Graphic Packaging PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graphic Packaging Bundle

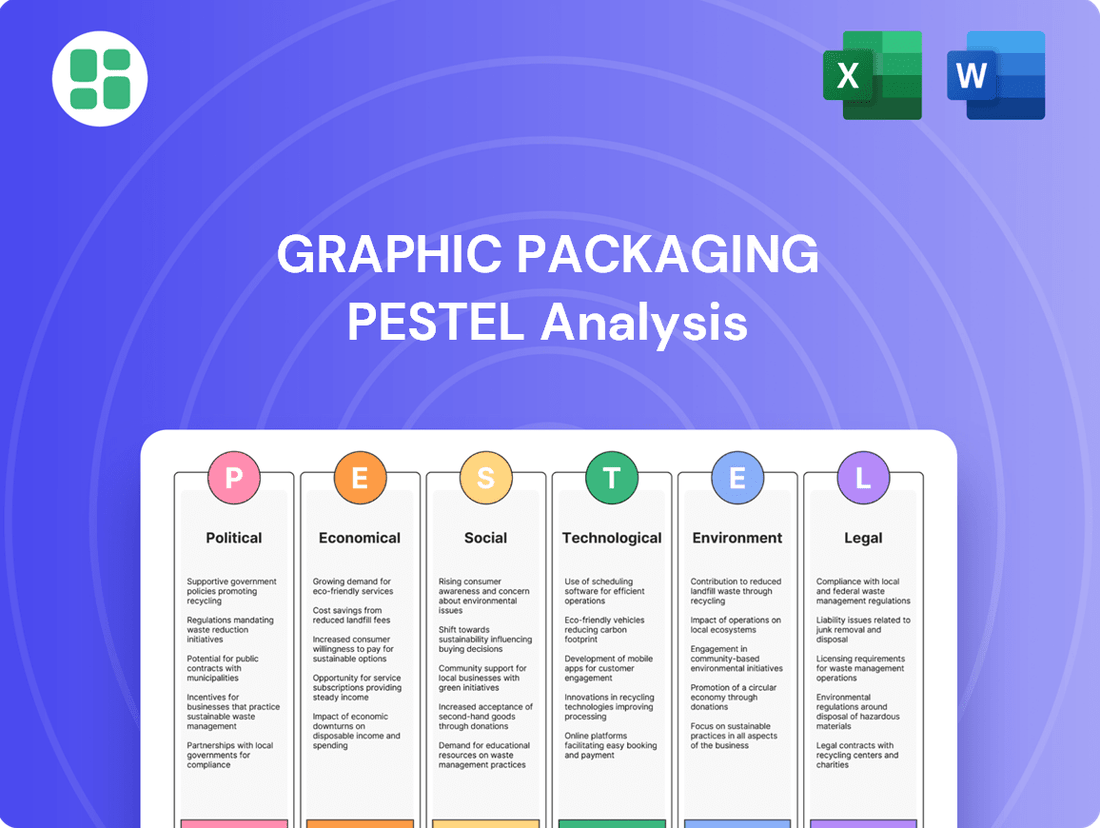

Uncover the political, economic, social, technological, legal, and environmental forces shaping Graphic Packaging's future. Our PESTLE analysis provides critical insights into market dynamics and potential challenges. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Download the full, expertly crafted report now.

Political factors

The global trade environment significantly influences Graphic Packaging's operations. For instance, the imposition of tariffs on key raw materials such as paperboard, aluminum, and plastics can directly increase import costs. This was evident in early 2024 discussions around potential tariffs on imported paper products, which could have added millions in expenses for companies relying on these materials.

These trade policy shifts necessitate strategic adjustments in supply chain management. Companies like Graphic Packaging may need to explore domestic sourcing options or renegotiate existing supplier agreements to mitigate the impact of tariffs, thereby potentially altering their cost structure and competitive positioning in international markets.

The resulting volatility from trade disputes and tariff changes can directly affect profitability and pricing strategies. For example, a 10% tariff on imported aluminum could raise costs for beverage can manufacturers, a key market for Graphic Packaging, impacting their ability to offer competitive pricing for their packaging solutions.

Governments globally are tightening rules on packaging waste, pushing for a circular economy. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) mandates higher recyclability, reuse, and recycled content percentages. Graphic Packaging must align its product innovation and production with these dynamic legal frameworks, which often necessitate substantial R&D funding.

Extended Producer Responsibility (EPR) schemes are increasingly becoming a significant political factor for companies like Graphic Packaging. Many regions, including several U.S. states and the European Union, are implementing or expanding these laws, directly impacting producers by shifting the financial responsibility for packaging waste management. This means companies are now tasked with funding the collection, sorting, and recycling of their packaging materials.

