Granite Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Granite Construction Bundle

Granite Construction faces significant competitive pressures, notably from the intense rivalry among existing players and the substantial bargaining power of its buyers, often large government entities and private developers. Understanding these dynamics is crucial for any stakeholder looking to navigate the construction landscape.

The complete report reveals the real forces shaping Granite Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Granite Construction's reliance on suppliers for essential materials like aggregates and asphalt components, along with specialized equipment and skilled labor, places significant influence in the hands of these suppliers. The degree to which these suppliers are concentrated, especially for unique or high-quality inputs, directly shapes their bargaining power. For instance, in 2024, the construction materials sector experienced price volatility for key commodities, which could amplify supplier leverage if alternatives are scarce.

The costs associated with switching suppliers for essential construction materials or specialized equipment can be substantial for Granite Construction. These costs extend beyond mere price differences, encompassing logistical hurdles, the establishment of new procurement relationships and processes, and potentially the re-calibration of existing operational workflows and equipment compatibility. For instance, a switch in concrete suppliers might require adjustments to batching processes or quality testing protocols.

High switching costs significantly bolster the bargaining power of suppliers. This is because Granite would face considerable expenses and operational disruptions if it were to change providers, making it less inclined to seek alternative suppliers even if current providers increase their prices. This inertia creates a dependency, allowing suppliers to potentially dictate terms more effectively.

In 2023, the construction industry experienced an average increase in material costs, with some key inputs like lumber and steel seeing double-digit percentage rises. For a company like Granite, which relies on a consistent supply of diverse materials, the difficulty in quickly shifting to new suppliers for these volatile commodities directly translates to increased supplier leverage.

The construction sector, including companies like Granite Construction, grapples with persistent shortages of skilled labor. This scarcity significantly bolsters the bargaining power of both individual skilled workers and specialized subcontractors. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a continued deficit in skilled trades, with many positions remaining unfilled for extended periods.

This tight labor market translates directly into increased wage demands and more stringent contract terms from these skilled professionals. Consequently, Granite Construction, like its peers, faces upward pressure on its labor costs and potential delays in project execution due to the difficulty in securing qualified personnel. The ability to attract and retain a skilled workforce is therefore a critical factor influencing Granite's operational efficiency and overall profitability.

Vertical Integration of Suppliers

Some suppliers, especially major material producers, might be vertically integrated. This means they could potentially compete with Granite Construction in certain areas or restrict Granite's access to essential materials. For instance, a large cement producer that also offers construction services could be seen as a competitor.

However, Granite Construction itself practices vertical integration. They produce their own aggregates and asphalt. This internal production capability significantly reduces the bargaining power of external suppliers for these specific, crucial materials. In 2023, Granite reported that its construction materials segment generated $1.2 billion in revenue, highlighting the importance of their internal supply chain capabilities.

- Vertical Integration by Suppliers: Large material producers may integrate forward, creating potential competition or supply constraints for Granite.

- Granite's Counter-Strategy: Granite's own vertical integration in aggregates and asphalt production directly counters supplier power in these key input areas.

- Impact on Cost Control: Internal production of materials like aggregates helps Granite manage input costs and ensures a more stable supply, crucial for project timelines.

- Strategic Advantage: This internal capability provides a competitive edge, allowing for better cost management and potentially higher margins compared to competitors reliant on external suppliers.

Impact of Raw Material Price Volatility

Fluctuations in raw material prices, like bitumen and steel, directly impact Granite Construction's operational expenses. For instance, the average price of asphalt binder, a key component for paving, saw significant volatility in 2024, with some reports indicating year-over-year increases of over 15% in certain regions due to global energy market shifts. This volatility means suppliers can pass on higher costs, squeezing Granite's profit margins if not managed proactively through contract negotiation or pricing adjustments in bids.

The bargaining power of suppliers is amplified when they can dictate price increases due to their own rising input costs. Granite may face pressure to accept these higher prices, especially if alternative suppliers are limited or if long-term contracts are not in place. This dynamic can directly affect the company's profitability on projects where material costs are a substantial portion of the overall budget.

- Increased Input Costs: Volatile raw material prices directly translate to higher construction costs for Granite.

- Margin Squeeze: Suppliers passing on price hikes can reduce Granite's profit margins if not offset by bid adjustments.

