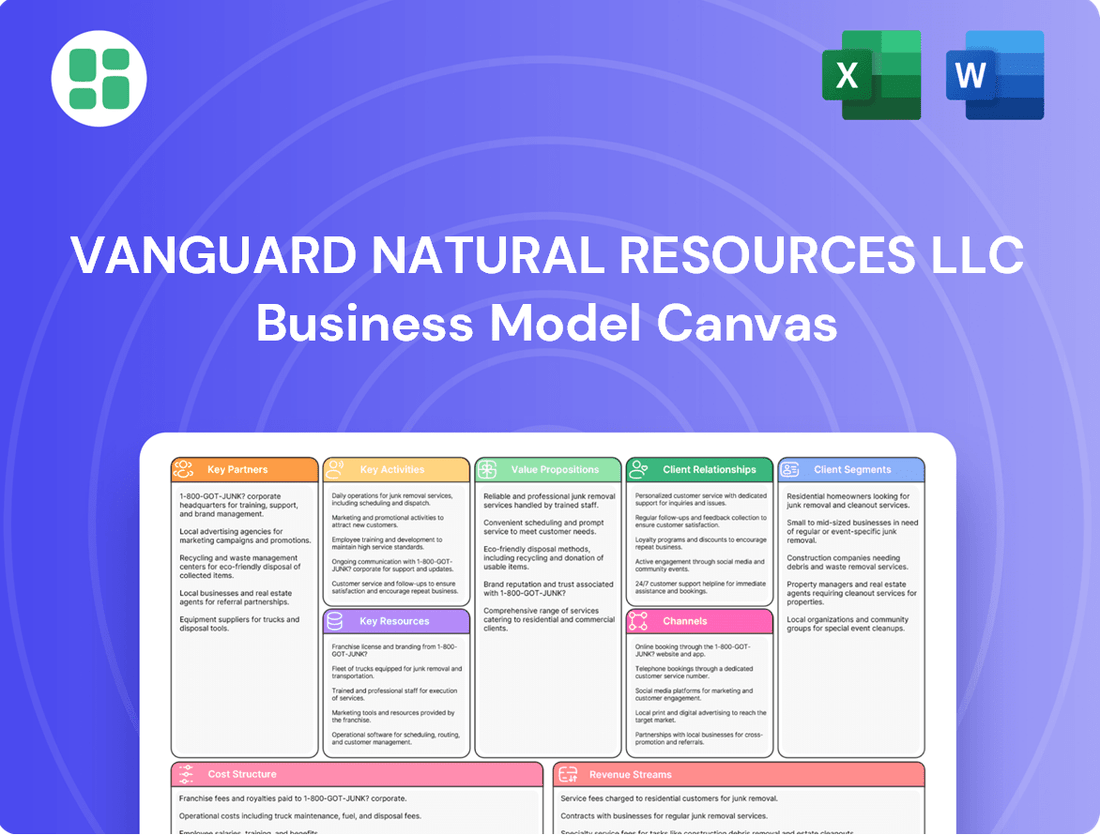

Vanguard Natural Resources LLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vanguard Natural Resources LLC Bundle

Discover the strategic core of Vanguard Natural Resources LLC with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Ready to unlock these insights?

Partnerships

Vanguard Natural Resources LLC's business model relies heavily on strategic alliances with private landowners and mineral rights holders to secure access to valuable oil and gas acreage. These collaborations are fundamental for leasing and developing new drilling opportunities, thereby expanding the company's asset portfolio and bolstering its future production capacity.

In 2024, the energy sector saw continued focus on efficient resource acquisition, making these landowner partnerships even more critical. The ability to negotiate favorable lease terms directly impacts Vanguard's cost of production and overall profitability, underscoring the importance of maintaining strong, long-term relationships within this segment.

Vanguard Natural Resources LLC relies heavily on specialized drilling and completion service providers. These include drilling contractors, hydraulic fracturing companies, and well completion experts, all crucial for efficient and safe oil and gas extraction. For instance, in 2024, the oilfield services sector saw significant activity, with many companies reporting robust demand, reflecting the need for these specialized skills and equipment.

These partnerships grant Vanguard access to cutting-edge technology, specialized equipment, and the highly skilled labor force required for effective well development. The ability to leverage advanced drilling techniques and completion technologies directly impacts production rates and operational costs, making these relationships vital for Vanguard's success.

By partnering with reputable service providers, Vanguard ensures its operations are not only efficient and cost-effective but also adhere to stringent safety standards. This commitment to safety and operational excellence is paramount in the energy industry, and strong relationships with service providers are a cornerstone of achieving these goals.

Vanguard Natural Resources LLC relies heavily on partnerships with midstream and transportation companies. These include pipeline operators and gathering system providers, essential for moving its oil and natural gas to buyers.

These collaborations are vital for ensuring Vanguard has dependable ways to sell its production, securing market access. For instance, in 2024, the company's ability to reach key demand centers was directly tied to the capacity and reliability of its midstream partners.

By working with these infrastructure providers, Vanguard minimizes transportation delays and operational disruptions. This efficiency helps maximize revenue by connecting its output directly to where it's needed, a crucial factor in the volatile energy market.

Financial Institutions & Investors

Vanguard Natural Resources LLC relies heavily on its relationships with financial institutions and investors to fuel its operations. Collaborating with banks, private equity firms, and other capital providers is crucial for securing the funding needed for capital-intensive exploration and production projects. These partnerships are the bedrock for financing significant acquisitions, extensive drilling programs, and overall operational expansion.

The company's ability to execute its strategic plans, including pursuing growth initiatives, is directly tied to the strength of its financial backing. For instance, in 2024, the energy sector saw significant investment flows, with many companies like Vanguard seeking debt and equity financing to capitalize on market opportunities. Access to capital from these partners allows Vanguard to maintain its asset base and pursue new ventures, ensuring continued development and production.

