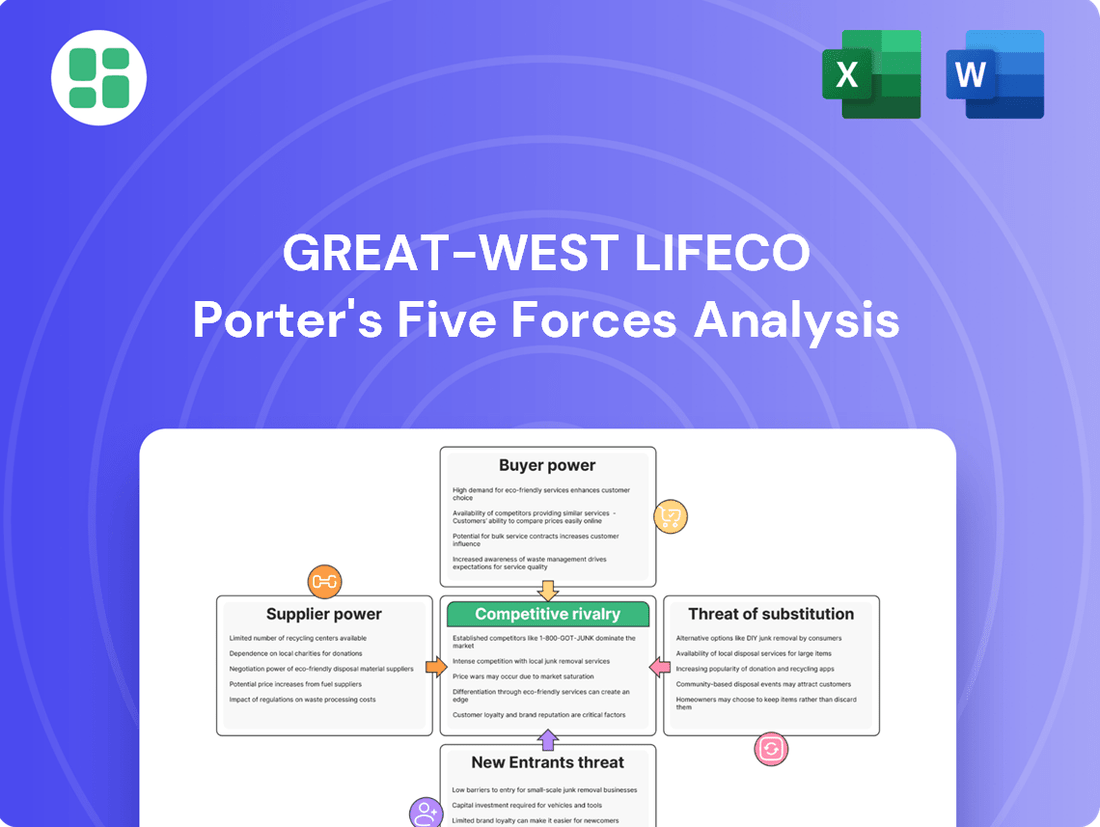

Great-West Lifeco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great-West Lifeco Bundle

Great-West Lifeco navigates a complex insurance landscape shaped by intense rivalry and significant buyer power. Understanding the nuances of supplier influence and the threat of new entrants is crucial for sustained success.

The complete report reveals the real forces shaping Great-West Lifeco’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Great-West Lifeco's dependence on sophisticated technology and software for its digital operations and data analytics means that specialized tech vendors hold considerable bargaining power. The financial services sector's increasing adoption of AI and machine learning further amplifies the influence of vendors offering proprietary solutions that drive competitive advantages and efficiency.

Data and analytics providers wield significant bargaining power over companies like Great-West Lifeco. Access to high-quality, real-time data and advanced analytics is absolutely critical for effective risk assessment, crafting personalized customer offerings, and making smart strategic decisions within the insurance and wealth management sectors. Suppliers who offer unique or demonstrably superior insights into market trends and customer behavior, especially in the rapidly evolving digital landscape of 2024, can command higher prices and more favorable terms.

