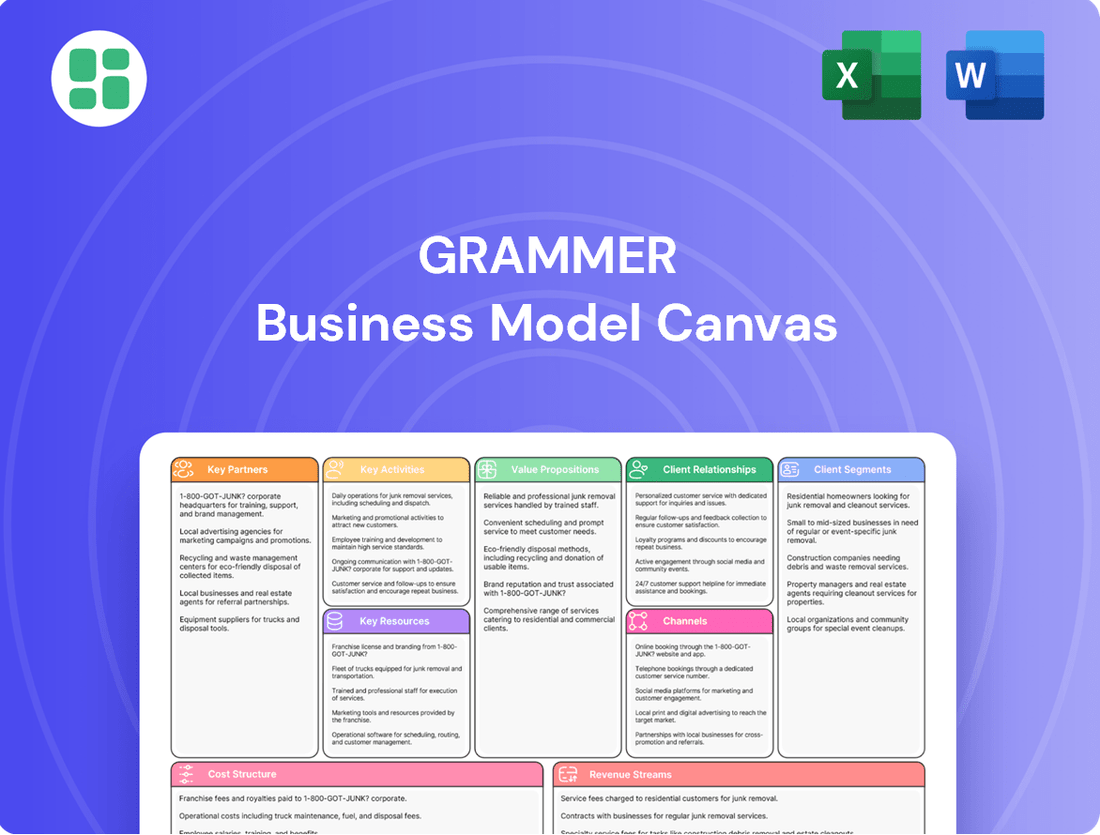

Grammer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grammer Bundle

Curious about how Grammer achieves its market position? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Ready to uncover the strategic framework that drives their operations?

Unlock the complete strategic blueprint behind Grammer's success with our detailed Business Model Canvas. This in-depth analysis reveals their customer segments, value propositions, and revenue streams, providing actionable insights for your own business strategy. Elevate your understanding and download the full version today!

Partnerships

Grammer AG's primary focus is supplying interior components and seating systems to major automotive and commercial vehicle manufacturers, known as Original Equipment Manufacturers (OEMs). These relationships are fundamental to Grammer's business model, enabling seamless integration of their products into new vehicle designs and fostering collaborative development of innovative solutions. In 2024, Grammer continued to solidify its position by securing significant supply agreements with leading OEMs, reflecting the ongoing demand for advanced interior solutions in the automotive sector.

Grammer’s collaborations with suppliers of fabrics, foams, metals, plastics, and electronic components are crucial for a steady supply chain. These partnerships are key to managing costs effectively and integrating new, innovative materials into their product lines.

These relationships enable Grammer to uphold high quality standards and boost production efficiency. For instance, in 2024, Grammer continued to strengthen its ties with key material providers, ensuring they could meet the increasing demand for sustainable and advanced materials in the automotive and commercial vehicle sectors.

Grammer actively partners with technology firms and research institutions to pioneer advanced seating solutions. These collaborations are crucial for integrating cutting-edge features like health monitoring systems and ensuring readiness for autonomous driving technology, as seen in their ongoing work with specialized design houses.

These strategic alliances empower Grammer to differentiate its product offerings and maintain a leading position in automotive interior innovation. For instance, in 2024, Grammer continued to invest in R&D, with a significant portion of their innovation budget allocated to developing smart interior technologies and advanced ergonomic seating concepts in partnership with external specialists.

Logistics and Distribution Partners

Grammer relies heavily on a robust network of logistics and distribution partners to ensure the seamless flow of its seating systems and related components to Original Equipment Manufacturers (OEMs) worldwide. These partnerships are foundational for meeting the demanding delivery schedules of the automotive industry.

These collaborations with freight forwarders, warehousing providers, and transportation specialists are crucial for maintaining Grammer's competitive edge. By optimizing routes and storage, Grammer can effectively reduce lead times and manage supply chain expenses. For example, in 2023, Grammer reported that its logistics costs represented a significant portion of its operating expenses, underscoring the importance of efficient partner management.

