GoTo Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoTo Bundle

GoTo's marketing success hinges on a carefully crafted blend of Product, Price, Place, and Promotion. Discover how their innovative software solutions are positioned, priced competitively, distributed effectively, and promoted to reach their target audience.

Unlock the full potential of GoTo's marketing strategy with our comprehensive 4Ps analysis. This detailed report provides actionable insights into their product development, pricing models, channel partnerships, and promotional campaigns, empowering you to refine your own marketing efforts.

Ready to gain a competitive edge? Our complete GoTo 4Ps Marketing Mix Analysis offers a deep dive into their strategic decisions, providing a ready-to-use framework for your business planning, client presentations, or academic research.

Product

GoTo's Integrated Digital Ecosystem is the cornerstone of its Product strategy, bringing together on-demand services, e-commerce, and financial technology into a single, cohesive platform. This integration is designed to streamline everyday tasks for consumers and unlock growth opportunities for businesses throughout Indonesia. For instance, in 2023, Gojek's ride-hailing and delivery services saw continued strong demand, while Tokopedia's e-commerce platform processed millions of transactions daily.

The synergy between Gojek, Tokopedia, and GoTo Financial creates significant cross-service utility. This means users can seamlessly transition between ordering food, shopping online, and managing their finances, all within the GoTo app. By Q1 2024, GoTo Financial reported a substantial increase in its user base, demonstrating the growing adoption of its integrated financial services alongside its core platform offerings.

Gojek's product portfolio is anchored by its extensive on-demand services, primarily through its ride-hailing and diverse delivery verticals. These services, encompassing everything from transporting people to delivering meals and packages, form the core of its user-facing offerings.

The on-demand segment has demonstrated remarkable resilience and growth, evidenced by significant year-on-year increases in Gross Transaction Value (GTV). For instance, Gojek's GTV in Q1 2024 reached IDR 152 trillion, a notable jump from the previous year, underscoring its expanding market penetration and transaction volume.

Profitability within this segment is also a key highlight, with adjusted EBITDA showing consistent positive trends. GoTo reported that its on-demand segment achieved positive adjusted EBITDA, contributing to the company's overall financial health and strategic focus on sustainable growth.

Continuous innovation is a driving force, with ongoing enhancements to both mobility and delivery services. These improvements aim to boost user experience, operational efficiency, and service reliability, ensuring Gojek remains competitive in the rapidly evolving on-demand landscape.

Tokopedia, as GoTo's primary e-commerce offering, functions as a comprehensive marketplace connecting a vast array of sellers with consumers for diverse goods and services. Its strategic positioning targets medium-frequency, high-value transactions, creating a synergistic balance with Gojek's frequent, lower-value service offerings within the broader GoTo ecosystem.

In 2023, Tokopedia continued its strategic push to enhance user engagement and merchant value. For instance, GoTo reported that its e-commerce segment, largely driven by Tokopedia, saw gross transaction value (GTV) growth, with specific initiatives focused on boosting average order values and encouraging repeat purchases through personalized promotions and loyalty programs.

Financial Technology Services (GoTo Financial)

GoTo Financial, a key component of GoTo's marketing mix, is demonstrating impressive growth through its expanding fintech offerings. The GoPay app and consumer lending services are central to this expansion, driving significant increases in net revenue and loan book size. For instance, GoTo Financial's net revenue saw a notable year-on-year increase, reaching IDR 2.7 trillion in the first nine months of 2024, a substantial jump from IDR 1.7 trillion in the same period of 2023. The loan book also expanded considerably, growing by 47% year-on-year to IDR 17.2 trillion by the end of Q3 2024.

The success of GoTo Financial is underpinned by strategic innovations and a focus on the underbanked Indonesian market. Initiatives like GoPay Hadiah THR, which offers special rewards during the holiday season, enhance user engagement and transaction volume. Furthermore, the company prioritizes prudent risk management, leveraging a tech-driven operating model to ensure sustainable growth and effective service delivery in a dynamic market.