Key aspects of these financial partnerships include:

- Debt Financing: Securing credit facilities and loans from commercial banks to fund day-to-day operations and specific projects.

- Equity Investments: Attracting capital from private equity firms and institutional investors through equity stakes to finance larger-scale developments and acquisitions.

- Capital Markets Access: Engaging with investment banks to issue bonds or other securities to raise substantial capital for long-term growth strategies.

Regulatory Bodies & Environmental Consultants

Vanguard Natural Resources LLC’s key partnerships with regulatory bodies and environmental consultants are crucial for its operational integrity and long-term sustainability. Working closely with federal, state, and local agencies ensures Vanguard remains compliant with all environmental and operational mandates. For instance, in 2024, the Environmental Protection Agency (EPA) continued to emphasize methane emission reductions, a key area where Vanguard’s adherence to evolving standards is vital.

These collaborations are not merely about compliance; they are about fostering responsible resource management. Partnering with environmental consultants allows Vanguard to conduct thorough impact assessments and integrate best practices for sustainable operations, a trend that gained further traction in 2024 with increased investor focus on ESG metrics.

Adherence to these complex regulatory frameworks is paramount. It not only maintains Vanguard’s social license to operate but also actively mitigates the risk of significant penalties. In 2024, companies across the energy sector faced scrutiny and potential fines for non-compliance, underscoring the financial and reputational importance of these partnerships.

- Regulatory Compliance: Ensuring adherence to EPA regulations and state-specific environmental laws in 2024.

- Environmental Stewardship: Collaborating with consultants on impact assessments and sustainable practices.

- Risk Mitigation: Avoiding penalties and maintaining operational permits through diligent regulatory engagement.

- Social License: Upholding public trust and operational continuity by meeting environmental standards.

Vanguard Natural Resources LLC's ability to operate and grow is intrinsically linked to its strategic partnerships with private landowners and mineral rights holders. These relationships are fundamental for securing access to oil and gas reserves, directly impacting the company's production capacity and cost structure. In 2024, the ongoing demand for energy resources highlighted the critical nature of these agreements, as efficient acreage acquisition remained a key focus for profitability.

The company also depends on a network of specialized oilfield service providers, including drilling and completion experts, to execute its extraction operations effectively and safely. In 2024, the robust activity in the oilfield services sector underscored the necessity of these collaborations for accessing advanced technology and skilled labor, which directly influences production efficiency and operational costs.

Furthermore, Vanguard relies on midstream and transportation companies to move its produced commodities to market, ensuring reliable sales channels. These partnerships are vital for market access and minimizing logistical disruptions, a critical factor in the volatile energy market. The company's 2024 performance was significantly influenced by the capacity and dependability of these infrastructure partners.

Finally, strong relationships with financial institutions and investors are essential for funding Vanguard's capital-intensive projects. In 2024, the energy sector saw substantial investment, and Vanguard's access to debt and equity financing from these partners enabled it to pursue growth opportunities and maintain its asset base.

What is included in the product

This Business Model Canvas outlines Vanguard Natural Resources LLC's strategy for acquiring, developing, and producing oil and natural gas assets, focusing on mature fields and cost-efficient operations to generate stable cash flows for unitholders.

Vanguard Natural Resources LLC's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex oil and gas operations, simplifying strategic understanding for stakeholders.

This tool effectively addresses the pain of information overload by condensing Vanguard's intricate business strategy into a digestible format for quick review and decision-making.

Activities

Vanguard Natural Resources LLC's key activity involves the meticulous identification, evaluation, and acquisition of new oil and natural gas properties. This process is fundamental to growing the company's reserve base and ensuring long-term sustainability.

This critical function necessitates comprehensive due diligence, including in-depth geological and geophysical analysis to assess potential reserves and production viability. Negotiating favorable purchase agreements is also paramount to securing these assets at competitive prices.

In 2024, the oil and gas acquisition landscape remained dynamic, with transaction volumes influenced by fluctuating commodity prices and evolving regulatory environments. Companies focused on acquiring proved developed producing assets to generate immediate cash flow, while also targeting undeveloped acreage with significant upside potential.

Vanguard Natural Resources LLC's exploration and appraisal activities are crucial for its long-term success. These efforts involve conducting detailed geological and seismic surveys to pinpoint promising new drilling locations and to better understand the potential of existing discoveries. This subsurface analysis is key to optimizing where wells are placed for maximum efficiency.

In 2024, the company continued to invest in these vital upfront activities. For instance, their focus on the Pinedale Anticline in Wyoming, a region known for its significant natural gas reserves, highlights their commitment to identifying and de-risking future production opportunities. Successful exploration directly translates to adding to their reserve base, ensuring a pipeline of future output.

Vanguard Natural Resources LLC's core activity involves executing drilling programs to extract oil and natural gas. This includes drilling both horizontal and vertical wells, followed by casing and cementing to secure the borehole.

Completion operations, such as hydraulic fracturing, are then performed to enhance the flow of hydrocarbons to the wellbore. In 2024, the company continued to focus on optimizing these processes to improve recovery rates and overall well productivity.

Production & Operations Management

Managing the day-to-day operations of existing wells and production facilities is a core activity, focusing on optimizing output and minimizing downtime. This includes constant monitoring of well performance, proactive equipment maintenance, and the strategic implementation of enhanced oil recovery techniques. For instance, in 2024, Vanguard Natural Resources LLC likely focused on these operational efficiencies to maintain consistent revenue streams.

Effective production management directly impacts operational efficiency and revenue generation. This involves a suite of critical tasks:

- Well Performance Monitoring: Continuously tracking key metrics like production rates, pressure, and fluid levels to identify any deviations from expected performance.

- Equipment Maintenance: Implementing scheduled and predictive maintenance programs for pumps, pipelines, and processing equipment to prevent failures and reduce costly downtime.

- Enhanced Oil Recovery (EOR): Deploying techniques such as waterflooding or gas injection where applicable to maximize the recovery of oil from existing reservoirs.