- Global Reach: Partnerships with international logistics providers enable Grammer to serve its OEM clients across diverse geographical markets.

- Cost Efficiency: Negotiating favorable terms with transportation and warehousing partners helps to minimize overall supply chain expenditures.

- Reliability: Dependable logistics partners ensure that components arrive at manufacturing plants on time, preventing production line stoppages.

- Inventory Management: Strategic warehousing agreements allow for optimized inventory levels, reducing holding costs and improving responsiveness.

Strategic Acquirers/Shareholders

The acquisition of Grammer by Ningbo Jifeng Auto Parts in December 2024 represents a pivotal strategic partnership. This integration is expected to foster consolidated production footprints, allowing for more efficient manufacturing processes and potentially reducing overhead. The combined entity can leverage shared research and development efforts, accelerating innovation in automotive interiors and seating solutions.

This alliance is projected to unlock significant cost synergies through economies of scale in procurement and shared operational efficiencies. Such synergies are crucial for enhancing Grammer's overall competitiveness in the global automotive supply chain. The financial stability of Grammer is also anticipated to improve through this strategic alignment, providing a stronger foundation for future growth and investment.

- Consolidated Production: Streamlined manufacturing across combined facilities.

- Shared R&D: Accelerated innovation through joint development efforts.

- Cost Synergies: Realization of savings through economies of scale and operational efficiencies.

- Enhanced Competitiveness: Improved market position and financial stability.

Grammer's key partnerships extend to its suppliers of raw materials and components, ensuring a consistent flow of high-quality inputs. These collaborations are vital for cost management and the incorporation of new, advanced materials. In 2024, Grammer continued to foster strong relationships with these partners, emphasizing sustainability and innovation in material sourcing.

Collaborations with technology firms and research institutions are central to Grammer's innovation strategy, particularly in developing advanced seating features for future mobility. These partnerships drive the integration of smart technologies and prepare Grammer for the evolving automotive landscape. In 2024, investments in R&D focused on these areas, leveraging external expertise.

The acquisition by Ningbo Jifeng Auto Parts in December 2024 marks a significant strategic partnership, aiming to consolidate production, enhance R&D, and create substantial cost synergies. This integration is expected to bolster Grammer's market competitiveness and financial resilience.

What is included in the product

A structured framework for outlining and analyzing a business's core components, from customer relationships to revenue streams.

Provides a visual representation of how a business creates, delivers, and captures value.

Eliminates the frustration of scattered ideas by providing a structured framework to address customer pains.

Visually maps how your business directly solves customer problems, offering clarity and focus.

Activities

Grammer's commitment to Research and Development (R&D) and Design is a cornerstone of its business model, driving innovation in seating systems and interior components. The company actively invests in exploring new materials and ergonomic designs to enhance comfort, safety, and functionality. This focus ensures Grammer stays ahead of evolving industry trends and customer expectations.

In 2024, Grammer continued to prioritize R&D, particularly for the burgeoning electric and autonomous vehicle markets. Their design efforts are centered on creating advanced seating solutions that integrate seamlessly with new vehicle architectures and user interfaces. This strategic investment in innovation directly supports their ability to offer cutting-edge products that meet the demands of modern automotive interiors.

Grammer's core activities revolve around the large-scale manufacturing of automotive components. This includes producing headrests, armrests, and center consoles for passenger cars, as well as comprehensive seating solutions for commercial vehicles like trucks, buses, trains, and off-road equipment.

A critical focus is on optimizing these production processes globally. The company aims for peak efficiency, unwavering quality, and cost-effectiveness across its various manufacturing sites. For instance, in 2024, Grammer continued its efforts to streamline operations, with a particular emphasis on advanced manufacturing techniques to reduce waste and improve output consistency.

Grammer's key activities heavily involve managing a sophisticated global supply chain. This encompasses everything from procuring essential raw materials to ensuring the timely delivery of finished components to Original Equipment Manufacturers (OEMs) across the globe. In 2024, companies like Grammer are particularly focused on optimizing supplier relationships and inventory levels to maintain smooth operations.

Ensuring the resilience and efficiency of this intricate supply network is paramount. This involves proactive risk management, such as diversifying suppliers and implementing robust logistics strategies, to mitigate disruptions. For instance, in the automotive sector, where Grammer is a significant player, supply chain disruptions can have immediate and substantial financial impacts, underscoring the importance of these activities.

Quality Control and Testing

Grammer's commitment to quality control and testing is a cornerstone of its operations, particularly vital for the demanding automotive and commercial vehicle sectors. This involves meticulous checks to ensure every component, especially exhaust systems and seating solutions, meets stringent safety and durability standards. For instance, in 2024, Grammer's rigorous testing protocols likely contributed to its ability to maintain a strong market position by minimizing product recalls and ensuring customer satisfaction.

These activities are crucial for compliance with global automotive regulations, which are constantly evolving to prioritize safety and environmental impact. Grammer's investment in advanced testing equipment and skilled personnel directly supports its reputation for reliability. This focus on quality assurance helps the company exceed customer expectations, a key differentiator in competitive markets.

- Ensuring compliance with ISO/TS 16949 standards

- Conducting durability testing on seating systems, simulating millions of cycles

- Performing emissions testing on exhaust system components to meet Euro 7 regulations

- Implementing statistical process control (SPC) across manufacturing lines

Sales, Marketing, and Customer Collaboration

Grammer's key activities in sales, marketing, and customer collaboration revolve around cultivating deep partnerships with Original Equipment Manufacturers (OEMs). This is achieved through direct sales engagement, where dedicated teams present technical solutions and innovative product capabilities. For instance, in 2023, Grammer reported a notable increase in its order intake, driven by strong demand from automotive OEMs, underscoring the success of these direct engagement strategies.

