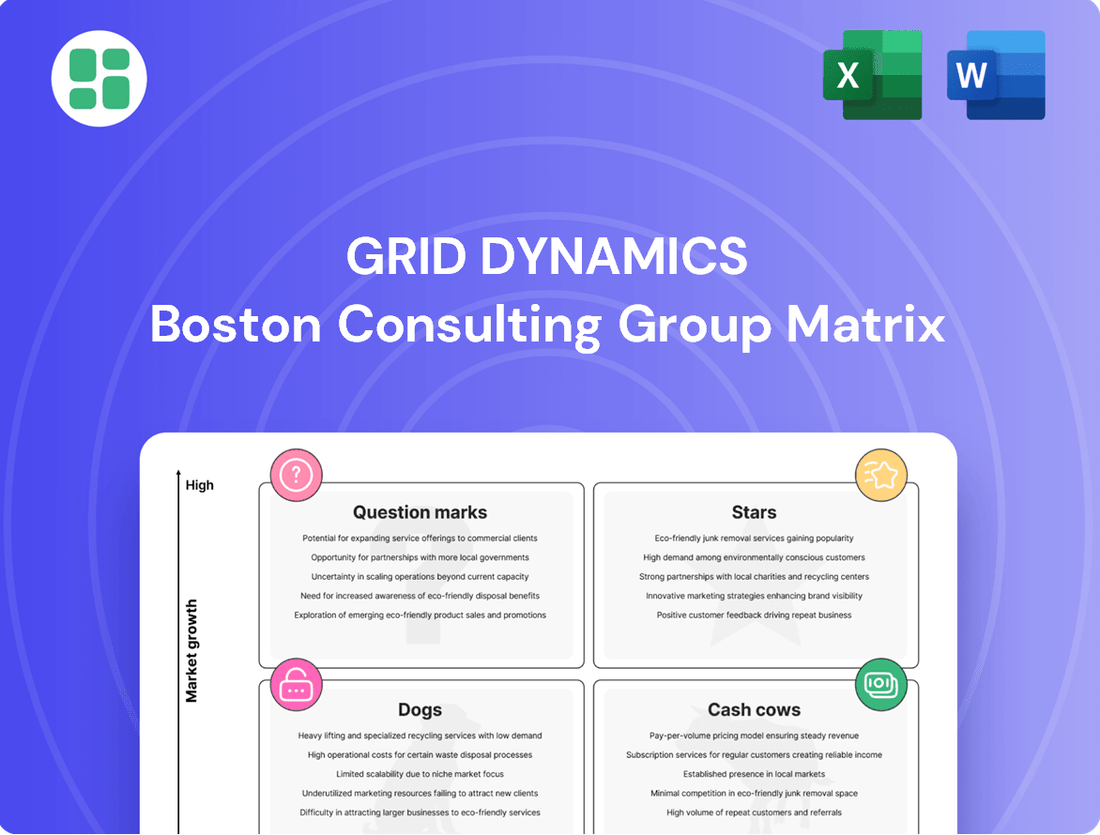

Grid Dynamics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grid Dynamics Bundle

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See where your investments are shining as Stars, generating consistent revenue as Cash Cows, or potentially hindering growth as Dogs or Question Marks.

This glimpse is just the beginning of understanding your competitive landscape. Purchase the full BCG Matrix to receive detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your product strategy and resource allocation.

Stars

Grid Dynamics' AI and Data practice is a powerhouse, contributing a substantial 23% to their total organic revenue in the first half of 2025. This segment is on a rapid ascent, expanding at a rate nearly three times faster than the company's overall organic growth.

The company is strategically pivoting towards an AI-first model, integrating advanced AI capabilities across its operations and service delivery. This proactive approach solidifies Grid Dynamics' standing as a frontrunner in developing self-optimizing enterprise technologies.

The Financial Services vertical is a standout performer, exhibiting remarkable growth. It has doubled its year-over-year revenue for four consecutive quarters, a testament to its strong market position.

This segment has ascended to become the second-largest revenue contributor, accounting for 25.1% of total revenues in Q2 2025. This impressive expansion is driven by robust demand from key sectors like fintech, banking, and insurance.

Furthermore, strategic acquisitions have bolstered its market share within this rapidly growing industry. The vertical’s success highlights its ability to capitalize on evolving market needs and integrate new capabilities effectively.

