Good Times Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Good Times Bundle

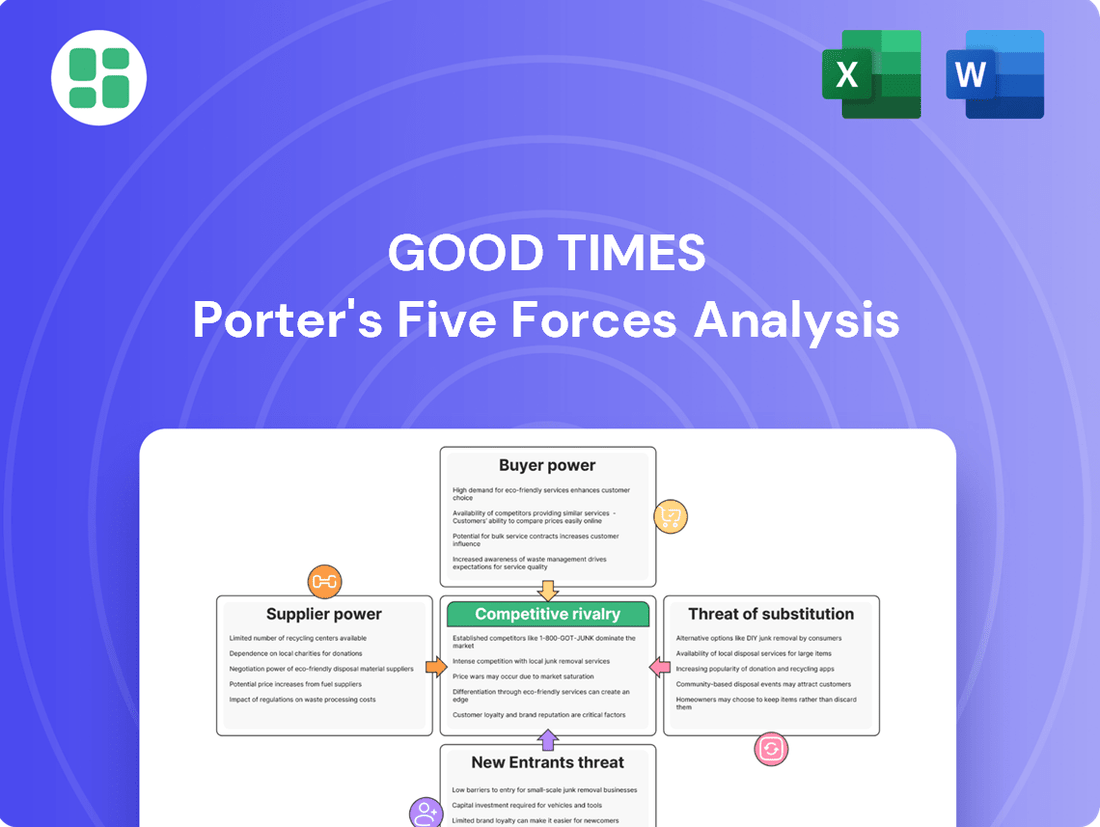

Good Times's Porter's Five Forces Analysis reveals a dynamic competitive landscape. Understanding the intensity of rivalry and the bargaining power of suppliers is crucial for navigating this market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Good Times’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Good Times Restaurants Inc.'s commitment to 'all-natural' and 'fresh ingredients' for its Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar brands significantly influences supplier power. This focus narrows the field of potential suppliers who can consistently meet these quality and sourcing standards.

When only a limited number of suppliers can provide specialized, high-quality items, such as Meyer All-Natural, All-Angus beef or unique frozen custard ingredients, their leverage over Good Times grows. For instance, in 2024, the demand for ethically sourced and premium beef continued to rise, with reports indicating that suppliers of such products often command higher prices due to their specialized production and limited availability.

Input cost volatility is a major concern for restaurants like Good Times, as fluctuating prices for ingredients directly impact their bottom line. For instance, the U.S. Bureau of Labor Statistics reported that the producer price index for food away from home increased by 7.1% in 2023, reflecting these cost pressures.

Several factors contribute to this volatility. Higher production costs, labor shortages, rising fuel prices, and the impact of severe weather events on agriculture all play a role. Diseases affecting livestock or crops can also create sudden supply shortages, driving up prices for essential commodities.

