GoodRx SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

GoodRx leverages its strong brand recognition and extensive user base as key strengths, but faces significant threats from evolving healthcare regulations and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the prescription savings market.

Want the full story behind GoodRx's competitive advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market research.

Strengths

GoodRx boasts a powerful brand, recognized by millions of Americans. In 2024, nearly 30 million unique consumers turned to GoodRx, demonstrating its significant reach and deep integration into healthcare spending for a vast number of households.

This established brand and massive user base translate directly into high consumer engagement. People consistently rely on GoodRx to find savings, which fuels repeat usage and strengthens the company's market dominance in prescription drug discount aggregation.

The sheer scale of GoodRx's impact is undeniable; the platform has facilitated over $85 billion in savings for Americans on their medications since its inception in 2011. This consistent delivery of value reinforces its brand promise and encourages continued user loyalty.

GoodRx's primary strength is its robust digital platform, which excels at comparing prescription drug prices across numerous pharmacies. This allows users to access substantial savings through readily available discount codes and coupons, directly addressing the critical need for affordable medications in the U.S. healthcare system.

This price transparency and the consistent offering of competitive prices are significant differentiators for GoodRx. For instance, in 2023, GoodRx reported that its users saved an estimated $20 billion on prescriptions, a testament to the platform's effectiveness in delivering value to cost-conscious consumers.

GoodRx consistently demonstrates impressive gross profit margins, reported at around 94% in recent financial statements. This high margin indicates efficient operations and strong control over the cost of services delivered, contributing to the company's financial health and profitability.

Despite revenue fluctuations, the ability to maintain such margins provides a solid foundation for future investments and growth initiatives, showcasing a core operational strength.

Growing Pharma Manufacturer Solutions Segment

GoodRx's Pharma Manufacturer Solutions segment is a powerful growth engine. This area saw revenue jump 32% year-over-year in the second quarter of 2025. Looking ahead, projections indicate continued robust expansion, with the segment expected to grow 30% or more for the entirety of 2025.

This impressive growth is fueled by key strategic alliances with pharmaceutical companies. These partnerships enable GoodRx to offer direct pricing and patient access programs, effectively broadening the company's revenue base beyond its established prescription discount business.

- Significant Revenue Growth: Q2 2025 revenue increased by 32% year-over-year.

- Strong Full-Year Outlook: Projected to grow 30%+ for the full year 2025.

- Strategic Partnerships: Driven by collaborations with pharmaceutical manufacturers.

- Diversified Revenue Streams: Offers direct pricing and patient access programs.

Strategic Partnerships and Diversified Offerings

GoodRx is actively building a robust network of strategic partnerships. These alliances extend to major pharmaceutical companies, such as Novo Nordisk and Boehringer Ingelheim, enhancing its ability to offer value to consumers. Furthermore, collaborations with retail pharmacy chains, like Hy-Vee, are introducing innovative payment options, including 'pay-over-time' solutions, which can significantly improve affordability and access for users.

The company's strategic expansion beyond its core prescription discount business is a key strength. By integrating telehealth services through GoodRx Care, the platform is evolving into a more comprehensive digital health destination. This diversification broadens its market appeal and creates multiple touchpoints for consumer engagement, moving beyond just cost savings to offering a more complete healthcare experience.

- Strategic Alliances: Partnerships with pharmaceutical giants like Novo Nordisk and Boehringer Ingelheim.

- Retail Pharmacy Collaborations: Agreements with chains such as Hy-Vee for new payment solutions.

- Telehealth Integration: Expansion into services like GoodRx Care for a holistic health offering.

- Diversified Revenue Streams: Moving beyond discounts to include telehealth and potentially other health services.

GoodRx's brand recognition is a significant asset, with nearly 30 million unique consumers using the platform in 2024. This massive user base fuels high engagement as people consistently rely on GoodRx for prescription savings, reinforcing its market leadership.

The platform's ability to facilitate substantial savings, exceeding $85 billion since 2011, underscores its value proposition. In 2023 alone, users saved an estimated $20 billion, highlighting the platform's effectiveness in delivering cost-conscious solutions.

GoodRx maintains impressive gross profit margins, hovering around 94%, which indicates operational efficiency and financial health. This profitability supports future growth initiatives and investments.

The Pharma Manufacturer Solutions segment is a key growth driver, with revenue increasing 32% year-over-year in Q2 2025 and projected to grow over 30% for the full year 2025, driven by strategic pharmaceutical partnerships.