- Supplier Leverage: Limited supplier options or lack of long-term agreements empower suppliers to dictate terms.

- Risk Management Necessity: Effective risk management through bidding and supply agreements is crucial for Granite to mitigate these impacts.

Granite Construction faces moderate bargaining power from its suppliers, particularly for specialized equipment and certain raw materials where supplier concentration is higher. However, Granite's own vertical integration in aggregates and asphalt production significantly mitigates supplier power in these crucial areas. The company's ability to manage input costs and ensure supply stability is enhanced by these internal capabilities, providing a strategic advantage.

In 2023, Granite's construction materials segment generated $1.2 billion in revenue, underscoring the importance of their internal supply chain. This internal production capability directly reduces reliance on external suppliers for aggregates and asphalt, thereby lowering their bargaining power. For instance, if asphalt binder prices rose by 15% in 2024, as reported in some regions, Granite's internal production would insulate them from this specific cost increase, unlike competitors who must purchase externally.

The construction sector's ongoing shortage of skilled labor in 2024, as noted by the U.S. Bureau of Labor Statistics, amplifies the bargaining power of specialized subcontractors and individual skilled workers. This can lead to increased labor costs and potential project delays for Granite, influencing contract terms and wage demands. While Granite benefits from its own material production, the labor market remains a key area where supplier (labor) power is elevated.

| Factor | Impact on Granite Construction | 2023/2024 Data Point |

| Supplier Concentration (Specialized Equipment) | Moderate to High | N/A (Industry Trend) |

| Granite's Vertical Integration (Aggregates, Asphalt) | Lowers Supplier Power | $1.2 billion revenue from construction materials segment |

| Skilled Labor Shortages | Increases Supplier (Labor) Power | Continued deficit in skilled trades reported by BLS in 2024 |

| Raw Material Price Volatility (e.g., Asphalt Binder) | Increases Supplier Power | Potential >15% year-over-year increases in some regions in 2024 |