Specialized actuarial and financial consulting firms are crucial for Great-West Lifeco, offering expertise in product development, risk modeling, and regulatory compliance. The limited pool of highly skilled actuaries and the critical nature of their work grant these suppliers considerable leverage, especially when Great-West Lifeco requires specialized knowledge for intricate insurance or retirement products.

Reinsurance Providers

The bargaining power of reinsurance providers is a critical factor for Great-West Lifeco. As a significant player in the insurance industry, Great-West Lifeco, through its subsidiaries like Canada Life, relies on reinsurance to manage risk and capital. The availability and cost of reinsurance capacity from global reinsurers directly influence Great-West Lifeco's profitability and its ability to underwrite new business.

In 2024, the reinsurance market continued to experience hardening conditions, with reinsurers demonstrating strong pricing power due to ongoing global catastrophe losses and rising inflation. This environment means that Great-West Lifeco, like its peers, likely faces increased costs for reinsurance coverage, impacting its net income. For instance, property catastrophe reinsurance rates saw substantial increases globally in early 2024 renewals, with some segments experiencing hikes of 20-50% or more, illustrating the leverage reinsurers hold.

- Reinsurer Concentration: A limited number of large, global reinsurers dominate the market, giving them significant leverage in setting terms and prices.

- Capital Requirements: Reinsurers' own capital positions and their appetite for risk directly affect the supply and cost of reinsurance capacity.

- Specialized Expertise: Reinsurers possess specialized underwriting knowledge and risk modeling capabilities that are difficult for primary insurers to replicate internally.

- Impact on Profitability: Higher reinsurance premiums directly reduce the profitability of Great-West Lifeco's insurance operations.

Financial Market Infrastructure Providers

Financial market infrastructure providers, like those offering payment processing or trading platforms, hold significant bargaining power. Their services are fundamental, and the stability and security they offer are paramount for companies like Great-West Lifeco. Established players benefit from high switching costs and the complexity of integrating new systems, making it difficult for clients to change providers.

The critical nature of these services means that even if they appear commoditized, their reliability is a non-negotiable factor. For instance, the global payments market, a key area for infrastructure providers, was projected to reach over $3 trillion in transaction value by 2024, highlighting the sheer scale and importance of these foundational services. This reliance grants these providers considerable leverage.

- Criticality of Services: Payment processing, custodial services, and trading platforms are essential for financial operations.

- High Switching Costs: The expense and complexity of changing established infrastructure create lock-in for clients.

- Stability and Security Demands: Non-negotiable requirements for reliability give established, secure providers an advantage.

- Market Size: The vast global payments market, valued in trillions, underscores the importance of these infrastructure providers.

Suppliers of specialized technology and data analytics services hold significant bargaining power over Great-West Lifeco. The increasing reliance on AI and advanced analytics in the financial sector, especially in 2024, means that vendors with proprietary solutions that enhance efficiency and provide competitive advantages can dictate terms. For example, the global AI market was projected to grow substantially in 2024, with specific segments like AI in finance experiencing rapid adoption, indicating strong demand for these specialized suppliers.

Reinsurance providers exert considerable leverage over Great-West Lifeco, particularly given the hardening market conditions observed in 2024. Increased global catastrophe losses and inflation have empowered reinsurers, leading to higher premiums for primary insurers. This trend is evident in the property catastrophe reinsurance market, where rates saw significant increases globally during early 2024 renewals, impacting the cost of risk transfer for companies like Great-West Lifeco.

