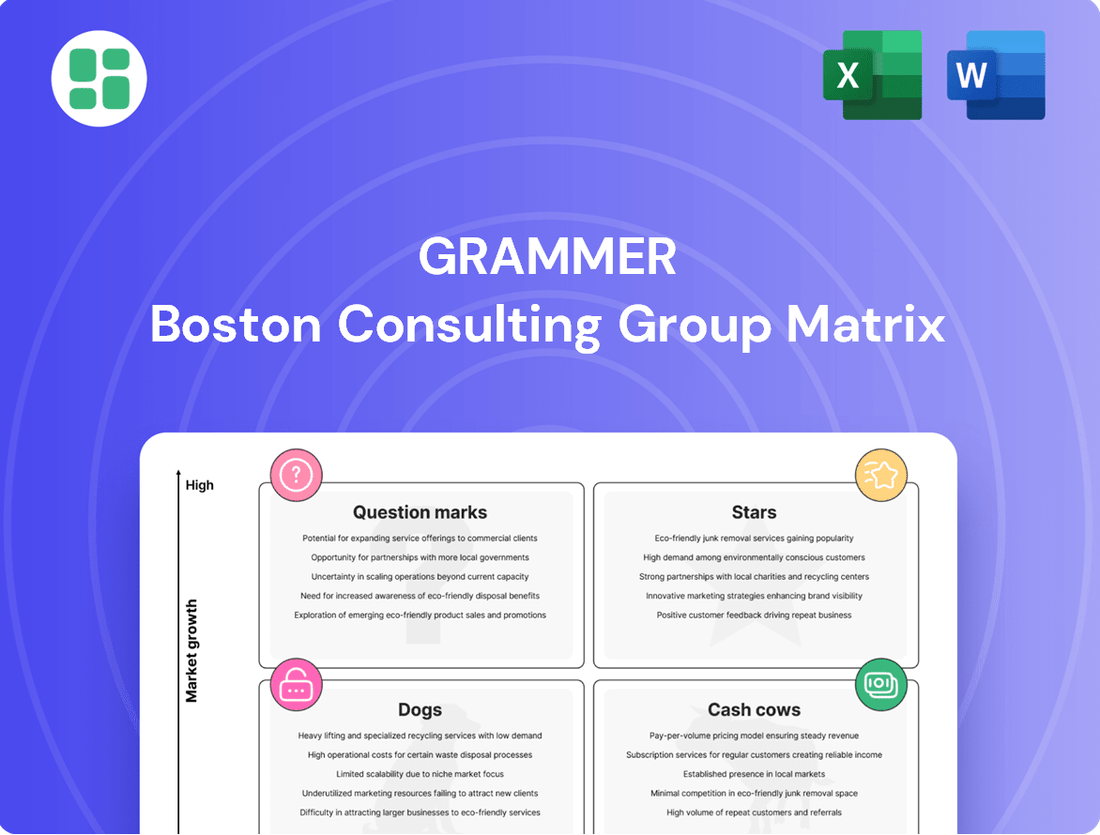

Grammer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grammer Bundle

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and relative market share. This preview offers a glimpse into how these categories can illuminate strategic decisions.

Unlock the full potential of strategic planning by purchasing the complete BCG Matrix. Gain detailed insights into each product's position, enabling you to make informed decisions about resource allocation, investment, and divestment for optimal business growth.

Stars

The automotive interiors and seating market is booming, with electric and autonomous vehicle demand being a major catalyst. Grammer's specialization in advanced, ergonomic seating for EVs is a strategic advantage in this expanding sector. For example, the global automotive seating market was valued at approximately USD 75 billion in 2023 and is projected to grow significantly, with EVs representing a key growth driver.

Smart interior components, such as digital cockpits and advanced lighting, represent a high-growth area within the automotive sector. The market is seeing a significant shift towards these innovations, driven by consumer demand for enhanced user experiences and connectivity.

Grammer, through its integration with Jifeng Automotive Interior Group, is well-positioned to capitalize on this trend. Their focus on research and development suggests a pipeline of smart interior modules designed to meet these evolving market needs.

These sophisticated interior solutions offer substantial value. For instance, the global automotive interior market was valued at approximately $180 billion in 2023 and is projected to grow significantly, with smart components being key drivers of this expansion.

