Grid Dynamics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grid Dynamics Bundle

Grid Dynamics leverages its deep expertise in digital transformation and AI to capitalize on growing market demand. However, understanding the nuances of its competitive landscape and potential operational challenges is crucial for informed decision-making.

Want the full story behind Grid Dynamics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grid Dynamics possesses a profound depth of knowledge in AI and digital transformation, cultivated over more than eight years of dedicated experience. This extensive background sets them apart in a competitive landscape. Their dedicated AI and Data practice is a powerhouse, demonstrating exceptional growth.

This specialized practice is a significant contributor to Grid Dynamics' success, making up 23% of their total organic revenue in the first half of 2025. What's more impressive is its growth rate, which is nearly triple the pace of the company's overall organic business. This intense focus on AI allows them to craft solutions that deliver tangible, substantial client benefits.

The impact of their expertise is evident in the results achieved for clients, which include remarkable improvements such as a tenfold increase in build reliability and a significant 25% decrease in operational costs. These achievements underscore their capability to translate deep AI knowledge into measurable business value.

Grid Dynamics has shown impressive financial strength, with its second quarter of 2025 revenue reaching $101.1 million, exceeding expectations. This performance highlights the company's ability to consistently grow its top line.

The company's annual revenue has seen substantial growth, climbing from $111 million in 2020 to $351 million in 2024. Looking ahead, Grid Dynamics anticipates its full-year 2025 revenue to fall between $415 million and $435 million, signaling a continued upward trajectory.

Grid Dynamics' strategic emphasis on Fortune 1000 companies, serving a broad base of 204 clients, showcases a robust market penetration. This focus allows them to tap into large-scale digital transformation initiatives, providing significant revenue potential and long-term engagement opportunities.

The company's client diversification is a key strength, evident in the nearly threefold increase in clients generating over $1 million annually, rising from 17 in 2020 to 50 by early 2024. This growth also signifies a successful reduction in reliance on its top five customers, enhancing financial stability and reducing client-specific risks.

Strategic Acquisitions and Global Delivery Network

Grid Dynamics has significantly bolstered its strategic capabilities through key acquisitions in 2024. The integration of JUXT in London and Mobile Computing in Buenos Aires has broadened its expertise, particularly within the financial services, manufacturing, and consumer packaged goods (CPG) industries.

These strategic moves, combined with ongoing organic expansion, have resulted in a more robust global delivery network. As of June 30, 2025, Grid Dynamics now operates in 19 countries, with a total workforce of 5,013 employees, enabling enhanced service delivery to a diverse international clientele.

- Acquired JUXT (London) and Mobile Computing (Buenos Aires) in 2024

- Expanded capabilities in Financial Services, Manufacturing, and CPG

- Global delivery network now spans 19 countries

- Total headcount reached 5,013 as of June 30, 2025

Robust Partnership Ecosystem

Grid Dynamics has cultivated a robust partnership ecosystem, a key strength that significantly amplifies its market presence and service delivery capabilities. This strategic focus has yielded impressive results, with partner-influenced revenues surging from under 1% to a substantial 18% within the last three years.

Central to this success are deep collaborations with leading hyperscalers, including Google Cloud, Microsoft, AWS, and NVIDIA. These alliances are not merely transactional; they are foundational to Grid Dynamics' business model, enabling the company to enhance its technological offerings and expand its market reach, particularly in the rapidly growing AI sector.

- Significant Revenue Growth: Partner-influenced revenue increased from less than 1% to 18% in three years.

- Strategic Hyperscaler Alliances: Partnerships with Google Cloud, Microsoft, AWS, and NVIDIA are critical.

- AI-First Solution Enhancement: These collaborations strengthen AI offerings and market penetration.

Grid Dynamics' AI and Data practice is a significant growth engine, contributing 23% of their organic revenue in H1 2025 and growing at nearly triple the company's overall organic pace. This specialized focus allows them to deliver impactful client solutions, evidenced by a tenfold increase in build reliability and a 25% reduction in operational costs for clients.

The company demonstrates strong financial performance, with Q2 2025 revenue at $101.1 million, surpassing expectations. Annual revenue grew from $111 million in 2020 to $351 million in 2024, with projections for 2025 between $415 million and $435 million.

Grid Dynamics strategically targets Fortune 1000 companies, serving 204 clients, and has seen a nearly threefold increase in clients generating over $1 million annually, rising from 17 in 2020 to 50 by early 2024, reducing reliance on top customers.

