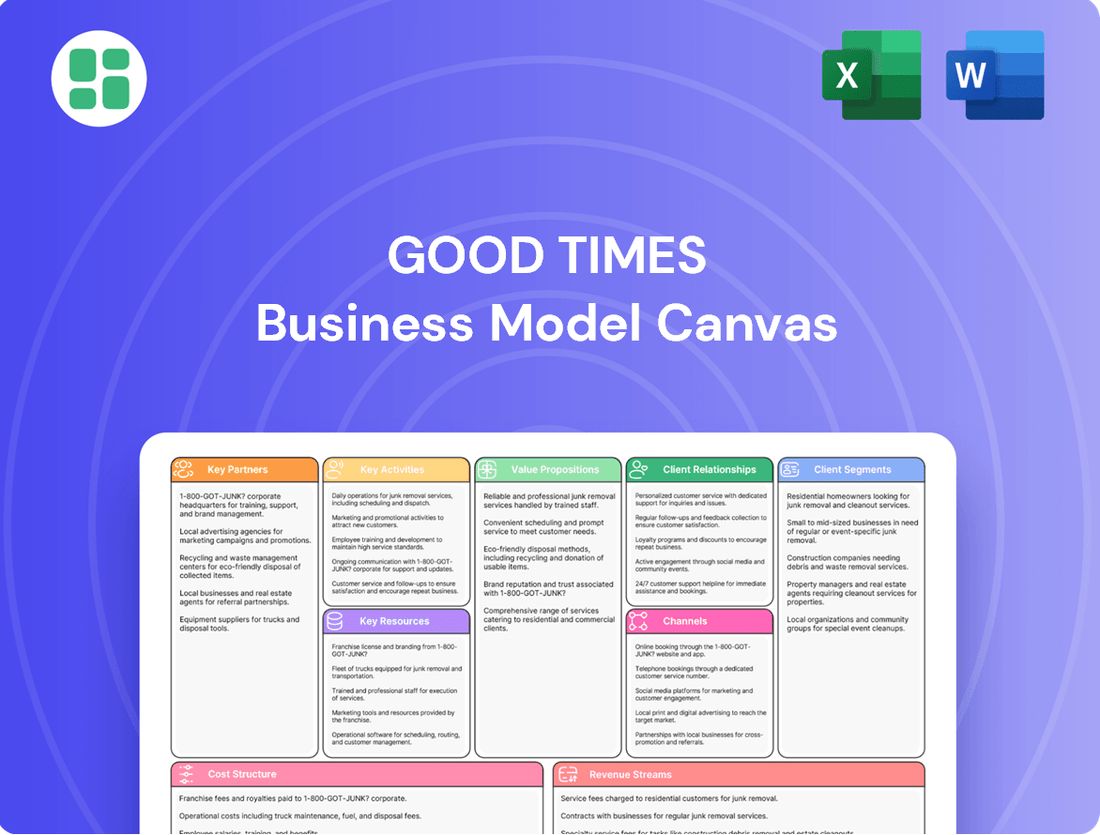

Good Times Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Good Times Bundle

Curious about Good Times's winning formula? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the complete version to gain a strategic advantage.

Partnerships

Good Times Restaurants Inc. strategically partners with suppliers like Meyer All-Natural and Springer Mountain Farms to secure premium, all-natural ingredients. These collaborations are vital for upholding the brand's commitment to high-quality, fresh products, which is a cornerstone of their customer appeal.

These key partnerships directly support Good Times' value proposition by ensuring the consistent availability of the fresh ingredients that define their menu. Maintaining these relationships is critical, especially as the company navigates fluctuating commodity prices, such as those seen in ground beef and eggs, which can impact overall operational costs and supply chain stability.

Good Times Restaurants Inc. actively leverages franchisees and licensees to drive expansion and brand presence. In 2024, the company continued its dual-brand strategy, notably with Taco John's in Wyoming, a model that allows for shared overhead and increased customer traffic.

Furthermore, the licensing of the Bad Daddy's brand, exemplified by its operation at Charlotte Douglas International Airport, demonstrates a capital-light approach to market penetration. This strategy allows Good Times to reach new customer bases and geographic areas without the direct financial burden of owning and operating every location, a crucial element for sustained growth in the competitive quick-service restaurant sector.

Good Times Restaurants Inc. is forging key partnerships with technology and POS system providers to drive modernization. A significant collaboration involves Toast, a leading POS provider, for implementing a next-generation system across their locations.

These technology alliances are crucial for enhancing the customer experience and boosting operational efficiency. By integrating digital menu boards and advanced POS systems, Good Times aims to streamline order taking and payment processing, ultimately improving the speed and accuracy of service.

As of September 2024, Good Times Restaurants Inc. planned to have completed the upgrade of all company-owned locations with digital menu boards and updated POS systems. This strategic technology investment underscores their commitment to leveraging innovation for competitive advantage.

Marketing and Advertising Agencies

Good Times Restaurants Inc. collaborates with marketing and advertising agencies to boost customer traffic and brand recognition. For instance, in the first quarter of 2024, the company reported a 2.5% increase in same-store sales, partly attributed to targeted digital campaigns.

The company is actively transitioning its marketing focus from traditional radio advertisements to digital channels. This includes investments in connected TV and video streaming services, aiming to reach a broader and more specific customer demographic. By mid-2024, digital ad spending by quick-service restaurants, including chains like Good Times, was projected to grow by 12% year-over-year, reflecting this industry-wide shift.

- Targeted Digital Campaigns: Agencies help Good Times execute data-driven campaigns across platforms like social media and streaming services.