Financial market infrastructure providers, such as payment processors and trading platforms, also possess strong bargaining power. The essential nature of their services, coupled with high switching costs and the critical demand for stability and security, grants them leverage. The immense scale of the global payments market, valued in trillions of dollars by 2024, underscores the foundational importance and thus the power of these infrastructure suppliers.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Great-West Lifeco | Example Data/Trend (2024) |

|---|---|---|---|

| Technology & Data Analytics | Proprietary AI/ML solutions, critical for competitive advantage | Higher costs for essential digital services | Global AI market growth projected to exceed 30% in 2024 |

| Reinsurance Providers | Limited capacity, hardening market conditions, specialized expertise | Increased reinsurance premiums, reduced profitability | Property catastrophe reinsurance rates up 20-50%+ in early 2024 renewals |

| Financial Market Infrastructure | Criticality of services, high switching costs, stability demands | Potential for higher fees for essential operational services | Global payments market transaction value projected over $3 trillion in 2024 |

What is included in the product

This analysis of Great-West Lifeco's competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, providing strategic insights into its market position.

Navigate competitive pressures with a dynamic Porter's Five Forces model, allowing for rapid scenario planning and strategic adjustments to mitigate risks and capitalize on opportunities.

Customers Bargaining Power

Customers today are incredibly connected and accustomed to the slick, intuitive interfaces of tech giants. This digital fluency means they expect the same level of seamless, personalized service from financial institutions. For Great-West Lifeco, this translates to a need to constantly innovate in digital offerings to meet these elevated expectations.

The ease with which customers can now switch providers, especially with digital platforms, significantly amplifies their bargaining power. If Great-West Lifeco doesn't deliver on convenience and tailored solutions, customers have readily available alternatives. In 2024, digital adoption rates continued to climb, with many consumers actively seeking out financial services that offer superior online and mobile experiences, putting pressure on established players.

For standardized insurance and investment products, customers often have a keen eye on price. They can readily compare what different companies offer, making them quite sensitive to cost. This is particularly true for products that are seen as similar across the board.

Great-West Lifeco, while diverse, faces this reality in certain areas. Intense competition means customers can push for lower prices, especially when products are viewed as commodities. For instance, in the group benefits sector, where plans can be quite similar, employers often shop around, putting pressure on providers like Great-West Lifeco to remain competitive on price.

Customers today have unprecedented access to information. Online comparison platforms and financial aggregators, readily available in 2024, allow individuals to easily compare product features, pricing, and performance across various financial institutions. This transparency significantly reduces search costs for consumers, empowering them to make more informed decisions.

Large Institutional Clients (e.g., Pension Plans, Group Benefits)

Large institutional clients, such as pension plans and group benefit sponsors, wield considerable bargaining power over Great-West Lifeco's workplace solutions, particularly through its Empower brand. These clients manage vast asset bases, often in the billions of dollars, enabling them to negotiate favorable terms. For instance, the average U.S. corporate pension plan assets were in the hundreds of millions, and large plans easily surpass this, giving them leverage to demand highly customized offerings, reduced fees, and superior service standards.

Their ability to shift substantial sums of money makes them highly valuable, and they can exert pressure for competitive pricing. This can manifest as demands for lower administrative fees or performance-based fee structures. In 2023, the retirement services industry saw continued fee compression, a trend driven by these large institutional buyers seeking maximum value for their assets.

- Significant Asset Bases: Institutional clients control large pools of capital, giving them leverage in negotiations.

- Demand for Customization: Their unique needs require tailored solutions, increasing the cost and complexity for providers.

- Fee Sensitivity: Large mandates allow for aggressive fee negotiation, impacting provider profitability.

- Potential for Mandate Shifts: The ease with which they can move substantial assets incentivizes providers to maintain high service levels and competitive pricing.

Desire for Personalized Advice and Holistic Solutions

Customers are shifting from simple product purchases to demanding personalized financial advice and comprehensive, holistic solutions. This means they want guidance that aligns with their specific life stages and financial aspirations, moving beyond just buying individual insurance policies or investment funds.

This growing desire for integrated services and tailored recommendations significantly bolsters customer bargaining power. Those who value in-depth financial planning and a trusted advisory relationship are in a stronger position to negotiate terms and seek out providers who can deliver this complete package.

