Goodwin Procter SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodwin Procter Bundle

Goodwin Procter's strengths lie in its strong reputation and deep industry expertise, but understanding its vulnerabilities and the competitive landscape is crucial. Our comprehensive SWOT analysis dives deep into these areas, revealing key opportunities for growth and potential threats that demand strategic attention.

Want the full story behind Goodwin Procter's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning, client pitches, and informed investment decisions.

Strengths

Goodwin Procter has cemented its position as a global leader in Mergers and Acquisitions, consistently ranking number one in deal count for the past five years. This includes their strong performance through fiscal year 2024 and into the first half of 2025.

This sustained dominance underscores the firm's deep transactional expertise and significant market influence. Their M&A activity in fiscal year 2024 alone saw a remarkable value increase of almost 65% compared to the prior year, showcasing substantial growth and impact.

Goodwin Procter's deep industry specialization is a significant strength, particularly in high-growth sectors like technology, private equity, life sciences, real estate, and financial services. This focused approach allows them to offer uniquely valuable strategic and commercial advice to both emerging companies and established investors navigating these dynamic markets. For instance, in 2024, Goodwin advised on a substantial number of technology and life sciences deals, demonstrating their continued dominance in these areas.

Goodwin Procter demonstrates robust financial health, evidenced by its consistent ranking among the top 16 law firms globally. The firm achieved a notable $2.24 billion in revenue in 2023, underscoring its market leadership and operational efficiency.

This strong financial performance provides a solid bedrock for future initiatives, including strategic associate recruitment and investment in new service areas. The firm's commitment to growth is further highlighted by its proactive hiring plans, signaling confidence in its ongoing expansion.

High Rankings and Esteemed Reputation

Goodwin Procter's commitment to excellence is consistently validated by its high rankings in prestigious legal publications. For instance, The American Lawyer has frequently recognized the firm for its outstanding performance, and the Legal 500 US 2025 edition specifically lauded Goodwin in numerous practice areas, underscoring their deep market knowledge and client-focused approach. Chambers USA 2025 also awarded the firm top-tier rankings across a broad spectrum of practice groups, reflecting the exceptional quality of their legal talent and services.

These consistent accolades, including those from The Best Lawyers in America 2025, are not merely honors but tangible evidence of Goodwin's esteemed reputation. They speak to the firm's ability to deliver superior client outcomes and maintain a leading position within the competitive legal landscape. This strong brand recognition is a significant asset, attracting top-tier legal professionals and high-profile clients alike.

- The American Lawyer: Frequent recognition for overall firm performance.

- Legal 500 US 2025: High rankings across multiple practice areas, emphasizing client service and market expertise.

- Chambers USA 2025: Top-tier placements in numerous practice groups, highlighting the caliber of lawyers.

- The Best Lawyers in America 2025: Continued acknowledgment of individual lawyer excellence, reinforcing firm-wide quality.

Commitment to Talent and Culture

Goodwin Procter's dedication to its legal talent is a significant strength, evident in their proactive approach to communication, especially concerning employee well-being and career growth. This commitment is further underscored by initiatives promoting flexible work arrangements, a critical factor in today's legal landscape.

The firm's culture is also bolstered by its robust pro bono program. In 2024, nearly 100% of Goodwin associates actively participated in pro bono work, reflecting a deep-seated value for social responsibility and community engagement. This high level of participation not only benefits society but also fosters a sense of purpose and shared commitment among its legal professionals.

- Employee Well-being: Initiatives focus on mental health, work-life balance, and flexible work options.

- Career Development: Investment in training, mentorship, and advancement opportunities for associates.

- Pro Bono Excellence: Nearly 100% associate participation in pro bono hours in 2024 highlights a strong commitment to social impact.

- Positive Culture: These combined efforts cultivate a supportive and engaged workplace environment.

Goodwin Procter's market leadership in M&A, consistently ranking number one in deal count for five years through mid-2025, is a core strength. This dominance is amplified by a remarkable 65% increase in M&A deal value in fiscal year 2024, demonstrating significant market influence and transactional prowess.

