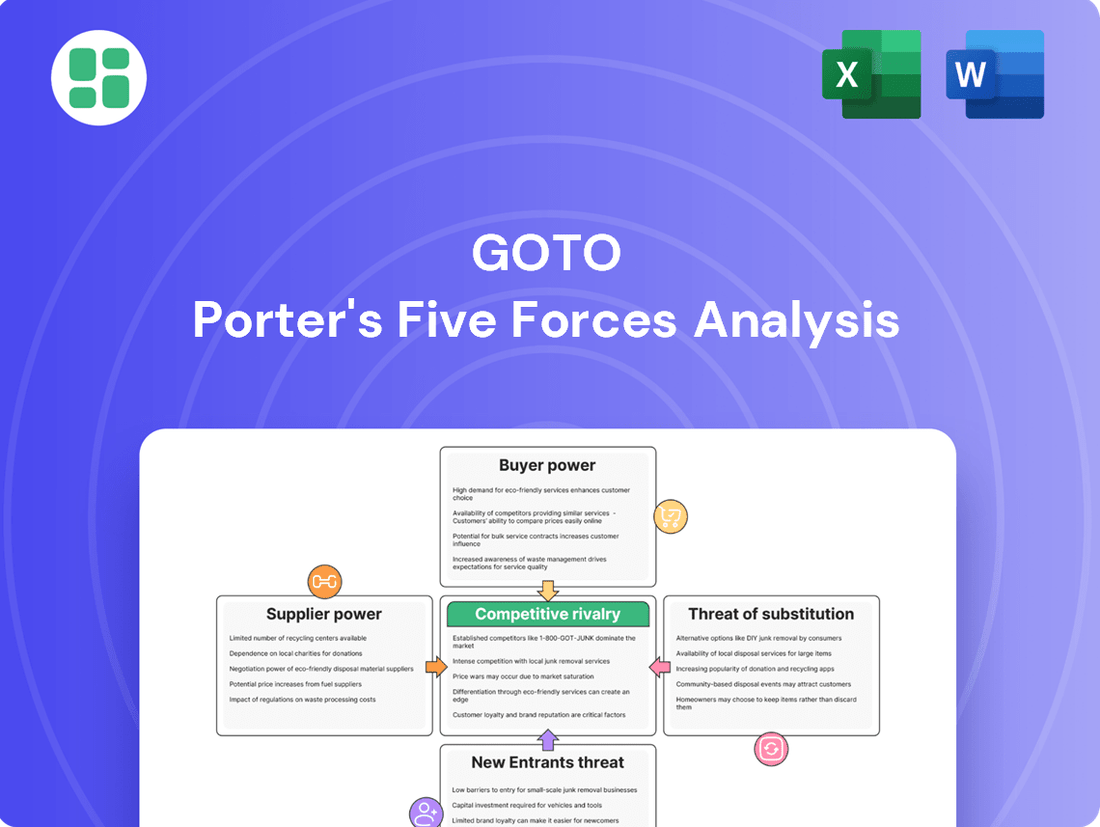

GoTo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoTo Bundle

GoTo faces moderate buyer power due to the availability of alternative remote access solutions, but its strong brand recognition and integrated offerings can mitigate this. The threat of new entrants is somewhat low, as establishing a robust and secure platform requires significant investment and expertise.

The complete report reveals the real forces shaping GoTo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GoTo's operational backbone, particularly for its ride-hailing (Gojek) and e-commerce (Tokopedia) segments, depends on a broad base of driver-partners and merchants. While the sheer number of these individual suppliers generally dilutes their collective bargaining power, GoTo's substantial scale enables it to secure advantageous terms across many of these relationships.

However, the bargaining power shifts significantly when considering specialized suppliers. Providers of unique technology, such as advanced AI solutions or critical cloud infrastructure, or partners offering distinct payment processing capabilities, can wield considerable influence. For instance, if a key cloud service provider for GoTo's platform were to increase prices, GoTo might face immediate cost pressures due to the difficulty in quickly switching to an alternative without disrupting services.