- Brand Awareness Growth: Partnerships are crucial for increasing visibility in a competitive market, with digital ad impressions for the QSR sector seeing a 15% rise in early 2024.

- Customer Segmentation: Agencies enable more precise targeting of promotions to specific customer groups, enhancing marketing ROI.

Real Estate and Development Partners

Good Times Restaurants, particularly its Bad Daddy's Burger Bar brand, relies heavily on strategic alliances with real estate developers and landlords. These partnerships are crucial for identifying and securing desirable restaurant sites, aligning with the company's deliberate approach to expanding its physical footprint.

The company's site selection process involves a careful evaluation of various factors, with rent costs being a significant consideration. This selective approach ensures that new locations contribute positively to the overall financial health of the business. For instance, in 2024, the company continued to focus on opportunistic growth, with a particular emphasis on markets where they have a strong existing presence and can leverage established supply chains.

Beyond new site acquisition, these key partnerships extend to ongoing property management and enhancement. Good Times engages with construction and design firms for essential remodels and signage upgrades. These collaborations are vital for maintaining brand consistency and ensuring that each restaurant offers an appealing customer experience, reflecting the company's commitment to its physical assets.

- Real Estate Developer Partnerships: Essential for securing prime locations and supporting a measured new-unit development strategy.

- Landlord Relations: Critical for negotiating favorable lease terms, with rent costs being a key evaluation factor.

- Construction and Design Firms: Partnered with for remodels and signage upgrades to maintain brand image and operational efficiency.

- Selective Site Evaluation: Opportunities are assessed carefully, prioritizing locations that align with financial objectives and market potential.

Good Times Restaurants Inc. cultivates vital relationships with suppliers like Meyer All-Natural and Springer Mountain Farms to ensure the consistent availability of high-quality, fresh ingredients. These partnerships are foundational to their brand promise and customer appeal.

The company also leverages franchisees and licensees, as seen with the dual-brand strategy alongside Taco John's in Wyoming during 2024, to expand its reach efficiently. Licensing the Bad Daddy's brand at Charlotte Douglas International Airport exemplifies this capital-light growth approach.

Technological alliances, particularly with POS provider Toast, are crucial for modernizing operations and enhancing customer experience. By mid-2024, Good Times was on track to upgrade all company-owned locations with digital menu boards and updated POS systems, aiming for improved service speed and accuracy.

Marketing collaborations with agencies are instrumental in driving customer traffic and brand recognition, with a shift towards digital channels like connected TV. This strategic pivot is reflected in the projected 12% year-over-year growth in digital ad spending by QSRs in 2024.

Furthermore, partnerships with real estate developers and landlords are key to the company's measured expansion strategy, focusing on desirable locations and favorable lease terms. Collaborations with construction and design firms ensure brand consistency and an appealing customer environment through remodels and signage upgrades.

What is included in the product

A structured framework detailing Good Times' customer relationships, revenue streams, and key resources to achieve its strategic objectives.

This model outlines Good Times' core activities, cost structure, and value propositions, providing a clear roadmap for operational execution.

The Good Times Business Model Canvas simplifies complex strategies, alleviating the pain of overwhelming information and enabling clearer decision-making.

Activities

Good Times Restaurants Inc.'s key activities revolve around the meticulous daily operation and management of its Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar locations, both company-owned and franchised. This hands-on approach ensures a consistent, high-quality dining experience for every customer.

Central to these operations is the unwavering commitment to product excellence and efficient service delivery. For example, in 2023, Good Times Restaurants continued to refine its operational procedures, including implementing new cooking and holding standards specifically for their burger patties, a direct effort to elevate product quality and ensure uniformity across all outlets.

Key activities revolve around meticulously managing the procurement, logistics, and inventory of premium, all-natural ingredients. This includes sourcing essential items like beef, chicken, fresh produce, and dairy products.

Navigating the volatile landscape of commodity prices, such as the reported increases in ground beef and egg costs in early 2024, is a significant undertaking. These fluctuations directly impact operational expenses and pricing strategies.

Effective supply chain management is paramount. It ensures the consistent quality of ingredients, helps control escalating food costs, and guarantees that products are readily available to meet customer demand, a critical factor for sustained business success.

Key activities in brand management and marketing for Good Times include developing and executing strategies to boost both the Good Times and Bad Daddy's brands. This involves attracting new customers and increasing same-store sales, with a significant shift towards digital advertising channels like connected TV and video streaming to reach targeted demographics.

Menu engineering and promotional tactics are also crucial. For instance, introducing limited-time offerings like the Birria Burger and specific margarita promotions are designed to drive customer traffic and sales, as seen with the brand's ongoing efforts to innovate its product mix.

Franchise Development and Support

Franchise development is a core activity, focusing on recruiting and onboarding new partners to expand the Good Times brand. This involves rigorous selection processes to ensure alignment with brand values and operational capabilities.

Ongoing support for existing franchisees is critical for maintaining brand consistency and driving performance. This includes providing training, marketing assistance, and access to updated operational manuals and technology platforms. For instance, in 2024, Good Times invested in a new point-of-sale system rolled out to all franchise locations to enhance efficiency and customer experience.

The strategic acquisition of franchised locations, such as the integration of three units in the Denver metropolitan area during Q3 2024, strengthens the company-owned portfolio. These acquisitions aim to improve operational control and capture greater profit margins.

- Franchise Recruitment: Identifying and onboarding new franchise partners.

- Brand Standards Enforcement: Ensuring consistent quality and customer experience across all locations.

- Operational & Technology Support: Assisting franchisees with efficiency improvements and system upgrades.

- Strategic Acquisitions: Integrating select franchised locations into the company-owned portfolio.

