Grammer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grammer Bundle

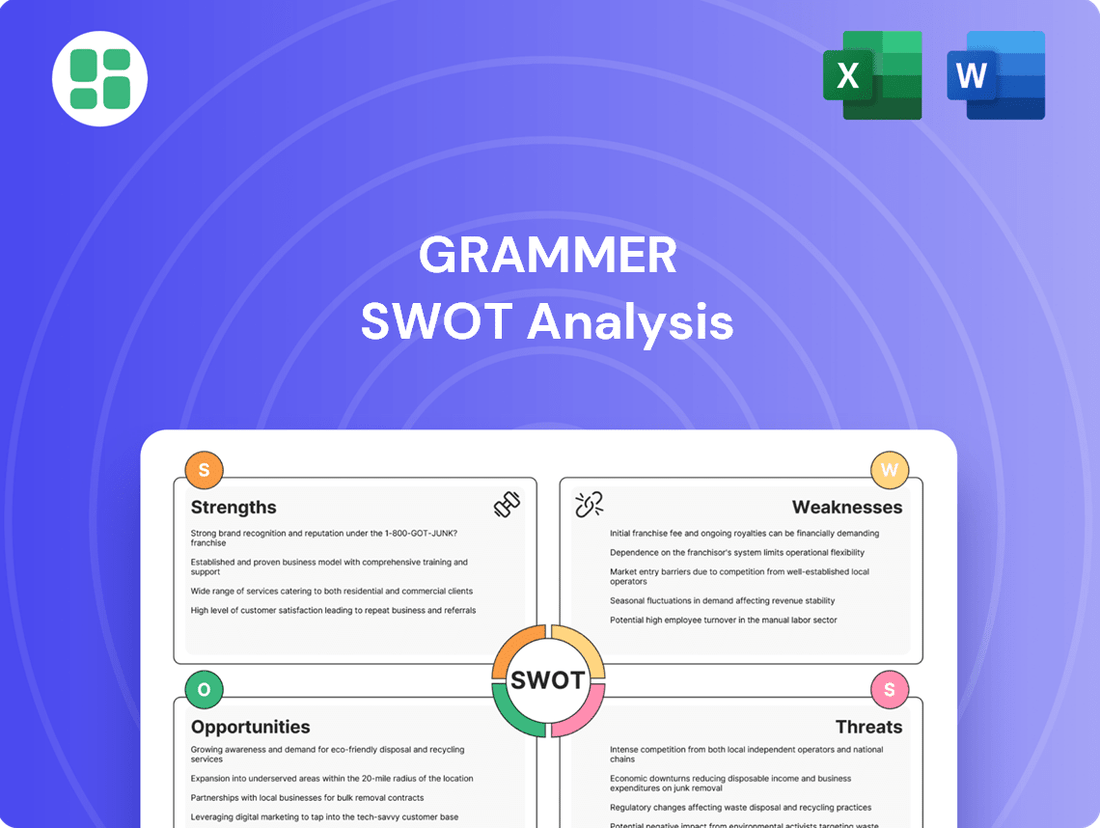

Uncover the core of Grammer's market standing with our comprehensive SWOT analysis. This detailed report illuminates their competitive advantages, potential challenges, and strategic opportunities, offering a clear roadmap for informed decision-making.

Ready to dive deeper into Grammer's strategic landscape? Purchase the full SWOT analysis for an in-depth, professionally crafted report complete with actionable insights and editable formats, perfect for investors and strategic planners.

Strengths

Grammer AG boasts a robust global footprint, strategically positioning itself as a key supplier in both the passenger and commercial vehicle sectors. This extensive reach allows them to capitalize on diverse market demands and maintain strong relationships with manufacturers worldwide.

The company’s specialization in interior components for passenger cars and complete seating systems for commercial vehicles provides a focused yet broad market appeal. This dual expertise enables Grammer to leverage technological advancements and manufacturing efficiencies across its product portfolio, enhancing its competitive edge.