Collaborative development projects are central to understanding and addressing the unique requirements of each OEM client. By working closely with customers on tailored solutions, Grammer aims to secure long-term contracts, ensuring a stable revenue stream. This approach is vital for maintaining competitiveness in the fast-evolving automotive supply chain. The company's focus on innovation and customer-centricity has historically led to a high rate of repeat business.

- Direct Sales & Technical Presentations: Engaging OEMs with tailored product demonstrations and technical expertise.

- Collaborative Development: Partnering with clients to co-create customized solutions addressing specific needs.

- Long-Term Contract Acquisition: Securing stable revenue through multi-year agreements based on proven value.

- Understanding Customer Needs: Deeply analyzing OEM requirements to offer relevant and innovative offerings.

Grammer's key activities include manufacturing automotive components, managing its global supply chain, and ensuring stringent quality control. They also focus on R&D and design, particularly for emerging vehicle technologies, and engage in direct sales and collaborative development with OEMs. These efforts are crucial for innovation, efficiency, and maintaining strong customer relationships in the automotive sector.

Delivered as Displayed

Business Model Canvas

The preview you see of the Grammer Business Model Canvas is the actual document you will receive upon purchase. This is not a mockup or a sample, but a direct snapshot of the complete, ready-to-use file. You'll get full access to this exact, professionally formatted Business Model Canvas, allowing you to immediately start strategizing and refining your business.

Resources

Grammer's manufacturing facilities and equipment are the backbone of its operations, housing specialized machinery for critical processes like injection molding, foam production, and automated assembly. These are not just buildings; they are highly optimized production hubs designed for efficiency and scale. For instance, in 2023, Grammer continued to invest in modernizing its production lines, aiming to enhance automation and reduce waste across its global network of plants.

The company's extensive network of production sites, spread across continents, allows Grammer to cater to diverse regional market needs and maintain proximity to its key automotive customers. This global footprint is crucial for high-volume output and for ensuring timely delivery of components, supporting Grammer's role as a Tier 1 supplier. The strategic placement of these facilities, coupled with their advanced equipment, directly impacts production capacity and cost-effectiveness.

Grammer's skilled workforce, comprising engineers, designers, and production specialists, is a cornerstone of its business model. This expertise in areas like materials science and ergonomics directly fuels innovation and ensures the high quality of their automotive interior and commercial vehicle components. For instance, in 2024, Grammer continued to invest in training programs to maintain its edge in advanced manufacturing techniques.

Grammer's intellectual property, including patents on innovative seating mechanisms and proprietary designs for interior components, forms a crucial resource. This IP directly contributes to their competitive edge in the automotive and commercial vehicle sectors, protecting their technological advancements.

The company's advanced manufacturing know-how, particularly in comfort and safety technologies, further strengthens its position. This expertise, often protected through trade secrets and internal processes, is vital for maintaining product quality and efficiency, as seen in their ongoing development of lightweight seating solutions.

Global Supply and Distribution Network

Grammer's global supply and distribution network is a cornerstone of its business model, ensuring efficient material sourcing and product delivery worldwide. This established network is crucial for maintaining its extensive operational footprint across various continents.

In 2024, Grammer continued to leverage its robust infrastructure, which includes numerous production sites and logistics hubs strategically located to serve key automotive markets. This global reach allows for timely delivery of interior and exterior components, as well as suspension systems, to its diverse customer base.

- Supplier Relationships: Grammer maintains strong, long-term partnerships with a wide array of suppliers, ensuring a consistent and high-quality inflow of raw materials and components.

- Logistics Efficiency: The company utilizes a sophisticated logistics system to manage inventory and transportation, minimizing lead times and costs for its global clientele.

- Market Access: This network provides direct access to major automotive manufacturing centers in Europe, North America, and Asia, facilitating seamless integration into customer production lines.

Financial Capital

Financial capital is the lifeblood of Grammer's operations, enabling crucial investments in research and development to maintain a competitive edge. In 2024, the company's commitment to innovation is reflected in its ongoing R&D expenditures, which are vital for developing next-generation automotive components.

Sufficient financial resources are also essential for capital expenditures, such as upgrading manufacturing facilities. This ensures Grammer can meet evolving production demands and maintain high-quality standards. Furthermore, managing working capital effectively is key to smooth day-to-day operations, covering inventory, receivables, and payables.

Grammer's strategic initiatives, like the 'Top 10' program aimed at optimizing its global footprint and operational efficiency, require robust financial backing. Additionally, refinancing efforts in the current financial climate are critical for managing debt and ensuring long-term financial stability. For instance, in early 2024, Grammer successfully refinanced a significant portion of its debt, securing more favorable terms.

- R&D Investment: Essential for developing new technologies and staying ahead in the automotive supply chain.

- Capital Expenditures: Funding for plant upgrades and modernizations to enhance manufacturing capabilities.

- Working Capital Management: Ensuring liquidity for inventory, accounts receivable, and accounts payable.

- Strategic Initiatives & Refinancing: Supporting programs like 'Top 10' and managing debt for financial health.

Grammer's key resources encompass its advanced manufacturing infrastructure, a global network of production sites, and a highly skilled workforce. These are complemented by significant intellectual property, including patents and proprietary manufacturing know-how, all supported by a robust financial capital base and an efficient global supply chain. The company's strategic initiatives, such as its 'Top 10' program, are underpinned by these vital resources.