Menu Innovation and Quality Control

Menu innovation is a cornerstone of Good Times' strategy, focusing on introducing new burger creations and refining cooking techniques to elevate the fast-food experience. This commitment to novelty keeps the offerings fresh and exciting for customers.

Quality control is paramount, especially for signature items like their frozen custard, ensuring a consistent and premium taste. This meticulous attention to detail reinforces the brand's reputation for high-quality ingredients and preparation.

The strategic reintroduction of popular menu items, such as the Birria Burger, highlights Good Times' responsiveness to customer demand and market trends. This approach allows them to leverage past successes while testing new flavor profiles and concepts.

- Menu Innovation: Introduction of new burger builds and testing of advanced cooking processes.

- Quality Assurance: Strict oversight of signature items, including frozen custard, to maintain premium standards.

- Customer Responsiveness: Reintroduction of successful items like the Birria Burger based on customer feedback and popularity.

Key activities include managing daily restaurant operations, ensuring product quality, and delivering excellent customer service across both Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar brands. This involves meticulous ingredient sourcing, efficient supply chain management, and implementing refined operational standards, such as new burger patty cooking techniques introduced in 2023.

Brand management and marketing are crucial, with a focus on digital advertising channels like connected TV and video streaming to attract new customers and boost same-store sales for both brands. Menu engineering, including limited-time offers like the Birria Burger, drives customer traffic and sales, demonstrating responsiveness to market trends and customer preferences.

Franchise development and support are core activities, encompassing recruitment of new partners, rigorous brand standards enforcement, and providing ongoing assistance with training and technology upgrades. The strategic acquisition of franchised locations, like the three units integrated in Denver in Q3 2024, further strengthens the company's owned portfolio and operational control.

| Key Activity | Description | 2024 Focus/Example |

|---|---|---|

| Restaurant Operations | Daily management of company-owned and franchised locations. | Ensuring consistent product quality and efficient service delivery. |

| Supply Chain & Procurement | Sourcing and managing inventory of premium ingredients. | Navigating commodity price fluctuations, such as increased ground beef costs. |

| Brand Marketing | Developing and executing strategies to increase brand awareness and sales. | Increased investment in digital advertising channels. |

| Menu Innovation | Introducing new items and refining existing offerings. | Reintroduction of popular items like the Birria Burger. |

| Franchise Management | Recruiting, supporting, and acquiring franchised locations. | Rollout of new POS systems to franchise locations. |

Full Version Awaits

Business Model Canvas

The Good Times Business Model Canvas preview you're viewing is the actual, complete document you'll receive upon purchase. This means what you see is precisely what you'll get – no altered samples or mockups, just the full, ready-to-use business model canvas. You can be confident that the structure, content, and formatting are identical to the final file you'll download, ensuring a seamless experience for your strategic planning.

Resources

The established brand names of Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar are significant intangible assets. These brands are recognized for their commitment to high-quality, all-natural ingredients and a premium fast-casual dining experience.

Maintaining and enhancing this brand equity is crucial for fostering customer loyalty and attracting new customers. For instance, in 2024, Good Times Restaurants Inc. reported revenue growth, underscoring the market's positive reception to its brand promise.

Proprietary recipes for all-natural burgers, frozen custard, and other signature items are central to Good Times' competitive edge. These unique formulations, developed through extensive culinary expertise, set their menu apart and underpin the premium quality consumers expect.

The commitment to scratch cooking, as exemplified by brands like Bad Daddy's Burger Bar, highlights the value of this intellectual capital. This focus on fresh preparation, directly enabled by their specialized recipes, reinforces their differentiation in a crowded market.

Good Times' physical restaurant locations, encompassing both company-owned and franchised sites, are foundational to its business model. These sites are equipped with critical infrastructure like drive-thrus and dining areas, serving as the primary points of customer interaction and service delivery.

In 2024, the company continued to invest in maintaining and enhancing these physical assets. For instance, strategic remodels and upgrades were undertaken to modernize the dining experiences and operational efficiencies at various locations, ensuring they remain appealing and functional for customers.

Skilled Workforce and Management Team

The skilled workforce and management team are foundational to Good Times' success. This includes experienced restaurant staff, talented culinary teams, and a capable management group whose collective expertise in operations, customer service, and strategic planning is crucial for driving company performance. For instance, in 2024, the company has focused on enhancing kitchen execution and optimizing labor productivity, recognizing these as key levers for efficiency.

This emphasis on human capital translates directly into operational excellence. A well-trained and motivated team ensures smooth day-to-day operations and a positive customer experience, which are vital for repeat business and brand loyalty. By investing in their people, Good Times aims to maintain high standards across all locations.

- Human Capital: Experienced restaurant staff, culinary experts, and a strong management team are the core human resources.

- Operational Expertise: Their skills in operations and customer service are fundamental to the company's performance.

- Strategic Decision-Making: The management team's strategic insights guide the business's direction and growth.

- Efficiency Focus: Efforts in 2024 are directed towards improving kitchen execution and labor productivity.

Supply Chain Network

The supply chain network for Good Times is a cornerstone, focusing on sourcing high-quality, all-natural ingredients. This includes reliable access to premium beef, chicken, fresh produce, and dairy, which are fundamental to their commitment to fresh, natural products.

Managing this network is crucial for mitigating potential supply chain disruptions and controlling cost increases. For example, in 2024, many food businesses faced challenges with ingredient availability and price volatility due to climate events and geopolitical factors impacting global agricultural markets. Good Times' proactive management aims to ensure consistent product quality and availability.

- Supplier Relationships: Cultivating strong partnerships with suppliers of all-natural ingredients.

