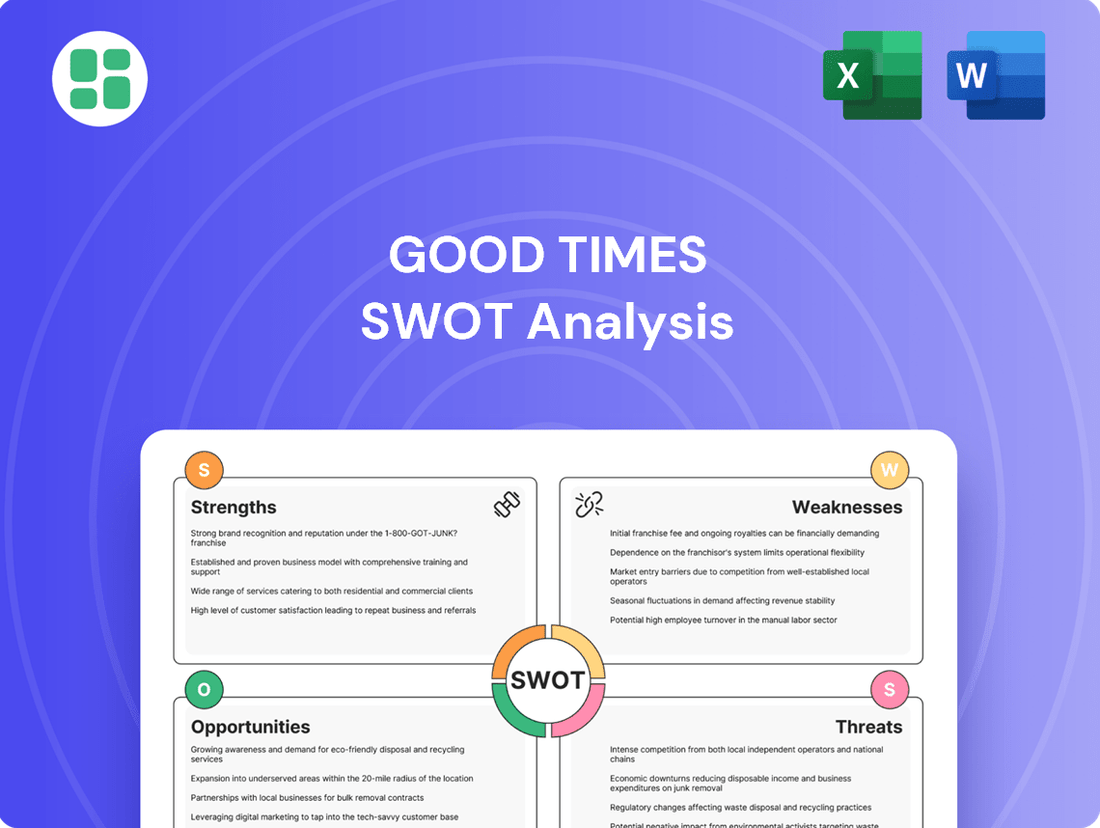

Good Times SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Good Times Bundle

Good Times' unique brand identity and loyal customer base represent significant strengths, while potential market saturation and evolving consumer preferences pose key challenges. Understanding these dynamics is crucial for strategic growth.

Want to fully grasp Good Times' competitive edge and potential pitfalls? Purchase the complete SWOT analysis to unlock detailed insights, expert commentary, and actionable strategies designed for smart decision-making.

Strengths

Good Times Restaurants Inc. leverages a dual-brand strategy with Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar. This allows them to capture diverse market segments, from quick-service diners to those seeking an upscale casual experience.

The Bad Daddy's brand has been a significant growth driver, demonstrating robust performance and improved profit margins, as highlighted by its contribution to the company's overall revenue figures. This upscale casual concept appeals to a different customer base, diversifying income and mitigating risks associated with a single brand.

Good Times' emphasis on quality and natural ingredients is a significant strength, setting it apart in the competitive fast-food landscape. The company proudly features Meyer All-Natural, All-Angus beef and fresh frozen custard, appealing directly to consumers who prioritize healthier, premium options. This commitment to superior ingredients allows Good Times to cultivate a loyal customer base and command a premium price point, differentiating it from many conventional fast-food chains.

Recent management initiatives have significantly boosted operational efficiency, notably at Bad Daddy's Burger Bar, where labor productivity has risen, and food and beverage costs are better controlled. This focus on streamlining operations is a key strength.