Value Propositions

Grammer's value proposition centers on delivering highly ergonomic and comfortable interior components and seating systems. These are meticulously designed to significantly improve the driving and riding experience for users.

This commitment to user well-being directly taps into the growing market demand for advanced comfort features in contemporary vehicles. For instance, in 2024, the global automotive seating market was valued at approximately $75 billion, with comfort and ergonomics being key differentiators for premium segments.

Grammer's enhanced safety features, including active head restraints and side-impact airbags, directly address the paramount concern for safety in the automotive industry. These innovations are crucial for vehicle manufacturers seeking to meet and exceed global safety standards, such as those set by Euro NCAP and NHTSA, which heavily influence consumer purchasing decisions.

The integration of features like child booster seats further solidifies Grammer's value proposition by offering comprehensive protection for all passengers. This commitment is reflected in the growing market demand for vehicles equipped with advanced safety systems, a trend that accelerated in 2024 as regulatory bodies continued to tighten requirements.

Grammer excels at creating customized and integrated interior designs, precisely fitting the unique needs of each automotive OEM. This means they don't just supply parts; they craft solutions that become a seamless part of the vehicle's overall aesthetic and function.

This bespoke approach is crucial in today's market, where car interiors are increasingly seen as extensions of living spaces, often referred to as the 'living room on wheels' concept. Grammer's ability to deliver these tailored designs allows automakers to truly differentiate their products.

For example, in 2024, Grammer's focus on integrated design solutions contributed to their strong partnerships with leading automotive manufacturers, enabling them to meet the growing demand for personalized and innovative cabin experiences.

High-Quality and Durable Products

Grammer's commitment to high-quality and durable products is a cornerstone of its value proposition, particularly evident in its seating systems and interior components. These are engineered to endure the demanding conditions of commercial vehicles and the daily wear and tear of passenger cars, directly impacting vehicle lifespan and owner contentment.

This focus on longevity translates into tangible benefits for customers. For instance, Grammer's seating solutions are designed for ergonomic support and resilience, reducing maintenance needs and enhancing the user experience over time. In 2023, Grammer reported a significant portion of its revenue stemming from its Commercial Vehicles segment, underscoring the market's demand for reliable, long-lasting components.

- Durability: Grammer products are built to last, reducing replacement costs for vehicle operators.

- Reliability: Consistent performance in harsh environments minimizes downtime and ensures operational efficiency.

- Customer Satisfaction: High-quality components contribute to a positive ownership experience and brand loyalty.

- Reduced Lifecycle Costs: The extended lifespan of Grammer parts offers a lower total cost of ownership for fleet managers and individual owners alike.

Global Manufacturing and Supply Capability

Grammer's global manufacturing and supply capability is a cornerstone of its value proposition, ensuring consistent product availability for Original Equipment Manufacturers (OEMs) worldwide. This extensive network allows for localized production, which is crucial for meeting the diverse demands of international automotive and commercial vehicle markets.

The company's commitment to a widespread global footprint translates into tangible benefits for its clients. For instance, in 2024, Grammer operated numerous production sites across key automotive manufacturing hubs in Europe, North America, and Asia. This distributed manufacturing model significantly reduces lead times and transportation costs for OEMs, enhancing supply chain efficiency.

- Global Reach: Grammer maintains production facilities in over 20 countries, enabling localized supply and support for OEMs operating on a global scale.

- Supply Chain Resilience: The diversified manufacturing base strengthens the supply chain, mitigating risks associated with regional disruptions and ensuring continuity of operations for clients.

- Cost Efficiency: Local production capabilities allow for optimized logistics and reduced shipping expenses, contributing to overall cost savings for international OEMs.

- Quality Consistency: Grammer implements standardized quality management systems across all its facilities, guaranteeing consistent product quality regardless of the manufacturing location.

Grammer's value proposition is built on delivering superior comfort and ergonomics in vehicle interiors, directly addressing the increasing consumer demand for enhanced driving experiences. This focus is critical in a market where comfort features are significant purchase drivers, particularly in premium vehicle segments.

The company also prioritizes safety, integrating advanced features like active head restraints and child booster seats. These innovations are essential for automakers aiming to meet stringent global safety regulations and appeal to safety-conscious buyers.

Grammer's expertise in customized and integrated interior designs allows automotive manufacturers to differentiate their offerings, aligning with the trend of vehicle cabins becoming personalized living spaces. This bespoke approach ensures seamless integration and aesthetic appeal.

Furthermore, Grammer's commitment to high-quality, durable products reduces lifecycle costs for customers, enhancing reliability and user satisfaction, especially in demanding commercial vehicle applications.

| Value Proposition Aspect | Description | Market Relevance (2024 Data) |

|---|---|---|

| Comfort & Ergonomics | Highly ergonomic and comfortable interior components and seating systems. | Global automotive seating market valued at ~$75 billion; comfort is a key differentiator. |

| Enhanced Safety | Active head restraints, side-impact airbags, integrated child booster seats. | Crucial for meeting Euro NCAP and NHTSA standards, influencing consumer choice. |

| Customized & Integrated Design | Tailored interior solutions that seamlessly fit OEM vehicle aesthetics and function. | Aligns with the 'living room on wheels' concept, enabling product differentiation. |

| Quality & Durability | High-quality, long-lasting seating systems and interior components. | Reduces maintenance, enhances user experience, and supports commercial vehicle demands. |

Customer Relationships

Grammer cultivates enduring partnerships with its Original Equipment Manufacturer (OEM) clients by assigning dedicated account managers. These professionals act as a direct conduit, fostering deep understanding of each client's evolving requirements and enabling proactive business development.

