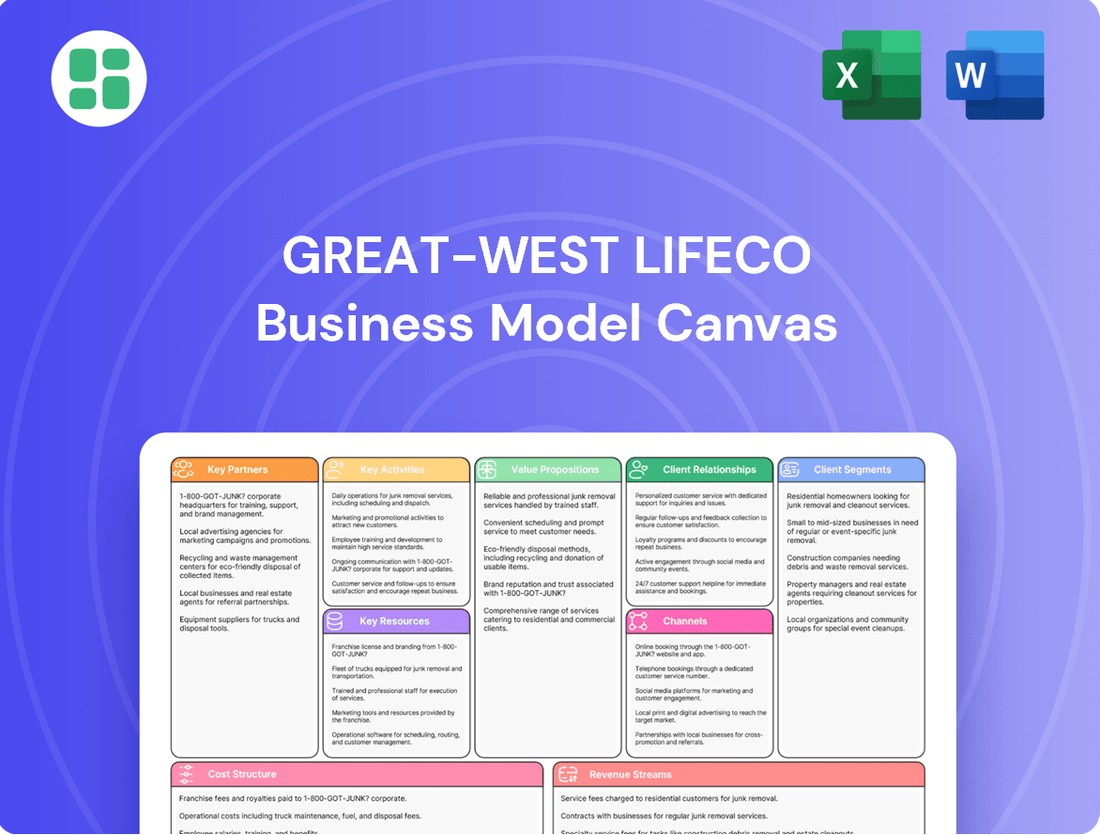

Great-West Lifeco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great-West Lifeco Bundle

Unlock the strategic blueprint behind Great-West Lifeco's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear picture of how they operate in the competitive financial services landscape. Ideal for anyone seeking to understand market-leading strategies, this resource provides actionable insights for your own business ventures.

Partnerships

Great-West Lifeco has significantly bolstered its commitment to sustainable finance by deepening its strategic partnership with Power Sustainable Manager Inc., a dedicated climate-focused investment manager. This collaboration sees Great-West Lifeco acquiring a minority stake in Power Sustainable, signaling a strong alignment of long-term goals.

This alliance is crucial as Great-West Lifeco commits to investing in Power Sustainable's diverse funds, with a particular emphasis on sustainable private equity and infrastructure. This move directly expands the investment universe available to Great-West Lifeco's clients and its own general account.

The partnership directly supports Great-West Lifeco's overarching value-creation strategy by integrating sustainable finance principles. It's a clear demonstration of the company's dedication to growing its sustainable investment offerings and contributing to broader environmental, social, and governance (ESG) objectives.

Great-West Lifeco actively partners with major technology firms like Cisco, SAP, IBM, and Microsoft to accelerate its digital transformation. These collaborations are vital for tapping into extensive research and development capabilities and securing access to specialized technical expertise, thereby strengthening their technology infrastructure and customer data security protocols.

By leveraging these partnerships, Great-West Lifeco can more effectively develop user-friendly digital platforms and optimize its operational processes. For instance, in 2023, the company continued to invest heavily in technology, with IT expenses representing a significant portion of its operating costs, underscoring the importance of these strategic alliances in achieving efficiency and innovation.

Great-West Lifeco's business model thrives on its extensive distribution networks and deeply ingrained advisor relationships. These are not just channels; they are the lifeblood of its market penetration, connecting its diverse product offerings to millions of individuals and businesses.

The company boasts relationships with thousands of distribution partners and a vast advisor network spanning Canada, the United States, and Europe. This expansive reach is crucial for serving approximately 40 million customer relationships, a testament to the effectiveness of these key partnerships in distributing a comprehensive suite of financial security products and services.

Subsidiaries like Canada Life, Empower, and Irish Life actively leverage these established networks. For instance, Empower, a major player in retirement services, relies heavily on its advisor relationships to onboard new clients and retain existing ones, further solidifying Great-West Lifeco's market presence and ability to cater to varied customer needs.

Mortgage Servicing and Digital Mortgage Providers

Canada Life, a key subsidiary of Great-West Lifeco, has strategically partnered with nesto, a Canadian digital mortgage innovator. This collaboration focuses on transferring the servicing and support for Canada Life's existing residential mortgage portfolio to nesto.