Grammer's ergonomic and safety-enhanced driver seats for commercial vehicles represent a strong contender in the market. The commercial vehicle seat sector is experiencing robust growth, with a projected CAGR of 4.4% from 2025 to 2034, fueled by a growing emphasis on driver comfort and well-being.

Grammer's focus on features like adjustable backrests directly addresses driver fatigue and promotes better health, making their products highly desirable for fleet operators. This commitment to innovation and compliance with health regulations positions these seats as a strategic product for Grammer.

Modular and Multi-System Group (MSG) Seats

Grammer's Modular and Multi-System Group (MSG) seats are a key growth area, especially within the commercial vehicle market. These seats are designed with integrated storage and a modular approach, offering significant flexibility and improved functionality for users.

The inherent modularity of MSG seats allows Grammer to cater to a diverse range of commercial vehicle applications, enabling customization to meet specific customer needs. This adaptability is a strong selling point, broadening their appeal and market reach. In 2024, Grammer reported a notable increase in demand for these innovative seating solutions, reflecting their growing importance in the company's product strategy.

- Product Innovation: MSG seats offer integrated storage and modular designs, enhancing user experience and utility.

- Market Focus: Strong traction observed in the commercial vehicle sector, indicating a strategic alignment with market needs.

- Growth Driver: The modularity facilitates customization, expanding the addressable market and sales potential.

- Financial Impact: Increased demand in 2024 contributed positively to Grammer's revenue streams in this segment.

Sustainable Interior Solutions

Sustainable Interior Solutions represent a significant growth opportunity for Grammer, fitting squarely into the Stars quadrant of the BCG matrix. The automotive industry's increasing demand for eco-friendly materials and practices directly fuels this segment's potential. Grammer's 'Green Company' initiative, focusing on developing products from recycled and sustainable sources, positions them well to capitalize on this trend.

This focus on sustainability is not just a niche; it's becoming a mainstream requirement. OEMs are actively seeking suppliers who can provide interior components made from environmentally conscious materials without compromising on quality, comfort, or safety. For instance, by 2024, many major automotive manufacturers have set ambitious targets for the percentage of recycled content in their vehicles, creating a robust market for Grammer's sustainable offerings.

- Market Growth: The global automotive lightweight materials market, which includes sustainable alternatives, is projected to reach over $35 billion by 2027, with a significant portion driven by eco-friendly innovations.

- OEM Demand: Major automotive manufacturers are increasingly incorporating sustainability metrics into their supplier selection criteria, prioritizing partners with strong environmental credentials.

- Consumer Preference: Consumer surveys consistently show a growing preference for vehicles with sustainable interiors, influencing OEM purchasing decisions.

- Grammer's Advantage: Grammer's investment in R&D for sustainable materials and manufacturing processes provides a competitive edge in this expanding market.

Sustainable interior solutions are a prime example of Grammer's Stars in the BCG matrix. This segment benefits from strong market growth driven by increasing demand for eco-friendly automotive components. Grammer's commitment to using recycled and sustainable materials, exemplified by their 'Green Company' initiative, directly addresses this trend.

The automotive industry's push towards sustainability is creating significant opportunities. By 2024, many leading automakers have established targets for incorporating recycled content into their vehicles, making sustainable interior solutions a critical requirement for suppliers.

Grammer's focus on developing innovative, sustainable materials and manufacturing processes gives them a competitive advantage. This strategic alignment with market demands and evolving consumer preferences positions their sustainable interior offerings for continued success and expansion.

| Segment | Market Growth Potential | Grammer's Position | Key Drivers |

|---|---|---|---|

| Sustainable Interior Solutions | High | Star | OEM sustainability targets, consumer preference for eco-friendly products, regulatory push for greener manufacturing. |

| Commercial Vehicle Seats (MSG) | High | Star | Demand for driver comfort and well-being, modularity for customization, increasing fleet modernization. |

| Smart Interior Components | High | Star | Consumer demand for enhanced user experience, integration of digital technologies, connectivity features. |

What is included in the product

Strategic framework for analyzing product portfolios based on market growth and share.

A clear visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Grammer's standard headrests and armrests for passenger vehicles are classic cash cows. With a deep history in manufacturing these essential interior components, Grammer benefits from established relationships with major automakers and highly optimized production. This mature market segment, characterized by consistent demand, fuels stable cash flow for the company.

Grammer's conventional driver seats for trucks and buses represent a strong Cash Cow within its portfolio. This segment is the company's bedrock, consistently delivering significant revenue. In 2024, the OEM market for commercial vehicle seating remained robust, with Grammer holding a substantial share.

