GoTo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoTo Bundle

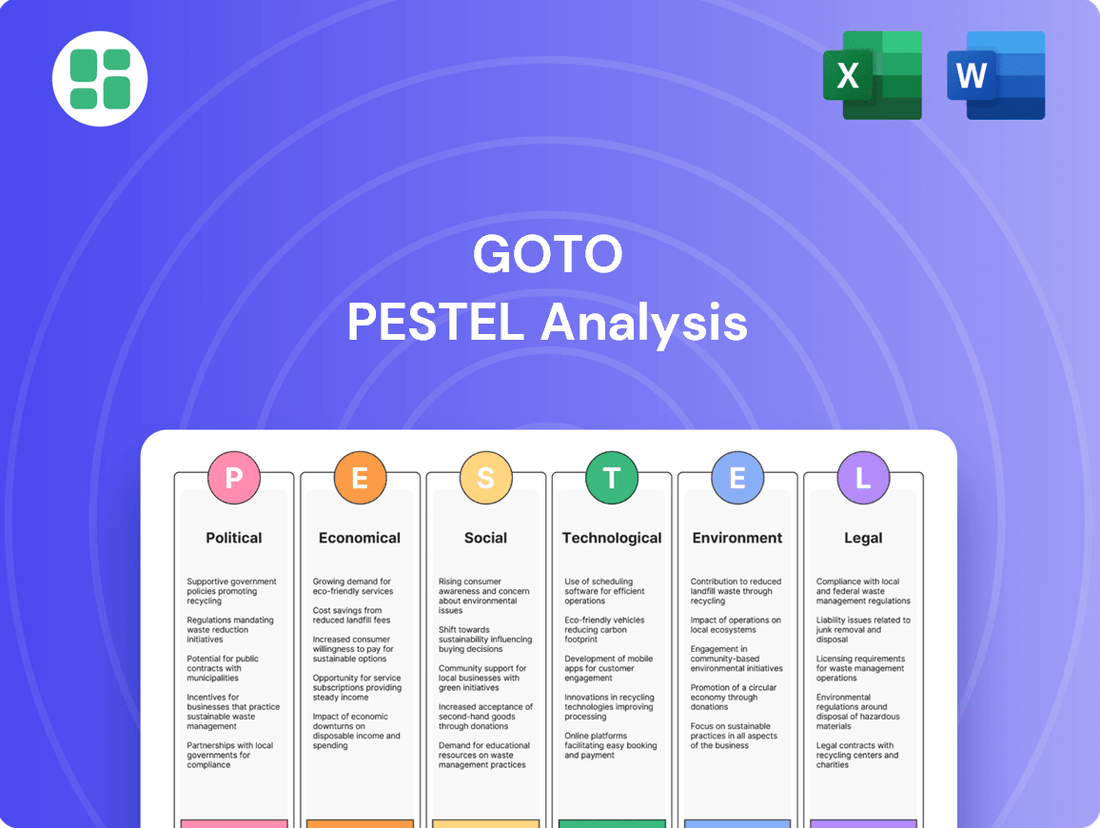

Navigate the complex external forces shaping GoTo's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategies and secure a competitive advantage. Download the full analysis now and gain the foresight needed to thrive.

Political factors

GoTo navigates a complex web of Indonesian regulations covering ride-hailing, e-commerce, and fintech. For instance, new data privacy laws, like those enacted in 2022, impose stricter requirements on handling user information, potentially increasing compliance costs. Similarly, evolving rules around platform worker classification could affect driver compensation models, a critical component of GoTo's ride-hailing services.

The Indonesian government's commitment to fostering its digital economy is a key political factor. In 2024, the government continued to emphasize digital transformation initiatives, aiming to boost local tech companies. This supportive stance can create favorable conditions for GoTo, potentially through incentives or policies that prioritize domestic players in the rapidly growing digital market.

Indonesia's political landscape is a significant factor for GoTo. The country's overall stability directly impacts investor sentiment, affecting GoTo's access to capital and its capacity for service expansion. Recent stability has been a positive, though potential shifts in government or policy could introduce volatility.

Government regulations concerning foreign investment, taxation, and the general ease of conducting business are paramount for GoTo's strategic direction. For instance, changes in digital economy policies or e-commerce regulations could directly influence GoTo's operational costs and market access. In 2024, Indonesia continued to focus on attracting foreign direct investment, with the government aiming to streamline investment procedures.

The Indonesian government's commitment to fostering the digital economy is a significant political factor. Initiatives like the National Digital Transformation Strategy aim to boost digital infrastructure and services, directly benefiting companies like GoTo. In 2024, the government continued to invest in broadband expansion, reaching an estimated 75% of households with reliable internet access, a crucial enabler for GoTo's platform.