Switching costs for GoTo's core technology suppliers, like cloud service providers such as Alibaba or Tencent, could be substantial. This is primarily due to the intricate integration of these services into GoTo's existing infrastructure and the significant effort required for data migration. For instance, migrating vast datasets and reconfiguring complex systems can incur considerable time and financial investment, potentially running into millions of dollars annually depending on the scale of the services utilized.

While individual drivers or small merchants are unlikely to integrate forward, major technology or payment gateway suppliers could theoretically develop their own consumer-facing platforms. This would allow them to capture more of the value chain, similar to how GoTo operates its super-app.

However, the significant capital investment, complex regulatory landscape, and the need to overcome GoTo's established network effects in Indonesia make this a generally low threat. For instance, building a comparable super-app ecosystem requires billions in investment, a hurdle most suppliers would find prohibitive.

Importance of GoTo to Supplier's Business

For many individual driver-partners and small to medium-sized merchants on the GoTo platform, their reliance on GoTo for income and customer access is substantial. In 2024, ride-sharing platforms like GoTo continued to be a primary income source for millions of gig workers globally, with many relying on these platforms for over 50% of their earnings. This high dependence typically weakens their individual bargaining power with GoTo.

However, the potential for collective action among a significant number of drivers could shift this dynamic. Historically, organized driver groups have successfully negotiated for better terms, such as improved commission structures or fairer dispute resolution processes. While specific data for GoTo's driver collective bargaining power in 2024 is not publicly detailed, the general trend in the gig economy shows that organized groups can exert influence.

For larger, strategic technology partners, GoTo represents a crucial client within the expanding digital services sector. These partners often provide essential services like payment processing or mapping technology, and their integration with GoTo's operations makes them significant players. GoTo's growth in 2024, as it continued to expand its service offerings, likely solidified its position as a key revenue driver for these strategic partners, potentially increasing their leverage in negotiations.

The bargaining power of suppliers to GoTo can be viewed through several lenses:

- Driver-Partner Dependence: Many individual drivers and small merchants rely heavily on GoTo for their livelihood, limiting their individual negotiation leverage.

- Collective Action Potential: Organized groups of drivers can increase their bargaining power through unified demands.

- Strategic Partner Value: GoTo is a significant client for larger tech firms providing essential platform services, giving these suppliers some leverage.

- Market Growth: The increasing digitalization of services means GoTo is a valuable partner for tech suppliers, influencing their willingness to negotiate terms.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for a company like GoTo. In a market as large and dynamic as Indonesia, GoTo benefits from a vast pool of potential driver-partners and merchants. This sheer volume inherently dilutes the power of any individual or small group of suppliers, as GoTo can readily source alternatives.

While certain specialized technological inputs might present fewer direct substitutes, GoTo's strategic approach to innovation and its flexibility in engaging with various solution providers effectively neutralizes this supplier leverage. The rapid expansion of the digital economy further fuels this dynamic, constantly introducing new and competitive solution providers into the market.

- Driver and Merchant Pool: Indonesia's large population provides GoTo with a substantial and diverse base of potential driver-partners and merchants, reducing reliance on any single supplier group.

- Technological Substitutes: For specialized tech inputs, GoTo's internal innovation capabilities and its ability to switch between different providers limit the bargaining power of any one technology supplier.

- Digital Economy Growth: The burgeoning digital economy fosters a competitive landscape for input providers, encouraging new entrants and offering GoTo a wider array of choices.

GoTo's bargaining power with its suppliers is generally strong due to its massive scale and the availability of numerous alternatives for many inputs, particularly its vast network of drivers and merchants. However, reliance on specialized technology providers can introduce leverage for those suppliers.

The bargaining power of suppliers to GoTo hinges on the availability of substitutes and the switching costs associated with changing providers. For instance, while GoTo has a large pool of drivers, a key cloud service provider might have significant leverage if switching is complex and costly.

In 2024, the gig economy continued to see drivers relying heavily on platforms like GoTo for income, typically exceeding 50% of their earnings, which weakens individual driver bargaining power. Conversely, strategic tech partners providing essential services like payment gateways can exert influence, especially as GoTo's digital services expand.