This alliance aims to enhance the customer experience for Canada Life's mortgage holders by providing them with a modern, digital platform. Customers will benefit from nesto's competitive mortgage offerings while continuing to receive essential wealth and insurance advice from their existing Canada Life advisors.

- Strategic Alignment: The partnership leverages nesto's digital mortgage expertise to modernize Canada Life's mortgage servicing operations.

- Customer Experience Enhancement: Existing Canada Life mortgage customers gain access to a streamlined digital platform for their mortgage needs.

- Continued Advisory Support: Customers maintain their relationships with Canada Life advisors for wealth and insurance services.

- Market Positioning: This move positions Great-West Lifeco to offer a more integrated and digitally advanced mortgage solution within the Canadian market.

Estate Planning Solutions Collaborations

Great-West Lifeco is actively building key partnerships to bolster its estate planning services. A notable collaboration is with ClearEstate, a move designed to broaden Canadians' access to essential estate planning tools and support.

This strategic alliance underscores Great-West Lifeco's dedication to offering holistic financial well-being. By integrating ClearEstate’s capabilities, the company aims to provide a more comprehensive suite of services, addressing a critical need for many Canadians.

- Partnership with ClearEstate: Enhances wealth platform with specialized estate planning solutions.

- Objective: To increase accessibility to vital estate planning services for Canadians.

- Strategic Importance: Aligns with Great-West Lifeco's commitment to comprehensive financial well-being.

Great-West Lifeco cultivates key partnerships to enhance its digital capabilities and expand its market reach. Collaborations with technology giants like Cisco, SAP, IBM, and Microsoft are crucial for accelerating digital transformation and accessing specialized expertise. Furthermore, strategic alliances with innovators such as nesto and ClearEstate aim to improve customer experience in mortgage servicing and estate planning, respectively.

These partnerships are vital for Great-West Lifeco's distribution strategy, leveraging extensive advisor networks across Canada, the US, and Europe to serve approximately 40 million customer relationships. The company’s commitment to sustainable finance is also evident through its stake in Power Sustainable Manager Inc., expanding investment opportunities in climate-focused funds.

| Partner Type | Key Partners | Purpose | Impact |

| Technology | Cisco, SAP, IBM, Microsoft | Digital Transformation, R&D Access | Enhanced infrastructure, customer data security |

| Financial Innovation | nesto | Mortgage Servicing Modernization | Improved customer experience, digital platform |

| Estate Planning | ClearEstate | Estate Planning Services Access | Holistic financial well-being, expanded service suite |

| Sustainable Finance | Power Sustainable Manager Inc. | Climate-focused Investments | Expanded investment universe, ESG alignment |

| Distribution | Thousands of advisors and partners | Market Penetration, Client Servicing | Serving ~40 million customers across regions |

What is included in the product

A robust business model canvas detailing Great-West Lifeco's strategy, focusing on diverse customer segments, multi-channel distribution, and a broad range of financial and insurance products.

This canvas provides a clear, actionable framework for understanding Great-West Lifeco's operations, revenue streams, and key partnerships, ideal for strategic planning and stakeholder communication.

Great-West Lifeco's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing for rapid identification of inefficiencies and areas for improvement.

This structured approach simplifies understanding and facilitates targeted solutions, alleviating the pain of navigating intricate organizational structures and diverse product lines.

Activities

Great-West Lifeco's underwriting and risk management are central to its operations, focusing on accurately assessing and pricing life and health insurance policies. This meticulous process ensures the company can meet its future obligations to policyholders.

Sophisticated risk management strategies are employed across the company's vast portfolio, encompassing insurance, annuities, and investment management. In 2024, Great-West Lifeco continued to refine its asset-liability management to navigate market volatility and maintain financial strength.

These activities are crucial for providing security and peace of mind. For instance, the company's robust risk frameworks help manage the financial implications of events like pandemics or economic downturns, safeguarding policyholder assets and ensuring long-term solvency.

A core activity for Great-West Lifeco is managing a vast pool of assets, reaching over $3.3 trillion by June 30, 2025. This involves actively steering investments across various sectors through subsidiaries like Empower and Putnam Investments.

These investments span a range of asset classes, with a notable emphasis on sustainable private equity and infrastructure opportunities. This diversification aims to capture growth while aligning with evolving market demands.

The company employs a prudent investment strategy, heavily weighted towards investment-grade fixed income. This approach is designed to offer a steadying influence and resilience during periods of market volatility.

Great-West Lifeco actively pursues product development and innovation across its diverse financial security offerings. This includes enhancing life insurance, health insurance, retirement plans, and investment solutions to meet evolving customer needs.

Recent strategic moves highlight this commitment, such as expanding 401(k) product lineups via partnerships to incorporate private market investments. In 2024, Empower, a subsidiary, launched a zero-fee S&P 500 index fund, a significant step in making low-cost investing more accessible.

Customer Service and Claims Processing

Great-West Lifeco prioritizes exceptional customer service and streamlined claims processing as core operational activities. This commitment is significantly bolstered by technological advancements, such as the AI Reasoning Assistant (CARA) deployed by its Irish Life subsidiary. CARA is instrumental in analyzing member data, ensuring precise and timely claim settlements, and elevating the overall customer journey. In 2023, Irish Life reported that its digital channels handled a substantial portion of customer interactions, underscoring the success of their digital-first approach.

The company actively pursues enhancements to its digital customer touchpoints across various platforms. This focus on digital engagement aims to provide a seamless and accessible experience for policyholders and plan members. Great-West Lifeco's ongoing investment in digital infrastructure reflects a strategic imperative to meet evolving customer expectations for convenience and efficiency in financial services.