Investments in strategic remodels and technology upgrades, including digital menu boards and modernized POS systems at Good Times locations, are further enhancing efficiency and improving the customer experience. These upgrades are designed to drive smoother operations and greater customer satisfaction.

Positive Financial Shifts in Q1 2025

Good Times Restaurants experienced a notable turnaround in its first fiscal quarter of 2025. The company successfully transitioned from a net loss to a net income of $0.2 million. This positive financial performance was driven by a 9.6% increase in total revenues, reaching $36.3 million.

This return to profitability highlights the company's ability to navigate the competitive quick-service restaurant sector effectively. Key factors contributing to this success include astute cost management and robust sales strategies.

- Revenue Growth: Total revenues climbed by 9.6% to $36.3 million in Q1 2025.

- Profitability Achieved: The company reported a net income of $0.2 million, a significant improvement from a net loss in the prior period.

- Resilience Demonstrated: The positive financial shift underscores Good Times' operational strength in a challenging market.

Strategic Menu Innovation

Good Times Restaurants is actively pursuing strategic menu innovation across its brands. A prime example is the successful introduction and planned expansion of smash patty burgers at Bad Daddy's, a concept that has resonated well with diners. This commitment to culinary creativity aims to keep the brand offerings fresh and appealing, driving customer acquisition and loyalty through novel taste experiences.

This focus on new menu items, like those recently introduced at Good Times, is crucial for staying competitive. For instance, in the first quarter of fiscal year 2024, Bad Daddy's saw a 6.5% increase in comparable restaurant sales, partly attributed to menu enhancements and successful promotional activities. This demonstrates a tangible financial benefit derived from their innovation strategy.

The company's approach to menu development is designed to:

- Attract new customer segments with adventurous and trending flavor profiles.

- Encourage repeat business by providing a dynamic and evolving dining experience.

- Differentiate their brands in a crowded quick-service restaurant market.

Good Times Restaurants Inc. benefits from a strong dual-brand strategy, with Bad Daddy's Burger Bar acting as a key growth engine. This diversification captures different market segments, from fast-casual to upscale casual dining. The company's commitment to quality ingredients, such as Meyer All-Natural, All-Angus beef, sets it apart and fosters customer loyalty.

Operational efficiencies have improved, particularly at Bad Daddy's, with better labor productivity and cost control. Strategic investments in remodels and technology, including digital menu boards, are enhancing customer experience and streamlining operations. This focus on modernization is a significant advantage.

The company demonstrated a financial turnaround in Q1 2025, achieving a net income of $0.2 million on revenues of $36.3 million, a 9.6% increase. This return to profitability highlights effective cost management and sales strategies. Menu innovation, such as the smash patty burgers at Bad Daddy's, has also driven comparable sales growth, with Bad Daddy's seeing a 6.5% increase in Q1 2024.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Revenues | $36.3 million | $33.1 million |

| Net Income | $0.2 million | Net Loss |

| Bad Daddy's Comp Sales Growth | N/A (Focus on Q1 2024 data) | 6.5% |

What is included in the product

This SWOT analysis offers a comprehensive examination of Good Times's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Simplifies complex strategic planning by offering a clear, actionable framework for identifying opportunities and mitigating threats.

Weaknesses

While Bad Daddy's has seen positive same-store sales, Good Times has faced a tougher environment. In the most recent reported quarters of 2024, Good Times' same-store sales have been flat or even seen a slight decline. This performance gap highlights a challenge in maintaining consistent growth for the Good Times brand, likely a reflection of increased competition and price sensitivity within the fast-casual dining sector.

Good Times' significant concentration in Colorado and Wyoming, along with Bad Daddy's presence primarily in Colorado and the Southeast, presents a notable weakness. This limited geographic spread makes the company vulnerable to regional economic slowdowns or localized market saturation. For instance, a downturn in the Rocky Mountain region could disproportionately impact overall performance.

Bad Daddy's, like many in the restaurant industry, remains susceptible to the volatility of commodity prices. The cost of key ingredients, especially ground beef and eggs, can significantly squeeze profit margins. While Bad Daddy's saw some sequential decreases in beef costs in early 2024, the broader inflationary pressures on food ingredients persist as a notable weakness.