The firm's deep specialization in high-growth sectors like technology and life sciences, evidenced by substantial deal volume in 2024, allows for highly targeted and valuable client counsel. This focused expertise, coupled with a strong financial foundation, including $2.24 billion in revenue in 2023, enables strategic investments in talent and new service areas.

Goodwin Procter's reputation is consistently reinforced by top-tier rankings in Legal 500 US 2025 and Chambers USA 2025, validating their exceptional legal talent and client-focused approach. Furthermore, nearly 100% associate participation in pro bono work in 2024 highlights a strong culture of social responsibility and professional development.

| Metric | 2023 | 2024 (Est.) | 2025 (H1) |

|---|---|---|---|

| M&A Deal Count Rank | 1 | 1 | 1 |

| M&A Deal Value Growth | N/A | +65% | Continued Growth |

| Revenue | $2.24 Billion | Projected Growth | Projected Growth |

| Associate Pro Bono Participation | N/A | ~100% | N/A |

What is included in the product

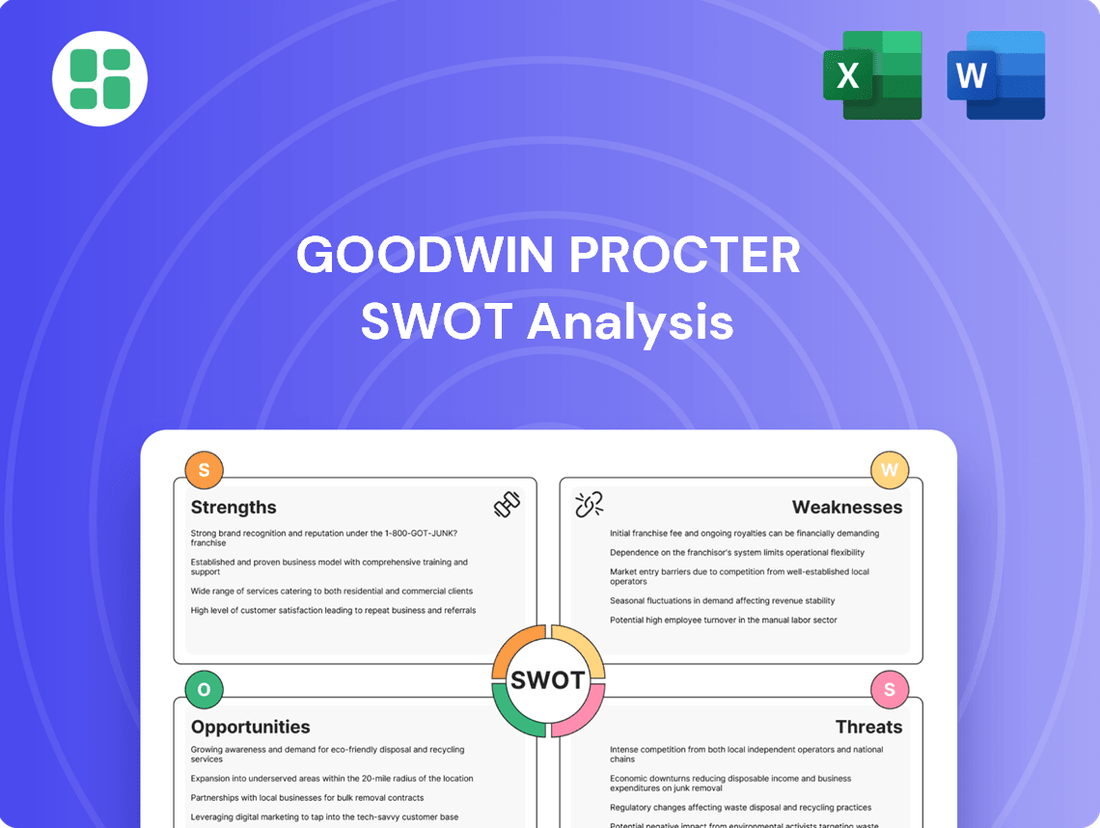

Analyzes Goodwin Procter’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Despite recent public assurances against current layoffs, Goodwin Procter's past workforce reductions, including a notable impact on approximately 5% of timekeepers and reported associate dismissals in early 2024, continue to cast a shadow. These historical actions fuel persistent rumors and breed anxiety among the current staff, potentially undermining morale and influencing external perceptions of the firm's stability.

