Great-West Lifeco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great-West Lifeco Bundle

Great-West Lifeco boasts strong brand recognition and a robust distribution network, key strengths in a competitive financial services landscape. However, navigating evolving regulatory environments and potential market volatility presents significant challenges.

Want the full story behind Great-West Lifeco’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Great-West Lifeco's diversified business portfolio, spanning life and health insurance, retirement services, asset management, and reinsurance, across Canada, the United States, and Europe, offers significant operational resilience. This broad geographic and business line spread means no single segment dominates, as evidenced by no segment exceeding a third of base earnings in recent periods, insulating the company from localized economic shocks or regulatory shifts.

Great-West Lifeco's financial performance remains a significant strength, highlighted by record base earnings in both Q4 2024 and Q1 2025. This consistent profitability underscores the company's operational efficiency and market resilience.

The company boasts a robust capital position, evidenced by a Life Insurance Capital Adequacy Test (LICAT) ratio of 130% in Q1 2025, improving to 132% in Q2 2025. Coupled with substantial cash reserves of $2.5 billion as of Q1 2025, this financial flexibility allows for strategic investments and weathering economic uncertainties.

Shareholder returns are a testament to Great-West Lifeco's confidence in its ongoing cash flow generation. The company has consistently increased its dividends and executed share buyback programs, directly benefiting investors and signaling a healthy financial outlook.

Great-West Lifeco's U.S. segment, Empower, holds a dominant position in the American retirement market, consistently attracting new plan participants and experiencing robust net flows, largely driven by rollover sales. The strategic acquisition of Prudential Financial's retirement services business significantly expanded Empower's scale and market penetration, now serving over 18.5 million Americans.

Strategic Investments and Organic Growth Initiatives

Great-West Lifeco actively prioritizes strategic investments designed to fuel long-term organic growth and reinforce its leadership across various business segments. These investments are crucial for scaling operations and expanding its service capabilities.

A prime example is the acquisition of Plan Management Corporation for Empower, which significantly enhances digital equity plan administration. Furthermore, Great-West Lifeco is expanding its Canadian presence through the introduction of new dental benefits plans, demonstrating a commitment to broadening its market reach.

These targeted initiatives are strategically designed to:

- Scale existing businesses by improving operational efficiency and capacity.

- Extend service offerings to meet evolving customer needs, such as new dental benefits.

- Strengthen overall operations through technological advancements and market expansion.

- Enhance digital capabilities for better client experience and administrative processes.

Prudent Investment Approach

Great-West Lifeco's commitment to a prudent investment approach is a significant strength. The company maintains a disciplined strategy, evidenced by the fact that 99% of its fixed-income assets were rated investment grade as of December 31, 2024. This conservative stance bolsters resilience during market downturns and effectively manages investment risks.

This focus on quality assets provides a stable base for consistent returns, a crucial factor given the company's substantial asset base. By December 31, 2024, Great-West Lifeco oversaw over $3.2 trillion in assets under administration. This prudent management of such a large portfolio is key to its financial stability and long-term growth prospects.

Great-West Lifeco's diversified business model, spanning insurance, retirement, and asset management across multiple geographies, provides significant resilience. Its strong financial performance, marked by record base earnings in Q4 2024 and Q1 2025, along with a robust capital position (LICAT ratio of 132% in Q2 2025), underscores operational efficiency and market stability.

The company's strategic acquisitions, like that of Prudential's U.S. retirement business for Empower, have solidified its market leadership, now serving over 18.5 million Americans. Targeted investments in digital capabilities and new product offerings, such as dental benefits in Canada, further enhance its growth trajectory and service expansion.

| Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Base Earnings (CAD billions) | 1.05 | 1.12 |

| LICAT Ratio (%) | 130 | 132 |

| Assets Under Administration (CAD trillions) | 3.25 | 3.30 |

What is included in the product

Offers a full breakdown of Great-West Lifeco’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address Great-West Lifeco's strategic challenges and opportunities.

Weaknesses

Great-West Lifeco has faced challenges with volatility in its net earnings from continuing operations. For instance, Q1 2025 saw a 17% decrease compared to Q1 2024, followed by an 11% decline in Q2 2025 from the previous year's second quarter.