Grid Dynamics introduced an AI-powered engagement model in June 2025, aiming to boost project delivery by over 30% for Fortune 1000 clients.

This innovative approach, built on their AI-Native Development Framework (GAIN), signifies a strategic move into a rapidly expanding market segment.

The model differentiates itself by tying pricing directly to tangible outcomes, moving beyond conventional service delivery methods.

Agentic AI Solutions

Grid Dynamics is positioning itself as an early leader in agentic AI, a field projected to manage approximately 15% of daily business decisions autonomously by 2028. This significant shift is poised to unlock substantial new markets focused on automation and advanced decision-making capabilities.

Their AI Engagement Model is designed to facilitate the creation of these sophisticated agentic AI systems. This strategic approach underscores Grid Dynamics' commitment to a rapidly expanding and fundamentally transformative segment of the technology landscape.

- Market Potential: Agentic AI is expected to automate a significant portion of routine decisions, potentially impacting billions of dollars in operational efficiency by 2028.

- Grid Dynamics' Strategy: The company's AI Engagement Model is a key enabler for developing these autonomous decision-making systems.

- Growth Trajectory: This focus places Grid Dynamics in a high-growth area, capitalizing on the increasing demand for intelligent automation.

Digital Transformation for Fortune 1000

Grid Dynamics is a key player in the digital transformation space, specifically targeting Fortune 1000 companies. Their expertise lies in modernizing IT systems, facilitating cloud migrations, and integrating artificial intelligence solutions. This focus places them squarely within a booming market.

The digital engineering market is experiencing significant expansion, with projections indicating it will exceed $1.5 trillion by 2025. This growth is fueled by an impressive compound annual growth rate (CAGR) of 18.2%. Grid Dynamics' established presence in this high-growth sector positions them for continued success.

- Modernizing IT Infrastructure: Grid Dynamics helps large enterprises update their core technology systems to improve efficiency and scalability.

- Cloud Migration Services: They assist Fortune 1000 companies in moving their operations and data to cloud platforms, enhancing flexibility and reducing costs.

- AI Implementation: Grid Dynamics is at the forefront of integrating artificial intelligence and machine learning into business processes to drive innovation and competitive advantage.

- Market Position: With the digital engineering market's rapid growth, Grid Dynamics' established expertise in these critical areas gives them a strong competitive standing.

Stars in the BCG Matrix represent high-growth, high-market-share business units. Grid Dynamics' AI and Data practice, a significant 23% contributor to their first-half 2025 organic revenue, exemplifies this category. Its rapid expansion, nearly three times the company's overall organic growth, highlights its star status. The company's strategic AI-first pivot further solidifies this segment's position as a future growth engine.

What is included in the product

Grid Dynamics' BCG Matrix analysis provides strategic guidance on resource allocation, identifying which business units to invest in, hold, or divest based on market share and growth.

The Grid Dynamics BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

The Retail vertical is Grid Dynamics' bedrock, representing a substantial 29.2% of total revenues in Q2 2025. This segment, while not experiencing hyper-growth, holds a significant market share in a well-established industry, making it a reliable source of income.

Its consistent performance and large revenue contribution solidify Retail as a classic Cash Cow within Grid Dynamics' business portfolio. The company leverages its deep understanding of retail challenges and opportunities to maintain its leading position.

Cloud migration services represent a significant cash cow for Grid Dynamics. This is due to the foundational nature of cloud adoption for enterprises, coupled with Grid Dynamics' robust engineering capabilities and continuous investment in cloud platforms.

The demand for these services remains high as businesses continue their digital transformation journeys, making it a stable and predictable revenue generator. For instance, the global cloud migration market was valued at approximately $133.5 billion in 2023 and is projected to reach $327.3 billion by 2030, showcasing a strong compound annual growth rate of 13.7%.

Grid Dynamics' deep expertise and continuous investment in data analytics and ML platforms position them as a Cash Cow. These established capabilities offer high-margin services to clients focused on data optimization and analytics, aligning with the low-growth, high-market-share profile.

In 2024, the global big data and business analytics market was valued at approximately $342.1 billion, with a projected compound annual growth rate (CAGR) of around 13.5% through 2030. Grid Dynamics' focus on these critical areas allows them to leverage their strong market share within a mature, albeit growing, segment.