The potential for suppliers to integrate forward, such as a tech partner launching its own app, is a theoretical threat but largely mitigated by the immense capital and regulatory hurdles involved in replicating GoTo's super-app ecosystem in Indonesia.

| Supplier Type | Bargaining Power Factors | GoTo's Position (2024 Context) |

|---|---|---|

| Driver-Partners/Merchants | High dependence on GoTo for income/customers; large pool of alternatives | Generally Low individual power; potential for collective action |

| Specialized Tech Providers (e.g., Cloud, AI) | High switching costs; proprietary technology | Moderate to High power for critical providers |

| Payment Gateway Providers | Integration complexity; essential service | Moderate power, influenced by GoTo's transaction volume |

What is included in the product

This analysis dissects the competitive forces impacting GoTo, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, and the intensity of rivalry.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Customers Bargaining Power

GoTo's vast user base, encompassing millions of individual consumers and merchants across Indonesia, inherently dilutes customer concentration. This broad reach means no single customer or small cluster of customers represents a substantial portion of GoTo's overall revenue.

Consequently, the bargaining power of individual customers is significantly limited. For instance, in 2023, GoTo reported a Gross Transaction Value (GTV) of IDR 400 trillion (approximately USD 25 billion), underscoring the sheer scale and diversification of its customer transactions, which further weakens any single customer's leverage.

Customers seeking ride-hailing services have numerous alternatives, with Grab being a prominent example, alongside other local players. Similarly, the e-commerce landscape is highly competitive, featuring giants like Shopee, Lazada, and the rapidly growing TikTok Shop, offering a wide array of products and services. This abundance of choices significantly amplifies customer bargaining power.

In financial services, the market is no longer dominated by traditional banks alone. A surge of fintech applications and digital payment platforms provides consumers with diverse options for managing their money, from payments to investments. This easy accessibility to substitutes means customers can readily switch to platforms offering better pricing, greater convenience, or superior service quality, directly impacting GoTo's ability to dictate terms.

While switching between individual services might seem low, GoTo's integrated ecosystem, combining transport, e-commerce, and fintech, creates moderate switching costs for users deeply embedded in its super-app experience. This stickiness is further reinforced by cross-vertical synergies, such as loyalty points and integrated payments, making it less appealing for users to extract themselves from the platform.

Price Sensitivity of Customers

Customers in Indonesia, especially those using on-demand services and e-commerce platforms like GoTo, tend to be quite sensitive to pricing. This means they actively look for deals and are influenced by discounts or special offers. For instance, a significant portion of Indonesian consumers actively compare prices across different platforms before making a purchase.

This price sensitivity directly impacts GoTo's strategy. They must constantly balance offering competitive prices to attract and keep users with the need to maintain profitability. This often involves running targeted promotions and loyalty programs to encourage repeat business and prevent customers from switching to rivals solely based on price.

- Price Sensitivity in Indonesia: Indonesian consumers are known for their price-consciousness, actively seeking promotions and discounts across various sectors, including ride-hailing and food delivery.

- GoTo's Pricing Challenge: GoTo faces pressure to manage its pricing and incentive structures to remain competitive, as customers readily switch for better deals.

- Impact on Strategy: The company must carefully calibrate its promotional activities and loyalty programs to retain its user base without eroding margins.

Customer Information and Transparency

The digital realm grants GoTo's customers a wealth of information. They can readily access details on pricing structures, service quality benchmarks, and the competitive landscape. This transparency is a significant factor in amplifying their ability to negotiate and secure favorable terms.

For instance, in the ride-hailing sector, a market GoTo operates within, customers frequently compare fares and driver ratings across multiple platforms before booking. In 2024, studies indicated that over 70% of ride-sharing users actively checked prices on at least two different apps before making a choice. This readily available data directly translates into increased customer bargaining power.

- Information Access: Digital platforms provide easy access to pricing, service quality, and competitor data.

- Price Sensitivity: Customers can swiftly compare offerings, driving a focus on value.

- Increased Negotiation: Transparency empowers customers to demand better terms, influencing GoTo's pricing and service strategies.