What is included in the product

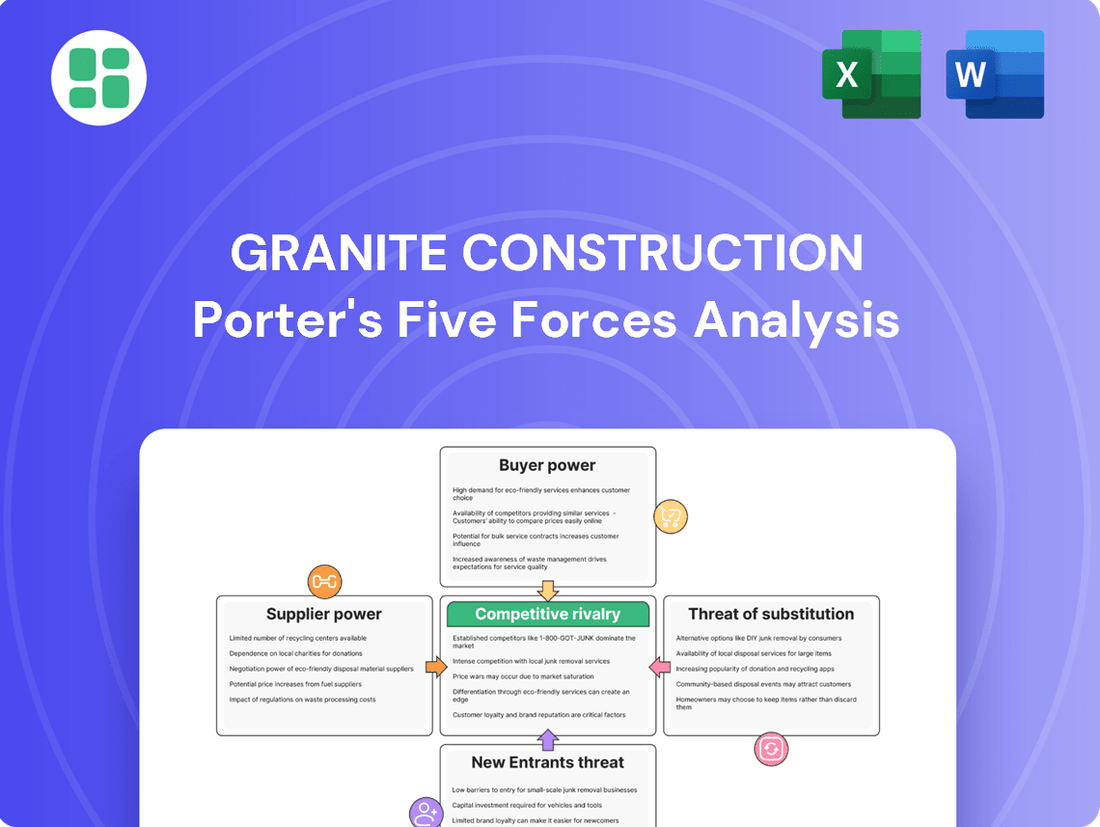

Tailored exclusively for Granite Construction, analyzing its position within its competitive landscape by evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Granite Construction's competitive landscape to identify and address key pain points.

Customers Bargaining Power

Granite Construction's bargaining power of customers is significantly influenced by its reliance on the public sector. A substantial portion of their revenue, often exceeding 50% in recent years, is derived from federal, state, and local government entities for major infrastructure work. For instance, in 2023, government contracts represented a core segment of their business, highlighting this dependency.

These public sector clients typically engage in rigorous competitive bidding processes. This procurement method inherently empowers customers by fostering price competition among contractors, potentially leading to lower margins for companies like Granite. The need to win these bids often forces contractors to offer their services at the most competitive rates possible.

However, the stability and scale of public funding, especially with initiatives like the Infrastructure Investment and Jobs Act (IIJA) injecting billions into infrastructure development, create a robust and consistent demand. This consistent demand mitigates some of the buyer power, as the sheer volume of available projects ensures a steady stream of potential work for qualified contractors.

Granite Construction focuses on large, intricate civil infrastructure projects. These projects demand substantial planning, unique skills, and considerable financial backing. For instance, in 2024, the company secured a significant contract for a complex transportation project valued at over $500 million, highlighting the scale of their undertakings.

The specialized nature of these endeavors means fewer contractors can effectively compete. This scarcity can reduce the bargaining power of customers, enabling Granite to negotiate more favorable terms and protect its profit margins by leveraging its proven expertise in delivering these demanding projects.

Customer concentration can significantly impact Granite Construction's bargaining power. While Granite works with many clients, if a few large government agencies or private developers account for a substantial portion of its revenue, these major clients gain leverage. For instance, if a single large project owner represents, say, 15% of Granite's annual revenue, that customer could more easily negotiate for lower prices or more favorable contract terms, potentially squeezing Granite's profit margins.

Importance of Project Quality and Timeliness

For critical infrastructure projects, customers place a high premium on quality, reliability, and on-time completion. This focus significantly diminishes their willingness to negotiate on price, as project delays or subpar execution can lead to far greater costs and reputational damage. Granite Construction's commitment to these factors is a key differentiator.

Granite's emphasis on quality and safety, consistently reinforced in their annual reports, allows them to command better pricing. For instance, in 2023, Granite reported a strong backlog of $7.0 billion, reflecting customer confidence in their ability to deliver complex projects. This reputation directly translates to reduced customer price sensitivity.

- Customer Priority: Quality, reliability, and timely completion are paramount in infrastructure projects, limiting price concessions.

- Granite's Advantage: A proven track record in quality and safety enhances customer trust and reduces price sensitivity.

- 2023 Financials: Granite's $7.0 billion backlog underscores customer reliance on their delivery capabilities.

Backward Integration Potential of Customers

The potential for Granite Construction's customers to integrate backward and undertake complex civil infrastructure projects themselves is generally quite low. This is a significant factor in limiting their bargaining power.

Most clients, whether government entities or private developers, simply do not possess the specialized in-house expertise, heavy machinery, and vast operational capacity needed for large-scale construction. For instance, a municipal government typically lacks the extensive fleet of specialized equipment and the trained workforce that a company like Granite maintains.

This lack of capability means customers are largely reliant on external contractors, reducing their ability to dictate terms or bring construction in-house. In 2023, Granite reported revenue of $3.7 billion, a testament to the scale and complexity of projects they manage, which are beyond the typical capabilities of their customer base.

- Limited In-House Expertise: Most clients lack the specialized knowledge and skilled labor required for complex civil projects.

