for more focused strategic planning.

Customers Bargaining Power

The commoditization of oil and natural gas significantly enhances customer bargaining power. Because these resources are largely undifferentiated, buyers can easily switch suppliers based on price, as there's little perceived difference in the product itself. This lack of product differentiation limits the ability of companies like Vanguard Natural Resources LLC to command premium pricing, making them highly susceptible to customer price demands.

Large volume buyers like midstream companies and refiners wield significant bargaining power over producers like Vanguard Natural Resources LLC. These entities, responsible for transporting, processing, and refining crude oil and natural gas, often purchase vast quantities. For instance, in 2024, major refiners like Marathon Petroleum, with its significant refining capacity, can dictate terms due to the sheer volume of feedstock they require. This allows them to negotiate lower prices and more favorable contract durations, directly impacting Vanguard's profitability on a per-unit basis.

The oil and gas sector, including companies like Vanguard Natural Resources LLC, generally exhibits high market transparency. Information on crude oil and natural gas prices is readily accessible, often in real-time. This accessibility empowers customers, giving them the data needed to compare offerings from various producers and negotiate pricing more effectively.

For instance, as of early 2024, West Texas Intermediate (WTI) crude oil prices have fluctuated, with reports indicating averages around $75-$80 per barrel for much of the first half of the year, while Henry Hub natural gas prices have seen significant volatility, ranging from below $2 per MMBtu to over $3 per MMBtu depending on seasonal demand and storage levels. This constant flow of pricing data means buyers can pinpoint the most advantageous deals, thereby increasing their bargaining power.

Companies operating within this environment, such as Grizzly Energy, find their individual pricing power constrained. The market's pricing is predominantly shaped by broader global supply and demand forces, rather than the actions of a single producer. This dynamic means customers can readily switch suppliers if pricing or terms are not competitive, further amplifying their leverage.

Customer Switching Costs

Customer switching costs are a key factor in the bargaining power of customers. For major buyers of natural gas, like pipeline operators or refineries, the expense and effort involved in changing suppliers can be minimal. This is particularly true in markets where there are numerous producers, making it easier to find alternatives.

Even with existing long-term agreements, the potential for customers to switch suppliers gives them significant leverage during price negotiations. This means that companies like Grizzly Energy, which operates in the natural gas sector, must continually present attractive terms and pricing to keep their existing customers, known as off-takers.

- Low Switching Costs: For large industrial consumers of natural gas, the costs of changing suppliers, such as modifying pipeline connections or processing equipment, are often low, especially in a market with many producers.

- Customer Leverage: The ease with which customers can switch suppliers grants them considerable bargaining power, allowing them to negotiate more favorable terms.

- Competitive Pressure: Companies must maintain competitive pricing and service offerings to retain their customer base in such an environment.

Demand Fluctuations and Economic Cycles

Customer demand for oil and natural gas is intrinsically linked to the ebb and flow of global economic growth and industrial activity. Seasonal variations also play a significant role, impacting consumption patterns.

During economic downturns or periods of reduced demand, the bargaining power of customers tends to rise. This is because supply can exceed demand, giving buyers more leverage to negotiate prices.

- Demand Sensitivity: In 2024, global economic uncertainty and slower industrial output in key regions have led to fluctuations in energy demand, directly impacting the pricing power of consumers.

- Price Volatility: Oil prices, for instance, experienced considerable volatility throughout 2024, with benchmarks like West Texas Intermediate (WTI) trading in a range influenced by these demand shifts.

- Impact on Producers: Companies like Vanguard Natural Resources LLC (or its successors/related entities) face profitability challenges when demand weakens, as they must contend with lower prices or reduced sales volumes.

The bargaining power of customers in the oil and natural gas sector is substantial, driven by the commodity nature of the products and the presence of large-volume buyers. With minimal switching costs and high market transparency, customers can easily compare prices and negotiate favorable terms, directly impacting producers like Vanguard Natural Resources LLC.

In 2024, the influence of major refiners and midstream companies, such as Marathon Petroleum, remains significant due to their immense purchasing power. These entities can leverage their scale to secure lower prices for crude oil and natural gas, as evidenced by the price fluctuations of WTI and Henry Hub natural gas throughout the year, which averaged around $75-$80 per barrel for WTI and ranged from below $2 to over $3 per MMBtu for natural gas.

