Goodwin Procter PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodwin Procter Bundle

Gain a critical understanding of the external forces shaping Goodwin Procter's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors influencing the firm's strategic decisions and market position. Equip yourself with this essential intelligence to anticipate challenges and identify opportunities. Download the full PESTLE analysis now for actionable insights to refine your own strategy.

Political factors

Government regulatory shifts significantly influence Goodwin Procter's business. For instance, in 2024, the US Securities and Exchange Commission (SEC) continued its focus on ESG (Environmental, Social, and Governance) disclosures, impacting many of the firm's publicly traded clients in financial services and technology. New regulations around data privacy, such as potential updates to CCPA in California, also create a strong demand for legal counsel in the life sciences and tech sectors.

Global trade agreements, tariffs, and investment policies directly shape the international landscape for Goodwin Procter's clients. For instance, the ongoing evolution of trade relations, including potential adjustments to agreements like the USMCA or new frameworks emerging from global economic shifts, can significantly alter market access and the cost of cross-border transactions. These policy shifts directly impact the volume and complexity of M&A deals and foreign direct investment that the firm handles.

Fluctuations in these international policies can create both challenges and opportunities. For example, changes in tariffs or investment restrictions in key markets could increase the complexity of supply chain legal issues for multinational corporations. Goodwin Procter must remain acutely aware of these developments, such as the World Trade Organization's (WTO) most recent trade statistics which often highlight trends in global trade flows, to effectively guide clients through geopolitical risks and emerging market opportunities.

Political stability in major global economies, where Goodwin Procter's clients conduct substantial business, directly influences investor confidence and capital movement. For instance, ongoing geopolitical tensions in Eastern Europe and the Middle East, as of early 2024, have heightened demand for legal counsel on sanctions compliance and navigating complex international regulations.

Geopolitical events like the expansion of trade disputes or regional conflicts can foster uncertainty, consequently boosting the need for legal services focused on risk management, sanctions advisory, and handling distressed asset transactions. Goodwin Procter's expertise in anticipating and advising on these evolving risks is therefore paramount to client success.

Antitrust and Competition Policy

Global antitrust and competition policies are increasingly dynamic, especially impacting the technology and private equity sectors. This evolving landscape directly influences how clients approach growth, mergers, and achieving market leadership. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its aggressive stance, with proposed merger guidelines aiming to scrutinize deals more closely, potentially impacting a broader range of transactions than in previous years.

Stricter enforcement and new regulations concerning market concentration demand highly specialized legal guidance. Goodwin Procter's deep understanding of these complex antitrust reviews is therefore critical for clients aiming to achieve their strategic goals without running afoul of new regulatory frameworks. The firm’s ability to anticipate and navigate these shifts provides a significant advantage.

- Increased Regulatory Scrutiny: In 2024, regulatory bodies like the FTC and the European Commission have shown a heightened focus on market concentration, particularly in digital markets, leading to more in-depth merger reviews.

- Impact on M&A: Companies in the technology and private equity spaces must anticipate more rigorous antitrust hurdles for mergers and acquisitions, potentially delaying or blocking deals that were previously more likely to be approved.

- Need for Expert Counsel: Navigating these evolving competition laws requires sophisticated legal advice to ensure client strategies for growth and market positioning are compliant and effective.

- Focus on Dominant Firms: Antitrust efforts are increasingly targeting firms perceived to hold significant market power, necessitating careful strategic planning for market expansion and competitive engagement.

Government Funding and Innovation Initiatives

Government funding and innovation initiatives play a crucial role in shaping the economic landscape. For instance, the U.S. government's commitment to scientific advancement through agencies like the National Institutes of Health (NIH) and the National Science Foundation (NSF) directly fuels growth in sectors like life sciences. In 2024, the NIH budget was over $47 billion, supporting groundbreaking research that creates opportunities for firms like Goodwin Procter to advise emerging biotech and pharmaceutical companies on securing grants and navigating intellectual property landscapes.

Furthermore, tax incentives and regulatory sandboxes designed to foster technological innovation can significantly impact business development. Many governments are actively promoting areas such as artificial intelligence and clean energy through specific programs. For example, the Inflation Reduction Act of 2022 in the U.S. offers substantial tax credits for renewable energy projects, stimulating investment and creating demand for legal services related to project finance and regulatory compliance. This environment allows Goodwin Procter to offer expertise to both established energy companies and startups in this burgeoning field.

- Increased R&D Spending: Government grants and tax credits encourage higher research and development investment across key industries.

- Support for Emerging Technologies: Initiatives often target nascent fields, fostering the growth of startups and innovative businesses.

- Regulatory Clarity: Sandboxes and streamlined approval processes reduce barriers to entry and accelerate market adoption.

- Economic Growth Stimulation: These policies contribute to a more dynamic and investment-friendly economic climate, benefiting legal advisors.