This personalized approach is crucial, especially in the automotive sector where Grammer's 2024 revenue reached €2.1 billion, underscoring the importance of sustained, high-quality customer engagement for maintaining market share and driving future growth.

Grammer cultivates long-term strategic partnerships with leading automotive and commercial vehicle manufacturers, often spanning multiple years. These collaborations are built on a foundation of trust and shared commitment, involving joint planning for upcoming vehicle generations.

In 2024, Grammer's focus on these deep relationships is crucial for securing future business. For example, their involvement in developing interior components for electric vehicle platforms with major OEMs demonstrates this strategy. Such partnerships are vital for revenue stability and innovation.

Grammer actively partners with automotive manufacturers on collaborative product development, co-creating advanced interior and seating systems. This joint effort spans from initial concept ideation through to full-scale production, ensuring solutions are precisely tailored to evolving vehicle architectures and consumer demands.

For instance, in 2024, Grammer's investments in R&D, which directly fuel these collaborative projects, reached €150 million, underscoring their commitment to innovation driven by customer needs. This strategic alignment resulted in the successful launch of several new seating technologies in key markets, contributing to a significant portion of their new business pipeline.

After-Sales Support and Service

Grammer's commitment to after-sales support is crucial for customer retention and product value. This includes ensuring the availability of spare parts and providing expert technical assistance, which directly impacts customer satisfaction and the extended performance of their seating and interior systems. For instance, in 2023, Grammer highlighted its focus on enhancing service networks to better support its global customer base, aiming to reduce downtime for agricultural and commercial vehicle operators.

- Spare Parts Availability: Maintaining a robust inventory of genuine spare parts ensures minimal disruption for customers, facilitating quicker repairs and continued operation of Grammer products.

- Technical Assistance: Offering accessible and knowledgeable technical support, whether through online resources, phone support, or on-site service, empowers customers to resolve issues efficiently.

- Product Lifecycle Management: Comprehensive after-sales service contributes to the overall longevity and optimal performance of Grammer's innovative solutions, reinforcing their value proposition.

- Customer Satisfaction: Proactive and responsive support fosters strong customer relationships, leading to increased loyalty and positive brand perception in a competitive market.

Technical Consulting and Expertise

Grammer provides customers with invaluable technical consultation, drawing on extensive expertise in ergonomics, materials science, and advanced manufacturing processes. This advisory service is crucial for Original Equipment Manufacturers (OEMs) seeking to refine their vehicle designs and seamlessly incorporate Grammer's innovative seating and interior solutions.

This deep technical knowledge allows Grammer to act as a strategic partner, not just a supplier. For instance, in 2024, Grammer's engineering teams collaborated with several leading truck manufacturers, contributing to the development of next-generation cabs that prioritize driver comfort and safety, directly impacting vehicle efficiency and driver retention.

- Ergonomic Optimization: Grammer's experts advise on seating arrangements and cabin layouts to reduce driver fatigue, a critical factor in the logistics industry where driver well-being directly correlates with operational hours and safety records.

- Material Innovation: The company shares insights into advanced materials that enhance durability, reduce weight, and improve sustainability in vehicle interiors, aligning with the automotive sector's increasing focus on environmental impact and lifecycle costing.

- Integration Support: Grammer offers hands-on assistance to ensure its products are perfectly integrated into OEM production lines, minimizing assembly time and potential manufacturing defects, thereby improving overall production efficiency.

Grammer's customer relationships are characterized by deep, collaborative partnerships with OEMs, focusing on co-development and long-term strategic alignment. This approach, crucial for securing future business, is supported by dedicated account management and extensive technical consultation, ensuring Grammer's solutions are precisely tailored to client needs.

The company's commitment extends to robust after-sales support, including readily available spare parts and expert technical assistance, which are vital for customer retention and product lifecycle management. This comprehensive support fosters strong loyalty and enhances Grammer's value proposition in a competitive market.

| Customer Relationship Type | Key Activities | Financial Impact (2024 Data) |

| Dedicated Account Management | Proactive understanding of OEM needs, business development | Supports €2.1 billion revenue |

| Collaborative Product Development | Joint planning, co-creation of interior/seating systems | Drives new business pipeline, supported by €150M R&D investment |

| Technical Consultation | Ergonomic optimization, material innovation, integration support | Enhances OEM vehicle design, improves production efficiency |

| After-Sales Support | Spare parts availability, technical assistance, product lifecycle management | Boosts customer satisfaction and loyalty |

Channels

Grammer's direct sales force is a cornerstone for engaging with Original Equipment Manufacturers (OEMs) in the automotive and commercial vehicle sectors worldwide. This approach enables in-depth technical dialogues and the negotiation of substantial, long-term agreements.

This direct channel facilitates the presentation of customized solutions precisely meeting the complex requirements of major vehicle manufacturers. In 2024, Grammer continued to leverage these dedicated teams to secure key partnerships, underscoring the importance of direct customer relationships for high-value business.

Grammer's global production and delivery network is a cornerstone of its business model, featuring numerous production sites and logistics operations strategically positioned worldwide. This extensive infrastructure allows for the direct manufacturing and efficient delivery of components to customer assembly plants, ensuring localized supply chains and responsive distribution.

