Graphic Packaging Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graphic Packaging Bundle

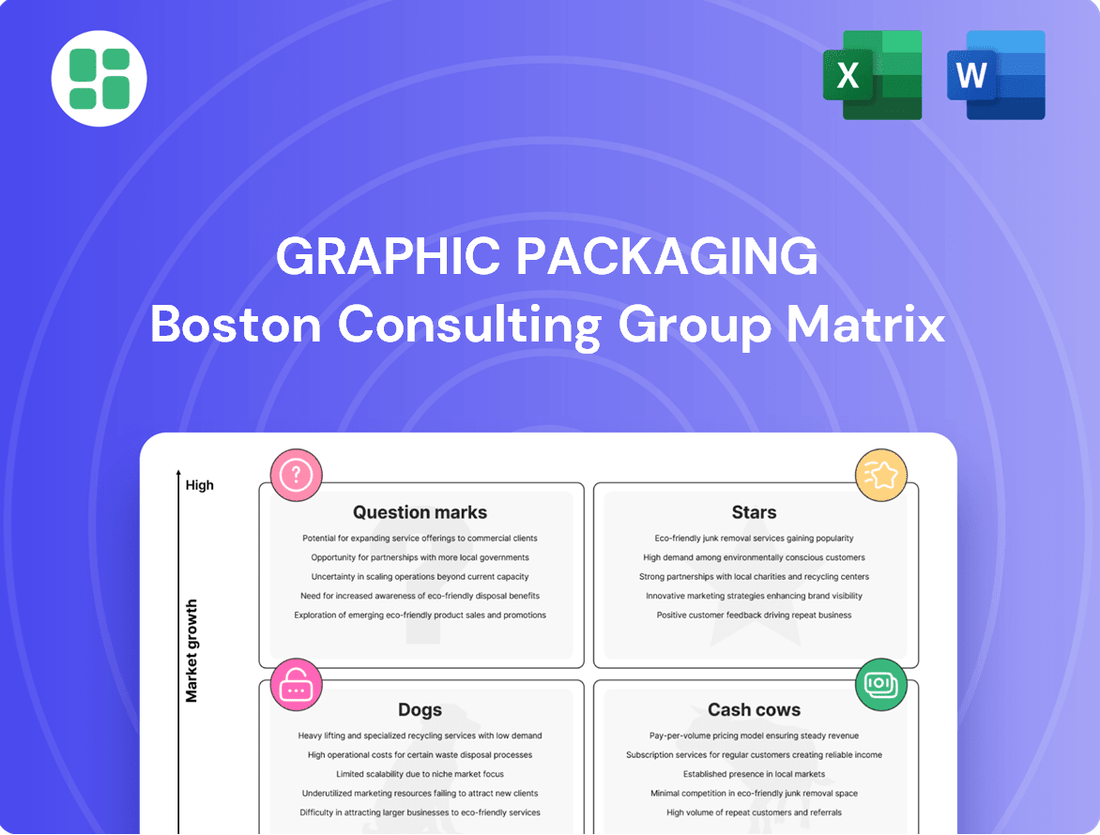

Graphic Packaging's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of products. Understand which segments are driving growth and which require careful management to unlock their full potential.

This preview offers a glimpse into Graphic Packaging's market performance, but the full BCG Matrix report provides the critical data and strategic insights needed to make informed decisions. Purchase the complete analysis to navigate your own product portfolio with confidence.

Stars

Graphic Packaging's sustainable paperboard innovations, like EnviroClip™, are a prime example of their commitment to replacing plastics. This focus taps into a significant growth opportunity fueled by both consumer preference and stricter regulations favoring eco-friendly packaging.

In 2024, these innovative solutions generated $205 million in sales for Graphic Packaging. The company anticipates this segment will see at least 2% growth in 2025, underscoring the strong market acceptance and the ongoing potential for these environmentally conscious products to expand their reach.