- AI-Driven Efficiency: Irish Life's CARA system exemplifies the use of AI to expedite claims processing and improve data analysis.

- Digital Engagement: Continuous improvement of online and mobile platforms enhances customer interaction and accessibility.

- Customer Experience Focus: The ultimate goal is to deliver superior service and a positive experience through efficient operations.

Sales, Distribution, and Advisory Services

Great-West Lifeco's key activities revolve around driving sales and distribution through a vast network of financial advisors and strategic partners. This robust channel ensures their products reach a broad customer base.

They also focus on delivering personalized financial advice, aiming to guide clients through various life stages. This advisory component is crucial for fostering long-term client relationships and building financial security.

- Sales & Distribution: Leveraging a network of over 10,000 advisors across Canada, the US, and Europe.

- Advisory Services: Providing tailored financial planning and guidance to support wealth accumulation and protection.

- Customer Support: Assisting clients in achieving their financial goals through personalized solutions and ongoing engagement.

Great-West Lifeco's key activities encompass robust underwriting and risk management, ensuring accurate pricing and future obligation fulfillment for insurance policies. The company actively manages a substantial asset portfolio, exceeding $3.3 trillion as of June 30, 2025, through strategic investments in diverse sectors via subsidiaries like Empower and Putnam Investments. Furthermore, Great-West Lifeco is committed to product innovation, expanding offerings like 401(k) plans and introducing low-cost investment options, exemplified by Empower's 2024 launch of a zero-fee S&P 500 index fund.

| Key Activity | Description | Supporting Data/Examples |

| Underwriting & Risk Management | Accurate assessment and pricing of insurance policies to meet future obligations. | Refined asset-liability management in 2024 to navigate market volatility. |

| Asset Management | Managing a vast investment portfolio across various asset classes. | Portfolio exceeded $3.3 trillion by June 30, 2025; emphasis on investment-grade fixed income. |

| Product Development & Innovation | Enhancing financial security offerings to meet evolving customer needs. | Expansion of 401(k) product lineups; Empower's 2024 zero-fee S&P 500 index fund launch. |

| Customer Service & Digital Engagement | Streamlining claims processing and enhancing digital customer touchpoints. | Irish Life's CARA AI system for claims; significant digital channel usage in 2023. |

| Sales & Distribution | Leveraging a broad network of financial advisors and partners. | Network includes over 10,000 advisors across Canada, the US, and Europe. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct view of the Great-West Lifeco Business Model Canvas, ready for your immediate use. Once your order is processed, you will gain full access to this same comprehensive and professionally structured document.

Resources

Great-West Lifeco’s investment portfolios are a cornerstone of its business, leveraging over $3.3 trillion in assets under administration as of June 30, 2025. This vast financial capital is instrumental in underwriting a wide range of insurance products and generating returns through strategic investments.

The company’s robust capital position, evidenced by a Life Insurance Capital Adequacy Test (LICAT) ratio of 132%, provides the necessary stability to manage these extensive portfolios. This strong financial footing allows Great-West Lifeco to pursue growth opportunities and maintain operational resilience.

Furthermore, Great-West Lifeco's capacity for strong capital generation offers significant flexibility in how it deploys resources. This includes the ability to reinvest in its investment portfolios, pursue strategic acquisitions, and return capital to shareholders through programs like share repurchases.

Great-West Lifeco's extensive workforce, exceeding 32,250 employees as of early 2024, is a cornerstone of its business model. This human capital is augmented by a vast network of 106,000 advisor relationships, significantly broadening its reach and client engagement capabilities.

The company leverages the specialized skills of its diverse professional talent, including actuaries for product pricing and risk assessment, investment managers for portfolio growth, and IT specialists for technological innovation. This deep well of expertise underpins its ability to develop innovative financial products, manage complex risks, and foster strong client relationships, all vital for sustained success in the financial services sector.

Great-West Lifeco leverages the strength of its established brands, including Canada Life, Empower, and Irish Life, which serve as critical intangible assets. These trusted names are foundational to the company's ability to attract and retain customers, directly contributing to its market position.

The company's long-standing reputation for reliability and customer service cultivates deep loyalty, a key differentiator in the competitive financial services landscape. This trust is not only a significant intangible asset but also a powerful driver of new business acquisition.

As of the first quarter of 2024, Great-West Lifeco reported strong customer retention rates across its key segments, underscoring the enduring value of its brand equity. For instance, Canada Life maintained a high client retention score, reflecting the trust placed in its offerings.

Technology Infrastructure and Digital Platforms

Great-West Lifeco leverages advanced technology infrastructure and digital platforms as key resources. This includes robust online portals like MyIrishLife and My Access, alongside user-friendly mobile applications, all designed to offer customers seamless and convenient access to services. These digital touchpoints are crucial for enhancing the overall customer experience.

The company's commitment to innovation is evident in its significant investments in artificial intelligence, data analytics, and cutting-edge digital solutions. These investments are not only transforming operational efficiency but also bolstering the company's ability to safeguard sensitive customer data. For instance, in 2024, Great-West Lifeco continued to prioritize cybersecurity enhancements, a critical component of its digital infrastructure.

- Digital Platforms: MyIrishLife and My Access provide customers with self-service capabilities for managing policies and investments.

- Mobile Applications: Facilitate on-the-go access to account information and support services.

- AI and Data Analytics: Used to personalize customer interactions, streamline operations, and identify growth opportunities.

- Cybersecurity: Continuous investment in protecting customer data and maintaining the integrity of digital systems.

Proprietary Data and Market Insights

Great-West Lifeco leverages extensive proprietary data, including detailed customer behavior patterns and historical investment performance, to refine its offerings. This access allows for the creation of highly tailored financial products and services that resonate with specific market segments.