For Graphic Packaging, compliance with these evolving EPR mandates requires careful strategic planning and may lead to increased operational costs. These costs are directly tied to supporting the end-of-life solutions for their packaging products, reflecting a growing trend in environmental policy that holds producers accountable for the entire lifecycle of their goods.

Food Safety and Material Contact Legislation

Global regulations on food contact materials are tightening, impacting Graphic Packaging's operations. For instance, the U.S. Food and Drug Administration (FDA) continues to update its guidelines, while the European Union has implemented new rules restricting substances like per- and polyfluoroalkyl substances (PFAS) and bisphenol A (BPA) in packaging. These evolving standards necessitate continuous adaptation of Graphic Packaging's product development and material sourcing to ensure compliance and market access.

Graphic Packaging's commitment to food safety is paramount, especially given its significant presence in the food and beverage packaging sector. The company must navigate a complex web of international legislation that dictates acceptable chemical compositions and migration limits for packaging materials. Failure to comply can result in significant penalties, product recalls, and damage to brand reputation, underscoring the critical nature of these political factors.

- Stricter Substance Bans: The EU's ongoing review of chemical regulations, including potential restrictions on additional substances beyond PFAS and BPA, demands proactive material innovation from Graphic Packaging.

- FDA Modernization Efforts: U.S. FDA initiatives to modernize food contact notification processes and enhance safety assessments require Graphic Packaging to maintain robust scientific data and compliance protocols.

- Global Harmonization Challenges: Divergent national regulations create complexities for Graphic Packaging's international supply chains, necessitating careful management to ensure consistent adherence across different markets.

- Consumer Trust and Safety: Public perception of food safety is heavily influenced by packaging materials, making strict adherence to legislation a key factor in maintaining consumer confidence for Graphic Packaging.

Political Stability and Geopolitical Tensions

Geopolitical instability, including regional conflicts and trade disputes, directly impacts global supply chains, influencing the availability and cost of raw materials like paperboard and energy for Graphic Packaging. For instance, the ongoing geopolitical tensions in Eastern Europe have contributed to increased volatility in global energy prices throughout 2024, affecting manufacturing input costs.

These disruptions create significant risks for Graphic Packaging's production schedules and logistics. Delays in raw material shipments or energy supply can lead to increased operational complexities and potential cost overruns, impacting the company's ability to meet customer demand efficiently.

To counter these political risks, Graphic Packaging must prioritize supply chain flexibility and diversification of sourcing. Strategies such as securing multiple suppliers for key inputs and exploring regional production hubs can build resilience against unforeseen geopolitical events.

- Supply Chain Vulnerability: Geopolitical events in 2024 have underscored the fragility of global supply chains, with disruptions impacting key commodity prices.

- Operational Impact: Production delays and increased logistics costs are direct consequences of geopolitical instability for packaging manufacturers.

- Mitigation Strategies: Diversifying supplier bases and enhancing supply chain agility are critical for Graphic Packaging to navigate political risks effectively.

Government regulations on packaging waste, particularly the push for a circular economy, are a significant political factor. The EU's Packaging and Packaging Waste Regulation (PPWR), aiming for higher recyclability and recycled content, directly influences Graphic Packaging's product development and necessitates substantial R&D investment to meet evolving legal frameworks.

Extended Producer Responsibility (EPR) schemes are increasingly impacting Graphic Packaging, with more regions implementing or expanding these laws. This shifts the financial burden for packaging waste management to producers, potentially increasing operational costs for Graphic Packaging as they fund collection and recycling efforts for their products.

Global tightening of food contact material regulations, such as restrictions on PFAS and BPA in the EU and evolving FDA guidelines in the U.S., requires continuous adaptation in Graphic Packaging's material sourcing and product development to ensure compliance and maintain market access.

Geopolitical instability in 2024 has highlighted supply chain vulnerabilities, affecting raw material and energy costs for Graphic Packaging. Diversifying suppliers and enhancing supply chain agility are crucial mitigation strategies for the company against these political risks.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Graphic Packaging, offering a comprehensive view of its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Graphic Packaging a clear understanding of external factors impacting their business.

Helps support discussions on external risk and market positioning during planning sessions, allowing Graphic Packaging to proactively address potential challenges and opportunities.

Economic factors

Graphic Packaging's profitability is directly tied to the volatile costs of essential raw materials like paperboard, pulp, and energy. For instance, the price of pulp, a key component, saw significant fluctuations in 2024 due to supply chain disruptions and increased demand from the packaging sector, impacting Graphic Packaging's cost of goods sold.