Government policy and regulatory changes are critical drivers for Goodwin Procter's operations and client advisory services. In 2024, increased governmental focus on ESG reporting, data privacy (like potential CCPA updates), and antitrust enforcement, particularly in tech and private equity, directly shapes the demand for specialized legal expertise. These evolving regulations necessitate proactive counsel to ensure clients navigate compliance and strategic growth effectively.

What is included in the product

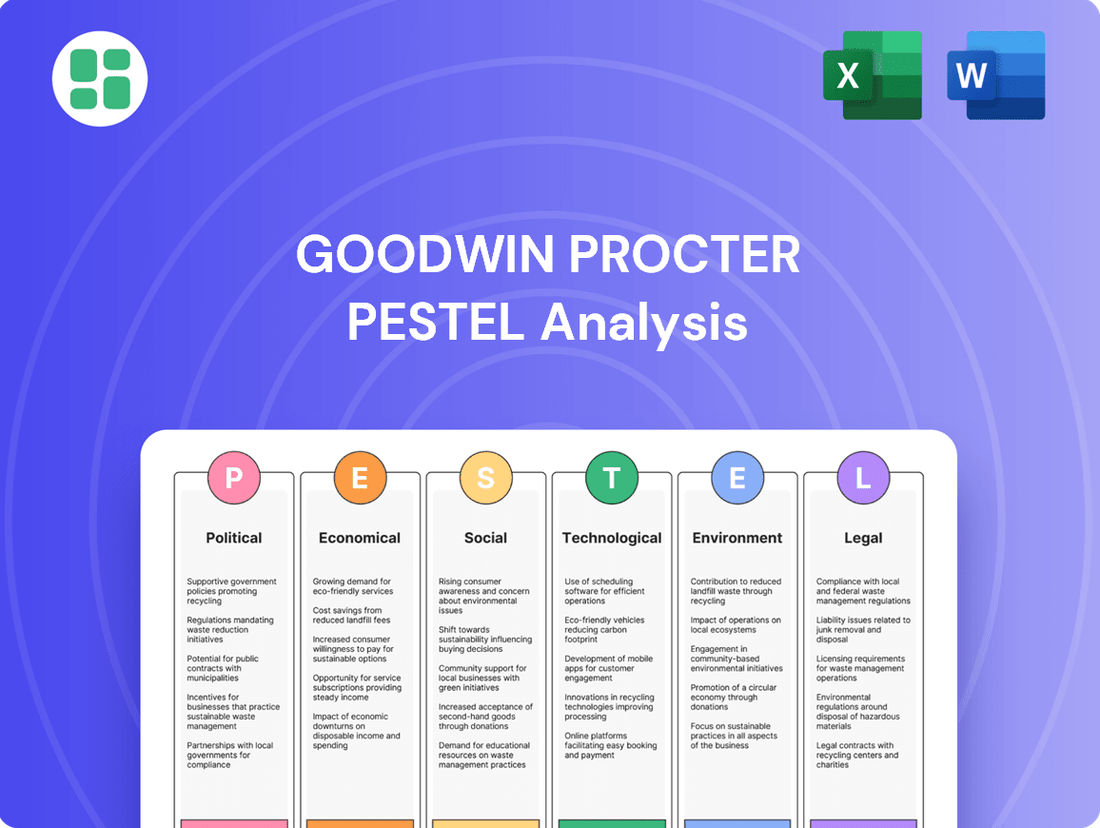

This PESTLE analysis meticulously examines the external macro-environmental forces influencing Goodwin Procter across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights to identify strategic threats and opportunities, enabling proactive planning within the firm's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering quick insights into external factors impacting Goodwin Procter.

Economic factors

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% for 2024 and 3.3% for 2025. However, recession risks remain, particularly in developed economies, due to persistent inflation, high interest rates, and geopolitical instability. This economic climate directly impacts the demand for legal services at Goodwin Procter, influencing transactional work like mergers and acquisitions (M&A) and private equity deals.

During robust economic periods, increased corporate activity typically drives higher demand for Goodwin Procter's transactional practices. Conversely, economic downturns often see a contraction in M&A and IPO volumes, potentially shifting focus towards restructuring and litigation services. For instance, a slowdown in global deal-making in late 2023 and early 2024, influenced by tighter credit conditions, likely affected the pipeline for such services.

Central banks' monetary policy significantly shapes the interest rate environment, directly influencing capital availability. For instance, the Federal Reserve's target federal funds rate, which stood at 5.25%-5.50% as of early 2024, impacts borrowing costs across the economy.

Higher interest rates increase the cost of debt for companies and private equity, potentially cooling M&A activity and slowing fundraising efforts. Conversely, lower rates can spur investment and deal-making. The ease with which businesses can access capital directly correlates with the volume of new legal mandates for firms like Goodwin Procter.