- Demand for Personalization: Clients increasingly expect financial advice tailored to their unique circumstances, not one-size-fits-all products.

- Holistic Approach Valued: Customers prefer integrated solutions covering various financial needs, from retirement planning to estate management.

- Shift from Product to Service: The focus is moving from transactional product sales to ongoing advisory relationships.

- Increased Bargaining Power: This demand for comprehensive, personalized service empowers customers, allowing them to seek out and negotiate with providers offering superior advisory capabilities.

The bargaining power of customers for Great-West Lifeco is significant, driven by increased transparency, ease of switching, and a growing demand for personalized, holistic financial solutions. Customers can readily compare offerings, pushing for better pricing and service, especially in standardized product areas. In 2024, digital channels further empowered consumers, allowing for seamless comparison and provider switching, intensifying this pressure.

Institutional clients, particularly within Great-West Lifeco's Empower segment, wield substantial influence due to their vast asset bases. These clients, managing billions, can negotiate highly favorable terms, demanding customized solutions and fee reductions. This trend of fee compression continued in 2023, reflecting the leverage these large players have in securing competitive pricing for their mandates.

The shift towards personalized financial advice and integrated solutions also enhances customer leverage. Clients seeking comprehensive planning are more discerning, actively negotiating with providers who can offer a complete, tailored package. This elevates the importance of advisory services and strengthens the customer's hand in seeking value.

| Customer Attribute | Impact on Great-West Lifeco | 2024/2023 Data Point |

|---|---|---|

| Digital Savvy & Information Access | Increased price sensitivity and ease of switching providers. | Continued rise in digital financial service adoption, with a significant portion of consumers actively comparing options online. |

| Standardized Products | Pressure for lower prices due to easy comparability. | Group benefits sector sees employers frequently re-evaluating providers based on cost and plan similarity. |

| Institutional Client Size | Ability to negotiate favorable terms, lower fees, and demand customization. | Average U.S. corporate pension plan assets in the hundreds of millions, with large plans easily exceeding this, driving fee compression in retirement services. |

| Demand for Personalization & Holistic Solutions | Need for tailored advice and integrated services, strengthening customer negotiation power. | Growing preference for financial planning that aligns with life stages and financial aspirations, moving beyond basic product transactions. |

What You See Is What You Get

Great-West Lifeco Porter's Five Forces Analysis

This preview showcases the comprehensive Great-West Lifeco Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape within the life insurance and retirement services industry. The document you are viewing is the exact, professionally formatted report you will receive immediately upon purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The financial services sector, especially in Canada, the U.S., and Europe, is dominated by substantial, well-funded established companies. These include major life insurance providers and prominent wealth management firms, creating a highly competitive landscape.

Great-West Lifeco faces significant competition from other major players. In Canada, for instance, its rivals include Manulife Financial Corp and Sun Life Financial Inc., both of which are substantial entities with extensive market reach and resources, intensifying the rivalry.

Competitors in the financial services sector are pouring significant capital into digital transformation, with a strong emphasis on artificial intelligence and data analytics. This strategic push aims to elevate customer experiences, optimize operational efficiencies, and pioneer new product offerings. For instance, in 2024, many leading life insurers reported substantial increases in their technology budgets, with some allocating over 15% of their operating expenses to digital initiatives to stay ahead in this innovation race.

This intense competition to digitalize compels companies like Great-West Lifeco to constantly innovate. Failing to keep pace with technological advancements risks falling behind in meeting evolving customer expectations for seamless, personalized, and efficient service delivery. The pressure is on to develop cutting-edge solutions that differentiate them in a crowded marketplace.

Many financial services firms, including Great-West Lifeco, boast extensive product ranges that cover insurance, investments, and retirement planning. This diversification enables them to cross-sell and bundle services, creating comprehensive solutions for clients. For instance, in 2023, Great-West Lifeco reported strong growth in its wealth management segment, which often complements its insurance offerings, allowing for integrated sales strategies.

