Granite Construction Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Granite Construction Bundle

Granite Construction's marketing strategy is a masterclass in aligning product, price, place, and promotion for impactful results in the competitive infrastructure sector. Understanding how they position their diverse construction services, manage pricing for large-scale projects, select optimal distribution channels, and craft their promotional messages is key to grasping their market dominance.

Ready to unlock the full strategic blueprint? Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis for Granite Construction, designed for professionals and students seeking actionable insights and a competitive edge.

Product

Granite Construction's Integrated Infrastructure Solutions offer a comprehensive, end-to-end service for major transportation, water, and power projects. This means they manage everything from the initial design and engineering phases through to the final construction, providing a seamless experience for clients. In 2023, Granite reported over $3.5 billion in revenue, with a significant portion stemming from these large-scale infrastructure projects, highlighting their capability in delivering complex civil works.

This integrated approach allows Granite to tackle diverse projects from conception to completion, delivering holistic value to both public sector entities and private developers. Their expertise covers a wide array of sectors, ensuring that each client receives a service package specifically designed to meet their unique project demands. This comprehensive offering is crucial in a market where efficiency and specialized knowledge are paramount for project success.

Granite Construction's heavy civil product offering encompasses the specialized construction of vital infrastructure such as highways, bridges, airports, and dams. This segment demands extensive technical expertise, the management of substantial equipment fleets, and unwavering commitment to rigorous quality and safety protocols.

The company's proven track record in these complex projects, including significant contributions to transportation networks, highlights their capability. For instance, in 2023, Granite reported substantial revenue from its Heavy Civil segment, underscoring its importance to the company's overall performance and its role in national infrastructure advancement.

Granite Construction's materials segment is a cornerstone of its operations, producing and supplying critical components like aggregates, asphalt, and ready-mix concrete. This robust supply chain, managed through a wide network of facilities, not only fuels Granite's own extensive construction projects but also serves a broad external customer base. In 2023, Granite's Construction Materials segment generated $1.7 billion in revenue, showcasing its significant market presence and ability to meet diverse industry needs.

Sustainable and Resilient Infrastructure

Granite Construction is increasingly emphasizing sustainable and resilient infrastructure, a key aspect of its product strategy. This involves developing projects that can withstand environmental stressors and incorporate eco-friendly materials and techniques. For instance, in 2024, Granite reported a significant increase in projects incorporating recycled content, aiming to divert substantial tonnage from landfills.

The company's commitment to sustainability is driven by several factors:

- Client Demand: Many clients, particularly government agencies and large corporations, now mandate sustainable practices in their infrastructure projects.

- Regulatory Environment: Stricter environmental regulations are pushing the industry towards greener construction methods.

- Long-Term Value: Resilient infrastructure reduces future maintenance and repair costs, offering better long-term economic viability. In 2025, projections indicate a 15% growth in the market for green building materials within the infrastructure sector.

Project Management and Consulting Services

Granite Construction’s Project Management and Consulting Services extend beyond the physical build, offering clients crucial pre-construction planning and engineering expertise. This advisory arm is designed to streamline project lifecycles, ensuring clients benefit from Granite's deep industry knowledge. In 2024, the company continued to emphasize these value-added services, which are integral to their strategy of delivering complex projects successfully.

These consulting and project management offerings are key to mitigating risks and optimizing resource deployment. By leveraging their extensive experience, Granite helps clients navigate challenges, thereby improving the likelihood of achieving project goals on time and within budget. This focus on strategic planning and execution is a significant differentiator in the construction sector.

The value proposition of these services is evident in their ability to enhance client outcomes. Granite’s consulting arm acts as an extension of the client’s team, providing insights that lead to more efficient and cost-effective project delivery. This integrated approach solidifies Granite's position as a comprehensive solutions provider.

- Risk Mitigation: Granite's consulting services proactively identify and address potential project risks, a critical factor in successful construction outcomes.

- Resource Optimization: Expert project management ensures efficient allocation of labor, materials, and equipment, driving cost savings and schedule adherence.

- Enhanced Project Outcomes: Leveraging decades of industry experience, Granite's advisory services contribute to meeting and exceeding client objectives.

- Strategic Planning: Pre-construction consulting and engineering support lay the groundwork for projects, improving feasibility and execution.