- High Capital Investment: Acquiring and maintaining the necessary heavy construction equipment represents a substantial barrier to entry for customers.

- Operational Scale: The sheer scale of operations for major infrastructure projects is beyond the typical capacity of customer organizations.

The bargaining power of Granite Construction's customers is generally moderate, largely due to the specialized nature of its projects and the high cost of switching contractors. While public sector clients, which form a significant revenue base, often use competitive bidding, the complexity of infrastructure work limits the number of qualified bidders. For instance, in 2023, Granite's backlog stood at $7.0 billion, reflecting sustained demand for their specialized services.

Customers prioritize quality and reliability in large infrastructure projects, which can diminish their price sensitivity. Granite's strong reputation for delivering complex projects, such as a major transportation contract secured in 2024 valued at over $500 million, reinforces this. This focus on execution excellence reduces the customer's ability to push for lower prices without compromising project success.

The low likelihood of customers integrating backward to perform such complex civil engineering themselves further constrains their bargaining power. Most clients lack the specialized equipment and expertise. Granite's substantial revenue, reported at $3.7 billion in 2023, highlights the scale of projects they undertake, which is typically beyond the in-house capabilities of their client base.

| Factor | Impact on Customer Bargaining Power | Granite's Position |

|---|---|---|

| Project Specialization & Complexity | Reduces the pool of qualified contractors, limiting customer options. | Granite possesses specialized expertise and capabilities. |

| Customer Dependence on Quality & Reliability | Prioritizes performance over price, reducing price negotiation leverage. | Strong track record and reputation for successful project delivery. |

| Low Likelihood of Backward Integration | Customers lack the in-house resources and expertise to self-perform. | Granite operates at a scale and complexity that clients cannot replicate. |

| Competitive Bidding (Public Sector) | Can drive down prices, increasing customer power. | Mitigated by project complexity and Granite's competitive advantages. |

Preview Before You Purchase

Granite Construction Porter's Five Forces Analysis

This preview showcases the complete Granite Construction Porter's Five Forces Analysis, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, offering a comprehensive strategic overview. You're looking at the actual document, ready for immediate use, providing all the insights you need to understand Granite Construction's competitive landscape.

Rivalry Among Competitors

The civil infrastructure and construction materials sector is indeed a crowded arena. Granite Construction operates alongside a substantial number of competitors, ranging from massive national enterprises to nimble regional outfits and countless smaller, localized contractors. This sheer volume means that for any given project, there are many hands reaching for the same pie.

This intense competition directly impacts pricing. When numerous companies are all eager to win contracts, they often resort to aggressive bidding to secure work. This can drive down the price of services and materials, ultimately squeezing profit margins for everyone involved, including established players like Granite.

For instance, in 2023, the U.S. construction industry saw a significant number of firms actively bidding on infrastructure projects. While exact numbers vary by sub-sector, reports indicate thousands of companies were involved in public works bids alone. This competitive pressure is a constant factor that Granite must navigate.

The U.S. civil infrastructure market is booming, with the Infrastructure Investment and Jobs Act (IIJA) injecting substantial federal funding. This massive investment, estimated to be over $1.2 trillion, is creating a larger market for construction companies, which can temper intense rivalry by increasing available projects.

Granite Construction's vertical integration, encompassing both contracting and material supply, sets it apart in a sector that can otherwise be commoditized. By producing its own aggregates, asphalt, and concrete, Granite achieves significant cost efficiencies and tighter quality control, a clear differentiator from competitors solely focused on construction.

High Exit Barriers

The construction sector, inherently capital-intensive, presents significant hurdles for companies looking to exit. Substantial investments in heavy machinery, material production facilities, and specialized workforce development mean that fixed costs are very high. This makes it difficult and costly for firms to divest assets or cease operations, compelling them to remain active in the market. For instance, in 2024, the average capital expenditure for a large-scale construction project can easily run into tens of millions of dollars, with specialized equipment alone representing a considerable sunk cost.

These high exit barriers directly contribute to intensified competitive rivalry. Because leaving the industry is so expensive, companies are often incentivized to continue competing, even when market conditions are unfavorable or profit margins are thin. This persistence leads to a more aggressive competitive landscape as firms fight for market share to cover their substantial fixed costs. In 2023, the average operating margin for general building contractors in the US was around 1.5%, highlighting the pressure to maintain activity despite tight profitability.

