Granite Construction Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Granite Construction Bundle

Unlock the strategic blueprint behind Granite Construction's success. This comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear view of how they build and maintain market leadership.

Dive into the actionable insights of Granite Construction's business model. This detailed canvas reveals their key resources, activities, and cost structure, providing a powerful framework for understanding their operational efficiency and competitive advantage.

Ready to learn from the best? Download the full Business Model Canvas for Granite Construction to gain a complete, professionally organized overview of their entire business strategy, perfect for analysis and inspiration.

Partnerships

Granite Construction relies heavily on a network of subcontractors and specialty contractors. These partners bring essential expertise in areas like electrical, plumbing, and specialized structural work, allowing Granite to tackle a broader range of complex projects. In 2024, approximately 60% of Granite's total project costs were allocated to subcontracted labor and materials, highlighting the critical nature of these relationships for project execution and capacity management.

Granite Construction relies on external material suppliers for essential raw components not produced in-house, such as specialized chemicals or additives for concrete and asphalt. In 2024, the company continued to foster relationships with key equipment and machinery providers to maintain its operational efficiency and technological edge in material production.

Collaborations with other material producers are also crucial for Granite, allowing them to supplement their internal production capacity for aggregates, asphalt, and concrete. These partnerships ensure a robust and consistent supply chain, which is vital for meeting project demands and maintaining quality standards across their operations.

Granite Construction relies heavily on partnerships with government agencies and public entities, as a substantial portion of its revenue stems from public infrastructure projects. For instance, in 2023, the Heavy Civil segment, which includes transportation infrastructure, represented a significant portion of Granite's net revenue, highlighting the importance of these relationships.

These collaborations are crucial for securing contracts with bodies such as the California Department of Transportation (Caltrans) and numerous other state and local Departments of Transportation (DOTs). Such partnerships are essential for navigating complex regulatory environments and aligning with public investment strategies, particularly those influenced by federal funding programs like the Infrastructure Investment and Jobs Act (IIJA).

Joint Venture Partners

Granite Construction frequently enters into joint ventures for large, intricate, or high-risk projects. These collaborations are crucial for accessing larger projects and managing associated risks.

These joint ventures facilitate the consolidation of resources and knowledge, allowing Granite to pursue and complete projects that would be unfeasible as a solo entity. For example, in 2023, Granite participated in several significant joint ventures, contributing to its backlog of large-scale infrastructure and heavy civil projects.

- Resource Pooling: Enables access to greater capital, equipment, and skilled labor.

- Risk Diversification: Spreads financial and operational risks across multiple partners.

- Expertise Sharing: Leverages specialized knowledge and experience from each partner.

- Market Access: Opens doors to projects requiring specific certifications or consortiums.

Technology and Innovation Providers

Granite Construction actively partners with technology and innovation providers to integrate cutting-edge solutions into its operations. These collaborations are vital for adopting advanced construction methods, digital tools, and sustainable practices, as demonstrated by their focus on improving energy efficiency and eco-friendly materials. For instance, in 2024, the construction industry saw significant investment in AI-driven project management software, with some firms reporting up to a 15% reduction in project delays through better resource allocation and predictive analytics.

These strategic alliances enable Granite to explore and implement innovations such as autonomous equipment and next-generation materials. Such partnerships are crucial for staying competitive, as evidenced by the growing trend of construction companies investing in R&D for sustainable building materials, with a projected global market growth of 10% annually through 2030.

- Technology Providers: Collaborations with software developers for advanced project management and BIM (Building Information Modeling) tools.

- Research Institutions: Partnerships with universities and research centers to explore and develop new, sustainable construction materials and techniques.

- Equipment Manufacturers: Joint ventures to pilot and integrate autonomous or semi-autonomous construction machinery, enhancing safety and efficiency.

Granite Construction's key partnerships extend to financial institutions and surety bond providers, which are essential for securing large-scale projects and managing financial risks. These relationships are critical for maintaining liquidity and ensuring the company can undertake complex, capital-intensive infrastructure developments. In 2024, access to robust credit lines and surety capacity remained a cornerstone of Granite's ability to bid on and execute major contracts, particularly in the public sector.

The company also collaborates with industry associations and regulatory bodies to stay abreast of evolving standards, safety protocols, and market trends. These engagements are vital for shaping industry best practices and ensuring compliance. For example, participation in industry forums in 2024 allowed Granite to contribute to discussions on sustainable construction practices and workforce development initiatives.

| Partner Type | Role in Business Model | Impact/Benefit |

| Subcontractors & Specialty Contractors | Execute specific project components, provide specialized expertise | Broadens project capabilities, manages workforce fluctuations; ~60% of 2024 project costs |

| Material Suppliers | Provide raw materials (aggregates, asphalt, concrete, additives) | Ensures consistent supply chain, maintains quality; crucial for operational efficiency |

| Government Agencies & Public Entities | Clients for public infrastructure projects | Drives significant revenue, particularly in Heavy Civil segment (major contributor in 2023) |

| Joint Venture Partners | Share resources, risks, and expertise on large projects | Enables pursuit of larger, complex projects; access to greater capital and knowledge |

| Technology & Innovation Providers | Integrate advanced solutions, digital tools, sustainable practices | Enhances operational efficiency, safety, and competitiveness; adoption of AI and new materials |

What is included in the product

This Business Model Canvas outlines Granite Construction's strategy for delivering infrastructure and heavy civil construction services, focusing on its diverse customer base, project delivery methods, and key partnerships.

It details Granite's value proposition of reliable, high-quality construction solutions, supported by its operational capabilities and market positioning.

Granite Construction's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling rapid identification of inefficiencies and strategic alignment across diverse projects.

Activities

Granite Construction's core activity is the meticulous planning, management, and execution of large-scale civil infrastructure projects. This encompasses a wide range of critical public works, including transportation networks like highways, bridges, and airports, as well as vital water resources such as dams and pipelines, and essential power infrastructure.