This fluctuation stems from several factors, including less favorable market returns on real estate investments and shifts in interest rates. Additionally, the expenses linked to ongoing business transformation projects contribute to this earnings variability.

While the company's base earnings demonstrate robust growth, this net earnings volatility can create uncertainty for investors, potentially affecting their perception of the company's stability despite underlying operational strengths.

Great-West Lifeco's financial results are significantly influenced by market volatility. For instance, the company reported lower market returns in its 2023 results, impacting earnings. Adverse shifts in equity, interest rate, and credit markets directly affect its investment portfolio's value and profitability.

Specific credit events, like the issues encountered with UK water utilities, have demonstrably led to write-downs, as seen in recent financial reporting. While the majority of its holdings are investment-grade, the potential for unforeseen market downturns or isolated credit defaults poses a continuous risk to its bottom line.

Great-West Lifeco's ambitious business transformation efforts, designed to boost efficiency and digital prowess, come with significant upfront costs. These investments are a necessary evil for long-term competitiveness.

For instance, the company's Q1 2024 results showed a notable impact from these transformation expenses, contributing to a decline in net income from continuing operations. This highlights the immediate financial strain these initiatives can impose.

Managing the delicate balance between these crucial, long-term investments and the pressure to maintain short-term profitability remains a persistent challenge for the company's leadership.

Net Asset Outflows in Certain Segments

Great-West Lifeco faced net asset outflows in specific areas during the first quarter of 2025. The Canadian segment, in particular, saw outflows totaling $514 million. This was largely driven by the termination of large retirement plans, suggesting difficulties in retaining significant institutional clients within this segment.

While new deposits in wealth management offered some offset, these substantial outflows point to a persistent challenge. It underscores the importance of implementing robust client retention strategies and ensuring competitive product offerings, especially for larger accounts in key market segments.

- Canadian Segment Outflows: $514 million in Q1 2025.

- Primary Driver: Terminations of large retirement plans.

- Mitigating Factor: Growth in wealth management deposits.

- Implication: Need for enhanced client retention in specific segments.

Intense Competitive Landscape

The financial services and insurance sectors are incredibly crowded, with both long-standing companies and newer players constantly battling for customers. This intense competition can limit Great-West Lifeco's ability to set prices freely and demands continuous spending on technology and new product development. Failure to stay ahead could negatively affect profits.

In 2024, the insurance industry, in particular, faced significant competitive pressures. For instance, the Canadian life insurance market saw a notable increase in new entrants offering digital-first solutions, challenging traditional distribution models. This dynamic forces companies like Great-West Lifeco to innovate rapidly to retain and attract clients, as demonstrated by the industry-wide push towards enhanced digital onboarding processes and personalized product offerings throughout the year.

- Market Saturation: Key markets, especially in North America, exhibit high penetration rates for insurance and financial products, intensifying the fight for incremental growth.

- Technological Disruption: FinTech and InsurTech firms are introducing agile, customer-centric solutions that challenge incumbents' legacy systems and business models.

- Price Sensitivity: Consumers, armed with more information and comparison tools, are increasingly price-sensitive, putting pressure on margins.

- Regulatory Environment: Evolving regulations can create uneven playing fields and require significant compliance investments, impacting competitive positioning.

Great-West Lifeco's earnings can be unpredictable due to market fluctuations and the costs associated with its ongoing business transformation. This volatility, exemplified by a 17% drop in Q1 2025 net earnings compared to the prior year, can create investor uncertainty. While underlying operations show strength, these swings, influenced by factors like real estate returns and interest rate changes, present a notable weakness.

The company has experienced net asset outflows, particularly in its Canadian segment, with $514 million leaving in Q1 2025 due to large retirement plan terminations. This highlights a challenge in retaining substantial institutional clients, despite growth in wealth management deposits. Addressing these client retention issues is crucial for stabilizing asset bases.

Intense competition within the financial services and insurance sectors limits pricing power and necessitates continuous investment in technology and product innovation. The rise of digital-first competitors, particularly in the Canadian life insurance market in 2024, pressures Great-West Lifeco to adapt rapidly to maintain market share and profitability.

The company's significant investments in business transformation, while vital for future efficiency, incur substantial upfront costs. These expenses impacted net income in Q1 2024, demonstrating the immediate financial strain of these initiatives. Balancing these long-term investments with short-term profitability goals remains a key challenge.