Key performance indicators for GoTo Financial in 2024 highlight its strategic importance:

- Net Revenue Growth: Significant year-on-year increases, with IDR 2.7 trillion in the first nine months of 2024 compared to IDR 1.7 trillion in the prior year.

- Loan Book Expansion: A 47% year-on-year increase in the loan book, reaching IDR 17.2 trillion by the end of Q3 2024.

- User Engagement: Continued growth in GoPay transaction volume and active users, driven by targeted promotions and expanded services.

- Market Penetration: Strong performance in serving the underbanked population in Indonesia through accessible digital financial solutions.

AI-Driven Enhancements and Business Solutions

GoTo is leveraging AI to significantly upgrade its product offerings and streamline business operations. This includes personalized recommendations on its digital platforms, aiming to boost engagement and sales. For instance, Sahabat AI is designed to directly improve user experience and operational workflows for its partners.

The company's integrated platform also delivers AI-powered business solutions tailored for merchants and partners of all sizes. This strategic integration of AI is a key component of GoTo's product strategy, enhancing value for both end-users and its business clientele.

- AI Integration: GoTo is embedding AI across its ecosystem to personalize user journeys and optimize backend processes.

- Sahabat AI: This initiative specifically targets enhancing user experience and operational efficiency for GoTo's partners.

- Business Solutions: The platform offers AI-driven tools to support diverse merchant needs, fostering growth and efficiency.

- Customer Experience: AI enhancements are projected to drive higher customer satisfaction and retention rates by offering more relevant and timely interactions.

GoTo's product strategy centers on its integrated digital ecosystem, merging on-demand services, e-commerce, and fintech. This synergy enhances user experience and unlocks business growth, as seen with Gojek's strong performance and Tokopedia's high transaction volumes in 2023. GoTo Financial's rapid expansion, particularly in consumer lending, is a key driver, with its loan book growing 47% year-on-year to IDR 17.2 trillion by Q3 2024.

The product suite is continuously refined with AI integration, exemplified by Sahabat AI, to personalize user journeys and boost partner efficiency. This focus on innovation ensures GoTo remains competitive and delivers increasing value across its diverse service verticals.

| Product Segment | Key 2023/2024 Performance Highlights | Strategic Focus |

|---|---|---|

| Gojek (On-Demand) | GTV reached IDR 152 trillion in Q1 2024. Achieved positive adjusted EBITDA. | Service enhancement, operational efficiency, user experience. |

| Tokopedia (E-commerce) | Continued growth in Gross Transaction Value (GTV). Initiatives to boost average order value. | User engagement, merchant value, personalized promotions. |

| GoTo Financial (Fintech) | Net revenue IDR 2.7 trillion (9M 2024). Loan book IDR 17.2 trillion (Q3 2024), up 47% YoY. | Fintech expansion, underbanked market, risk management. |

| AI Integration | Personalized recommendations, Sahabat AI for partner efficiency. | Enhanced customer experience, optimized operations. |

What is included in the product

This analysis offers a comprehensive breakdown of GoTo's Product, Price, Place, and Promotion strategies, providing actionable insights for marketers and managers seeking to understand their competitive positioning.

It delves into GoTo's actual brand practices and market context, delivering a professionally structured document ideal for reports, presentations, or strategic benchmarking.

Simplifies complex GoTo 4P's analysis into actionable insights, alleviating the pain of overwhelming marketing data.

Place

GoTo's distribution strategy heavily leans on its mobile application ecosystem, featuring the Gojek, Tokopedia, and GoPay apps. These platforms act as direct conduits to a massive user base, offering integrated access to a wide array of services.

This mobile-centric approach ensures unparalleled convenience, allowing users to seamlessly transition between ride-hailing, e-commerce, and digital payment services within a single, unified digital environment.

As of early 2024, GoTo reported over 100 million monthly active users across its key super-apps, underscoring the significant reach and engagement of its mobile distribution channels.