In 2024, the market anticipated potential rate cuts by major central banks, which could lead to increased deal flow and legal work. For example, if the Fed were to lower rates by 0.75% by the end of 2024, as some forecasts suggested, it would likely stimulate investment and M&A activity.

Persistent inflationary pressures in 2024 and early 2025 are significantly increasing operating costs for businesses, including law firms like Goodwin Procter. This rise in expenses, from salaries to office overhead, directly impacts profitability and necessitates adjustments in pricing strategies for services rendered.

For clients, the ongoing inflation can erode investment returns, prompting a more cautious and scrutinizing approach to discretionary spending, including legal services. This may lead to a shift in demand towards more cost-effective solutions or a prioritization of essential legal matters.

Goodwin Procter faces the dual challenge of managing its internal cost base effectively while simultaneously advising clients on strategies to navigate the financial complexities and mitigate the impact of these rising costs across their own operations and investments.

Venture Capital and Private Equity Investment Trends

Goodwin Procter's deep involvement in venture capital and private equity makes its business performance directly tied to the health of these investment markets. When venture capital firms and private equity funds are actively raising money and deploying capital, it fuels demand for the complex legal services Goodwin provides in deal-making. This activity is a key driver for the firm's transactional revenue streams.

The fundraising environment is a crucial indicator. For instance, in the first half of 2024, global venture capital fundraising saw a notable slowdown compared to previous years, with fewer mega-funds being raised. This directly impacts the amount of capital available for investment, and consequently, the volume of deals that require legal counsel.

Private equity deal activity also directly influences Goodwin's pipeline. A slowdown in deal closures, whether due to economic uncertainty or higher interest rates impacting financing, translates to fewer billable hours for the firm's transactional practices. For example, while private equity deal volumes in 2023 experienced a dip from the record highs of 2021 and 2022, there are early indicators in 2024 suggesting a gradual recovery in certain sectors.

- Fundraising Environment: Global VC fundraising in H1 2024 showed a contraction compared to prior periods, impacting the capital available for new investments.

- Deal Deployment: Active deployment of capital by PE and VC funds is essential for generating demand for legal services in M&A and financing.

- Market Cycles: A downturn in investment activity, as seen in some segments of the PE market in 2023, directly reduces the firm's transactional workload.

- Sectoral Recovery: Emerging signs of recovery in specific PE deal sectors during 2024 offer potential for increased legal work.

Sector-Specific Economic Performance

Goodwin Procter's revenue is closely tied to the economic health of its key client industries: technology, life sciences, real estate, and financial services. A robust economy in these sectors translates to increased demand for the firm's legal services.

For example, the technology sector, a significant area for Goodwin, saw substantial venture capital funding in 2023, reaching over $150 billion globally, indicating a strong need for corporate and IP legal support for startups and growth companies. Similarly, the life sciences sector continues to be a growth engine, with biotech IPOs and M&A activity remaining strong through early 2024, driving demand for regulatory and transactional legal expertise.

The firm's strategic diversification across these sectors acts as a buffer against economic slowdowns in any single industry. While the real estate market experienced some headwinds in late 2023 and early 2024 due to higher interest rates, the continued activity in technology and life sciences helps to offset potential dips in other areas.

Key sector economic indicators influencing Goodwin Procter include:

- Technology Sector Growth: Venture capital investment trends and IPO activity in the tech space directly correlate with demand for corporate finance and M&A legal services. Global tech VC funding in 2023 was robust, though some segments saw moderation.

- Life Sciences Innovation and Funding: The pace of drug development, clinical trials, and biopharmaceutical M&A activity fuels the need for specialized legal counsel in areas like intellectual property and regulatory compliance.

- Real Estate Market Dynamics: Transaction volumes, construction starts, and financing conditions in commercial and residential real estate impact demand for real estate law services.

- Financial Services Regulatory Environment: Changes in financial regulations and market volatility can create opportunities for litigation, compliance, and restructuring work for financial institutions.

The global economic outlook for 2024 and 2025 suggests moderate growth, with the IMF projecting 3.2% for 2024 and 3.3% for 2025, though recession risks persist. This environment directly influences demand for legal services, particularly in transactional areas like M&A, which are sensitive to economic cycles and capital availability. Persistent inflation in 2024 and 2025 is increasing operating costs for businesses and law firms, necessitating careful cost management and pricing adjustments.