Successfully delivering these complex projects demands the seamless coordination of a vast array of resources. Granite expertly manages labor forces, heavy equipment fleets, and material supply chains to ensure adherence to precise project specifications, strict timelines, and allocated budgets. For instance, in 2024, Granite reported a significant backlog of transportation and water projects, indicating the robust demand for their execution capabilities.

Granite Construction's core operations heavily rely on the efficient production and supply of key construction materials. This includes aggregates, asphalt, and ready-mix concrete, forming a vital part of their vertically integrated model.

By controlling these material streams, Granite ensures consistent quality and cost management for its own extensive projects. This integration also unlocks external revenue opportunities, as they supply these essential materials to other contractors and developers.

In 2024, Granite's Construction Materials segment reported significant contributions, with revenues reflecting the demand for these foundational products. For instance, their asphalt production capacity is a key asset, supporting numerous paving projects across their operating regions.

Granite Construction's core activity revolves around actively pursuing and winning new construction contracts. This requires a sophisticated process of identifying opportunities, meticulously estimating project costs, and crafting compelling bids. For instance, in 2023, Granite secured a significant portion of its revenue from new contract awards, demonstrating the critical nature of this function.

The company's success in bidding hinges on its ability to accurately assess project requirements, potential risks, and competitive pricing strategies. They often compete on a 'best value' basis, meaning the lowest bid isn't always the winner, but rather the proposal offering the most advantageous combination of cost, quality, and schedule. This was evident in several major infrastructure projects awarded in 2024 where collaborative approaches were favored.

Safety and Quality Management

Granite Construction prioritizes safety and quality as core operational pillars, integrating them into every project phase. This commitment is demonstrated through comprehensive safety programs designed to safeguard employees and the public, alongside stringent quality control measures ensuring adherence to engineering specifications and industry best practices.

In 2023, Granite reported a Total Recordable Incident Rate (TRIR) of 0.78, significantly below the industry average, highlighting their dedication to workplace safety. Their quality management systems are geared towards delivering durable, compliant, and high-performing structures, which is crucial for client satisfaction and long-term project success.

- Safety Programs: Implementation of robust safety protocols, including regular training, site inspections, and hazard identification, to minimize risks and prevent accidents.

- Quality Assurance: Rigorous testing and inspection of materials and workmanship at various stages of construction to guarantee compliance with project specifications and regulatory standards.

- Continuous Improvement: Ongoing review and enhancement of safety and quality procedures based on performance data, incident analysis, and industry advancements.

- Client Trust: Building and maintaining client confidence through a proven track record of delivering safe, high-quality construction projects.

Strategic Mergers and Acquisitions (M&A)

Granite Construction actively engages in strategic mergers and acquisitions (M&A) to bolster its market presence and operational strength. The company prioritizes acquisitions of materials-led, vertically integrated businesses, alongside smaller bolt-on acquisitions that complement existing operations.

These M&A activities are instrumental in expanding Granite's geographic reach and solidifying its position in core markets. For instance, in 2023, Granite completed several acquisitions, contributing to its reported revenue growth and enhanced capabilities in specialized construction sectors.

- Geographic Expansion: Acquiring companies in new regions broadens Granite's service area and client base.

- Vertical Integration: Targeting materials suppliers improves supply chain control and cost efficiency.

- Bolt-on Acquisitions: Smaller, strategic purchases enhance specific service offerings or market penetration.

- Market Position Enhancement: M&A directly contributes to a stronger competitive standing and increased market share.

Granite Construction's key activities focus on securing new contracts through competitive bidding, emphasizing value over just low cost, and executing these projects with a strong commitment to safety and quality. They also manage their own material production for consistency and cost control, and strategically pursue mergers and acquisitions to expand their reach and capabilities.

In 2023, Granite secured a significant portion of its revenue from new contract awards, demonstrating the critical nature of this function. Their 2023 Total Recordable Incident Rate (TRIR) of 0.78 highlights their dedication to safety.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Contract Acquisition | Pursuing and winning new construction contracts via meticulous bidding processes. | Significant portion of 2023 revenue from new awards. |

| Project Execution | Managing labor, equipment, and materials for large-scale civil infrastructure projects. | Robust backlog of transportation and water projects in 2024. |

| Materials Production | Producing aggregates, asphalt, and concrete for internal use and external sales. | Construction Materials segment reported significant contributions in 2024. |

| Mergers & Acquisitions | Strategic acquisitions to expand geographic reach and operational strength. | Completed several acquisitions in 2023, contributing to revenue growth. |