Global supply and demand imbalances, alongside geopolitical tensions, create unpredictable price swings for these inputs, directly affecting the company's production expenses. The energy component of production costs, particularly natural gas prices, remained a concern throughout late 2024 and early 2025, adding to the input cost volatility.

Effectively managing these input costs through strategic sourcing and the negotiation of long-term contracts is crucial for Graphic Packaging to maintain healthy profit margins. By securing favorable pricing for key materials, the company can better insulate itself from market shocks and ensure more predictable financial performance.

Persistent inflation, particularly in North America and Europe, continues to impact consumer spending habits. In 2024, elevated inflation rates have led many households to re-evaluate discretionary spending, with a noticeable trend towards value-oriented purchases. This directly affects demand for packaged goods, as consumers may opt for smaller pack sizes or private label alternatives.

Graphic Packaging has acknowledged this shift, noting that consumers are actively seeking more affordable options. This can lead to a change in the company's product mix, potentially favoring lower-margin, high-volume products. For instance, in Q1 2024, the company reported that while overall sales volumes remained relatively stable, there was a discernible shift towards value-centric packaging solutions.

The company faces a strategic challenge in managing these inflationary pressures. Graphic Packaging must carefully consider whether to absorb rising input costs, which would squeeze margins, or to pass these costs onto consumers through price increases. This decision is critical for maintaining market competitiveness, as aggressive price hikes could drive customers to alternative packaging materials or suppliers, impacting market share.

The health of the global economy directly influences consumer spending on food, beverages, and foodservice, which in turn affects demand for Graphic Packaging's products. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a potentially moderating demand environment.

Economic downturns can reduce packaging volumes as consumers cut back on discretionary spending, impacting Graphic Packaging's revenue. Conversely, periods of strong economic expansion, like the projected 2.8% global growth for 2025, typically boost demand for packaged goods and encourage investment in more sophisticated, sustainable packaging solutions.

Foreign Exchange Rate Fluctuations

As a global enterprise, Graphic Packaging's financial results are significantly influenced by foreign exchange rate fluctuations. When the company translates its international sales, costs, and earnings back into its primary reporting currency, changes in exchange rates can alter these figures. For instance, a stronger US dollar against other currencies would make Graphic Packaging's overseas earnings worth less when converted back to dollars, impacting reported revenue and profitability.

This currency volatility introduces a layer of financial uncertainty that necessitates proactive management. Companies like Graphic Packaging often employ hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. This helps to stabilize financial performance and protect against adverse currency movements, ensuring more predictable earnings.

For example, in early 2024, the US dollar experienced some strengthening against major currencies like the Euro and Japanese Yen. This trend, if sustained, could have presented a headwind for US-based multinational corporations with substantial overseas operations, potentially reducing the reported value of their foreign-sourced income. Graphic Packaging, with its extensive global footprint, would be directly exposed to such market dynamics.

- Impact on Revenue: A stronger US dollar can decrease the reported USD value of sales made in weaker foreign currencies.

- Cost Management: Conversely, a weaker US dollar can increase the cost of imported raw materials or components purchased in foreign currencies.

- Earnings Translation: Fluctuations directly affect the translation of foreign subsidiary profits into the parent company's financial statements.

- Hedging Costs: Implementing currency hedging strategies involves costs, which are factored into financial planning and can impact net income.

Competition and Industry Consolidation

The packaging sector is highly competitive, with a noticeable trend towards consolidation. This means companies are either buying out rivals or being acquired themselves, which significantly reshapes how the market operates, influencing prices and who holds the most power. Graphic Packaging needs to stay ahead by innovating and keeping its costs low to thrive in this environment.

For instance, in 2024, the global packaging market was valued at approximately $1.1 trillion, with projections showing continued growth, but also highlighting the pressure from mergers. Major players are actively seeking acquisitions to expand their capabilities and market reach. Graphic Packaging's strategy must account for these shifts, potentially through strategic partnerships or further acquisitions to secure its position.

- Intensified Rivalry: Increased competition from both large, established firms and agile, niche players demands constant efficiency improvements.

- Merger & Acquisition Activity: Ongoing consolidation among packaging providers and their clients directly impacts market share and pricing leverage.

- Innovation Imperative: Continuous investment in new materials, sustainable solutions, and advanced manufacturing is crucial for differentiation.

- Cost Optimization: Maintaining a lean operational structure is vital to compete effectively against consolidated entities with greater economies of scale.

Persistent inflation, particularly in North America and Europe, continues to impact consumer spending habits, leading households to re-evaluate discretionary purchases and favor value-oriented options throughout 2024. This trend directly influences demand for packaged goods, potentially shifting consumer preferences towards smaller pack sizes or private label alternatives as they seek more affordable solutions.