Paperboard packaging for beverages is a strong performer in the market. The sector is expected to grow at a compound annual growth rate of 6.65% through 2030, driven by a move towards sustainable materials. This shift is due to increasing environmental awareness and regulations favoring renewable and recyclable options over plastics.

Graphic Packaging benefits significantly from this trend. Their established relationships with major global beverage companies solidify their market share in this growing area. By focusing on paperboard, they are well-positioned to capitalize on the industry-wide pivot away from less sustainable packaging solutions.

High-Performance Folding Cartons are a cornerstone of Graphic Packaging's portfolio, positioned as Stars in the BCG Matrix. The folding carton market is expected to grow around 5% annually from 2024 to 2029, driven by the food and beverage industry and a move away from plastics.

Graphic Packaging's strong market share in this segment is supported by its investments in advanced printing and design technologies. These cartons are essential for packaging numerous consumer goods, solidifying their status as a high-growth, high-market-share product.

Recycled Paperboard Solutions

Graphic Packaging's focus on recycled paperboard is a key driver in the growing sustainable packaging market. Their significant investment in the Waco, Texas facility, slated for a Q4 2025 startup, is designed to boost their capacity and market leadership in eco-friendly materials. This expansion is projected to deliver substantial incremental EBITDA, underscoring the strategic importance of recycled paperboard to their business.

- Market Demand: The paperboard packaging sector is experiencing robust growth, largely fueled by consumer and regulatory demand for sustainable and eco-friendly solutions.

- Strategic Investment: Graphic Packaging's substantial investment in its Waco, Texas facility, a state-of-the-art recycled paperboard production site, is a direct response to this market trend.

- Future Performance: The Waco facility is anticipated to commence operations in Q4 2025 and is expected to contribute significantly to the company's earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Sustainability Commitment: The company's 2024 Impact Report showcases a commitment to circularity, detailing the recycling of 1 million metric tons of waste materials, reinforcing their brand as a leader in sustainable practices.

International Packaging Operations

Graphic Packaging's International Packaging Operations are showing promising growth, with a 3% volume increase in the first quarter of 2025. This positive trend highlights the company's ability to capitalize on expanding international markets that have a growing appetite for sustainable packaging.

The company's strategic investments, such as the virtual power purchase agreement for solar projects in Spain set to activate in late 2025, are crucial. This initiative will power 70% of their EMEA electricity needs, underscoring a commitment to supporting international expansion with sustainable energy practices.

- International Volume Growth: Q1 2025 saw a 3% increase in international packaging volumes.

- Market Capture: Strategic global presence allows for market share gains in high-demand international regions.

- Sustainability Focus: A virtual power purchase agreement for Spanish solar projects will cover 70% of EMEA electricity usage from late 2025.

Graphic Packaging's High-Performance Folding Cartons are firmly positioned as Stars within the BCG Matrix. This segment benefits from robust market demand, driven by the food and beverage industry and a widespread shift away from plastics towards more sustainable packaging solutions. The company's ongoing investments in advanced printing and design technologies further solidify its strong market share in this high-growth area, making these cartons a significant contributor to their overall success.

| Product Segment | BCG Category | Key Growth Drivers | 2024 Sales Contribution (Est.) | Projected 2025 Growth |

|---|---|---|---|---|

| High-Performance Folding Cartons | Stars | Demand for sustainable packaging, food & beverage industry growth | Significant portion of total revenue | ~5% |

| Sustainable Paperboard Innovations (e.g., EnviroClip™) | Stars | Consumer preference for eco-friendly options, regulatory tailwinds | $205 million | ~2% |

| International Packaging Operations | Stars | Growing international markets, increasing demand for sustainable solutions | Growing | 3% volume increase (Q1 2025) |

What is included in the product

This BCG Matrix overview provides tailored analysis for Graphic Packaging's product portfolio, highlighting which units to invest in, hold, or divest.

The Graphic Packaging BCG Matrix provides a clear, actionable overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Graphic Packaging's established food packaging folding cartons are a prime example of a Cash Cow. This segment, representing about 38% of their total packaging sales, benefits from deeply entrenched customer relationships and widespread market adoption within stable food categories.