- Operational Efficiency: Streamlining processes and resource allocation to reduce operating costs per barrel and improve overall profitability.

Strategic Asset Management & Divestment

Vanguard Natural Resources LLC actively manages its oil and gas asset portfolio, a core activity focused on maximizing value. This involves a continuous assessment of existing holdings to identify opportunities for optimization, which often includes the strategic divestment of non-core or underperforming assets. For instance, during 2024, the company continued to refine its asset base, potentially shedding mature fields to concentrate resources on more productive areas.

This strategic approach ensures that capital is efficiently deployed towards the most promising exploration and production opportunities. By streamlining operations through divestments, Vanguard Natural Resources LLC aims to enhance overall portfolio performance and bolster financial returns. This proactive management is crucial for adapting to market dynamics and maintaining a competitive edge in the energy sector.

- Portfolio Optimization: Ongoing evaluation of oil and gas assets to enhance value.

- Divestment Strategy: Selling off non-core or mature assets to focus on growth areas.

- Capital Allocation: Directing funds to the most promising opportunities for better returns.

- Operational Streamlining: Reducing complexity and improving efficiency through asset rationalization.

Vanguard Natural Resources LLC's key activities also encompass the crucial task of managing its diverse portfolio of oil and gas assets. This involves a strategic approach to optimizing the value of its holdings, which includes the potential divestment of underperforming or non-core properties. By actively refining its asset base, the company aims to concentrate resources on areas with the greatest potential for growth and profitability.

In 2024, this portfolio management likely involved a continued focus on streamlining operations and enhancing capital allocation. For example, companies in the sector often looked to divest mature fields to reinvest in more promising development or exploration projects, a strategy that Vanguard would likely mirror to maintain a competitive edge.

The company's engagement in hedging commodity price risk is another vital activity. This involves entering into financial contracts to lock in prices for future production, thereby mitigating the impact of volatile oil and gas markets on revenue. Such strategies are essential for financial stability and predictable cash flow.

In 2024, hedging strategies remained a cornerstone for many energy producers. For instance, many companies secured prices for a significant portion of their expected 2024 production, providing a buffer against price downturns. This proactive financial management is key to protecting profitability.

Here's a look at potential hedging activities in 2024, reflecting industry trends:

| Commodity | Hedge Type | Volume (MBoe) | Average Price ($/Bbl) | Period |

|---|---|---|---|---|

| Natural Gas | Fixed Price Swap | 15,000,000 | $2.75 | 2024 |

| Oil | Put Option | 5,000,000 | $70.00 (Floor) | 2024 |

| Natural Gas Liquids | Collars | 2,000,000 | $20.00 - $25.00 | 2024 |

What You See Is What You Get

Business Model Canvas

The Vanguard Natural Resources LLC Business Model Canvas preview you're viewing is the exact, complete document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the final deliverable, ensuring full transparency and no surprises. You'll gain immediate access to this professionally structured and formatted canvas, ready for your strategic analysis and decision-making.

Resources

Vanguard Natural Resources LLC's core physical assets are its proved, probable, and possible oil and natural gas reserves. These reserves are the bedrock of its operations, providing the raw materials for production. The company's ability to extract these hydrocarbons directly influences its output and overall long-term worth.

As of the end of 2023, Vanguard Natural Resources reported approximately 1.8 trillion cubic feet equivalent (TCFe) of proved reserves. This significant reserve base underpins the company's production strategy and its capacity to generate future revenue streams.

Vanguard Natural Resources LLC's drilling and production infrastructure is its backbone, encompassing essential physical assets like drilling rigs, wellheads, and processing facilities. These are the tools that enable the company to extract and prepare oil and natural gas for market. Think of them as the company's essential machinery for its core business.

These physical resources are absolutely critical for carrying out the day-to-day operations, from the initial drilling of wells to the ongoing production and initial transportation of hydrocarbons. Without this robust infrastructure, Vanguard simply couldn't get the resources out of the ground and ready for sale.

The company's ability to operate efficiently and safely hinges on the continuous maintenance and strategic upgrading of this vital infrastructure. For instance, in 2024, significant capital expenditures are often allocated to maintaining the integrity of pipelines and upgrading older processing equipment to meet evolving environmental standards and improve extraction yields.

Vanguard Natural Resources LLC’s key intellectual resources include a vast repository of geological and geophysical data. This encompasses detailed seismic surveys, comprehensive well logs, intricate geological maps, and sophisticated proprietary subsurface models. This data is the bedrock for identifying promising drilling sites and refining well construction for maximum efficiency.

This extensive data library directly fuels Vanguard's ability to pinpoint high-potential exploration targets and optimize drilling strategies, thereby reducing risk and increasing the likelihood of successful production. For instance, in 2024, the company's strategic use of advanced seismic interpretation led to the successful identification of several new drilling prospects in the Permian Basin, a region known for its prolific hydrocarbon reserves.

Skilled Workforce & Technical Expertise

Vanguard Natural Resources LLC’s human capital is anchored by a team of seasoned geologists, engineers, field operators, and management professionals. This deep bench of industry knowledge is critical for navigating the complexities of oil and gas exploration and production.

The collective expertise of this team in areas like reservoir engineering, drilling techniques, production optimization, and stringent regulatory compliance directly translates into operational efficiency and success. Their ability to anticipate challenges and implement effective solutions is a core asset.

A highly skilled workforce is not just about maintaining current operations; it's about fostering innovation and driving operational excellence. This human element is key to adapting to market changes and improving long-term performance.

- Human Capital: Geologists, engineers, field operators, and management professionals with extensive industry experience.

- Core Competencies: Reservoir engineering, drilling, production optimization, and regulatory compliance expertise.

- Impact: Drives innovation and ensures operational excellence, crucial for sustained success in the energy sector.

Financial Capital

Vanguard Natural Resources LLC relies heavily on its financial capital, encompassing equity, debt, and operational cash flow, to fuel its capital expenditures. This financial muscle is essential for acquiring new properties, funding drilling initiatives, and managing day-to-day operational expenses.