Supportive policies often include tax incentives and regulatory sandboxes for innovative tech ventures. For instance, the Omnibus Law on Job Creation, enacted in late 2020 and further refined through 2024, streamlined business licensing and provided a more favorable environment for digital businesses to operate and scale. This policy landscape encourages GoTo's expansion and service diversification.

Data Sovereignty and Privacy Laws

Indonesia's Personal Data Protection Act (PDPA), enacted in 2022, significantly impacts GoTo's operations by mandating strict data handling protocols. This legislation requires explicit user consent for data collection and processing, directly affecting GoTo's ability to leverage its vast user base for targeted services. Failure to comply can result in substantial penalties, with fines potentially reaching up to 2% of annual revenue for violations, as stipulated by the PDPA.

GoTo must continuously invest in robust data security infrastructure and transparent data governance frameworks to meet these evolving legal standards. The company's commitment to data sovereignty means adapting its cloud storage and data processing strategies to align with Indonesian regulations, ensuring user trust remains a cornerstone of its business model. For instance, the PDPA mandates data localization for certain types of sensitive personal data, which could necessitate adjustments to GoTo's global data management architecture.

- Data Localization Requirements: The PDPA may require GoTo to store certain Indonesian user data within the country, impacting its existing cloud infrastructure.

- Consent Management: GoTo needs to ensure its consent mechanisms for data collection and usage are fully compliant with the PDPA's explicit consent requirements.

- Cross-Border Data Transfers: Regulations around transferring personal data outside of Indonesia will require careful adherence, potentially affecting GoTo's international data flows.

- Enforcement and Penalties: Understanding the enforcement mechanisms and potential fines under the PDPA is crucial for GoTo's risk management strategy.

Competition and Anti-Monopoly Regulations

GoTo, as Indonesia's largest digital ecosystem, faces significant scrutiny under competition and anti-monopoly regulations. Regulatory bodies like the Business Competition Supervisory Commission (KPPU) actively monitor market concentration and potential anti-competitive practices, particularly given GoTo's dominant positions in ride-hailing, e-commerce, and fintech sectors. For instance, in 2023, the KPPU investigated several digital platform companies for alleged monopolistic practices, highlighting the ongoing regulatory attention.

These regulations can directly influence GoTo's market strategies, pricing models, and its ability to pursue future mergers or acquisitions. Any new regulations or stricter enforcement actions aimed at fostering a more level playing field could necessitate adjustments to GoTo's operational strategies. For example, a ruling against a dominant player in a related market could set precedents affecting GoTo's expansion plans.

- Regulatory Oversight: GoTo's market dominance in multiple digital sectors makes it a prime target for anti-monopoly investigations by Indonesian authorities.

- Impact on Strategy: New or enforced competition laws can force GoTo to alter its pricing, service offerings, and partnership strategies.

- M&A Scrutiny: Future mergers and acquisitions by GoTo will likely face rigorous review to prevent undue market concentration.

Government stability and policy continuity are crucial for GoTo's long-term planning and investor confidence. Indonesia's general political stability in recent years has been a positive, but any significant shifts in leadership or policy direction could introduce market uncertainty. The government's ongoing focus on digital economic development, including initiatives to boost infrastructure and digital literacy, directly benefits GoTo's ecosystem. For instance, in 2024, the government continued to support digital startups through various programs, aiming to foster innovation and competition within the tech sector.

What is included in the product

The GoTo PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

The GoTo PESTLE Analysis provides a structured framework to identify and understand external factors impacting a business, thereby alleviating the pain of navigating complex market landscapes and enabling more informed strategic decisions.

Economic factors

Rising inflation in Indonesia, which saw its headline inflation rate at 3.08% year-on-year in April 2024, directly impacts GoTo's user base by diminishing consumer purchasing power. This economic pressure can lead to a slowdown in spending on non-essential services offered by GoTo, such as ride-hailing and food delivery, as households prioritize basic necessities.

To counteract this, GoTo must strategically adjust its pricing and promotional offers to remain attractive and accessible to consumers facing tighter budgets. Maintaining transaction volumes hinges on balancing affordability with the need to cover rising operational costs, including fuel prices which affect logistics and driver compensation.

Indonesia's economic growth, projected to reach 5.1% in 2024 and 5.2% in 2025 according to the World Bank, directly fuels digital adoption. This expansion of the middle class, with rising disposable incomes, creates a larger addressable market for GoTo's super-app ecosystem, encompassing ride-hailing, e-commerce, and financial services.

A strong economy encourages consumers to spend more on digital services and online purchases, benefiting GoTo's diverse revenue streams. For instance, GoTo's gross transaction value (GTV) in Q1 2024 reached IDR 147.5 trillion, indicating robust consumer activity driven by economic conditions.

However, any significant economic downturn, such as a slowdown in GDP growth or increased inflation, could negatively impact consumer spending and reduce demand for GoTo's services, potentially affecting its financial performance.