GoTo's extensive partner network is a cornerstone of its marketing mix, particularly its 'Place' strategy. This network comprises a vast number of driver-partners and merchant-partners throughout Indonesia, which is essential for GoTo's on-demand services and e-commerce operations.

This broad geographical reach ensures GoTo can serve customers and businesses across the archipelago, even in less accessible regions. For instance, as of late 2024, GoTo's ecosystem included millions of active driver-partners and hundreds of thousands of merchant-partners, facilitating seamless transactions and deliveries.

The continuous expansion and refinement of this partner network are central to GoTo's objective of increasing its market penetration and solidifying its position in the Indonesian digital economy.

GoTo's integrated digital infrastructure, heavily reliant on cloud services, is the engine powering its extensive operations. This allows for dependable and efficient service delivery across its diverse platforms, from ride-hailing to e-commerce. The company's commitment to a strong digital backbone ensures it can handle massive transaction volumes and the vast amounts of data generated daily.

Strategic alliances with leading cloud providers such as Alibaba Cloud and Tencent Cloud are central to GoTo's strategy. These partnerships are designed to enhance operational efficiency and drive cost reductions by leveraging advanced technological capabilities. This focus on optimizing the underlying technology is crucial for maintaining a competitive edge and supporting future growth initiatives, especially as transaction volumes are projected to continue their upward trajectory in the coming years.

Direct-to-Consumer Digital Channels

GoTo leverages its digital presence beyond core applications through dedicated websites and integrated in-app features. These direct channels are crucial for customer engagement and acquisition, offering a streamlined path for users to discover and utilize GoTo's services. The company consistently invests in refining these platforms, aiming for enhanced user experience and accessibility.

In 2024, GoTo's digital channels are central to its customer outreach strategy, with a focus on optimizing the user journey. For instance, their website traffic and in-app engagement metrics are key performance indicators. By continuously updating features and improving interfaces, GoTo seeks to make its offerings more discoverable and easier to use, driving higher adoption rates.

- Website Optimization: GoTo continually updates its primary websites to improve navigation and information delivery, aiming to increase conversion rates for new sign-ups and existing customer upgrades.

- In-App Engagement: Features within GoTo's applications are designed to foster deeper user interaction, promoting feature discovery and encouraging repeat usage.

- User Interface (UI) Enhancements: Significant efforts are made to ensure intuitive and user-friendly interfaces across all digital touchpoints, reducing friction in the customer experience.

- Digital Marketing Integration: Direct digital channels are tightly integrated with marketing campaigns to ensure a cohesive and effective customer acquisition and retention strategy.

Strategic Localized Reach

GoTo's distribution strategy is deeply rooted in strengthening its presence across Indonesia, adapting its offerings to suit the unique demands and tastes of local consumers. This focus on its primary market is key to maximizing its impact.

The company is also strategically looking at expanding its footprint within the broader Southeast Asian region. This expansion is carefully considered, prioritizing profitability and operational efficiency to ensure sustainable growth.

This localized strategy is crucial for GoTo's success, as it allows the company to remain relevant and deliver its services effectively in the varied cultural and economic landscapes of the region. For instance, in 2023, GoTo reported a significant increase in its gross transaction value (GTV) for its ride-hailing and food delivery segments, demonstrating the effectiveness of its localized approach in driving user engagement and transaction volume within Indonesia.

Key aspects of GoTo's localized reach include:

- Deepening Indonesian Market Penetration: Tailoring services to specific regional needs and consumer behaviors within Indonesia.

- Southeast Asian Expansion Focus: Prioritizing profitable and efficient geographical growth in neighboring markets.

- Adaptable Service Delivery: Ensuring relevance and effectiveness by customizing offerings for diverse local contexts.

- Leveraging Local Ecosystems: Integrating with local businesses and communities to enhance service accessibility and adoption.

GoTo's 'Place' in the marketing mix is fundamentally about its extensive physical and digital presence across Indonesia. This includes its vast network of driver-partners and merchant-partners, which form the backbone of its on-demand services and e-commerce operations. The company's strategy is to be accessible everywhere, from bustling city centers to more remote areas, ensuring broad market coverage.