Granite Construction's product strategy centers on delivering integrated infrastructure solutions, encompassing heavy civil construction, materials supply, and project management. This diverse offering addresses the full spectrum of client needs in large-scale public and private projects. The company's commitment to sustainable and resilient infrastructure development is a growing focus, aligning with market demands and regulatory trends.

| Product Category | Key Offerings | 2023 Revenue Contribution | Strategic Focus |

| Integrated Infrastructure Solutions | End-to-end management of transportation, water, and power projects. | Significant portion of over $3.5 billion total revenue. | Comprehensive project delivery, client-centric solutions. |

| Heavy Civil Construction | Highways, bridges, airports, dams, complex civil works. | Substantial revenue from this segment. | Technical expertise, safety, quality assurance. |

| Materials | Aggregates, asphalt, ready-mix concrete. | $1.7 billion in revenue. | Robust supply chain, serving internal and external markets. |

| Project Management & Consulting | Pre-construction planning, engineering, risk mitigation. | Value-added services integral to project success. | Optimizing resources, enhancing project outcomes. |

| Sustainable Infrastructure | Eco-friendly materials, resilient designs. | Increasing project incorporation of recycled content. | Meeting client demand, regulatory compliance, long-term value. |

What is included in the product

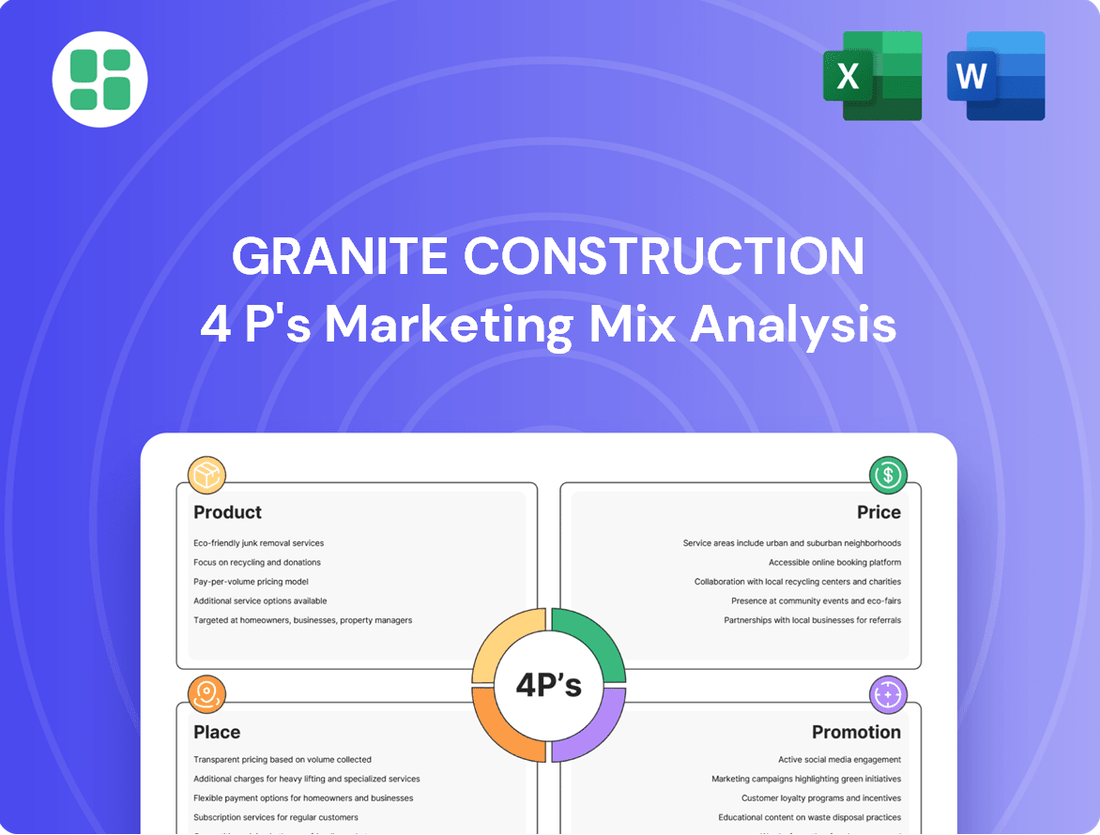

This analysis provides a comprehensive examination of Granite Construction's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion tactics to offer insights into their market positioning and competitive approach.