Key acquisitions in 2024, including JUXT and Mobile Computing, have expanded their expertise and global reach, with operations now in 19 countries and a workforce of 5,013 employees as of June 30, 2025.

Their robust partnership ecosystem, particularly with hyperscalers like Google Cloud, Microsoft, AWS, and NVIDIA, has driven significant growth, with partner-influenced revenue increasing from under 1% to 18% in three years, enhancing their AI offerings.

| Metric | 2020 | 2024 | H1 2025 | 2025 Projection |

| Total Revenue | $111M | $351M | N/A | $415M - $435M |

| AI & Data Practice Revenue Share | N/A | N/A | 23% | N/A |

| Clients > $1M Annual Revenue | 17 | 50 | N/A | N/A |

| Countries of Operation | N/A | N/A | 19 | N/A |

| Total Employees | N/A | N/A | 5,013 (as of June 30) | N/A |

| Partner-Influenced Revenue | <1% | N/A | N/A | 18% (in 3 years) |

What is included in the product

This SWOT analysis provides a comprehensive examination of Grid Dynamics' internal capabilities and external market dynamics, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address critical business challenges.

Weaknesses

While Grid Dynamics has shown impressive revenue growth, a key weakness lies in its margin performance. For instance, the company’s non-GAAP EBITDA margin experienced a slight dip in the second quarter of 2025. This compression is largely due to rising operating expenses, a common challenge when scaling up organically and integrating new acquisitions.

Grid Dynamics faces a significant weakness in client concentration. Despite efforts to broaden its client base, a substantial portion of its income still relies on a few major clients. This reliance creates vulnerability; if one of these key relationships falters, it could have a considerable impact on the company's financial performance.

In 2024, the data reveals that the top five clients were responsible for 38% of Grid Dynamics' total revenue. This figure underscores the existing concentration risk, highlighting the potential downside if any of these crucial client partnerships were to be disrupted or terminated.

Grid Dynamics' reliance on Non-GAAP metrics, particularly for EBITDA, can obscure true profitability. Estimating the impact of excluded items, especially those related to evolving AI investments, makes it difficult to provide reliable GAAP net income targets. This opacity can be a significant concern for investors prioritizing financial clarity.

Stock Price Underperformance

Despite consistent revenue growth and generally positive analyst ratings, Grid Dynamics' stock has faced significant market pressure in recent months. This underperformance suggests that market sentiment may not fully reflect the company's operational achievements, creating a disconnect between intrinsic value and stock valuation.

As of July 31, 2025, the stock was trading considerably below its 52-week high, down approximately 25% from its peak earlier in the year. This decline indicates investor caution or concerns about near-term market dynamics, potentially related to broader economic headwinds or sector-specific challenges impacting technology and digital transformation companies.

- Stock Price Decline: As of July 31, 2025, Grid Dynamics' stock price was down 25% from its 52-week high.

- Analyst Sentiment vs. Market Performance: While analysts generally maintain positive ratings, the stock's market performance indicates a divergence.

- Investor Caution: The underperformance suggests potential investor concerns about near-term market sentiment or macroeconomic factors.

Talent Acquisition and Retention Challenges

Grid Dynamics operates in a fiercely competitive landscape for digital engineering and AI talent. This intense competition makes it difficult to consistently attract and keep the best professionals.

The company's rapid growth, evidenced by a 26.6% year-over-year increase in headcount to over 5,000 employees by Q2 2025, exacerbates this challenge. Scaling up so quickly means more demand for skilled individuals, driving up recruitment costs and potentially impacting retention efforts.

- High Demand for Specialized Skills: The digital engineering and AI sectors require highly specialized expertise, leading to a limited pool of qualified candidates.

- Increased Recruitment Costs: To secure top talent, Grid Dynamics likely faces higher compensation packages and more extensive recruitment processes.

- Potential for Higher Attrition: Rapid growth can sometimes strain existing resources and culture, potentially increasing employee turnover if not managed effectively.