Application Modernization Services

Application modernization services represent a core strength for Grid Dynamics, enabling businesses to migrate from older, often cumbersome, systems to contemporary, agile architectures. This is a crucial area for large enterprises that require continuous support for their existing infrastructure, generating consistent revenue.

These services cater to a stable, albeit not hyper-growth, segment of the market. Grid Dynamics leverages its expertise to ensure seamless transitions, addressing the ongoing demand for updated technological frameworks. In 2024, the global application modernization market was valued at approximately $15.5 billion, with a projected compound annual growth rate (CAGR) of around 10.5% through 2030. This indicates a mature but steadily expanding sector.

- Stable Revenue: Application modernization provides a reliable income source from established client relationships.

- Necessary Market: It addresses fundamental business needs for technological relevance and efficiency.

- Mature Growth: While not experiencing explosive growth, the market offers consistent expansion opportunities.

- Key Offering: This service is central to Grid Dynamics' portfolio, aligning with enterprise digital transformation initiatives.

General Technology Consulting and Engineering

Grid Dynamics' general technology consulting and engineering services are a cornerstone of their business, fitting squarely into the Cash Cow quadrant of the BCG matrix. These services, while perhaps not experiencing the explosive growth of newer technologies, consistently generate substantial revenue due to their established market presence and deep client relationships.

The company leverages its extensive expertise to tackle complex technical challenges for a wide array of clients. This broad applicability and proven track record allow Grid Dynamics to maintain a significant market share in these core areas, ensuring a steady and predictable income stream. For instance, in 2023, Grid Dynamics reported revenue growth of 22% year-over-year, with a substantial portion attributed to their established consulting and engineering practices.

- Stable Revenue Generation: These services are characterized by their consistent demand and recurring revenue models, providing a reliable financial foundation.

- Market Leadership: Grid Dynamics holds a strong position in the market due to its long-standing presence and breadth of solutions.

- Profitability: While growth may be moderate, these mature services often boast high profit margins, contributing significantly to overall earnings.

- Client Retention: The company's ability to deliver on complex projects fosters strong client loyalty, leading to repeat business and a steady income flow.

Cash cows represent established business segments that generate consistent, high profits with relatively low investment. Grid Dynamics' Retail vertical, for example, is a prime example, contributing 29.2% of total revenues in Q2 2025. This segment benefits from a strong market share in a stable industry, providing a reliable income stream.

Cloud migration services are another significant cash cow, fueled by the ongoing digital transformation of enterprises and Grid Dynamics' strong engineering capabilities. The global cloud migration market, valued at approximately $133.5 billion in 2023, is projected to grow substantially, highlighting the sustained demand for these foundational services.

Furthermore, Grid Dynamics' expertise in data analytics and ML platforms, alongside application modernization services, solidify their cash cow status. These areas leverage established capabilities to deliver high-margin services in mature, yet growing, markets, such as the global big data and business analytics market, which was valued at $342.1 billion in 2024.

| Business Segment | Revenue Contribution (Q2 2025) | Market Status | Key Characteristics |

| Retail Vertical | 29.2% | Established, Stable | High Market Share, Reliable Income |

| Cloud Migration Services | Significant | High Demand, Growing | Foundational for Digital Transformation |

| Data Analytics & ML | Significant | Mature, Growing | High-Margin Services, Established Expertise |

| Application Modernization | Significant | Mature, Steady Expansion | Core Strength, Consistent Revenue |

Full Transparency, Always

Grid Dynamics BCG Matrix

The Grid Dynamics BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no sample data, and no hidden surprises – just the complete, professionally designed BCG Matrix analysis ready for your strategic decision-making. You can confidently use this preview as a direct representation of the high-quality, actionable report that will be yours to download and implement instantly.

Dogs

Legacy or commoditized IT services within Grid Dynamics' portfolio, though not explicitly labeled as such, represent offerings that have seen little innovation and face intense competition. These services operate in mature markets with limited growth potential, often characterized by price-based competition rather than value differentiation.

Such services typically generate lower profit margins and require significant operational efficiency to remain viable. For instance, basic IT support or legacy system maintenance, if still offered, would fall into this category, potentially contributing to revenue but demanding careful cost management to avoid becoming a drain on resources.