Provides a clear, actionable framework to address market challenges and optimize Granite Construction's strategic approach to Product, Price, Place, and Promotion.

Place

Granite Construction's direct project engagement strategy is central to its market approach, focusing on building relationships with key clients like government bodies and private developers. This direct interaction is crucial for securing large-scale infrastructure contracts, a significant portion of their business. For example, in 2023, Granite reported approximately $3.9 billion in revenue, with a substantial amount derived from these direct engagements, highlighting the effectiveness of their client-centric distribution model.

Granite Construction leverages a decentralized network of regional offices and local facilities throughout the United States, strategically placing them close to vital project locations and material sources. This approach, as seen in their robust presence in states like California and Texas, which consistently rank high in infrastructure spending, ensures proximity to key markets.

This distributed operational model facilitates streamlined project execution by enabling quicker access to local labor and resources. For instance, their ability to source materials locally can significantly reduce transportation costs and lead times, contributing to project efficiency and cost-effectiveness, a critical factor in securing and completing large-scale infrastructure contracts.

A strong local presence is indispensable for Granite Construction, fostering better client relationships through direct engagement and understanding of specific regional needs. It also enhances their ability to navigate diverse local regulatory landscapes and build community trust, which is vital for securing permits and maintaining social license to operate.

Granite Construction operates a robust network of material production facilities, including quarries for aggregates, asphalt plants, and ready-mix concrete plants. These are crucial for its supply chain, supporting both its internal construction needs and external sales. As of late 2024, Granite's extensive plant footprint allows for efficient distribution, a key component of its product strategy.

Supply Chain and Logistics Network

Granite Construction's extensive supply chain and logistics network is a cornerstone of its operational efficiency, facilitating the seamless movement of heavy equipment, construction materials, and skilled labor to a multitude of project sites. This robust infrastructure is vital for managing transportation, optimizing inventory levels, and strategically deploying equipment, all of which are critical to keeping complex infrastructure projects on track and within financial parameters.

The company's commitment to efficient logistics directly impacts project timelines and cost control. For instance, in 2023, Granite reported a significant portion of its revenue derived from large-scale heavy civil projects, underscoring the importance of timely material and equipment delivery. Their ability to navigate complex logistical challenges, such as those encountered in major transportation infrastructure developments, minimizes costly delays and maximizes the utilization of valuable resources.

- Transportation Management: Granite utilizes a diverse fleet and third-party logistics providers to ensure materials and equipment reach project sites efficiently, even in remote locations.

- Inventory Optimization: Strategic warehousing and just-in-time delivery practices minimize on-site storage needs and reduce material waste.

- Equipment Deployment: Advanced fleet management systems track and deploy specialized heavy machinery across projects, ensuring availability where and when needed.

- Project Site Integration: Logistics planning is integrated early in project phases to anticipate needs and pre-position resources, a key factor in their successful project execution.

Digital Platforms for Project Management

Granite Construction, while rooted in physical infrastructure, is increasingly leveraging sophisticated digital platforms to manage its projects. These tools are crucial for everything from bidding processes to ongoing communication with clients and suppliers, reflecting a significant shift towards digital integration in a traditionally physical industry.

The adoption of these platforms directly impacts operational efficiency by boosting transparency, streamlining complex workflows, and improving the seamless exchange of vital project data. This digital backbone is essential for Granite's ability to execute projects effectively and maintain strong relationships with its stakeholders.

By facilitating remote collaboration and enhancing data management, these digital solutions are key to Granite's strategy for efficient project delivery. For instance, in 2024, Granite reported increased investment in digital transformation initiatives aimed at improving project oversight and client engagement, with a stated goal of enhancing productivity by 15% through better data utilization.

- Enhanced Project Oversight: Digital platforms provide real-time visibility into project progress, resource allocation, and potential risks, allowing for more proactive management.

- Streamlined Communication: Centralized digital hubs improve communication channels between internal teams, clients, and external partners, reducing delays and misunderstandings.

- Data-Driven Decision Making: The ability to collect, analyze, and share project data digitally supports more informed and timely decision-making.

- Improved Efficiency: Automation of routine tasks and better data flow contribute to faster project cycles and reduced operational costs, with Granite aiming to see a 10% reduction in administrative overhead by 2025 through these digital tools.