Goodwin Procter's performance is intrinsically linked to the health of venture capital and private equity markets, with fundraising and deal deployment being key revenue drivers. For instance, global VC fundraising in the first half of 2024 saw a contraction, impacting capital available for investments. The firm's deep ties to sectors like technology and life sciences mean that sector-specific economic trends, such as robust VC funding in tech in 2023, significantly shape its workload and revenue streams.

| Economic Factor | 2024/2025 Projection/Data | Impact on Goodwin Procter |

|---|---|---|

| Global GDP Growth | IMF: 3.2% (2024), 3.3% (2025) | Moderate growth supports transactional work but recession risks temper deal flow. |

| Inflation | Persistent in 2024-2025 | Increases operating costs; clients may become more cost-conscious. |

| Interest Rates | Fed Funds Rate: 5.25%-5.50% (early 2024) | Higher rates can cool M&A activity; potential rate cuts could stimulate deal flow. |

| VC Fundraising | Contracted in H1 2024 | Reduced capital for investments impacts deal volume and legal services demand. |

| Technology Sector VC Funding | >$150 billion globally (2023) | Strong tech funding drives demand for corporate and IP legal support. |

Preview the Actual Deliverable

Goodwin Procter PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Goodwin Procter delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm. It provides actionable insights for strategic planning.

You'll gain a deep understanding of the external forces shaping Goodwin Procter's business environment, enabling informed decision-making.

Sociological factors

Shifting workforce demographics, particularly the increasing prevalence of Gen Z and Millennials, are reshaping expectations regarding work-life balance and flexible work arrangements. For Goodwin Procter, this translates to a need to adapt recruitment and retention strategies to appeal to a talent pool that prioritizes purpose and well-being alongside compensation. In 2024, surveys indicated that over 70% of Gen Z professionals consider work-life balance a top priority when choosing an employer.

Goodwin Procter must therefore refine its compensation models and firm culture to attract and retain a diverse range of legal professionals. This includes offering competitive salaries and benefits, but also fostering an environment that supports professional development and personal fulfillment. The firm's ability to remain agile in its approach to talent acquisition will be crucial for maintaining its competitive edge in the legal market.

Societal and client expectations regarding Diversity, Equity, and Inclusion (DEI) are increasingly shaping the legal industry. Clients are not just seeking legal expertise but also partners who reflect their own commitments to a diverse workforce and inclusive practices. This trend is a critical consideration for firms like Goodwin Procter, as it directly impacts client relationships and brand perception.

Goodwin Procter's ability to cultivate a genuinely diverse and inclusive internal culture is paramount. This commitment is vital not only for attracting and retaining top talent from a wider pool but also for aligning with the values of their sophisticated client base. For instance, many major corporations now publicly report on their DEI metrics, and they scrutinize their outside counsel's performance in this area. Firms that can demonstrate robust DEI initiatives are better positioned to win and maintain business.

Furthermore, the firm's role extends to advising clients on their own DEI strategies and compliance. As businesses navigate complex regulations and evolving societal norms around diversity, Goodwin Procter can provide valuable counsel, reinforcing its position as a strategic partner. This dual focus—internal commitment and external advisory capacity—is essential for navigating the contemporary legal landscape.

Clients today expect a higher degree of transparency, efficiency, and demonstrable value from legal services. Societal shifts toward instant gratification and digital convenience mean clients are less tolerant of traditional, opaque billing and slower response times. For instance, a 2024 survey by LexisNexis found that 70% of corporate legal departments prioritize technology adoption for efficiency gains.

This evolving landscape compels law firms like Goodwin Procter to rethink their service delivery. Clients are actively seeking innovative approaches, such as alternative fee arrangements (AFAs) and greater use of legal tech for project management and data analytics. A 2025 report by Thomson Reuters indicated that firms offering flexible billing options saw a 15% increase in client retention compared to those relying solely on hourly rates.

Societal Attitudes Towards Technology and Innovation

Societal attitudes towards technology significantly shape the legal environment, impacting areas like data privacy and artificial intelligence. Growing public trust in AI, for instance, can accelerate its adoption and, consequently, the need for new legal frameworks. In 2024, surveys indicated that over 60% of consumers are comfortable with AI assisting in customer service roles, a trend that necessitates legal guidance on AI accountability and consumer rights.

As technology becomes more embedded in daily life, novel legal quandaries emerge, particularly concerning digital assets and online conduct. The increasing volume of data generated globally, reaching an estimated 120 zettabytes in 2023, underscores the urgency for robust legal responses to privacy concerns. Goodwin Procter's proactive engagement with these evolving societal expectations is crucial for offering advanced legal counsel.

- Broad societal acceptance of technology: Drives demand for legal services in AI, data privacy, and digital assets.

- Increasing pervasiveness of technology: Creates new legal questions and regulatory challenges.

- Goodwin Procter's tech sector focus: Requires anticipation and response to societal attitudes for cutting-edge advice.

- Consumer comfort with AI: Over 60% in 2024, signaling a need for AI legal frameworks.