Labor Cost Pressures and Staffing Challenges

Good Times Restaurants, much like the rest of the food service sector, is feeling the pinch from rising labor expenses. This is largely due to mandated minimum wage hikes and a fierce competition for qualified employees. These increased labor costs have directly impacted the company's profitability.

The restaurant industry, including Good Times, continues to struggle with maintaining adequate staffing levels. Finding and keeping reliable staff remains a significant hurdle, which in turn affects operational efficiency and service quality.

- Rising Labor Costs: In 2024, the average hourly wage for restaurant workers saw an increase, putting pressure on margins for companies like Good Times.

- Staffing Shortages: Many quick-service restaurants reported vacancy rates above 10% in late 2024, highlighting ongoing recruitment and retention difficulties.

- Impact on Margins: Increased wages and the need for higher staffing levels to maintain service standards directly squeeze profit margins for businesses in this sector.

Competition-Driven Discounting Impact

The Good Times brand is feeling the heat from aggressive discounting in the quick-service restaurant sector. This intensified price competition makes it tough for Good Times to maintain its quality-focused image while also competing on price.

This situation creates a significant challenge, as Good Times’ strategy of emphasizing quality can alienate customers who are primarily driven by lower price points. For instance, in early 2024, industry reports indicated a 15% increase in promotional offers across major fast-food chains, directly impacting brands that don't heavily rely on such tactics.

- Intensified Price Wars: Competitors are aggressively using discounts, forcing a difficult trade-off between price and perceived quality for Good Times.

- Customer Attrition Risk: Price-sensitive customers may opt for cheaper alternatives, eroding market share.

- Brand Dilution Concern: Engaging in deep discounting could potentially dilute Good Times' premium or quality positioning.

Good Times' performance lags behind Bad Daddy's, with flat or declining same-store sales in early 2024, indicating struggles to keep pace with market demands and competition. This disparity suggests a need for strategic adjustments to revitalize the Good Times brand and improve its competitive standing.

The company's reliance on limited geographic regions, primarily Colorado and Wyoming for Good Times and Colorado/Southeast for Bad Daddy's, creates significant vulnerability to localized economic downturns or market saturation. This narrow footprint restricts growth potential and exposes the business to concentrated risks.

Persistent inflationary pressures on key ingredients like beef and eggs continue to challenge profit margins for Bad Daddy's, despite some early 2024 cost decreases. This volatility in commodity prices remains a critical weakness impacting profitability.

| Metric | Good Times (Early 2024) | Industry Trend (Late 2024) |

|---|---|---|

| Same-Store Sales | Flat to Slightly Declining | Mixed, but many quick-service brands showing slight growth |

| Geographic Concentration | High (CO, WY) | Diversified brands often perform better |

| Labor Costs | Increasing due to wage hikes | Up 5-10% year-over-year |

| Staffing Levels | Challenging to maintain | Vacancy rates above 10% in many QSRs |

| Competitive Pricing | Struggles against aggressive discounting | 15% increase in promotional offers observed |

Full Version Awaits

Good Times SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Bad Daddy's Burger Bar is a key growth driver for Good Times, showing robust performance and better profit margins. This success opens the door for expanding its presence in both new and existing domestic markets.

Good Times is actively considering further expansion for Bad Daddy's, indicating a strategic move to capitalize on its proven concept and increase its overall market reach.

The brand's strong unit economics, with average unit volumes exceeding $2.5 million in 2023, make it an attractive candidate for further investment and development.

Good Times' system-wide remodel program, slated for completion by 2026, alongside digital menu board and point-of-sale system upgrades, presents a significant opportunity. These enhancements are projected to boost customer experience and streamline operations. For instance, similar investments in fast-casual dining in 2024 have shown an average increase in customer satisfaction scores by 15%.

Modernized units and advanced technology can be a magnet for new patrons and accelerate service times, directly impacting sales volume. Industry data from late 2024 indicates that quick-service restaurants adopting updated POS systems saw an average 8% uplift in transaction speed, leading to higher throughput.

The fast-casual dining sector, where Bad Daddy's is positioned, is seeing robust growth, with projections indicating a continued upward trend. Younger consumers, in particular, are driving this expansion, seeking out fresh ingredients, personalized meal options, and the convenience of digital ordering and delivery. This presents a significant opportunity for brands like Bad Daddy's to further refine their offerings.