Granite Construction's place strategy is defined by its extensive, geographically dispersed network of regional offices and operational facilities. This physical presence ensures proximity to key markets and project sites across the United States, facilitating efficient logistics and direct client engagement. Their strategic placement of material production facilities, such as quarries and asphalt plants, further strengthens their supply chain and supports both internal needs and external sales.

This localized approach allows Granite to better understand and respond to specific regional demands and regulatory environments, fostering stronger client relationships and community trust. For instance, their significant operations in infrastructure-heavy states like California and Texas exemplify this strategy, allowing them to capitalize on substantial public and private sector investments. By maintaining a robust physical footprint, Granite ensures timely access to labor, materials, and equipment, which is critical for the successful execution of large-scale construction projects.

Granite Construction's strategic placement of its assets is a key differentiator, enabling efficient project execution and cost control. The company's network of over 50 aggregate and asphalt facilities, for example, provides a significant advantage in securing and delivering materials. This distributed model, combined with their integrated logistics, allows for optimized resource deployment and reduced transportation costs, directly impacting profitability and competitiveness in the heavy civil construction sector.

| Geographic Focus | Key Strengths | Impact on Operations |

|---|---|---|

| United States | Extensive regional offices and facilities | Proximity to project sites, efficient logistics |

| Key Markets (e.g., California, Texas) | Strong local presence and understanding | Enhanced client relationships, navigating regulations |

| Material Production Sites | Quarries, asphalt, and concrete plants | Supply chain efficiency, cost reduction |

Full Version Awaits

Granite Construction 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Granite Construction 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain immediate access to this ready-to-use analysis upon completing your order.

Promotion

Granite Construction prioritizes relationship-based marketing and networking, leveraging its robust reputation and established connections with government bodies, public entities, and private developers. This strategy is crucial for securing significant new projects, as evidenced by their continued success in bidding for large infrastructure contracts.

Active engagement in industry conferences, professional organizations, and local community initiatives allows Granite to cultivate and sustain vital relationships. For instance, their presence at major construction expos in 2024 and 2025 provides direct access to key decision-makers and potential clients, fostering trust and demonstrating their commitment to the sector.

This emphasis on trust, proven expertise, and a nuanced understanding of client requirements is fundamental to winning high-value contracts. Granite's ability to consistently secure multi-million dollar projects, such as the recent $200 million highway expansion contract announced in early 2025, underscores the effectiveness of this relationship-driven approach.

Granite Construction actively promotes its expertise and successful project completions through strategic public relations and industry recognition. This includes leveraging industry awards and press releases to bolster its brand image and credibility within the civil infrastructure sector.

Showcasing complex or innovative projects, such as their work on the I-80/50/395 Project in Nevada, demonstrates their capabilities to potential clients and stakeholders. This project, a significant infrastructure upgrade, highlights their ability to manage large-scale, technically challenging endeavors.

Positive media coverage and peer recognition, like being named a top contractor by Engineering News-Record, reinforce Granite's position as a leading and reliable infrastructure contractor. This external validation is crucial for building trust and attracting future business opportunities.

Granite Construction's digital presence, anchored by its corporate website, acts as a central repository for detailed project showcases, service offerings, and sustainability initiatives. This online hub effectively communicates their extensive capabilities to a broad audience.

Professional engagement on platforms like LinkedIn further amplifies their corporate messaging, aids in attracting top talent, and positions Granite as a thought leader in the industry. This strategic use of social media enhances their brand visibility and stakeholder interaction.

In 2023, Granite Construction reported a significant digital footprint, with their website attracting over 1.5 million unique visitors, underscoring its importance as a key communication channel. Their LinkedIn page saw a 20% increase in engagement throughout the year, reflecting a successful strategy in online corporate outreach.

Direct Sales and Business Development Teams

Granite Construction's direct sales and business development teams are instrumental in securing large, complex infrastructure projects. These dedicated professionals proactively identify new opportunities and cultivate client relationships, often engaging in lengthy sales cycles. Their focus is on understanding client needs deeply to craft bespoke solutions.

In 2023, Granite reported a backlog of $7.0 billion in November, highlighting the effectiveness of their business development efforts in securing future work. This direct engagement is vital for a B2B environment where trust and tailored proposals are paramount for winning high-value, long-term contracts.

