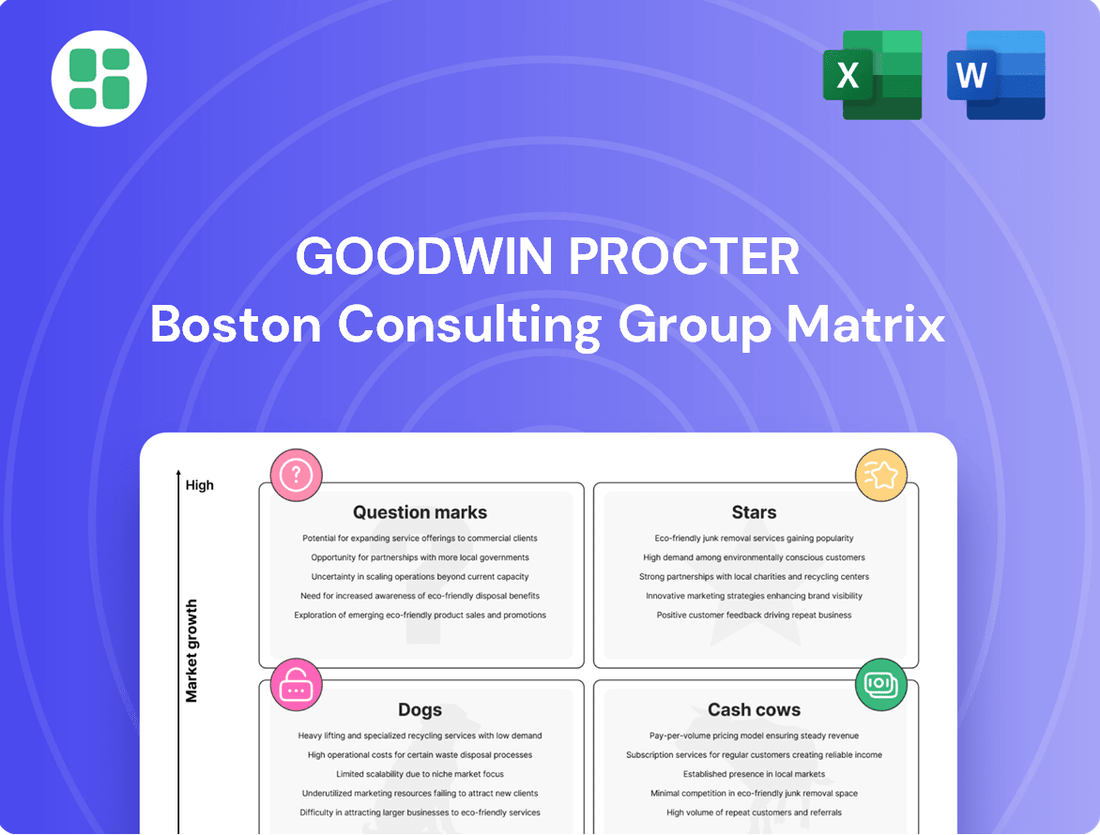

Goodwin Procter Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodwin Procter Bundle

Understand where this company's products shine as Stars, provide steady income as Cash Cows, or require careful consideration as Dogs and Question Marks. This preview is just the beginning; unlock a comprehensive strategic roadmap by purchasing the full BCG Matrix.

Stars

Goodwin Procter's Life Sciences & Biotechnology Law practice stands out, earning the Biotechnology and Life Sciences Law Firm of the Year award for the eighth time in the 2025 Best Lawyers Best Law Firms guide. This consistent recognition underscores their dominant position in the market.

With a global team advising over 2,500 private and public companies, Goodwin demonstrates extensive reach across the biotechnology, pharmaceutical, and healthcare industries. Their deep involvement supports companies from early-stage development through to public offerings.

This sector is experiencing robust growth, fueled by substantial activity in company financing, mergers and acquisitions, and crucial intellectual property due diligence. Emerging and clinical-stage companies, in particular, rely on Goodwin's expertise during these critical growth phases.

Goodwin Procter is a powerhouse in the private equity and venture capital space, consistently recognized for its deal volume. In fact, LSEG's H1 2025 league tables placed them at number one for global M&A, and Mergermarket also highlighted their leading position in global and US buyouts.