In 2024, Grammer operated over 30 production facilities across more than 15 countries, a testament to its commitment to global reach and localized support. This network is vital for serving its key automotive customers, enabling just-in-time delivery and reducing transportation costs and lead times.

Grammer actively participates in key industry gatherings, such as the bauma 2025 trade show, a significant event for the construction machinery sector. This engagement allows them to present cutting-edge products, like their new driver seat, directly to a targeted audience of industry professionals and potential clients, fostering direct interaction and feedback.

These events are crucial for Grammer's customer relations and market penetration. In 2024, Grammer reported a strong presence at numerous automotive and commercial vehicle exhibitions globally, facilitating direct conversations with over 5,000 industry stakeholders, reinforcing their position as an innovator in seating solutions.

Corporate Website and Digital Presence

Grammer's corporate website acts as a crucial digital gateway, offering comprehensive information for investors, journalists, and potential employees. It's the central point for accessing financial reports, company news, and detailed product catalogs, ensuring transparency and accessibility for all stakeholders.

In 2024, Grammer continued to leverage its digital presence to communicate key developments. The investor relations section, for instance, provides up-to-date financial data, including their 2023 annual report which showed a revenue of €2.1 billion, and press releases detailing strategic partnerships and market expansions.

- Investor Relations Hub: Access to financial statements, annual reports, and stock performance data.

- Product Showcasing: Detailed information and visuals of Grammer's innovative automotive interior and commercial vehicle components.

- News and Media Center: Latest press releases, media coverage, and corporate announcements.

- Career Portal: Information on job openings and the company culture, attracting top talent.

Technical Sales Presentations and Workshops

Technical Sales Presentations and Workshops are key for Grammer to engage directly with Original Equipment Manufacturer (OEM) engineering and procurement teams. These sessions allow for a deep dive into product capabilities, addressing specific integration challenges faced by clients. For instance, in 2024, Grammer’s technical workshops focused on showcasing advancements in lightweight seating solutions for the commercial vehicle sector, a critical area for fuel efficiency mandates.

These presentations serve as a direct conduit for technical collaboration, enabling Grammer to understand evolving OEM needs and tailor solutions accordingly. By demonstrating how their components can be seamlessly integrated and enhance performance, Grammer builds trust and establishes itself as a preferred technical partner. This approach is crucial for securing long-term supply agreements, especially as the automotive industry navigates the transition to electric and autonomous driving technologies.

- Demonstrate Advanced Product Features: Highlight innovations like smart suspension systems and advanced material composites.

- Address Integration Challenges: Provide practical solutions for incorporating Grammer components into OEM vehicle architectures.

- Foster Technical Collaboration: Engage in Q&A sessions to understand specific OEM pain points and co-develop solutions.

- Showcase ROI: Quantify the benefits of Grammer products, such as improved fuel efficiency or enhanced driver comfort, backed by 2024 performance data.

Grammer's channels are multifaceted, encompassing direct sales, participation in trade fairs, and a robust digital presence. The direct sales force is key for engaging with major automotive and commercial vehicle OEMs, facilitating complex negotiations and customized solutions. In 2024, these direct interactions were vital for securing significant, long-term contracts.

Industry events like bauma provide platforms for showcasing new products and engaging directly with sector professionals. Grammer's digital channels, particularly its corporate website, serve as a crucial hub for investors, media, and potential employees, offering transparent access to financial reports and company news. The company’s 2023 revenue reached €2.1 billion, highlighting the scale of its operations communicated through these channels.

| Channel | Purpose | Key Activities/Focus | 2024 Emphasis |

|---|---|---|---|

| Direct Sales Force | Engage OEMs, negotiate contracts | Technical dialogues, customized solutions | Securing key partnerships |

| Industry Trade Fairs | Product showcasing, direct interaction | Presenting new products, gathering feedback | Strong presence, engaging stakeholders |

| Corporate Website | Information dissemination, stakeholder engagement | Financial reports, news, product catalogs | Communicating developments, investor relations |

Customer Segments

Grammer's Passenger Vehicle OEMs segment is a cornerstone of its business, supplying essential interior components like headrests, armrests, center consoles, and integrated child booster seats to major global car manufacturers. This segment is a significant revenue driver, reflecting the high demand for these specialized parts in the automotive industry.

In 2024, the automotive industry saw continued demand for advanced interior solutions. Grammer's commitment to innovation in areas like lightweight materials and enhanced comfort features positions them well within this competitive landscape, serving clients who are constantly seeking to differentiate their passenger vehicle offerings.

Commercial Vehicle Original Equipment Manufacturers (OEMs) are a core customer segment, encompassing companies that build trucks, buses, and specialized vehicles for agriculture, construction, and material handling. These manufacturers require highly durable and ergonomically designed seating solutions to ensure driver comfort and productivity in demanding operational environments. In 2024, the global commercial vehicle market saw significant activity, with sales of heavy-duty trucks alone projected to reach over 3 million units.

Grammer's Train and Railcar Manufacturers segment is a crucial part of their business, focusing on providing specialized seating solutions. These manufacturers demand high levels of comfort, safety, and durability, making this a high-value, niche market. In 2024, the global rail market continued its growth trajectory, with significant investments in new rolling stock and modernization projects across various regions, creating sustained demand for Grammer's offerings.

Bus Manufacturers

This customer segment targets manufacturers of various bus types, including city buses, intercity coaches, and long-distance tour buses. These manufacturers need seating solutions that are robust, comfortable for extended journeys, and meet stringent safety regulations for public transportation. For instance, in 2024, the global bus market saw significant activity, with sales of new buses projected to reach over 1 million units annually, highlighting the demand for specialized components like seating.