Preview Before You Purchase

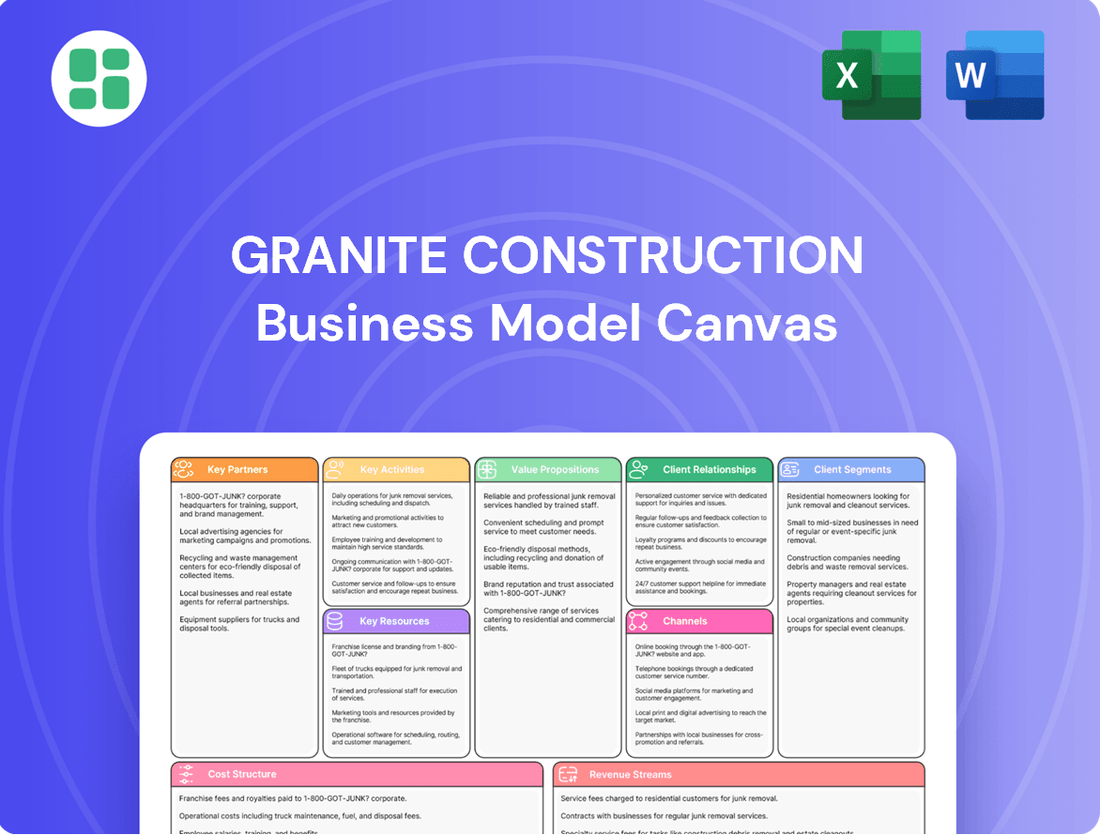

Business Model Canvas

The Granite Construction Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited version of the strategic framework that outlines Granite Construction's core business operations and value proposition. Once your order is confirmed, you will gain full access to this exact file, ready for immediate use and analysis.

Resources

Granite's most valuable asset is its deeply experienced workforce, encompassing seasoned engineers, project managers, skilled equipment operators, and dedicated craftspeople. This human capital is the engine driving their success in complex civil infrastructure projects.

The collective expertise of Granite's employees in areas like heavy civil construction, specialized materials production, and advanced construction techniques is absolutely crucial. It's this know-how that ensures projects are delivered efficiently and to the highest standards, a key differentiator in the market.

For instance, in 2024, Granite highlighted its commitment to workforce development, investing in training programs designed to enhance specialized skills in areas such as advanced tunneling and bridge construction. This focus on expertise directly translates to their ability to tackle challenging, high-value projects.

Granite Construction's heavy equipment and fleet are a cornerstone of its operational strategy. The company boasts a vast collection of machinery, encompassing everything from excavators and dozers to pavers and specialized trucks, all crucial for tackling a wide array of construction projects.

This owned fleet significantly enhances Granite's ability to execute projects efficiently and cost-effectively. By minimizing reliance on rentals, the company gains better control over operational expenses and maintains a consistent pace of work, a key advantage in the competitive construction landscape.

As of the end of 2023, Granite Construction reported property and equipment, net of accumulated depreciation, at approximately $1.8 billion, underscoring the substantial investment in its fleet. This robust asset base allows for rapid deployment and adaptability to project demands.

Granite Construction operates a robust network of material production facilities, including numerous asphalt plants, aggregate quarries, and ready-mix concrete facilities. These are complemented by significant material reserves, giving them a strong foundation for operations.

This vertical integration is a cornerstone of their business model, enabling Granite to produce and supply essential construction materials efficiently. In 2023, their materials segment contributed $1.8 billion to their total revenue, highlighting the importance of these assets.

Having these in-house capabilities provides a distinct cost advantage and ensures a reliable supply of materials for their diverse construction projects, a critical factor in maintaining project timelines and profitability.

Financial Capital and Strong Balance Sheet

Granite Construction’s access to significant financial capital is a cornerstone of its operations. This includes robust cash reserves, readily available credit lines, and the established capacity to raise funds through issuing equity or debt. This financial muscle is critical for undertaking massive infrastructure projects.

This financial strength directly empowers Granite to:

- Fund Large-Scale Projects: Enabling the company to bid on and execute major construction initiatives that require substantial upfront investment.

- Invest in Capital Expenditures: Allowing for the acquisition of cutting-edge equipment and advanced technologies to enhance efficiency and project quality.

- Pursue Strategic Acquisitions: Providing the means to grow through mergers and acquisitions, thereby expanding market reach and capabilities.

- Manage Operational Cash Flow: Ensuring smooth day-to-day operations and the ability to navigate economic fluctuations.

As of the first quarter of 2024, Granite Construction reported total debt of approximately $800 million, demonstrating a manageable leverage ratio that supports its capital-intensive business model and its ability to access further financing when needed.

Established Relationships and Reputation

Granite Construction's established relationships and reputation are cornerstones of its business model. These long-standing connections with public agencies, private clients, and various industry stakeholders provide a consistent pipeline of opportunities and invaluable insights. This network is a significant competitive advantage, built over years of reliable performance.

The company's reputation for safely delivering complex projects on schedule and within budget is a critical asset. This unwavering commitment to quality and sustainability not only builds trust but also encourages repeat business, a vital component for sustained growth. For instance, Granite's track record often leads to being a preferred bidder on major infrastructure projects.

- Long-standing relationships with key public agencies and private developers provide a stable foundation for project acquisition.

- Reputation for excellence in safety, timely delivery, and budget adherence fosters client loyalty and attracts new business.

- Commitment to quality and sustainability enhances Granite's brand image and aligns with the increasing demands of clients and regulators.