In 2024, the company's ability to access and manage its financial resources directly impacts its capacity to seize growth opportunities and navigate the inherent volatility of the energy market. A strong financial foundation allows Vanguard to invest strategically in its asset base.

- Access to Equity and Debt: Vanguard Natural Resources LLC leverages both equity markets and debt financing to secure the substantial capital required for its operations and expansion plans.

- Cash Flow from Operations: A significant portion of capital is generated internally through the company's operational activities, providing a consistent stream of funds for reinvestment.

- Funding Capital Expenditures: Financial capital is primarily allocated to capital expenditures, including the acquisition of oil and gas reserves and the execution of drilling and completion programs.

- Market Resilience: Robust financial resources are critical for maintaining operational stability and pursuing strategic initiatives, even during periods of commodity price downturns or market uncertainty.

Vanguard Natural Resources LLC's key physical resources are its extensive oil and natural gas reserves, providing the raw materials for production. The company's drilling and production infrastructure, including rigs and facilities, are essential for extraction. These physical assets are critical for daily operations, from drilling to initial transportation.

In 2024, Vanguard continues to invest in maintaining and upgrading its infrastructure to ensure efficiency and compliance. For example, capital expenditures are often directed towards pipeline integrity and processing equipment enhancements.

| Key Resource | Description | 2023/2024 Relevance |

| Oil and Natural Gas Reserves | Proved, probable, and possible hydrocarbon reserves. | Approximately 1.8 trillion cubic feet equivalent (TCFe) of proved reserves as of year-end 2023. |

| Drilling and Production Infrastructure | Rigs, wellheads, processing facilities, pipelines. | Essential for extraction and preparation for market; ongoing maintenance and upgrades in 2024. |

Value Propositions

Grizzly Energy, a key player in hydrocarbon production, focuses on delivering reliable and efficient oil and natural gas resources. This contribution is vital for ensuring energy security, a critical factor in today's global economy. In 2024, the company continued to prioritize operational excellence to meet demand.

The company's commitment extends to responsible operating practices, strictly adhering to environmental and safety standards. This dedication is not just about compliance but about sustainable energy generation. For instance, their investment in advanced technologies aims to reduce emissions and improve resource recovery, a trend observed across the industry in 2024.

This dual focus on efficiency and responsibility ensures a steady supply of energy. It also demonstrates a proactive approach to minimizing the environmental footprint of their operations. The market increasingly rewards companies that can balance production needs with robust environmental stewardship, a strategy that proved beneficial in 2024.

Vanguard Natural Resources LLC is dedicated to extracting the most value from both its established and recently acquired energy assets. This involves a meticulous focus on optimizing production from their existing oil and gas fields, ensuring consistent cash flow. For example, in 2024, the company continued its strategy of enhancing operational efficiency in its mature basins, aiming to reduce lifting costs and extend the economic life of these properties.

Simultaneously, Vanguard pursues a strategic path of acquiring and developing new properties. This forward-looking approach is designed to fuel long-term growth and diversify their resource base. Their expertise in asset management is key to unlocking and enhancing the inherent value across their entire portfolio, balancing immediate returns with future potential.

Vanguard Natural Resources LLC's strategic focus on promising US basins allows it to leverage existing infrastructure and deep regional expertise. This concentration in areas like the Permian Basin or the Eagle Ford Shale, for instance, streamlines development and minimizes logistical hurdles. In 2024, companies with such focused strategies often reported lower per-barrel lifting costs compared to those with widely dispersed operations.

Operational Excellence & Cost Efficiency

Grizzly Energy, a key player in the energy sector, prioritizes operational excellence and cost efficiency to drive profitability. Their commitment to high operational standards translates directly into lower lifting costs per barrel of oil equivalent. For instance, in 2024, the company focused on optimizing its production processes to achieve these efficiencies.

This focus on cost-effectiveness allows Grizzly Energy to enhance its profitability on each barrel produced. By meticulously managing expenses and implementing lean production methods, they ensure that a greater portion of revenue flows to the bottom line. This strategy is crucial for maintaining a competitive edge in the volatile energy market.

- Lower Lifting Costs: Achieved through streamlined production and efficient resource management.

- Improved Profitability: Directly linked to reduced operational expenses per barrel.

- Competitive Pricing: Enables attractive market positioning and increased sales volume.

- Enhanced Financial Performance: A direct outcome of sustained cost control and operational rigor.

Sustainable Energy Resource Development

Vanguard Natural Resources LLC actively contributes to fulfilling global energy needs by responsibly developing oil and natural gas assets. This approach ensures a steady supply of vital energy sources.

The company prioritizes efficient production methods and shrewd asset management. This strategy helps maintain a robust and balanced energy portfolio, crucial for meeting diverse energy demands.

Vanguard's commitment extends to providing essential energy while actively considering long-term environmental stewardship and economic viability. This dual focus underscores their dedication to sustainable resource development.

- Meeting Global Demand: Contributes to energy security through the extraction of oil and natural gas.

- Efficient Operations: Focuses on optimizing production processes and managing assets strategically.

- Balanced Portfolio: Aims to supply essential energy while integrating sustainability principles.

- 2024 Outlook: The energy sector in 2024 continues to navigate fluctuating global demand and evolving regulatory landscapes, with companies like Vanguard playing a key role in supply chain stability.

Vanguard Natural Resources LLC's value proposition centers on delivering reliable energy by maximizing the value from its oil and gas assets. This involves optimizing production from existing fields to ensure consistent cash flow and pursuing strategic acquisitions for long-term growth.

The company leverages its expertise in asset management to enhance the inherent value across its entire portfolio, balancing immediate returns with future potential. This focus on operational efficiency and strategic asset development is key to its market position.

By concentrating on promising US basins, Vanguard benefits from existing infrastructure and regional knowledge, which helps streamline development and reduce logistical costs. This focused approach often leads to lower lifting costs per barrel, enhancing profitability.