Strategic alliances with pharmaceutical companies like Novo Nordisk and retail chains like Hy-Vee are expanding GoodRx's offerings. Integrating telehealth services through GoodRx Care further diversifies its business, creating a more comprehensive digital health destination.

| Metric | 2024 (approx.) | Q2 2025 | Full Year 2025 (projected) |

|---|---|---|---|

| Unique Consumers | ~30 million | N/A | N/A |

| Total Savings Facilitated (since inception) | >$85 billion | N/A | N/A |

| Savings Facilitated (2023) | N/A | ~$20 billion | N/A |

| Gross Profit Margin | ~94% | ~94% | ~94% |

| Pharma Manufacturer Solutions Revenue Growth (YoY) | N/A | 32% | 30%+ |

What is included in the product

GoodRx's SWOT analysis highlights its strong brand recognition and user base as key strengths, while potential regulatory changes and competition represent significant threats.

GoodRx's user-friendly platform and extensive drug discount network act as a pain point reliever by simplifying prescription access and affordability for consumers.

Weaknesses

GoodRx has seen a concerning drop in its user base, with Monthly Active Consumers (MACs) falling by 4% to 6.4 million in the first quarter of 2025. This decline, coupled with a 7% decrease in subscription revenue, partly attributed to the end of its Kroger Savings Club collaboration, signals potential issues with keeping users engaged and the long-term viability of some subscription offerings.

GoodRx's core business model hinges heavily on its partnerships with pharmacies and Pharmacy Benefit Managers (PBMs). This reliance creates a significant vulnerability, as any shifts in these relationships can directly impact the company's revenue streams. The health of these crucial alliances is paramount for GoodRx's continued success.

This dependency was starkly illustrated by the bankruptcy of Rite Aid, a major retail partner. GoodRx anticipates this event will shave $35 to $40 million off its revenue in 2025, underscoring the tangible financial consequences of disruptions within its partner network. Furthermore, actions taken by PBMs, such as changes in reimbursement rates or network access, pose a constant threat to GoodRx's profitability.

GoodRx faces a fiercely competitive environment, with established players like Amazon Pharmacy, CVS Health, and Walgreens offering integrated services alongside specialized discount platforms such as Blink Health, RxSaver, and WellRx. This crowded market exerts significant pricing pressure and necessitates continuous investment in marketing and innovation to retain its customer base and market share.

Guidance Cuts and Missed Analyst Expectations

GoodRx's financial performance in Q2 2025 presented a notable challenge, with modest revenue growth failing to meet analyst expectations for both top-line figures and earnings per share. This underperformance triggered a significant drop in its stock price.

Compounding these issues, the company has implemented multiple guidance cuts since May 2024, indicating a potential disconnect between internal projections and market realities. Such revisions can erode investor confidence and raise questions about the efficacy of strategic execution and market forecasting capabilities.

- Q2 2025 Revenue Miss: Revenue growth was modest, falling short of analyst consensus estimates.

- EPS Shortfall: Earnings per share also failed to meet analyst expectations in the same quarter.

- Guidance Revisions: Multiple downward revisions to future financial guidance have been issued since May 2024.

- Stock Price Impact: The combination of missed expectations and guidance cuts led to a substantial decline in the company's stock value.

Susceptibility to Regulatory and Policy Changes

GoodRx operates within the heavily regulated healthcare sector, making it vulnerable to shifts in government policies concerning drug pricing, pharmacy benefit manager (PBM) operations, and data privacy. For instance, the Inflation Reduction Act of 2022, which introduced measures to lower prescription drug costs for Medicare beneficiaries, highlights the potential for legislative actions to impact GoodRx's core business. Such changes can necessitate significant adjustments to its business model and revenue generation strategies, demanding continuous adaptation.

The company's reliance on prescription drug savings means that any policy aimed at reducing out-of-pocket costs for consumers or altering the reimbursement landscape could directly affect its value proposition and profitability. For example, proposals to increase price transparency or limit PBM spread pricing could reshape the competitive environment in which GoodRx operates. The company must remain agile to navigate these evolving regulatory waters.

- Regulatory Uncertainty: GoodRx's business model is sensitive to changes in healthcare policy, including drug pricing regulations and PBM oversight.

- Impact of Legislation: Laws like the Inflation Reduction Act can alter the prescription drug market dynamics, potentially affecting GoodRx's revenue streams.

- Adaptation Costs: Responding to new regulations may require significant investment in compliance and business model adjustments.

- Competitive Landscape: Policy shifts could also influence the competitive positioning of GoodRx relative to pharmacies and PBMs.

GoodRx faces a significant challenge in maintaining user engagement, evidenced by a 4% decline in Monthly Active Consumers to 6.4 million in Q1 2025, alongside a 7% drop in subscription revenue. This directly impacts its ability to retain its customer base and generate consistent income.