The health of the global economy directly influences consumer spending on food, beverages, and foodservice, which in turn affects demand for Graphic Packaging's products. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, indicating a potentially moderating demand environment that could reduce packaging volumes.

As a global enterprise, Graphic Packaging's financial results are significantly influenced by foreign exchange rate fluctuations, with a stronger US dollar in early 2024 potentially decreasing the reported USD value of sales made in weaker foreign currencies.

What You See Is What You Get

Graphic Packaging PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for Graphic Packaging.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Graphic Packaging.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Graphic Packaging.

Sociological factors

Consumers are increasingly prioritizing packaging that is kind to the planet, seeking out options that are recyclable, compostable, or made from renewable resources. This shift in demand is significant, with studies showing a substantial percentage of consumers willing to pay more for sustainable packaging. For Graphic Packaging, this translates into a direct opportunity as their core business in paper-based solutions aligns perfectly with this growing eco-consciousness.

Modern consumers increasingly value convenience, fueling demand for single-serve and ready-to-eat options. This shift directly impacts packaging needs, pushing for designs that are easily portable and user-friendly for busy lifestyles. For instance, the global market for convenience foods was projected to reach over $1.1 trillion by 2024, highlighting the scale of this trend.

Consumers are increasingly prioritizing health and safety, leading to a growing demand for packaging that is free from harmful chemicals and clearly labeled regarding its food contact materials. This trend directly impacts Graphic Packaging, as it necessitates a focus on certified food-grade solutions.

For instance, a 2024 survey indicated that over 70% of consumers actively seek out packaging with transparent ingredient lists and safety certifications when purchasing food products. This highlights the critical need for Graphic Packaging to not only meet but exceed stringent safety regulations.

Graphic Packaging's commitment to robust safety standards and clear communication about its packaging's material composition is paramount for building and retaining consumer trust in the competitive food and beverage market.

Demographic Changes

Global demographic shifts, including an aging population and increasing urbanization, directly impact consumer purchasing habits and, consequently, packaging demand. For instance, the proportion of individuals aged 65 and over in developed nations is projected to rise significantly, potentially increasing demand for smaller, easier-to-handle packaging formats.

Smaller household sizes, a trend observed in many regions, also steer consumers towards single-serving or smaller multi-pack options, influencing the types of packaging Graphic Packaging develops and supplies. By 2025, it's estimated that over 55% of the global population will reside in urban areas, a concentration that often correlates with a preference for convenience and portability in packaged goods.

- Aging Population: Increased demand for accessible and single-serving packaging.

- Urbanization: Growth in demand for convenient, portable, and smaller-format packaging.

- Household Size: Shift towards multi-packs for families and single-servings for smaller households.

Brand Reputation and Corporate Social Responsibility

Consumers and stakeholders are placing a higher premium on companies that exhibit strong corporate social responsibility (CSR) and ethical conduct. This societal shift means that Graphic Packaging's efforts in sustainability, such as its commitment to responsible fiber sourcing and reducing greenhouse gas emissions, directly bolster its brand image. For instance, in 2023, Graphic Packaging reported achieving a 33% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline, a tangible demonstration of its environmental commitment.

A positive reputation built on robust CSR initiatives acts as a magnet, drawing in customers, investors, and skilled employees. This can translate into tangible business benefits, like increased market share and a stronger financial position. Graphic Packaging's focus on circular economy principles, aiming to increase the use of recycled content in its packaging solutions, resonates with environmentally conscious consumers and aligns with evolving regulatory landscapes.

The company's dedication to social responsibility extends beyond environmental concerns, encompassing fair labor practices and community engagement. These efforts are crucial for maintaining a positive perception among a broad range of stakeholders. Graphic Packaging's participation in programs like the Forest Stewardship Council (FSC) certification for its paperboard products underscores its commitment to ethical supply chains.

- Consumer Demand for Sustainability: A 2024 Nielsen study indicated that 73% of global consumers are willing to change their purchasing habits to reduce their environmental impact.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) investments continue to grow, with global ESG assets projected to reach $50 trillion by 2025, making strong CSR performance a financial imperative.

- Talent Acquisition: A 2024 Deloitte survey found that 60% of job seekers consider a company's social and environmental impact when choosing an employer.

- Brand Loyalty: Companies with strong CSR reputations often experience higher customer loyalty, with studies showing a significant willingness to pay a premium for sustainably produced goods.