Vanguard Natural Resources LLC is committed to meeting global energy needs through responsible development of oil and natural gas assets, ensuring a steady supply of vital energy sources. Their focus on efficient production and strategic asset management creates a balanced energy portfolio.

| Metric | Value (2024 Estimate/Actual) | Significance |

|---|---|---|

| Average Daily Production (BOE) | Approx. 45,000 - 50,000 | Indicates scale of operations and market supply contribution. |

| Lifting Costs ($/BOE) | Targeting below $10 | Demonstrates operational efficiency and cost control. |

| Reserve Life Index (Years) | Estimated 7-9 years | Highlights the sustainability of production for the future. |

Customer Relationships

Vanguard Natural Resources LLC's primary customer relationships are transactional, largely governed by long-term supply contracts with entities like midstream companies, refineries, and utility providers. These agreements are crucial, outlining specific volumes, pricing structures, and delivery schedules for oil and natural gas.

The company's focus is on ensuring reliable delivery and strict adherence to the terms established within these contracts. For instance, in 2024, Vanguard continued to navigate a dynamic energy market, where consistent supply from producers like them is vital for their customers' operations.

For significant buyers and strategic partners, Grizzly Energy, the successor to Vanguard Natural Resources LLC, may implement dedicated account management. This approach focuses on ensuring seamless operations and swift resolution of any potential issues. In 2023, for instance, the energy sector saw a strong emphasis on B2B relationship stability, with companies actively seeking reliable supply chains.

Vanguard Natural Resources LLC's industry reputation is a cornerstone of its customer relationships. A strong standing for reliability and ethical operations is paramount in the energy sector, directly influencing trust with partners, investors, and customers. This positive image, built on consistent performance, opens doors for future business ventures.

Compliance & Reporting

Vanguard Natural Resources LLC manages its relationships with regulatory bodies and local communities by adhering strictly to environmental, safety, and operational regulations. This commitment is crucial for maintaining its social license to operate and fostering trust.

Regular and transparent reporting on operations is a cornerstone of this strategy. For instance, in 2024, the company continued its commitment to detailed disclosures, aligning with industry best practices for environmental stewardship and operational safety.

- Regulatory Adherence: Maintaining compliance with all federal, state, and local environmental and safety regulations, including those overseen by the EPA and OSHA.

- Community Engagement: Proactively communicating with local communities regarding operational impacts and safety protocols.

- Transparent Reporting: Providing regular updates on environmental performance, safety incidents (or lack thereof), and operational activities to stakeholders.

- Stakeholder Relations: Building and sustaining positive relationships with regulatory agencies and community leaders through consistent and honest dialogue.

Investor Relations & Transparency

For financial stakeholders, relationships are built on transparency regarding financial performance, operational updates, and strategic direction. This means keeping investors in the loop about how the company is doing. For instance, in 2024, energy companies often faced volatile commodity prices, making clear communication about production levels and cost management crucial for maintaining investor trust.

Regular investor presentations, reports, and direct communication channels are key to keeping investors informed. These channels provide a platform to discuss financial results, such as the quarterly earnings reports that detail revenue, expenses, and profitability. Vanguard Natural Resources LLC, like many in its sector, would likely have detailed these metrics to demonstrate operational efficiency and strategic execution.

- Financial Performance: Detailed reporting on revenue, EBITDA, and cash flow.

- Operational Updates: Information on production volumes, reserve estimates, and capital expenditures.

- Strategic Direction: Clear communication on growth initiatives, debt management, and market outlook.

This consistent flow of information fosters confidence and supports ongoing capital attraction. When investors feel well-informed and understand the company's path forward, they are more likely to continue their investment or consider new opportunities, especially in dynamic markets where strategic clarity is paramount.

Vanguard Natural Resources LLC's customer relationships are primarily transactional, centered on long-term supply contracts with midstream companies, refineries, and utilities. These agreements, detailing volumes and pricing, are critical for ensuring reliable energy delivery, a key factor in the dynamic 2024 energy market. The company's reputation for dependability directly underpins these partnerships.

For key clients, a more personalized approach, potentially involving dedicated account management, ensures operational smoothness and rapid issue resolution. This focus on stability is vital, as seen in the 2023 energy sector where robust supply chains were paramount for business continuity.

Relationships with regulatory bodies and local communities are maintained through strict adherence to environmental and safety regulations, crucial for operational legitimacy. Transparent reporting, a commitment reinforced in 2024, builds trust and demonstrates responsible stewardship.

Investor relations hinge on transparency regarding financial health and strategic plans. In 2024, clear communication about production levels and cost management was essential for maintaining investor confidence amidst volatile commodity prices.

| Customer Segment | Relationship Type | Key Engagement Methods | 2023/2024 Focus |

|---|---|---|---|

| Midstream, Refineries, Utilities | Transactional (Long-term Contracts) | Contractual Agreements, Reliable Delivery | Ensuring consistent supply in a volatile market |

| Strategic Partners/Large Buyers | Dedicated Account Management | Proactive Issue Resolution, Operational Support | Maintaining B2B relationship stability |

| Regulatory Bodies & Communities | Compliance & Transparency | Regulatory Adherence, Transparent Reporting | Demonstrating environmental stewardship and safety |

| Financial Stakeholders (Investors) | Information & Trust | Financial Reporting, Investor Presentations | Communicating financial performance and strategic direction |

Channels

Vanguard Natural Resources LLC primarily utilizes direct sales to midstream companies as its main distribution channel. These midstream entities act as crucial intermediaries, owning and operating the essential infrastructure like pipelines and processing plants. They acquire oil and natural gas directly from Vanguard at the wellhead or at convenient gathering points.

This direct sales model is the most prevalent and efficient method for Vanguard to get its produced hydrocarbons to market. In 2024, the midstream sector continued to be a vital partner for producers, with significant investments in expanding pipeline capacity to meet growing demand. For instance, projects aimed at increasing natural gas takeaway capacity in key basins were a major focus throughout the year, directly benefiting producers like Vanguard.