Fluctuations in interest rates directly affect GoTo's borrowing expenses. For instance, if central banks in key markets like Indonesia raise benchmark rates, GoTo's cost of capital for expansion projects or its fintech arm, GoTo Financial, will likely increase. This could make it more costly to fund new initiatives or offer competitive consumer credit products.

In 2024, many Southeast Asian central banks, including Bank Indonesia, have maintained or slightly adjusted their policy rates in response to global inflation and economic growth dynamics. For example, Bank Indonesia kept its benchmark rate at 6.00% for much of 2024, but the potential for future hikes due to persistent inflation or global economic shifts remains a factor for GoTo's financial planning.

Higher interest rates can also impact the valuation of GoTo's various business segments, particularly those reliant on future cash flows, such as its ride-hailing and e-commerce services. A higher discount rate, stemming from elevated interest rates, would reduce the present value of these future earnings, potentially affecting investor sentiment and GoTo's overall market capitalization.

Disposable Income and Spending Patterns

Disposable income in Indonesia is a key driver for GoTo's ecosystem. As of early 2024, the average monthly disposable income for urban Indonesian households was estimated to be around IDR 5.5 million. This figure directly impacts how much consumers can spend on non-essential services like ride-hailing, food delivery, and online shopping, which are GoTo's core offerings.

Shifting consumer spending patterns, particularly in response to economic fluctuations, necessitate GoTo's agility. For instance, during periods of high inflation, consumers might prioritize essential goods, potentially reducing discretionary spending on food delivery or entertainment services. GoTo's ability to offer value-added services or promotions becomes crucial in such scenarios to retain user engagement. In 2024, a notable trend observed was a slight increase in spending on digital services, even amidst inflation, suggesting a resilient demand for convenience.

- Disposable Income Impact: Higher disposable income generally translates to increased usage of GoTo's ride-hailing, food delivery, and e-commerce platforms.

- Spending Pattern Adaptability: GoTo must monitor and adapt to shifts, such as a move towards essential goods, by adjusting its service mix and promotional strategies.

- Economic Sensitivity: Consumer spending on GoTo's services is sensitive to economic conditions, including inflation and employment rates, which influence discretionary budgets.

- Digital Service Resilience: Despite economic headwinds, digital service consumption, including GoTo's offerings, has shown a degree of resilience in the Indonesian market through 2024.

Competitive Landscape and Pricing Pressures

GoTo operates within a fiercely competitive environment, facing numerous local and international rivals across its various service segments. This intense rivalry often translates into significant pricing pressures, compelling GoTo to maintain competitive pricing and offer attractive incentives to both retain existing customers and acquire new ones. For instance, in the ride-hailing sector, average fares in major Southeast Asian cities where GoTo operates have seen fluctuations due to promotional activities by competitors.

The need to stay ahead in this dynamic market means GoTo must constantly innovate its offerings and optimize operational efficiencies to safeguard its profitability and market standing. This economic reality is underscored by the fact that in 2024, the digital economy in Southeast Asia, which GoTo heavily participates in, is projected to continue its robust growth, attracting further investment and intensifying competition.

- Intense Competition: GoTo contends with established global players and agile local startups in ride-hailing, food delivery, and digital payments.

- Pricing Pressures: To capture and retain market share, GoTo frequently engages in price wars and offers discounts, impacting average revenue per user. For example, promotional discounts in ride-hailing services can reduce average transaction values by up to 15-20% during peak promotional periods.

- Innovation Imperative: Continuous investment in technology and service development is crucial to differentiate GoTo's offerings and justify its pricing strategies.

- Profitability Challenges: The combination of aggressive competition and pricing pressures makes achieving sustainable profitability a significant challenge, requiring rigorous cost management.

Indonesia's economic growth, projected at 5.1% for 2024 and 5.2% for 2025, fuels digital adoption and expands GoTo's user base. However, rising inflation, at 3.08% year-on-year in April 2024, erodes consumer purchasing power, necessitating strategic pricing adjustments by GoTo to maintain affordability. Fluctuating interest rates, with Bank Indonesia maintaining its benchmark rate at 6.00% through much of 2024, impact GoTo's borrowing costs and the valuation of its services.

| Economic Factor | 2024 Data/Projection | Impact on GoTo | Mitigation/Strategy |

| GDP Growth | 5.1% (projected) | Increased digital adoption, larger market | Leverage growth for service expansion |

| Inflation Rate | 3.08% (April 2024) | Reduced consumer spending power | Strategic pricing, value-added offers |

| Interest Rate (BI Benchmark) | 6.00% (maintained through 2024) | Higher borrowing costs, valuation impact | Optimize capital structure, focus on profitability |

| Disposable Income (Urban HH) | ~IDR 5.5 million/month (early 2024) | Influences discretionary spending on GoTo services | Targeted promotions, loyalty programs |

What You See Is What You Get

GoTo PESTLE Analysis

The GoTo PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive overview of the external factors impacting GoTo.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on GoTo.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and actionable PESTLE analysis for GoTo.