Corporate Social Responsibility (CSR) and ESG Awareness

Societal expectations are increasingly pushing corporations towards greater accountability through Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) frameworks. This shift directly impacts how businesses operate and where capital is allocated, with investors actively seeking out companies demonstrating strong ESG performance. For instance, a 2024 survey by PwC indicated that 80% of investors consider ESG factors material to their investment decisions.

Law firms like Goodwin Procter are experiencing a heightened demand for specialized legal counsel concerning ESG compliance, reporting standards, and the mitigation of associated risks. Clients are actively seeking guidance on navigating evolving regulations and communicating their ESG initiatives effectively. This necessitates a proactive approach from legal service providers to build robust ESG expertise.

- Growing Investor Demand: In 2024, sustainable investing assets under management globally reached an estimated $37.8 trillion, demonstrating a significant market shift towards ESG-conscious investments.

- Client Needs: Law firms are increasingly advising clients on climate-related disclosures, supply chain ethics, and diversity and inclusion policies, reflecting a broad spectrum of ESG concerns.

- Regulatory Landscape: The SEC's proposed climate disclosure rules in the US and similar initiatives in Europe are creating a complex regulatory environment that requires expert legal navigation.

- Reputational Risk: Companies failing to address ESG concerns face reputational damage and potential boycotts, making proactive legal and strategic advice crucial for brand protection.

Societal expectations regarding work-life balance are significantly influencing talent acquisition and retention within the legal sector. Younger generations, particularly Gen Z and Millennials, prioritize flexibility and well-being, with over 70% of Gen Z professionals in 2024 citing work-life balance as a top job consideration. Goodwin Procter must adapt its compensation and firm culture to meet these evolving demands, ensuring it remains competitive in attracting diverse legal talent.

Technological factors

The legal industry is experiencing a significant technological shift, with artificial intelligence and automation tools rapidly evolving. These advancements are poised to revolutionize how legal services are delivered, offering substantial gains in efficiency for tasks like due diligence and document review.

For a firm like Goodwin Procter, this means a strategic imperative to embrace and integrate these legal technologies. By leveraging AI and machine learning, the firm can streamline internal processes, potentially reducing operational costs and enhancing the speed and accuracy of legal research and analysis.

The adoption of these tools is not just about internal optimization; it's also about client value. By improving efficiency, Goodwin Procter can offer more competitive pricing and faster turnaround times, directly addressing client demands for cost-effective and agile legal solutions in 2024 and beyond.

The legal sector, including firms like Goodwin Procter, faces escalating cybersecurity risks due to increasingly sophisticated cyber threats. In 2024, the global average cost of a data breach reached $4.73 million, a figure that underscores the financial implications for law firms entrusted with sensitive client information.

Simultaneously, the evolving landscape of data privacy regulations, such as the GDPR and CCPA, presents both challenges and opportunities. Compliance with these stringent rules, which govern how personal data is collected, processed, and stored, requires significant investment in robust cybersecurity infrastructure and legal expertise.

Goodwin Procter actively advises clients on navigating these complex data privacy compliance issues, breach response strategies, and cybersecurity litigation. This specialized legal work has become a substantial and growing revenue stream for the firm, highlighting the critical importance of technological adaptation and expertise in this domain.

Goodwin Procter's key client sectors, including technology, life sciences, and financial services, are experiencing accelerated digital transformation. This shift is generating novel legal demands concerning digital platforms, e-commerce, blockchain, fintech, and health tech.

To remain a valuable advisor, the firm must consistently enhance its knowledge base to address the legal complexities arising from these evolving business models and technologies. For instance, the global fintech market was valued at approximately $11.3 trillion in 2023 and is projected to grow significantly, highlighting the expanding legal landscape.

Impact of Cloud Computing and Remote Work Infrastructure

The increasing reliance on cloud computing and the normalization of remote and hybrid work models demand sophisticated and secure technological infrastructure for law firms like Goodwin Procter. This directly influences how data is stored, how teams collaborate, and how client interactions are managed. For instance, the global legal tech market, including cloud services, was projected to reach approximately $25 billion in 2024, highlighting the significant investment in these areas.

Goodwin Procter must actively harness these technological advancements to ensure uninterrupted operations, safeguard sensitive client data, and support the flexible work needs of its international legal professionals. The firm's ability to adapt to these shifts is crucial for maintaining competitive advantage and operational efficiency in the evolving legal landscape.

- Cloud Adoption: Global public cloud spending by enterprises was expected to grow by 20.4% in 2024, reaching $679 billion, demonstrating the broad trend towards cloud-based solutions in professional services.

- Remote Work Tools: Investments in collaboration platforms and cybersecurity measures for remote access are critical, with the cybersecurity market alone projected to exceed $200 billion in 2024.

- Data Security: Robust data encryption and access control protocols are paramount, especially as law firms handle highly confidential information, making data breaches a significant financial and reputational risk.