These external pressures grant suppliers greater bargaining power. They can more easily pass on their increased costs to restaurants, squeezing profit margins. For Good Times, this means that unpredictable ingredient expenses can significantly affect their ability to maintain competitive pricing and overall profitability.

The difficulty and cost for Good Times to switch suppliers for its core ingredients, particularly those underpinning its premium fast-food experience and sustainability claims, significantly bolster supplier leverage. For instance, sourcing organic beef that meets stringent quality and ethical standards can involve extensive vetting and auditing processes, potentially costing thousands of dollars per new supplier. This makes transitioning away from established, trusted partners a considerable undertaking.

Building new supplier relationships and ensuring consistent quality across different vendors, alongside adapting existing supply chain logistics, represents a substantial investment of both time and capital for Good Times. A 2024 industry report indicated that the average cost for a food service business to onboard a new primary ingredient supplier can range from $5,000 to $20,000, factoring in quality control and logistical adjustments.

Therefore, Good Times must proactively manage these supplier relationships with a strategic focus to effectively mitigate the risks associated with high switching costs. This involves fostering strong partnerships and exploring long-term contracts that might offer price stability and preferential treatment, thereby reducing the immediate impact of supplier power.

Supplier's Importance to Good Times

The bargaining power of suppliers for Good Times is a critical factor in its operational costs and profitability. If Good Times represents a minor part of a large supplier's revenue, that supplier holds significant leverage, potentially dictating higher prices or less favorable terms. For instance, if a key ingredient supplier's sales to Good Times constitute less than 1% of their total business, Good Times has limited ability to negotiate favorable pricing.

Conversely, Good Times could gain leverage if it is a substantial customer for a smaller, specialized supplier. Imagine a scenario where Good Times accounts for over 20% of a niche producer's output; in such cases, the supplier might be more accommodating to maintain the business relationship. The company's commitment to specific 'all-natural' ingredients, a trend gaining momentum in the food industry, can increase its dependence on particular suppliers who can reliably meet these stringent sourcing requirements.

- Supplier Dependence: Good Times' reliance on a few key suppliers for its unique, all-natural ingredients could significantly amplify supplier bargaining power.

- Customer Size Impact: If Good Times is a small customer for a large supplier, the supplier can exert more influence on pricing and contract terms.

- Market Trends: The growing consumer demand for natural and organic products, a key differentiator for Good Times, may limit the availability of alternative suppliers, thus strengthening the position of existing ones.

- Ingredient Specificity: Sourcing highly specialized or proprietary ingredients means fewer alternative suppliers, granting those suppliers greater leverage.

Availability of Substitute Inputs

The bargaining power of suppliers for Good Times is influenced by the availability of substitute inputs. While Good Times emphasizes unique, all-natural ingredients, the existence of alternative, perhaps less premium, raw materials could lessen the leverage of their primary suppliers. For instance, if a key supplier of a specific organic fruit faces supply chain issues, Good Times might explore sourcing from a different region or using a similar, readily available fruit, though this could impact their premium positioning.

However, Good Times' core brand identity is built on high-quality, fresh, and often proprietary ingredients. Substituting these with less premium alternatives, even if readily available, would likely dilute their brand promise and alienate their customer base, which values the specific attributes of their products. This commitment to quality significantly restricts their ability to switch suppliers without impacting their market appeal.

- Brand Integrity: Good Times' reliance on specific 'all-natural' and high-quality ingredients means that readily available but lower-quality substitutes pose a significant risk to their brand image.

- Customer Perception: A shift to less premium inputs could lead to negative customer reactions, potentially impacting sales and brand loyalty, as seen in the organic food market where ingredient authenticity is paramount.

- Limited Flexibility: The strict adherence to their quality standards inherently limits the bargaining power Good Times can exert by threatening to switch to substitute inputs, as such switches are not truly viable options without compromising their business model.

The bargaining power of suppliers significantly impacts Good Times' operational costs due to its commitment to 'all-natural' and 'fresh ingredients'. This specialization limits the pool of qualified suppliers, granting those who meet stringent quality and sourcing standards greater leverage. For instance, in 2024, the demand for premium, ethically sourced beef continued to drive up prices for suppliers capable of meeting these requirements.

High switching costs for specialized ingredients further empower suppliers. The process of vetting and onboarding new suppliers for items like organic beef can be time-consuming and expensive, potentially costing thousands of dollars per new vendor, as noted in a 2024 industry report which estimated onboarding costs between $5,000 and $20,000.