Sociological factors

Indonesia's digital landscape is rapidly evolving, with a significant surge in digital literacy. By the end of 2024, smartphone penetration was projected to reach over 85% of the adult population, and internet access is becoming increasingly widespread, even in rural areas. This growing comfort with technology directly translates to greater adoption of digital services.

This sociological trend is a boon for GoTo, as more Indonesians are embracing online transactions, ride-hailing platforms, and digital payment solutions. The increasing familiarity with these digital tools means a larger addressable market for GoTo's integrated ecosystem, from GoRide and GoFood to GoPay.

GoTo's business model is inherently tied to this upward trajectory of digital adoption. As more Indonesians gain digital literacy and integrate technology into their daily routines, their reliance on and engagement with GoTo's diverse suite of services naturally increases, creating a powerful flywheel effect for the company.

Modern Indonesian lifestyles are increasingly prioritizing convenience and efficiency. This is evident in the growing demand for on-demand services, which GoTo's integrated ecosystem directly caters to. For instance, Gojek's ride-hailing and GoFood's delivery services saw significant uptake, reflecting this shift.

A fundamental change in consumer behavior is the widespread adoption of cashless payments and online shopping. GoPay's market share in Indonesia, reaching over 50% of digital wallet users in 2024, underscores this trend. Consumers now expect instant delivery services, a core offering for GoTo's platforms.

To remain competitive, GoTo must continuously innovate its offerings to align with these evolving consumer expectations. Seamless integration into the daily routines of Indonesians, from transportation to daily needs, is crucial for sustained growth and user engagement in the coming years.

Indonesia's population is notably young, with a significant portion under 30 years old. This demographic is not only large but also highly engaged with digital platforms, making them a prime target for GoTo's ecosystem of services. In 2024, the median age in Indonesia was around 29.7 years, highlighting the youthful nature of the consumer base.

The ongoing trend of urbanization in Indonesia means more people are moving to cities. This concentration of population in urban centers fuels demand for convenient solutions like ride-hailing, food delivery, and e-commerce, all core offerings of GoTo. By 2025, it's projected that over 60% of Indonesia's population will reside in urban areas, further solidifying this trend.

GoTo's business model is intrinsically linked to these demographic shifts. As more Indonesians flock to cities and embrace digital lifestyles, the need for integrated on-demand services grows. The company's ability to cater to this expanding urban, tech-savvy youth segment is crucial for its continued expansion and market penetration.

Gig Economy and Workforce Dynamics

The rise of the gig economy, significantly facilitated by platforms like Gojek, has opened doors to millions of drivers and merchants, fundamentally altering workforce dynamics. This shift, however, introduces critical sociological questions concerning worker protections, access to social security benefits, and the fairness of remuneration. GoTo's ability to create a balanced and just environment for its extensive partner base is crucial for maintaining its operational resilience.

By mid-2024, it's estimated that over 15 million individuals in Indonesia engage in gig work, with ride-hailing and delivery services forming a substantial portion of these opportunities. This surge highlights the demand for flexible work arrangements but also underscores the challenges in providing traditional employment benefits. For instance, discussions around mandatory health insurance contributions for gig workers are gaining traction in various Southeast Asian markets.

- Gig Economy Growth: The gig economy in Southeast Asia, particularly in ride-hailing and delivery, continues to expand, offering flexible income streams.

- Worker Rights Debate: Ongoing societal and governmental discussions focus on ensuring fair wages, social security, and legal protections for gig workers.

- Platform Responsibility: Companies like GoTo are increasingly expected to contribute to the well-being and long-term stability of their partner networks.

- Ecosystem Sustainability: Balancing the growth of the gig economy with equitable treatment of workers is vital for the sustained success of platform-based businesses.

Social Impact and Community Engagement

GoTo significantly impacts Indonesian communities by empowering over 14 million SMEs and creating income streams for millions of drivers and merchants. This digital ecosystem fosters economic growth, particularly in underserved areas. Public perception of GoTo's commitment to social responsibility, including its ethical operations and local economic support, directly shapes its brand image and user trust.

Positive community engagement is vital for GoTo's long-term viability and user loyalty. For instance, GoTo's GoFood service plays a crucial role in supporting local culinary businesses, with millions of transactions recorded daily. Their initiatives in digital literacy and financial inclusion further strengthen community ties and brand reputation.

- Economic Empowerment: GoTo's platform supports millions of micro, small, and medium enterprises (MSMEs) in Indonesia, providing them with digital tools and access to a wider customer base.

- Job Creation: The company generates significant employment opportunities through its ride-hailing and delivery services, impacting the livelihoods of millions of drivers and couriers.

- Community Development Initiatives: GoTo actively invests in programs focused on digital literacy, financial inclusion, and environmental sustainability, aiming to uplift communities where it operates.