The company's heavy reliance on partnerships with pharmacies and PBMs creates substantial vulnerability. The bankruptcy of Rite Aid, a key partner, is projected to reduce GoodRx's 2025 revenue by $35 to $40 million, highlighting the financial risks associated with partner instability.

GoodRx's Q2 2025 performance missed analyst expectations for both revenue and earnings per share, leading to a notable stock price decrease. This underperformance, coupled with multiple downward guidance revisions since May 2024, raises concerns about strategic execution and market forecasting accuracy.

| Metric | Q1 2025 (Actual) | Q2 2025 (Estimate) | Impact |

|---|---|---|---|

| Monthly Active Consumers (MACs) | 6.4 million | N/A | -4% decline |

| Subscription Revenue | N/A | N/A | -7% decline |

| Rite Aid Bankruptcy Impact | N/A | N/A | $35-40 million revenue reduction in 2025 |

| Revenue Growth | N/A | Modest (below expectations) | Stock price decline |

| Earnings Per Share (EPS) | N/A | Below expectations | Stock price decline |

What You See Is What You Get

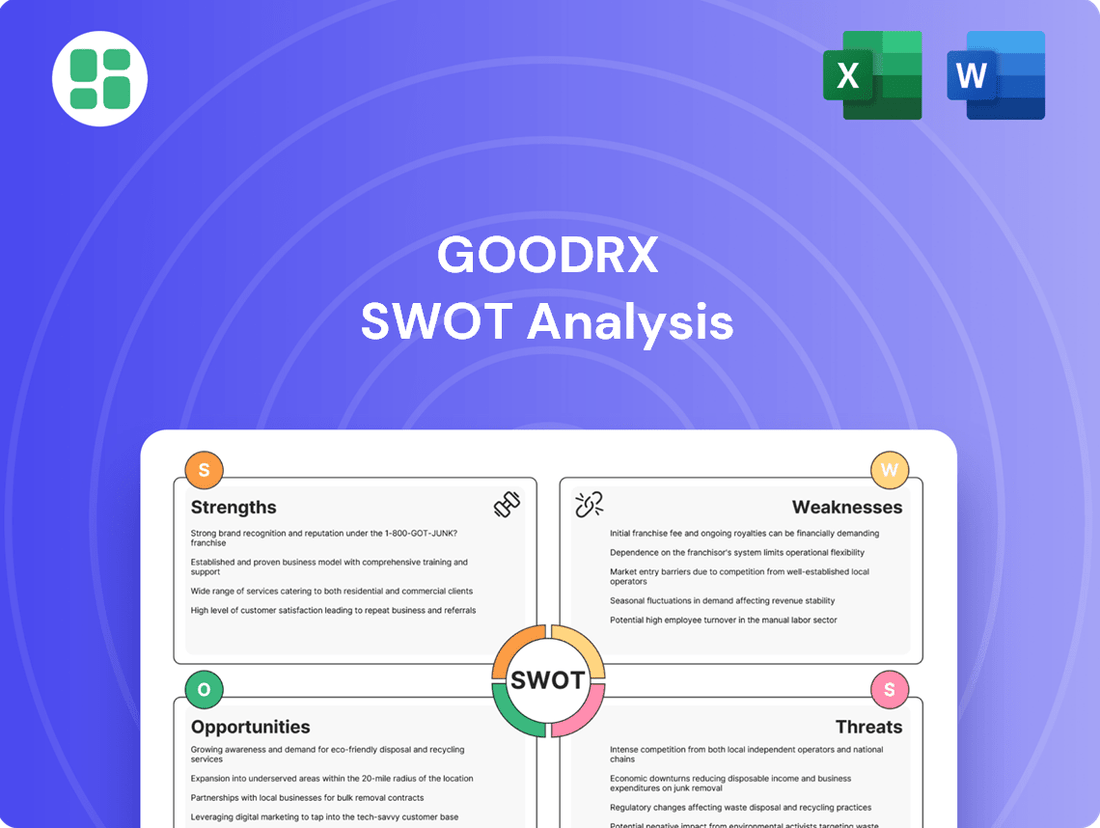

GoodRx SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights into GoodRx's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a complete understanding of GoodRx's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the GoodRx SWOT analysis, allowing for further customization.

Opportunities

GoodRx can significantly grow its Integrated Savings Program (ISP) to cover more generic and brand-name drugs not typically handled by insurance. This expansion directly tackles the problem of people not filling their prescriptions due to cost, potentially boosting consumer loyalty by offering a more complete way to save money.