Granite's key resources include its skilled workforce, extensive equipment fleet, and strategically located material production facilities. These are complemented by strong financial capital and a well-established network of relationships and reputation.

| Resource Category | Description | 2023/2024 Data Point |

|---|---|---|

| Human Capital | Experienced engineers, project managers, operators, and craftspeople | Investment in specialized training programs in 2024 |

| Physical Assets | Heavy construction equipment and a fleet of machinery | Property and equipment, net of depreciation, was approx. $1.8 billion at end of 2023 |

| Material Production | Asphalt plants, aggregate quarries, ready-mix concrete facilities, and material reserves | Materials segment revenue was $1.8 billion in 2023 |

| Financial Capital | Cash reserves, credit lines, and ability to raise funds | Total debt was approx. $800 million in Q1 2024 |

| Reputation & Relationships | Long-standing connections with clients and industry stakeholders | Preferred bidder status on major infrastructure projects due to track record |

Value Propositions

Granite Construction excels in managing highly complex infrastructure projects, spanning transportation, water, and energy sectors. Their deep expertise ensures successful delivery of large-scale public works, a capability highlighted by their involvement in significant projects like the $1.3 billion SR 99 Tunnel project in Seattle, which was completed ahead of schedule and under budget.

Granite Construction's integrated model offers a distinct advantage by combining construction services with its own material supply, including aggregates and asphalt. This vertical integration means clients benefit from cost savings and a guaranteed level of material quality.

This self-sufficiency directly translates to reduced supply chain disruptions, a critical factor in project timelines. For instance, in 2023, Granite reported significant revenue from its Construction Materials segment, highlighting the scale and importance of this integrated offering to its overall business.

Granite Construction prioritizes dependable project completion, consistently aiming to finish on time and within budget. This reliability is underpinned by sophisticated project management techniques and a deeply ingrained safety-first approach throughout all operations.

The company's unwavering dedication to safety is demonstrably proven by its record-best OSHA incident rate, a key factor that instills client confidence. This commitment assures customers they are partnering with a construction firm that operates both efficiently and with the utmost responsibility.

Sustainable and Environmentally Responsible Practices

Granite Construction champions sustainable and environmentally responsible practices, weaving them into the fabric of its operations. This commitment resonates strongly with clients who prioritize green initiatives, positioning Granite as a forward-thinking partner in infrastructure development.

The company actively incorporates recycled content into its asphalt production, diverting waste from landfills and conserving natural resources. Furthermore, Granite is dedicated to enhancing energy efficiency across its materials facilities, demonstrating a tangible effort to reduce its environmental footprint.

- Recycled Content Utilization: Granite actively uses recycled materials in its asphalt mixes, contributing to a circular economy. For instance, in 2023, the company reported significant volumes of recycled asphalt pavement (RAP) incorporated into its products.

- Energy Efficiency Initiatives: Investments in upgrading equipment and optimizing processes at materials facilities aim to lower energy consumption. These efforts directly translate to reduced greenhouse gas emissions.

- Client Appeal: This focus on sustainability aligns with the growing demand from public and private sector clients for environmentally conscious construction solutions, often a key differentiator in bid processes.

Local Market Knowledge and Relationships

Granite Construction’s home market strategy, supported by its network of regional offices, is a cornerstone of its value proposition. This localized approach allows the company to cultivate and leverage deep market intelligence, understanding the nuances of specific geographic areas. For instance, in 2024, Granite continued to emphasize its regional strengths, which are crucial for securing and executing projects effectively within those territories.

These established relationships with local owners and regulators are invaluable. They foster trust and streamline project approvals, contributing to smoother execution and reduced risk. This network is not just about access; it’s about building collaborative partnerships that benefit all stakeholders. In the competitive landscape of 2024, these strong local ties provided a distinct advantage.

- Deep Local Intelligence: Granite's regional presence allows for a granular understanding of local economic conditions, labor markets, and material availability, which is critical for accurate bidding and efficient project management.

- Established Relationships: Long-standing connections with local clients, subcontractors, and government agencies facilitate smoother project lifecycles, from initial planning through to final delivery.

- Tailored Project Solutions: By understanding regional specificities, Granite can offer more responsive and customized approaches to project needs, increasing the likelihood of successful outcomes.

- Regulatory Navigation: Familiarity with local permitting processes and environmental regulations, honed through years of operation in specific markets, helps mitigate potential delays and compliance issues.

Granite Construction's value proposition centers on its ability to manage complex infrastructure projects with deep sector expertise, ensuring successful delivery. Their integrated model, combining construction with in-house material supply, offers clients cost efficiencies and quality assurance, as evidenced by their significant Construction Materials segment revenue in 2023.

Reliability in project completion, underscored by a strong safety record with industry-leading OSHA incident rates, builds client confidence. Furthermore, their commitment to sustainability, including the use of recycled materials and energy efficiency initiatives, appeals to environmentally conscious clients, a growing demand in the market.

Granite's home market strategy, leveraging deep local intelligence and established relationships with owners and regulators, allows for tailored solutions and smoother project execution. This localized approach, emphasized in 2024, provides a distinct competitive advantage in securing and delivering projects effectively.

| Value Proposition Element | Description | Supporting Data/Facts |

|---|---|---|

| Complex Project Management | Expertise in large-scale transportation, water, and energy infrastructure. | Involvement in the $1.3 billion SR 99 Tunnel project (Seattle), completed ahead of schedule and under budget. |

| Integrated Model | In-house material supply (aggregates, asphalt) for cost and quality control. | Significant revenue contribution from Construction Materials segment in 2023, highlighting scale. |

| Reliability & Safety | Dependable project completion with a strong safety-first culture. | Record-best OSHA incident rate, demonstrating operational responsibility and efficiency. |

| Sustainability Focus | Environmentally responsible practices, including recycled content and energy efficiency. | Active use of recycled asphalt pavement (RAP) in 2023; investments in energy efficiency at materials facilities. |

| Home Market Strategy | Leveraging local intelligence and relationships for tailored solutions. | Continued emphasis on regional strengths in 2024 to secure and execute projects effectively. |

Customer Relationships

Granite Construction primarily engages in transactional, project-based customer relationships, formalized through specific contracts for civil infrastructure work. These agreements outline clear expectations, performance benchmarks, and project timelines, ensuring mutual understanding and accountability.