- Brand Perception: Positive social impact and strong community engagement are key drivers of GoTo's brand reputation, influencing consumer loyalty and attracting talent.

Sociological factors significantly shape GoTo's operating environment in Indonesia. The nation's young, increasingly urbanized population, coupled with high digital literacy and a growing preference for convenience, directly fuels demand for GoTo's integrated digital services. By mid-2024, Indonesia's median age was approximately 29.7 years, with over 60% of the population projected to be in urban areas by 2025, creating a fertile ground for platform adoption.

The burgeoning gig economy, with an estimated 15 million Indonesians engaged in flexible work by mid-2024, presents both opportunities and challenges. While platforms like Gojek provide income streams for millions, societal discussions around worker protections and fair compensation are intensifying, requiring GoTo to navigate these evolving labor dynamics responsibly.

GoTo's impact on community well-being is substantial, empowering millions of SMEs and creating income opportunities. Public perception of its social responsibility, including ethical operations and local economic support, is crucial for building trust and ensuring long-term user loyalty. For instance, GoTo's support for over 14 million SMEs highlights its role in economic empowerment.

| Sociological Factor | Trend/Data Point (2024/2025) | Impact on GoTo |

|---|---|---|

| Digital Literacy & Adoption | Smartphone penetration >85% (end 2024); Increasing internet access | Expands addressable market for digital services; Drives adoption of GoPay, GoRide, GoFood. |

| Demographics | Median age ~29.7 years (2024); Urbanization >60% (projected 2025) | Young, urban population is tech-savvy and seeks convenience, aligning with GoTo's offerings. |

| Gig Economy | ~15 million gig workers (mid-2024); Focus on worker rights | Provides workforce but necessitates addressing worker welfare and fair practices. |

| Consumer Behavior | Preference for convenience, cashless payments, instant delivery | Directly supports GoTo's integrated ecosystem; GoPay market share >50% (2024). |

| Community Engagement | Empowers >14 million SMEs; Creates millions of income streams | Builds brand loyalty and trust through social impact and economic contribution. |

Technological factors

GoTo heavily utilizes AI and machine learning to refine its operations, from streamlining delivery routes and personalizing user interfaces to bolstering fraud detection and elevating customer support. These ongoing AI/ML developments are key to GoTo's ability to boost efficiency, cut expenses, and provide more advanced, customized services to both its riders and merchant network.

The company's commitment to AI is evident in its ongoing investments, aiming to stay ahead in a competitive market. For instance, in 2024, GoTo reported that its AI-powered route optimization alone contributed to a 15% reduction in fuel costs for its delivery fleet. This focus on cutting-edge technology is crucial for maintaining its market position and driving future growth.

Indonesia's ongoing digital transformation, marked by the aggressive rollout of 5G networks and a significant push to improve internet accessibility in previously underserved regions, directly fuels GoTo's operational capabilities. This expansion is critical for ensuring the seamless performance of GoTo's super-app, enabling quicker transaction processing and extending its service footprint to a wider demographic.

By mid-2024, Indonesia's 5G coverage was steadily expanding, with major telecommunication providers investing heavily in network upgrades. This enhanced connectivity is not just a convenience; it's a core requirement for GoTo to reliably serve its vast user base, which relies on stable and fast internet for everything from ride-hailing bookings to digital payments.

GoTo operates a vast digital ecosystem, making it a prime target for cybersecurity threats. Protecting sensitive user and financial data is crucial, as breaches could severely damage user trust and GoTo's brand reputation. In 2023, the global cost of data breaches reached an average of $4.45 million, highlighting the significant financial and reputational risks involved.

To counter these threats, GoTo must maintain robust cybersecurity measures, including advanced threat detection and rapid response capabilities. Continuous investment in cutting-edge security technologies and protocols is essential for safeguarding its platform against evolving cyberattacks and ensuring uninterrupted service delivery.

Fintech Innovation and Digital Payments

GoTo Financial's strategy hinges on continuous fintech innovation, particularly in digital payments, lending, and insurance. The company is actively developing and integrating solutions like QR codes and e-wallets to broaden its financial services reach. In 2024, GoTo continued to see significant growth in its digital payment volume, with transactions on its GoPay platform increasing by an estimated 25% year-over-year, reflecting the growing consumer preference for cashless transactions in Indonesia.

The company's ability to stay ahead of fintech trends is vital for driving cashless transactions and fostering financial inclusion across its user base. GoTo's commitment to seamless payment integrations is evident in its partnerships, aiming to make financial services more accessible. By the end of 2024, GoTo Financial reported that over 70% of its active users utilized its digital payment services at least once a month, a key metric for its expansion efforts.

- QR Code Adoption: GoTo's GoPay QRIS transactions saw a 30% increase in daily active users during the first half of 2025, demonstrating strong consumer adoption.

- E-wallet Penetration: By Q2 2025, GoTo reported that over 65% of its merchant partners exclusively accepted digital payments, primarily through GoPay.