The pharma manufacturer solutions segment is a significant growth avenue for GoodRx, with expectations of surpassing 30% growth in 2025. This expansion is fueled by forging deeper direct relationships with drug makers.

By collaborating more closely with pharmaceutical companies, GoodRx can develop more robust patient access programs. These programs not only benefit patients but also enhance gross-to-net margins for manufacturers, establishing a mutually advantageous arrangement.

The increasing demand for prescription drugs at full price, often driven by affordability challenges and PBMs steering patients away from certain plans, presents a significant opportunity for GoodRx. This growing cash pay market allows GoodRx to leverage its existing point-of-sale discount solutions to capture a larger share of these transactions, directly benefiting consumers who need affordable access to their medications.

Strategic Partnerships for Enhanced Payment Solutions

GoodRx is strategically enhancing its payment solutions through key partnerships, aiming to increase medication accessibility. A notable example is the late 2024 launch of a 'pay-over-time' option with Affirm, initially implemented with Hy-Vee pharmacies. This collaboration directly addresses consumer financial flexibility, a critical factor in prescription affordability.

These financial flexibility initiatives are designed to attract a wider consumer base and foster deeper integration within the prescription fulfillment journey. By offering more manageable payment structures, GoodRx can solidify its position as a go-to resource for cost-effective healthcare solutions.

- Partnership with Affirm: Launched late 2024 with Hy-Vee pharmacies, offering 'pay-over-time' options for prescription costs.

- Increased Accessibility: Aims to make medications more affordable by providing consumers with financial flexibility.

- Broader Consumer Appeal: The 'pay-over-time' feature is expected to attract a larger segment of the population seeking cost-effective healthcare.

- Deeper Integration: Positions GoodRx to become more integral to the prescription fulfillment process beyond just price comparison.

Leveraging Data for Broader Healthcare Solutions

GoodRx's extensive repository of prescription drug pricing and utilization data presents a significant opportunity to expand its offerings beyond simple discounts. By leveraging this information, the company can develop more sophisticated tools aimed at enhancing healthcare cost transparency for consumers.

This data could fuel the creation of personalized health insights and medication adherence programs, moving GoodRx closer to becoming a comprehensive health management platform. For instance, in 2023, GoodRx reported over 200 million visits to its website, highlighting the scale of user engagement that can be tapped for these new services.

- Expanding Transparency: Develop tools that offer deeper insights into drug costs across various insurance plans and pharmacies.

- Personalized Health: Utilize user data to provide tailored advice on medication management and potential cost-saving alternatives.

- Adherence Programs: Create features that remind users to take their medications and track their progress, improving health outcomes.

- Platform Integration: Explore partnerships to integrate with broader health management systems, offering a more holistic patient experience.

GoodRx can capitalize on the growing demand for prescription drugs in the cash-pay market, especially as affordability remains a concern for many consumers. The company's existing discount solutions are well-positioned to capture a larger share of these transactions, directly benefiting individuals seeking more affordable medication access.

The expansion of its Integrated Savings Program (ISP) to encompass a wider range of generic and brand-name drugs, including those not typically covered by insurance, presents a significant growth opportunity. This initiative addresses the critical issue of prescription non-adherence due to cost, fostering greater consumer loyalty by offering a more comprehensive savings solution.

GoodRx's pharma manufacturer solutions segment is projected for robust growth, with expectations of exceeding 30% expansion in 2025. This growth is driven by cultivating deeper, direct relationships with pharmaceutical companies to develop more effective patient access programs, which also benefit manufacturers by improving gross-to-net margins.

The strategic enhancement of payment solutions, exemplified by the late 2024 partnership with Affirm for a 'pay-over-time' option at Hy-Vee pharmacies, aims to increase medication accessibility by offering consumers greater financial flexibility. This move is expected to attract a broader consumer base and deepen GoodRx's integration into the prescription fulfillment journey.

| Opportunity Area | Key Initiative/Driver | Projected Impact/Data Point |

| Cash Pay Market Growth | Leveraging existing discount solutions for full-price drugs | Increasing capture of transactions in a growing market. |

| Integrated Savings Program (ISP) Expansion | Covering more generic and brand-name drugs outside insurance | Boosting consumer loyalty and addressing prescription affordability. |

| Pharma Manufacturer Solutions | Forging deeper direct relationships with drug makers | Expected to surpass 30% growth in 2025; enhancing patient access programs. |

| Enhanced Payment Solutions | Partnership with Affirm for 'pay-over-time' (late 2024) | Increasing medication accessibility and financial flexibility for consumers. |

Threats

The healthcare sector, especially concerning drug pricing and Pharmacy Benefit Manager (PBM) operations, is under a microscope with heightened regulatory attention. Legislation like the Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, signals a significant shift. This increased oversight could directly affect GoodRx's core business by altering the dynamics of drug price negotiations and discount mechanisms.