Granite Construction cultivates enduring strategic partnerships with major public sector entities and significant private sector clients. These relationships are characterized by consistent repeat business and collaborative contract structures, fostering a profound understanding of client requirements.

This deep client engagement translates into preferred contractor status for Granite, ensuring predictable and stable revenue streams. For instance, in 2023, Granite reported that approximately 70% of its revenue came from repeat clients, underscoring the success of its relationship-focused strategy.

Granite Construction's customer relationships often start and are sustained through a competitive bidding process, particularly for public sector projects. This means Granite must consistently prove its ability to deliver projects cost-effectively, showcase its technical expertise, and highlight its overall value to win new business against other firms.

In 2024, Granite secured significant contract wins through this competitive engagement. For instance, their backlog of construction and materials bookings as of the first quarter of 2024 was approximately $6.7 billion, reflecting successful bids on numerous projects. This demonstrates their ongoing ability to win and maintain relationships by offering competitive pricing and demonstrating strong execution capabilities.

Dedicated Account Management and Project Teams

Granite Construction prioritizes strong client connections through dedicated account management and specialized project teams, especially for their larger endeavors. This ensures seamless communication and proactive problem-solving from start to finish.

This focused approach is crucial for navigating intricate stakeholder landscapes and fostering high levels of client satisfaction. For instance, in 2023, Granite reported a significant portion of its revenue coming from repeat clients, underscoring the success of these relationship-building strategies.

- Dedicated Project Teams: Assigned to major projects for focused attention and expertise.

- Account Managers: Serve as primary points of contact, ensuring responsiveness and client alignment.

- Client Satisfaction: The personalized service aims to enhance overall project experience and build long-term partnerships.

- 2023 Performance: Repeat business contributed substantially to Granite's revenue, validating their customer relationship model.

Post-Completion Support and Maintenance

For infrastructure projects with extended lifespans, Granite Construction might provide post-completion support and maintenance. This commitment fosters long-term client relationships and guarantees the sustained performance of critical assets.

Granite's potential for ongoing service agreements, particularly in sectors like transportation and utilities, reinforces client loyalty. For instance, in 2024, the US Department of Transportation allocated significant funds towards infrastructure upgrades, highlighting the demand for durable construction and potential for follow-on maintenance contracts.

- Long-term Asset Performance: Ensuring the continued functionality and structural integrity of built infrastructure.

- Client Retention: Building enduring partnerships through reliable post-construction services.

- Revenue Diversification: Creating recurring revenue streams beyond the initial project completion.

- Market Differentiation: Offering comprehensive solutions that set Granite apart from competitors.

Granite Construction's customer relationships are a blend of transactional engagements for specific projects and deeply cultivated strategic partnerships with key clients. This dual approach ensures both immediate project success and long-term business stability.

The company's success hinges on its ability to win competitive bids, particularly in the public sector, by consistently demonstrating value and expertise. This is evident in their substantial backlog of bookings, such as the approximately $6.7 billion in construction and materials bookings reported in the first quarter of 2024.

Dedicated project teams and account managers are central to Granite's strategy, fostering strong communication and client satisfaction. This focus on personalized service is a key driver of their high repeat business rate, which accounted for a significant portion of their 2023 revenue.

Furthermore, Granite aims to build lasting relationships through potential post-completion support and maintenance services, especially for critical infrastructure projects. This strategy not only ensures client loyalty but also opens avenues for recurring revenue streams in a market with substantial infrastructure investment, as highlighted by the US Department of Transportation's funding allocations in 2024.

| Relationship Type | Key Characteristics | Example Data/Impact |

|---|---|---|

| Transactional | Project-specific contracts, clear deliverables | Winning bids for individual infrastructure projects |

| Strategic Partnerships | Repeat business, collaborative structures, deep understanding | Approximately 70% of 2023 revenue from repeat clients |

| Engagement Mechanism | Competitive bidding, technical expertise, value demonstration | $6.7 billion backlog of bookings (Q1 2024) |

| Relationship Support | Dedicated teams, account managers, post-completion services | Enhanced client satisfaction, long-term asset performance |

Channels

Granite Construction primarily secures projects by directly bidding on and submitting proposals to government bodies like state Departments of Transportation and municipal water authorities, as well as major private sector clients. This core channel necessitates a dedicated internal team focused on opportunity identification, bid preparation, and contract negotiation.

Granite Construction actively engages with government procurement portals and public tenders, a mandatory process for securing public sector infrastructure projects. These digital platforms serve as vital channels for identifying new business opportunities and submitting competitive, compliant bids.

In 2024, the U.S. federal government alone awarded over $700 billion in contracts, with a significant portion dedicated to infrastructure development, a key area for Granite. The company's participation in these public tender processes is fundamental to its strategy for growth in the public works sector.

Granite Construction actively participates in industry conferences and associations like the Associated General Contractors (AGC) and the National Asphalt Pavement Association (NAPA). These engagements are crucial for networking, allowing Granite to connect with potential clients and partners. In 2024, the AGC of America alone boasts over 27,000 member firms, highlighting the vast network opportunities available.

These events serve as a vital channel for showcasing Granite's capabilities and staying abreast of emerging market trends and potential projects. By attending, Granite gains insights into the latest innovations and regulatory changes impacting the construction sector, which is essential for strategic planning and maintaining a competitive edge.