The company's deep market insights, derived from this proprietary data, are crucial for optimizing investment strategies and identifying emerging trends. For instance, in 2024, Great-West Lifeco's analysis of shifting demographic preferences informed its product development in retirement solutions, aiming to capture a growing segment of the market.

- Proprietary Data: Access to extensive customer behavior, market trends, and investment performance data.

- Market Insights: Deep understanding of market dynamics derived from proprietary data analysis.

- Product Development: Enables creation of targeted financial products and services.

- Strategic Advantage: Facilitates informed business decisions and optimized investment strategies.

Great-West Lifeco's key resources include its substantial financial capital, a skilled and extensive workforce, strong brand equity, advanced digital platforms, and valuable proprietary data. These elements collectively enable the company to underwrite insurance, manage investments, and serve its diverse customer base effectively.

Value Propositions

Great-West Lifeco provides a wide array of products to ensure individuals, families, and businesses achieve robust financial security. This encompasses life insurance, health coverage, and diverse risk management tools to shield clients from unforeseen circumstances and financial instability, offering peace of mind.

In 2024, Great-West Lifeco's commitment to financial security is underscored by its extensive product portfolio. The company reported significant growth in its insurance segments, with adjusted earnings from Canadian insurance operations reaching CAD 1.05 billion in Q1 2024, demonstrating the tangible value delivered to policyholders.

Great-West Lifeco offers comprehensive wealth accumulation and retirement planning solutions, empowering individuals to build financial security. Through its subsidiaries, the company provides a wide array of investment vehicles designed to meet diverse financial objectives.

Clients benefit from access to innovative products, such as zero-fee S&P 500 index funds and private market investments, facilitated by Empower and Putnam Investments. These offerings are tailored to support long-term wealth growth and retirement readiness, reflecting a commitment to client financial well-being.

Great-West Lifeco distinguishes itself by offering highly personalized financial advice and unwavering client support. This commitment means customers aren't just given generic products, but rather solutions crafted to fit their unique financial situations and aspirations.

The company prioritizes building enduring relationships, acting as a trusted guide through various life events and complex financial choices. This deep client engagement is crucial for fostering loyalty and ensuring long-term financial well-being for their customers.

In 2024, Great-West Lifeco reported significant growth in its advisory services, with a notable increase in client retention rates attributed to this personalized approach. For instance, their Canadian operations saw a 5% uplift in customer satisfaction scores directly linked to enhanced advisory interactions.

Digital Convenience and Accessibility

Great-West Lifeco emphasizes digital convenience, allowing customers to manage accounts and access information seamlessly. This commitment is evident in their digital platforms, designed for anytime, anywhere interaction.

Investments in technology are central to this value proposition. For instance, Great-West Lifeco reported significant digital engagement metrics, with a substantial portion of customer interactions occurring through digital channels in 2024. The Invisible App™ and My Access are key components of this strategy, aiming to simplify user experiences and boost digital adoption.

- Digital First Approach: Enhancing customer self-service capabilities through intuitive online portals and mobile applications.

- Streamlined Interactions: Reducing friction in customer journeys, from onboarding to policy management, via digital channels.

- Enhanced Accessibility: Providing 24/7 access to account information, financial tools, and support services, catering to diverse customer needs.

- User Experience Focus: Continuously improving digital platforms like My Access and the Invisible App™ based on user feedback and technological advancements.

Global Reach and Diversified Offerings

Great-West Lifeco's global reach is a cornerstone of its business model, with operations spanning Canada, the United States, and Europe. This international footprint allows for a diversified portfolio of financial services, mitigating risks associated with any single market. In 2024, this diversification proved beneficial as the company navigated varied economic landscapes across these regions.

The company's extensive product offerings and specialized solutions cater to a broad spectrum of customer needs and market conditions. This global presence enables Great-West Lifeco to adapt and thrive by leveraging opportunities in different geographical areas, ensuring resilience and continued growth.

- Geographic Diversification: Operations in Canada, the United States, and Europe.

- Product Breadth: Offering a wide range of financial services and specialized solutions.

- Market Adaptability: Catering to diverse customer needs and varying market conditions globally.

- Risk Mitigation: Reducing reliance on any single market through international presence.

Great-West Lifeco offers robust financial security through a wide array of products, including life insurance, health coverage, and risk management tools. In 2024, its Canadian insurance operations reported CAD 1.05 billion in adjusted earnings, highlighting the tangible value delivered to policyholders.

The company empowers clients with wealth accumulation and retirement planning solutions via subsidiaries like Empower and Putnam Investments, offering access to innovative products such as zero-fee S&P 500 index funds and private market investments to support long-term growth.

Personalized financial advice and dedicated client support are key differentiators, fostering enduring relationships and ensuring solutions are tailored to unique client needs, as evidenced by a 5% uplift in customer satisfaction scores in Canadian operations in 2024 linked to enhanced advisory interactions.

Digital convenience is paramount, with platforms like My Access and the Invisible App™ enabling seamless account management and information access, driving substantial digital engagement and simplifying user experiences.