Intellectual Property in Emerging Technologies

The rapid evolution of technologies like quantum computing, advanced biotech, and metaverse applications presents significant intellectual property (IP) hurdles. Goodwin Procter's expertise is crucial in navigating patenting novel inventions, safeguarding trade secrets, and resolving copyright concerns in burgeoning digital spaces.

The global IP market is experiencing substantial growth, with the World Intellectual Property Organization (WIPO) reporting a 4.5% increase in international patent filings in 2023, reaching over 270,000 applications. This surge underscores the increasing value and complexity of protecting new technological innovations.

- Patent landscape: Emerging technologies often push the boundaries of existing patent law, requiring sophisticated strategies for protection.

- Trade secrets: As innovation accelerates, the confidential know-how behind these advancements becomes a critical asset to protect.

- Digital IP: The rise of virtual worlds and digital assets necessitates new approaches to copyright and ownership.

- Monetization strategies: Expert legal guidance is vital for firms to effectively monetize their IP in these dynamic sectors.

Technological advancements, particularly in AI and automation, are reshaping legal service delivery, offering efficiency gains in areas like due diligence and document review. Goodwin Procter's strategic integration of these tools can streamline operations, reduce costs, and enhance research accuracy.

The firm's ability to leverage these technologies directly translates into client value, enabling more competitive pricing and faster service delivery. This focus on efficiency is crucial for meeting client demands for agile and cost-effective legal solutions in the current market. For example, global legal tech market spending was projected to reach approximately $25 billion in 2024.

Goodwin Procter must also navigate escalating cybersecurity risks, with the global average cost of a data breach reaching $4.73 million in 2024. Simultaneously, evolving data privacy regulations like GDPR and CCPA necessitate robust cybersecurity infrastructure and expertise, areas where the firm actively advises clients.

| Technology Trend | Impact on Legal Services | Goodwin Procter's Strategic Response | Relevant Data (2024/2025) |

|---|---|---|---|

| AI & Automation | Increased efficiency in due diligence, document review, legal research. | Integration of AI tools for process optimization and enhanced accuracy. | Legal tech market projected to grow significantly. |

| Cybersecurity | Heightened risk of data breaches, requiring robust security measures. | Advising clients on breach response and cybersecurity litigation; investing in internal security. | Global average cost of data breach: $4.73 million. |

| Digital Transformation | New legal demands in fintech, health tech, e-commerce, blockchain. | Enhancing expertise in emerging technologies and digital business models. | Fintech market valued at ~$11.3 trillion in 2023, with strong growth projections. |

| Cloud Computing & Remote Work | Need for secure, flexible infrastructure for global operations. | Harnessing cloud solutions for collaboration and data management. | Global public cloud spending expected to grow by 20.4% in 2024. |

Legal factors

Amendments to corporate governance and securities laws significantly impact Goodwin Procter's practice, especially for private equity and tech clients. For instance, in 2024, the SEC's proposed rule changes regarding cybersecurity risk management for public companies and investment advisers introduced new compliance burdens, requiring firms like Goodwin to advise on enhanced disclosure and governance frameworks. These evolving regulations, including those affecting capital markets and disclosure obligations, demand constant vigilance and expert interpretation to ensure clients navigate complex transactions and regulatory environments effectively.

Intellectual property law is constantly shifting, largely due to rapid technological advancements and the expansion of global commerce. This dynamic environment directly affects Goodwin Procter's clients, especially those in the technology and life sciences industries.

For instance, evolving standards for patent eligibility, particularly concerning software and biotechnologies, create both hurdles and avenues for innovation. Similarly, the protection of digital content under copyright law and the effectiveness of trademark enforcement in online marketplaces are critical considerations.

Goodwin Procter's intellectual property practice needs to be highly adaptable. They must provide expert guidance on safeguarding and capitalizing on new forms of intellectual assets, ensuring their clients can navigate these complex legal landscapes effectively. The firm's ability to stay ahead of these legal trends is crucial for client success.

The financial services industry is indeed experiencing a significant uptick in regulatory oversight. In 2024, we've seen a continued focus on strengthening consumer protection measures, with regulators issuing new guidelines aimed at preventing predatory lending and ensuring fair treatment of customers. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively enforcing rules related to fair credit reporting and debt collection practices.

Furthermore, anti-money laundering (AML) and know your customer (KYC) regulations remain a critical area of concern. Financial institutions are investing heavily in technology and personnel to comply with evolving AML standards, driven by global efforts to combat financial crime. The Financial Crimes Enforcement Network (FinCEN) continues to issue advisories and update reporting requirements, making robust compliance programs essential for firms.

The ongoing concern about systemic risk also fuels regulatory action. Following events in 2023, regulators are scrutinizing capital adequacy, liquidity management, and operational resilience across the financial sector. This heightened attention means that financial services clients, including those advised by Goodwin Procter, need sophisticated legal support to navigate these complex, interconnected regulatory landscapes and avoid costly enforcement actions.