Online Presence and Corporate Website

Granite Construction's corporate website is a vital touchpoint, offering a comprehensive overview of their operations and financial health. It serves as a primary channel for investor relations, detailing financial reports and strategic updates. This digital platform effectively showcases their extensive portfolio of completed projects, highlighting their diverse capabilities across various sectors.

The website also functions as a crucial resource for potential employees and partners, detailing career opportunities and the company's commitment to sustainability. In 2024, Granite continued to leverage its online presence to communicate its ESG (Environmental, Social, and Governance) initiatives, a key focus for many stakeholders.

- Investor Relations Hub: Provides access to financial statements, annual reports, and SEC filings.

- Project Showcase: Features detailed case studies and imagery of completed infrastructure and building projects.

- Corporate Information: Includes sections on leadership, sustainability efforts, and company news.

- Careers Portal: Lists job openings and information about working at Granite Construction.

Professional Networks and Referrals

Granite Construction leverages professional networks and referrals as a key, though often indirect, channel for business development. This involves actively nurturing relationships with industry peers, suppliers, and past clients. In 2024, a significant portion of new project opportunities for large construction firms often originate from these trusted sources, bypassing more traditional, competitive bidding processes.

Existing client relationships are paramount; a satisfied client is the most powerful advocate. Granite's success in past projects directly fuels future work through positive referrals. For instance, a strong track record in infrastructure development can lead to repeat business or introductions to other government agencies or private developers with similar needs. This organic growth is crucial for maintaining a robust project pipeline.

- Industry Reputation: A solid reputation built on quality and reliability often results in direct invitations to bid on projects, giving Granite a competitive edge.

- Client Advocacy: Positive experiences from previous clients translate into powerful word-of-mouth marketing and direct referrals.

- Partnership Opportunities: Strong professional networks can open doors to joint ventures or sub-contracting roles on larger, more complex projects.

- Cost-Effectiveness: Referral-based business development is generally more cost-effective than broad-stroke marketing campaigns.

Granite Construction utilizes direct bidding on government and private sector projects as a primary channel, requiring dedicated internal teams for proposal management. They also actively engage with public procurement portals and tenders, essential for securing public infrastructure work.

Industry conferences and associations are key networking channels, fostering connections with potential clients and partners, while their corporate website serves as a vital hub for investor relations and showcasing project capabilities.

Professional networks and referrals are significant indirect channels, with existing client relationships driving repeat business and new opportunities. This organic growth, fueled by a strong reputation, is crucial for pipeline development.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Bidding | Submitting proposals to government and private clients. | Crucial for securing infrastructure projects awarded by state DOTs and municipalities. |

| Public Procurement Portals | Digital platforms for government tenders. | Essential for accessing and bidding on over $700 billion in U.S. federal contracts in 2024. |

| Industry Conferences/Associations | Networking and showcasing capabilities. | Engaging with over 27,000 member firms in organizations like AGC of America. |

| Corporate Website | Investor relations, project showcase, ESG initiatives. | Communicating ESG efforts, a key focus for stakeholders in 2024. |

| Professional Networks/Referrals | Nurturing relationships for new business. | A significant source of new project opportunities for construction firms. |

Customer Segments

Federal, state, and local government agencies represent Granite Construction's most significant and consistent customer base. These entities, including departments of transportation and public works, are primarily responsible for the development and maintenance of public infrastructure, making them a cornerstone of Granite's business.

These government clients typically engage Granite for large-scale, long-term projects, often funded through public budgets and infrastructure initiatives. For instance, in 2023, Granite secured a $230 million contract for the I-80 corridor project in California, a prime example of the substantial public works they undertake.

Private developers represent a crucial customer segment for Granite Construction, particularly those engaged in substantial commercial, residential, and industrial developments. These clients often require extensive civil infrastructure services, including intricate site preparation, the construction of new roadways, and the installation of essential utilities. For instance, a major urban revitalization project might involve millions of dollars in earthwork and utility upgrades, directly benefiting Granite’s civil construction capabilities.

Industrial clients, especially those in sectors like energy and mining, also form a significant part of this segment. They frequently need specialized infrastructure solutions tailored to their unique operational demands. In 2024, the infrastructure spending in the United States, particularly for industrial facilities and energy projects, saw continued growth, with projections indicating sustained investment in these areas, creating a robust market for companies like Granite.

Utility companies, encompassing water, wastewater, and power sectors, are a key customer segment for Granite Construction. These entities require highly specialized infrastructure, including extensive pipeline networks for water and wastewater, as well as robust pump stations and power transmission facilities. Granite's proven capabilities in water resources and power infrastructure development align perfectly with these critical needs.

In 2024, the demand for upgrading aging utility infrastructure remained a significant driver for this segment. For instance, the U.S. Environmental Protection Agency (EPA) has estimated that trillions of dollars will be needed over the coming decades to maintain and improve water infrastructure. Granite's ability to deliver complex projects in these essential areas positions them to capture a substantial portion of this ongoing investment.

Other Construction Contractors

Granite's Materials segment is a key supplier to other construction contractors, providing essential raw materials like aggregates, asphalt, and ready-mix concrete. This B2B relationship leverages Granite's robust production capacity and commitment to high-quality products, ensuring reliability for their customers' diverse projects.

In 2024, the demand for construction materials remained strong, driven by infrastructure spending and private sector development. Granite's Materials segment is well-positioned to capitalize on this, offering a consistent supply chain that is crucial for contractors managing tight project timelines and budgets.

- Key Offerings: Aggregates, asphalt, and ready-mix concrete are the core products supplied to external contractors.

- Value Proposition: Extensive production capabilities and assurance of material quality are paramount.

- Market Role: Facilitates project execution for other construction firms by providing essential building blocks.

- 2024 Performance Indicator: Growth in materials sales to third-party contractors reflects strong market demand and Granite's competitive supply.