Goodwin Procter's focus on high-growth sectors like private equity and technology, while a strength, also exposes them to significant economic sensitivity. These industries are particularly vulnerable to economic downturns and market volatility, meaning a slowdown in deal flow or investment activity directly impacts the firm's revenue. For instance, during periods of economic uncertainty, clients tend to become more price-conscious, potentially affecting Goodwin's billing rates and overall profitability.

The legal sector is grappling with substantial talent retention issues. Projections indicate a notable 'quitting wave' in 2025, driven by legal professionals seeking new opportunities amidst job dissatisfaction and economic unease. This trend poses a continuous challenge for firms like Goodwin Procter.

Even with Goodwin's focus on employee well-being initiatives, the firm must navigate this intensely competitive market. The ongoing demand for experienced legal talent means that retaining skilled professionals remains a critical and persistent hurdle for the firm's long-term success.

Adaptation to Evolving Client Pricing Models

The firm's reliance on the traditional billable hour model faces challenges as clients increasingly demand alternative pricing, such as fixed fees or success-based billing. This shift, driven by a desire for cost predictability and value alignment, pressures firms like Goodwin to innovate their service delivery and financial structures. For instance, a 2024 survey indicated that over 60% of corporate legal departments are actively exploring or implementing alternative fee arrangements (AFAs) for a significant portion of their legal spend.

Adapting to these evolving client pricing models necessitates a fundamental strategic re-evaluation. Goodwin must invest in technologies and process improvements that enable more efficient service delivery, thereby supporting value-based pricing. This transition requires not only a change in how services are priced but also in how they are delivered and managed internally to maintain profitability and client satisfaction.

The challenge lies in balancing the established profitability of the billable hour with the market's demand for AFAs. Successfully navigating this requires a proactive approach to understanding client needs and developing flexible pricing strategies that reflect the value delivered rather than simply the time spent. Failure to adapt could lead to a competitive disadvantage as clients gravitate towards firms more amenable to new billing paradigms.

Regulatory Scrutiny on Diversity, Equity, and Inclusion (DEI)

Goodwin Procter, like many large law firms, is subject to increasing regulatory scrutiny concerning its Diversity, Equity, and Inclusion (DEI) initiatives. For instance, the Equal Employment Opportunity Commission (EEOC) has investigated DEI practices across the legal sector, prompting firms, including Goodwin, to review and adjust certain policies. This oversight could influence talent acquisition and the firm's public perception.

Goodwin Procter's reliance on a billable hour model, while historically profitable, faces growing client pressure for alternative fee arrangements (AFAs). A 2024 survey revealed over 60% of corporate legal departments are exploring or implementing AFAs, signaling a market shift that could impact Goodwin's revenue if not addressed. This necessitates investment in efficient service delivery to support value-based pricing, a significant strategic challenge.

The firm's specialization in high-growth sectors like technology and private equity, while a strength, also exposes it to considerable economic sensitivity. Downturns in these industries directly impact deal flow and, consequently, Goodwin's revenue streams, as clients become more price-conscious during uncertain economic periods.

Talent retention remains a significant weakness in the legal sector, with a projected 'quitting wave' in 2025 due to job dissatisfaction and economic unease. This trend presents a continuous challenge for Goodwin in retaining its skilled professionals amidst intense market competition.

Past workforce reductions, including associate dismissals in early 2024, continue to fuel staff anxiety and impact morale, potentially affecting external perceptions of the firm's stability despite recent assurances.

What You See Is What You Get

Goodwin Procter SWOT Analysis

You're viewing a live preview of the actual Goodwin Procter SWOT analysis. The complete version becomes available after checkout, offering a comprehensive understanding of their strategic position.