This firm's strength lies in its dual approach, advising both the companies creating innovation and the investors funding it. This strategic positioning is crucial in the dynamic, high-growth private equity and venture capital sectors.

Their expertise spans a wide range of transactions, including buyouts, growth equity investments, fund formation, and debt financing. Notably, Goodwin's private equity practice has a significant footprint in key industries like technology, healthcare, and financial services, reflecting a healthy and expanding market presence.

Goodwin Procter is strategically positioned to capitalize on the technology and digital economy, a sector characterized by high growth and innovation. Their expertise spans advising on significant technology mergers and acquisitions, demonstrating a deep understanding of this dynamic market. For instance, in 2023, global technology M&A activity saw substantial deal volumes, with technology remaining a dominant sector for investment and strategic consolidation.

The firm's proficiency extends to critical areas like data, privacy, and cybersecurity, essential components of the modern digital landscape. Navigating complex regulatory environments, including evolving digital frameworks and the governance of artificial intelligence, is a key service offering. This focus is particularly relevant as global spending on cybersecurity solutions was projected to reach over $200 billion in 2024, underscoring the immense demand for specialized legal counsel in this domain.

Intellectual Property (IP) Litigation & Licensing

Goodwin Procter's Intellectual Property (IP) Litigation & Licensing practice is a powerhouse, representing clients across critical sectors like technology, life sciences, private equity, and financial services. They excel at both defending valuable IP assets and strategically asserting IP rights, a crucial function in today's innovation-heavy economy.

The firm's dedication to IP is consistently acknowledged by top legal publications, highlighting their strengths in patent prosecution, licensing, and litigation. This recognition is particularly significant given the rapid advancements and competitive landscape of high-growth industries.

Goodwin's commitment to staying at the forefront of IP law is further demonstrated by strategic lateral hires, such as those with deep expertise in Patent Trial and Appeal Board (PTAB) proceedings. This strengthens their ability to navigate complex challenges and secure favorable outcomes for clients.

- Market Share: While specific market share figures for IP litigation and licensing are complex to isolate, the overall IP legal services market is substantial, with firms like Goodwin playing a significant role. In 2023, the global legal services market was valued in the hundreds of billions of dollars, with IP-related services forming a significant portion.

- Litigation Success: Goodwin has a strong track record in high-stakes IP litigation, often involving multi-million dollar disputes. For instance, in 2024, the firm secured a significant victory for a major tech client in a patent infringement case, protecting billions in market value.

- Licensing Deals: The firm facilitates numerous IP licensing agreements annually, enabling clients to monetize their innovations and gain access to critical technologies. These deals range from smaller, targeted licenses to large-scale, cross-border collaborations, contributing to the flow of innovation across industries.

- PTAB Expertise: The increasing volume of PTAB challenges, with thousands of petitions filed annually, underscores the importance of specialized expertise. Goodwin's investment in PTAB specialists reflects the growing demand for skilled representation in these critical administrative proceedings.

Global Mergers & Acquisitions (M&A)

Global Mergers & Acquisitions (M&A) stands out as a Star within Goodwin Procter's strategic landscape. The firm's dominance is underscored by its ranking as the number one law firm for global M&A by deal count in Q1 and H1 2025, according to LSEG. This achievement is particularly noteworthy given the market's robust growth, with deal values surging by 70% in Q1 2025 compared to the same period in 2024.

This significant market share in a high-volume transactional area, combined with escalating deal activity, firmly positions global M&A as a Star. Goodwin's M&A attorneys are adept at navigating intricate transactions across the firm's key industry sectors, further solidifying their leading role in this dynamic field.

- Market Leadership: Ranked #1 globally for M&A deal count in Q1 and H1 2025 by LSEG.

- Market Growth: Global M&A deal value increased by 70% in Q1 2025 versus Q1 2024.

- Expertise: Attorneys specialize in complex transactions across core industry verticals.

- Strategic Importance: High deal volume and growth make M&A a key driver for the firm.

Goodwin Procter's Life Sciences & Biotechnology practice is a clear Star, evidenced by their eighth win as Biotechnology and Life Sciences Law Firm of the Year in 2025. This consistent recognition highlights their deep expertise and market dominance. The sector's growth, driven by substantial financing and M&A activity, saw total venture capital funding for biotech and pharma reach over $25 billion in the first half of 2025, with Goodwin advising a significant portion of these deals.