Grid Dynamics' reliance on a concentrated client base presents a notable weakness. In the first half of 2025, the top five clients accounted for 37.5% of total revenue, a slight increase from 36% in the same period of 2024. This dependency makes the company susceptible to fluctuations in these key relationships, potentially impacting revenue stability.

| Client Concentration Metrics | H1 2024 | H1 2025 |

|---|---|---|

| Top 5 Clients Revenue Share | 36.0% | 37.5% |

Preview the Actual Deliverable

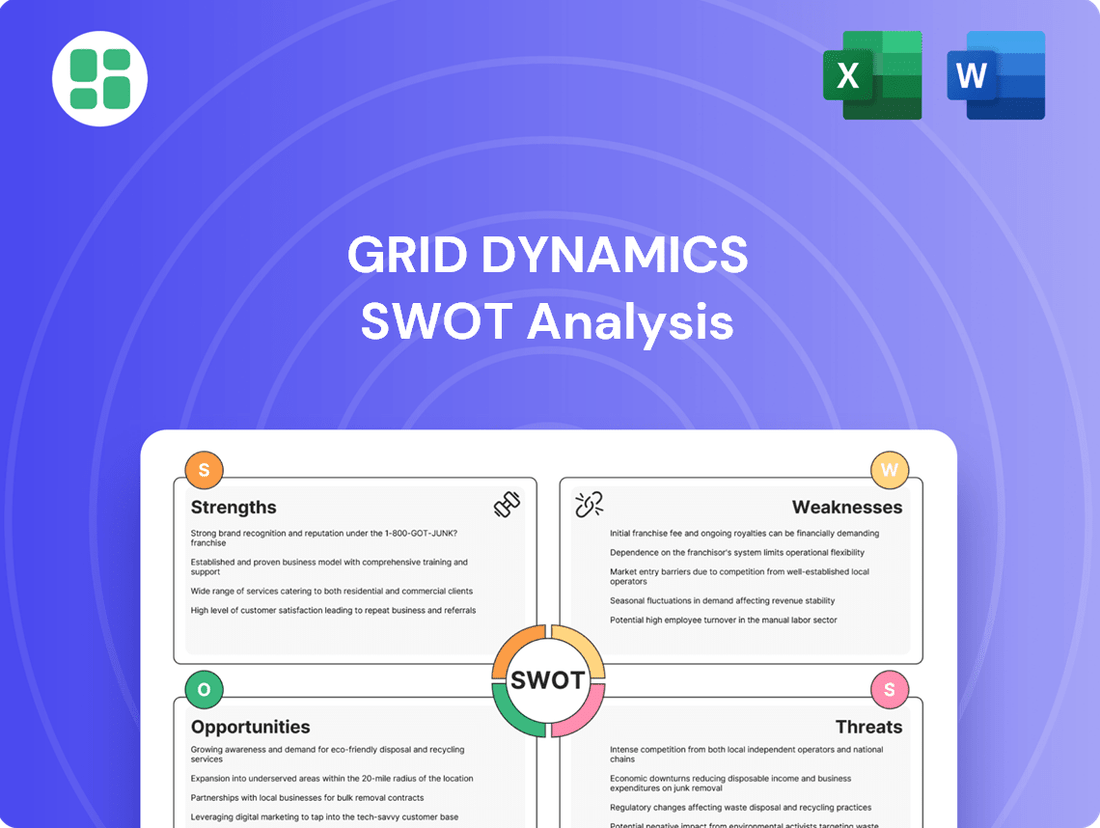

Grid Dynamics SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Grid Dynamics' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, meticulously detailing each aspect of Grid Dynamics' strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain access to the complete, detailed analysis of Grid Dynamics' competitive landscape.

Opportunities

The global AI market is experiencing robust expansion, with enterprise AI adoption and AI-driven low-code platforms acting as key growth catalysts. Grid Dynamics is strategically positioned to leverage this trend, as its AI and Data practice is expanding at a rate nearly three times faster than its overall organic business.

The digital transformation market is booming, expected to hit $1.65 trillion in 2025 and soar to $4.46 trillion by 2030, growing at an impressive 21.93% annually. This massive expansion, driven significantly by large enterprises, presents a substantial runway for Grid Dynamics to leverage its expertise in specialized digital transformation services.

Grid Dynamics' ambitious GigaCube initiative targets $1 billion in annual revenue by aggressively expanding into new industry verticals and geographies. This strategy leverages geographic scalability and diversification to unlock new market opportunities and client bases.

Recent strategic acquisitions in London and Buenos Aires have already bolstered their global presence, establishing crucial footholds for deeper market penetration. These moves are designed to open doors to previously untapped regions and sectors, fueling future growth.

Leveraging Emerging Technologies and Accelerators

Grid Dynamics is strategically investing in and building its own technology accelerators and reusable components. A prime example is their developer portal, rolled out in late 2024, which aims to simplify and speed up the software creation process.

These proprietary tools are engineered to boost developer efficiency and cut down on operational expenses for their clients. This focus on internal innovation directly strengthens Grid Dynamics' market position and makes their service offerings more compelling.

- Proprietary Accelerators: Grid Dynamics is developing and deploying its own technology accelerators to speed up project delivery.