Furthermore, if Good Times represents a small portion of a supplier's total sales, the supplier has less incentive to offer favorable terms. Conversely, Good Times could gain leverage if it is a major customer for a niche producer, accounting for over 20% of their output.

The limited availability of viable substitutes for Good Times' premium ingredients restricts its ability to negotiate based on alternative sourcing, as using less premium inputs would compromise its brand integrity and customer perception. This reliance on specific, high-quality components solidifies supplier influence.

| Factor | Impact on Good Times' Supplier Power | Supporting Data/Example (2024 Focus) |

|---|---|---|

| Ingredient Specificity | Increases supplier leverage due to limited qualified sources. | Commitment to 'all-natural' and 'fresh' limits supplier options. |

| Switching Costs | Bolsters supplier power by making it costly and time-consuming to change providers. | Onboarding new primary ingredient suppliers can cost $5,000-$20,000. |

| Customer Size Relative to Supplier | Supplier has more power if Good Times is a small client. | Good Times' sales as <1% of a large supplier's business grants supplier leverage. |

| Availability of Substitutes | Limits Good Times' negotiation power as premium substitutes are scarce. | Using less premium inputs risks brand dilution and negative customer reaction. |

What is included in the product

Uncovers the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Good Times' market position.

Instantly identify and mitigate competitive threats with a visually intuitive breakdown of Porter's Five Forces, empowering proactive strategy development.

Customers Bargaining Power

Customers in the quick-service and fast-casual restaurant sectors are becoming more aware of prices, especially as eating out costs more than preparing meals at home. Good Times competes in an environment where patrons are actively looking for good deals and affordable choices.

This heightened price sensitivity means customers hold considerable sway. If Good Times' prices seem too high, consumers can readily switch to less expensive competitors. For instance, a 2024 survey indicated that 65% of consumers consider price a primary factor when choosing a fast-food restaurant, highlighting the significant bargaining power customers possess.

The cost for a customer to switch from Good Times to a competitor is practically nil. This means if a customer isn't happy with the price, quality, service, or menu, they can easily walk over to another restaurant. In 2024, the quick-service restaurant market is highly saturated, with thousands of establishments competing for consumer dollars, making this low switching cost a significant factor.

The quick-service and fast-casual dining sectors are brimming with options, creating a highly competitive landscape. Major players like McDonald's, Wendy's, and Burger King, alongside premium brands such as Shake Shack and Five Guys, offer consumers a vast selection for their meals.

This sheer volume of substitutes significantly boosts customer bargaining power. With so many alternatives readily available, diners can easily switch providers if they feel they aren't receiving adequate value or service, putting pressure on businesses to constantly innovate and offer competitive pricing and quality.

Customer Information and Transparency

Customer information and transparency have significantly amplified their bargaining power. In 2024, readily available online data on menus, pricing, and reviews empowers diners to make swift, informed choices. For instance, platforms like Yelp and Google Reviews allow consumers to compare restaurant offerings instantly, pushing businesses to maintain competitive pricing and quality. This digital accessibility means customers can easily identify the best value, directly influencing restaurant profitability and strategic decisions.

The ease of access to information directly translates into increased customer leverage. Consumers can now research nutritional content, ingredient sourcing, and even competitor pricing with just a few clicks. This transparency forces businesses to be more open about their operations and pricing structures. A report from Statista in early 2024 indicated that over 70% of consumers regularly check online reviews before dining out, underscoring the impact of this information availability on their purchasing decisions.

- Information Accessibility: Online platforms and mobile apps provide easy access to menus, pricing, reviews, and nutritional information.

- Informed Decision-Making: Customers can quickly compare offerings, enhancing their ability to find the best value.

- Competitive Pressure: Transparency forces restaurants to maintain competitive pricing and quality standards.

- Digital Influence: Loyalty programs and online presence play a crucial role in influencing customer choices and driving demand.

Evolving Consumer Expectations

Modern consumers, especially younger demographics like Gen Z and Millennials, are increasingly demanding more than just basic products. They're looking for convenience, personalized options, healthier choices, and memorable experiences. For Good Times, this means their commitment to all-natural and premium ingredients needs to be matched with accessible pricing and ongoing innovation to meet these evolving desires.