By leveraging its super-app ecosystem, GoTo creates a seamless digital marketplace that users can access from anywhere. This digital infrastructure is supported by strategic alliances with cloud providers, ensuring reliability and scalability. The company's focus remains on deepening its penetration within Indonesia while strategically expanding into other Southeast Asian markets, always adapting to local needs.

As of late 2024, GoTo's ecosystem included millions of active driver-partners and hundreds of thousands of merchant-partners, facilitating transactions across the archipelago. This physical network, combined with its robust digital platforms, allows GoTo to effectively reach and serve its target audience throughout Indonesia and beyond.

| Metric | Value (as of late 2024) | Significance |

|---|---|---|

| Active Driver-Partners | Millions | Ensures broad coverage for ride-hailing and delivery services. |

| Active Merchant-Partners | Hundreds of Thousands | Facilitates extensive e-commerce and on-demand service offerings. |

| Monthly Active Users (Super-apps) | Over 100 Million | Demonstrates significant reach and engagement of digital distribution channels. |

What You See Is What You Get

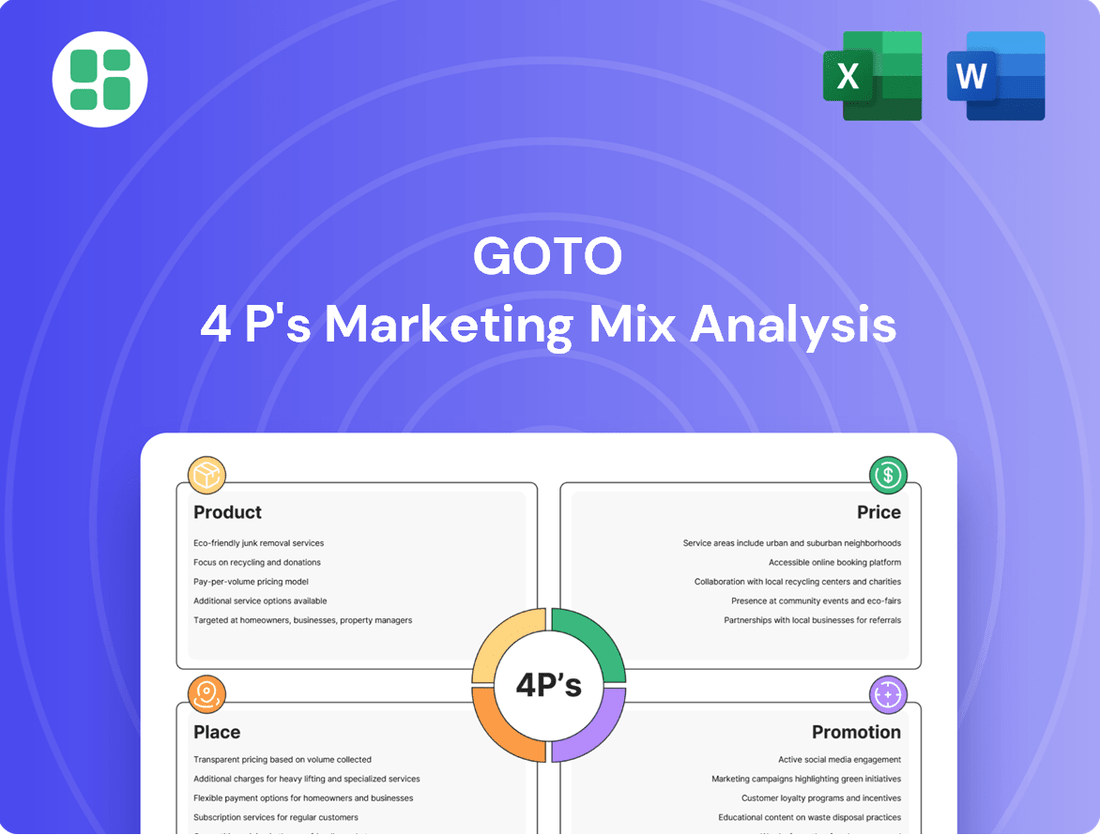

GoTo 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive GoTo 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

GoTo actively cultivates ecosystem synergy, promoting cross-usage between Gojek, Tokopedia, and GoTo Financial services. This approach leverages existing user bases to boost adoption across its platforms, significantly lowering customer acquisition costs.