The ability of customers to switch suppliers with ease, coupled with the commoditized nature of energy resources, compels producers to maintain competitive pricing and service. This dynamic limits individual producers' pricing power, as market prices are largely dictated by broader supply and demand forces, making it challenging for companies like Grizzly Energy to command premium pricing.

| Factor | Impact on Customer Bargaining Power | Example (2024 Data) |

|---|---|---|

| Product Differentiation | Low differentiation increases power | Oil and natural gas are largely undifferentiated commodities. |

| Buyer Volume | High volume increases power | Major refiners like Marathon Petroleum purchase vast quantities. |

| Switching Costs | Low switching costs increase power | Minimal costs for customers to change natural gas suppliers. |

| Market Transparency | High transparency increases power | Real-time pricing data for WTI and Henry Hub natural gas. |

| Demand Sensitivity | Weak demand increases power | Economic downturns can lead to lower energy consumption and higher customer leverage. |

Same Document Delivered

Vanguard Natural Resources LLC Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Vanguard Natural Resources LLC, providing an in-depth examination of industry competition. The document you see here is precisely what you'll receive immediately after purchase, offering a ready-to-use strategic overview. It meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the natural resources sector.

Rivalry Among Competitors

The U.S. onshore oil and gas exploration and production (E&P) sector, the operational arena for companies like Vanguard Natural Resources LLC (VNR), is intensely competitive. It features a broad spectrum of players, from nimble independent producers to vast integrated oil majors. This diversity means VNR faces rivals of all sizes, each with different strengths and strategies.

In 2024, the U.S. E&P landscape continues to be populated by thousands of independent companies, alongside the major integrated players. For instance, the number of active drilling rigs in the U.S. fluctuated throughout 2024, with the Baker Hughes U.S. Rotary Rig Count averaging around 620 for the year, indicating a substantial number of active participants. This high level of activity underscores the constant jostling for prime acreage, skilled labor, and access to capital.

This crowded field forces companies like VNR to remain highly attuned to market dynamics and competitor actions. Whether it's a small private firm acquiring leases or a major investing heavily in new technology, every move by these diverse competitors impacts VNR's ability to secure resources and achieve its strategic objectives.

The oil and natural gas sector, particularly in established regions where companies like Grizzly Energy operate, often sees growth slow down. This slower pace naturally cranks up the competition for available projects and resources.

In such mature markets, the fight for market share frequently boils down to price and operational efficiency. Companies can't just rely on the market getting bigger; they have to out-perform rivals on cost and productivity. For instance, in 2024, the U.S. Energy Information Administration (EIA) projected modest growth for natural gas production, underscoring the need for efficiency gains.

Energy exploration and production (E&P) firms like Vanguard Natural Resources LLC typically face substantial fixed costs. These include significant investments in drilling equipment, pipelines, and the acquisition of oil and gas leases. For instance, in 2023, capital expenditures for E&P companies often ran into hundreds of millions, if not billions, of dollars, reflecting the upfront investment required.

These high fixed costs, coupled with the specialized nature of their assets, create formidable exit barriers. Companies are often compelled to continue operating and producing, even when market prices are low, simply to recoup their substantial investments and cover ongoing operational expenses. This dynamic can lead to an oversupply of oil and gas, intensifying price competition and putting downward pressure on profit margins for all players, including Vanguard Natural Resources.

Product Differentiation (Limited)

In the oil and natural gas sector, product differentiation is inherently limited because these are commodity products. This means that the core offering – crude oil or natural gas – is largely the same across producers.

Consequently, competition intensifies around factors like cost efficiency, operational excellence, securing access to prime drilling locations, and astute management of existing energy assets. For instance, Vanguard Natural Resources LLC, like its peers, must focus on these operational advantages to stand out.

- Limited Product Differentiation: Oil and natural gas are commodities, making it difficult to differentiate based on product features.

- Key Competitive Factors: Competition hinges on cost efficiency, operational excellence, acreage access, and strategic asset management.

- Vanguard's Strategy: Vanguard Natural Resources LLC's success relies on optimizing production and managing its asset portfolio effectively in a largely undifferentiated market.

Mergers, Acquisitions, and Divestitures

The exploration and production (E&P) sector is characterized by frequent mergers, acquisitions, and divestitures that can quickly reshape the competitive arena. Companies often buy assets to boost economies of scale, secure new reserves, or streamline their holdings, leading to the emergence of larger, more powerful rivals or novel strategic partnerships.

For instance, in 2024, the oil and gas industry saw significant M&A activity. The total value of global oil and gas M&A deals reached an estimated $200 billion by the third quarter of 2024, a substantial increase from the previous year. This trend directly impacts competitive rivalry by consolidating market share and creating entities with greater operational leverage.