Preview Before You Purchase

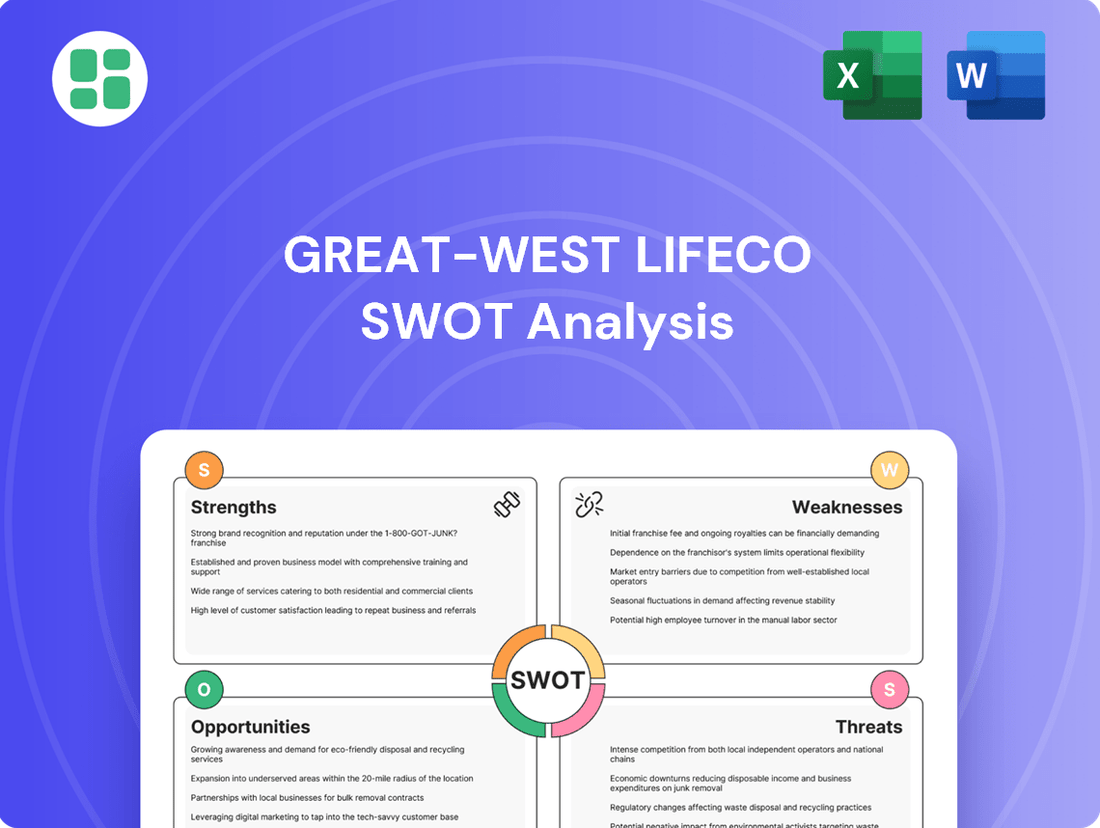

Great-West Lifeco SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Great-West Lifeco's Strengths, Weaknesses, Opportunities, and Threats, equipping you with actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a detailed examination of the factors influencing Great-West Lifeco's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the analysis to your specific needs and integrate it into your business planning.

Opportunities

Great-West Lifeco is strategically prioritizing expansion in wealth and asset management, recognizing it as a crucial avenue for growth across its diverse business segments. This focus is already yielding positive results, evidenced by strong net flows within its U.S. Wealth operations and a notable improvement in trends observed in its Canadian Wealth segment.

The company is actively bolstering its product suite to cater to evolving client demands, notably by incorporating private market investments and developing integrated health and wealth solutions. This proactive product development is designed to position Great-West Lifeco to capture a more substantial portion of the expanding global wealth management market.

Favorable demographic trends, particularly aging populations globally, are fueling a significant increase in demand for retirement planning solutions. This presents a substantial growth opportunity for Great-West Lifeco, especially through its U.S. entity, Empower. By 2030, it's projected that 1 in 5 Americans will be 65 or older, highlighting the expanding market for retirement services.