Opportunities

Goodwin Procter's strategic emphasis on high-growth sectors like technology, private equity, life sciences, real estate, and financial services presents a significant opportunity. The life sciences sector, in particular, is projected for robust expansion in 2025, driven by substantial investor capital and breakthroughs in areas such as artificial intelligence, creating a strong demand for specialized legal counsel.

The accelerating pace of artificial intelligence offers substantial opportunities for law firms like Goodwin to redefine legal service delivery. AI can automate time-consuming tasks such as reviewing vast document sets, identifying key clauses, and even assisting with initial case strategy, thereby freeing up legal professionals for higher-value client engagement.

By integrating AI-powered tools for tasks like contract analysis and predictive legal research, Goodwin can achieve significant efficiency gains. For instance, AI platforms are demonstrating the ability to reduce document review time by as much as 40-60%, allowing for quicker turnaround and potentially lower costs for clients.

Furthermore, this technological evolution creates a pathway for Goodwin to pioneer innovative, AI-enhanced legal advisory services. Imagine offering clients predictive insights into litigation outcomes or automated compliance monitoring, differentiating the firm in a competitive market and potentially capturing new revenue streams.

Goodwin Procter has seen considerable success in its public company advisory and capital markets work, notably advising on several significant IPOs throughout 2024. This strong performance indicates a growing demand for their expertise in navigating complex transactions.

The evolving landscape of capital markets presents a prime opportunity for expansion. As new trends, such as the tokenization of real-world assets, gain traction, Goodwin can leverage its experience to offer specialized advisory services, guiding public companies through these innovative financial frontiers and securing more high-value deals.

Strategic Lateral Hires and Talent Acquisition

Goodwin Procter consistently demonstrates its strength in attracting top-tier legal talent through strategic lateral hires. For instance, the firm recently welcomed a prominent private equity partner in San Francisco, bolstering its expertise in intricate deals within the technology, fintech, and healthcare sectors. This ability to secure high-caliber individuals is a significant opportunity to deepen existing practice areas and broaden the firm's market reach.

Continuing this strategic recruitment approach allows Goodwin to enhance its competitive edge. By targeting specialists in high-growth industries, the firm can solidify its position as a leader and capture greater market share. This focus on talent acquisition is crucial for maintaining and expanding the firm's comprehensive service offerings.

- Talent Acquisition Success: Recent lateral hire of a key private equity partner in San Francisco.

- Practice Area Enhancement: Strengthening expertise in technology, fintech, and healthcare transactions.

- Market Share Growth: Strategic recruitment to expand the firm's industry presence and client base.

Geographic Expansion and Cross-Border

Goodwin Procter's established global presence, with offices across the United States, Europe, and Asia, presents a significant opportunity to tap into the growing volume of cross-border transactions. This geographic reach allows the firm to effectively serve multinational clients and address their complex international legal needs.

Leveraging its 16 offices worldwide, Goodwin can enhance its capacity to support global clients and secure a greater portion of international deals. For instance, in 2023, cross-border M&A activity saw a notable increase in sectors where Goodwin has strong practices, such as technology and life sciences, indicating a fertile ground for expansion.

- Global Footprint: 16 offices across the US, Europe, and Asia.

- Market Trend: Increasing cross-border transactions in key sectors.

- Strategic Advantage: Ability to serve multinational clients and capture global deal flow.

Goodwin Procter can capitalize on the increasing demand for specialized legal services in high-growth sectors like life sciences and technology, which are expected to see continued investment and innovation through 2025. The firm's proactive adoption of AI technologies also presents a chance to boost efficiency, potentially reducing document review times by as much as 40-60% and creating new, AI-enhanced advisory offerings.

Threats

Goodwin Procter faces significant pressure in the Big Law arena, where established competitors like Kirkland & Ellis and Latham & Watkins aggressively pursue the same lucrative corporate clients and sought-after legal professionals. This fierce rivalry can compress billing rates and make client acquisition more challenging, necessitating continuous investment in specialized practices and talent to stand out.