Marketing campaigns emphasize the integrated platform's ability to simplify daily life, offering a comprehensive suite of solutions. For instance, in Q1 2024, GoTo reported that users engaging with multiple services within its ecosystem exhibited a 20% higher retention rate compared to single-service users.

GoTo heavily leverages digital marketing, including social media, online ads, and in-app campaigns, to boost brand visibility and attract new users. These efforts are crucial for driving growth in transaction volumes for their ride-hailing and delivery services.

In 2024, GoTo's digital marketing spend is projected to be a significant portion of its overall marketing budget, aiming to enhance user acquisition by an estimated 15-20% compared to the previous year. Targeted in-app promotions are particularly effective, with studies showing they can increase conversion rates by up to 30% for specific service offerings.

GoTo's brand building strategy for its integrated services centers on cultivating a robust, cohesive GoTo identity while respecting the established individual brands of Gojek, Tokopedia, and GoTo Financial. This careful balance aims to leverage existing trust and recognition while signaling the expanded benefits of the combined ecosystem.

This dual-brand approach is crucial for instilling confidence and ensuring widespread recognition across GoTo's varied service portfolio. The emphasis is on highlighting the inherent reliability and seamless convenience that customers can expect from the entire integrated group, a key differentiator in the competitive digital landscape.

To achieve this, GoTo employs consistent messaging across all its platforms. For instance, in Q1 2024, GoTo reported a significant increase in cross-selling opportunities, with 25% of Gojek users also engaging with Tokopedia services, underscoring the effectiveness of their unified brand narrative in driving ecosystem adoption.

Customer Loyalty and Incentive Programs

GoTo actively cultivates customer loyalty through a variety of programs designed to attract new users and keep existing ones engaged. These initiatives often involve discounts and tailored incentives, frequently supported by their merchant partners, to foster ongoing interaction and increased spending within their platform. For instance, in 2024, GoTo continued to refine its data-driven incentive strategies for its on-demand services, aiming to optimize user acquisition and retention.

The company’s approach focuses on creating a sticky ecosystem where users are encouraged to return and spend more. This is achieved through strategic promotions that directly target user activity and purchasing behavior. By understanding user data, GoTo can make precise adjustments to these incentives, ensuring they remain effective in driving desired outcomes.

- Incentive Adjustments: GoTo regularly modifies its incentive structures based on user data to maximize engagement and spending.

- Merchant Funding: Many loyalty and incentive programs are co-funded by merchants, aligning GoTo's goals with those of its partners.

- User Activity Boosts: Special promotions are a key tactic to encourage consistent user activity and transactions within the GoTo ecosystem.

- Data-Driven Strategies: The effectiveness of these programs is continuously evaluated and improved using data analytics.

Public Relations and ESG Initiatives

GoTo actively leverages public relations and Environmental, Social, and Governance (ESG) initiatives to bolster its brand image and foster deeper connections with its diverse stakeholder base. These efforts are crucial for building trust and demonstrating a commitment beyond just financial performance.

The company's ESG reporting underscores its dedication to sustainable operations. For instance, GoTo has reported progress in areas like reducing its carbon footprint and implementing effective waste management strategies. These actions directly address growing investor and consumer demand for corporate responsibility.

Furthermore, GoTo's initiatives aim to dismantle economic barriers for its partners, enhancing social impact. This focus on community empowerment and inclusive growth is a key component of its ESG framework. By highlighting these efforts, GoTo aims to position itself as a responsible corporate citizen committed to long-term value creation.

- Brand Reputation Enhancement: GoTo's PR and ESG activities are designed to cultivate a positive brand image, attracting both customers and investors who prioritize ethical business practices.