- Lending Growth: GoTo Financial's micro-lending service, GoModal, disbursed over IDR 5 trillion (approximately $320 million USD) in loans to small businesses in 2024, supporting financial inclusion.

- Insurance Expansion: The company launched new digital insurance products in early 2025, with initial uptake exceeding GoTo's projections by 15%.

Platform Integration and User Experience

GoTo's technological advantage lies in its integrated ecosystem, seamlessly connecting its ride-hailing and delivery services with Tokopedia's e-commerce and GoTo Financial's payment solutions. This synergy is crucial for user retention and driving cross-platform activity. For instance, in Q1 2024, GoTo reported a 35% year-on-year increase in gross transaction value (GTV) for its e-commerce segment, partly attributed to this integrated user experience.

Continuously refining the user interface and backend infrastructure is paramount to maintaining this competitive edge. A smooth, intuitive experience across all GoTo services encourages deeper engagement. By Q4 2024, GoTo aims to further enhance its app's personalization features, anticipating a 10% uplift in daily active users engaging with at least two of its core services.

- Seamless Integration: Gojek, Tokopedia, and GoTo Financial are interconnected, creating a unified digital experience.

- User Experience Focus: Ongoing development prioritizes intuitive design and backend efficiency to boost user satisfaction and engagement.

- Ecosystem Growth: In the first quarter of 2024, GoTo's combined ecosystem GTV reached IDR 145 trillion, demonstrating the power of its integrated platform.

- Future Enhancements: Planned upgrades in 2024 aim to increase cross-service usage by 10% through improved personalization and feature accessibility.

GoTo's technological foundation is built on advanced AI and machine learning, enhancing everything from delivery logistics to customer service, with AI-powered route optimization alone cutting fuel costs by 15% in 2024. The ongoing expansion of 5G networks across Indonesia is critical, ensuring the seamless operation of GoTo's super-app and enabling faster transactions for its growing user base. Robust cybersecurity is paramount to protect sensitive data, a necessity given the average global cost of data breaches reached $4.45 million in 2023.

| Technology Area | 2024/2025 Data Point | Impact on GoTo |

|---|---|---|

| AI/Machine Learning | 15% reduction in fuel costs (2024) | Increased operational efficiency, cost savings |

| 5G Network Expansion | Steady expansion of 5G coverage (mid-2024) | Improved service performance, wider reach |

| Cybersecurity | Average global data breach cost: $4.45 million (2023) | Mitigation of financial and reputational risks |

| Fintech Innovation | 25% YoY growth in GoPay transaction volume (2024) | Driving cashless transactions, financial inclusion |

Legal factors

GoTo must navigate Indonesia's robust consumer protection framework, which dictates fair practices in service delivery, transparent pricing, and effective dispute resolution mechanisms. Adherence to these regulations, such as those enforced by the Ministry of Trade, is crucial for maintaining user trust and avoiding penalties. For instance, in 2023, the Indonesian Consumers Foundation (YLKI) reported a significant increase in consumer complaints related to digital services, underscoring the importance of diligent compliance.

The legal landscape for gig workers in Indonesia, including Gojek drivers and delivery partners, remains dynamic. Recent discussions and potential legislative changes in 2024 and 2025 are focusing on defining their employment status, which directly impacts rights regarding minimum wage, social security coverage, and working hour regulations.

GoTo must actively monitor and adapt to these evolving labor laws to ensure compliance. This includes understanding potential new mandates for social security contributions, which could affect operational costs, and adhering to any updated guidelines on working hours and the right to collective bargaining, crucial for maintaining a harmonious relationship with its vast network of partners.

Tokopedia, a key player in Indonesia's digital economy, navigates a complex web of e-commerce regulations. These rules govern everything from ensuring product authenticity and securing online transactions to defining merchant responsibilities and managing import/export procedures. GoTo must actively ensure its platform supports compliance for all users, thereby reducing exposure to risks like counterfeit products or illicit online dealings.

Compliance with these legal frameworks is not just a formality but a cornerstone for GoTo's e-commerce success. For instance, Indonesia's Consumer Protection Law (UU No. 8 Tahun 1999) mandates clear product information and fair trade practices, impacting how merchants list items on Tokopedia. Failure to adhere can lead to significant penalties and damage to brand reputation, especially given the platform's substantial market share.

Financial Technology (FinTech) Regulations

GoTo Financial operates under the watchful eye of Indonesian financial regulators, including Bank Indonesia and the Otoritas Jasa Keuangan (OJK). These bodies enforce stringent rules governing digital payments, lending, and other financial services offered by the company.

Key legal obligations for GoTo Financial include securing and retaining necessary operating licenses, meeting capital adequacy requirements, and implementing robust anti-money laundering (AML) and know-your-customer (KYC) frameworks. For instance, OJK regulations often mandate specific minimum capital levels for digital financial service providers, which GoTo Financial must consistently meet to maintain its licenses.