These mature product lines are highly reliable revenue generators, consistently producing strong cash flow. While consumer preferences do evolve, the foundational demand for these essential packaging solutions ensures a steady and predictable income stream for Graphic Packaging.

Graphic Packaging's standard paper cups for foodservice, especially for quick-service restaurants, operate as a classic Cash Cow. This segment offers consistent, dependable demand, even if the growth rate isn't explosive. For instance, in 2024, the global paper cup market was valued at approximately $12.5 billion, with foodservice being a significant driver.

Despite some shifts in consumer behavior, these cups benefit from established, high-volume contracts and strong brand presence within the industry. This stability means they generate substantial cash flow with minimal need for heavy promotional spending, as the market is quite mature.

Graphic Packaging's Core Bleached Paperboard Production, despite divesting its Augusta facility, remains a vital component. This segment continues to supply bleached paperboard for both internal consumption in their high-value consumer packaging and for select external customers, underscoring its foundational role.

While the open market for bleached paperboard has seen price and volume decreases, this segment is crucial for Graphic Packaging's integrated model. It ensures a stable internal supply chain, directly supporting the production of their premium packaging solutions and contributing to operational efficiencies across the company.

Packaging for Household Products

Graphic Packaging's packaging solutions for household products are a classic example of a cash cow. This market is mature, meaning demand is stable and predictable, allowing the company to generate consistent revenue. In 2023, the consumer staples sector, which heavily relies on household products, demonstrated resilience, with companies reporting steady sales despite economic fluctuations.

The mature nature of this segment means that Graphic Packaging likely commands a substantial market share, benefiting from established customer relationships and efficient production processes. These operations are optimized for cost-effectiveness rather than rapid expansion. For instance, in 2024, Graphic Packaging continued to invest in upgrading its converting facilities, focusing on energy efficiency and automation to further lower production costs in its paperboard packaging divisions.

- Stable Demand: The household products market offers consistent purchasing patterns, ensuring reliable revenue streams for Graphic Packaging.

- Market Position: The company likely holds a significant share in this mature segment, leveraging its established presence.

- Efficiency Focus: Investments are directed towards maintaining operational efficiency and cost control, rather than aggressive growth initiatives.

- Predictable Cash Generation: This segment serves as a primary source of predictable cash flow, supporting other business areas.

Paperboard for Multi-Pack Beverages

Graphic Packaging's paperboard for multi-pack beverages is a classic Cash Cow. This segment operates in a mature market, meaning it’s well-established and generates consistent demand, even if growth isn't explosive. Think of it as a reliable workhorse for the company.

Despite a reported decline in the beverage segment during Q1 2025, the sheer volume of this market keeps it substantial. Graphic Packaging's deep-rooted connections with major beverage manufacturers are key here, securing their leading position. This means they consistently capture a significant piece of the pie.

While there's ongoing promotional activity that can shift product mix, this segment continues to deliver stable, predictable cash flow. These funds are crucial, as they can be reinvested in other parts of the business, like Stars or Question Marks, to fuel future growth.

- Market Maturity: Operates in a well-established, high-volume sector.

- Market Share: Benefits from strong, long-standing relationships with major beverage brands.

- Cash Flow Generation: Provides steady and reliable income, even with market fluctuations.

- Strategic Importance: Funds can be redeployed to support growth initiatives in other business segments.

Graphic Packaging's established folding cartons for food, standard paper cups for foodservice, and packaging for household products are all strong Cash Cow examples. These segments benefit from stable demand in mature markets, allowing for consistent revenue generation and predictable cash flow. For instance, the global paper cup market was valued at approximately $12.5 billion in 2024, with foodservice being a major contributor.