- Stakeholder Engagement: Communicating ESG progress, such as emission reduction targets for 2025, helps GoTo build stronger relationships with investors, employees, and the communities it serves.

- Sustainable Growth Commitment: By focusing on environmental stewardship and social impact, GoTo signals its commitment to a business model that is both profitable and sustainable in the long run.

- Economic Opportunity Creation: Efforts to remove economic barriers for partners, a key social pillar of ESG, directly contribute to GoTo's ecosystem's growth and resilience.

GoTo's promotional strategy centers on highlighting its integrated ecosystem, driving cross-usage and customer loyalty through digital marketing and tailored incentives. The company emphasizes a dual-brand approach, reinforcing the GoTo identity while respecting individual platform recognition.

In 2024, GoTo's digital marketing spend aims for a 15-20% user acquisition increase, with in-app promotions boosting conversion rates by up to 30%. Furthermore, Q1 2024 data shows a 25% cross-engagement rate between Gojek and Tokopedia users, demonstrating the success of their unified brand messaging in fostering ecosystem adoption.

Loyalty programs, often co-funded by merchants, are continuously refined using data analytics to boost user activity and spending. GoTo also leverages PR and ESG initiatives to enhance brand reputation and stakeholder engagement, with a reported commitment to sustainability targets for 2025.

| Promotional Tactic | Key Objective | 2024/2025 Impact/Data |

|---|---|---|

| Ecosystem Synergy Promotion | Increase cross-usage and retention | 20% higher retention for multi-service users (Q1 2024); 25% cross-engagement (Gojek/Tokopedia, Q1 2024) |

| Digital Marketing Campaigns | Boost brand visibility and user acquisition | Projected 15-20% user acquisition increase (2024); In-app promotions increase conversion by up to 30% |

| Loyalty & Incentive Programs | Drive user activity and spending | Data-driven adjustments for optimal engagement; Merchant co-funding common |

| PR & ESG Initiatives | Enhance brand reputation and stakeholder trust | Focus on sustainability targets (e.g., 2025 emissions); Building positive corporate image |

Price

GoTo's Gojek platform leverages dynamic pricing, a core element of its marketing mix, to adjust fares in real-time. This means prices can fluctuate based on factors like how many people need a ride or delivery, how far you're going, and even the time of day.

This dynamic approach is designed to create a win-win scenario. It helps ensure drivers earn more during peak demand, while users benefit from potentially lower fares during off-peak times. For instance, during the 2024 holiday season, Gojek likely saw significant price adjustments in major Indonesian cities like Jakarta to manage the surge in demand.

The ultimate goal is to strike a delicate balance. GoTo aims to keep its services competitive and appealing to customers, maintain a high level of service quality, and ensure the platform remains profitable for both GoTo and its driver partners.

Tokopedia, a core part of GoTo's ecosystem, relies heavily on a commission-based model. This means they earn a percentage from every sale made by merchants on their platform. This is a crucial income stream for GoTo, ensuring consistent cash flow.

In the first quarter of 2024, GoTo reported that its e-commerce segment, which includes Tokopedia, saw a gross transaction value (GTV) of IDR 146 trillion. The company actively manages its commission rates, aiming to balance merchant competitiveness with revenue optimization.

GoTo's subscription models, like GoFood Plus, are designed to boost user experience and offer extra benefits for a recurring payment. This strategy targets users who spend more, aiming to create steadier income and foster greater loyalty within their platform.

By offering premium features, GoTo seeks to transform casual users into more valuable subscribers. For instance, GoFood Plus, launched in 2024, provides benefits like free delivery on eligible orders and exclusive discounts, directly appealing to frequent users of their food delivery service.

Promotional Pricing and Targeted Incentives

GoTo frequently employs promotional pricing and targeted incentives to boost demand and acquire new users. These strategies often involve discounts for riders, bonuses for drivers, and promotions funded by merchants. For instance, in late 2024, ride-sharing platforms saw increased driver sign-ups driven by guaranteed earnings promotions, with some markets offering up to $1,000 for new drivers meeting specific ride quotas.