Societal expectations are increasingly shaping consumer preferences and corporate accountability. Consumers are actively seeking brands that align with their values, particularly concerning environmental impact and ethical sourcing. This societal push is a significant driver for Graphic Packaging, as its paper-based packaging solutions naturally cater to the demand for sustainable alternatives.

The growing emphasis on corporate social responsibility (CSR) means that companies like Graphic Packaging must demonstrate tangible commitments to sustainability and ethical practices. For example, Graphic Packaging reported a 33% reduction in Scope 1 and 2 greenhouse gas emissions intensity by 2023 compared to its 2019 baseline, showcasing its dedication to environmental stewardship.

Furthermore, investor interest in ESG (Environmental, Social, and Governance) factors is escalating, with global ESG assets projected to reach $50 trillion by 2025. This financial imperative underscores the importance of Graphic Packaging's focus on circular economy principles and responsible fiber sourcing to attract and retain investment.

Talent acquisition is also influenced by societal values, with a 2024 Deloitte survey revealing that 60% of job seekers consider a company's social and environmental impact. Graphic Packaging's commitment to ethical labor practices and community engagement, evidenced by its participation in FSC certification, enhances its appeal to potential employees.

| Sociological Factor | Impact on Graphic Packaging | Supporting Data/Trend |

|---|---|---|

| Consumer Demand for Sustainability | Increased demand for recyclable, compostable, and renewable packaging. | 73% of global consumers willing to change purchasing habits for environmental impact (Nielsen, 2024). |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and customer loyalty. | 33% reduction in GHG emissions intensity by 2023 (Graphic Packaging). |

| Investor Scrutiny (ESG) | Attracts investment and financial support. | Global ESG assets projected to reach $50 trillion by 2025. |

| Talent Acquisition | Attracts skilled employees valuing ethical companies. | 60% of job seekers consider social/environmental impact (Deloitte, 2024). |

Technological factors

Ongoing research and development are fueling innovation in sustainable packaging, with a strong emphasis on fiber-based materials as alternatives to traditional plastics. This trend is a significant technological factor influencing the packaging industry.

Graphic Packaging is strategically positioned to benefit from this shift, focusing on paperboard solutions such as their EnviroClip™ and Boardio™ designs. These innovations directly address the growing demand for more eco-friendly packaging options.

These advancements allow Graphic Packaging to offer increasingly circular and environmentally responsible packaging to their customer base, aligning with broader sustainability goals and regulatory pressures. For instance, the company reported a 2% increase in sales for sustainable packaging solutions in their Q1 2024 earnings report.

Automation and advanced manufacturing are revolutionizing how packaging is produced, leading to significant gains in efficiency and a reduction in labor expenses. Graphic Packaging's strategic investments, like their new recycled paperboard mill in Waco, Texas, completed in 2023, exemplify this trend, aiming to secure cost benefits and expand production capabilities. These technological advancements are also instrumental in accelerating the introduction of novel packaging solutions to the market.

Technological progress is driving packaging beyond mere containment, introducing enhanced functionality. Innovations like advanced barrier materials are extending product shelf life, a critical factor for food and beverage manufacturers. For instance, advancements in polymer science are enabling packaging that offers superior protection against oxygen and moisture, directly impacting spoilage rates and waste reduction.

Graphic Packaging is actively leveraging these technological shifts to create value. Their focus on innovation translates into packaging solutions that cater to demands for greater convenience and improved user experience, such as easy-open features or resealable closures. This commitment to functional design helps their clients differentiate their products on crowded retail shelves.

The integration of smart technologies, like QR codes or RFID tags, is also becoming a significant trend, offering enhanced traceability and consumer engagement. By incorporating these elements, packaging can provide valuable information about a product's origin or authenticity. This is particularly relevant in sectors like pharmaceuticals and high-value consumer goods, where supply chain transparency is paramount.

Digitalization and Data Analytics

The increasing digitalization of supply chains and manufacturing processes is a significant technological factor for Graphic Packaging. This trend allows for more robust data collection and analysis, which is crucial for optimizing operations. For instance, by 2024, the global manufacturing execution systems market was projected to reach $18.6 billion, highlighting the widespread adoption of digital tools in production environments.

Leveraging advanced data analytics and artificial intelligence (AI) presents substantial opportunities. These technologies can refine production planning, improve demand forecasting accuracy, and pinpoint areas for efficiency gains. Companies using AI in supply chain management have reported improvements in forecast accuracy by up to 20%.

Graphic Packaging can strategically employ these digital tools to foster data-driven decision-making. This approach not only streamlines operational workflows but also provides valuable competitive intelligence. A McKinsey report indicated that companies that excel in data analytics are 23 times more likely to acquire customers and 19 times more likely to be profitable.