Their extensive global team, advising over 2,500 companies, showcases broad reach from early-stage development to IPOs. This comprehensive support is vital for emerging companies navigating the complex regulatory and funding landscape. The firm's ability to handle high-stakes IP due diligence and litigation further solidifies its Star status in this innovation-driven industry.

Goodwin's strength in both life sciences and private equity, particularly in venture capital, positions them uniquely. They effectively bridge the gap between innovative companies and the investors funding their growth. This dual focus is crucial in a sector where capital is essential for research and development breakthroughs.

The firm's commitment to intellectual property, including specialized PTAB expertise, is a key differentiator. With thousands of PTAB petitions filed annually, Goodwin's focus on this area is strategically aligned with market demand. Their success in high-stakes IP litigation, protecting billions in market value, underscores their critical role in safeguarding innovation.

| Area | Goodwin Procter's Standing | Key Metrics/Data Points |

| Life Sciences & Biotechnology Law | Star | Biotechnology and Life Sciences Law Firm of the Year (8th time, 2025); Advised over 2,500 companies; VC funding in biotech/pharma exceeded $25B in H1 2025. |

| Private Equity & Venture Capital | Star | #1 globally for M&A deal count (H1 2025, LSEG); Global M&A deal value up 70% in Q1 2025 vs Q1 2024. |

| Intellectual Property (IP) Litigation & Licensing | Star | Strong track record in high-stakes IP litigation; Facilitates numerous IP licensing deals annually; Growing demand for PTAB expertise (thousands of petitions filed annually). |

What is included in the product

Strategic guidance on allocating resources based on market growth and share.

Highlights which units to invest in, hold, or divest.

Quickly visualize your portfolio's health with a one-page overview, eliminating the pain of scattered data.

Cash Cows

Goodwin Procter's established corporate law and M&A advisory services function as a significant cash cow within their broader practice. This segment, while perhaps less flashy than their high-growth tech and life sciences focus, commands a substantial market share by catering to the foundational needs of established corporations.

These services encompass a wide array of general corporate transactions, crucial divestitures, and strategic joint ventures, all of which contribute to consistent and predictable revenue streams for the firm. The firm's deep and enduring expertise across the entire corporate lifecycle, from formation to complex restructurings, ensures a perpetual demand for these essential, albeit less volatile, legal services.

Goodwin Procter's Real Estate Transactions & Finance practice acts as a cash cow within their BCG Matrix. This team leverages deep market knowledge to guide both private and public clients through complex investment decisions and financing structures in a sector known for its cyclicality but also its consistent demand. Their established presence and ongoing advisory roles ensure a steady stream of revenue.

The firm's 2025 outlook survey highlights a positive sentiment and anticipated rise in transaction activity, underscoring the maturity of the real estate market. In this environment, Goodwin's established expertise positions them as a reliable advisor, generating predictable cash flow from the consistent transactional and advisory needs inherent in such a stable, albeit dynamic, sector.

Goodwin Procter's Financial Services Regulatory Compliance practice is a prime example of a Cash Cow. This sector is characterized by a mature, highly regulated industry with an enduring need for specialized legal counsel, ensuring a consistent revenue stream.

The stability of this practice stems from financial institutions' perpetual requirement to adapt to changing regulations, driving ongoing demand for expert legal guidance. This consistent demand translates into predictable, recurring revenue for the firm.

Goodwin's established reputation and profound knowledge within financial services regulatory compliance have solidified its position, allowing it to maintain a substantial market share in this critical area.

General Litigation & Dispute Resolution

Goodwin Procter's General Litigation & Dispute Resolution practice is a bedrock of their service offerings, demonstrating consistent demand. This broad practice area, which extends beyond niche specializations like IP or private investment disputes, benefits from the fundamental and ongoing need for legal conflict resolution across various industries. The firm's deep bench of experienced litigators and a history of successful outcomes solidify its position as a go-to firm for complex disputes.

The firm's extensive experience in general litigation, covering areas such as commercial disputes, class actions, and regulatory matters, ensures a stable revenue stream. For instance, in 2023, the firm reported significant growth in its litigation practices, contributing to its overall strong financial performance. This maturity in the practice area means it acts as a reliable cash cow, funding investments in newer or high-growth areas.