Airport and Port Authorities

Airport and port authorities represent a vital customer segment for Granite Construction, particularly for large-scale, specialized transportation infrastructure. These public entities require significant expertise in projects such as runway rehabilitation, taxiway construction, and the expansion or modernization of port facilities. For instance, in 2024, the U.S. Department of Transportation allocated billions towards airport infrastructure improvements, a significant portion of which flows to contractors undertaking complex airfield and port development.

Granite's capabilities in heavy civil construction, including earthwork, paving, and concrete structures, directly align with the needs of these authorities. They often manage multi-year, multi-million dollar contracts. For example, in 2023, Granite secured a substantial contract for improvements at a major West Coast port, highlighting their capacity to handle such demanding projects.

- Airport Authorities: Focus on airfield pavement, runway extensions, and terminal access roads.

- Port Authorities: Require expertise in dredging, quay wall construction, and intermodal connection infrastructure.

- Public Funding: Projects are often driven by government grants and infrastructure spending initiatives, making them sensitive to public budget cycles.

- Long Project Lifecycles: These engagements typically involve extensive planning, environmental reviews, and multi-phase construction.

Granite Construction serves a diverse range of clients, with government agencies at federal, state, and local levels forming its largest and most stable customer base. These entities are crucial for public infrastructure development and maintenance, often awarding Granite large, long-term contracts funded by public budgets. For example, in 2023, Granite was awarded a $230 million contract for the I-80 corridor project in California, underscoring the scale of their public works engagements.

Private developers, particularly those involved in significant commercial, residential, and industrial projects, also represent a key segment. They frequently require extensive civil engineering services, such as site preparation and utility installation. Industrial clients, especially in energy and mining, need specialized infrastructure solutions. The continued growth in U.S. infrastructure spending in 2024, particularly for industrial and energy projects, creates a robust market for Granite.

Utility companies are another vital customer group, needing specialized infrastructure like water and wastewater pipelines, and power transmission facilities. The ongoing need to upgrade aging utility infrastructure, with the EPA estimating trillions needed for water systems, positions Granite to capture significant investment. Lastly, Granite's Materials segment supplies essential raw materials like aggregates and asphalt to other construction contractors, benefiting from strong market demand in 2024 driven by infrastructure and private development.

Cost Structure

Labor and personnel expenses represent a substantial component of Granite Construction's cost structure. This includes wages, salaries, benefits, and ongoing training for a diverse workforce, from skilled craftspeople to project managers and administrative personnel.

In 2024, effective management of this significant labor pool is paramount for controlling overall project costs and maintaining profitability. Granite's focus on talent retention and efficient workforce deployment directly impacts its ability to manage these expenses effectively.

Granite Construction's operational backbone relies heavily on its extensive fleet of heavy machinery. The initial investment in acquiring or leasing this equipment represents a significant capital outlay. For instance, in 2024, the average cost of a new large excavator can range from $300,000 to over $500,000, while a new dump truck might cost between $150,000 and $300,000.

Beyond acquisition, maintaining this fleet is a constant expense. Regular servicing, replacement parts, and unforeseen repairs are critical to ensure operational uptime. In 2023, companies in the heavy construction sector often allocated 10-15% of their equipment's purchase price annually for maintenance and repairs.

Fuel is another major, and often volatile, cost component. The sheer volume of fuel consumed by large excavators, bulldozers, and trucks operating on job sites across the country significantly impacts profitability. Managing fuel efficiency and hedging against price fluctuations are therefore paramount for cost control.

Granite Construction incurs significant costs for external raw materials like cement and specialized chemicals, alongside payments to subcontractors for services such as electrical work or specialized equipment operation. In 2023, for instance, materials and supplies represented a substantial portion of their cost of revenue, highlighting the critical need for efficient procurement strategies and strong subcontractor relationships to manage these expenses effectively.

Operating Costs for Material Production Facilities

Operating costs for Granite Construction's material production facilities, such as asphalt plants, aggregate quarries, and concrete plants, are significant. These expenses encompass energy consumption, which can fluctuate with market prices, and the ongoing costs of permitting and environmental compliance, which are critical for regulatory adherence. Depreciation of heavy machinery is also a substantial factor, reflecting the capital-intensive nature of these operations.

Granite Construction actively pursues investments in energy efficiency to mitigate these operating expenses. For instance, in 2023, the company reported that its focus on operational improvements, including energy efficiency initiatives, contributed to a reduction in its cost of goods sold as a percentage of revenue.

- Energy Consumption: Costs related to powering heavy machinery and processing materials.

- Permitting and Environmental Compliance: Fees and expenses associated with regulatory approvals and environmental stewardship.

- Machinery Depreciation: The gradual reduction in the value of plant and quarry equipment over time.

- Maintenance and Repairs: Ongoing costs to keep production facilities operational and efficient.

General, Selling, and Administrative (SG&A) Expenses

General, Selling, and Administrative (SG&A) expenses for Granite Construction encompass a range of operational overheads. These include costs associated with executive and administrative staff salaries, general office expenses, marketing and advertising efforts, legal and compliance fees, and investments in research and development to foster innovation.

Granite Construction actively pursues SG&A discipline as a key lever for enhancing overall profitability. By carefully managing these indirect costs, the company aims to improve its bottom line and deliver greater value to shareholders. For instance, in the first quarter of 2024, Granite reported SG&A expenses of $134.7 million, a slight increase from the previous year, reflecting strategic investments in growth initiatives while maintaining a focus on cost efficiency.

- Overhead Costs: Executive salaries, administrative staff, office rent, utilities, and supplies form a significant portion of SG&A.

- Marketing and Sales: Expenses related to advertising, business development, and customer outreach are included.

- Professional Services: Legal fees, accounting services, and consulting costs fall under this category.

- Research and Development: Investments in new technologies and process improvements contribute to SG&A.