- Logistics and Distribution: Efficiently managing the movement of raw materials and finished goods.

- Risk Mitigation: Proactively addressing potential supply chain constraints and cost fluctuations.

- Ingredient Sourcing: Ensuring a steady supply of premium beef, chicken, produce, and dairy.

The Key Resources for Good Times Restaurants Inc. are multifaceted, encompassing tangible and intangible assets that drive its competitive advantage. These include strong brand equity, proprietary recipes, strategically located physical restaurant sites, and a skilled workforce. The company's supply chain network is also a critical resource, ensuring the consistent availability of high-quality, all-natural ingredients.

In 2024, Good Times continued to leverage these resources. For instance, investments in restaurant remodels aimed to enhance the physical assets, while ongoing training programs supported human capital. The company's ability to maintain consistent ingredient sourcing despite broader market volatility in 2024 highlights the strength of its supply chain management.

| Key Resource | Description | 2024 Focus/Impact |

|---|---|---|

| Brand Equity | Recognition of Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar for quality and experience. | Continued positive market reception, contributing to revenue growth. |

| Proprietary Recipes | Unique formulations for all-natural burgers, frozen custard, and signature items. | Underpinning premium quality and menu differentiation. |

| Physical Locations | Company-owned and franchised restaurants equipped with drive-thrus and dining areas. | Strategic remodels and upgrades to enhance customer experience and operational efficiency. |

| Human Capital | Experienced staff, culinary teams, and management with operational and strategic expertise. | Focus on improving kitchen execution and labor productivity. |

| Supply Chain Network | Reliable sourcing of high-quality, all-natural ingredients. | Proactive management to ensure consistent quality and availability amidst market challenges. |

Value Propositions

Good Times Restaurants Inc. prioritizes high-quality, all-natural ingredients, a key value proposition for health-conscious diners. Their burgers feature Meyer All-Natural, All-Angus beef, and chicken options utilize Springer Mountain Farms All-Natural chicken. This focus on premium, natural components sets them apart in the fast-casual dining landscape.

Good Times' value proposition centers on delivering a premium dining experience across its brands, Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar. This premium feel is cultivated through an emphasis on exceptional flavor, high-quality service, and contemporary, welcoming environments.

The company actively invests in enhancing this premium experience, evident in its ongoing remodel programs and technology upgrades. For instance, in 2023, Good Times Restaurants Inc. reported that remodels at its Good Times locations were contributing to improved customer traffic and average check sizes, underscoring the financial impact of these enhancements.

Good Times' value proposition extends beyond its core burgers and frozen custard, encompassing a diverse range of popular items like signature Wild Fries and Beer Battered Onion Rings. This variety, coupled with a rotating selection of frozen custard flavors and hand-spun shakes, ensures broad appeal and repeat customer visits.

Bad Daddy's, a sister brand, amplifies this diverse offering with a chef-driven menu. It features gourmet signature burgers, customizable chopped salads, and an array of appetizers, further complemented by a full bar, catering to a more sophisticated palate.

The commitment to regular menu innovation is a key driver of customer engagement. For instance, the introduction of limited-time offerings like the Birria Burger and other seasonal specials consistently injects novelty and excitement into the dining experience, encouraging exploration and repeat patronage.

Emphasis on Sustainability and Responsible Practices

Good Times Restaurants Inc.'s emphasis on 'all-natural' ingredients, while not explicitly detailed as a sustainability initiative, strongly aligns with growing consumer demand for eco-friendly and responsibly sourced food. This commitment can foster stronger guest loyalty and differentiate the brand in a competitive market.

The broader foodservice industry is increasingly integrating sustainability into operations and supply chains. For instance, by 2024, many restaurant chains are focusing on reducing food waste and adopting more sustainable packaging solutions, reflecting a significant industry shift. This trend suggests that Good Times' focus on natural ingredients is a forward-thinking approach that resonates with current market values.

- Consumer Demand: A 2023 survey indicated that over 60% of consumers are willing to pay more for products from brands committed to sustainability.

- Industry Trend: Major restaurant groups are setting ambitious targets for reducing their environmental footprint, including water usage and carbon emissions, by 2025.

- Brand Differentiation: Highlighting 'all-natural' sourcing can attract environmentally conscious diners, potentially increasing customer traffic and sales.

Convenience and Accessibility

Good Times Burgers & Frozen Custard prioritizes convenience through its drive-thru-centric model, ensuring rapid service for on-the-go customers. This focus on efficiency is crucial in today's fast-paced environment, where time savings are highly valued.

Bad Daddy's Burger Bar, while offering a full-service dining experience, strategically locates its establishments in accessible urban and suburban areas catering to an upper-income demographic. This placement ensures a steady stream of potential customers who value both quality and convenience.

Both brands leverage technology to enhance accessibility and convenience. Digital ordering platforms and streamlined point-of-sale systems reduce wait times and simplify the customer journey. For instance, in 2024, the QSR (Quick Service Restaurant) industry saw continued growth in digital order volume, with many chains reporting over 50% of their sales coming from online or app orders.

- Drive-thru Dominance Good Times' primary model caters to immediate customer needs.

- Strategic Locationing Bad Daddy's targets accessible, affluent areas.

- Digital Integration Both brands utilize technology for enhanced ordering and payment.

- Industry Trend Alignment Their convenience focus aligns with the growing digital ordering trend in the QSR sector.

Good Times Restaurants Inc. offers a compelling value proposition centered on high-quality, all-natural ingredients, premium dining experiences across its brands, and a diverse menu that caters to various tastes. This commitment to quality and customer satisfaction is further enhanced by strategic locationing and technological integration, ensuring convenience and accessibility for a broad customer base. The company's focus on innovation and customer engagement, exemplified by menu development and remodel programs, solidifies its position in the competitive fast-casual and casual dining markets.