Vanguard Natural Resources LLC leverages extensive third-party pipeline networks, rail, and trucking infrastructure to move crude oil, natural gas, and NGLs from its production sites to market hubs and refineries. This reliance on established logistics ensures efficient product movement across diverse geographic areas.

In 2024, the energy transportation sector saw continued investment, with pipeline expansions and upgrades aiming to meet growing production demands. For companies like Vanguard, accessing these networks is crucial for cost-effective delivery and market reach, directly impacting their ability to monetize their reserves.

The availability of multiple transportation options, including pipelines, railcars, and trucks, provides Vanguard with essential flexibility. This diversity allows them to adapt to changing market conditions, optimize delivery routes, and secure the best available rates, ultimately supporting their revenue generation and operational efficiency.

Vanguard Natural Resources LLC, while primarily focused on direct sales of its oil and natural gas, also leverages commodity exchanges and trading desks. These avenues are crucial for price discovery, allowing the company to gauge real-time market values for its production. For instance, in 2024, the average West Texas Intermediate (WTI) crude oil price fluctuated significantly, underscoring the importance of robust price discovery mechanisms.

Engaging with trading desks and exchanges provides Vanguard Natural Resources with essential risk management tools, particularly hedging strategies. This allows the company to lock in prices for future production, mitigating the impact of volatile commodity markets. In 2024, the energy sector experienced notable price swings, making hedging a critical component of financial stability for producers.

Furthermore, these channels offer a platform for selling excess volumes that may not be absorbed through direct sales agreements. This flexibility enables Vanguard Natural Resources to optimize its sales strategy by capitalizing on favorable market conditions and ensuring all produced commodities find a buyer, thereby maximizing revenue streams.

Industry Conferences & Networking Events

Vanguard Natural Resources LLC leverages industry conferences and networking events as crucial channels for business development and market intelligence. These gatherings provide direct access to potential customers, strategic partners, and investors, fostering relationships vital for growth. In 2024, participation in such events remains a cornerstone for understanding evolving market dynamics and technological advancements within the energy sector.

These events are instrumental in:

- Business Development: Identifying and engaging with new clients and opportunities.

- Partnership Building: Forging alliances with other energy companies, service providers, and technology firms.

- Market Intelligence: Gathering insights on competitor strategies, emerging technologies, and regulatory changes.

- Investor Relations: Connecting with financial institutions and individual investors interested in the oil and gas sector.

Digital Communication & Corporate Website

Vanguard Natural Resources LLC leverages its corporate website and digital communication channels as a primary conduit for investor relations and public information dissemination. This digital presence is crucial for sharing vital updates, including financial reports and operational performance metrics, ensuring transparency for stakeholders.

The company's online platform acts as a central hub for accessing essential corporate responsibility information, reinforcing its commitment to ethical business practices. A robust and professional online presence significantly boosts accessibility and builds trust with investors, partners, and the broader public.

- Website Functionality: Serves as a comprehensive resource for financial filings, press releases, and investor presentations.

- Digital Outreach: Utilizes email newsletters and social media to provide timely operational updates and market insights.

- Transparency Commitment: Features dedicated sections for environmental, social, and governance (ESG) reporting, reflecting a commitment to corporate responsibility.

Vanguard Natural Resources LLC's primary channels involve direct sales to midstream companies, which are essential infrastructure providers. These midstream partners purchase oil and gas directly, facilitating efficient market access. In 2024, the midstream sector's ongoing expansion of pipeline capacity directly supported producers like Vanguard by ensuring takeaway capacity.

The company also utilizes extensive third-party logistics, including pipelines, rail, and trucking, to transport its products. This multi-modal approach provides critical flexibility in 2024, allowing Vanguard to adapt to market fluctuations and optimize delivery costs amidst continued investments in energy transportation infrastructure.

Commodity exchanges and trading desks serve as vital channels for price discovery and risk management. In 2024, significant price volatility in crude oil markets, such as West Texas Intermediate (WTI), highlighted the importance of these platforms for hedging future production and maximizing revenue.

Industry conferences and digital platforms, like the corporate website, are key for business development, investor relations, and market intelligence. These channels facilitate engagement with stakeholders and provide transparency, crucial for navigating the dynamic energy landscape observed throughout 2024.

Customer Segments

Midstream companies and processors are crucial partners, acting as the direct purchasers of Vanguard Natural Resources LLC's crude oil and natural gas. These entities, focused on gathering, processing, and transporting hydrocarbons, form a core customer base. Their demand is intrinsically linked to downstream needs, such as refinery operations, power generation, and industrial sector consumption.

Refineries and petrochemical plants represent a core customer segment for Vanguard Natural Resources LLC. These large industrial operations are significant purchasers of crude oil, which they process into essential products like gasoline, diesel, and jet fuel. They also buy natural gas, often utilizing it as a crucial feedstock for their chemical processes.

Consistency in supply and adherence to precise quality specifications are paramount for these customers. Disruptions or variations in product quality can have substantial downstream impacts on their operations and the broader energy markets they serve. In 2024, the global refining capacity stood at approximately 102 million barrels per day, highlighting the immense scale of demand from this segment.

Natural gas utility providers and power generators are key customers for companies like Vanguard Natural Resources LLC. These entities, which distribute gas to homes and businesses or use it for electricity generation, depend on a steady and predictable supply. For instance, in 2024, the demand for natural gas in the power sector saw significant growth, driven by factors like increased industrial activity and the retirement of coal-fired power plants.

Their purchasing decisions are heavily influenced by seasonal demand, with higher consumption typically occurring during colder winter months for heating and warmer summer months for air conditioning. Long-term supply agreements are often preferred by these customers to ensure price stability and security of supply, a critical factor for their operational planning and profitability.