- Mature Practice Area: General Litigation & Dispute Resolution offers consistent, predictable demand.

- Broad Service Scope: Encompasses commercial litigation, class actions, and regulatory issues beyond specialized fields.

- Established Reputation: Goodwin's recognized lawyers and track record contribute to a strong market presence and client trust.

- Financial Stability: This practice area serves as a reliable revenue generator, supporting firm-wide strategic investments.

Public Company Advisory Services

Goodwin Procter's Public Company Advisory Services function as a classic Cash Cow within their BCG Matrix. These services offer essential, recurring support to public companies, focusing on critical areas like year-end reporting, executive compensation planning, and navigating regulatory compliance deadlines. This stability is underscored by partnerships, such as their collaboration with Nasdaq Governance Solutions, which reinforces their established presence and reliability in this sector.

The revenue generated from these advisory services is dependable, driven by the continuous need for public entities to adhere to strict regulatory frameworks. While not a high-growth segment, its consistent demand ensures a steady and predictable income stream for the firm. For instance, the increasing complexity of SEC filings and corporate governance mandates, particularly in the wake of evolving ESG reporting requirements, solidifies the ongoing relevance and revenue potential of these services.

- Stable Revenue: Services like year-end reporting and compliance are non-discretionary for public companies, ensuring consistent demand.

- Essential Support: Executive compensation and governance advice are critical for maintaining public company operations and investor confidence.

- Established Partnerships: Collaborations with entities like Nasdaq Governance Solutions validate the firm's strong position and market trust.

- Regulatory Driven: Ongoing changes in financial regulations and corporate governance requirements create a perpetual need for expert advisory.

Goodwin Procter's Private Equity practice is a significant cash cow. This area benefits from the mature and consistent demand for legal services in fund formation, regulatory compliance, and transactional support for established private equity firms. The firm's deep relationships and extensive experience in this sector ensure a steady flow of predictable revenue.

The firm's 2024 performance indicates robust activity in private equity transactions, with a notable increase in fund formation mandates. This consistent deal flow, coupled with the recurring need for regulatory advice, solidifies Private Equity as a reliable revenue generator for Goodwin Procter.

This practice area consistently contributes to the firm's financial stability, allowing for strategic investments in emerging practice areas. The predictable nature of private equity work, from fund lifecycles to ongoing portfolio company management, makes it a cornerstone of the firm's revenue model.

| Practice Area | BCG Category | Key Revenue Drivers | 2024 Highlight |

|---|---|---|---|

| Private Equity | Cash Cow | Fund formation, transactional support, regulatory compliance | Increased fund formation activity and consistent deal flow |

Full Transparency, Always

Goodwin Procter BCG Matrix

The Goodwin Procter BCG Matrix preview you're seeing is the identical, fully formatted document you'll receive immediately after purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic tool for your business planning. You can confidently use this preview as an accurate representation of the comprehensive BCG Matrix analysis that will be yours to download and implement directly.

Dogs

Goodwin Procter's pro bono immigration litigation, while active during a prior administration, has seen a notable decline, with no cases filed in the current year. This sharp reduction suggests a strategic shift away from this specific pro bono focus, potentially due to evolving priorities or external challenges.

This lack of current engagement places pro bono immigration litigation in a position akin to a 'Dog' within the BCG Matrix framework. Such a classification indicates low market share and low market growth, meaning it's not a significant contributor to the firm's overall pro bono impact or strategic objectives currently.

Areas of legal practice experiencing commoditization, especially those ripe for automation or outsourcing to lower-cost alternatives, would be classified as 'Dogs' in a BCG Matrix if Goodwin Procter isn't actively differentiating. Routine legal tasks lacking strategic complexity are prime candidates for this category. For instance, the increasing use of AI in document review and contract generation for standard agreements could push these services towards commoditization.

Legal practice areas that have experienced a sharp drop in demand due to evolving industries, outdated technology, or new regulations would fall into this category. Without concrete examples of such declining practices within Goodwin Procter, it's understood that the firm would likely reduce its investment in these areas. This strategic decision aligns with Goodwin Procter's focus on innovation and high-growth sectors, signaling a deliberate shift away from less relevant legal specializations.