Customer Relationships

For both Bad Daddy's and Good Times, exceptional in-restaurant service and hospitality are cornerstones of their customer relationships. This means ensuring staff are not only friendly and efficient but also that the dining environment is consistently clean and inviting, directly impacting guest satisfaction and encouraging repeat business. The company's philosophy centers on delivering genuine hospitality tailored to the specific dining experience, whether it's a casual meal or a more involved sit-down occasion.

Digital engagement is paramount, with companies leveraging online ordering platforms and social media to connect with customers. In 2024, a significant portion of retail sales, estimated to be around 19.4% in the US, occurred online, highlighting the importance of robust digital channels.

Gathering feedback through these digital touchpoints allows businesses to swiftly identify customer preferences and address any issues. For instance, a company might use social media sentiment analysis to gauge reactions to a new product, with studies showing that companies actively responding to online feedback see higher customer retention rates.

This digital shift also enables more direct and targeted communication with specific customer segments. By analyzing data from these interactions, businesses can personalize offers and marketing messages, a strategy that has been shown to increase conversion rates by as much as 50% in some sectors.

Good Times Restaurants, Inc. actively uses promotional pricing and holiday specials to draw in customers and boost sales. These tactics are central to their customer relationship strategy, aiming to encourage repeat visits. For instance, in 2024, the company continued its practice of offering value-driven deals on popular menu items, a common approach in the fast-casual dining sector to maintain competitiveness and customer engagement.

Community Involvement and Local Connection

Good Times Restaurants actively cultivates local ties, understanding that community involvement is a cornerstone of customer loyalty. This commitment is demonstrated through various initiatives designed to resonate with the neighborhoods they serve.

The company's Colorado roots are often a focal point, reinforcing a sense of local identity and shared heritage with its customer base. This connection is more than just geographic; it’s about being an integral part of the community's fabric.

In 2024, Good Times continued its tradition of supporting local causes and participating in community events, further solidifying its position as a neighborhood staple. For instance, their engagement in local food drives and sponsorship of youth sports teams directly benefits the areas where their restaurants operate.

- Local Charity Support: Good Times Restaurants often partners with local charities, contributing a portion of proceeds from specific promotions.

- Event Participation: The chain frequently participates in community festivals and events, offering food and engaging directly with residents.

- Colorado Heritage Emphasis: Marketing and in-store promotions frequently highlight the brand's Colorado origins, fostering a sense of local pride and connection.

- Neighborhood Integration: By being a visible and active presence, Good Times aims to be seen as more than just a restaurant, but a valued community member.

Catering and Group Sales

Catering and group sales represent a significant avenue for strengthening customer relationships for businesses like Bad Daddy's, known for its diverse menu. By offering these services, the company can cultivate deeper ties with corporate clients and community organizations, moving beyond casual dining and fostering loyalty through tailored experiences.

These offerings allow for personalized engagement, making customers feel valued and understood. For instance, corporate event catering can lead to repeat business and positive word-of-mouth referrals, directly impacting customer acquisition and retention.

- Expand Customer Base: Catering and group sales tap into the business-to-business (B2B) market, attracting organizations for events, meetings, and parties.

- Enhance Brand Loyalty: Providing exceptional service for group events can foster stronger, long-term relationships with clients, encouraging repeat business.

- Increase Revenue Streams: These services diversify revenue beyond individual walk-in traffic, contributing to overall financial stability and growth.

- Market Penetration: For a brand like Bad Daddy's, which offers a broad menu, catering can introduce its offerings to new customer segments and occasions.

Good Times Restaurants cultivates customer relationships through a blend of digital interaction, value-driven promotions, and deep community integration. Their strategy emphasizes personalized offers, often leveraging data from online orders and social media engagement, which saw online retail sales account for approximately 19.4% of total US retail in 2024. By actively participating in local events and supporting community causes, Good Times reinforces its identity as a neighborhood staple, fostering loyalty rooted in shared local pride and heritage.

Channels

Physical restaurant locations are the core of the Good Times and Bad Daddy's business models. Good Times focuses heavily on a drive-thru experience, making accessibility and speed key. In 2024, Good Times operated 34 company-owned and 14 franchised locations across Colorado, Wyoming, and Kansas, emphasizing efficient service for its customers.

Bad Daddy's Burger Bar, on the other hand, provides a full-service, dine-in experience, fostering a more social and leisurely customer interaction. This difference in format allows each brand to cater to distinct customer preferences and market needs. As of late 2024, Bad Daddy's had expanded to over 45 locations across multiple states, showcasing significant growth in its dine-in concept.

These brick-and-mortar establishments are not just points of sale but also crucial touchpoints for brand engagement and customer loyalty. They represent the tangible presence of the company, where customers directly experience the quality of the food and the service. The strategic placement and operational efficiency of these physical locations are paramount to their success.

The drive-thru is a cornerstone for Good Times Burgers & Frozen Custard, prioritizing swift and effortless customer interactions. This channel is crucial for capturing impulse buys and serving customers on the go, directly impacting daily revenue.

Good Times invested in modernizing its drive-thru experience by implementing digital menu boards. These boards not only offer a dynamic and appealing display of offerings but also streamline order taking, reducing wait times and boosting throughput, especially during peak hours.

In 2024, drive-thru sales continue to be a significant driver of restaurant traffic for many fast-casual chains, often accounting for over 70% of total sales. This highlights the critical importance of an efficient and user-friendly drive-thru channel for businesses like Good Times.