- Licensing: GoTo Financial must hold specific licenses from Bank Indonesia and OJK for its payment gateway, lending, and other financial products.

- Compliance: Adherence to AML and KYC regulations is paramount to prevent illicit financial activities.

- Capital Requirements: Maintaining sufficient capital buffers, as stipulated by regulators, is crucial for operational stability.

- Evolving Landscape: Anticipating and adapting to new fintech regulations, such as those concerning data privacy or digital asset handling, is a continuous legal challenge.

Intellectual Property and Data Privacy

Protecting GoTo's intellectual property (IP), encompassing its software, brand identity, and unique algorithms, is paramount to maintaining its edge in the competitive digital landscape. This includes safeguarding its ride-hailing, delivery, and financial technology innovations.

Simultaneously, GoTo faces the critical imperative of adhering to stringent data privacy regulations. For instance, compliance with Indonesia's Personal Data Protection Act (UU PDP), enacted in 2022, is essential for the responsible handling of vast amounts of sensitive user data collected across its services. Failure to comply can result in significant penalties and reputational damage.

To navigate these legal complexities, GoTo must establish and maintain robust legal frameworks and advanced technological safeguards. These measures are vital for effectively managing its IP rights and ensuring comprehensive compliance with evolving data privacy laws, thereby building user trust.

- Intellectual Property Protection: Safeguarding GoTo's proprietary software, algorithms, and brand assets is key to its sustained competitive advantage.

- Data Privacy Compliance: Strict adherence to regulations like Indonesia's UU PDP is mandatory for handling user data ethically and legally.

- Legal Frameworks and Safeguards: Implementing strong legal structures and technological solutions is necessary for IP management and data privacy assurance.

GoTo must remain vigilant regarding Indonesia's evolving consumer protection laws, ensuring fair practices and transparent dealings across all its services. The company's commitment to these regulations, particularly those concerning digital transactions and service quality, directly impacts user trust and regulatory standing.

The legal status of gig economy workers in Indonesia is a significant area of focus, with potential legislative changes in 2024 and 2025 aiming to clarify employment rights for Gojek drivers and delivery partners. These changes could mandate new social security contributions and working hour regulations, influencing GoTo's operational costs and labor relations.

Tokopedia, as a major e-commerce platform, operates under stringent regulations governing product authenticity, transaction security, and merchant conduct. Compliance with laws like Indonesia's Consumer Protection Law (UU No. 8 Tahun 1999) is vital to prevent issues such as counterfeit goods and to maintain a trustworthy marketplace, especially given Tokopedia's substantial market share.

GoTo Financial's operations are overseen by Bank Indonesia and the OJK, requiring strict adherence to licensing, capital adequacy, and robust anti-money laundering (AML) and know-your-customer (KYC) protocols. For instance, OJK regulations often stipulate minimum capital levels for digital financial service providers, a key requirement for GoTo Financial's ongoing operations.

Protecting GoTo's intellectual property and complying with data privacy laws, such as Indonesia's Personal Data Protection Act (UU PDP) enacted in 2022, are critical. These legal obligations necessitate strong internal frameworks and technological safeguards to manage user data responsibly and secure proprietary innovations.

Environmental factors

GoTo's extensive logistics and delivery operations, particularly through its Gojek platform, inherently contribute to carbon emissions due to vehicle usage. For instance, Gojek's fleet, a significant component of its service, relies on internal combustion engine vehicles that produce greenhouse gases.

To mitigate this environmental impact, GoTo is actively pursuing initiatives like transitioning its fleet towards electric vehicles (EVs). By the end of 2023, Gojek had already deployed thousands of EVs in its Indonesian operations, aiming for a substantial portion of its fleet to be electric in the coming years. Route optimization software is also employed to minimize mileage and fuel consumption, further reducing emissions.

Furthermore, GoTo is exploring sustainable packaging solutions for its e-commerce and food delivery services, aiming to reduce waste and the environmental toll of discarded materials. This commitment to sustainability is crucial as environmentally conscious consumers and investors increasingly scrutinize corporate environmental, social, and governance (ESG) performance, with carbon footprint reduction being a key metric.

The massive volume of e-commerce transactions facilitated by GoTo's platform, particularly Tokopedia, results in substantial packaging waste. In 2023, Indonesia's e-commerce sector saw a significant uptick, contributing to this environmental concern.

GoTo is actively tackling the challenge of promoting sustainable packaging solutions and encouraging recycling initiatives across its operations. Exploring circular economy principles, where materials are reused and repurposed, is a key strategy to minimize its environmental footprint.

By prioritizing waste reduction and eco-friendly practices, GoTo can significantly bolster its brand image, resonating with environmentally conscious consumers and aligning with broader global sustainability objectives. This focus is becoming increasingly critical for long-term business viability.