These data-driven adjustments are vital for maintaining a healthy balance between expanding market share and ensuring profitability. By analyzing the effectiveness of different incentive structures, GoTo can optimize spending to improve unit economics. For example, a targeted campaign in early 2025 might offer a 15% discount on rides during off-peak hours, aiming to increase overall utilization without significantly impacting profitability.

- Promotional Pricing: Discounts and special offers are common to attract and retain customers.

- Driver Incentives: Bonuses and guaranteed earnings are used to ensure driver availability.

- Merchant-Funded Promotions: Partnerships with businesses to offer joint discounts.

- Data-Driven Optimization: Continuous analysis of incentive effectiveness to improve ROI.

Growth in Financial Services Loan Book

GoTo's financial services segment is aggressively growing its consumer loan book, a key driver for revenue through interest and service fees. This expansion is particularly impactful as it taps into Indonesia's large unbanked population, offering them accessible credit solutions. The company reported that its lending business, GoModal, saw a significant uptick in loan disbursements in early 2024.

This strategic focus on lending directly bolsters GoTo's financial performance. By leveraging its extensive user base across ride-hailing, e-commerce, and digital payments, GoTo can efficiently cross-sell these loan products. For instance, in Q1 2024, GoTo Financial’s loan portfolio expanded by over 30% year-on-year, contributing to a notable increase in net revenue from financial services.

- Loan Book Expansion: GoTo's financial technology arm is prioritizing the growth of its consumer loan portfolio.

- Revenue Streams: Revenue is generated from interest income and service fees associated with these lending products.

- User Base Leverage: The company utilizes its existing user base to cross-sell financial products, reaching the unbanked segment.

- Financial Impact: The rapid increase in outstanding consumer loans is a significant contributor to GoTo's overall revenue and profitability.

GoTo's pricing strategy is multifaceted, encompassing dynamic fares for ride-hailing and commission structures for e-commerce. For instance, Gojek's dynamic pricing adjusts based on demand and supply, a strategy evident during peak periods like the 2024 year-end holidays where surge pricing was likely implemented in major cities.

Tokopedia, on the other hand, operates on a commission model, earning a percentage of each transaction. In Q1 2024, Tokopedia facilitated IDR 146 trillion in gross transaction value, showcasing the significant revenue generated through these commissions.

Subscription services like GoFood Plus, introduced in 2024, offer benefits such as free delivery, aiming to increase customer loyalty and recurring revenue. This tiered pricing approach targets frequent users, enhancing perceived value and encouraging consistent platform engagement.

Promotional pricing and targeted incentives are also key. In late 2024, ride-sharing saw increased driver acquisition through guaranteed earnings promotions, with some markets offering up to $1,000 for new drivers. These data-driven adjustments, like a potential 15% discount on off-peak rides in early 2025, aim to optimize utilization and profitability.

| Pricing Strategy | Mechanism | Example/Data Point | Objective |

| Dynamic Fares (Gojek) | Real-time adjustment based on demand, supply, distance, time | Likely surge pricing during 2024 holiday season in Jakarta | Balance driver earnings and user cost, manage demand |

| Commission Model (Tokopedia) | Percentage of each sale | IDR 146 trillion GTV in Q1 2024 | Generate consistent revenue from e-commerce |

| Subscription Services (GoFood Plus) | Recurring payment for premium benefits | Launched in 2024, offers free delivery | Increase customer loyalty, predictable revenue |

| Promotional Pricing/Incentives | Discounts, bonuses, guaranteed earnings | Up to $1,000 sign-up bonus for drivers (late 2024) | Boost user acquisition, driver availability, market share |

4P's Marketing Mix Analysis Data Sources

Our GoTo 4P's Marketing Mix Analysis is built upon a robust foundation of data, including official company statements, product launch details, pricing strategies, and distribution network information. We meticulously gather insights from investor relations materials, industry publications, and direct observations of GoTo's market presence.