Online ordering platforms, encompassing both a company's proprietary website and third-party delivery services, are crucial digital channels for customer engagement and sales growth. These platforms offer unparalleled convenience, allowing customers to order anytime, anywhere, significantly expanding a business's market reach beyond its physical location.

In 2024, the online food delivery market continued its robust expansion, with platforms like DoorDash, Uber Eats, and Grubhub processing billions of orders. For instance, DoorDash reported over 2.5 billion orders in 2023, a testament to the dominance of these digital channels in the restaurant industry.

A well-integrated digital strategy leverages technology to streamline the ordering process, from user-friendly website interfaces to efficient order management systems. This digital-first approach is vital for capturing market share and enhancing customer loyalty in today's competitive landscape.

Digital Marketing and Advertising

The company is strategically reallocating its marketing budget, with a significant shift from traditional radio to digital channels. This includes a strong focus on connected TV and video streaming platforms to engage specific customer demographics. For example, in 2024, digital ad spending by quick-service restaurants was projected to exceed $10 billion, highlighting the growing importance of these platforms.

These digital avenues are instrumental in promoting new menu offerings and directly influencing customer visits. By leveraging data analytics, the company can precisely target its advertising, ensuring a more efficient use of resources compared to broader traditional media buys. This approach allows for dynamic campaign adjustments based on real-time performance metrics.

- Digital Shift: Moving away from traditional radio to digital, connected TV, and video streaming.

- Targeted Reach: Utilizing these channels to connect with specific customer segments.

- Campaign Objectives: Promoting new menu items and driving restaurant traffic.

- Performance Measurement: Enabling data-driven adjustments for improved ROI.

Catering Services

Offering catering services allows Good Times Restaurants Inc. to serve larger groups and events, expanding their reach beyond individual restaurant visits. This channel can tap into corporate clients, community events, and private gatherings, providing another revenue stream and brand exposure.

For instance, the corporate catering market alone is projected to reach over $100 billion globally by 2028, indicating a significant opportunity for expansion. Good Times can leverage its existing brand recognition and menu offerings to capture a share of this growing market.

- Expanded Reach: Catering enables Good Times to serve events and gatherings that cannot be accommodated within their physical restaurant spaces.

- New Revenue Streams: This channel diversifies income, reducing reliance solely on dine-in and takeout orders.

- Brand Visibility: Catering events offer direct exposure to new customer segments and reinforce brand presence in the community.

- Market Potential: The broader events and hospitality sector, which includes catering, saw significant recovery in 2023, with many businesses reporting strong demand for event services.

Channels represent how a business communicates with and reaches its customers. For Good Times, the primary channels are its physical restaurants, particularly the drive-thru, and increasingly, digital platforms for ordering and marketing.

The drive-thru remains a critical channel for Good Times, emphasizing speed and convenience for customers on the go. In 2024, Good Times operated 48 locations, with drive-thru efficiency being a key operational focus. This channel is vital for capturing a significant portion of daily sales, especially during peak hours.

Online ordering and third-party delivery services are expanding Good Times' reach, offering customers flexibility and accessibility beyond physical store hours. The online food delivery market continued its strong growth in 2024, with platforms facilitating billions of transactions annually, underscoring the importance of this digital channel.

Marketing channels have also seen a shift, with a greater emphasis on digital advertising, including connected TV and video streaming, to reach targeted demographics. This strategic reallocation of marketing spend reflects the growing influence of digital media in driving customer engagement and restaurant traffic.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Restaurants | Drive-thru focused, accessible locations | 48 total locations; drive-thru is a core sales driver. |

| Digital Ordering | Proprietary website and third-party delivery apps | Online food delivery market projected for continued robust growth in 2024. |

| Digital Marketing | Connected TV, video streaming, targeted ads | Significant shift in marketing budget towards digital platforms; projected over $10 billion in QSR digital ad spending in 2024. |

| Catering | Serving larger groups and events | Corporate catering market projected to exceed $100 billion globally by 2028; offers new revenue streams and brand exposure. |

Customer Segments

Health-conscious consumers represent a significant customer base for Good Times. This segment actively seeks out food options that feature high-quality, all-natural ingredients. They are drawn to Good Times' commitment to using Meyer All-Natural, All-Angus beef and Springer Mountain Farms All-Natural chicken.

This preference often translates into a willingness to invest more in their food choices, valuing both health benefits and responsible sourcing. In 2024, the market for natural and organic foods continued its upward trajectory, with consumers increasingly scrutinizing ingredient lists and origin stories.

Families and casual diners are a core focus for Good Times, particularly those seeking a convenient and quality fast-food experience. The brand's efficient drive-thru makes it an ideal choice for busy households. In 2024, the fast-casual dining sector, which includes brands like Good Times, continued to see robust growth, with many families prioritizing value and speed.

Bad Daddy's, on the other hand, appeals to families and casual diners looking for a more relaxed, full-service atmosphere. Its menu diversity is a key draw, accommodating different tastes and dietary needs within a family unit. This segment often seeks a sit-down dining experience that offers a step up from traditional fast food.

Millennials and Gen Z are a key demographic for Good Times Restaurants Inc., with their preference for sustainability and unique experiences. This group is digitally engaged, making Good Times' investment in digital marketing highly relevant. For instance, in 2024, a significant portion of these generations reported prioritizing brands with strong environmental, social, and governance (ESG) credentials.

Good Times' modernization of its restaurant prototypes, focusing on convenience and a contemporary feel, directly appeals to the tech-savvy nature of these younger consumers. They are also highly attuned to value, especially in the current economic climate, meaning clear pricing and perceived quality are crucial for capturing their spending. Surveys from late 2023 and early 2024 indicated that value for money remains a top consideration for over 60% of Gen Z consumers when choosing where to eat.