GoTo's extensive user base, spanning millions across Indonesia, significantly dilutes the bargaining power of individual customers. With a Gross Transaction Value (GTV) reaching IDR 400 trillion in 2023, the sheer volume of transactions means no single customer holds substantial sway. However, the competitive landscape in ride-hailing, e-commerce, and fintech offers numerous alternatives, empowering customers to switch for better deals, thus increasing their leverage.

| Factor | Impact on GoTo | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | Low | Millions of users, IDR 400 trillion GTV (2023) |

| Availability of Substitutes | High | Competition from Grab, Shopee, Lazada, TikTok Shop, various fintech apps |

| Price Sensitivity | High | Over 70% of ride-sharing users compare prices across apps (2024) |

| Switching Costs | Moderate | Integrated ecosystem, loyalty programs, cross-vertical synergies |

| Information Transparency | High | Easy access to pricing, service quality, and competitor data |

Preview Before You Purchase

GoTo Porter's Five Forces Analysis

This preview displays the complete GoTo Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely what you'll receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The Indonesian digital landscape is intensely competitive, with formidable players like Grab, a dominant force in ride-hailing and food delivery, and Sea Ltd, which commands significant market share in e-commerce through Shopee and fintech via SeaMoney. This robust competition extends to numerous other local e-commerce and fintech ventures, creating a dynamic and challenging environment for GoTo.

This diverse array of competitors intensifies rivalry across all of GoTo's core service verticals, from ride-hailing and delivery to financial technology and e-commerce. For instance, in 2023, Grab reported a substantial increase in its gross transaction value (GTV) in Southeast Asia, putting direct pressure on GoTo's market share in these segments.

Indonesia's digital economy is a hotbed of activity, with projections indicating it will surpass $130 billion by 2025. This robust expansion, while generally a positive sign, also fuels a highly competitive landscape.

The rapid growth rate means that while the pie is getting bigger, companies are fiercely battling for their slice. This intense rivalry is evident as numerous players strive to capture market share and attract new users across various digital services.

GoTo's strategy hinges on its 'super-app' concept, aiming to bundle ride-hailing, food delivery, and fintech services to foster customer loyalty. This integration creates network effects, making it harder for users to switch to single-service competitors.

However, this approach intensifies rivalry, as rivals like Grab are also building similar integrated ecosystems. For instance, Grab reported a 2023 revenue of approximately $1.5 billion, showcasing the scale of investment in these broad platforms, directly challenging GoTo's ecosystem lock-in strategy.

High Fixed Costs and Exit Barriers

Operating a large digital ecosystem like GoTo comes with significant fixed costs. These include substantial investments in technology infrastructure, ongoing marketing campaigns to maintain brand presence, and the operational costs of managing a vast network of drivers, merchants, and users. For instance, in 2023, GoTo reported significant operational expenses related to its technology and platform development, underscoring the capital-intensive nature of its business.

High exit barriers further intensify competitive rivalry within GoTo's operating landscape. Companies are often compelled to stay and compete due to considerable sunk costs in infrastructure and market development. The strategic importance of the Indonesian market, a key growth area for many digital platforms, also makes it difficult for players to simply withdraw, leading to sustained and often aggressive competition to capture market share.

- Significant Investments: GoTo's continued investment in technology and user acquisition, as seen in its 2023 financial reports, creates high fixed costs for all players.

- Market Commitment: The strategic value of the Indonesian market discourages companies from exiting, ensuring a competitive environment.

- Operational Scale: Maintaining a broad operational network requires continuous expenditure, acting as a barrier to entry and a driver for existing players to compete fiercely.

Strategic Stakes and Aggressiveness of Competitors

The Indonesian market is a fiercely contested arena for super-apps, driven by its substantial, youthful, and digitally adept consumer base. This makes it a crucial battleground for regional players aiming for supremacy.

Competitors are deploying aggressive tactics to capture market share and solidify their positions. These strategies encompass significant mergers and acquisitions, such as the notable combination of TikTok Shop and Tokopedia, alongside aggressive pricing strategies and continuous product innovation.

The intensity of this rivalry is underscored by the significant investment and strategic maneuvering observed. For instance, in 2024, the digital economy in Indonesia continued its rapid expansion, with e-commerce transactions alone projected to reach hundreds of billions of dollars, incentivizing intense competition among platforms vying for user attention and transaction volume.

- High Stakes: Indonesia's large, young, and digitally native population makes it a prime target for super-app growth, leading to intense competition.

- Aggressive Tactics: Competitors utilize mergers, acquisitions, price wars, and rapid product development to gain an edge.