The company's paperboard for multi-pack beverages also fits the Cash Cow profile, operating in a high-volume, well-established sector. Despite some market shifts, deep-rooted customer relationships ensure a significant market share and steady cash generation. Investments in upgrading converting facilities, like those focused on energy efficiency in 2024, further bolster the cost-effectiveness of these mature operations.

| Segment | BCG Category | Key Characteristics | Supporting Data/Facts |

| Food Packaging Folding Cartons | Cash Cow | Mature market, entrenched customer relationships, stable demand | Represents ~38% of total packaging sales. |

| Standard Paper Cups (Foodservice) | Cash Cow | Consistent, dependable demand, high-volume contracts | Global paper cup market valued at ~$12.5 billion in 2024. |

| Household Products Packaging | Cash Cow | Stable and predictable demand, significant market share | Consumer staples sector showed resilience in 2023. |

| Paperboard for Multi-Pack Beverages | Cash Cow | Mature market, high volume, strong brand connections | Ongoing investment in facility upgrades for efficiency. |

Preview = Final Product

Graphic Packaging BCG Matrix

The BCG Matrix preview you're currently viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means you'll get the complete analysis, precisely as it appears now, without any alterations or watermarks, ready for your strategic planning. Rest assured, the file is polished, professionally formatted, and directly transferable to your workflow for immediate application in business decision-making.

Dogs

Graphic Packaging's divestiture of its Augusta, Georgia bleached paperboard facility in May 2024 clearly illustrates a 'Dog' in the BCG Matrix. This facility was sold because of falling prices and volumes in the market.

The strategic move helped Graphic Packaging decrease its exposure to open market sales, allowing a pivot to more lucrative consumer packaging segments. While this sale reduced overall sales figures, it was a necessary step to offload underperforming assets.

Graphic Packaging's underperforming recycled paperboard manufacturing facilities, like the Middletown, Ohio plant slated for closure, represent the Dogs in their BCG Matrix. These operations typically exhibit low market share and low growth prospects, often requiring significant capital investment without commensurate returns.

The decision to re-examine the East Angus, Quebec plant further underscores this classification. Such facilities can become cash traps, draining resources for turnaround efforts that struggle to generate meaningful profit, impacting the company's overall efficiency and profitability.

Graphic Packaging's reduced involvement in open market bleached paperboard sales, especially after the Augusta divestiture, signals that this area offered limited growth and was probably characterized by fierce competition and price sensitivity. This strategic pivot away from commoditized markets, where the company lacked a distinct competitive edge, aligns with a focus on more value-added segments. In 2023, Graphic Packaging reported that its strategic shift away from certain paperboard sales, including those in the open market, contributed to improved profitability and a more focused business model.

Legacy Packaging Formats with Low Sustainability

Legacy packaging formats that are not easily recyclable or do not align with modern sustainability trends would be considered Dogs as the market rapidly shifts. With 97% of Graphic Packaging's products now recyclable, any remaining non-recyclable or less sustainable offerings would have low market appeal and declining demand. These products would likely struggle in a market increasingly focused on circularity.

Graphic Packaging's commitment to sustainability means that products not meeting these evolving standards are becoming increasingly obsolete. For instance, the company has invested heavily in developing recyclable and compostable solutions, making older, less eco-friendly options a clear disadvantage.

- Limited Market Share: These legacy formats represent a shrinking portion of Graphic Packaging's overall business, likely below 3% given their 97% recyclability target.

- Declining Demand: Consumer and regulatory pressure favors sustainable packaging, leading to reduced orders for non-compliant options.

- High Disposal Costs: Non-recyclable materials often incur higher waste management fees, impacting profitability.

- Brand Reputation Risk: Continued offering of unsustainable packaging can damage Graphic Packaging's brand image in an environmentally conscious market.

Outdated Manufacturing Processes

Outdated manufacturing processes can significantly hinder a company's competitive edge, leading to higher production costs and reduced efficiency. For Graphic Packaging, this means older equipment or methods that make it harder to keep pace with market demands and cost expectations. While not a direct product, these inefficiencies, when tied to specific product lines, can make those offerings unprofitable.