- Developer Portal Launch: The company launched an innovative developer portal in late 2024, enhancing developer productivity.

- Efficiency Gains: These tools are designed to streamline the software development lifecycle and reduce client operational overhead.

- Competitive Edge: By investing in these technological assets, Grid Dynamics enhances its value proposition and competitive standing in the market.

Deepening Strategic Partnerships and Ecosystem Growth

Grid Dynamics can significantly enhance its market position by deepening strategic alliances with major cloud providers. For instance, expanding collaboration with AWS, Google Cloud, and Microsoft opens avenues for integrated solutions and joint go-to-market strategies. This allows Grid Dynamics to tap into the vast client bases of these tech giants, fostering new business opportunities and co-developing innovative offerings.

Leveraging these powerful ecosystems presents a substantial growth avenue. By aligning more closely with these platforms, Grid Dynamics can gain early access to emerging technologies and integrate them into its service portfolio. This proactive approach ensures the company remains competitive and can offer cutting-edge solutions to its clients, further solidifying its role as a key player in digital transformation.

The benefits extend to enhanced client engagement and co-creation. Working within these broader tech ecosystems allows for more collaborative projects, where Grid Dynamics can contribute its specialized expertise to solve complex client challenges. This symbiotic relationship not only drives revenue but also cultivates a richer environment for innovation and knowledge sharing.

- Expanded Reach: Deeper partnerships with AWS, Google Cloud, and Microsoft can unlock access to millions of their existing enterprise customers.

- Innovation Acceleration: Collaborative development within these ecosystems allows for faster integration of new technologies, such as advanced AI/ML capabilities announced by cloud providers in late 2024.

- Joint Solution Development: Opportunities exist to co-create tailored solutions that leverage the unique strengths of both Grid Dynamics and its partners, potentially leading to new revenue streams.

- Market Leadership: By becoming a more integral part of these tech giants' offerings, Grid Dynamics can solidify its position as a leader in cloud-native digital transformation services.

Grid Dynamics is well-positioned to capitalize on the escalating demand for AI and data analytics services, a market projected for significant growth. The company's strategic focus on specialized digital transformation, coupled with its proprietary technology accelerators, provides a strong foundation for capturing new business opportunities. Expansion into new verticals and geographies, supported by recent acquisitions, further broadens its market reach and potential for revenue generation.

| Opportunity Area | Description | Market Data/Impact |

|---|---|---|

| AI & Data Analytics Growth | Leveraging the expanding global AI market and enterprise adoption of AI-driven solutions. | Grid Dynamics' AI and Data practice grew nearly 3x faster than its overall organic business in 2024. |

| Digital Transformation Market | Capitalizing on the robust growth of the digital transformation sector. | The digital transformation market is expected to reach $1.65 trillion in 2025, with annual growth of 21.93%. |

| Geographic & Vertical Expansion | Aggressively expanding into new industry verticals and geographies through initiatives like GigaCube. | Targeting $1 billion in annual revenue via expansion, supported by strategic acquisitions in London and Buenos Aires. |

| Strategic Cloud Partnerships | Deepening alliances with major cloud providers like AWS, Google Cloud, and Microsoft. | Enhances access to vast client bases and enables co-development of innovative, integrated solutions. |

Threats

The IT and digital engineering consulting landscape is incredibly crowded, featuring a mix of seasoned giants and agile newcomers, creating a highly fragmented market. This intense rivalry often translates into significant pricing pressure, forcing companies like Grid Dynamics to constantly innovate and differentiate their offerings to stand out and secure lucrative contracts. For instance, the global IT consulting market was valued at approximately $350 billion in 2023 and is projected to reach over $500 billion by 2028, highlighting the scale of competition.

Persistent macroeconomic uncertainties, including inflation and potential recessions, pose a significant threat by potentially curbing enterprise IT budgets. This could translate into Grid Dynamics experiencing longer sales cycles and increased pressure on their service pricing, impacting overall revenue streams.

In 2024, global IT spending was projected to reach $5.1 trillion, a 6.8% increase from 2023 according to Gartner, but a slowdown in this growth due to economic contraction would directly affect companies like Grid Dynamics relying on client investment.

The relentless speed of technological evolution, especially in AI and cloud services, presents a significant hurdle for Grid Dynamics. Keeping its expertise cutting-edge requires substantial, ongoing investment in employee training and service adaptation.