- Merger Example: The 2024 merger of TikTok Shop and Tokopedia exemplifies the strategic consolidation occurring to build dominant market positions.

- Market Dynamics: The digital economy's rapid growth in Indonesia fuels this competitive environment, with platforms investing heavily to capture user engagement and transaction value.

Competitive rivalry is a defining characteristic of GoTo's operating environment in Indonesia. The market is crowded with strong players like Grab, which continues to expand its super-app offerings, and Sea Ltd's Shopee, a dominant e-commerce force. This intense competition is fueled by Indonesia's rapidly growing digital economy, which is projected to exceed $130 billion by 2025, attracting significant investment and aggressive market share grabs from all participants.

Companies are investing heavily in technology, marketing, and user acquisition, leading to high fixed costs and significant operational expenditures, as evidenced by GoTo's 2023 financial reports. The strategic importance of the Indonesian market and substantial sunk costs create high exit barriers, compelling existing players to compete fiercely for dominance. This dynamic is further intensified by strategic moves like the 2024 merger of TikTok Shop and Tokopedia, signaling a trend towards consolidation and the deployment of aggressive tactics such as price wars and rapid product innovation to capture market share.

| Competitor | Key Services | 2023 Performance Indicator (Approx.) |

|---|---|---|

| Grab | Ride-hailing, Food Delivery, Fintech | Increased Gross Transaction Value (GTV) in Southeast Asia |

| Sea Ltd (Shopee) | E-commerce, Fintech | Significant Market Share in E-commerce and Fintech |

| TikTok Shop/Tokopedia | E-commerce, Social Commerce | Merger completed in 2024, creating a formidable e-commerce entity |

SSubstitutes Threaten

The threat of substitutes for GoTo's services is a significant factor. For its ride-hailing segment, services like public transportation or the use of personal vehicles present lower-cost alternatives. While these may lack the on-demand convenience and speed of ride-hailing, the cost savings can be compelling for price-sensitive consumers.

In the e-commerce space, traditional brick-and-mortar retail continues to be a strong substitute. Consumers often value the ability to physically inspect products and receive immediate gratification, which online platforms cannot fully replicate. This is a persistent challenge for GoTo's e-commerce offerings, especially for certain product categories.

GoTo's strategy often hinges on its ability to offer a compelling price-performance trade-off. It aims to balance the convenience, speed, and integrated nature of its platform against the cost advantages of substitutes. For instance, in 2024, ride-hailing services globally continued to see users weigh cost against convenience, with public transport ridership showing resilience in many urban centers.

Switching costs to substitutes for GoTo's offerings can be quite low for standalone services. For example, a user needing only a single webinar platform can readily switch to Zoom or Microsoft Teams, often with minimal setup effort. This ease of transition highlights a vulnerability where customers can easily opt for a competitor if GoTo's pricing or features become less attractive for that specific need.

However, for customers who utilize multiple GoTo products, like GoTo Meeting, GoTo Webinar, and GoTo Connect, the integration and familiarity build a form of soft switching cost. The convenience of managing various communication and collaboration needs within a single GoTo ecosystem, accessible through one login and interface, can deter users from migrating to separate providers for each service, even if individual service costs are competitive elsewhere.

Customer loyalty to existing solutions presents a significant threat of substitutes. While digital platforms aim to build strong customer relationships through personalized experiences and loyalty programs, some customers may still opt for traditional methods for specific needs. For instance, a 2024 survey indicated that 35% of consumers still prefer cash for everyday transactions, demonstrating a persistent loyalty to established payment systems even with the proliferation of digital alternatives.

Availability of Direct and Indirect Substitutes

GoTo faces a significant threat from substitutes across its diverse business segments. For its ride-hailing services, consumers can opt for public transportation, personal vehicles, or even other ride-sharing platforms, limiting Gojek's pricing power and market share. In 2023, ride-hailing services globally saw continued competition, with established players and new entrants vying for market dominance.

Tokopedia, GoTo's e-commerce arm, contends with a broad range of substitutes. Traditional brick-and-mortar retail stores, direct-to-consumer brand websites, and numerous other online marketplaces offer consumers ample choices. The sheer volume of online shopping platforms available means that customer loyalty can be easily swayed by price, convenience, or product availability. In Southeast Asia, the e-commerce landscape remains highly fragmented, with significant competition from both local and international players.