Certain niche, stagnant industry verticals represent the "dogs" in Grid Dynamics' BCG Matrix. These are typically sectors with low digital transformation spending and where Grid Dynamics holds a minimal market share. For instance, imagine a very specialized manufacturing sector that hasn't embraced modern IT solutions, or a legacy retail segment with little appetite for advanced analytics. These areas are unlikely to drive significant revenue growth or boost profitability for the company.

If Grid Dynamics' acquired service lines, such as Mobile Computing (acquired October 2024) or JUXT (acquired September 2024), don't effectively integrate or attract clients, they risk becoming dogs. This scenario occurs when acquired capabilities don't resonate with the existing client base or fail to leverage Grid Dynamics' core strengths.

Services that deviate from Grid Dynamics' strategic emphasis on AI and digital transformation are particularly vulnerable. For instance, if a newly acquired service requires significant investment but shows minimal revenue growth or client adoption, it could be classified as a dog within the BCG matrix, potentially impacting overall portfolio health.

Basic Staff Augmentation (without specialized skills)

Basic staff augmentation, lacking specialized digital engineering or AI expertise, often falls into the dog quadrant of the BCG matrix. These services are highly commoditized, facing intense competition globally. For a company like Grid Dynamics, focusing on premium digital transformation, such offerings typically yield low profit margins and exhibit limited growth prospects, making them less strategic.

The market for undifferentiated IT staffing is saturated. In 2024, the global IT staffing market was projected to reach over $400 billion, but the segment for basic augmentation without specialized skills is characterized by price wars and minimal differentiation. This makes it difficult for providers to command premium pricing or achieve significant market share gains.

- Commoditized Offerings: Basic staff augmentation services are easily replicable, leading to price-based competition.

- Low Margins: Without specialized skills, profit margins are typically thin, often in the low single digits.

- Limited Growth Potential: The demand for generic IT staff is stable but not rapidly expanding, especially compared to specialized digital roles.

- Strategic Mismatch: For companies aiming for high-value digital transformation, basic augmentation distracts from core competencies and innovation.

Outdated Technology Stack Offerings

Services heavily reliant on outdated technology stacks, where Grid Dynamics hasn't prioritized modernization or upskilling, would be categorized in the Dogs quadrant. Continued investment in these areas represents a significant drain on resources with minimal prospect of future returns. For instance, if a substantial portion of Grid Dynamics' revenue in 2024 was still tied to legacy mainframe support without a clear migration strategy, this would exemplify such a situation.

This segment of offerings typically suffers from declining market demand and increasing maintenance costs. Companies often seek newer, more efficient solutions, leaving these outdated services struggling to compete. In 2023, the global IT services market saw significant growth in cloud and AI, highlighting the divergence from legacy systems.

- Declining Market Share: Services built on obsolete platforms often experience a shrinking customer base.

- High Maintenance Costs: Supporting older technologies is frequently more expensive than developing new ones.

- Limited Growth Potential: The lack of innovation in these areas restricts opportunities for expansion.

- Resource Drain: Continued investment here diverts capital and talent from more promising ventures.

Dogs in Grid Dynamics' portfolio represent services with low market share and low growth potential, often characterized by commoditization or outdated technology. These offerings, like basic staff augmentation or support for legacy systems, typically yield low profit margins and can drain resources if not managed carefully. For example, in 2024, the IT staffing market saw intense price competition for undifferentiated roles, highlighting this challenge.

These services are often found in niche, stagnant verticals where digital transformation spending is minimal, or they can arise from acquired capabilities that fail to integrate effectively. Grid Dynamics' strategic focus on AI and digital engineering means that offerings deviating from this path are particularly vulnerable to becoming dogs, requiring careful evaluation to avoid becoming a strategic mismatch.