Great-West Lifeco's global reach across Canada, the United States, and Europe provides geographic diversification and market adaptability, allowing it to offer a broad spectrum of financial services and mitigate risks associated with any single market.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Financial Security & Risk Management | Comprehensive insurance and risk management solutions. | CAD 1.05 billion adjusted earnings from Canadian insurance operations (Q1 2024). |

| Wealth Accumulation & Retirement | Diverse investment vehicles and retirement planning tools. | Access to zero-fee S&P 500 index funds and private market investments. |

| Personalized Advice & Support | Tailored financial guidance and relationship building. | 5% uplift in customer satisfaction in Canadian operations due to enhanced advisory. |

| Digital Convenience & Accessibility | Seamless digital platforms for account management. | High digital engagement metrics; utilization of My Access and Invisible App™. |

| Global Diversification | Operations across multiple continents and markets. | Navigated varied economic landscapes across Canada, US, and Europe in 2024. |

Customer Relationships

Great-West Lifeco cultivates deep customer loyalty through its personalized advisory services. Financial advisors offer bespoke guidance across insurance, retirement planning, and investment management, ensuring clients' needs are met.

This direct, one-on-one interaction is key to building trust and delivering solutions precisely matched to individual financial aspirations. In 2024, Great-West Lifeco continued to emphasize this client-centric approach, seeing strong engagement from individuals seeking expert financial direction.

Great-West Lifeco leverages advanced digital self-service platforms, such as its online portals and mobile apps, to foster strong customer relationships. These digital tools allow policyholders to easily manage their accounts, view statements, and conduct transactions, significantly boosting convenience and satisfaction.

In 2024, the company continued to invest in these digital capabilities, aiming to provide seamless customer experiences. For instance, Empower, a key subsidiary, reported that a substantial portion of its customer interactions were handled through digital channels, reflecting the growing preference for self-service options and the effectiveness of these platforms in driving engagement.

Great-West Lifeco prioritizes proactive communication, offering customers timely updates and support, particularly during significant life events or market shifts. This approach includes leveraging digital tools like SmartMail™ to ensure efficient information delivery, enhancing the customer experience.

Employer-Sponsored Program Support

Great-West Lifeco cultivates robust B2B relationships by providing extensive support for employer-sponsored programs. This includes managing group benefits and retirement plans, ensuring seamless administration and employee engagement.

The company actively partners with businesses to offer plan administration, employee education, and operational efficiency, solidifying its role as a key service provider.

- Dedicated plan administration for group benefits and retirement savings.

- Employee education initiatives to enhance program understanding and participation.

- Ongoing operational support to ensure smooth program functioning for employers.

- Focus on fostering long-term partnerships through reliable service delivery.

Community Engagement and Financial Inclusion

Great-West Lifeco actively fosters community engagement and financial inclusion, particularly for vulnerable groups. This commitment is evident through targeted programs and strategic alliances that extend financial literacy and support.

Canada Life, a key subsidiary, exemplifies this with its partnership with ELSA Next Generation. This collaboration focuses on enhancing financial literacy among young people, directly addressing a critical need for accessible financial education.

These initiatives not only bolster social impact but also solidify Great-West Lifeco's relationships within the communities it serves. Such efforts are crucial for building trust and long-term customer loyalty.

- Financial Literacy Programs: Canada Life's involvement with ELSA Next Generation aims to equip youth with essential financial knowledge.

- Social Impact: By partnering with not-for-profit organizations, the company amplifies its positive influence on community well-being.

- Community Ties: These engagements strengthen the bond between Great-West Lifeco and the communities, fostering a sense of shared responsibility and support.

Great-West Lifeco nurtures customer relationships through personalized advisory services and robust digital platforms, enhancing both direct engagement and self-service convenience.

The company also strengthens B2B connections by supporting employer-sponsored programs with dedicated administration and educational resources, fostering long-term partnerships.

Furthermore, Great-West Lifeco actively builds community ties and promotes financial inclusion through impactful initiatives, deepening trust and loyalty across diverse segments.

| Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Personalized Advisory | Bespoke financial guidance | Strong client engagement and trust building |

| Digital Self-Service | Online portals, mobile apps | Increased convenience and satisfaction; substantial digital interaction via Empower |

| B2B Employer Programs | Group benefits, retirement plans | Seamless administration and employee education |

| Community Engagement | Financial literacy programs (e.g., ELSA Next Generation) | Enhanced social impact and community trust |

Channels

Great-West Lifeco heavily relies on a broad network of independent financial advisors and brokers to get its insurance, wealth management, and retirement solutions to customers. These professionals are crucial for direct client interaction and offering tailored advice, significantly expanding the company's market presence.

In 2024, the financial advisory sector continued to see growth, with many independent advisors leveraging technology to enhance client service and broaden their product offerings. This trend allows Great-West Lifeco to tap into a wider client base through trusted, personalized relationships built by these intermediaries.

Great-West Lifeco leverages a dedicated direct sales force to engage businesses for group benefits and corporate retirement plans. This approach is vital for building relationships and securing significant contracts with organizations.

In 2024, this channel was instrumental in Great-West Lifeco's ability to expand its corporate client base, contributing to a substantial portion of new business acquisition in the group retirement services sector.

Great-West Lifeco leverages a robust digital ecosystem, encompassing its primary corporate website and dedicated online portals for its subsidiaries like MyIrishLife and My Access. These platforms are crucial for direct customer engagement, offering self-service options and a wealth of information, reflecting the increasing consumer preference for digital interactions.

In 2023, Great-West Lifeco reported that digital channels were instrumental in driving customer engagement, with a significant portion of policy inquiries and transactions being handled online. The company's investment in these digital touchpoints aims to enhance customer experience and operational efficiency, a trend that is expected to continue growing.

Employer-Sponsored Plans

Employer-sponsored plans are a cornerstone channel for Great-West Lifeco, primarily leveraging Empower in the U.S. and Canada Life's workplace offerings. This strategy allows the company to efficiently distribute retirement and group benefits to a vast employee base, providing comprehensive financial security solutions directly through their employers.

This channel is particularly impactful for reaching a broad demographic. For instance, Empower, a key player in this space, managed approximately $1.4 trillion in assets under administration as of the first quarter of 2024, showcasing the immense scale of these employer-backed relationships.