Graphic Packaging's substantial investments in facility upgrades, such as those at their Waco plant, demonstrate a strategic shift. These capital expenditures, totaling hundreds of millions of dollars in recent years, are aimed at modernizing operations and moving away from these legacy systems. For instance, the company has highlighted efforts to improve automation and material handling, directly addressing the inefficiencies of older setups.

- Increased Production Costs: Older machinery often consumes more energy and requires more frequent maintenance, directly increasing the cost per unit produced.

- Reduced Competitiveness: Slower production cycles and higher costs make it difficult to offer competitive pricing, especially against rivals with more advanced technology.

- Quality Inconsistencies: Outdated equipment may lead to less precise manufacturing, resulting in higher defect rates and potential customer dissatisfaction.

- Limited Scalability: Inefficient processes can cap a product line's ability to scale up production quickly to meet unexpected surges in demand.

Graphic Packaging's 'Dogs' represent business segments with low market share and low growth potential, often requiring divestiture or significant restructuring. The sale of its Augusta bleached paperboard facility in May 2024 for an undisclosed sum exemplifies this, driven by declining market prices and volumes. Similarly, the planned closure of the Middletown, Ohio plant, a recycled paperboard manufacturing site, highlights operations that are no longer economically viable due to these factors.

These 'Dog' assets, including legacy packaging formats that don't meet sustainability standards, are being phased out. For example, products not easily recyclable, which constitute less than 3% of their offerings given the 97% recyclability target, face declining demand and higher disposal costs. Outdated manufacturing processes also contribute to these 'Dogs' by increasing production costs and reducing competitiveness.

Graphic Packaging's strategic divestments and closures, such as the Augusta facility sale and the Middletown plant shutdown, are aimed at optimizing its portfolio. These actions allow the company to redirect resources toward higher-growth, more profitable segments, improving overall financial health and operational efficiency.

The company's commitment to sustainability, with 97% of products being recyclable, means that any remaining non-compliant items are clear 'Dogs'. These are products with low market appeal and diminishing demand, directly impacted by consumer and regulatory preferences for circular economy solutions.

Question Marks

The market for bio-based and compostable packaging is experiencing rapid growth, with projections indicating a significant expansion in the coming years. For Graphic Packaging, this represents a potential high-growth area, though their current market share in these developing technologies may still be establishing itself. For instance, the global bioplastics market was valued at approximately USD 12.5 billion in 2023 and is expected to reach over USD 30 billion by 2030, showcasing the immense potential.

Developing these innovative packaging solutions demands substantial investment in research and development, along with dedicated efforts in market education and adoption. These investments are crucial for these products to gain traction and potentially displace conventional plastic packaging. The cost of R&D for new bio-based materials and the infrastructure needed for composting can be considerable, impacting initial profitability.

If Graphic Packaging successfully navigates these investment hurdles and achieves widespread adoption, these bio-based and compostable packaging lines could transition into Stars within the BCG matrix. Their ability to offer sustainable alternatives to traditional materials positions them favorably for future market leadership, especially as consumer and regulatory demand for eco-friendly options intensifies.

The packaging industry is seeing a significant shift towards smart and interactive solutions. Think about smart label technologies, QR codes, and augmented reality (AR) – these are becoming increasingly popular. Consumers really want to know more about the products they buy, and these technologies offer that transparency and a more engaging experience. For instance, a Nielsen study found that 73% of consumers are interested in packaging that provides product information. This points to a high-growth area for packaging companies.

Graphic Packaging is certainly aware of these trends and is exploring innovations in this space. However, given the nascent stage of widespread adoption for many of these digitally integrated solutions, their current market share in smart packaging is likely still relatively low. To truly capitalize on this burgeoning market, substantial investment will be crucial. Companies need to develop robust capabilities in areas like data analytics and digital integration to stand out.

The investment required isn't just for the technology itself, but also for the infrastructure to support it and the marketing to educate consumers. For example, developing AR experiences for packaging can be complex and costly. Companies like Graphic Packaging will need to dedicate resources to research and development, strategic partnerships, and potentially acquisitions to build a strong competitive position. This differentiation is key to capturing value in this evolving segment of the packaging market.