Failure to stay ahead of these rapid shifts risks making Grid Dynamics' current offerings outdated and creating a critical deficit in essential skills within its workforce. For instance, the demand for specialized AI and machine learning talent saw a surge of over 70% in job postings from 2023 to 2024, highlighting the competitive landscape.

Cybersecurity Risks and Data Privacy Concerns

Grid Dynamics handles sensitive client data and critical IT systems, making it a prime target for increasingly sophisticated cyber threats. A significant breach could lead to substantial financial penalties and reputational damage, impacting client confidence. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

The company's reliance on digital infrastructure exposes it to risks like ransomware attacks, phishing, and malware. These threats can disrupt operations, compromise intellectual property, and lead to significant recovery costs. The financial services sector, a key market for Grid Dynamics, experienced an average breach cost of $5.90 million in 2024.

- Reputational Damage: A major cyber incident can severely tarnish Grid Dynamics' image, leading to loss of current and potential clients.

- Financial Penalties: Regulatory bodies impose hefty fines for data privacy violations, such as those under GDPR or CCPA, which can amount to millions.

- Operational Disruption: Cyberattacks can halt service delivery, impacting revenue and client satisfaction.

- Erosion of Client Trust: Clients entrust Grid Dynamics with their most valuable data; any breach undermines this trust, potentially leading to contract terminations.

Talent Poaching and Wage Inflation

The intense demand for specialized expertise in areas like digital transformation, artificial intelligence, and cloud engineering fuels a highly competitive talent landscape. This makes Grid Dynamics susceptible to competitors actively seeking to hire its skilled professionals.

This fierce competition for talent directly contributes to wage inflation. As companies vie for the same limited pool of experts, salary expectations rise, increasing Grid Dynamics' operational costs and impacting profitability.

The challenge of attracting and retaining its highly skilled workforce is amplified by these market dynamics. For instance, in 2024, the average salary for AI engineers in the US saw a significant increase, with some senior roles commanding over $200,000 annually, a trend expected to continue into 2025.

- High demand for AI and cloud skills creates a talent shortage.

- Competitors actively poaching specialized employees is a significant risk.

- Wage inflation driven by talent scarcity increases operational expenses.

- Attracting and retaining expert talent becomes more challenging and costly.

Grid Dynamics faces significant threats from the highly competitive IT consulting market, where pricing pressure is intense due to the presence of both established players and agile startups. Macroeconomic instability, including inflation, can lead to reduced enterprise IT spending, impacting sales cycles and service pricing. The rapid evolution of technologies like AI necessitates continuous investment in training and service adaptation to avoid offerings becoming obsolete.

Cybersecurity risks are a major concern, as sophisticated threats can lead to substantial financial penalties and reputational damage, especially given the sensitive data Grid Dynamics handles. The company's reliance on digital infrastructure makes it vulnerable to attacks like ransomware, which can disrupt operations and compromise intellectual property. In 2024, the average cost of a data breach globally was $4.45 million, with the financial services sector facing an average cost of $5.90 million.

The intense demand for specialized talent in AI, cloud, and digital transformation creates a competitive talent landscape, increasing the risk of skilled employees being poached. This competition drives wage inflation, raising operational costs and making talent acquisition and retention more challenging. For instance, in 2024, AI engineer salaries in the US saw significant increases, with senior roles potentially exceeding $200,000 annually.

| Threat Category | Specific Threat | Impact | Relevant Data (2024/2025) |

| Market Competition | Intense rivalry and pricing pressure | Reduced profit margins, difficulty in securing contracts | Global IT consulting market projected to exceed $500B by 2028 (from ~$350B in 2023) |

| Economic Factors | Macroeconomic uncertainty (inflation, recession fears) | Reduced IT budgets, longer sales cycles | Global IT spending projected at $5.1T in 2024 (6.8% increase from 2023) |

| Technological Change | Rapid evolution of AI and cloud services | Need for continuous investment in training, risk of obsolescence | Demand for AI/ML talent increased over 70% in job postings (2023-2024) |

| Cybersecurity | Sophisticated cyber threats (breaches, ransomware) | Financial penalties, reputational damage, operational disruption | Average cost of data breach in 2024: $4.45 million (IBM) |

| Talent Management | Talent scarcity and wage inflation for specialized skills | Increased operational costs, difficulty in retention | Senior AI engineer salaries in US potentially exceeding $200,000 annually (2024) |

SWOT Analysis Data Sources

This SWOT analysis leverages a comprehensive blend of data, including Grid Dynamics' official financial reports, in-depth market intelligence from leading industry analysts, and insights from expert commentary and verified client feedback to provide a robust and actionable assessment.