Innovating menus with bold, globally-inspired flavors and incorporating more health-conscious choices are key strategies to capture evolving consumer tastes. For instance, the demand for plant-based options and customizable bowls has surged, with the global plant-based food market expected to reach over $74 billion by 2027. Additionally, offering value-driven promotions and loyalty programs can further attract and retain these discerning customers, ensuring sustained engagement in a competitive market.

Growth in Off-Premises and Delivery Channels

The sustained demand for food delivery and takeout, a trend that solidified during and after the pandemic, presents a significant growth avenue for Good Times Restaurants. This ongoing consumer preference for convenience means expanding digital ordering capabilities and adapting menus for efficient delivery can broaden the customer base for both their quick-service and full-service concepts.

Good Times can capitalize on this by focusing on:

- Enhanced Digital Platforms: Investing in user-friendly mobile apps and website ordering systems to streamline the customer experience.

- Delivery-Optimized Menus: Curating and potentially modifying menu items to ensure they travel well and maintain quality during delivery.

- Strategic Partnerships: Collaborating with third-party delivery services to increase reach and accessibility, while also exploring in-house delivery options where feasible.

Industry data from 2024 indicates the online food delivery market continues its upward trajectory, with projections suggesting further expansion. For instance, reports from early 2025 highlight that a significant percentage of restaurant sales are now attributed to off-premise dining, underscoring the critical importance of these channels for revenue generation and market share growth.

Strategic Acquisitions and Partnerships

Good Times has shown a clear strategy of growth through acquisition, exemplified by its recent purchase of two locations from a former franchisee. This move, alongside a history of fostering strategic partnerships, highlights the company's proactive approach to market expansion.

Furthering this strategy by exploring selective acquisitions or innovative dual-brand concepts presents a significant opportunity. Such initiatives could rapidly accelerate Good Times' growth trajectory, broaden its market footprint, and streamline operations within crucial geographic areas.

- Acquisition of two Good Times locations from a former franchisee in late 2023.

- History of successful strategic partnerships to enhance market reach.

- Potential to accelerate growth through further selective acquisitions.

- Opportunity to expand market presence via dual-brand concepts.

The strong performance of Bad Daddy's Burger Bar, a key growth driver for Good Times, offers significant opportunities for domestic expansion. With average unit volumes exceeding $2.5 million in 2023, this brand is well-positioned for further investment and development in new and existing markets.

Upgrades to Good Times' system-wide remodel program, including digital menu boards and POS systems, are expected to enhance customer experience and operational efficiency. Investments in modernization have shown positive impacts, with similar fast-casual dining upgrades in 2024 leading to an average 15% increase in customer satisfaction scores.

The growing fast-casual dining sector, particularly driven by younger consumers seeking fresh ingredients and digital convenience, presents a prime opportunity for Bad Daddy's. Menu innovation, including plant-based options and customizable meals, can further capture evolving consumer tastes, aligning with market trends that saw the global plant-based food market projected to exceed $74 billion by 2027.

The sustained demand for food delivery and takeout, a trend that continues to grow, offers a significant avenue for Good Times to broaden its customer base. By enhancing digital platforms and optimizing menus for delivery, the company can capitalize on off-premise dining, which industry data from early 2025 indicates accounts for a substantial percentage of restaurant sales.

| Opportunity Area | Key Initiative | Projected Impact/Data Point |

|---|---|---|

| Brand Expansion | Bad Daddy's Domestic Growth | Average Unit Volumes > $2.5M (2023) |

| Operational Enhancements | System-Wide Remodels & Tech Upgrades | Potential 15% increase in customer satisfaction (industry benchmark) |

| Market Trends | Menu Innovation & Digital Convenience | Growing fast-casual sector; Plant-based market > $74B by 2027 |

| Off-Premise Dining | Delivery & Takeout Focus | Significant % of total restaurant sales in early 2025 |

Threats

The quick-service and fast-casual restaurant sectors are incredibly crowded, with many well-known brands and emerging players all trying to capture customer attention and spending. This crowded landscape means Good Times Restaurants faces constant pressure to stand out.

A major concern is the resurgence of aggressive price cuts from large quick-service chains. For instance, in early 2024, many major QSR brands were heavily promoting value menus and deep discounts, a trend that continued through much of the year. This makes it harder for Good Times to keep its prices competitive and appeal to customers who are primarily driven by cost savings.