Granite Construction's cost structure is heavily influenced by its capital-intensive operations. Beyond labor and machinery, significant expenditures are tied to materials like asphalt and aggregate, as well as fuel for its vast fleet. These variable costs require diligent management and strategic procurement to maintain profitability.

In 2024, managing these costs is critical. For example, fluctuations in asphalt prices, which can range from $50 to $100 per ton depending on market conditions, directly impact project margins. Similarly, fuel costs, which represent a substantial portion of operating expenses, necessitate efficiency measures and careful purchasing strategies.

| Cost Category | 2023/2024 Data Point | Impact on Granite |

|---|---|---|

| Labor & Personnel | Significant portion of operating expenses. Focus on retention for cost control. | Directly impacts project profitability and workforce capacity. |

| Machinery Acquisition/Lease | New large excavator: $300k-$500k+; Dump truck: $150k-$300k (2024 est.) | Represents substantial upfront capital investment. |

| Machinery Maintenance | 10-15% of purchase price annually (industry avg. 2023) | Ensures operational uptime but adds ongoing expense. |

| Fuel | Volatile market prices impact operating margins. | Requires efficient usage and potential hedging strategies. |

| Materials & Subcontractors | Substantial portion of cost of revenue (2023). | Efficient procurement and strong subcontractor relationships are key. |

| SG&A | Q1 2024: $134.7 million (slight increase from prior year) | Reflects strategic investments while aiming for cost efficiency. |

Revenue Streams

Granite Construction's main income source is securing substantial, long-term contracts for civil infrastructure work. These projects are typically awarded by government bodies and private entities, covering everything from roads and bridges to utilities.

The company utilizes various contract structures, including fixed-price agreements where the cost is set upfront, cost-plus contracts where they are reimbursed for expenses plus a fee, and design-build contracts where they handle both design and construction. For instance, in 2023, Granite reported a significant portion of its revenue derived from these large infrastructure contracts, reflecting the ongoing demand for public works improvements.

Granite Construction generates revenue by selling construction materials like aggregates, asphalt, and ready-mix concrete. This income stream benefits from Granite's vertical integration, allowing them to supply their own projects and sell to outside clients. In 2023, Granite reported total revenue of $3.7 billion, with a significant portion attributed to their construction materials and related activities.

Granite Construction actively pursues revenue through Public-Private Partnership (P3) arrangements. These collaborations involve working with government agencies to finance, construct, and often maintain critical infrastructure projects. For instance, in 2024, Granite was involved in significant P3 projects, contributing to their diverse revenue streams through long-term concession fees and availability payments tied to project performance.

Maintenance and Rehabilitation Contracts

Granite Construction also generates revenue from maintenance and rehabilitation contracts for existing infrastructure. These agreements provide a steady, recurring income that supplements their new construction projects.

This segment of their business is crucial for long-term stability. For instance, in 2023, Granite secured a significant contract for the rehabilitation of a major highway, highlighting the ongoing demand for these services.

- Recurring Revenue: Maintenance contracts offer a predictable income stream, reducing reliance on the cyclical nature of new construction.

- Infrastructure Longevity: These services extend the life of existing assets, ensuring continued need for Granite's expertise.

- Diversification: Rehabilitation work diversifies Granite's project portfolio, mitigating risks associated with large-scale new builds.

Design-Build and Best Value Project Fees

Granite Construction leverages design-build and best value project fees as key revenue streams. These models allow for potentially higher fees because Granite takes on greater responsibility, integrating both the design and construction phases. This comprehensive approach often leads to better risk management for the client, justifying a premium on the fees charged.

In 2024, this approach is particularly valuable in complex infrastructure projects. For instance, in design-build scenarios, Granite's ability to control the entire project lifecycle from conception to completion can streamline processes and reduce overall project costs for the client, leading to more attractive fee structures for Granite.

- Integrated Service: Design-build contracts combine design and construction, allowing Granite to offer a single point of responsibility.

- Risk Mitigation: Best value selection often rewards firms that can demonstrate superior risk management capabilities.

- Enhanced Profitability: Higher fees are typically associated with these more complex and integrated project delivery methods.

- Market Demand: There is a growing demand for integrated project delivery methods in the construction industry.

Granite Construction's revenue is primarily generated from large-scale civil infrastructure projects, often secured through government contracts. They also profit from selling construction materials like aggregates and asphalt, a segment bolstered by their vertical integration. Public-Private Partnerships (P3s) represent another significant income source, involving collaboration on financing, building, and maintaining infrastructure.

| Revenue Stream | Description | 2023 Data/Significance |

|---|---|---|

| Civil Infrastructure Contracts | Securing and executing large projects for public and private entities. | A substantial portion of their $3.7 billion total revenue in 2023 was derived from these contracts, reflecting ongoing infrastructure investment. |

| Construction Materials Sales | Supplying aggregates, asphalt, and ready-mix concrete to internal projects and external clients. | Contributed significantly to 2023 revenue, highlighting the benefit of vertical integration. |

| Public-Private Partnerships (P3s) | Collaborating with government agencies on infrastructure projects, including financing and maintenance. | Active involvement in P3 projects in 2024, generating revenue through concession fees and availability payments. |

| Maintenance & Rehabilitation | Contracts for upkeep and repair of existing infrastructure. | Secured significant rehabilitation contracts in 2023, providing a stable, recurring income stream. |

| Design-Build & Best Value Fees | Fees earned from integrated project delivery where Granite handles both design and construction. | These models offer potentially higher fees due to increased responsibility and risk management, particularly valuable in complex projects in 2024. |

Business Model Canvas Data Sources

The Granite Construction Business Model Canvas is built upon a foundation of financial statements, investor reports, and industry-specific market analysis. These sources provide the quantitative and qualitative data needed to accurately define Granite's value proposition, customer segments, and revenue streams.