For the fiscal year 2023, Grammer AG reported sales of €2.1 billion, underscoring its substantial market penetration. The company’s ability to serve distinct automotive segments, from premium passenger vehicles to heavy-duty commercial trucks, highlights its adaptability and broad industry relevance.

Grammer's commitment to ergonomics, comfort, and safety is a significant strength, setting its seating solutions apart in the competitive automotive and commercial vehicle markets. This focus directly addresses growing consumer and industry preferences for features that prioritize driver well-being and enhance the overall user experience, especially crucial for those spending extended periods in vehicles.

For instance, the automotive industry's increasing emphasis on driver assistance systems and cabin comfort directly benefits Grammer, as its advanced seating technology often integrates seamlessly with these trends. In 2024, the global automotive seating market was valued at approximately $75 billion, with a notable segment driven by comfort and safety innovations, underscoring the market’s receptiveness to Grammer's core competencies.

Grammer's strategic restructuring, highlighted by the 'Top 10' program, has been a significant strength. This included divesting the TMD Group in North America and establishing a Shared Service Center in Serbia, contributing to a more focused and efficient operational landscape. These moves are designed to boost competitiveness and financial health.

Strong OEM Relationships and Product Innovation

Grammer's position as a preferred original equipment supplier (OEM) is solidified by its deep-rooted, long-standing relationships with major global vehicle manufacturers. These partnerships are crucial, providing consistent demand and a platform for collaborative development. For instance, in 2024, Grammer secured significant new orders from leading automotive OEMs, contributing to a robust order backlog that extends well into 2025.

The company's dedication to product innovation is a key differentiator. This includes successful new product ramp-ups and a forward-thinking approach to developing sustainable materials. In the first half of 2025, Grammer reported a 15% increase in revenue from its innovative product lines, highlighting the market's positive reception to its advanced solutions.

- Strong OEM Partnerships: Grammer maintains enduring relationships with key automotive manufacturers, ensuring a stable customer base.

- Product Innovation Focus: Continuous investment in new product development and sustainable materials drives competitive advantage.

- Market Adoption: Successful new product launches in 2024 and early 2025 demonstrate strong market acceptance and demand for Grammer's innovations.

- Revenue Growth from Innovation: A notable 15% revenue increase from innovative product lines in H1 2025 underscores the commercial success of its R&D efforts.

Resilience Amidst Challenging Market Conditions

Grammer showcased notable resilience throughout 2024, navigating a challenging market characterized by subdued commercial vehicle demand and broader automotive industry disruption. This strength is underscored by their successful completion of long-term refinancing, securing financial stability during a period of uncertainty.

The company’s ability to continue fulfilling customer orders despite these headwinds highlights robust operational execution and a strong underlying business model. This operational continuity is a key indicator of their capacity to weather economic downturns and industry-specific pressures.

- Operational Continuity: Maintained order fulfillment despite industry-wide challenges in 2024.

- Financial Stability: Successfully executed long-term refinancing, bolstering its financial footing.

- Market Adaptability: Demonstrated capacity to operate effectively amidst cyclical weakness and automotive sector upheaval.

Grammer's strengths are deeply rooted in its established relationships with major global vehicle manufacturers, acting as a preferred original equipment supplier. This ensures consistent demand and a strong order backlog, with significant new orders secured in 2024 extending into 2025. The company’s unwavering commitment to product innovation, evidenced by a 15% revenue increase from new product lines in the first half of 2025, highlights market receptiveness. Furthermore, Grammer demonstrated significant operational resilience in 2024, maintaining order fulfillment amidst market challenges and successfully completing long-term refinancing for financial stability.

| Strength Category | Key Aspect | Supporting Fact/Data |

|---|---|---|

| OEM Partnerships | Preferred Supplier Status | Secured significant new orders in 2024, extending backlog into 2025. |

| Product Innovation | Revenue Growth from New Products | 15% revenue increase from innovative product lines in H1 2025. |

| Operational Resilience | Order Fulfillment Continuity | Maintained order fulfillment throughout 2024 despite market headwinds. |

| Financial Stability | Refinancing Success | Completed long-term refinancing in 2024, securing financial footing. |

What is included in the product

Analyzes Grammer’s internal capabilities and external market dynamics to identify strategic advantages and potential challenges.