- Capital Intensity: Construction demands massive upfront investment in physical assets and skilled labor.

- Sunk Costs: Specialized machinery and facilities represent significant, often irrecoverable, expenses.

- Industry Persistence: High exit barriers encourage companies to stay and compete, even in challenging economic periods.

- Rivalry Intensification: The inability to easily exit the market fuels aggressive competition among existing players.

Local Market Dynamics and Relationships

Granite Construction, despite its national reach, faces intense competition within its various home markets across the United States. Success hinges on cultivating strong local relationships with project owners, navigating regulatory landscapes, and securing a reliable workforce.

This regional focus means that established local contractors, possessing intimate knowledge of their markets and pre-existing ties, often present formidable rivalry. For instance, in 2024, the construction industry continued to see a significant number of smaller, specialized firms winning bids for regional projects, underscoring the importance of local presence and relationships.

- Local Dominance: Established regional players leverage deep market understanding and existing networks to maintain a competitive edge.

- Relationship Capital: Strong ties with local owners and regulators are critical for securing contracts and navigating project approvals.

- Human Capital Access: Availability of skilled labor is a key differentiator, with local firms often having a more readily accessible pool.

- Regional Competition Intensity: Competition is often fiercest at the local level, where established players have a significant advantage.

The competitive rivalry for Granite Construction is fierce, driven by a fragmented industry with numerous players vying for projects. This intense competition, particularly at the regional level, forces companies to bid aggressively, often compressing profit margins. For example, in 2023, the U.S. construction sector saw thousands of companies bidding on infrastructure projects, a testament to the crowded market.

High capital intensity and sunk costs, such as specialized machinery, create significant barriers to exit. This industry persistence means companies remain active even during downturns, fueling ongoing rivalry. In 2024, the average capital expenditure for large construction projects easily reaches tens of millions, reinforcing this dynamic.

Granite's vertical integration, producing its own materials, offers a cost advantage over competitors. However, the sheer volume of local contractors, with deep market knowledge and established relationships, presents a persistent challenge. In 2024, regional firms continued to win bids by leveraging these local strengths.

| Factor | Description | Impact on Granite |

|---|---|---|

| Industry Fragmentation | Numerous competitors, from national giants to local firms. | Intensifies price competition and requires strong local presence. |

| Exit Barriers | High capital investment and sunk costs make exiting difficult. | Encourages persistent competition, even with thin margins. |

| Regional Competition | Strong local players with established relationships. | Requires Granite to build strong local ties and adapt to regional market dynamics. |

| Pricing Pressure | Aggressive bidding due to high competition. | Can reduce profit margins for all industry participants. |

SSubstitutes Threaten

While asphalt, concrete, and aggregates are staples in civil infrastructure, the threat of substitutes is growing. Innovative materials and construction methods are emerging, offering potential advantages. For instance, the increasing focus on sustainability is driving the adoption of recycled content in concrete and the exploration of bio-based materials, which could present both performance and environmental benefits.

The increasing adoption of prefabrication and modular construction, particularly in the building sector, offers an alternative to traditional on-site building methods. While their impact on heavy civil infrastructure is currently limited, ongoing technological progress could lead to more off-site component manufacturing, thereby shrinking the scope of conventional on-site civil engineering projects.

Digital technologies like AI, robotics, and drones are emerging as significant substitutes in construction, offering potential for greater efficiency and cost reduction. For instance, the adoption of building information modeling (BIM) software, which streamlines design and planning, is becoming increasingly prevalent, impacting traditional project management approaches. In 2023, the global construction technology market was valued at approximately $11.4 billion and is projected to grow substantially, indicating a strong trend towards these digital substitutes.

Infrastructure Maintenance vs. New Construction

The threat of substitutes for new, large-scale infrastructure projects is significant, primarily stemming from increased investment in maintaining and rehabilitating existing infrastructure. This approach can often be more cost-effective and less disruptive than complete new builds.

While Granite Construction is active in both new construction and maintenance, a substantial pivot towards 'repair-in-place' methodologies or less intensive repair strategies could directly impact the demand for their major construction services. For instance, the U.S. Department of Transportation's Fixing America's Surface Transportation (FAST) Act, enacted in 2015 and extended through various measures, has allocated substantial funding towards infrastructure preservation, signaling a trend that prioritizes maintaining existing assets.