Grizzly Energy's approach to strategic asset management, including its active portfolio adjustments, is a direct response to this constantly shifting industry dynamic. Such maneuvers are designed to optimize the company's position within a landscape where competitors are continually consolidating or divesting to gain strategic advantages.

- E&P industry M&A activity in 2024 has significantly altered competitive dynamics.

- Acquisitions aim for economies of scale, new reserves, and portfolio rationalization.

- Grizzly Energy's active portfolio management reflects this M&A-driven environment.

- The total value of global oil and gas M&A deals was approximately $200 billion by Q3 2024.

The competitive rivalry within the U.S. onshore oil and gas exploration and production sector is exceptionally fierce. Vanguard Natural Resources LLC operates in an environment populated by thousands of independent producers and major integrated companies, all vying for resources and market share.

In 2024, the U.S. rig count averaged around 620, indicating sustained high activity and intense competition for prime acreage and skilled labor. This constant activity means companies like Vanguard must remain highly responsive to market shifts and competitor strategies.

The commodity nature of oil and gas means differentiation is minimal, pushing competition towards cost efficiency, operational excellence, and strategic asset management. Companies must out-perform rivals on cost and productivity, as demonstrated by the modest projected growth in natural gas production for 2024, according to the EIA.

Significant M&A activity in 2024, with global deals reaching approximately $200 billion by Q3, further intensifies rivalry by consolidating market share and creating larger, more powerful competitors, forcing companies like Vanguard to actively manage their portfolios.

| Factor | Description | 2024 Data/Context |

|---|---|---|

| Number of Competitors | Thousands of independent producers and major integrated oil companies. | U.S. Rotary Rig Count averaged ~620 throughout 2024. |

| Product Differentiation | Limited, as oil and gas are commodities. | Competition centers on cost, efficiency, and asset management. |

| Exit Barriers | High fixed costs and specialized assets. | Companies often continue production even at low prices to recoup investments. |

| Industry Consolidation | Frequent mergers, acquisitions, and divestitures. | Global oil & gas M&A value reached ~$200 billion by Q3 2024. |

SSubstitutes Threaten

The accelerating growth of renewable energy sources like solar and wind presents a significant threat of substitution for traditional fossil fuels. By early 2024, global renewable energy capacity continued its upward trajectory, with solar photovoltaic installations alone adding substantial gigawatts. This expansion directly impacts the demand for oil and natural gas, especially in power generation and emerging transportation sectors, potentially shrinking the addressable market for companies like Vanguard Natural Resources LLC.

The accelerating development and adoption of electric vehicles (EVs) pose a significant threat to traditional gasoline demand, a core product derived from crude oil. As EV performance improves and charging networks become more widespread, the appeal and practicality of internal combustion engine vehicles are diminishing, directly impacting the market for oil. For instance, by the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, signaling a clear shift in consumer preference and energy consumption patterns that could reduce future oil demand.

Improvements in energy efficiency and conservation are a significant threat. For instance, by 2024, the International Energy Agency reported that advancements in smart grid technology and more efficient appliances are steadily reducing energy demand per household. This directly impacts the need for traditional energy sources like those supplied by Vanguard Natural Resources LLC.

Sustainable building practices and a growing consumer focus on reducing their carbon footprint further exacerbate this threat. As more individuals and businesses adopt these measures, the overall demand for oil and natural gas can decline. This gradual erosion of the demand base poses a challenge to companies reliant on these commodities.

Development of Alternative Fuels

The advancement of alternative fuels like biofuels, hydrogen, and sophisticated battery storage presents a growing threat to traditional fossil fuel demand. While currently occupying niche markets, significant research and investment are fueling their potential to replace fossil fuels in various sectors.

These emerging energy sources offer distinct environmental and economic advantages, directly challenging the established market position of fossil fuels. For instance, by 2024, the global green hydrogen market is projected to reach substantial figures, indicating increasing adoption and technological progress.

- Biofuels: Continued innovation in cellulosic ethanol and sustainable aviation fuel could reduce reliance on gasoline and jet fuel.

- Hydrogen: Growing investment in fuel cell technology for transportation and industrial processes offers a clean alternative.

- Battery Storage: Advancements in battery density and cost reduction are making electric vehicles and grid-scale storage more competitive.

- Market Projections: The International Energy Agency reported in 2024 that renewable energy sources, including those powered by advanced storage, are increasingly expected to meet global energy demand growth.