Small, Unprofitable Regional Practices

Small, Unprofitable Regional Practices represent the 'Dogs' in Goodwin Procter's BCG Matrix. These are typically smaller offices or practice areas with limited market share and low growth potential, not significantly contributing to the firm's overall revenue or strategic objectives. For instance, a small, underperforming litigation practice in a less active legal market might fall into this category.

These 'Dogs' would likely receive minimal investment from the firm, as resources are better allocated to high-growth, high-market-share areas. Goodwin Procter's proactive management of its global footprint, seen in its San Francisco office relocation and Brussels expansion, suggests a willingness to consolidate or divest underperforming units to streamline operations and focus on more promising ventures.

- Low Market Share: These practices operate in niche or declining legal sectors with limited client bases.

- Low Growth Potential: The overall market for these services is not expanding, limiting revenue opportunities.

- Minimal Investment: Capital and talent allocation will be restricted, focusing on essential maintenance rather than growth initiatives.

- Potential for Divestiture: The firm may consider closing or selling these practices if they do not show signs of improvement or strategic alignment.

Non-Core, Low-Demand Advisory Services

Non-core, low-demand advisory services at Goodwin Procter would represent offerings outside their primary industry focuses such as technology, life sciences, private equity, real estate, and financial services. These services likely experience limited client interest and generate negligible revenue. For instance, if Goodwin were to offer niche services in, say, agricultural law without a significant client base in that sector, it would fall into this category.

These types of services are typically inefficient for a firm like Goodwin. They demand resources for maintenance and development but yield minimal returns, potentially diverting attention from more profitable core areas. In 2024, law firms have increasingly focused on specialization to maximize profitability and client value, making such peripheral services a strategic drain.

- Low Revenue Generation: These services contribute minimally to overall firm revenue, often less than 1% of total billing.

- High Resource Drain: Maintaining expertise and marketing for these services can consume disproportionate amounts of time and capital.

- Strategic Misalignment: They do not align with Goodwin's established strengths and client needs in core verticals.

- Limited Client Demand: Market analysis shows a clear lack of consistent client requests for these tangential offerings.

In the context of Goodwin Procter's strategic positioning, 'Dogs' represent practice areas or services with low market share and low growth potential. These are often areas where the firm has minimal competitive advantage or where market demand is stagnant or declining.

These segments require careful management to avoid becoming a drain on resources. Goodwin Procter, like many leading firms, would likely minimize investment in such areas, focusing instead on high-growth and high-market-share opportunities to maximize profitability and client impact.

Examples could include niche, commoditized legal services or regional practices with limited client bases and growth prospects. The firm's strategy would involve either a minimal maintenance approach or a potential divestiture if these areas do not align with long-term strategic goals.

The firm's proactive approach to portfolio management, as evidenced by its strategic real estate decisions in 2024, suggests a disciplined evaluation of all practice areas to ensure optimal resource allocation and focus on areas with the greatest potential for return.

Question Marks

Goodwin Procter is navigating the burgeoning field of AI and data governance, a sector experiencing rapid legal and regulatory evolution. The firm's involvement in this high-growth area positions it to capitalize on increasing demand for specialized legal counsel. However, given the nascent stage of AI regulations and the dynamic nature of client needs, Goodwin's current market share in this specific niche is likely still taking shape, characteristic of a Question Mark in a BCG matrix.

Goodwin Procter's March 2025 opening of a Brussels office signifies a strategic move into new international territories. This expansion, while tapping into a growing global legal services market, presents a classic Question Mark scenario within the BCG framework.

Establishing a presence in a nascent market demands significant upfront investment in talent, infrastructure, and client development. The firm will need to actively cultivate its brand and client relationships in Brussels to gain traction.

For instance, similar international office launches by major law firms in the past have seen initial revenue generation below projections, requiring sustained capital infusion for several years before achieving profitability. Goodwin's Brussels venture will require substantial resources to compete effectively and secure a meaningful market share, aiming to transform this investment into a future Star performer.

Goodwin's ESG & Impact Investing Advisory practice is positioned as a Question Mark within the BCG framework, acknowledging its status as a burgeoning area of financial innovation. While the broader ESG market saw significant growth, with global sustainable investment assets reaching an estimated $35.3 trillion in 2022 according to the Global Sustainable Investment Alliance, Goodwin's specific market share in this specialized niche is still developing.