GoTo Financial's digital payment and financial services also encounter strong substitutes. Traditional banks, with their established customer bases and comprehensive offerings, remain a primary alternative. Furthermore, a growing number of other digital wallets and fintech solutions are emerging, providing consumers with diverse options for managing their money. As of late 2023, digital payment adoption rates continued to climb across emerging markets, intensifying the competitive environment for financial services providers.

- Ride-hailing substitutes: Public transport, private cars, and rival ride-hailing apps.

- E-commerce substitutes: Traditional retail, brand websites, and other online marketplaces.

- Financial services substitutes: Traditional banks and numerous other digital wallets/fintech solutions.

- Impact of substitutes: Limits pricing power, erodes market share, and necessitates continuous innovation.

Technological Advancements Enabling Substitutes

Technological advancements are a significant driver in the threat of substitutes for GoTo. As new technologies emerge and existing ones improve, they can create more appealing alternatives to GoTo's services. For instance, the ongoing development in electric vehicle technology and autonomous driving could lead to more efficient and cost-effective personal transportation options that compete directly with ride-sharing and delivery services.

Consider the impact of enhanced public transport. Investments in high-speed rail or improved urban transit networks, often supported by government initiatives and technological upgrades, can offer viable alternatives for commuters. In 2023, many cities globally continued to invest heavily in public transport upgrades, with projects like London's Elizabeth Line demonstrating the potential for enhanced public transit to capture market share from private transportation services. This trend is expected to accelerate with further technological integration.

The rise of direct-to-consumer (DTC) models across various industries also presents a substitute threat. For GoTo’s delivery services, DTC platforms that manage their own logistics, empowered by sophisticated inventory management and delivery tracking software, can bypass third-party providers. Similarly, in the ride-sharing space, advancements in booking and payment systems for private car services or even car-sharing cooperatives could reduce reliance on platforms like GoTo.

Fintech innovations further bolster the substitute threat. New payment solutions and peer-to-peer transaction platforms can facilitate alternative mobility or delivery arrangements, potentially cutting out intermediary fees. GoTo must therefore maintain a robust innovation pipeline to ensure its offerings remain competitive against these evolving technological substitutes.

- Technological Advancements: Ongoing tech progress makes substitutes more attractive.

- Public Transport Improvements: Enhanced infrastructure and efficiency offer alternatives.

- Direct-to-Consumer Models: Companies managing their own logistics bypass third parties.

- Fintech Solutions: New payment and transaction systems enable alternative arrangements.

The threat of substitutes for GoTo is substantial, impacting its ride-hailing, e-commerce, and financial services. For ride-hailing, public transport and personal vehicles offer lower-cost alternatives, while e-commerce faces competition from traditional retail and direct-to-consumer brands. Fintech services are challenged by established banks and a growing number of digital wallets.

| Segment | Key Substitutes | User Consideration | 2024 Trend Observation |

| Ride-hailing | Public transport, personal vehicles, rival apps | Cost vs. Convenience | Resilient public transport ridership in urban centers |

| E-commerce | Brick-and-mortar retail, brand websites, other marketplaces | Product inspection, immediate gratification, price, availability | Fragmented Southeast Asian market with strong local/international competition |

| Financial Services | Traditional banks, other digital wallets, fintech solutions | Established trust, comprehensive offerings, new payment tech | Continued climb in digital payment adoption in emerging markets |

Entrants Threaten

The Indonesian digital ecosystem demands immense capital for technology, infrastructure, and network building. New players need significant funding to compete with established players like GoTo, making entry challenging.

GoTo's strong financial position, evidenced by its substantial cash reserves and solid performance throughout 2024, acts as a formidable barrier. This financial muscle allows GoTo to outspend potential rivals on expansion and innovation, further deterring new entrants.

GoTo benefits significantly from economies of scale and powerful network effects. As more users and merchants join its platform, its value proposition strengthens, creating a virtuous cycle that is hard for newcomers to replicate.

For instance, in 2024, GoTo's ride-hailing service saw daily active users in Indonesia reach tens of millions, a scale that new entrants would struggle to match, thus increasing the cost and difficulty of acquiring customers.