This ability to offer a wide array of financial products intensifies competition. Companies are not merely vying for market share on single products but are competing on their capacity to be a one-stop shop for diverse customer financial requirements. This holistic approach means that a competitor excelling in one area, like retirement services, can leverage that strength to attract customers who also need insurance, thereby deepening the competitive rivalry across the entire financial services spectrum.

Geographic and Segment Overlap

Great-West Lifeco's competitive landscape is shaped by significant geographic and segment overlap. The company actively competes in Canada, the United States, and Europe, encountering a mix of large global financial institutions and formidable regional specialists within each market. This broad operational footprint means Great-West Lifeco must navigate a complex web of competitive pressures that vary considerably based on local market conditions and specific business lines, including life insurance, health benefits, retirement solutions, and asset management.

This overlap intensifies rivalry, as competitors often share customer bases and product offerings across these diverse segments. For instance, in 2024, the North American life insurance market, a key area for Great-West Lifeco, saw continued consolidation and aggressive pricing strategies from established players. Similarly, the European retirement services sector, where Great-West Lifeco also has a presence, is characterized by increasing demand for personalized solutions, leading to heightened competition among providers aiming to capture market share.

- Canadian Market: Great-West Lifeco faces intense competition from domestic giants like Manulife and Sun Life Financial, which also have extensive operations in life insurance and wealth management.

- U.S. Market: In the U.S., the company contends with large diversified financial services firms and specialized annuity and retirement plan providers, where market share is often won through scale and technological innovation.

- European Market: European operations, particularly in retirement solutions, see competition from local banks and insurance companies with deep-rooted customer relationships and tailored product offerings.

- Segment Competition: Across all geographies, Great-West Lifeco competes with firms that may specialize in only one segment, such as pure asset managers or health insurance providers, allowing them to focus resources and expertise.

Mergers and Acquisitions Activity

Mergers and acquisitions are a constant feature in the financial services industry, reshaping the competitive arena. Larger, established companies frequently acquire smaller or niche players to bolster their market share, enhance their service offerings, or unlock cost efficiencies through synergy. This consolidation trend can significantly shift the balance of power among rivals. For instance, Empower's strategic acquisitions have demonstrably increased its scale and market influence.

The impact of these deals is substantial, with significant capital deployed. In 2023, the global M&A market saw a notable volume of activity within financial services, though specific figures for the life insurance and retirement services sector can fluctuate. For example, deals aimed at expanding digital capabilities or entering new geographic markets are common drivers.

- Industry Consolidation: Ongoing mergers and acquisitions are a key characteristic, leading to fewer, larger players.

- Strategic Drivers: Acquisitions are driven by goals such as increasing market share, expanding service portfolios, and achieving operational synergies.

- Competitive Landscape Shift: M&A activity can rapidly alter the competitive dynamics, empowering acquirers with greater scale and market power.

- Example: Empower's acquisition strategy illustrates how firms use M&A to enhance their competitive standing.

The competitive rivalry for Great-West Lifeco is fierce, driven by large, established financial institutions across Canada, the U.S., and Europe. These rivals often possess similar extensive product offerings, including insurance, wealth management, and retirement solutions, leading to direct competition for customer loyalty and market share. The drive for digital innovation, with significant investment in AI and data analytics in 2024, further intensifies this rivalry as companies strive to enhance customer experience and operational efficiency.

Consolidation through mergers and acquisitions is a constant factor, with larger entities acquiring smaller ones to boost scale and capabilities. This M&A activity, as seen with Empower, reshapes the competitive landscape, creating more formidable competitors. Great-West Lifeco must continually innovate and adapt to maintain its position against these well-capitalized and strategically active rivals across its diverse geographic and segment operations.

| Competitor | Primary Markets | Key Offerings | 2024 Digital Investment Focus |

|---|---|---|---|

| Manulife Financial Corp | Canada, U.S., Asia | Insurance, Wealth & Asset Management | AI-driven customer service, digital advice platforms |

| Sun Life Financial Inc. | Canada, U.S., Asia | Insurance, Investments, Health | Personalized digital health solutions, FinTech partnerships |

| Empower | U.S. | Retirement Services, Investment Management | Data analytics for personalized retirement planning, platform enhancements |