- Digitalization: Enhanced data capture across manufacturing and supply chain touchpoints.

- Data Analytics & AI: Tools for optimizing production, forecasting demand, and identifying efficiencies.

- Data-Driven Decisions: Enabling informed choices for streamlining operations and gaining competitive advantages.

- Market Trends: The manufacturing execution systems market is expanding, indicating a strong industry shift towards digital integration.

Recycling and Recovery Technologies

Technological advancements in recycling and material recovery are crucial for creating a truly circular economy. Innovations in sorting technologies, like advanced optical sorters, and improved de-inking processes are making it easier to reclaim high-quality paper and paperboard. These improvements directly benefit companies like Graphic Packaging by increasing the supply of suitable recycled content, thereby reducing their dependence on virgin pulp and supporting their sustainability objectives.

Graphic Packaging actively participates in and benefits from these technological leaps. For instance, their investment in advanced recycling infrastructure aims to enhance the quality and yield of recovered materials. By embracing these innovations, Graphic Packaging can more effectively meet its circularity targets, such as increasing the use of recycled content in its packaging solutions. In 2023, the company reported that approximately 40% of its packaging was made from recycled materials, a figure they aim to grow through these technological integrations.

- Enhanced Sorting Efficiency: New sorting technologies can identify and separate different paper grades with greater accuracy, leading to higher quality recycled feedstock.

- Improved De-inking Processes: Innovations in de-inking chemicals and methods are reducing the environmental impact of recycling while improving the brightness and purity of recycled pulp.

- Reprocessing Innovations: Developments in reprocessing allow for the conversion of a wider range of paper-based waste into usable materials, expanding the potential for recycled content.

Technological advancements are driving a significant shift towards sustainable packaging materials, with fiber-based solutions gaining prominence over plastics. Graphic Packaging is capitalizing on this trend with innovations like EnviroClip™ and Boardio™, which saw a 2% sales increase in sustainable packaging in Q1 2024.

Automation and digitalization are enhancing manufacturing efficiency and enabling data-driven decision-making. The global manufacturing execution systems market was projected to reach $18.6 billion by 2024, underscoring the industry's embrace of digital integration to optimize operations and gain competitive advantages.

Innovations in recycling technologies, such as advanced optical sorters and improved de-inking processes, are crucial for a circular economy. Graphic Packaging, which used approximately 40% recycled materials in 2023, benefits from these advancements by increasing the availability of high-quality recycled content.

| Technological Factor | Impact on Graphic Packaging | Supporting Data/Example |

|---|---|---|

| Sustainable Materials Innovation | Increased demand for fiber-based packaging, driving sales of eco-friendly solutions. | 2% sales increase in sustainable packaging (Q1 2024). |

| Automation & Digitalization | Improved production efficiency and data-driven operational optimization. | Manufacturing Execution Systems market projected at $18.6 billion (2024). |

| Recycling Technology Advancements | Enhanced supply of quality recycled content, supporting circularity goals. | 40% recycled materials used in packaging (2023). |

Legal factors

Graphic Packaging faces stringent legal obligations concerning packaging and waste, exemplified by regulations like the EU's proposed Regulation (EU) 2025/40, which sets ambitious targets for recycled content and end-of-life management. These laws mandate specific material compositions, recyclability standards, and waste reduction goals, impacting everything from product design to supply chain logistics. Non-compliance can lead to substantial fines and restrict access to key markets, making adherence a critical operational focus.

Graphic Packaging operates within a complex legal landscape shaped by Extended Producer Responsibility (EPR) laws. These regulations place the onus on manufacturers to manage their products and packaging throughout their lifecycle, including disposal and recycling. As of early 2024, numerous countries and regions, including many in Europe and Canada, have implemented or expanded EPR schemes, impacting packaging producers like Graphic Packaging.

Navigating these diverse EPR frameworks requires significant adaptation. Graphic Packaging must comply with varying financial obligations, such as paying fees to national recycling funds, and potentially invest in or manage collection and recycling systems. For instance, France's AGEC law, fully implemented in 2023, imposes broad EPR obligations on packaging, with penalties for non-compliance that can significantly impact profitability.

Failure to adhere to these evolving legal mandates carries substantial risks. Beyond financial penalties, which can amount to millions of euros for large corporations in cases of non-compliance with schemes like Germany's packaging act, businesses face reputational damage. Maintaining compliance is therefore critical for sustained operations and market access.

Graphic Packaging operates under stringent legal frameworks for food contact materials, prioritizing consumer safety. These regulations, such as those from the U.S. Food and Drug Administration (FDA) and the European Union (EU), dictate permissible chemicals and migration limits for packaging components. For instance, the EU's Regulation (EC) No 1935/2004 sets general principles for food contact materials, with specific measures for plastics and recycled plastics.