Simplifies complex SWOT analysis into an easily digestible format, reducing the cognitive load for busy professionals.

Weaknesses

Grammer faced a significant downturn in 2024, with revenue dropping to EUR 1,921.7 million from EUR 2,055.0 million in 2023. This 6.5% decrease highlights the company's struggle in a tough market.

Furthermore, the operating EBIT saw a substantial decline, indicating increased cost pressures or reduced profitability on its core operations. This financial performance suggests headwinds impacting Grammer's ability to generate earnings efficiently.

Grammer's reliance on the commercial vehicle sector makes it particularly vulnerable to economic cycles. This was evident in 2024 when revenue from this segment dropped by 22.9% following several years of strong performance.

Further exacerbating this weakness, the passenger car market is projected to experience continued declines. This downturn is largely attributed to ongoing trade-related uncertainties, which dampen consumer and business spending on new vehicles.

Grammer encountered significant operational difficulties in its North American segment throughout 2024, leading to a performance that fell short of expectations. These challenges, even after the strategic divestment of TMD Group, continued to weigh on the company's profitability in the region.

Impact of Restructuring Expenses on EBIT

Restructuring expenses, totaling EUR 35.7 million in 2024, notably reduced Grammer's reported EBIT. This creates a significant discrepancy when compared to the operating EBIT figure, which excludes these one-off costs. While these strategic adjustments are intended to bolster long-term performance, they impose considerable short-term financial strain.

The impact of these restructuring charges can be summarized as follows:

- Reduced Reported EBIT: The EUR 35.7 million in restructuring costs directly lowered Grammer's reported Earnings Before Interest and Taxes for 2024.

- Short-Term Financial Pressure: Despite the anticipated long-term benefits, these expenses create immediate financial headwinds for the company.

- Distorted Profitability Metrics: The difference between reported EBIT and operating EBIT highlights the temporary but substantial effect of these charges on profitability indicators.

Exposure to Volatile Raw Material Costs and Supply Chain Disruptions

Grammer, like many in the automotive supply chain, remains vulnerable to fluctuating raw material prices. For instance, the cost of plastics and metals, key components in their products, saw significant increases throughout 2024, impacting their cost of goods sold. This volatility directly affects profit margins if these increases cannot be fully passed on to customers.

Supply chain disruptions, especially the persistent semiconductor shortage, continue to pose a significant threat. While the situation has eased somewhat from its peak, the automotive sector still experienced production slowdowns in late 2024 and early 2025 due to component availability. This can lead to delayed deliveries and reduced output for Grammer.

These challenges can translate into:

- Increased production costs: Higher raw material prices directly inflate manufacturing expenses.

- Reduced profitability: Inability to fully offset cost increases with higher selling prices.

- Production delays: Shortages of critical components can halt or slow down assembly lines.

- Lower revenue: Reduced production output can lead to missed sales opportunities.

Grammer's revenue decline in 2024, falling to EUR 1,921.7 million from EUR 2,055.0 million in 2023, underscores its susceptibility to market downturns. The company's significant reliance on the commercial vehicle sector, which saw a 22.9% revenue drop in 2024, exposes it to economic cycles. Additionally, projected declines in the passenger car market, driven by trade uncertainties, further amplify this vulnerability. Operational issues in North America and substantial restructuring expenses of EUR 35.7 million in 2024 also negatively impacted profitability, creating short-term financial strain despite long-term strategic aims.

| Weakness | Impact | Data Point |

|---|---|---|

| Revenue Decline | Reduced overall financial performance | EUR 1,921.7 million (2024) vs EUR 2,055.0 million (2023) |

| Sectoral Reliance (Commercial Vehicles) | Vulnerability to economic cycles | -22.9% revenue drop in commercial vehicles (2024) |

| Restructuring Costs | Short-term financial pressure and reduced reported EBIT | EUR 35.7 million (2024) |

| Operational Issues (North America) | Underperformance and profitability drag | Continued challenges post-TMD Group divestment |

Preview Before You Purchase

Grammer SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a professionally structured and comprehensive report. No hidden surprises, just the full, detailed analysis ready for your use.