Customer expectations are constantly shifting, pushing businesses to adapt. For instance, in 2024, a significant portion of consumers reported being willing to pay more for sustainable or ethically sourced products, reflecting a growing awareness of broader impacts. This trend directly influences the bargaining power of customers, as they can leverage their preferences to influence company practices and product offerings.

- Evolving Preferences: Consumers now prioritize factors like convenience, customization, and health, alongside traditional quality.

- Value Proposition: While Good Times offers premium ingredients, customers expect this to be balanced with affordability and continuous innovation.

- Experiential Demand: Trends like 'swalty' flavors and unique dining experiences highlight a desire for more than just sustenance, increasing customer leverage.

- Sustainability Influence: In 2024, a notable percentage of consumers indicated a willingness to pay a premium for products aligned with sustainability and ethical sourcing.

Customers in the quick-service and fast-casual sectors possess significant bargaining power due to high price sensitivity and the abundance of alternatives. In 2024, 65% of consumers cited price as a key factor in choosing a fast-food restaurant, and the low switching costs mean customers can easily opt for competitors if dissatisfied.

The proliferation of online information, with over 70% of consumers checking reviews before dining in 2024, further empowers customers. This transparency allows for easy comparison of menus, pricing, and quality, pressuring restaurants like Good Times to maintain competitive offerings and value propositions.

Customer expectations are also evolving, with a growing demand for convenience, customization, and ethical sourcing, as evidenced by a notable percentage willing to pay more for sustainable products in 2024. This shifts the focus beyond just food quality to a broader value assessment.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High | 65% of consumers consider price primary for fast-food choice. |

| Availability of Substitutes | High | Saturated market with numerous competitors (McDonald's, Wendy's, Shake Shack, etc.). |

| Switching Costs | Very Low | Minimal barriers for customers to move between restaurants. |

| Information Accessibility | High | 70%+ consumers check online reviews; easy access to menus, pricing, and nutritional data. |

| Evolving Customer Preferences | Increasing | Demand for convenience, customization, health, and sustainability. |

Same Document Delivered

Good Times Porter's Five Forces Analysis

This preview showcases the comprehensive Good Times Porter's Five Forces Analysis, detailing the competitive landscape of the industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, containing all the insights and strategic implications. You can be confident that what you're previewing is the complete, ready-to-use document, providing you with a thorough understanding of the forces shaping Good Times' market.

Rivalry Among Competitors

The quick-service (QSR) and fast-casual restaurant sectors are incredibly crowded, featuring a wide array of competitors. Good Times faces intense rivalry from global powerhouses such as McDonald's, Starbucks, and Burger King, alongside a multitude of regional and local chains, including specialized burger joints.

This saturation means Good Times is not only up against established fast-food brands but also increasingly popular upscale fast-casual burger concepts and even broader casual dining establishments that offer similar menu items. For instance, the U.S. fast-casual market alone saw significant growth, with revenue projected to reach nearly $140 billion in 2024, highlighting the sheer volume of players vying for consumer attention and spending.

The quick-service restaurant (QSR) sector, especially the fast-casual 'better burger' niche, is booming. This growth, fueled by busy lifestyles and a craving for convenience, is a magnet for new players. The U.S. fast-casual market alone is expected to surge by a massive USD 385.1 billion between 2024 and 2029, with a compound annual growth rate of 16.6%.

This substantial expansion signals increased competition. As more businesses enter this lucrative space, particularly in already crowded markets, the rivalry intensifies. Existing players must innovate and differentiate to stand out amidst the influx of new concepts and established brands expanding their offerings.

Good Times strives to stand out with its promise of high-quality, all-natural burgers and a premium fast-food experience. However, the fast-casual market is crowded with rivals also touting fresh ingredients, extensive customization, and an elevated dining atmosphere. This makes it difficult for Good Times to carve out a truly unique selling proposition that customers can’t find elsewhere.

For instance, in 2024, the fast-casual dining segment continued to see significant growth, with many players investing heavily in marketing their "fresh" and "natural" offerings. This intensified competition means that simply claiming these attributes may not be enough to capture and retain market share. Good Times needs to demonstrate tangible differences in product quality or customer experience that competitors cannot easily replicate.

Aggressive Pricing and Marketing Strategies

Competitors in the fast-food sector, including those directly challenging Good Times, are known for aggressive pricing and marketing. This often manifests as frequent price promotions, value meals, and significant advertising spend. For instance, in 2024, major fast-food chains continued to heavily promote combo deals and limited-time offers, with some reporting marketing budgets in the hundreds of millions of dollars to capture market share.