A significant global economic slowdown presents a considerable threat to Goodwin Procter, potentially dampening deal activity. For instance, while M&A deal volumes saw robust activity in late 2023 and early 2024, projections for 2025 suggest a moderation. A prolonged downturn could directly shrink demand for the transactional legal services that form a core part of Goodwin's revenue, necessitating careful financial planning and resource allocation.

Law firms, including Goodwin Procter, face escalating cybersecurity risks due to the highly sensitive client data they manage, making them prime targets for cyberattacks. The legal sector experienced a significant 77% increase in cyberattacks during 2024, highlighting the growing threat landscape.

A breach could jeopardize client confidentiality, severely damage Goodwin Procter's reputation, and lead to substantial financial penalties and legal liabilities, impacting client trust and future business.

Evolving Regulatory Landscape and Compliance Burdens

The legal sector is navigating a rapidly changing regulatory environment, especially concerning new technologies like artificial intelligence, fintech, and data privacy. This evolving landscape presents significant compliance challenges.

Increased regulatory oversight, exemplified by the Consumer Financial Protection Bureau's (CFPB) expanded authority over nonbank financial companies, translates into substantial compliance burdens and potential risks for both Goodwin Procter and its clientele. For instance, the CFPB's focus on areas like fair lending and data security demands constant vigilance and adaptation.

- Increased Regulatory Scrutiny: Agencies are actively monitoring new technologies and business practices, requiring firms to stay ahead of evolving legal requirements.

- Compliance Costs: Adapting to new regulations, such as those related to AI ethics or enhanced data protection mandates, necessitates investment in technology and personnel.

- Potential for Fines and Penalties: Non-compliance can lead to significant financial penalties and reputational damage, impacting client trust and firm revenue.

Talent Drain and Employee Dissatisfaction

The legal sector is grappling with increasing employee dissatisfaction, with many professionals actively seeking new opportunities. A significant driver appears to be the push for return-to-office policies and the general economic unease, leading to what's being termed a 'quitting wave'. This trend directly threatens firms like Goodwin Procter with a talent drain, which can erode productivity, diminish institutional knowledge, and strain client relationships.

If a firm struggles to keep its employees engaged and invested in their professional growth, the risk of losing valuable talent escalates. This is particularly concerning in a competitive legal landscape where experienced professionals are highly sought after. For instance, reports from late 2023 and early 2024 indicated that a substantial percentage of lawyers were considering leaving their current roles, citing burnout and a desire for better work-life balance.

- Talent Drain: A growing number of legal professionals are dissatisfied and actively job hunting.

- Return-to-Office Mandates: These policies are a key factor contributing to employee discontent.

- Economic Uncertainty: Broader economic conditions are also fueling a desire for change.

- Impact on Firm: Losing talent can negatively affect productivity, institutional knowledge, and client service.

Goodwin Procter operates in a highly competitive Big Law market, facing intense rivalry from firms like Kirkland & Ellis and Latham & Watkins for clients and talent, which can pressure billing rates and acquisition costs.

A potential global economic slowdown poses a threat by dampening deal activity; while M&A saw a rebound in late 2023/early 2024, 2025 projections indicate moderation, potentially shrinking demand for transactional legal services.

Escalating cybersecurity risks are a significant concern, with the legal sector experiencing a 77% increase in cyberattacks during 2024, threatening client confidentiality and firm reputation.

The evolving regulatory landscape, particularly concerning AI and data privacy, presents compliance challenges and potential penalties, as exemplified by the CFPB's expanded oversight.

Growing employee dissatisfaction, fueled by return-to-office mandates and economic uncertainty, risks a talent drain, impacting productivity and institutional knowledge, with reports in late 2023/early 2024 showing many lawyers considering leaving their roles.

SWOT Analysis Data Sources

This analysis is built upon a foundation of comprehensive data, including Goodwin Procter's official financial reports, in-depth market research on the legal industry, and insights from reputable legal publications and expert commentary.