- Focus on Rehabilitation: A shift in government and private sector spending towards extending the life of current infrastructure rather than building entirely new structures presents a viable substitute.

- Cost-Effectiveness: Maintenance and rehabilitation projects often carry a lower upfront cost and shorter timelines compared to new construction, making them an attractive alternative.

- Technological Advancements: Innovations in materials science and construction techniques for repairs and upgrades can further enhance the appeal of maintaining existing infrastructure.

- Funding Allocations: Federal and state budgets increasingly reflect a balance between new projects and the upkeep of existing ones, with a notable emphasis on the latter in recent years.

Shift to Non-Traditional Infrastructure

The threat of substitutes for Granite Construction's traditional civil infrastructure services is evolving. A significant long-term substitute threat could arise from a fundamental societal or governmental pivot away from conventional infrastructure like roads and bridges. Instead, there might be a greater emphasis on entirely new infrastructure paradigms, such as advanced digital communication networks or widespread alternative energy grids. These emerging sectors demand distinct construction expertise and specialized materials, potentially bypassing traditional civil engineering firms.

Granite Construction is proactively addressing this by diversifying its service offerings. For instance, the company is actively expanding into areas like electric vehicle (EV) charging infrastructure. This strategic move acknowledges the potential shift in infrastructure needs and positions Granite to capitalize on new growth opportunities. In 2024, the global EV charging infrastructure market was valued at an estimated $25.9 billion, with projections indicating substantial growth, highlighting the strategic importance of such diversification.

- Evolving Infrastructure Needs: Societal and governmental shifts may favor digital networks and alternative energy grids over traditional civil infrastructure.

- New Expertise Required: These emerging infrastructure types necessitate different construction skills and materials, posing a challenge to traditional players.

- Granite's Diversification: Granite is expanding into areas like EV infrastructure to mitigate this substitute threat.

- Market Growth: The EV charging infrastructure market's significant growth in 2024 underscores the potential of these new sectors.

The threat of substitutes for Granite Construction's core business is multifaceted, ranging from alternative materials to evolving infrastructure priorities. The increasing emphasis on maintaining and rehabilitating existing infrastructure, rather than solely focusing on new builds, presents a significant substitute. For example, the U.S. Department of Transportation's infrastructure funding often balances new projects with preservation efforts, a trend evident in programs like the Infrastructure Investment and Jobs Act, which includes substantial allocations for repairs and upgrades.

Furthermore, advancements in construction technology, such as AI and robotics, offer more efficient and cost-effective project execution, acting as a substitute for traditional methods. The global construction technology market's growth, reaching an estimated $11.4 billion in 2023, highlights this trend. Granite's diversification into areas like EV charging infrastructure, a market valued at approximately $25.9 billion in 2024, also reflects an awareness of and response to these evolving substitute threats and new infrastructure paradigms.

| Substitute Area | Description | Impact on Granite | Supporting Data (2023-2024) |

|---|---|---|---|

| Infrastructure Rehabilitation | Focus on repairing and extending the life of existing assets | Reduces demand for new large-scale projects | FAST Act funding, IIJA allocations for repairs |

| Advanced Construction Tech | AI, robotics, drones, BIM | Increases efficiency, potentially lowers costs for competitors | Construction tech market valued at $11.4 billion (2023) |

| New Infrastructure Paradigms | Digital networks, alternative energy grids | Shifts demand away from traditional civil engineering | EV charging infrastructure market valued at $25.9 billion (2024) |

Entrants Threaten

The civil infrastructure and construction materials sectors demand massive upfront capital. Think heavy machinery, specialized equipment, and even entire plants for things like asphalt or quarrying. This initial financial hurdle is a major deterrent for anyone looking to break into the market.

New companies looking to enter the construction sector, especially large-scale infrastructure, must navigate a labyrinth of regulatory hurdles. These include stringent environmental impact assessments, complex zoning laws governing material sourcing and site development, and rigorous safety compliance standards. For instance, obtaining permits for a major highway project can take years and involve multiple government agencies, significantly increasing the initial investment and time-to-market.