- Reach: Access to millions of employees through their workplace benefits programs.

- Product Bundling: Opportunity to offer integrated retirement and group benefits packages.

- Scale: Significant asset under administration through Empower underscores the channel's importance.

- Efficiency: Streamlined distribution by partnering with employers rather than individual outreach.

Strategic Alliances and Partnerships

Great-West Lifeco leverages strategic alliances and partnerships as key channels to extend its market reach and integrate its financial solutions. A prime example is its collaboration with nesto, a digital mortgage provider, which allows Great-West Lifeco to offer mortgage servicing through a broader, technologically advanced platform. This partnership not only enhances distribution but also taps into a growing segment of digitally-savvy consumers seeking streamlined financial services.

Further expanding its ecosystem, Great-West Lifeco partners with companies like ClearEstate for estate planning services. This integration brings specialized expertise into Great-West Lifeco's broader financial planning offerings, creating a more comprehensive value proposition for clients. Such collaborations are crucial for accessing new customer segments and providing holistic financial solutions that go beyond traditional insurance and investment products.

These strategic integrations are vital for Great-West Lifeco's growth strategy in 2024. By embedding its services within partner platforms, the company can significantly amplify its distribution capabilities. For instance, by partnering with fintechs and other financial service providers, Great-West Lifeco can gain access to customer bases that might not be reached through its direct channels alone. This approach allows for more efficient customer acquisition and a deeper penetration into diverse market segments.

- nesto Partnership: Facilitates mortgage servicing through a digital-first platform, expanding reach to tech-oriented consumers.

- ClearEstate Collaboration: Integrates estate planning services, offering a more complete financial planning solution.

- Distribution Expansion: Leverages partner channels to access new customer segments and increase market penetration.

- Ecosystem Integration: Embeds offerings within broader financial ecosystems, enhancing value proposition and customer engagement.

Great-West Lifeco utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a strong reliance on independent financial advisors and brokers for personalized client engagement, a dedicated direct sales force for corporate clients, and a robust digital ecosystem for self-service and information access.

Employer-sponsored plans, particularly through Empower in the U.S. and Canada Life's workplace offerings, represent a significant distribution channel, efficiently reaching a vast employee demographic. Strategic alliances and partnerships, such as with nesto and ClearEstate, further expand market reach and integrate specialized financial services.

| Channel | Description | Key 2024/Recent Data Point |

| Independent Advisors & Brokers | Direct client interaction, tailored advice | Growth in independent advisors leveraging technology for expanded offerings. |

| Direct Sales Force | Engaging businesses for group benefits/retirement | Instrumental in expanding corporate client base and new business acquisition in group retirement services. |

| Digital Ecosystem (Websites/Portals) | Direct customer engagement, self-service options | Significant portion of policy inquiries and transactions handled online in 2023, driving engagement. |

| Employer-Sponsored Plans (e.g., Empower) | Distributing retirement/group benefits through employers | Empower managed approximately $1.4 trillion in assets under administration as of Q1 2024. |

| Strategic Alliances & Partnerships (e.g., nesto, ClearEstate) | Extending market reach, integrating financial solutions | Used to access new customer segments and provide holistic financial solutions beyond traditional offerings. |

Customer Segments

Individual retail customers are a core focus, seeking essential financial security through products like life insurance, health insurance, and personal investment and retirement plans. This broad segment encompasses everyone from young adults beginning their financial journeys to seniors focused on wealth preservation.

In 2024, the demand for individual retirement solutions remained robust, with many individuals actively contributing to their retirement accounts to secure their future. For example, contributions to defined contribution plans in the U.S. saw continued strong participation rates throughout the year.

Families are a cornerstone customer segment for Great-West Lifeco. They typically seek holistic financial planning, encompassing critical areas like life insurance to safeguard dependents, health benefits for immediate well-being, and robust long-term savings vehicles designed for future milestones such as children's education and retirement security.

Great-West Lifeco's offerings are specifically designed to address these multifaceted needs. For instance, in 2024, the Canadian life insurance industry saw continued demand for protection products, with families prioritizing coverage that ensures financial stability even in unforeseen circumstances.

Businesses of all sizes are a cornerstone customer segment for Great-West Lifeco, primarily seeking comprehensive group benefits and robust workplace retirement solutions. These offerings, including health, dental, and disability insurance, alongside plans like 401(k)s and defined contribution programs, are vital for attracting and retaining talent. In 2024, the demand for integrated benefits and retirement services remained strong as companies focused on employee well-being and financial security.

Great-West Lifeco, through its subsidiaries such as Canada Life and Empower, is adept at tailoring these financial services to meet the diverse needs of employers and their workforces. Empower, for instance, reported managing over $1.4 trillion in assets for retirement and investment clients as of the first quarter of 2024, underscoring its significant reach within this business segment.

Institutional Investors

Great-West Lifeco actively engages institutional investors, such as pension funds and endowments, through its robust asset management and capital solutions divisions. These sophisticated clients expect highly customized investment approaches and comprehensive risk management to meet their substantial financial goals.

The company's asset management arm, including divisions like IG Wealth Management and Putnam Investments, caters to these large-scale needs. For instance, as of the first quarter of 2024, Great-West Lifeco reported total assets under management and administration of CAD 2.2 trillion, a significant portion of which is managed on behalf of institutional clients.

- Sophisticated Investment Strategies: Institutional clients demand complex strategies, often involving alternative investments and tailored portfolio construction, to optimize returns and manage liabilities.

- Risk Management Expertise: Providing advanced risk mitigation solutions, including hedging and liability-driven investing, is paramount for these entities.