- Proactive Opportunity Identification: Business development teams actively scout for new infrastructure projects, ensuring a steady pipeline of potential work.

- Customized Proposal Development: Tailoring proposals to specific client challenges and strategic objectives is a core function, increasing win rates.

- B2B Relationship Building: The direct sales approach fosters strong client relationships, essential for navigating the complexities of long-cycle, high-value contracts.

- Focus on Client Needs: Teams prioritize understanding client pain points to deliver solutions that align with their specific goals and operational requirements.

Thought Leadership and Case Studies

Granite Construction actively cultivates thought leadership through the publication of white papers and detailed case studies. These materials showcase their innovative approaches to civil infrastructure challenges, reinforcing their position as industry pioneers. For instance, by detailing their work on projects like the SR 99 Alaskan Way Viaduct Replacement Program in Seattle, Granite demonstrates tangible problem-solving capabilities and technical expertise.

These publications serve a dual purpose: educating the market on advanced construction techniques and building credibility with potential clients. By highlighting successful project outcomes and the unique engineering solutions employed, Granite effectively communicates its strategic insight. This content marketing strategy is crucial for differentiating their services and fostering trust in a competitive landscape.

- Thought Leadership: Publishing white papers and case studies establishes Granite as an innovator in civil infrastructure.

- Demonstrated Expertise: Highlighting successful projects and innovative solutions showcases their technical prowess.

- Market Education: Content marketing efforts inform clients about advanced engineering and problem-solving capabilities.

- Trust Building: Showcasing project successes reinforces Granite's reputation and attracts new business opportunities.

Granite Construction's promotion strategy centers on building strong relationships and showcasing expertise, crucial for securing large infrastructure contracts. Their active engagement in industry events and professional organizations, alongside a robust digital presence, reinforces their credibility and market position.

The company effectively leverages public relations, industry awards, and detailed project showcases to highlight its capabilities and build trust. This approach is further amplified by direct sales efforts and the cultivation of thought leadership through publications, all aimed at demonstrating value and securing long-term partnerships.

Granite's 2023 backlog of $7.0 billion in November and a 20% increase in LinkedIn engagement in the same year demonstrate the success of these promotional strategies in driving business growth and market recognition.

Price

Granite Construction's pricing strategy for major infrastructure projects is largely dictated by competitive bidding. This involves submitting detailed proposals, factoring in precise cost estimates, project scope, and target profit margins. The intensely competitive nature of this market necessitates strategic pricing to secure contracts while ensuring financial viability.

For instance, in 2023, Granite secured a significant portion of its revenue through these competitive processes. The company's ability to accurately estimate costs and manage risks directly impacts its success in winning bids, as demonstrated by its backlog of awarded projects, which stood at $7.4 billion at the end of 2023.

For highly specialized projects where Granite Construction brings unique engineering prowess or proprietary methods, value-based pricing becomes a key strategy. This means pricing isn't just about costs, but about the significant long-term benefits and risk reduction Granite delivers to the client. For instance, in a complex infrastructure project in 2024, Granite's advanced tunneling technology could reduce project timelines by 15%, directly translating to substantial cost savings for the client, justifying a premium price.

Granite Construction employs a cost-plus pricing strategy for its construction materials like aggregates and asphalt. This involves calculating production and transportation expenses, then adding a predetermined profit margin. For instance, in 2024, the average cost of aggregates can fluctuate significantly based on extraction and processing, with transportation adding another layer of variable expense.

Market conditions play a crucial role in this pricing model. Fluctuations in raw material costs, energy prices, and local supply-demand dynamics directly impact the final price of materials. As of early 2025, the price of asphalt has seen upward pressure due to increased crude oil prices, impacting the cost of bitumen.

This approach ensures that Granite Construction maintains profitability within its materials segment. By factoring in all direct and indirect costs, plus a margin, they can cover operational expenses and reinvest in their business. This strategy also allows them to remain competitive within regional markets by adjusting their markups based on local market rates and competitor pricing.

Long-Term Contracts and Escalation Clauses

Granite Construction's long-term contracts, particularly in infrastructure, often incorporate escalation clauses. These are designed to account for unpredictable shifts in material costs, labor wages, and evolving regulations throughout extended project lifecycles. For instance, in 2023, the company reported that its backlog of heavy civil projects, which are typically subject to such clauses, remained robust, indicating a continued reliance on these protective measures.