The functional beverage market, encompassing sports drinks and performance enhancers, is experiencing robust growth, projected to reach over $200 billion globally by 2027. This surge in demand necessitates innovative and specialized packaging, a segment where Graphic Packaging might currently hold a Question Mark position.

While Graphic Packaging has a strong presence in the general beverage sector, capturing significant market share in these rapidly evolving functional categories requires tailored packaging solutions and targeted marketing efforts. The success of these specialized offerings hinges on their ability to resonate with specific consumer needs and preferences within these niche markets.

New Geographic Market Entries with Limited Presence

New geographic market entries where Graphic Packaging has a limited presence and the market itself is experiencing high growth are typically classified as question marks in the BCG Matrix. These represent opportunities with significant upside potential but also considerable risk and investment requirements.

These ventures demand substantial capital and strategic focus to establish a foothold and capture market share. For instance, entering rapidly expanding markets in Southeast Asia, where packaging demand is surging due to rising consumerism and industrialization, would fall into this category.

- High Growth Potential: Emerging markets in Asia-Pacific, such as Vietnam and Indonesia, are projected to see robust growth in the packaging sector, driven by increasing disposable incomes and a growing middle class.

- Low Market Share: Graphic Packaging's current penetration in these specific new markets is minimal, necessitating significant investment to build brand awareness and distribution networks.

- Substantial Investment Required: Establishing manufacturing facilities, sales teams, and marketing campaigns in these new territories will demand considerable upfront capital expenditure.

- Strategic Importance: Success in these question mark markets is crucial for long-term global expansion and diversification, aligning with the company's strategy to tap into new revenue streams.

Advanced Barrier Coatings for Paperboard

Graphic Packaging's pursuit of advanced barrier coatings for paperboard positions them in a technically demanding, high-growth segment. These innovations aim to enable paperboard to rival plastic in applications requiring significant moisture or grease resistance. The company is actively developing these solutions to facilitate plastic replacement.

While Graphic Packaging is investing heavily in research and development for these advanced coatings, the market's full adoption and the competitive landscape for these specific solutions are still evolving. This area demands considerable R&D investment, but it also presents a significant opportunity for future market leadership.

- Innovation Focus: Development of paperboard coatings to match plastic's barrier properties in moisture and grease resistance.

- Market Position: Graphic Packaging is innovating to replace plastics, but market adoption and competitive success are still being established for these advanced solutions.

- Financial Investment: These products require substantial R&D cash expenditure.

- Future Potential: Significant opportunity for future market leadership if adoption and competitive advantages are secured.

Question Marks represent areas where Graphic Packaging is investing in high-growth potential markets but has a low current market share. These ventures require significant capital and strategic focus to gain traction, offering substantial upside if successful but also carrying inherent risks. The company's ability to effectively execute its strategy in these segments will determine their future market position.

Graphic Packaging's focus on bio-based and compostable packaging, smart packaging technologies, and new geographic market entries are prime examples of Question Marks. These initiatives align with industry growth trends but demand considerable R&D and market development investment. The success of these ventures is critical for the company's long-term growth and diversification strategy.

The company's exploration of advanced barrier coatings for paperboard also fits the Question Mark profile. While this innovation aims to replace plastics in demanding applications, market adoption and competitive positioning are still being established. These R&D-intensive products require substantial investment, holding significant future potential if market advantages are secured.

Entering new, high-growth geographic markets, such as Southeast Asia, exemplifies a Question Mark strategy for Graphic Packaging. With minimal current penetration, these markets demand significant investment in infrastructure, distribution, and brand building. Success here is vital for global expansion and tapping into burgeoning consumer demand.

BCG Matrix Data Sources

Our Graphic Packaging BCG Matrix is constructed using a blend of proprietary market research, financial statements, and industry trend analysis to accurately position each business unit.