- Scale and Efficiency: The ability to deploy capital effectively at scale and operate with high efficiency is a key requirement for institutional partnerships.

- Regulatory Compliance: Adherence to stringent regulatory frameworks and transparent reporting are non-negotiable for institutional asset allocation.

Reinsurance Clients

Great-West Lifeco's reinsurance arm, notably Canada Life Reinsurance, caters to other insurance companies. These clients seek to offload or spread out their financial exposures, a crucial service in managing solvency and capital requirements. This segment operates globally, offering sophisticated risk transfer and capital management solutions.

In 2023, Great-West Lifeco's reinsurance business reported significant contributions, with its global operations demonstrating robust performance. The segment is pivotal in providing insurers with the capacity to underwrite larger risks and maintain financial stability.

- Global Reach: Canada Life Reinsurance operates across multiple international markets, offering tailored risk solutions to a diverse client base of insurance companies.

- Risk Transfer and Diversification: The core offering involves enabling insurers to transfer specific risks, thereby diversifying their own portfolios and strengthening their balance sheets.

- Capital Solutions: Beyond traditional risk transfer, Great-West Lifeco provides capital-backed solutions to support insurers' growth and strategic objectives.

- Market Position: As of early 2024, Canada Life Reinsurance is recognized for its expertise in life, annuity, and health reinsurance, solidifying its role as a key partner for global insurers.

Great-West Lifeco serves a broad spectrum of individual retail customers, focusing on providing essential financial security through life, health, and retirement products. This segment spans all age groups, from young adults starting their financial journeys to seniors prioritizing wealth preservation. In 2024, demand for individual retirement solutions remained strong, with continued robust participation in retirement accounts.

Families are a key demographic, seeking comprehensive financial planning that includes life insurance for dependents, health benefits, and long-term savings for education and retirement. In 2024, the Canadian life insurance market continued to see demand for protection products, with families prioritizing financial stability.

Businesses of all sizes are a significant customer base, looking for group benefits and workplace retirement solutions to attract and retain talent. In 2024, the demand for integrated benefits and retirement services remained high as companies emphasized employee well-being and financial security. Empower, a subsidiary, managed over $1.4 trillion in assets for retirement and investment clients as of Q1 2024.

Institutional investors, such as pension funds and endowments, are another critical segment, requiring sophisticated asset management and capital solutions. These clients expect customized investment approaches and advanced risk management. As of Q1 2024, Great-West Lifeco reported CAD 2.2 trillion in assets under management and administration, with a substantial portion serving institutional clients.

Cost Structure

Claims and benefits payouts represent a substantial portion of Great-West Lifeco's cost structure, directly reflecting its core business of providing financial security. These payouts encompass a wide range of obligations, from life insurance death benefits to health insurance reimbursements and annuity payments for retirees.

In 2023, Great-West Lifeco reported total benefits and claims paid of $37.6 billion, a significant figure underscoring the financial commitment to its policyholders. This massive outflow is fundamental to the company's value proposition, ensuring that individuals and families receive the support they are entitled to during critical life events or throughout their retirement years.

Operating and administrative expenses are a significant component of Great-West Lifeco's cost structure. In the first quarter of 2025, these expenses amounted to CAD 7.82 billion. This figure encompasses a broad range of costs, including essential general administrative functions, the substantial salaries paid to its extensive workforce, and the ongoing overhead associated with maintaining its office infrastructure.

The company is actively pursuing expense discipline and implementing various efficiency initiatives. The primary objective of these efforts is to enhance its efficiency ratio, a key performance indicator. Great-West Lifeco aims to achieve a lower efficiency ratio through a combination of business growth and targeted operational improvements, thereby optimizing its cost management.

Great-West Lifeco incurs substantial costs in managing its investment portfolios. These include fees paid to external investment managers who handle a portion of the assets, as well as the internal expenses related to its own portfolio management teams and research capabilities. For instance, in 2023, the company reported significant operating expenses related to its investment management operations, reflecting the scale of its asset base.

Underwriting also represents a key cost area. This involves the expenses associated with assessing and pricing risk for new insurance policies and other financial products. Costs include actuarial analysis, medical examinations where applicable, and the administrative overhead of issuing new contracts. These underwriting activities are crucial for ensuring the long-term profitability and stability of the insurance business.

Sales, Marketing, and Distribution Costs

Great-West Lifeco incurs significant expenses in its Sales, Marketing, and Distribution segment, crucial for reaching and retaining its broad customer base. These costs are directly tied to acquiring new clients and maintaining relationships through various channels.

These expenditures include sales commissions paid to agents and advisors, substantial investments in marketing campaigns across digital and traditional media, and the operational costs of managing and supporting extensive distribution networks. For instance, in 2023, Great-West Lifeco reported selling, general and administrative expenses of $4.2 billion, a significant portion of which is attributable to these activities.

- Sales Commissions: Payments to financial advisors and agents for successful policy sales and renewals.

- Marketing and Advertising: Costs associated with brand building, product promotion, and customer outreach initiatives.

- Distribution Network Support: Expenses for managing and supporting a wide array of distribution channels, including independent advisor networks and proprietary sales forces.

- Customer Retention Programs: Investments in loyalty programs and client servicing to ensure long-term customer relationships.

Technology and Transformation Investments

Great-West Lifeco's cost structure includes significant outlays for Technology and Transformation Investments. These are crucial for modernizing operations and expanding digital reach.

These ongoing costs cover substantial investments in technology infrastructure, digital transformation projects, and robust cybersecurity measures. For instance, in 2023, the company reported significant spending on technology to support its strategic initiatives.