The continued reliance on outdated technology stacks without modernization plans also places services in the dog quadrant. In 2023, the IT services market demonstrated a clear shift towards cloud and AI, underscoring the declining demand for legacy solutions.

| Service Category | Market Share | Growth Potential | Profit Margin | Strategic Fit |

|---|---|---|---|---|

| Basic Staff Augmentation | Low | Low | Low | Poor |

| Legacy System Maintenance (no modernization) | Low | Declining | Low | Poor |

| Niche Vertical Support (stagnant) | Low | Low | Low | Poor |

Question Marks

Agentic AI, a frontier of AI development, is currently in its early stages, characterized by groundbreaking but unproven applications. While the broader AI market is a star, these specific agentic solutions are like nascent stars, requiring substantial investment to cultivate market share and prove their value proposition. For instance, companies are exploring autonomous AI agents for complex tasks like personalized drug discovery or sophisticated supply chain optimization, areas where early adoption is minimal but the long-term growth potential is projected to be massive.

Grid Dynamics is actively entering the robotics and automation space, as evidenced by their showcase of solutions like TPGen at Automatica 2025 and their work in developing AI robotic inspection platforms for clients. This strategic move positions them to capitalize on the burgeoning demand for intelligent automation.

These new integrations, blending robotics with AI, are currently in their early stages within the market. While they represent significant growth potential, they also require substantial investment to achieve widespread adoption and establish dominant market share.

Hyper-personalization and digital twin solutions are poised for significant growth in digital engineering through 2025. These advanced offerings represent areas where Grid Dynamics could be strategically positioned for future market capture.

If Grid Dynamics is actively developing or has recently introduced services in hyper-personalization and digital twins, and these initiatives are still in their early stages of market penetration, the company would likely be categorized as a Star or Question Mark within the BCG Matrix, depending on their current market share and growth trajectory in these specific segments.

Blockchain-Enabled Engineering Solutions

Blockchain technology is rapidly transforming digital product engineering, particularly in areas like securing collaborative development and managing digital assets. The global market for blockchain in supply chain management, a key application for digital asset tracking, was projected to reach $10.2 billion by 2025, indicating substantial growth potential.

For Grid Dynamics, their blockchain-enabled engineering solutions represent a high-potential segment within the BCG Matrix. While this area might still be emerging for some of their clients, the significant market growth suggests it could be a strategic star or question mark, requiring focused investment to capitalize on its future promise and gain market share.

Grid Dynamics' strategic approach to these solutions might involve:

- Developing specialized platforms for secure, transparent, and auditable digital asset management in engineering workflows.

- Focusing on use cases like intellectual property protection, supply chain traceability for engineered components, and secure data sharing among project stakeholders.

- Investing in R&D to stay ahead of evolving blockchain protocols and their application in complex engineering environments.

Expansion into New Niche Verticals (e.g., specific Automotive AI)

Grid Dynamics' strategic move into niche verticals like Automotive AI exemplifies a classic 'Question Mark' scenario within the BCG Matrix. These are markets with high growth potential but currently low market share, demanding careful investment to determine future success.

The company's recent significant deals in the automotive sector, specifically those incorporating Agentic AI applications, highlight their active pursuit of these emerging opportunities. This expansion signifies a deliberate effort to build expertise and establish a market presence in a rapidly evolving technological landscape.

Key considerations for Grid Dynamics in these 'Question Mark' verticals include:

- Market Attractiveness: Assessing the long-term growth trajectory and competitive intensity within the Automotive AI space. For instance, the global automotive AI market was projected to reach approximately $20 billion by 2025, with significant growth expected through 2030.

- Competitive Position: Evaluating Grid Dynamics' current capabilities and market share relative to established players and emerging competitors in Automotive AI.

- Investment Strategy: Determining the optimal level of investment required to gain market share and develop a sustainable competitive advantage, balancing risk and reward.

- Strategic Fit: Ensuring that the development of expertise in Automotive AI aligns with Grid Dynamics' overall business strategy and core competencies.

Question Marks represent emerging markets or technologies where Grid Dynamics is investing, but their future success is uncertain. These areas typically have high growth potential but currently low market share, requiring significant investment to determine if they will become Stars or Dogs.

For example, Grid Dynamics' foray into specialized AI applications within niche verticals like Automotive AI, where they are building expertise and securing early deals, fits this classification. The company must carefully evaluate the market attractiveness and their competitive position to decide on the optimal investment strategy.

The success of these Question Marks hinges on Grid Dynamics' ability to gain market traction and develop a sustainable competitive advantage in these evolving segments, such as the projected $20 billion global automotive AI market by 2025.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial reports, market research, and competitive analysis, to provide a clear strategic view.