GRAMMER's offerings to bus manufacturers are tailored to these specific needs, focusing on ergonomic designs for passenger and driver well-being, enhanced durability to withstand heavy daily use, and compliance with evolving safety standards. The company's commitment to innovation is crucial in a sector where passenger experience directly impacts ridership and operator reputation.

- Targeted Products: Specialized seating for city, intercity, and coach buses.

- Key Requirements: Comfort, durability, safety, and compliance with transport regulations.

- Market Context (2024): The global bus market is a substantial industry, indicating consistent demand for seating solutions.

- GRAMMER's Value Proposition: Providing innovative, ergonomic, and safe seating to enhance passenger and driver experience.

Aftermarket and Spare Parts Customers

Grammer’s aftermarket and spare parts segment caters to customers seeking to maintain and repair existing seating systems. This is a crucial revenue stream, offering a more sustainable and economical choice compared to replacing entire units.

For instance, in 2023, the demand for spare parts remained robust, reflecting the extended lifespan of commercial vehicle fleets and the ongoing need for maintenance. This customer segment values the availability of genuine Grammer parts to ensure the continued performance and safety of their equipment.

- Value Proposition: Providing genuine, high-quality spare parts for Grammer seating systems, extending product life and reducing operational costs for customers.

- Customer Needs: Reliable access to replacement components for maintenance, repair, and refurbishment of existing seating solutions.

- Market Opportunity: Leveraging the installed base of Grammer seating systems to generate recurring revenue through the sale of spare parts and aftermarket services.

- Competitive Advantage: Offering OEM-certified parts ensures compatibility and performance, differentiating from generic aftermarket alternatives.

Grammer's customer segments are diverse, primarily focusing on Original Equipment Manufacturers (OEMs) across the automotive, commercial vehicle, and rail industries. They also serve the aftermarket for spare parts. This segmentation allows Grammer to tailor its specialized seating and interior component solutions to the unique demands of each sector.

The company's core customer base includes passenger vehicle OEMs, seeking advanced interior components, and commercial vehicle OEMs, requiring durable and ergonomic seating. Additionally, railcar manufacturers represent a key niche, demanding high comfort and safety standards for rolling stock.

The aftermarket segment is vital for maintaining existing installations and generating recurring revenue. Grammer's strategy involves providing genuine spare parts, ensuring performance and customer satisfaction across its product lifecycle.

| Customer Segment | Key Products/Services | 2024 Market Focus/Data |

|---|---|---|

| Passenger Vehicle OEMs | Headrests, armrests, center consoles, integrated child seats | Continued demand for advanced, lightweight interior solutions. |

| Commercial Vehicle OEMs | Durable, ergonomic seating for trucks, buses, agricultural/construction vehicles | Global heavy-duty truck sales projected over 3 million units. |

| Train and Railcar Manufacturers | Specialized seating with high comfort, safety, and durability | Global rail market growth driven by new rolling stock and modernization. |

| Bus Manufacturers | Robust, comfortable, and safe seating for city, intercity, and coach buses | Global bus market sales projected over 1 million units annually. |

| Aftermarket & Spare Parts | Genuine spare parts for maintenance and repair of seating systems | Robust demand for spare parts reflecting extended fleet lifespans. |

Cost Structure

Grammer's cost structure is heavily influenced by the raw materials and components it purchases for its manufacturing processes. This includes plastics, metals, textiles, and foams, which are essential for producing its seating systems and interior components. For instance, in 2023, the company's cost of sales stood at €1.8 billion, reflecting the significant expenditure on these inputs.

These procurement costs are not static; they are directly impacted by global commodity price volatility and the complexities of the supply chain. Fluctuations in the prices of metals like steel or aluminum, as well as petrochemical-based plastics, can significantly alter Grammer's overall production expenses. The company's ability to manage these variable costs is crucial for maintaining profitability.

Manufacturing and production expenses form a significant part of Grammer's cost structure. These costs encompass labor for their factory workforce, the energy required to run their production facilities, and the ongoing upkeep of their machinery. For instance, in 2024, Grammer continued to focus on optimizing these expenditures, including measures like reducing excess capacities in the EMEA region to improve efficiency.

Grammer's commitment to innovation drives significant investment in Research and Development (R&D). These costs are fundamental to developing new products, improving existing ones, and exploring advanced materials, ensuring Grammer stays ahead in the competitive automotive and commercial vehicle sectors.

In 2024, companies across the automotive supplier industry, including those focused on advanced materials and components like Grammer, are expected to continue robust R&D spending. For instance, the global automotive R&D spending was projected to reach over $150 billion in 2023, with a significant portion allocated to electrification, autonomous driving, and material science, areas directly relevant to Grammer's strategic focus.

Sales, General, and Administrative (SG&A) Costs

Sales, General, and Administrative (SG&A) costs are a significant component of Grammer's operational expenses. These include the salaries of management and administrative staff, marketing and sales expenditures, and general corporate overhead. For instance, in 2023, Grammer reported €122.6 million in SG&A expenses, representing a notable portion of their overall costs.

Grammer actively seeks to optimize these costs through strategic initiatives. A key example is the establishment of a Shared Service Center in Serbia, designed to centralize and streamline administrative functions, thereby reducing overhead and improving efficiency. This move is part of a broader effort to enhance profitability by managing these essential but often substantial expenses more effectively.

- SG&A Expenses: Grammer's SG&A costs amounted to €122.6 million in 2023, reflecting investments in sales, marketing, and administrative operations.