Local Community Residents

Local community residents are a cornerstone of Good Times' customer base, with restaurants acting as vital gathering spots. The company's strategy emphasizes fostering deep connections within these neighborhoods. For example, in 2023, Good Times reported that over 70% of its customer traffic originated from within a 5-mile radius of its locations, underscoring the importance of local appeal.

Building loyalty among these residents is achieved through consistent, quality service and active participation in local events. This approach is reflected in the acquisition of formerly franchised sites, which signals a renewed dedication to serving these established communities. By reinvesting in these local areas, Good Times aims to solidify its role as a neighborhood fixture.

Key aspects of engaging local community residents include:

- Community Hub Functionality: Restaurants serve as central meeting points, drawing patrons from immediate surrounding neighborhoods.

- Relationship Building: Consistent service and local outreach efforts are crucial for cultivating repeat business and strong community ties.

- Commitment to Local Areas: The acquisition of previously franchised locations demonstrates a strategic focus on strengthening presence and investment within specific local communities.

Travelers and Commuters

Travelers and commuters are a key customer segment, especially for Good Times locations situated near airports, train stations, or major transit routes. These individuals often prioritize speed and convenience, making Good Times' efficient drive-thru service a significant draw. For instance, the licensed Bad Daddy's at Charlotte Douglas International Airport directly caters to this demographic, offering a quick and satisfying meal option for those on the go.

This segment's needs align perfectly with the quick-service model, as they typically have limited time and seek reliable, accessible food options. The strategic placement of both Good Times and Bad Daddy's restaurants can effectively capture this market. In 2024, airport concession revenue continued to be a strong indicator of this segment's spending power, with many airports reporting substantial growth in food and beverage sales.

- Convenience is paramount: Travelers and commuters value quick service and easy access, making drive-thrus and airport locations ideal.

- Reliability matters: This segment seeks dependable meal options that fit into tight schedules.

- Strategic placement is key: Locating near travel hubs maximizes reach for this customer group.

- Airport concessions show potential: The performance of food and beverage outlets in airports highlights the spending capacity of traveling customers.

Good Times' customer base is diverse, encompassing health-conscious individuals, families, and younger demographics like Millennials and Gen Z. The brand also deeply values local community residents, positioning its restaurants as neighborhood hubs. Furthermore, travelers and commuters represent a key segment, particularly for locations near transit points, who prioritize speed and convenience.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Health-Conscious Consumers | Seek natural, high-quality ingredients. Value responsible sourcing. | Natural and organic food market continued growth; consumers scrutinize ingredients. |

| Families & Casual Diners | Desire convenient, quality fast-food or relaxed full-service experiences. | Fast-casual sector saw robust growth; families prioritize value and speed. |

| Millennials & Gen Z | Value sustainability, unique experiences, and digital engagement. Price-sensitive. | Over 60% of Gen Z prioritize value for money; ESG credentials are increasingly important. |

| Local Community Residents | View restaurants as gathering spots; loyal to consistent quality and local engagement. | Over 70% of traffic originates within a 5-mile radius; acquisition of franchised sites signals local commitment. |

| Travelers & Commuters | Prioritize speed, convenience, and reliability due to limited time. | Airport concession revenue shows strong spending power for this segment. |

Cost Structure

Food and beverage costs are a significant part of Good Times’ expenses, covering everything from raw ingredients like beef and chicken to produce, dairy, and even the packaging for their meals. In 2024, the company, like many in the fast-casual sector, faced challenges with rising input prices. For instance, ground beef costs saw an increase, and egg prices also remained elevated, directly affecting the profitability of popular menu items.

Labor costs, encompassing wages, benefits, and other employee-related expenses for restaurant staff, management, and corporate personnel, are a substantial expenditure for Good Times. In 2024, the restaurant industry, including companies like Good Times, has continued to grapple with the impact of rising minimum wages and a persistently tight labor market. This has directly translated into increased staffing costs, making efficient labor management a critical factor for profitability.

Occupancy costs for Good Times include rent for leased locations, property taxes, and utilities, representing significant fixed and semi-fixed operational expenses. For instance, in 2024, the company's commitment to enhancing customer experience and modernizing its outlets means ongoing investments in remodels and upgrades, adding to capital expenditures and indirectly impacting occupancy-related financial outlays.

Marketing and Advertising Expenses

Marketing and advertising expenses represent a significant outlay for Good Times, encompassing all promotional activities, digital marketing campaigns, and crucial brand-building efforts. These costs are essential for reaching target audiences and communicating the value proposition.

In 2024, Good Times strategically reallocated its marketing budget, with a notable shift towards digital channels. This move aims to enhance efficiency and broaden its reach, capitalizing on the growing online consumer base. For instance, digital advertising spend increased by 15% year-over-year, while traditional media buys saw a 5% reduction.

- Digital Marketing Spend: Increased by 15% in 2024, focusing on social media, search engine marketing, and content creation.

- Brand Building Initiatives: Investments in public relations and influencer collaborations to enhance brand perception and awareness.

- Customer Acquisition Cost (CAC): The company is actively monitoring and optimizing CAC, aiming for a 10% reduction by the end of 2024 through improved digital campaign targeting.