Established players like Granite Construction enjoy significant advantages due to economies of scale. For instance, in 2023, Granite reported revenues of $3.7 billion, allowing for bulk purchasing of materials and efficient utilization of its extensive fleet of heavy equipment. New entrants would find it challenging to match these cost efficiencies without substantial upfront investment and a proven track record of project execution, hindering their ability to compete on price for major infrastructure projects.

Access to Distribution Channels and Supply Chains

Granite Construction's significant vertical integration and deeply entrenched relationships with a wide network of suppliers and subcontractors create substantial barriers for new entrants seeking to access critical distribution channels and supply chains. Building these essential partnerships from the ground up requires considerable time, capital, and proven reliability, making it a formidable hurdle.

New competitors would face the daunting task of replicating Granite's established infrastructure and securing dependable access to essential materials and specialized services. For example, in 2024, the construction industry continued to grapple with supply chain disruptions, underscoring the value of pre-existing, robust supplier networks. Granite's ability to navigate these challenges, demonstrated by its consistent project execution, highlights the difficulty new firms would encounter in establishing a comparable supply chain advantage.

- Established Supplier Relationships: Granite benefits from long-standing partnerships, ensuring consistent material availability and favorable terms.

- Vertical Integration: Control over key aspects of the supply chain, from material sourcing to specialized services, reduces reliance on external parties.

- High Initial Investment: New entrants must invest heavily in building similar supplier networks and securing reliable access to raw materials and equipment.

- Risk Mitigation: Granite's diversified supplier base and internal capabilities offer resilience against market volatility and supply disruptions, a key differentiator in 2024's challenging economic climate.

Brand Reputation and Established Relationships

Granite Construction benefits immensely from its century-long operating history, fostering a robust brand reputation. This established goodwill, particularly with public sector clients and private developers, makes it difficult for newcomers to penetrate the market and secure initial contracts. For instance, in 2023, Granite secured significant infrastructure projects, underscoring the trust placed in its long-standing capabilities.

The company's deep-rooted relationships with government agencies and private sector entities act as a formidable barrier to entry. New entrants struggle to replicate the trust and proven track record that Granite has cultivated over decades, which is crucial for winning bids on large-scale, complex projects. These established connections are not easily built and require significant time and consistent performance.

- Brand Loyalty: Granite's long history has cultivated strong brand loyalty among its client base.

- Relationship Capital: Decades of successful project delivery have built invaluable relationships with key stakeholders.

- Trust and Credibility: A proven track record over 100+ years provides a significant trust advantage over new competitors.

- Access to Opportunities: Established relationships facilitate access to lucrative bidding opportunities in both public and private sectors.

The threat of new entrants for Granite Construction is moderate to low, primarily due to the substantial capital requirements and extensive regulatory landscape inherent in the civil infrastructure and construction materials sectors. These barriers, coupled with established players' economies of scale and entrenched relationships, make it challenging for newcomers to compete effectively.

New entrants face significant hurdles in replicating Granite's established supplier networks and vertical integration, essential for navigating supply chain complexities, especially noted in 2024. Furthermore, Granite's century-long reputation and deep-rooted relationships with government and private entities provide a critical trust advantage, making it difficult for new firms to secure initial contracts and build credibility.

| Barrier to Entry | Impact on New Entrants | Granite's Advantage (2023/2024 Data) |

|---|---|---|

| Capital Requirements | High initial investment needed for machinery and infrastructure. | Granite's $3.7 billion 2023 revenue enables bulk purchasing and efficient equipment utilization. |

| Regulatory Hurdles | Complex environmental, zoning, and safety compliance. | Long-standing expertise in navigating permits for large infrastructure projects. |

| Economies of Scale | Difficulty matching established players' cost efficiencies. | Achieved through bulk material purchasing and optimized equipment fleet. |

| Supplier Relationships & Vertical Integration | Challenging to build comparable networks and secure reliable access. | Deeply entrenched relationships and control over key supply chain aspects. |

| Brand Reputation & Relationships | Hard to replicate trust and proven track record. | Over 100 years of successful project delivery, fostering strong client and government trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Granite Construction leverages data from company annual reports, SEC filings, and industry-specific market research reports. We also incorporate insights from construction trade publications and economic databases to provide a comprehensive view of the competitive landscape.