The demand for these seats from major truck and bus manufacturers is stable, ensuring predictable and substantial cash flow. While growth in this mature market is moderate, the high market penetration and consistent order volumes solidify its Cash Cow status, providing the financial stability needed to invest in other business areas.

Grammer's interior components for mid-range passenger cars, such as center consoles, represent a significant portion of their business, likely holding a strong market share. This stability is fueled by consistent demand from established automotive manufacturers, providing a predictable revenue stream.

In 2024, the automotive industry saw continued demand for mid-range vehicles, with global passenger car production estimated to exceed 60 million units. Grammer's focus on these core components positions them to benefit from this ongoing market activity, leveraging optimized production for healthy profit margins.

Seating Systems for Off-Road Machinery (Established Models)

Grammer's seating systems for established off-road machinery models are considered cash cows. This segment benefits from high market share due to Grammer's long-standing contracts and strong customer relationships within this niche.

Despite some cyclicality in the broader commercial vehicle market during 2024, Grammer's off-road seating business demonstrated resilience. The consistent demand is further bolstered by the extended lifecycle support requirements typical for these specialized seating products.

- Segment: Seating Systems for Off-Road Machinery (Established Models)

- Market Share: High, due to established contracts and long-term relationships.

- Market Growth: Stable, supported by long product lifecycles and ongoing support needs.

- Revenue Contribution: Consistent and reliable, acting as a significant contributor to Grammer's overall revenue.

Aftermarket Spare Parts for Seating Systems

Grammer's aftermarket spare parts for seating systems represent a classic Cash Cow within its business portfolio. This segment is a significant driver of recurring income, contributing a solid 15% to the company's overall revenue.

This steady revenue stream highlights a mature, low-growth, yet highly profitable business area. The consistent demand for replacement parts for established vehicle fleets ensures a predictable and reliable cash flow, minimizing the need for substantial investments in marketing or the development of new products.

- Revenue Contribution: Aftermarket spare parts accounted for 15% of Grammer's revenue.

- Market Position: Represents a mature, low-growth, high-margin business segment.

- Demand Stability: Driven by steady and predictable demand from existing vehicle fleets.

- Profitability: Offers a reliable cash stream with relatively low investment requirements.

Grammer's established product lines, such as standard headrests and armrests for passenger vehicles, function as significant cash cows. These components benefit from optimized production processes and long-standing relationships with major automakers, ensuring a consistent and stable revenue stream. The demand in this mature market segment remains predictable, providing a reliable financial foundation for the company.

Similarly, Grammer's conventional driver seats for trucks and buses are a bedrock cash cow, consistently generating substantial revenue. In 2024, the commercial vehicle seating market remained strong, with Grammer maintaining a significant market share. This stability is driven by consistent demand from major manufacturers, solidifying its position as a key revenue generator.

| Product Segment | Market Position | Revenue Contribution | Growth Outlook | Profitability |

| Passenger Vehicle Interior Components (Headrests, Armrests) | High Market Share, Established Relationships | Consistent & Stable | Mature, Low Growth | High, Optimized Production |

| Commercial Vehicle Driver Seats (Trucks, Buses) | Substantial Market Share | Significant Revenue Generator | Stable Demand | Reliable Cash Flow |

What You’re Viewing Is Included

Grammer BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully-formatted report you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready tool for strategic decision-making.

Dogs

Legacy interior components for discontinued vehicle platforms typically fall into the Dogs category of the BCG Matrix. These products serve niche markets with shrinking demand as older car models are phased out, resulting in a low market share.

The costs associated with maintaining production lines or holding inventory for these components can be substantial, while the returns are minimal. For instance, Grammer's 2024 financial reports indicated a strategic focus on optimizing its product portfolio, which often involves divesting or reducing emphasis on low-volume, legacy product lines to improve overall profitability and resource allocation.

Grammer's Automotive segment in EMEA faced a revenue drop, with standardized interior trim parts in highly competitive markets being a key factor. These products, characterized by low margins and intense rivalry, struggle to command significant market share or achieve robust profitability.

In 2024, the Automotive division's revenue in EMEA saw a notable decline, reflecting the pressures on these less differentiated components. The market for such parts is often saturated, with limited pricing power for suppliers like Grammer.