Indonesia's susceptibility to extreme weather, such as the projected increase in flood events, poses a direct threat to GoTo's core services. These disruptions can significantly impact its on-demand transportation and logistics networks, affecting delivery times and driver availability.

To counter these environmental risks, GoTo's climate resilience strategy is paramount. This includes developing robust contingency plans and adapting infrastructure to maintain service continuity, especially as climate change impacts intensify.

GoTo must proactively assess and mitigate operational risks stemming from climate change. For instance, analyzing the potential economic impact of weather-related disruptions, such as a 10% increase in delivery delays due to flooding, would inform necessary operational adjustments.

Sustainable Supply Chain Practices

GoTo's extensive network of merchants and suppliers means it's crucial to foster sustainable practices across its entire supply chain. This involves encouraging environmentally sound sourcing, ethical production methods, and minimizing the ecological footprint of products sold on platforms like Tokopedia.

For instance, in 2024, Tokopedia reported a 15% increase in sellers offering eco-friendly products, indicating a growing consumer demand for sustainability. GoTo's commitment to this area is further demonstrated by its partnerships with logistics providers aiming to reduce carbon emissions by 20% by 2026 through optimized delivery routes and the use of electric vehicles.

Collaborating with partners to adopt greener practices not only enhances GoTo's environmental stewardship but also builds resilience against potential regulatory changes and reputational risks associated with unsustainable operations. This focus aligns with broader market trends, where consumers and investors increasingly prioritize companies with strong environmental, social, and governance (ESG) credentials.

- Encouraging Environmentally Responsible Sourcing: GoTo actively promotes sourcing materials and products from suppliers who adhere to environmental standards, such as those certified by the Forest Stewardship Council (FSC) for paper products or those with verifiable waste reduction programs.

- Promoting Ethical Production: This includes working with suppliers to ensure fair labor practices, safe working conditions, and the absence of child labor, which is becoming a key differentiator for consumers in 2024.

- Reducing Ecological Impact: GoTo is investing in initiatives to reduce packaging waste, promote recyclable materials, and optimize logistics to lower fuel consumption and carbon emissions across its operations.

- Collaborating for Greener Practices: Through programs and incentives, GoTo supports its merchant base in adopting sustainable business models, such as offering repair services or promoting product longevity.

Corporate Social Responsibility and Green Initiatives

Public perception and investor sentiment are increasingly shaped by a company's dedication to environmental sustainability and corporate social responsibility (CSR). GoTo's involvement in green initiatives, such as tree planting drives or collaborations promoting eco-friendly practices, directly impacts its brand image and long-term resilience.

Demonstrating authentic environmental commitment is crucial for GoTo's market standing. For instance, by 2024, over 60% of global consumers indicated they would pay more for sustainable products, highlighting the financial implications of green strategies.

- Brand Reputation: GoTo's CSR efforts, like its partnerships with environmental organizations, enhance its appeal to environmentally conscious consumers and investors.

- Investor Sentiment: A strong ESG (Environmental, Social, and Governance) profile, which includes green initiatives, can attract significant investment; in 2024, ESG funds saw continued inflows, reaching trillions globally.

- Long-Term Viability: Proactive environmental management mitigates regulatory risks and builds resilience against climate-related disruptions, ensuring GoTo's sustained operation.

GoTo's environmental strategy focuses on reducing its carbon footprint through fleet electrification and route optimization, aiming to cut emissions significantly. The company is also addressing packaging waste from its e-commerce and delivery services by promoting sustainable materials and circular economy principles.

Indonesia's vulnerability to climate events like floods necessitates GoTo's focus on climate resilience and contingency planning to ensure service continuity. Furthermore, GoTo is driving sustainability across its supply chain by encouraging eco-friendly sourcing and production among its vast network of merchants.

Public and investor perception is increasingly tied to GoTo's environmental commitment, influencing brand reputation and investment. By 2024, a significant majority of global consumers expressed willingness to pay more for sustainable products, underscoring the financial imperative of GoTo's green initiatives.

| Initiative | 2023/2024 Data | Target/Impact |

|---|---|---|

| EV Deployment (Gojek Indonesia) | Thousands deployed by end of 2023 | Substantial portion of fleet to be electric |

| Sustainable Packaging | Increased focus on recyclable materials | Reduced packaging waste |

| Eco-Friendly Product Sellers (Tokopedia) | 15% increase in 2024 | Meeting growing consumer demand |

| Logistics Emissions Reduction Partnership | Partnership targeting 20% reduction by 2026 | Optimized routes and EV usage |

| Consumer Willingness for Sustainable Products | Over 60% in 2024 | Financial benefit from green strategies |

PESTLE Analysis Data Sources

Our GoTo PESTLE analysis is grounded in data from reputable sources including government publications, international organizations, and leading market research firms. We incorporate economic indicators, regulatory updates, technological advancements, and socio-cultural trends.