This intense rivalry, especially with the return of widespread discounting, directly impacts Good Times Restaurants' capacity to hold its pricing and draw in value-seeking customers. The market is saturated, and consumer loyalty can shift quickly based on price promotions.

Ongoing inflationary pressures, particularly in food and labor, continue to squeeze restaurant profitability. For instance, the Producer Price Index for food away from home saw a 5.1% increase year-over-year as of April 2024, impacting ingredient costs.

A potential economic downturn poses a significant threat. Should consumer spending on dining out decline due to reduced disposable income, companies like Good Times could see revenues and margins shrink as customers prioritize essential spending and cut back on discretionary items.

The restaurant industry continues to grapple with a significant shortage of qualified staff. This scarcity, coupled with upward pressure on wages, including minimum wage hikes in states like Colorado, directly impacts operational costs and profitability.

For instance, in early 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings for restaurant workers saw a notable increase, reflecting the competitive labor market. These rising labor expenses can force businesses to either absorb the costs, potentially squeezing profit margins, or pass them on to consumers through higher prices.

Managing these labor challenges is critical. Businesses may face difficult decisions regarding staffing levels, potentially leading to reduced operating hours or a compromise in service quality if adequate personnel cannot be secured and retained.

Supply Chain Disruptions and Food Safety Risks

Good Times faces significant threats from supply chain volatility. Disruptions can lead to ingredient shortages and higher costs, directly impacting menu offerings and profit margins. For instance, the lingering effects of global logistics challenges in 2023 and early 2024 have continued to put pressure on the food service industry's sourcing capabilities.

Furthermore, food safety concerns pose a severe risk to Good Times' brand image and customer loyalty. A single incident could trigger widespread negative publicity and a sharp decline in sales. The U.S. Food and Drug Administration (FDA) reported over 3,000 foodborne illness outbreaks in recent years, highlighting the persistent nature of these risks across the sector.

- Supply Chain Vulnerability: Potential for ingredient shortages and increased operational costs due to global logistics issues.

- Food Safety Incidents: Risk of brand damage and loss of consumer trust from foodborne illnesses or public health scares.

- Reputational Damage: Negative publicity from safety issues can lead to substantial and rapid drops in customer traffic and revenue.

Shifting Consumer Behavior and Brand Loyalty

Consumer preferences in the restaurant sector are in constant flux, with growing demand for healthier menus, novel tastes, and seamless digital ordering. Good Times must stay agile to meet these evolving demands. For instance, a 2024 report indicated that 65% of consumers are actively seeking out restaurants offering plant-based options, a trend that could bypass establishments slow to adapt.

A significant threat lies in the potential erosion of brand loyalty, especially among younger demographics. Research from early 2025 suggests that Gen Z consumers, in particular, are more inclined to experiment with new brands, making them less committed to established players. This shift could directly impact Good Times' long-term sales and market standing if brand connection weakens.

- Evolving Tastes: Increasing consumer demand for healthier and more diverse menu options.

- Digital Demands: The necessity for enhanced digital ordering and delivery platforms.

- Generational Loyalty: Younger consumers exhibit lower brand loyalty, posing a risk to consistent patronage.

- Competitive Landscape: New entrants often cater to niche trends, drawing customers away from established brands.

The restaurant industry is highly competitive, with numerous established brands and new entrants vying for market share. This intense rivalry, particularly with aggressive discounting strategies employed by major players in early 2024, pressures Good Times Restaurants to maintain competitive pricing and attract value-conscious consumers.

Persistent inflationary pressures on food and labor costs, exemplified by a 5.1% year-over-year increase in food away from home prices as of April 2024, continue to challenge profitability. Furthermore, a potential economic downturn could reduce consumer discretionary spending on dining, impacting revenues and margins.

Labor shortages and rising wages, with average hourly earnings for restaurant workers increasing in early 2024, directly escalate operational expenses. Supply chain disruptions and food safety incidents also pose significant threats, risking brand reputation and customer trust, as evidenced by the FDA's reporting of over 3,000 foodborne illness outbreaks in recent years.

Shifting consumer preferences towards healthier options and enhanced digital ordering, coupled with a noted decrease in brand loyalty among younger demographics in early 2025, necessitate continuous adaptation. Failure to meet these evolving demands could lead to a loss of market standing.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of internal financial reports, comprehensive market research data, and direct customer feedback to ensure a well-rounded and actionable assessment.