Government Policies and Carbon Pricing

Government policies designed to curb carbon emissions, such as carbon taxes and renewable energy mandates, directly impact the cost of fossil fuels. For instance, the European Union's Emissions Trading System (EU ETS) has seen carbon prices fluctuate, reaching over €100 per tonne of CO2 in early 2024, making cleaner energy sources more competitive. These regulations incentivize a shift away from oil and natural gas, thereby increasing the threat of substitutes for companies like Vanguard Natural Resources LLC.

Regulatory frameworks that promote renewable energy adoption, like the Inflation Reduction Act in the United States, further enhance the attractiveness of alternative energy sources. The IRA, enacted in 2022, offers significant tax credits for solar, wind, and other clean energy technologies, accelerating their deployment and reducing their cost. This creates a more challenging competitive landscape for traditional hydrocarbon producers.

The increasing global focus on climate change and the implementation of national and international climate agreements underscore the growing influence of government policy on energy markets. By 2024, a significant number of countries have established net-zero emission targets, which will likely lead to stricter regulations on fossil fuel extraction and consumption. This trend amplifies the threat of substitutes, as policy-driven demand shifts favor renewable and lower-carbon energy alternatives.

- Carbon Pricing Impact: Policies like carbon taxes make fossil fuels more expensive, enhancing the economic viability of substitutes.

- Renewable Energy Incentives: Government subsidies and tax credits for renewables accelerate their adoption and cost reduction.

- Global Climate Targets: Widespread net-zero commitments by 2024 signal a long-term trend favoring cleaner energy alternatives.

The increasing adoption of renewable energy sources and electric vehicles presents a substantial threat of substitution for traditional fossil fuels. By early 2024, global renewable energy capacity continued its rapid expansion, with solar and wind power leading the charge. This shift directly impacts demand for oil and natural gas, particularly in the transportation and power generation sectors, potentially shrinking the market for companies like Vanguard Natural Resources LLC.

Advancements in energy efficiency and the growing consumer preference for sustainable practices also contribute to this threat. By 2024, initiatives promoting energy conservation and the adoption of greener technologies were steadily reducing overall energy consumption. This trend, coupled with government policies like carbon pricing and renewable energy incentives, further amplifies the competitive pressure from substitute energy sources.

| Substitute Energy Source | Key Developments (Early 2024) | Impact on Fossil Fuels |

|---|---|---|

| Renewable Energy (Solar & Wind) | Continued capacity expansion, cost reductions | Reduced demand in power generation |

| Electric Vehicles (EVs) | Surpassing 13.6 million global sales in 2023, expanding charging infrastructure | Decreased gasoline demand |

| Energy Efficiency & Conservation | Smart grid technology, efficient appliances | Lower overall energy consumption |

| Alternative Fuels (Biofuels, Hydrogen) | Growing investment, market expansion projections | Potential displacement in transportation and industry |

Entrants Threaten

The oil and natural gas exploration and production (E&P) sector demands colossal capital outlays. Companies need substantial funds for exploration, drilling operations, building essential infrastructure like pipelines, and acquiring valuable land rights. For instance, in 2024, the average cost to drill and complete a horizontal oil well in the Permian Basin could range from $6 million to $10 million, highlighting the immense financial commitment required.

Newcomers face a daunting challenge in matching the financial muscle of established entities. Without access to billions in funding, a new entrant simply cannot acquire the necessary assets or operational scale to compete. This necessity for massive upfront investment serves as a significant deterrent, effectively limiting the number of new players entering the market and protecting existing companies.

Established players in the oil and gas sector, such as those operating in the Permian Basin, often hold significant leasehold positions and proven reserves. For example, as of Q1 2024, companies with established acreage in prolific basins have a distinct advantage in securing future production.

New entrants find it difficult to acquire economically viable acreage, particularly in mature and productive regions where prime locations are already controlled by existing companies. This scarcity of desirable land presents a substantial barrier to entry, impacting the potential for new companies to establish a foothold.

Access to high-quality reserves is not just beneficial but essential for the long-term viability of any oil and gas operation. The significant capital required to explore and develop new reserves, coupled with the competition for existing, proven resources, makes this a major hurdle for any new entity seeking to enter the market.

The oil and gas sector faces substantial regulatory burdens, including rigorous environmental standards and permitting requirements. New companies entering this market must possess deep knowledge and significant capital to ensure compliance with these complex rules, which can significantly deter potential entrants.

Navigating the intricate web of environmental regulations, safety protocols, and permitting processes is a major barrier for new players in the oil and gas industry. For instance, the Environmental Protection Agency (EPA) in the United States enforces numerous regulations impacting exploration, production, and emissions, requiring substantial investment in compliance technologies and expertise.