SSubstitutes Threaten

The proliferation of low-cost, self-directed investment platforms and robo-advisors presents a potent substitute for Great-West Lifeco's traditional wealth management offerings. These digital solutions, appealing to younger, tech-savvy investors, provide automated portfolio management and financial guidance at a fraction of the cost of human advisors. For instance, the robo-advisor market segment saw substantial growth, with assets under management reaching hundreds of billions by 2023, indicating a clear shift in consumer preference towards these accessible alternatives.

Direct-to-consumer digital insurance models, often powered by Insurtech startups, present a significant threat. These companies are simplifying insurance products and selling them directly to customers, cutting out the need for traditional agents. This bypasses established distribution networks, offering a more streamlined and potentially cheaper alternative for consumers.

For instance, by mid-2024, several Insurtechs have reported substantial growth in customer acquisition, with some achieving double-digit percentage increases in policy volume year-over-year. Their digital-first approach, featuring quick online applications and policy management, directly substitutes for the more complex, agent-assisted sales processes common in traditional insurance, potentially eroding market share for incumbents like Great-West Lifeco.

Government-provided social security and healthcare systems in Canada and Europe directly compete with Great-West Lifeco's offerings. For instance, Canada's universal healthcare system, funded through taxes, reduces the demand for private health insurance. Similarly, robust public pension plans can diminish the perceived necessity for private retirement savings products.

Embedded Finance Solutions

The increasing prevalence of embedded finance solutions poses a threat of substitutes for traditional financial service providers like Great-West Lifeco. Non-financial companies are integrating financial services directly into their customer journeys. For instance, e-commerce platforms now frequently offer point-of-sale financing or insurance at checkout, making these services readily available without engaging a separate financial institution.

This trend means customers can access financial products through familiar, non-financial channels, potentially bypassing traditional providers altogether. This seamless integration can reduce the perceived need for specialized financial services from established players. By 2024, the global embedded finance market was projected to reach hundreds of billions of dollars, highlighting the significant shift in how consumers access financial tools.

- Growing Accessibility: Embedded finance makes financial services convenient, often appearing within a user's existing digital experience.

- Reduced Reliance: Customers may no longer feel the need to seek out dedicated financial institutions for everyday needs like payments, lending, or insurance.

- Market Growth: The embedded finance market is experiencing rapid expansion, indicating a strong customer preference for integrated financial solutions.

- Competitive Pressure: Traditional providers face pressure to adapt or risk losing market share to tech-forward companies offering bundled financial products.

Alternative Savings and Investment Vehicles

The threat of substitutes for Great-West Lifeco's offerings is significant, as customers increasingly explore avenues beyond traditional financial products. Real estate, for instance, remains a popular long-term investment. In 2024, housing prices in many major markets continued their upward trend, making property a compelling alternative for capital accumulation.

Direct investments in private businesses or startups also present a substitute. Venture capital funding in Canada saw a notable increase in early 2024, indicating a growing appetite for direct business ownership. This competes for funds that could otherwise be directed towards Great-West Lifeco's managed investment portfolios.

Emerging digital assets, including cryptocurrencies and tokenized securities, represent another evolving substitute. While volatile, their growing acceptance and accessibility mean they capture a portion of investor capital. For example, the global digital asset market capitalization fluctuated significantly in 2024, demonstrating its growing, albeit speculative, presence in the investment landscape.

- Real Estate: Continued appreciation in housing markets in 2024 offers a tangible investment alternative.

- Direct Business Investment: Increased venture capital activity in Canada in early 2024 highlights a growing trend in direct equity participation.

- Digital Assets: The fluctuating but substantial global digital asset market capitalization in 2024 signifies an emerging competitor for investor funds.