Opportunities

The automotive interiors market is experiencing robust growth, with projections indicating a compound annual growth rate of around 5-7% through 2028. This expansion is fueled by consumers actively seeking more sophisticated and personalized cabin experiences, including advanced comfort features and integrated smart technologies. Grammer's established strengths in developing ergonomic and safe interior components are perfectly aligned to meet this evolving demand.

The automotive industry's rapid electrification presents a significant opportunity for Grammer. As electric vehicles (EVs) gain market share, there's a growing demand for redesigned interiors that prioritize minimalist design, smart technology integration, and, crucially, sustainable materials. This shift allows Grammer to leverage its expertise in seating and interior components by developing innovative solutions using recycled fabrics, bio-based plastics, and lightweight composites.

Grammer can capitalize on this trend by investing in research and development for eco-friendly materials. For instance, the global market for sustainable automotive materials is projected to reach over $10 billion by 2027, indicating substantial growth potential. By offering advanced, environmentally conscious interior solutions, Grammer can position itself as a key supplier to EV manufacturers, meeting both regulatory demands and consumer preferences for greener vehicles.

The commercial vehicle market, after a challenging 2024, is showing strong signs of recovery heading into 2025. Analysts predict a rebound driven by fleet modernization and increased logistics needs.

This market upturn offers Grammer a significant opportunity to boost sales and profitability, particularly in its higher-margin commercial vehicle seating division. Companies are investing in new vehicles that prioritize driver comfort, safety, and advanced technology, areas where Grammer excels.

For instance, the global commercial vehicle market is anticipated to grow by approximately 5-7% in 2025, with specific segments like long-haul trucking expected to see even higher demand. Grammer's innovative seating solutions, designed for ergonomics and durability, are well-positioned to capitalize on this renewed investment.

Leveraging Synergies with Ningbo Jifeng

Grammer's majority ownership by Ningbo Jifeng, following the integration of Jifeng Automotive Interior Group, presents a significant opportunity to unlock operational efficiencies. This strategic alignment allows for the optimization of Grammer's global production network by potentially consolidating manufacturing processes and sharing best practices, thereby reducing costs and improving throughput.

The synergy with Ningbo Jifeng also opens doors for market expansion, particularly within the rapidly growing Asia-Pacific (APAC) region. Leveraging Jifeng's established presence and distribution channels in China, Grammer can accelerate its market penetration and increase its sales volume in this key automotive market. For instance, in 2024, the APAC region is projected to be a major growth driver for the automotive industry, with China alone accounting for a substantial portion of global vehicle sales.

Further opportunities lie in:

- Enhanced supply chain integration: Streamlining procurement and logistics by combining resources and negotiating better terms with suppliers.

- Cross-selling opportunities: Offering Grammer's interior solutions to Jifeng's existing customer base and vice versa.

- Joint R&D initiatives: Collaborating on the development of new materials and technologies for automotive interiors, potentially leading to innovative product offerings.

- Access to capital: Benefiting from Ningbo Jifeng's financial strength to fund further expansion and technological advancements.

Digitalization and Smart Manufacturing Adoption

The automotive sector's embrace of digitalization and smart manufacturing presents a significant opportunity for Grammer. By continuing its investment in digital transformation, exemplified by initiatives like its Shared Service Center in Serbia, Grammer can unlock substantial gains in operational efficiency and cost reduction.

This strategic focus allows for streamlined processes and improved resource allocation, directly impacting the bottom line. For instance, Grammer's commitment to efficiency improvements in 2023 aimed to reduce production costs by an estimated 3-5% through process optimization and automation.