This intense promotional activity creates pressure on Good Times to remain competitive. The high price sensitivity of many consumers in this market means that pricing plays a crucial role in purchasing decisions. Good Times must therefore continually assess its pricing structure and marketing initiatives to attract and retain customers without compromising its profitability.

- Price Wars: Competitors often engage in price wars, offering deep discounts that can impact Good Times' margins.

- Marketing Spend: Significant marketing investments by rivals aim to build brand loyalty and attract new customers.

- Value Perception: Consumers are highly attuned to value, forcing Good Times to balance affordability with quality.

- Promotional Cycles: The industry sees constant cycles of promotions, requiring agile responses from Good Times.

Low Exit Barriers

The restaurant industry, including chains like Good Times, generally exhibits low exit barriers. This means it's relatively straightforward for businesses to cease operations, often by selling off assets like kitchen equipment or simply closing down locations. This ease of exit can paradoxically lead to prolonged struggles for existing players.

When exit is simple, even unprofitable restaurants might linger, intensifying competition. They may engage in aggressive price wars or frequent promotional discounts to attract any available customers, thereby eroding profit margins for everyone in the market. This dynamic can create persistent overcapacity, putting continuous pressure on profitability across the sector.

- Low Exit Barriers: Restaurants can often sell equipment or close locations with relative ease.

- Prolonged Competition: Struggling firms may stay in the market longer, intensifying rivalry.

- Price Wars and Promotions: This can lead to increased discounting and reduced profitability for all players.

- Overcapacity: The ease of entry and exit can contribute to an oversupplied market, further pressuring margins.

The competitive rivalry for Good Times is fierce, with numerous players vying for market share in the crowded fast-casual and QSR sectors. This intense competition is further amplified by the ease with which new restaurants can enter and existing ones can exit, leading to prolonged market struggles and aggressive pricing strategies from competitors.

In 2024, the U.S. fast-casual market alone was projected to reach nearly $140 billion, indicating a highly competitive landscape where differentiation is key. Major brands like McDonald's and Starbucks, alongside numerous regional chains, constantly offer promotions and value deals, forcing Good Times to balance competitive pricing with its premium quality positioning.

The fast-casual segment is expected to grow significantly, with an anticipated surge of USD 385.1 billion between 2024 and 2029, a growth rate of 16.6%. This expansion attracts new entrants, intensifying the rivalry and requiring Good Times to continually innovate its offerings and customer experience to stand out.

| Competitor Type | Examples | Key Competitive Tactics | Market Share Impact |

|---|---|---|---|

| Global QSR Giants | McDonald's, Burger King | Aggressive pricing, value meals, extensive marketing | Significant pressure on pricing and promotions |

| Fast-Casual Chains | Chipotle, Panera Bread | Focus on fresh ingredients, customization, brand experience | Challenges Good Times' premium positioning |

| Niche Burger Joints | Local and regional specialized burger restaurants | Unique menu items, community focus, perceived quality | Direct competition for specific customer segments |

SSubstitutes Threaten

Home cooking presents a significant threat to restaurants. In 2024, the average cost of a restaurant meal continued to outpace the cost of groceries, pushing more consumers towards preparing food at home for budget reasons. This cost disparity is a primary driver for consumers seeking more economical dining solutions.

The rise of meal kit delivery services further strengthens this substitute. Companies like HelloFresh and Blue Apron offer convenient, pre-portioned ingredients and recipes, directly competing with the convenience factor restaurants often tout. This trend saw continued growth in 2024, with the meal kit market projected to reach over $20 billion globally.

Beyond direct burger rivals, a vast spectrum of alternative food service segments pose a significant threat to Good Times. Pizzerias, sandwich shops, taco stands, and various Asian cuisine establishments all cater to the fundamental consumer need for a convenient and satisfying meal. These diverse options directly compete for customer spending, potentially diverting diners who might otherwise choose Good Times.

Supermarkets and convenience stores are stepping up their game with a wider array of prepared foods, from gourmet ready-to-eat meals to extensive deli selections and hot food bars. This trend directly challenges traditional restaurants by offering a convenient and often more budget-friendly option for consumers seeking quick meals. For instance, in 2024, the prepared foods section in many major grocery chains saw a significant uptick in sales, with some reporting double-digit growth in this category as consumers prioritize value and speed.