The threat of substitutes for Great-West Lifeco's services is multifaceted, encompassing digital alternatives, government programs, embedded finance, and alternative investments. The rise of low-cost robo-advisors, direct-to-consumer Insurtech models, and embedded finance solutions are all capturing market share by offering convenience and lower costs. Furthermore, traditional substitutes like real estate and emerging digital assets continue to compete for investor capital, as evidenced by market trends in 2024.

| Substitute Category | Key Examples | 2024 Trend/Data Point |

|---|---|---|

| Digital Wealth Management | Robo-advisors | Assets under management in the robo-advisor segment reached hundreds of billions by 2023, indicating strong growth. |

| Direct-to-Consumer Insurance | Insurtech startups | Some Insurtechs reported double-digit percentage increases in policy volume year-over-year by mid-2024. |

| Embedded Finance | Point-of-sale financing on e-commerce platforms | The global embedded finance market was projected to reach hundreds of billions of dollars in 2024. |

| Alternative Investments | Real Estate, Digital Assets | Housing prices continued upward trends in many markets in 2024; global digital asset market capitalization fluctuated significantly. |

Entrants Threaten

The financial services sector, especially insurance and banking, faces substantial regulatory oversight. This includes stringent capital reserve mandates, licensing procedures, and the need for robust compliance systems. For instance, in 2024, the average capital adequacy ratio for major Canadian banks, a key indicator of financial health and regulatory compliance, remained well above the minimum requirements, signaling a high bar for new entrants.

These demanding regulatory frameworks and significant capital investment needs create formidable barriers for prospective competitors. Such requirements effectively shield incumbent companies, like Great-West Lifeco, from the immediate threat of new market entrants, ensuring a more stable competitive landscape.

Brand recognition and trust are significant barriers to entry in the financial services sector, a reality Great-West Lifeco navigates effectively. Building this trust, particularly when dealing with life savings and financial security, is a process that can take decades. For instance, Canada Life, a key subsidiary of Great-West Lifeco, has a history dating back to 1847, fostering a deep-seated customer loyalty that is hard for newcomers to overcome.

Established firms like Great-West Lifeco and its subsidiaries, including Empower, benefit from this long-standing reputation. This ingrained trust and established customer base make it exceptionally challenging for new entrants to quickly gain market share or replicate the confidence consumers place in these legacy brands. In 2023, Great-West Lifeco reported total assets under administration of C$2.4 trillion, a testament to the scale and trust built over many years.

Great-West Lifeco, like many in the insurance and wealth management sector, benefits from substantial economies of scale. Existing players have optimized underwriting, claims processing, and investment management operations, leading to lower per-unit costs. For instance, in 2024, major insurers continued to leverage technology to streamline these processes, further solidifying their cost advantages.

New entrants face a significant hurdle in replicating these efficiencies without massive upfront capital investment. Building comparable operational infrastructure and achieving the same cost-effectiveness is a long and expensive road. This makes it difficult for new companies to compete on price or service quality from the outset.

Furthermore, Great-West Lifeco's established distribution networks, encompassing a vast array of financial advisors, brokers, and employer benefit plans, act as a powerful barrier. These relationships, cultivated over years, provide consistent access to customers. Newcomers must invest heavily in building their own advisor force and securing distribution agreements, a process that can take considerable time and resources.

FinTech and Tech Giant Disruption

The threat of new entrants for Great-West Lifeco, particularly concerning FinTech and tech giant disruption, is a significant consideration. While established players benefit from regulatory hurdles and capital requirements, agile FinTech startups and tech behemoths like Google and Amazon pose a substantial challenge. These new entrants often leverage massive existing customer bases, advanced technological capabilities, and considerable financial resources to target specific, profitable segments within the financial services industry, potentially unbundling traditional offerings.