Compliance necessitates rigorous testing and certification to ensure products meet safety standards, including the avoidance of substances like per- and polyfluoroalkyl substances (PFAS) and bisphenol A (BPA), which are increasingly restricted. Graphic Packaging's commitment to these evolving legal requirements, including potential updates in 2024 and 2025 concerning chemical safety, is crucial for market access and brand reputation.

Labor Laws and Workplace Safety

Graphic Packaging International, as a global manufacturer, navigates a complex web of labor laws across its operating regions. These regulations govern everything from minimum wages and working hours to employee benefits and collective bargaining rights. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal standards, while individual states may impose stricter requirements. In 2024, many jurisdictions are seeing adjustments to minimum wage laws, impacting labor costs for companies like Graphic Packaging.

Workplace safety is another critical legal factor. Occupational safety and health administrations, such as OSHA in the U.S., mandate specific standards to prevent accidents and ensure a healthy work environment. Graphic Packaging's commitment to HSE excellence directly addresses these legal imperatives. In 2023, workplace injuries in the manufacturing sector remained a concern, underscoring the ongoing importance of robust safety protocols and compliance. The company's investment in safety training and equipment is a direct response to these legal and operational necessities.

- Compliance with diverse global labor laws, including wage and hour regulations, is essential for Graphic Packaging's international operations.

- Adherence to occupational health and safety standards, such as those set by OSHA, is a legal requirement to protect employees.

- The company's HSE excellence framework demonstrates a commitment to meeting and exceeding these legal obligations.

- Changes in minimum wage laws and workplace safety regulations in key markets can impact operational costs and require ongoing legal review.

Intellectual Property Rights Protection

Intellectual Property Rights Protection is paramount for Graphic Packaging. The company actively secures patents for its innovative packaging designs and advanced manufacturing processes, safeguarding its competitive advantage. In 2024, the global intellectual property services market was valued at over $200 billion, highlighting the significant investment companies make in IP protection.

Trademarks are also crucial for brand recognition and preventing consumer confusion. Graphic Packaging's brand portfolio, including its distinctive logos and product names, is protected through rigorous trademark registration. Copyrights further shield proprietary creative works, such as unique packaging artwork and technical documentation, from unauthorized use.

- Patent Filings: Graphic Packaging consistently files patents to protect novel packaging technologies, contributing to its innovation pipeline.

- Trademark Enforcement: The company actively monitors and enforces its trademarks to maintain brand integrity and prevent counterfeiting.

- Copyright Protection: Proprietary marketing materials and technical specifications are protected under copyright law, ensuring exclusive use.

Graphic Packaging faces evolving legal mandates regarding packaging sustainability, including proposed regulations like the EU's 2025/40, which targets recycled content and end-of-life management. These laws dictate material composition, recyclability, and waste reduction, influencing design and supply chains. Non-compliance risks substantial fines and market access restrictions.

Environmental factors

The global shift towards a circular economy is a significant environmental factor for Graphic Packaging, influencing consumer and regulatory demand for sustainable packaging solutions. This trend encourages the development of packaging designed for enhanced recyclability, reusability, and overall waste minimization.

Graphic Packaging is actively responding by substituting traditional plastic packaging with innovative paperboard alternatives, emphasizing designs that facilitate material circulation. For instance, in 2023, the company reported a 10% increase in the use of recycled content across its product lines, a move directly supporting circular economy principles.

These initiatives not only contribute to reducing landfill waste but also align the company with overarching international environmental objectives, such as those outlined in the UN's Sustainable Development Goals, fostering a more responsible and resource-efficient operational model.

Graphic Packaging faces increasing pressure to curb greenhouse gas (GHG) emissions, a direct consequence of growing global concerns over climate change. This environmental factor impacts the company's operational strategies and its entire supply chain.

To address this, Graphic Packaging has committed to science-based targets for emission reductions. A significant part of this strategy involves investing in renewable energy, exemplified by their virtual power purchase agreements.

These initiatives are not just about environmental stewardship; they are vital for regulatory compliance with international climate accords and for maintaining a positive corporate image. For instance, the company aims to reduce Scope 1 and 2 GHG emissions by 46% by 2030 from a 2021 baseline.

Environmental scrutiny on raw material sourcing, particularly for paper-based products, highlights the critical role of sustainable forestry. Graphic Packaging's commitment to sourcing a high percentage of its purchased forest products from certified, sustainably managed forests directly addresses concerns about deforestation and biodiversity loss. This focus ensures the long-term availability of renewable resources, a key factor in their operational strategy.