These clauses are fundamental to safeguarding Granite's profit margins on projects that can span several years. By allowing for price adjustments, they mitigate the risk of unforeseen cost increases eroding profitability. The ability to effectively manage and forecast these escalations is therefore a cornerstone of the company's financial health and project viability.

- Contractual Protection: Escalation clauses shield Granite from the financial impact of rising input costs on long-term projects.

- Profitability Safeguard: These provisions are crucial for maintaining healthy profit margins over extended project durations.

- Financial Stability: Proactive management of these clauses is essential for the company's financial stability and predictable earnings.

- Market Adaptation: The inclusion of escalation clauses reflects Granite's strategy to adapt to market volatility in the construction sector.

Economic Conditions and Market Demand

Granite Construction's pricing is heavily influenced by the broader economic climate. For instance, a strong economy typically translates to higher demand for construction services, allowing for more robust pricing. Conversely, economic downturns can necessitate more competitive pricing to secure work.

Government infrastructure spending is a critical lever for Granite. In 2024, the Bipartisan Infrastructure Law continued to inject significant capital into projects across the U.S., providing a tailwind for companies like Granite. However, the pace and allocation of these funds can create regional variations in demand and pricing power.

Regional market demand for construction services and materials directly impacts Granite's pricing strategies. Areas with high population growth and significant private development, such as certain Sun Belt states, may see stronger pricing for Granite's offerings. Competitive intensity also plays a role; in markets with many established players, pricing may be more constrained.

- Economic Outlook: As of mid-2025, while inflation showed signs of moderating, interest rates remained a key consideration for project financing and overall construction demand.

- Infrastructure Investment: Federal infrastructure spending commitments, totaling over $1.2 trillion through the Bipartisan Infrastructure Law, continued to support project pipelines in 2024 and into 2025, though project-specific funding and timelines varied.

- Regional Demand: Demand for heavy civil construction, Granite's core segment, saw varied strength across regions in 2024, with the West and Southeast generally outperforming other areas due to population growth and public works initiatives.

- Competitive Landscape: The construction sector remains competitive, with pricing influenced by the number of bidders on public and private projects, affecting Granite's ability to secure contracts at optimal margins.

Granite Construction's pricing strategy is a dynamic mix, heavily influenced by project type and market conditions. For large infrastructure bids, competitive pricing is paramount, with success hinging on accurate cost estimation and risk management, as seen in their $7.4 billion backlog at the end of 2023. Specialized projects leverage value-based pricing, reflecting unique capabilities like advanced tunneling technology that can reduce client timelines by 15% in 2024, justifying premium rates.

For construction materials, a cost-plus model prevails, adding a profit margin to production and transportation expenses. This ensures profitability, especially as input costs like asphalt fluctuate, influenced by crude oil prices as observed in early 2025. Long-term contracts often include escalation clauses to buffer against unpredictable cost shifts in materials, labor, and regulations, a critical safeguard for maintaining profit margins on multi-year projects, as evidenced by their robust heavy civil project backlog in 2023.

The broader economic climate and government spending significantly shape Granite's pricing power. Robust economic conditions and substantial federal infrastructure investment, such as the Bipartisan Infrastructure Law continuing to fund projects in 2024 and 2025, generally support stronger pricing. Regional demand, particularly in high-growth areas like the Sun Belt, also allows for more favorable pricing, though intense competition in certain markets can constrain margins.

| Metric | 2023 Data | 2024 Outlook/Data | Early 2025 Trend |

| Backlog of Awarded Projects | $7.4 Billion | Continued strong performance expected | Stable |

| Infrastructure Spending (Bipartisan Infrastructure Law) | Significant impact | Continued substantial capital injection | Ongoing support for project pipelines |

| Asphalt Pricing Trend | Variable | Subject to crude oil prices | Upward pressure due to increased crude oil prices |

| Regional Demand Strength (Heavy Civil) | Varied by region | West and Southeast generally outperforming | Continued regional disparities |

4P's Marketing Mix Analysis Data Sources

Our Granite Construction 4P's Marketing Mix Analysis is built upon comprehensive data, including official company reports, investor relations materials, and industry-specific publications. We also incorporate insights from project announcements and public bidding information to understand their product and place strategies.