For instance, in 2024, FinTech funding continued to be robust, with venture capital pouring into companies focused on areas like digital payments, wealth management, and insurtech. These startups are designed for agility, allowing them to innovate rapidly and offer user-friendly, often lower-cost alternatives to incumbent services. Great-West Lifeco must remain vigilant against these disruptive forces that can erode market share by focusing on niche areas or by offering superior digital customer experiences.

- FinTech Funding Trends: Global FinTech funding reached over $110 billion in 2023, with continued strong investment anticipated in 2024, particularly in AI-driven financial solutions and embedded finance.

- Tech Giant Expansion: Companies like Apple and Google are increasingly offering financial services, leveraging their vast ecosystems and user data to expand into payments, lending, and even investment products.

- Customer Acquisition Costs: New entrants often have lower customer acquisition costs due to digital-first strategies and viral marketing, contrasting with the higher costs traditionally faced by established financial institutions.

Talent Acquisition and Expertise

The financial services sector, including companies like Great-West Lifeco, demands highly specialized skills. Think about actuaries who calculate risk, investment managers who grow wealth, and compliance officers who navigate intricate regulations. New companies entering this space struggle to find and keep these experts, which is a significant hurdle.

For instance, in 2024, the demand for cybersecurity professionals in financial services saw a substantial increase, with some reports indicating a 40% year-over-year rise in job postings for these roles. This intense competition for specialized talent makes it difficult and costly for new entrants to build a capable workforce from scratch.

- Specialized Skill Requirements: Actuarial science, investment management, risk assessment, and regulatory compliance are critical.

- Talent Acquisition Challenges: New entrants face difficulties in attracting and retaining experienced professionals.

- Impact on Competition: The scarcity of specialized talent creates a barrier to entry, favoring established players with existing expertise.

- Cost of Expertise: High salaries and benefits are often necessary to secure top talent, increasing initial operating costs for newcomers.

The threat of new entrants for Great-West Lifeco is somewhat mitigated by high regulatory barriers, significant capital requirements, and the need for specialized skills, all of which demand substantial investment and time to overcome. Established brand loyalty and trust, built over decades by companies like Canada Life, further solidify existing market positions, making it difficult for newcomers to gain traction. Furthermore, economies of scale and extensive distribution networks enjoyed by incumbents like Great-West Lifeco create cost advantages and customer access that new entrants struggle to replicate.

However, the rise of agile FinTech companies and the expansion of tech giants into financial services present a growing challenge. These new players often leverage advanced technology, lower customer acquisition costs, and access to vast user bases to target specific profitable segments, potentially disrupting traditional offerings. For instance, global FinTech funding exceeded $110 billion in 2023, with continued strong investment expected in 2024, particularly in AI-driven solutions.

| Barrier Type | Description | Impact on New Entrants | Example for Great-West Lifeco | 2024 Relevance |

|---|---|---|---|---|

| Regulatory & Capital Requirements | Stringent licensing, capital reserves, compliance | High; requires significant upfront investment | Canadian banks' capital adequacy ratios remained well above minimums in 2024 | Maintains high entry costs |

| Brand Recognition & Trust | Long-standing reputation, customer loyalty | High; takes decades to build | Canada Life established in 1847 | Reinforces incumbent advantage |

| Economies of Scale | Lower per-unit costs through optimized operations | High; difficult to match without scale | Continued technology adoption for process streamlining by major insurers | Amplifies cost advantages for incumbents |

| Distribution Networks | Established relationships with advisors, brokers, employers | High; requires time and resources to build | Empower's extensive advisor network | Secures consistent customer access |

| Specialized Talent | Need for actuaries, investment managers, compliance experts | High; difficult and costly to acquire | 40% year-over-year rise in cybersecurity job postings in financial services (2024) | Increases operational costs for newcomers |

| FinTech & Tech Giants | Agile innovation, large customer bases, advanced tech | Growing; potential for disruption and unbundling | Robust FinTech funding in 2023, continued in 2024 | Challenges incumbents with new models |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Great-West Lifeco is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with insights from reputable industry research firms and financial news outlets to capture the competitive landscape.