Healthy Eating and Dietary Trends

The increasing consumer focus on health and wellness is a significant threat of substitutes for Good Times. As more people adopt specific dietary lifestyles, such as plant-based, keto, or gluten-free, they may look for alternatives that more closely align with these choices. This shift means that even Good Times' all-natural offerings might not be enough to retain customers who are prioritizing very specific nutritional profiles.

The market is seeing a substantial move towards whole food plant-based (WFPB) diets and functional foods, which offer targeted health benefits. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, demonstrating a robust growth trajectory. This expansion highlights the availability and increasing acceptance of substitutes that cater directly to health-conscious consumers.

- Growing Demand for Plant-Based Options: Consumers are actively seeking out meat and dairy alternatives, which directly compete with traditional fast-food menus.

- Rise of Functional Foods: Products fortified with vitamins, probiotics, or other beneficial ingredients are gaining traction, offering perceived health advantages over standard fast-food items.

- Dietary Trend Adoption: The popularity of diets like keto and gluten-free means consumers are looking for specialized menu items or entirely different dining experiences.

- Perception of Health: Even with 'all-natural' claims, fast-casual and fast-food environments may still be perceived as less healthy than dedicated health food stores or home-prepared meals.

Alternative Entertainment and Leisure Activities

Consumers have a wide array of entertainment and leisure options beyond dining out, directly impacting restaurants like Good Times. Instead of a meal, individuals might choose to attend a concert, visit a theme park, or even enjoy a night in with streaming services and home-cooked meals. This broad competitive landscape means Good Times is vying for discretionary income and leisure time, not just food budgets. For instance, in 2024, consumer spending on entertainment and recreation saw a notable increase, with many prioritizing experiences over traditional dining.

The threat of substitutes is significant because these alternatives often offer perceived higher value or a distinct experience. Consider the growing popularity of at-home entertainment solutions, which have become increasingly sophisticated and affordable. This trend is supported by data showing continued growth in the subscription video-on-demand market. However, the rise of experiential dining, where restaurants focus on unique ambiances and interactive elements, can serve as a counter-strategy for businesses like Good Times, turning a potential threat into an opportunity by offering a compelling reason to dine out.

- Broad Substitute Landscape: Consumers can choose from concerts, theme parks, and home entertainment instead of dining out.

- Competition for Discretionary Income: Good Times competes not just for food spending but for overall leisure time and money.

- Value Perception: Alternatives may be perceived as offering better value or a different kind of experience.

- Experiential Dining as a Mitigator: Focusing on unique dining experiences can counter the threat of substitutes.

The threat of substitutes for Good Times is multifaceted, encompassing everything from home cooking to diverse entertainment options. Consumers are increasingly opting for convenient and cost-effective alternatives, impacting traditional dining. These substitutes range from meal kits and prepared grocery store foods to entirely different leisure activities, all vying for consumer dollars and attention.

The rise of plant-based and functional foods presents a significant challenge, as consumers prioritize specialized dietary needs and perceived health benefits. This trend is underscored by the robust growth in the plant-based food market, which was valued at approximately $29.7 billion in 2023. Furthermore, the broader entertainment landscape, including streaming services and experiential activities, competes directly for discretionary spending, forcing businesses like Good Times to offer compelling value propositions.

| Substitute Category | Key Driver | 2024 Impact/Trend |

|---|---|---|

| Home Cooking | Cost savings, control over ingredients | Continued price advantage over restaurant meals |

| Meal Kit Services | Convenience, pre-portioned ingredients | Projected global market exceeding $20 billion |

| Prepared Foods (Grocery) | Convenience, value, speed | Double-digit sales growth in many grocery chains |

| Plant-Based/Functional Foods | Health consciousness, dietary trends | Robust growth, with plant-based market valued at $29.7 billion (2023) |

| Entertainment/Leisure | Discretionary spending, alternative experiences | Increased consumer spending on non-dining activities |

Entrants Threaten

Launching a single restaurant might not demand huge sums, but building a multi-location chain, especially one focused on quality like Good Times, requires substantial capital. This includes securing prime real estate, outfitting kitchens with modern equipment, implementing advanced technology for operations and customer experience, and establishing a robust supply chain to ensure consistent, high-quality ingredients.