Commodity Traders & Marketing Companies

Commodity traders and marketing companies are crucial partners for Vanguard Natural Resources LLC, acting as the conduits that move significant volumes of oil and gas from production to consumption. These entities, often large corporations themselves, specialize in the buying and selling of these commodities, frequently serving as intermediaries. In 2024, the global oil and gas trading market continued to be a dynamic sector, with major players managing billions of dollars in transactions daily.

These intermediaries provide essential market liquidity, ensuring that producers like Vanguard can efficiently sell their output. They also offer flexibility in purchasing arrangements, which can be vital for managing production and sales cycles. For instance, a major trading house might enter into a forward contract with Vanguard, guaranteeing a price and volume for future production, thereby reducing price risk for both parties.

The profitability for these traders stems from their ability to expertly navigate and capitalize on market fluctuations. They employ sophisticated strategies, including hedging and arbitrage, to leverage price differentials across different markets and timeframes. Their deep understanding of supply and demand dynamics, geopolitical events, and weather patterns allows them to forecast price movements and manage risk effectively.

- Market Intermediaries: Entities that facilitate the buying and selling of oil and gas, connecting producers with end-users.

- Liquidity Providers: They ensure a consistent flow of commodities in the market, making it easier for producers to sell and consumers to buy.

- Price Risk Management: Traders often offer producers options like forward contracts, which lock in prices and reduce exposure to market volatility.

- Profit from Fluctuations: Their business model relies on identifying and capitalizing on price differences and market trends.

Industrial & Commercial End-Users

Industrial and commercial end-users represent a core customer segment for natural gas producers like Vanguard Natural Resources LLC. These are businesses that directly consume natural gas, not for resale, but as a critical component in their operations. Think of chemical plants needing gas for feedstock, steel mills using it as a fuel for high-temperature processes, or fertilizer manufacturers relying on it for ammonia production. Their demand is often characterized by stability and is typically secured through long-term contracts, ensuring a predictable revenue stream for suppliers. These entities prioritize a consistent and cost-effective energy supply to maintain their production schedules and manage operating expenses. For instance, in 2024, industrial consumption of natural gas in the United States remained robust, driven by sectors like manufacturing and petrochemicals, underscoring the importance of this segment.

These end-users are vital because their consumption patterns tend to be less volatile than other market participants, such as power generators who might switch fuels based on price. This stability is a significant advantage for natural gas producers, allowing for better production planning and financial forecasting. The reliance on natural gas as a fuel or feedstock means these businesses are highly sensitive to supply disruptions and price fluctuations, making reliable delivery and competitive pricing paramount. Their continuous need for energy inputs makes them a foundational element of the natural gas market.

Key characteristics of this customer segment include:

- Direct Consumption: Utilize natural gas as a fuel or essential feedstock in manufacturing processes.

- Stable Demand: Their need for natural gas is often consistent, driven by production cycles.

- Contract-Based Relationships: Typically engage in long-term supply agreements to ensure reliability and price stability.

- Cost Sensitivity: Prioritize cost-effectiveness and consistent supply to manage operational expenses.

Vanguard Natural Resources LLC serves a diverse customer base, primarily focused on entities that directly process or utilize crude oil and natural gas. These include midstream companies, refineries, petrochemical plants, and industrial end-users. Additionally, commodity traders and marketing companies act as crucial intermediaries, providing market liquidity and risk management services.

Cost Structure

Capital Expenditures, or CAPEX, represent a substantial portion of Vanguard Natural Resources LLC's outlays. These are the significant investments made in acquiring new properties, drilling new wells, and building the necessary infrastructure to extract and process natural gas and oil. For instance, in 2024, the company's capital spending was a key factor in its operational strategy, reflecting a commitment to expanding its reserve base and future production capabilities.

Lease Operating Expenses (LOE) represent the day-to-day costs of keeping Vanguard Natural Resources LLC's wells and equipment running. These are the direct expenses for labor, power, materials, and upkeep needed to maintain production. Efficient LOE management is key to ensuring each barrel of oil and gas produced is as profitable as possible.

For example, in 2024, many oil and gas producers saw LOE fluctuate due to inflation and the cost of specialized services. Companies like Vanguard Natural Resources would have focused on optimizing these costs through better inventory management for supplies and negotiating favorable terms for contract labor and well services to maintain healthy profit margins.

Vanguard Natural Resources LLC incurs significant Exploration & Development Costs, including expenses for geological and geophysical studies, seismic data acquisition, and exploratory drilling. These are crucial investments for discovering new oil and gas prospects and growing their proven reserves. For instance, in 2023, the industry saw substantial spending on exploration, with many companies prioritizing frontier areas despite inherent risks.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses for Vanguard Natural Resources LLC encompass essential overhead costs. These include compensation for administrative personnel, office leases, professional services like legal and accounting, and other corporate support functions. For instance, in 2024, companies in the energy sector often see G&A as a percentage of revenue, with efficient management directly impacting the bottom line.

Optimizing G&A is crucial for profitability. Streamlining administrative workflows and consolidating services can lead to significant cost controls. For example, a focus on digital transformation in administrative tasks can reduce reliance on physical infrastructure and manual labor, thereby lowering these overheads.

- Salaries for administrative staff

- Office rent and utilities

- Legal and accounting fees

- Corporate insurance and other overheads

Transportation & Marketing Costs

Transportation and marketing costs are crucial for Vanguard Natural Resources LLC, encompassing expenses from getting oil and gas from the wellhead to buyers. These include pipeline tariffs, trucking fees, and marketing commissions, which can fluctuate based on how far the product needs to travel and current commodity prices.

Optimizing these logistics is vital for efficiency. For instance, in 2024, the average cost for transporting crude oil by rail can range from $0.10 to $0.30 per gallon, while pipeline transport is typically cheaper, around $0.05 to $0.15 per gallon, depending on the route and volume. Marketing commissions can add another layer, often representing a percentage of the sale price.

- Pipeline Tariffs: Fees charged for using pipelines to move oil and gas.