Consequently, these standardized interior trim parts are likely categorized as Dogs in the BCG Matrix. Their low growth potential and Grammer's probable modest market share in these specific segments suggest they may not warrant substantial investment and could be considered for divestment or restructuring.

Grammer's divestiture of its TMD Group in North America in September 2024 aligns with the BCG Matrix's classification of 'dogs'. These are businesses with low market share and low growth potential, often requiring significant cash infusions without promising returns. The sale signals a strategic move to shed underperforming or non-core assets, freeing up capital and management focus for more promising ventures.

Outdated Seating Technologies with Low Ergonomic Features

Outdated seating technologies with low ergonomic features are firmly positioned as Dogs in the Grammer BCG Matrix. As the automotive industry pivots towards enhanced comfort, advanced ergonomics, and stringent safety standards, these older seating solutions are experiencing a significant decline in market share. For instance, the global automotive seating market, valued at approximately $65 billion in 2023, is increasingly dominated by smart seating systems and advanced materials, leaving traditional, less ergonomic options behind.

Products failing to align with evolving consumer expectations or new regulatory mandates face substantial sales challenges and are consequently slated for discontinuation. By 2024, consumer demand for features like lumbar support, heating, ventilation, and memory functions has become a baseline expectation, particularly in mid-range and premium vehicle segments. This shift renders older, basic seating designs increasingly obsolete.

- Declining Market Share: Older seating technologies are losing ground as consumers prioritize comfort and advanced features.

- Regulatory Pressure: Evolving safety and comfort regulations further disadvantage outdated seating solutions.

- Consumer Demand Shift: Modern vehicles increasingly feature integrated ergonomic adjustments and smart seating capabilities.

- Phased Obsolescence: Manufacturers are phasing out production of seating that does not meet current market demands and technological advancements.

Products Requiring High Manual Labor in High-Cost Regions

Grammer's strategic initiatives, like the 'Top 10 program' focused on reducing excess capacities in EMEA, highlight a conscious effort to mitigate the impact of high labor costs. This program signals a move away from operational models heavily dependent on expensive manual labor in regions facing economic headwinds.

Products that fall into the 'Dogs' category within the BCG Matrix for Grammer, particularly those requiring significant manual labor in high-cost regions with diminishing demand, are likely characterized by low profitability and a shrinking market share. These offerings represent a drain on resources, yielding inadequate returns.

For instance, if a specific product line, like certain seating components manufactured through labor-intensive processes in Germany, experiences a decline in automotive production orders in that region, it would fit the 'Dog' profile. In 2024, the automotive industry in Europe has faced ongoing supply chain challenges and fluctuating demand, exacerbating the difficulties for such products.

- High Labor Costs: Products manufactured using extensive manual assembly in regions like Western Europe, where average manufacturing wages can exceed €30 per hour, become inherently less competitive.

- Declining Demand: If a particular product segment, for example, specialized agricultural machinery components, sees a year-over-year decrease in orders by 15% due to market saturation or technological shifts, it signals declining demand.

- Low Profitability: Products with profit margins falling below 5% due to high production costs and competitive pricing pressures are indicative of 'Dog' status.

- Resource Drain: Continued investment in maintaining production lines for these products, even with low returns, diverts capital and management attention from more promising growth areas.

Products classified as Dogs within Grammer's BCG Matrix represent legacy offerings with low market share and minimal growth prospects. These items, often legacy interior components for discontinued vehicle platforms or outdated seating technologies, struggle to compete in a rapidly evolving automotive landscape.

Grammer's 2024 strategic focus on portfolio optimization, as seen in the divestiture of its TMD Group, underscores the effort to shed such underperforming assets. These 'Dogs' typically yield low profitability, often below 5%, and can drain resources due to high production costs, especially those involving labor-intensive processes in high-cost regions.

The declining demand for standardized interior trim parts in competitive markets, as evidenced by revenue drops in Grammer's Automotive segment in EMEA during 2024, further solidifies their 'Dog' status. Such products face intense rivalry and limited pricing power, making them candidates for restructuring or divestment.

Question Marks

The market for autonomous vehicle interiors, including innovative seating systems, is a burgeoning sector with substantial growth prospects. Grammer, a key player in automotive seating, is well-positioned to capitalize on this trend, though its current market share in this specific, developing segment is likely modest given the early stages of autonomous technology adoption.