- Cost Optimization: The company is implementing strategies like the Shared Service Center in Serbia to reduce administrative overhead.

- Efficiency Drive: These efforts aim to streamline operations and improve the company's overall financial performance by controlling indirect costs.

Logistics and Distribution Costs

Grammer's cost structure heavily includes logistics and distribution. These encompass the expenses tied to transporting raw materials into their facilities and shipping finished products to a global customer base. This includes freight charges, warehousing fees, and any applicable customs duties or tariffs.

Optimizing these complex supply chains is crucial for Grammer's profitability. For instance, in 2024, global shipping costs saw fluctuations, with the Drewry World Container Index averaging around $1,700 per 40ft container in early 2024, a significant decrease from its peak but still a substantial operational expense. Efficient route planning and inventory management directly impact the bottom line.

- Transportation: Costs for moving raw materials and finished goods via sea, air, and land freight.

- Warehousing: Expenses related to storing inventory at various points in the supply chain.

- Customs and Duties: Tariffs and fees incurred when importing materials or exporting products across international borders.

- Inventory Management: Costs associated with holding and managing stock to meet demand while minimizing holding expenses.

Grammer's cost structure is significantly shaped by its investment in research and development. This is crucial for staying competitive in the automotive and commercial vehicle sectors, with global automotive R&D spending projected to exceed $150 billion in 2023. These expenditures fuel innovation in areas like electrification and material science, directly impacting product development and future market positioning.

Revenue Streams

Grammer generates significant revenue from selling automotive interior components like headrests, armrests, center consoles, and integrated child booster seats. These parts are supplied directly to passenger vehicle original equipment manufacturers (OEMs).

This segment represents a core revenue driver for Grammer, reflecting its established position within the automotive supply chain. In 2024, sales of these interior components are expected to remain a substantial portion of the company's total turnover.

Grammer generates significant income from selling driver and passenger seats designed for trucks, agricultural equipment, construction machinery, and other commercial vehicles. This segment is a key profit driver for the company, typically representing a high-margin product area.

In 2024, the commercial vehicle sector continued to be a cornerstone for Grammer's revenue. For instance, the company's focus on innovative seating solutions for the evolving needs of the logistics and construction industries directly fuels this income stream, reflecting strong demand for their specialized products.

Grammer generates revenue by selling specialized seating systems for trains and buses. This segment addresses the needs of public and commercial transportation, diversifying their income beyond individual vehicle seating.

In 2024, the global bus and coach seating market was valued at approximately $3.5 billion, with projections indicating steady growth. Grammer's participation in this sector, particularly with its advanced and ergonomic solutions, positions it to capture a significant share of this expanding market.

Aftermarket Parts and Service Revenue

Grammer generates revenue from selling genuine spare parts for its seating systems, ensuring product longevity and offering a consistent income stream. This aftermarket segment also includes service contracts, providing customers with ongoing support and maintenance.

- Genuine Spare Parts: Revenue from the sale of replacement components for Grammer's diverse seating solutions.

- Service Contracts: Income derived from agreements offering maintenance, repair, and support for installed seating systems.

- Recurring Revenue: This stream provides a stable, predictable revenue base that complements initial product sales.

- Product Lifecycle Support: Enhances customer satisfaction and loyalty by ensuring the continued functionality of Grammer products.

Licensing and Technology Transfer (Potential)

Grammer's strong foundation in research and development, evidenced by its consistent investment in innovation, opens avenues for potential revenue through licensing its advanced technologies. For instance, in 2024, the automotive supplier sector saw significant activity in technology sharing, with companies leveraging patents to expand market reach.

This could involve transferring proprietary manufacturing processes or patented product designs to other entities, creating a new income stream without direct production involvement. Such strategic partnerships allow Grammer to monetize its intellectual capital while focusing on its core competencies.

- Licensing Agreements: Granting rights to use Grammer's patented technologies in exchange for royalties or fees.

- Technology Transfer: Selling or assigning ownership of specific technological innovations to other companies.

- Joint Ventures: Collaborating with partners to commercialize new technologies, sharing risks and rewards.

- R&D Collaboration: Partnering with other firms on research projects, potentially leading to shared IP and revenue.

Grammer's revenue streams are diversified across several key areas, reflecting its deep integration into the automotive and commercial vehicle sectors. The company primarily earns from supplying interior components and specialized seating solutions. These core activities are complemented by aftermarket services and the strategic monetization of its technological innovations.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Automotive Interior Components | Sales of headrests, armrests, center consoles, and integrated child seats to OEMs. | A substantial portion of total turnover, with continued strong demand in 2024. |

| Commercial Vehicle Seating | Driver and passenger seats for trucks, agricultural, and construction machinery. | A cornerstone revenue driver, with focus on innovative solutions for logistics and construction in 2024. |

| Specialized Seating (Trains/Buses) | Seating systems for public and commercial transportation. | The global bus and coach seating market was valued around $3.5 billion in 2024, with Grammer positioned to capture market share. |

| Aftermarket & Services | Genuine spare parts and service contracts for seating systems. | Provides a stable, recurring revenue base, enhancing product lifecycle support and customer loyalty. |

| Technology Licensing & Transfer | Monetizing R&D through licensing patents and technology sharing. | Leveraging intellectual capital in a sector with significant technology sharing activity in 2024. |

Business Model Canvas Data Sources

The Business Model Canvas is built using customer feedback, competitive analysis, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information about our target market and business strategy.