Data Privacy and Cybersecurity Legislation

The expanding landscape of data privacy and cybersecurity legislation, including new state-level privacy acts in the US and ongoing refinements to global frameworks like GDPR, presents a significant compliance challenge. Goodwin Procter actively assists clients in navigating these complexities, offering guidance on data mapping, consent management, and breach notification protocols, which are crucial for operational integrity.

This dynamic legal field is central to the firm's advisory offerings, reflecting the increasing importance of robust data protection strategies. For instance, the California Privacy Rights Act (CPRA), fully effective in 2023, along with similar legislation in states like Virginia and Colorado, underscores the need for businesses to adapt their data handling practices. The firm's expertise in international data transfers is also vital, given the global nature of data flows.

- Global Regulatory Proliferation: Over 100 countries now have data protection laws, with many more in development, creating a patchwork of compliance requirements.

- Increased Enforcement: Regulators are actively enforcing privacy laws, with significant fines being levied for non-compliance, impacting businesses financially and reputationally.

- Evolving Breach Notification: Many jurisdictions have shortened breach notification timelines, requiring swift response and remediation plans.

Litigation Trends and Dispute Resolution Mechanisms

Changes in litigation trends, such as the increasing frequency of class action lawsuits and heightened regulatory enforcement, directly influence Goodwin Procter's litigation practice. For instance, the U.S. Securities and Exchange Commission (SEC) reported a 3% increase in enforcement actions in fiscal year 2023 compared to 2022, indicating a more aggressive regulatory environment that necessitates adaptive legal strategies.

The firm must continuously refine its dispute resolution mechanisms, incorporating arbitration and mediation to address evolving legal precedents and client demands. As of late 2024, arbitration continues to be a preferred method for many commercial disputes due to its efficiency, with a significant portion of international commercial arbitrations resolved within 18-24 months.

Understanding these dynamic legal landscapes is paramount for Goodwin Procter to effectively represent clients facing contentious matters. The ability to anticipate shifts in judicial interpretation and proactively adjust legal strategies ensures the firm remains at the forefront of dispute resolution services.

- Increased Class Action Filings: Data from the Stanford Law School Securities Class Action Clearinghouse shows a sustained high volume of securities class action filings, with approximately 200-250 new cases filed annually in recent years (2022-2024).

- Regulatory Scrutiny: The U.S. Department of Justice's False Claims Act recoveries reached $2.6 billion in fiscal year 2023, highlighting the continued emphasis on enforcement actions across various sectors.

- Arbitration Efficiency: The International Chamber of Commerce (ICC) reported that the average duration for arbitrations administered under its rules in 2023 was 24 months, demonstrating a trend towards faster resolution compared to traditional litigation.

- Evolving Judicial Interpretations: Recent Supreme Court decisions, such as those impacting data privacy and intellectual property, create new legal challenges and opportunities for firms specializing in these areas.

The legal landscape for Goodwin Procter is shaped by evolving corporate governance and securities laws, impacting clients in private equity and tech. For instance, the SEC's proposed cybersecurity rules in 2024 necessitate updated client advice on disclosure and governance. Furthermore, intellectual property law is in constant flux due to technological advances, requiring adaptability in areas like patent eligibility and digital content protection.

Environmental factors

The growing emphasis on ESG factors by investors, regulators, and the public is driving the creation of new environmental regulations and mandatory sustainability reporting for businesses. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, mandates detailed disclosures on environmental impacts.

Goodwin Procter's clients, especially in sectors like real estate and financial services, are experiencing increased pressure to report their environmental footprints and adopt sustainable operational methods. This includes navigating evolving disclosure standards and client expectations for greener portfolios.

The firm is tasked with guiding clients through compliance with these new mandates, assessing associated risks, and advising on emerging green financing options. This expertise is crucial as markets increasingly value environmental stewardship and transparent reporting.

Governments globally are intensifying climate change legislation, with many enacting carbon pricing mechanisms and ambitious emissions reduction targets. For instance, the European Union's Emissions Trading System (EU ETS) saw carbon prices average around €65 per tonne in 2023, a significant increase from previous years, signaling a growing cost for carbon-intensive operations.

These regulations directly affect sectors like manufacturing and real estate, potentially increasing compliance expenditures or spurring investment in green technologies. The push for renewable energy mandates, such as the US Inflation Reduction Act of 2022 which offers substantial tax credits for clean energy, is reshaping investment landscapes.

Goodwin Procter can leverage this evolving regulatory environment to guide clients through compliance challenges and identify opportunities in the burgeoning sustainable technology market. This includes advising on navigating new carbon footprint reporting requirements and facilitating transitions to more energy-efficient and lower-carbon operational models.