These combined forces create substantial barriers to entry. New competitors would need immense capital to subsidize user acquisition and merchant onboarding to a level that even approaches GoTo's established density and reach, making it a formidable challenge.

GoTo's established distribution channels, including its extensive logistics network and e-commerce platform, present a significant barrier to new entrants. These channels provide deep relationships with millions of merchants and driver-partners, making it difficult for newcomers to achieve comparable reach and operational efficiency.

Brand Identity and Customer Loyalty

GoTo, the Indonesian tech giant formed by the merger of Gojek and Tokopedia, benefits immensely from established brand identity and deep customer loyalty within its home market. This strong connection makes it challenging for newcomers to gain traction. For instance, in 2023, GoTo reported a significant portion of its revenue was driven by its ride-hailing and e-commerce segments, demonstrating the stickiness of its offerings.

New entrants would need to invest heavily in marketing and build substantial trust to replicate GoTo's brand equity. The sheer scale of GoTo's user base, which saw millions of active users across its platforms in 2024, presents a formidable barrier. This loyalty translates into repeat business and a higher customer lifetime value, which new players struggle to match from the outset.

- Brand Recognition: GoTo enjoys high brand recall in Indonesia, a result of years of operation and extensive marketing efforts.

- Customer Loyalty: A substantial percentage of GoTo's users are repeat customers, demonstrating a strong preference for its integrated services.

- Marketing Investment: Overcoming GoTo's established presence requires significant capital outlay for advertising and promotional activities.

- Trust Factor: Building consumer trust in a new platform, especially for financial and delivery services, is a long and arduous process.

Government Policy and Regulatory Hurdles

Government policy and regulatory hurdles present a significant threat to new entrants in Indonesia's digital economy. These complexities, including evolving data protection laws and e-commerce regulations, require substantial investment and expertise to navigate. For instance, Indonesia's Personal Data Protection Law (UU PDP), enacted in 2022, mandates strict data handling and privacy compliance, which can be costly for startups to implement from inception.

Established players like GoTo, having operated within this landscape for years, possess the experience and resources to adapt to these changes more readily. This existing compliance infrastructure and understanding of the regulatory environment act as a formidable barrier for newcomers. In 2024, the Indonesian government continued to refine its digital economy policies, with ongoing discussions around digital taxation and platform accountability, further increasing the compliance burden for any new market participants.

- Regulatory Complexity: Navigating Indonesia's digital economy laws, such as the UU PDP, demands significant upfront investment in compliance infrastructure.

- Established Player Advantage: GoTo's long-standing experience and resources allow for more agile adaptation to new or changing regulations compared to new entrants.

- Ongoing Policy Evolution: Continued government focus on digital taxation and platform accountability in 2024 creates an unpredictable and potentially costly compliance landscape for new businesses.

The threat of new entrants for GoTo is significantly mitigated by substantial capital requirements for technology, infrastructure, and network development in the Indonesian digital ecosystem. GoTo's robust financial standing in 2024, characterized by strong cash reserves, enables it to out-invest potential rivals, thereby raising the entry barrier. Furthermore, GoTo's deeply entrenched economies of scale and powerful network effects, evident in its millions of daily active users in 2024, create a competitive moat that is exceptionally difficult for newcomers to surmount.

| Barrier Type | Description | Impact on New Entrants | GoTo's Advantage (2024 Data) |

|---|---|---|---|

| Capital Requirements | High investment needed for tech, infrastructure, and network build-out. | Deters new players lacking significant funding. | GoTo's strong financial position and cash reserves. |

| Economies of Scale & Network Effects | Value increases with user and merchant adoption. | Newcomers struggle to reach critical mass and offer comparable value. | Millions of daily active users across platforms in 2024. |

| Brand Loyalty & Trust | Established brand recognition and customer preference. | New entrants face challenges in building trust and acquiring users. | Significant repeat business driven by integrated services. |

| Regulatory Landscape | Navigating complex Indonesian digital economy laws. | Compliance costs and expertise required are high for startups. | Existing experience and resources to adapt to evolving policies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GoTo leverages data from company investor relations sites, competitor announcements, market share data, and industry research reports to thoroughly assess competitive intensity.