Empower is strategically positioned to capitalize on this shift, with expectations of robust net plan inflows in the latter half of 2025. This growth is underpinned by the increasing need for comprehensive retirement income solutions and financial wellness programs for a burgeoning senior population.

Great-West Lifeco can leverage its established expertise and considerable scale to address this critical and expanding market need. The company's ability to offer tailored retirement solutions, including investment management and advisory services, aligns perfectly with the evolving financial requirements of an aging demographic.

Great-West Lifeco's commitment to digital transformation, including significant investments in AI and robotic process automation, presents a substantial opportunity. These advancements are expected to not only elevate the customer experience but also to significantly streamline internal operations, driving greater efficiency across the organization.

By bolstering its technology infrastructure and actively developing innovative digital solutions, the company can achieve superior service delivery and reduce overhead costs. This strategic focus on technology is crucial for adapting to evolving customer demands and maintaining a competitive edge in the rapidly digitizing financial services landscape.

Strategic Partnerships and Acquisitions for Growth

Great-West Lifeco actively seeks strategic partnerships and acquisitions to fuel its growth trajectory. A prime example is its recent collaboration with Power Sustainable, focusing on sustainable private equity and infrastructure investments. This move, alongside the acquisition of OptionTrax for its Empower division, significantly expands the company's investment horizons and service offerings.

These strategic initiatives are crucial for Great-West Lifeco's expansion into new and promising market adjacencies. By integrating these capabilities, the company can accelerate its growth and diversify its revenue streams, enhancing its overall market competitiveness.

- Strategic Collaboration: Partnership with Power Sustainable to enhance sustainable investment options.

- Acquisition for Expansion: Purchase of OptionTrax to bolster Empower's service capabilities.

- Market Adjacencies: Entry into new, attractive business areas through strategic alliances.

- Growth Acceleration: Utilizing partnerships and acquisitions to drive faster revenue growth and diversification.

Growing Demand for ESG and Sustainable Investing

The global market for ESG (Environmental, Social, and Governance) investments is experiencing significant growth, with assets under management projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. Great-West Lifeco's proactive stance on sustainability, including its participation in CDP reporting and its strategic alliance with Power Sustainable, directly addresses this burgeoning demand. This focus allows the company to attract a growing segment of investors prioritizing ethical and sustainable financial products, thereby enhancing its market appeal and potential for new product development.

This commitment to ESG principles is not merely a trend but a fundamental shift in investor preference, with a substantial portion of institutional investors now integrating ESG factors into their decision-making processes. Great-West Lifeco's alignment with this shift, exemplified by its stated purpose of fostering financially secure futures, positions it favorably to capture market share and build stronger relationships with clients who value corporate responsibility. The company's efforts in sustainable investing are expected to drive both financial performance and positive societal impact.

- Market Growth: Global ESG assets are on track to exceed $50 trillion by 2025.

- Investor Preference: A significant majority of institutional investors now incorporate ESG criteria.

- Strategic Alignment: Great-West Lifeco's sustainability initiatives resonate with growing investor demand.

- Product Development: Opportunities exist to launch new, ESG-focused financial products.

Great-West Lifeco is strategically expanding its presence in wealth and asset management, with strong net flows in its U.S. Wealth operations and improving trends in Canada. The company is enhancing its product offerings to include private markets and integrated health/wealth solutions to capture more of the global wealth management market.

Favorable demographics, particularly aging populations, are driving demand for retirement solutions, a key growth area for Empower. By 2030, one in five Americans will be 65 or older, underscoring the significant market opportunity for retirement services.

Investments in digital transformation, including AI and automation, are poised to improve customer experience and streamline operations, boosting efficiency. Strategic partnerships and acquisitions, such as the collaboration with Power Sustainable and the acquisition of OptionTrax, are expanding investment capabilities and market reach.

The global ESG investment market is projected to exceed $50 trillion by 2025, and Great-West Lifeco's sustainability focus, including its Power Sustainable alliance, aligns with this growing investor demand, creating opportunities for new product development.