The significant upfront investment needed for property, equipment, technology, and supply chain infrastructure for scaled operations presents a considerable barrier. For instance, the average cost to build out a new fast-casual restaurant in 2024 can range from $300,000 to $750,000 or more, depending on location and size, making it difficult for smaller players to compete at scale.

Good Times Restaurants Inc. benefits from strong brand loyalty and recognition through its popular Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar chains. This established presence makes it difficult for new competitors to quickly capture market share. For instance, in 2023, Good Times Restaurants reported total revenue of $172.8 million, indicating a significant customer base built over time.

Newcomers to the fast-casual dining sector, particularly those like Good Times that focus on fresh and natural ingredients, confront significant hurdles in securing dependable supply chains. Established brands often leverage long-standing partnerships and bulk purchasing power, creating cost advantages that new entrants struggle to match. For instance, a 2024 report indicated that the average cost of sourcing premium, all-natural beef can be 15-20% higher for smaller, unproven suppliers compared to major restaurant chains with established contracts.

Regulatory and Licensing Hurdles

The restaurant industry faces significant regulatory barriers to entry, particularly concerning health, safety, zoning, and licensing. Navigating these requirements can be a substantial undertaking for new businesses, often involving lengthy approval processes and considerable upfront investment. For instance, in 2024, obtaining all necessary permits and licenses for a new restaurant in major cities could easily take six months to over a year, with associated costs ranging from thousands to tens of thousands of dollars depending on the location and scale of the operation.

These compliance demands directly impact the threat of new entrants by increasing the initial capital required and the complexity of operations from day one. New players must not only develop a strong business concept and secure funding but also dedicate significant resources to understanding and adhering to a multitude of local, state, and federal regulations. Failure to comply can result in fines, temporary closures, or even permanent denial of operating permits, acting as a powerful deterrent.

- Health Codes: Strict adherence to food safety and sanitation standards is mandatory, often requiring specialized training and equipment.

- Zoning Laws: Restaurants must operate within designated commercial zones, and obtaining permits for specific locations can be challenging.

- Alcohol Licensing: For establishments serving alcohol, obtaining liquor licenses involves rigorous background checks and can be a lengthy and expensive process.

- Labor Laws: Compliance with minimum wage, working hours, and employee benefits adds to the operational overhead.

Experience and Operational Expertise

The threat of new entrants for Good Times, specifically concerning experience and operational expertise, is moderate. Successfully running a quick-service restaurant chain demands a deep understanding of efficient kitchen workflows, managing a large workforce, delivering consistent customer service, and integrating modern digital ordering and delivery systems. Good Times, having been in operation for decades, possesses a wealth of accumulated experience in these critical areas. This established operational excellence presents a significant hurdle for newcomers who lack the proven track record and refined processes necessary to compete effectively.

New entrants often struggle to replicate the seamless operations that established players like Good Times have honed over years. This includes everything from supply chain management to on-site execution. For instance, in 2023, the fast-casual dining sector saw a significant number of new openings, but many smaller chains faced challenges with scalability and maintaining quality as they expanded. Good Times' established infrastructure and learned efficiencies provide a competitive advantage.

- Operational Complexity: Managing multiple locations requires sophisticated systems for inventory, staffing, and quality control, which new entrants may not initially possess.

- Customer Service Standards: Building a reputation for reliable and friendly service takes time and consistent training, areas where Good Times has a long-established history.

- Digital Integration: The increasing reliance on mobile apps, online ordering, and delivery partnerships demands significant technological investment and expertise.

The threat of new entrants for Good Times is generally moderate due to substantial capital requirements, strong brand loyalty, and regulatory complexities. Building a successful multi-location restaurant chain demands significant upfront investment, estimated at $300,000 to $750,000 per location in 2024, covering real estate, equipment, and technology. Good Times' established brand recognition and customer base, evidenced by its $172.8 million in revenue in 2023, create a barrier for newcomers aiming to quickly capture market share.

New entrants face challenges in securing reliable, cost-effective supply chains for quality ingredients, with smaller suppliers potentially facing 15-20% higher costs for premium beef in 2024 compared to established chains. Furthermore, navigating stringent health, safety, zoning, and licensing regulations, which can take six months to over a year and cost thousands of dollars in 2024, adds another layer of difficulty. These combined factors increase the initial capital and operational complexity, acting as a deterrent to potential competitors.

Porter's Five Forces Analysis Data Sources

Our Good Times Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and publicly available trade association data to provide a comprehensive view of the competitive landscape.