Water Usage and Effluent Management

Water scarcity and pollution are critical environmental issues that necessitate stringent management of water resources within manufacturing. Graphic Packaging, particularly its paperboard mills, consumes significant amounts of water and discharges effluent, making responsible water stewardship paramount.

The company actively invests in advanced wastewater treatment systems to mitigate its environmental impact and works towards reducing its water intensity. For instance, in 2023, Graphic Packaging reported a reduction in its water intensity by 10% compared to its 2019 baseline, showcasing a commitment to improving its water usage efficiency.

- Water Intensity Reduction: Graphic Packaging achieved a 10% reduction in water intensity by the end of 2023, compared to a 2019 baseline.

- Wastewater Treatment Investment: The company continues to invest in upgrading its wastewater treatment facilities across its operational sites.

- Effluent Quality Monitoring: Ongoing monitoring ensures that discharged effluent meets or exceeds all regulatory standards for local water ecosystems.

Waste Management Infrastructure and Recycling Rates

The effectiveness of Graphic Packaging's paperboard packaging relies significantly on robust waste management infrastructure and strong recycling rates. Globally, while recycling rates are improving, significant regional disparities exist. For instance, in 2023, the European Union reported an average recycling rate for packaging waste of 67%, with some member states exceeding 80%, highlighting the critical role of infrastructure development.

Graphic Packaging is actively engaged in collaborations with its customers and industry partners to enhance the recovery of its paperboard packaging. These initiatives are crucial for realizing the full environmental potential of their products. The company's commitment is reflected in its participation in programs aimed at improving collection and sorting technologies.

The ongoing improvement of global recycling infrastructure is a paramount environmental consideration impacting the true circularity and ecological advantages of Graphic Packaging's solutions. As of early 2024, investments in advanced sorting facilities and public awareness campaigns are underway in many key markets, aiming to boost material recovery rates for paper and paperboard.

- Global Packaging Recycling Rates: While specific data for paperboard varies, overall packaging recycling rates are a key indicator. For example, the U.S. EPA reported a 75.5% recycling rate for paper and paperboard in 2021, a significant portion of which is packaging.

- Infrastructure Investment: Significant capital is being directed towards upgrading Material Recovery Facilities (MRFs) globally. These upgrades aim to improve the capture of recyclable materials, including paperboard, by an estimated 10-15% in well-invested regions by 2025.

- Customer and Partner Collaboration: Graphic Packaging's efforts to boost paperboard recovery are vital. Partnerships with retailers and waste management companies are essential to ensure materials are properly collected and processed, contributing to a more circular economy.

- Circularity Metrics: The environmental benefit of Graphic Packaging's products is directly tied to the percentage of material that is successfully recycled and reprocessed. Improved infrastructure directly increases these circularity metrics, reducing reliance on virgin materials.

Graphic Packaging's environmental performance is increasingly scrutinized, particularly concerning its carbon footprint and the lifecycle impact of its paperboard products. The company's commitment to reducing greenhouse gas emissions is a key strategic focus. For instance, Graphic Packaging aims to decrease its Scope 1 and 2 GHG emissions by 46% by 2030, using a 2021 baseline.

Water management is another critical environmental factor, with paperboard production being water-intensive. The company reported a 10% reduction in water intensity by the end of 2023 compared to its 2019 baseline, demonstrating progress in water stewardship.

The global push for a circular economy directly influences demand for sustainable packaging. Graphic Packaging is responding by increasing its use of recycled content, reporting a 10% rise in 2023 across its product lines. This aligns with broader efforts to improve recycling rates and reduce waste.

| Environmental Factor | 2023/2024 Focus/Data | Impact on Graphic Packaging |

|---|---|---|

| Greenhouse Gas Emissions | Target: 46% reduction in Scope 1 & 2 GHG by 2030 (from 2021 baseline) | Requires investment in renewable energy and operational efficiency |

| Water Intensity | Achieved 10% reduction by end of 2023 (vs. 2019 baseline) | Drives investment in advanced water treatment and conservation |

| Circular Economy & Recycled Content | 10% increase in recycled content use in 2023 | Boosts demand for recyclable packaging and sustainable sourcing |

| Sustainable Forestry | High percentage of forest products sourced from certified forests | Ensures long-term resource availability and mitigates deforestation risks |

PESTLE Analysis Data Sources

Our Graphic Packaging PESTLE Analysis is built on a comprehensive review of data from leading market research firms, government regulatory bodies, and reputable financial news outlets. This ensures that our insights into political, economic, social, technological, legal, and environmental factors impacting the packaging industry are both current and reliable.