The time and financial resources needed to secure the necessary permits for operations can be considerable, often running into millions of dollars and taking years to finalize. This lengthy and costly process acts as a powerful deterrent, protecting established companies like Vanguard Natural Resources LLC from immediate new competition.

Technological Expertise and Operational Experience

The energy sector, particularly exploration and production (E&P), demands deep technological expertise. Success hinges on mastering sophisticated techniques such as advanced seismic imaging for subsurface analysis, precision horizontal drilling, and efficient hydraulic fracturing. Companies like Vanguard Natural Resources LLC, through years of operation, have cultivated this specialized knowledge. For instance, in 2024, the cost of acquiring advanced geological data and the capital expenditure for specialized drilling equipment can easily run into tens of millions of dollars, a significant barrier for newcomers.

Operational experience is equally critical. Managing complex E&P projects involves navigating intricate regulatory landscapes, ensuring stringent safety protocols, and optimizing production from diverse geological formations. New entrants typically lack this accumulated practical know-how, making it challenging to achieve cost-effective and safe operations compared to established players. This experience gap translates directly into higher initial operating costs and increased risk for those without a proven track record in the field.

- Specialized Technology: Expertise in seismic imaging, horizontal drilling, and hydraulic fracturing is essential for efficient resource extraction.

- Operational Know-How: Years of experience in managing complex projects safely and efficiently are vital for success.

- Capital Intensity: High upfront costs for advanced technology and equipment create a significant barrier to entry.

- Risk Mitigation: Established companies benefit from a proven track record, reducing perceived risk for investors and partners.

Economies of Scale and Cost Advantages

Existing energy exploration and production (E&P) companies, like Vanguard Natural Resources LLC, often possess significant economies of scale. This allows them to achieve lower per-unit costs through bulk purchasing of materials, more efficient use of existing infrastructure, and streamlined operational processes across a larger number of wells and fields. For instance, in 2024, major E&P players continued to benefit from optimized supply chains and shared fixed costs, which new, smaller entrants struggle to replicate.

New entrants typically start with a smaller operational footprint, leading to higher per-unit costs for everything from drilling equipment to administrative overhead. This cost disadvantage makes it challenging for them to compete on price with established companies that have already amortized much of their infrastructure and benefit from ongoing operational efficiencies. Grizzly Energy's strategy, for example, emphasizes efficient production and strategic asset management, aiming to leverage these scale-related advantages to remain competitive.

- Economies of Scale: Established E&P firms benefit from lower per-unit costs due to larger production volumes and asset bases.

- Infrastructure Utilization: Existing companies can spread the cost of pipelines, processing facilities, and transportation networks over more output.

- Procurement Advantages: Larger entities often secure better pricing on essential supplies and services through bulk purchasing power.

- Operational Efficiencies: A broader operational scope allows for greater specialization and optimization of labor and equipment.

The threat of new entrants for Vanguard Natural Resources LLC is significantly low due to the immense capital requirements in the oil and gas sector. For example, in 2024, the average cost to drill and complete a horizontal oil well in the Permian Basin ranged from $6 million to $10 million, a substantial barrier for any newcomer. Furthermore, established players benefit from proprietary technological expertise and operational know-how, making it difficult for inexperienced companies to compete effectively.

Access to prime acreage and proven reserves is another major hurdle, as much of the desirable land is already controlled by existing entities. The complex regulatory environment and lengthy permitting processes, often costing millions and taking years, also deter new market participants. These factors, combined with the significant economies of scale enjoyed by established companies, create a formidable defense against new competition.

| Barrier to Entry | Description | 2024/2025 Relevance |

| Capital Intensity | Requires billions for exploration, drilling, and infrastructure. | Permian Basin well costs: $6M-$10M (2024). |

| Access to Resources | Difficulty securing economically viable acreage and proven reserves. | Established leasehold positions offer significant advantage. |

| Regulatory Hurdles | Complex environmental standards, safety protocols, and permitting. | EPA regulations require substantial compliance investment. |

| Technological Expertise | Need for advanced seismic imaging, drilling, and fracturing techniques. | Advanced geological data and drilling equipment cost tens of millions. |

| Economies of Scale | Established firms benefit from lower per-unit costs and efficient operations. | Optimized supply chains and shared fixed costs for major E&P players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Vanguard Natural Resources LLC is built upon a foundation of publicly available information, including their SEC filings (10-K, 10-Q), investor presentations, and annual reports. We supplement this with industry-specific data from reputable sources like the EIA and energy sector trade publications to capture market dynamics.