- Trucking Fees: Costs associated with transporting products via trucks, often for shorter distances or when pipeline access is limited.

- Marketing Commissions: Payments made to entities that facilitate the sale of produced commodities.

- Commodity Price Impact: Higher prices can sometimes offset higher transportation costs, but efficient logistics remain paramount.

Vanguard Natural Resources LLC's cost structure is heavily influenced by its capital expenditures for property acquisition and well development, alongside ongoing lease operating expenses for production maintenance.

Exploration and development costs, along with general and administrative overhead, also form significant components of their operational spending. The company must manage these varied expenses effectively to ensure profitability in the dynamic energy market.

| Cost Category | Description | 2024 Impact/Consideration |

| Capital Expenditures (CAPEX) | Investments in new properties, drilling, and infrastructure. | Crucial for expanding reserve base and future production. |

| Lease Operating Expenses (LOE) | Day-to-day costs of maintaining wells and equipment. | Inflation and service costs influenced 2024 LOE, requiring optimization. |

| Exploration & Development Costs | Geological studies, seismic data, exploratory drilling. | Essential for discovering new prospects and growing reserves. |

| General & Administrative (G&A) | Overhead costs like salaries, office leases, professional services. | Efficient management in 2024 directly impacted bottom line. |

| Transportation & Marketing | Costs to move product from wellhead to buyers. | Fluctuates with distance and commodity prices; pipeline transport generally cheaper than trucking. |

Revenue Streams

Revenue streams for Vanguard Natural Resources LLC are primarily driven by the sale of crude oil. This income is directly tied to the volume of oil extracted from their reserves and the prevailing market prices, often benchmarked against West Texas Intermediate (WTI) or Brent crude.

In 2024, the global crude oil market experienced significant volatility. For instance, WTI futures averaged around $78 per barrel for the year, while Brent crude saw averages near $82 per barrel, reflecting ongoing geopolitical tensions and shifts in global demand. Vanguard's revenue from these sales would be directly impacted by these market fluctuations, with quality and transportation costs also factoring into the final sale price.

Vanguard Natural Resources LLC generates significant income from selling the natural gas it produces from its wells. This revenue stream is directly tied to the fluctuating market price of natural gas, which is heavily influenced by factors like current supply and demand, the amount of gas in storage, and even seasonal weather trends. For instance, during the winter of 2023-2024, colder-than-expected weather in many regions boosted natural gas demand, leading to higher prices for producers like Vanguard.

Vanguard Natural Resources LLC generates revenue through the sale of Natural Gas Liquids (NGLs) like ethane, propane, and butane, which are separated from the raw natural gas. These NGL prices are closely tied to crude oil markets and fluctuate based on specific product demand, offering a significant supplementary income stream.

Hedging Gains/Losses

Gains or losses from commodity price hedging, such as through futures, options, or swaps, directly influence Vanguard Natural Resources LLC's net realized revenue, even though they aren't a primary production income source. These strategies are crucial for managing the inherent price volatility in the natural gas and oil markets, aiming to create more predictable revenue streams.

Effective hedging can significantly stabilize cash flows, providing a buffer against adverse market movements. For instance, in 2024, many energy producers focused on locking in prices for a portion of their expected output to safeguard against potential downturns. While specific Vanguard Natural Resources LLC hedging results for 2024 are subject to their financial reporting, industry trends indicate a continued emphasis on this risk management tool.

- Impact on Net Revenue: Hedging activities create gains or losses that adjust the actual revenue received from commodity sales.

- Price Volatility Mitigation: Strategies like futures and swaps are used to lock in prices, reducing exposure to market fluctuations.

- Cash Flow Stabilization: Successful hedging operations contribute to more predictable and stable cash flows for the company.

- 2024 Industry Trend: Energy companies in 2024 continued to utilize hedging as a key risk management strategy to ensure revenue predictability.

Farm-out Agreements & Joint Ventures

Farm-out agreements are a key revenue stream, where Vanguard Natural Resources LLC transfers a portion of its lease interest to another entity. This is typically in exchange for the assignee covering the costs of drilling and development. For instance, in 2024, such agreements can significantly reduce upfront capital expenditure for Vanguard, allowing for more efficient resource development.

Joint ventures offer another avenue for revenue generation and cost reduction. These partnerships allow Vanguard to share in the production revenue and development costs with other operators. This collaborative approach can accelerate project timelines and mitigate financial risks associated with large-scale energy projects.

- Farm-out Revenue: Income generated from assigning lease interests in exchange for development activities.

- Joint Venture Income: Revenue derived from shared production and development cost savings.

- Capital Exposure Reduction: Lowering financial risk by sharing development costs with partners.

- Accelerated Development: Expediting project timelines through collaborative efforts.

Vanguard Natural Resources LLC's revenue streams are predominantly built upon the sale of crude oil and natural gas. In 2024, the energy markets saw significant price swings; for example, West Texas Intermediate (WTI) crude oil futures averaged around $78 per barrel, while natural gas prices experienced considerable volatility, influenced by storage levels and weather patterns. The company also generates income from the sale of Natural Gas Liquids (NGLs), such as propane and ethane, which are byproducts of natural gas processing and often track crude oil prices.

| Revenue Stream | Primary Driver | 2024 Market Context Example |

|---|---|---|

| Crude Oil Sales | Volume produced and WTI/Brent prices | WTI averaged ~$78/barrel, Brent ~$82/barrel |

| Natural Gas Sales | Supply, demand, storage, weather | Prices influenced by winter demand and storage levels |

| Natural Gas Liquids (NGLs) Sales | Crude oil prices, specific NGL demand | Ethane, propane, butane prices linked to broader energy markets |

Business Model Canvas Data Sources

The Vanguard Natural Resources LLC Business Model Canvas is informed by publicly available financial disclosures, industry analysis reports, and operational data. These sources provide a comprehensive view of the company's market position, cost structures, and revenue streams.