Significant research and development investment is crucial for seating systems in future autonomous vehicles, as they must adapt to new interior layouts and passenger experiences. If the adoption of autonomous driving accelerates, these advanced seating solutions could evolve from question marks into Stars within Grammer's product portfolio, offering high growth and market share potential.

The premium and luxury car sectors are booming, fueling a desire for more sophisticated and tech-laden interiors. Grammer's involvement in this high-margin area requires substantial investment in cutting-edge features and premium materials, positioning them in a segment where their market share is still growing. This strategic focus on advanced interior modules, particularly in 2024, could unlock significant profitability for the company.

Grammer's innovative child booster seats with integrated technology represent a classic question mark in the BCG matrix. While the company has a presence in the child booster seat market, these technologically advanced versions are new entrants. The market for child safety seats is experiencing growth, with global sales projected to reach over $9.5 billion by 2026, indicating a promising demand for innovative solutions.

These seats, incorporating features like real-time safety monitoring or advanced impact absorption, are entering a growing segment. However, their success hinges on consumer adoption and effective marketing to overcome the initial uncertainty. Grammer will need to invest heavily in R&D and promotional activities to establish these products and potentially shift them into the star or cash cow categories.

Components Utilizing New Sustainable and Lightweight Materials

Grammer's investment in sustainable and lightweight materials positions its components in a rapidly expanding market. This aligns with a significant industry shift towards eco-friendly solutions, with the global market for lightweight automotive materials projected to reach over $40 billion by 2028, growing at a CAGR of around 6.5%.

While the overall market is robust, Grammer's specific market share for components utilizing these novel materials might currently be in the nascent stages. This is typical as production scales and customer adoption increases, placing these products in a "question mark" category within the BCG matrix. These strategic investments, though cash-intensive, are crucial for future growth and market relevance.

- Market Growth: The demand for sustainable and lightweight materials in automotive and other industries is experiencing significant expansion.

- Grammer's Position: Grammer is investing heavily in R&D for these materials, aiming to capture future market share.

- Investment Needs: Developing and scaling production for these new components requires substantial capital outlay.

- Strategic Importance: These initiatives are vital for Grammer's long-term competitiveness and alignment with industry trends.

Seating Solutions for Niche, High-Growth Off-Highway Applications

Grammer is actively exploring seating solutions for niche, high-growth off-highway applications, moving beyond traditional construction and agricultural machinery. These emerging sectors, such as advanced agricultural robotics or highly autonomous construction equipment, represent a strategic focus. While these markets may currently be small, their rapid expansion offers substantial upside potential for Grammer.

For instance, the global autonomous farming market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 7.5 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 17%. This growth indicates a fertile ground for specialized seating designed for these new vehicle types.

- Niche Market Focus: Grammer is targeting specialized agricultural technology and highly automated construction vehicles.

- Growth Potential: These markets, though currently small, show significant growth trajectories.

- Strategic Investment: Targeted investment in these areas is expected to yield future market share gains.

- Market Data: The autonomous farming market alone is set for substantial expansion, highlighting opportunities.

Grammer's innovative child booster seats with integrated technology are a prime example of a question mark. While the market for child safety seats is growing, with global sales projected to exceed $9.5 billion by 2026, these technologically advanced versions are new entrants. Significant investment in R&D and marketing is needed to convert these into stars.

Grammer's components made from sustainable and lightweight materials also fall into the question mark category. The market for these materials is expanding, expected to reach over $40 billion by 2028, but Grammer's market share in this specific application is still developing. Substantial capital is required to scale production and gain customer traction.

The company’s focus on seating for niche, high-growth off-highway applications, like autonomous farming, represents another question mark. The autonomous farming market alone was valued at approximately $2.5 billion in 2023 and is anticipated to grow significantly. Grammer's current share in these specialized segments is likely modest, necessitating targeted investment.

| Product Category | Market Growth | Grammer's Current Position | Investment Needs | Potential Future |

|---|---|---|---|---|

| Tech-Integrated Child Booster Seats | Growing (>$9.5B by 2026) | Nascent | High R&D, Marketing | Star / Cash Cow |

| Sustainable/Lightweight Materials Components | Robust (>$40B by 2028) | Developing | Capital for Scaling | Star / Cash Cow |

| Off-Highway Specialized Seating (e.g., Autonomous Farming) | High Growth (e.g., Autonomous Farming ~17% CAGR) | Modest | Targeted R&D, Market Entry | Star |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive landscape analyses, to accurately position each business unit.