Furthermore, these advancements bolster Grammer's capacity for innovation and faster product development cycles. The ability to leverage data analytics and smart technologies in manufacturing can lead to quicker adaptation to evolving market demands and enhanced product quality.

- Enhanced Operational Efficiency: Digitalization streamlines workflows, reducing manual intervention and potential errors.

- Cost Savings: Smart manufacturing techniques, including automation and predictive maintenance, lower operational expenses.

- Improved Product Development: Data-driven insights from smart factories accelerate R&D and product customization.

- Competitive Advantage: Early adoption of Industry 4.0 principles positions Grammer favorably against less digitized competitors.

Grammer is well-positioned to benefit from the increasing consumer demand for premium and technologically advanced automotive interiors, a trend expected to continue driving market growth through 2025 and beyond.

The ongoing electrification of the automotive sector creates a significant opportunity for Grammer to supply redesigned interiors optimized for EVs, focusing on lightweight materials and integrated smart features.

The projected recovery and growth in the commercial vehicle market for 2025 offers Grammer a chance to increase sales, particularly with its specialized, high-comfort seating solutions for this segment.

Leveraging its majority ownership by Ningbo Jifeng provides Grammer with avenues for operational efficiencies, market expansion in the APAC region, and enhanced supply chain integration.

Grammer's commitment to digitalization and smart manufacturing promises to deliver substantial improvements in operational efficiency, cost reduction, and accelerated product development.

| Opportunity Area | Description | Projected Impact/Data Point |

|---|---|---|

| Premium Interior Demand | Growing consumer desire for sophisticated and personalized cabin experiences. | Automotive interiors market CAGR of 5-7% through 2028. |

| EV Interior Solutions | Developing interiors for electric vehicles emphasizing minimalism, smart tech, and sustainability. | Global sustainable automotive materials market projected to exceed $10 billion by 2027. |

| Commercial Vehicle Market Rebound | Capitalizing on fleet modernization and increased logistics needs for commercial vehicles. | Global commercial vehicle market anticipated to grow 5-7% in 2025. |

| Ningbo Jifeng Synergy | Operational efficiencies, market expansion (APAC), and R&D collaboration. | APAC region a major growth driver for automotive industry in 2024. |

| Digitalization & Smart Manufacturing | Streamlining processes, reducing costs, and accelerating innovation through digital transformation. | Grammer's 2023 efficiency initiatives aimed for 3-5% production cost reduction. |

Threats

The passenger car market is facing a continued downturn, with projections indicating this trend will likely persist into 2025. This is largely due to ongoing trade uncertainties and the persistent affordability challenges associated with electric vehicles (EVs), which dampens consumer demand.

This sustained negative market sentiment directly threatens Grammer's automotive interior component sales. A shrinking overall market means fewer vehicles being produced, directly translating to lower demand for Grammer's specialized parts and potentially impacting their overall revenue streams for the foreseeable future.

The automotive supplier landscape is becoming increasingly competitive, fueled by significant structural changes and escalating operational costs. This intense rivalry is particularly pronounced within the electric vehicle (EV) sector, where overcapacity is a growing concern.

Major industry players are channeling substantial investments into research and development, aiming to gain a technological edge. This aggressive R&D spending by competitors poses a direct threat to Grammer's market share and could potentially squeeze its profit margins.

For instance, in 2024, the global automotive supplier market was valued at approximately $3.2 trillion, with projections indicating continued growth but also heightened competitive pressures as new entrants and established firms vie for dominance, especially in the burgeoning EV supply chain.

Escalating geopolitical tensions and the imposition of new trade barriers, like potential tariffs on automotive components, pose a significant threat to Grammer. These disruptions could directly impact its global supply chain efficiency and the profitability of its international operations, which rely on a widespread manufacturing presence.

Inflation, High Interest Rates, and Economic Pressures

Persistent economic headwinds, characterized by elevated interest rates and ongoing inflation, pose a significant threat by potentially reducing consumer appetite for new vehicles. For instance, the Federal Reserve’s benchmark interest rate, held in the 5.25%-5.50% range through early 2025, directly impacts auto loan affordability, making purchases less attractive. This scenario could translate into a more subdued market performance for automotive manufacturers, hindering a robust recovery.