The retail pharmacy sector is experiencing significant upheaval, with numerous store closures and high-profile bankruptcies, such as Rite Aid's Chapter 11 filing in October 2023, directly threatening GoodRx's prescription transaction revenue. This volatility can reduce the number of pharmacies available for discount fulfillment, impacting GoodRx's Integrated Savings Programs and presenting immediate growth hurdles.

The increasing prevalence of direct-to-consumer pharmacy models poses a substantial threat. New ventures like Mark Cuban's Cost Plus Drug Company, alongside established giants such as Amazon Pharmacy, CVS, and Walgreens, are all embracing transparent pricing strategies.

These innovative approaches aim to streamline the pharmaceutical supply chain by cutting out traditional middlemen. This disintermediation could diminish the reliance on third-party discount aggregators like GoodRx, directly impacting its core business model.

For instance, Amazon Pharmacy's continued expansion and its focus on competitive pricing, coupled with Cost Plus Drug Company's commitment to radical transparency, create a challenging competitive landscape. GoodRx's value proposition as a discount facilitator is directly challenged when consumers can access lower prices more directly.

Declining User Engagement and Subscription Attrition

GoodRx is facing a significant hurdle with declining user engagement and subscription churn. A consistent drop in Monthly Active Consumers (MACs) and subscription revenue points to difficulties in keeping users invested and attracting new ones. For instance, in Q1 2024, GoodRx reported a 6% year-over-year decrease in total revenue to $199.6 million, partly due to lower subscription revenue.

If this trend persists, it directly threatens the company's financial health. Reduced user activity translates to fewer prescription transactions, which are a core revenue driver. This shrinking recurring revenue base could negatively impact GoodRx's overall financial performance and its market valuation, making it harder to fund future growth initiatives.

- Declining MACs: A sustained decrease in the number of active users directly impacts transaction volumes.

- Subscription Attrition: Losing subscribers means a smaller and less predictable recurring revenue stream.

- Revenue Impact: Lower engagement and churn put pressure on overall revenue generation and profitability.

- Market Valuation Concerns: Persistent user decline can lead to a lower perception of the company's future growth potential by investors.

Actions by Pharmacy Benefit Managers (PBMs)

Pharmacy Benefit Managers (PBMs) are increasingly focusing on their own insurance savings programs, a move that directly challenges GoodRx's business model. By expanding formulary exclusions, PBMs can limit GoodRx's capacity to provide its discount and integrated savings programs.

These PBM strategies can diminish the appeal and effectiveness of GoodRx's offerings. Furthermore, they may divert consumers toward PBM-managed alternatives, thereby restricting GoodRx's market reach and potential revenue streams.

- PBMs' growing insurance savings programs: This directly competes with GoodRx's core discount services.

- Increased formulary exclusions: Limits the types of drugs available for GoodRx discounts, reducing its value proposition.

- Potential consumer redirection: PBMs can steer patients to their own solutions, bypassing GoodRx.

- Impact on GoodRx's revenue: Reduced market access and program effectiveness can lead to lower revenue for GoodRx.

The competitive landscape is intensifying with direct-to-consumer pharmacy models and PBMs developing their own savings programs. This disintermediation threatens GoodRx's role as a discount facilitator. For example, Amazon Pharmacy's expansion and Cost Plus Drug Company's transparent pricing directly challenge GoodRx's value proposition, potentially reducing reliance on third-party aggregators.

Regulatory scrutiny, particularly concerning drug pricing and PBM operations, presents a significant threat. Legislation like the Inflation Reduction Act, empowering Medicare to negotiate drug prices, could alter the dynamics of drug price negotiations and discount mechanisms, impacting GoodRx's core business.

Declining user engagement and subscription churn are also critical threats. A year-over-year decrease in total revenue, partly due to lower subscription revenue, highlights difficulties in retaining and attracting users, directly impacting transaction volumes and overall financial health.

The retail pharmacy sector's volatility, marked by store closures and bankruptcies like Rite Aid's in October 2023, directly impacts GoodRx's prescription transaction revenue by reducing available fulfillment points.

SWOT Analysis Data Sources

The data sources for this GoodRx SWOT analysis are comprehensive, drawing from publicly available financial reports, detailed market research, and reputable industry publications. This ensures a robust understanding of the company's competitive landscape and operational performance.