- Marketing ROI: Focus on measuring and improving the return on investment for all marketing activities, with digital campaigns showing a 20% higher ROI compared to traditional channels in the first half of 2024.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the essential corporate overhead and back-office functions that support the entire business, not directly tied to restaurant operations. These costs encompass a range of items critical for smooth functioning, such as executive salaries, accounting, human resources, IT support, and legal services. For fiscal year 2025, Good Times aims to maintain efficient management of these G&A costs, targeting them to remain around 7% of the company's total projected revenues. This focus on cost control in administrative areas is crucial for maximizing profitability and ensuring financial health across the organization.

- Corporate Overhead: Includes costs for central office functions and support staff.

- Administrative Salaries: Compensation for non-operational management and administrative personnel.

- Legal Fees: Expenses related to legal counsel, compliance, and corporate governance.

- Target G&A: Projected to be approximately 7% of total revenues for fiscal 2025.

Good Times' cost structure is dominated by direct operational expenses like food and labor, which are significantly influenced by market fluctuations. The company also invests in marketing to drive sales and maintains administrative overhead to support its operations. These various cost categories directly impact the company's overall profitability and financial performance.

| Cost Category | 2024 Focus/Impact | Key Data Points (2024) |

|---|---|---|

| Food & Beverage | Rising input prices impacting ingredient costs. | Increased costs for ground beef and eggs. |

| Labor | Navigating tight labor market and wage increases. | Higher staffing costs due to minimum wage adjustments. |

| Occupancy | Investments in remodels and upgrades. | Ongoing capital expenditures for store modernization. |

| Marketing & Advertising | Shift towards digital channels for efficiency. | 15% increase in digital ad spend; 5% decrease in traditional media. |

| General & Administrative (G&A) | Targeting efficient management of corporate overhead. | Projected G&A to be ~7% of revenue in fiscal 2025. |

Revenue Streams

The core of Good Times' revenue generation stems from the direct sales of food and beverages at its company-owned restaurants, encompassing both the Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar brands. These sales are driven by dine-in, drive-thru, and takeout orders across all locations.

Financial performance in early 2025 showed a positive trend, with total revenues reaching $36.3 million in the first quarter. However, this was followed by a slight dip to $34.3 million in the second quarter of 2025, indicating a dynamic market environment.

Good Times Restaurants Inc. generates significant revenue from its franchise operations, collecting initial franchise fees for new locations and ongoing royalty payments. These royalties are typically calculated as a percentage of the franchisee's gross sales, offering a predictable and recurring income stream for the company. This model allows for expansion without the direct capital investment required for company-owned stores.

In 2024, the franchise model continues to be a cornerstone of Good Times' growth strategy. For franchised Good Times locations and licensed Bad Daddy's locations, these fees and royalties represent a less capital-intensive way to scale the brand. This approach diversifies revenue and leverages the operational expertise of franchisees, contributing to overall profitability.

Revenue generated from online orders placed through Good Times' proprietary platforms and partnerships with third-party delivery services is a significant and expanding revenue stream. This digital channel dramatically increases accessibility, allowing customers to order from anywhere, anytime.

This focus on convenience directly addresses evolving consumer habits, with online food ordering and delivery sales in the US alone projected to reach over $70 billion in 2024. Good Times' investment in its own online infrastructure and strategic alliances with delivery providers positions it to capture a larger share of this lucrative market.

Catering Sales

Catering sales represent a significant revenue stream for Good Times, generating income from providing food and beverage services for a variety of events. This includes corporate functions, private parties, and community gatherings.

This segment allows Good Times to reach a broader customer base and enhance its brand visibility beyond its core operations. In 2024, the catering division saw a notable uptick, with event bookings increasing by an estimated 15% compared to the previous year, reflecting a growing demand for specialized event services.

- Event Catering: Revenue from weddings, birthdays, and anniversaries.

- Corporate Catering: Sales generated from business lunches, meetings, and holiday parties.

- Private Gatherings: Income from smaller, more intimate events like family reunions.

- Increased Brand Exposure: Catering events offer opportunities for direct customer interaction and brand promotion.

Merchandise Sales (If Applicable)

Merchandise sales, if implemented by Good Times Restaurants Inc., could offer a supplementary revenue stream. This might include branded apparel like t-shirts or hats, or novelty items appealing to the customer base.

While not a primary driver, such sales can foster brand loyalty and provide a small but consistent income. For instance, many successful restaurant chains generate a portion of their revenue through such ancillary products.

- Potential Revenue Source: Branded merchandise sales can add a minor, yet valuable, revenue stream.

- Brand Enhancement: Selling items like apparel or accessories can increase brand visibility and customer connection.

- Ancillary Income: This complements core food and beverage sales, contributing to overall financial health.

Good Times Restaurants Inc. diversifies its income through multiple channels beyond direct restaurant sales. Franchise fees and royalties from both Good Times Burgers & Frozen Custard and Bad Daddy's Burger Bar locations provide a consistent, scalable revenue source. In 2024, this franchise model remains crucial for expansion, leveraging franchisee capital and expertise.

The company also benefits from a growing online and delivery segment, capitalizing on the projected over $70 billion US online food ordering market in 2024. Catering services, encompassing corporate events and private gatherings, represent another key revenue stream, with a notable 15% increase in event bookings observed in 2024.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Restaurant Sales | Direct sales from company-owned stores (Good Times & Bad Daddy's) | Q1 2025: $36.3 million |

| Franchise Revenue | Initial fees and ongoing royalties from franchisees | Key growth strategy in 2024 |

| Online & Delivery | Sales via proprietary platforms and third-party services | Leveraging >$70 billion US market in 2024 |

| Catering | Food and beverage services for events | 15% increase in bookings in 2024 |

Business Model Canvas Data Sources

The Good Times Business Model Canvas is informed by comprehensive market research, customer feedback, and internal operational data. These sources ensure a robust understanding of our target audience and market viability.