These financial pressures also translate into increased operational expenses for automakers. Higher borrowing costs for capital investments and increased prices for raw materials, such as steel and semiconductors, can squeeze profit margins. For example, the average price of new vehicles in the US remained stubbornly high in late 2024, often exceeding $48,000, reflecting these underlying cost pressures and dampening demand.

- Reduced Consumer Spending: Higher interest rates make car loans more expensive, discouraging purchases.

- Increased Manufacturing Costs: Inflation drives up prices for materials and labor.

- Slower Market Recovery: Economic uncertainty leads to cautious consumer behavior and delayed purchases.

- Impact on Profitability: Rising operational costs and potentially lower sales volumes can negatively affect manufacturer earnings.

Cybersecurity Risks and Data Breaches

Grammer, like many in the increasingly connected automotive sector, faces escalating cybersecurity threats. As vehicles and their supply chains become more sophisticated and reliant on digital systems, the potential for disruptive attacks, such as ransomware or supply chain compromises, grows significantly. For instance, a 2024 report indicated a 40% increase in reported cybersecurity incidents within the manufacturing sector year-over-year, a trend directly impacting automotive suppliers.

A successful cyberattack could lead to severe operational disruptions for Grammer, halting production lines and impacting delivery schedules. Beyond immediate financial losses, the reputational damage from a data breach, especially concerning sensitive customer or proprietary information, could be substantial and long-lasting. The automotive industry, with its complex global networks, presents a broad attack surface, making robust cybersecurity measures critical for all participants, including key component manufacturers like Grammer.

- Increased attack surface: The growing digitalization of automotive manufacturing and vehicle systems expands opportunities for cyber threats.

- Supply chain vulnerabilities: Attacks targeting suppliers can have cascading effects, disrupting production for multiple manufacturers.

- Reputational and financial impact: Data breaches and operational shutdowns can lead to significant financial penalties and loss of customer trust.

- Industry-wide trend: Cybersecurity incidents in manufacturing saw a notable rise in 2024, highlighting the pervasive nature of this risk.

Grammer faces significant threats from a declining passenger car market, exacerbated by EV affordability issues and trade uncertainties, directly impacting interior component demand. Intense competition, particularly in the EV sector with overcapacity concerns, coupled with aggressive R&D spending by rivals, pressures Grammer's market share and profitability.

Geopolitical instability and trade barriers disrupt global supply chains and international operations, while persistent economic headwinds like high interest rates (Federal Reserve rate at 5.25%-5.50% through early 2025) reduce vehicle affordability and increase operational costs for automakers. Escalating cybersecurity threats, with manufacturing sector incidents up 40% in 2024, pose risks of operational disruption and reputational damage.

| Threat Category | Specific Threat | Impact on Grammer | Relevant Data/Context |

|---|---|---|---|

| Market Downturn | Declining Passenger Car Market | Reduced demand for interior components, lower revenue. | Projections indicate persistence into 2025; EV affordability challenges cited. |

| Competition | Intense Rivalry in EV Sector | Pressure on market share and profit margins. | Overcapacity concerns, aggressive R&D spending by major players. Global auto supplier market valued at $3.2 trillion in 2024. |

| Economic Factors | High Interest Rates & Inflation | Decreased consumer spending on vehicles, increased operational costs. | Federal Reserve rate 5.25%-5.50% through early 2025; Avg. new vehicle price in US >$48,000 in late 2024. |

| Geopolitical Risks | Trade Barriers & Tariffs | Supply chain disruptions, reduced profitability of international operations. | Potential tariffs on automotive components impacting global manufacturing presence. |

| Cybersecurity | Increased Cyberattacks | Operational halts, reputational damage from data breaches. | 40% year-over-year increase in manufacturing sector cybersecurity incidents in 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Grammer's official financial reports, comprehensive market research studies, and expert industry analyses to provide a well-rounded perspective.