Growing concerns about resource scarcity, particularly water and critical minerals essential for technology and green energy, are forcing businesses to rethink how they operate. For instance, the International Energy Agency (IEA) highlighted in its 2024 report that demand for critical minerals like lithium and cobalt, crucial for electric vehicle batteries, is projected to surge significantly by 2030, potentially straining existing supply chains. This necessitates a focus on supply chain resilience.

This shift creates new legal complexities, from navigating environmental permitting for resource extraction to ensuring sustainable sourcing practices. Companies are facing increased scrutiny over their environmental impact and the origin of their raw materials. Goodwin Procter can assist clients in managing these evolving risks, advising on strategies to secure reliable resource access and build more robust, less vulnerable supply networks.

Environmental Due Diligence in Transactions

Environmental factors are increasingly pivotal in corporate transactions, particularly within real estate and private equity sectors. Buyers and investors are now performing more rigorous environmental due diligence to pinpoint potential liabilities, contamination risks, and adherence to environmental regulations.

Goodwin Procter needs to embed comprehensive environmental due diligence into its transactional strategies to safeguard client interests effectively. For instance, in 2024, the global market for environmental consulting services was projected to reach over $40 billion, indicating a significant emphasis on these assessments.

- Growing Regulatory Scrutiny: Stricter environmental laws and enforcement actions are raising the stakes for transaction parties.

- Climate Change Impact: Physical risks from climate change, such as flooding and extreme weather, are becoming key considerations in property valuations and assessments.

- ESG Integration: Environmental, Social, and Governance (ESG) factors are now integral to investment decisions, with a notable increase in investor demand for transparency on environmental performance.

- Contamination Liabilities: The cost of remediating contaminated sites can be substantial, making thorough site assessments crucial to avoid unexpected financial burdens.

Stakeholder Pressure for Corporate Sustainability

Stakeholder pressure for corporate sustainability is intensifying, extending beyond mere regulatory compliance. Consumers, employees, and activist investors are increasingly demanding that companies showcase robust environmental stewardship. This translates into a significant need for legal counsel on developing effective sustainability strategies, substantiating green marketing claims, and proactively managing reputational risks tied to environmental performance. For instance, in 2024, a significant percentage of consumers indicated they would switch brands if a company's environmental practices did not align with their values.

Goodwin Procter's expertise is crucial in helping clients navigate these evolving societal expectations and the associated legal landscape. The firm can advise on the intricacies of ESG (Environmental, Social, and Governance) reporting, ensuring compliance and mitigating litigation risks. This includes guidance on climate-related disclosures, supply chain sustainability, and the ethical implications of environmental initiatives. The firm's understanding of these pressures allows clients to build trust and enhance their brand reputation.

- Growing Consumer Demand: Reports from 2024 indicate that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

- Employee Activism: In 2024, employee-led environmental initiatives and demands for corporate action on climate change have become more prominent across various industries.

- Investor Scrutiny: ESG-focused investment funds saw substantial inflows in 2024, with investors increasingly scrutinizing companies' environmental performance and sustainability strategies.

- Reputational Risk Management: Companies failing to meet stakeholder expectations on environmental issues faced increased negative media attention and potential boycotts throughout 2024.

Environmental regulations are tightening globally, impacting sectors like real estate and finance with increased reporting mandates, such as the EU's CSRD effective from 2024. Carbon pricing mechanisms, like the EU ETS averaging around €65 per tonne in 2023, are raising operational costs for carbon-intensive businesses.

Resource scarcity, particularly for critical minerals essential for green technologies, is a growing concern, with demand projected to surge by 2030, straining supply chains. This necessitates robust environmental due diligence in transactions, with the environmental consulting market exceeding $40 billion in 2024.

Stakeholder pressure for sustainability is intensifying, with over 60% of consumers in 2024 considering environmental practices in purchasing decisions. Investor scrutiny of ESG performance is also rising, with significant inflows into ESG-focused funds during the same year.

| Factor | 2023/2024 Data Point | Impact on Businesses | Goodwin Procter Relevance |

|---|---|---|---|

| EU ETS Carbon Price | Avg. €65/tonne (2023) | Increased operational costs for emissions | Advising on compliance and green financing |

| Critical Mineral Demand | Projected surge by 2030 | Supply chain risk and resource availability | Managing resource access and supply chain resilience |

| Consumer Sustainability Preference | >60% influence purchasing (2024) | Brand reputation and market demand | Guiding sustainability strategies and green marketing claims |

| ESG Investment Funds | Significant inflows (2024) | Increased investor scrutiny and capital allocation | Advising on ESG reporting and mitigating litigation risk |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a comprehensive range of data, including reports from leading financial institutions like the IMF and World Bank, alongside up-to-the-minute government policy updates and reputable industry-specific research. We meticulously gather insights from these trusted sources to ensure a robust understanding of each macro-environmental factor.