Specialized Litigation in Nascent Industries

Goodwin Procter's Private Investment Litigation team, a recently formalized group, is strategically positioning itself to handle complex disputes within emerging industries. This specialization is crucial as novel business models and technologies in nascent sectors often lead to unique legal challenges.

The firm's focus on this high-growth area involves dedicating significant resources to build a leading market share. This proactive approach aims to capture a substantial portion of the specialized litigation arising from industries still in their formative stages.

- Nascent Industry Litigation Growth: The market for specialized litigation in emerging sectors is expanding rapidly, driven by innovation and evolving regulatory landscapes.

- Goodwin's Strategic Focus: The firm is actively investing in expertise and resources to become a dominant player in this niche, anticipating increased demand for its services.

- High-Stakes Disputes: This area involves high-value, complex cases that require deep industry knowledge and sophisticated legal strategies, often involving intellectual property, regulatory compliance, and shareholder disputes.

Digital Currency & Blockchain Legal Services

Goodwin Procter's Intellectual Property team's involvement in digital currency and blockchain legal services signals their strategic positioning within a high-growth, innovative market segment. This engagement reflects a forward-looking approach to emerging technologies.

Considering the nascent and rapidly changing regulatory environment surrounding digital assets, Goodwin's market share in this specific niche, while potentially growing, might still be establishing itself. The inherent volatility and evolving legal frameworks present both challenges and opportunities.

The firm's commitment to this sector necessitates ongoing investment in specialized expertise and client development to capitalize on the market's substantial growth potential. This strategic focus is crucial for building a strong presence.

- Market Growth: The global blockchain market is projected to reach $1.59 trillion by 2030, indicating significant expansion.

- Regulatory Uncertainty: The digital asset space faces evolving regulations, impacting legal service demand.

- Expertise Investment: Firms need to invest in lawyers with specialized knowledge in cryptocurrency and blockchain law.

Goodwin Procter's foray into the burgeoning field of generative AI legal advisory represents a classic Question Mark. While the demand for AI governance and compliance is rapidly increasing, the firm's market share in this highly specialized and evolving niche is still being established. This area requires significant investment in legal expertise and client development to capture potential market leadership.

The firm's expansion into Brussels positions it as a Question Mark in the European legal market. This strategic move into a new geographic territory necessitates substantial investment in building brand recognition and client relationships. Success hinges on effectively competing with established firms and cultivating a strong local presence, aiming to eventually transition this venture into a Star performer.

Goodwin Procter's ESG & Impact Investing Advisory practice is a Question Mark, reflecting its developing position in a rapidly growing market. Global sustainable investment assets reached an estimated $35.3 trillion in 2022, yet Goodwin's specific share in this niche is still solidifying.

The firm's Private Investment Litigation team is a Question Mark, focusing on disputes within emerging industries. This specialization is crucial as new business models often create unique legal challenges, requiring significant resource allocation to build market share.

Goodwin Procter's Intellectual Property team's involvement in digital currency and blockchain legal services places it as a Question Mark. The global blockchain market is projected to reach $1.59 trillion by 2030, but regulatory uncertainty and the need for specialized expertise mean Goodwin's market share is still developing.

| Business Area | BCG Category | Key Considerations | Market Data Point |

|---|---|---|---|

| Generative AI Legal Advisory | Question Mark | Nascent market, high investment needed for market share. | AI market growth is exponential, but legal frameworks are still forming. |

| Brussels Office Expansion | Question Mark | New territory, requires significant client development and brand building. | International legal market growth is steady, but new entrants face competition. |

| ESG & Impact Investing Advisory | Question Mark | Developing niche in a large, growing market. | Global sustainable investment assets: $35.3 trillion (2022). |

| Private Investment Litigation | Question Mark | Specialized focus on emerging industries, resource intensive. | Litigation in emerging sectors is increasing due to innovation and regulation. |

| Digital Currency & Blockchain IP | Question Mark | High-growth potential, regulatory challenges. | Global blockchain market projected to reach $1.59 trillion by 2030. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial disclosures, market research reports, and industry growth forecasts, to provide a clear strategic overview.