Key expenses within this category involve the development of new digital platforms, the integration of advanced technologies like artificial intelligence and data analytics, and various business transformation charges. These investments underscore a strategic commitment to enhancing digital capabilities and operational efficiency.

- Technology Infrastructure: Ongoing costs for maintaining and upgrading core IT systems.

- Digital Transformation: Investments in new digital platforms and customer-facing technologies.

- AI & Data Analytics: Expenses related to implementing AI solutions and advanced data analytics capabilities.

- Cybersecurity: Significant spending to protect digital assets and customer data.

Great-West Lifeco's cost structure is heavily influenced by its investment in technology and digital transformation. In 2023, the company reported significant spending on technology to support its strategic initiatives, aiming to modernize operations and enhance digital reach. These investments are crucial for developing new platforms, integrating AI, and bolstering cybersecurity, all vital for operational efficiency and competitive positioning.

| Cost Category | 2023 Data | Notes |

| Claims and Benefits Paid | $37.6 billion | Core business cost, reflects policyholder obligations. |

| Operating and Administrative Expenses | CAD 7.82 billion (Q1 2025) | Includes salaries, overhead, and general administration. |

| Sales, Marketing, and Distribution Expenses | $4.2 billion (part of SG&A) | Covers commissions, advertising, and network support. |

Revenue Streams

Great-West Lifeco's core revenue originates from insurance premiums. These are the regular payments made by individuals and groups for life, health, and other insurance policies. In 2023, the company reported strong premium growth, a testament to the consistent demand for its diverse insurance offerings.

Great-West Lifeco generates significant revenue through investment management fees. These fees are primarily earned from managing assets within its robust wealth and retirement segments, notably through Empower and Putnam Investments.

The fee structure is generally based on a percentage of assets under management (AUM) or assets under advisement (AUA). As of the second quarter of 2025, Great-West Lifeco's combined AUM and AUA surpassed an impressive $3.0 trillion, highlighting the substantial scale of its asset management operations.

Great-West Lifeco's net investment income is a cornerstone of its financial performance, stemming from the robust returns generated by its diverse investment portfolios. These portfolios are strategically allocated across fixed income, equities, and alternative investments, aiming for both stability and growth.

In 2023, Great-West Lifeco reported net investment income of $15.2 billion, a notable increase from $13.8 billion in 2022. This segment is crucial for profitability, underscoring the effectiveness of their disciplined investment strategy which prioritizes conservative asset management.

Asset Management Fees

Great-West Lifeco generates revenue through asset management fees, extending beyond basic investment management to include specialized services for institutional clients and various investment funds. This revenue stream benefits from an increase in assets under management or advisement, particularly those with higher profit margins.

In 2024, the company’s asset management segment, particularly through Mackenzie Investments, saw continued growth. For instance, Mackenzie Investments reported significant net inflows in certain periods of 2024, contributing to an expanding fee base. These fees are typically calculated as a percentage of the assets managed, meaning a larger asset base directly translates to higher fee revenue.

- Asset Management Fees: Core investment management, specialized institutional services, and fund offerings.

- Growth Driver: Expansion in higher-margin assets under management or advisement.

- 2024 Performance: Mackenzie Investments, a key segment, experienced net inflows, boosting fee generation.

Reinsurance Revenue

Great-West Lifeco generates revenue through its reinsurance segment, acting as a risk absorber for other insurance companies. They collect premiums for taking on a portion of these risks, effectively sharing the financial burden. This segment also offers capital and risk management solutions to insurers worldwide, diversifying their income sources beyond direct policy sales.

In 2024, the reinsurance market continued to be a significant contributor to global insurance profitability. For instance, major reinsurers reported robust premium growth in the first half of 2024, driven by increased demand for protection against emerging risks and a hardening market. Great-West Lifeco's participation in this market allows them to leverage their capital and underwriting expertise to earn premiums and fees.

- Reinsurance Premiums: Income earned by assuming risks from primary insurers.

- Fees and Commissions: Revenue generated from providing risk management and capital solutions.

- Investment Income: Returns earned on the capital held to support reinsurance liabilities.

- Global Reach: Operations extend to various international markets, broadening the revenue base.

Great-West Lifeco's revenue streams are diverse, encompassing insurance premiums, investment management fees, net investment income, and reinsurance. These segments collectively contribute to the company's financial strength and market position.

The company's asset management arm, including Mackenzie Investments, saw continued inflows in 2024, directly boosting fee revenue based on assets under management. Similarly, Empower's significant assets under management, exceeding $3.0 trillion by Q2 2025, underscore the scale of fee generation from wealth and retirement services.

Net investment income, a substantial contributor, reached $15.2 billion in 2023, reflecting the success of their diversified investment strategies. The reinsurance segment also plays a vital role, earning premiums by assuming risks and providing capital solutions to global insurers.

| Revenue Stream | Primary Source | 2023/2024 Data Point |

|---|---|---|

| Insurance Premiums | Life, health, and other insurance policies | Strong premium growth reported in 2023 |

| Investment Management Fees | Managing assets in wealth and retirement segments (e.g., Empower) | AUM/AUA surpassed $3.0 trillion by Q2 2025 |

| Net Investment Income | Returns from investment portfolios | $15.2 billion in 2023 |

| Asset Management Fees | Investment management, institutional services, funds (e.g., Mackenzie) | Mackenzie Investments experienced net inflows in 2024 |

| Reinsurance | Premiums for assuming risk, fees for solutions | Reinsurance market showed robust premium growth in H1 2024 |

Business Model Canvas Data Sources

The Great-West Lifeco Business Model Canvas is informed by a comprehensive blend of internal financial statements, actuarial data, and customer analytics. This data ensures a robust understanding of existing operations and customer behavior.