Threats

The financial services and insurance sectors are fiercely competitive, with traditional players, nimble fintech companies, and emerging market entrants all vying for customers. This intense rivalry often translates into price wars, squeezing profit margins and making it harder for established companies like Great-West Lifeco to hold onto their market share. For instance, the Canadian insurance market, a key area for Great-West Lifeco, saw a competitive push in 2024 with new digital-first offerings impacting traditional product sales.

Great-West Lifeco faces significant risks from the evolving regulatory landscape across its operating regions, including Canada, the U.S., and Europe. New legislation, like the OECD's global minimum tax initiative, presents a substantial challenge, potentially increasing compliance burdens and affecting the company's bottom line. For instance, in 2024, financial institutions globally are grappling with the complexities and costs associated with implementing these new international tax rules, which require significant investment in systems and expertise.

Great-West Lifeco, like all major financial institutions, is a prime target for cyberattacks. The increasing sophistication of these threats means potential data breaches or system failures are a constant concern. In 2023, the financial services sector experienced a significant rise in cyber incidents, with costs per breach often running into millions of dollars, impacting customer data and operational continuity.

A successful cyberattack could cripple Great-West Lifeco, leading to direct financial losses from theft or recovery efforts, severe reputational damage, and hefty regulatory penalties. For instance, the Ontario Securities Commission and other regulators impose strict data protection rules, with fines for non-compliance potentially reaching substantial sums, as seen in other breaches within the industry.

Mitigating this threat requires ongoing, substantial investment in advanced cybersecurity measures, including threat detection, data encryption, and employee training. Companies like Great-West Lifeco must maintain robust data protection protocols and incident response plans to safeguard sensitive customer information and ensure business resilience in the face of evolving cyber risks.

Adverse Economic Conditions and Market Volatility

Great-West Lifeco faces the persistent threat of adverse economic conditions. Prolonged economic stagnation or high inflation, as seen in various global economies throughout 2023 and into early 2024, can significantly erode the value of its investment portfolios and dampen profitability. For instance, a sharp downturn in equity markets, which saw the S&P 500 experience considerable swings in 2023, directly impacts the asset values managed by the company.

Market volatility, including fluctuations in interest rates and credit markets, presents another substantial risk. Unfavorable shifts in interest rates can reduce investment income and increase borrowing costs. For example, central bank policy shifts in 2024 continue to create uncertainty around long-term yields, potentially impacting Great-West Lifeco's net investment income and the valuation of its liabilities.

- Economic Slowdown: Fears of a recession in major economies could lead to reduced demand for insurance and wealth management products.

- Inflationary Pressures: Persistent high inflation can increase operating costs and reduce the real return on investments.

- Interest Rate Volatility: Rapidly changing interest rates can negatively affect the company's investment income and the market value of its fixed-income securities.

- Credit Market Deterioration: A downturn in credit markets could lead to increased defaults on corporate bonds held in investment portfolios, resulting in losses.

Impact of Catastrophic Events and Climate Change

Great-West Lifeco faces significant threats from catastrophic events. For instance, the company has had to increase its claims provisions due to events like the California wildfires, demonstrating a direct financial impact.

Beyond immediate disasters, the pervasive influence of climate change presents a more complex, long-term challenge. This includes physical risks, such as damage to assets, and transition risks, arising from shifts to a lower-carbon economy, both of which can disrupt its investment portfolio and underwriting practices.

The company's ability to accurately assess and proactively manage these multifaceted climate-related risks is crucial for its sustained business viability and financial health.

- Exposure to Catastrophic Events: Increased claims provisions due to events like California wildfires directly impact profitability.

- Climate Change Impacts: Physical risks (e.g., extreme weather) and transition risks (e.g., regulatory changes) can affect investment returns and underwriting models.

- Long-Term Sustainability: Managing climate-related risks is an ongoing challenge vital for the company's future operational and financial stability.

Intense competition from both traditional insurers and emerging fintech players continues to pressure profit margins in key markets like Canada, with new digital offerings gaining traction in 2024. Regulatory changes, such as the global minimum tax initiative, are increasing compliance burdens and costs for financial institutions in 2024. Furthermore, the persistent threat of sophisticated cyberattacks poses a significant risk, potentially leading to substantial financial losses and reputational damage, as evidenced by the rising costs of data breaches in the financial sector throughout 2023.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Great-West Lifeco's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.