GoodRx Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

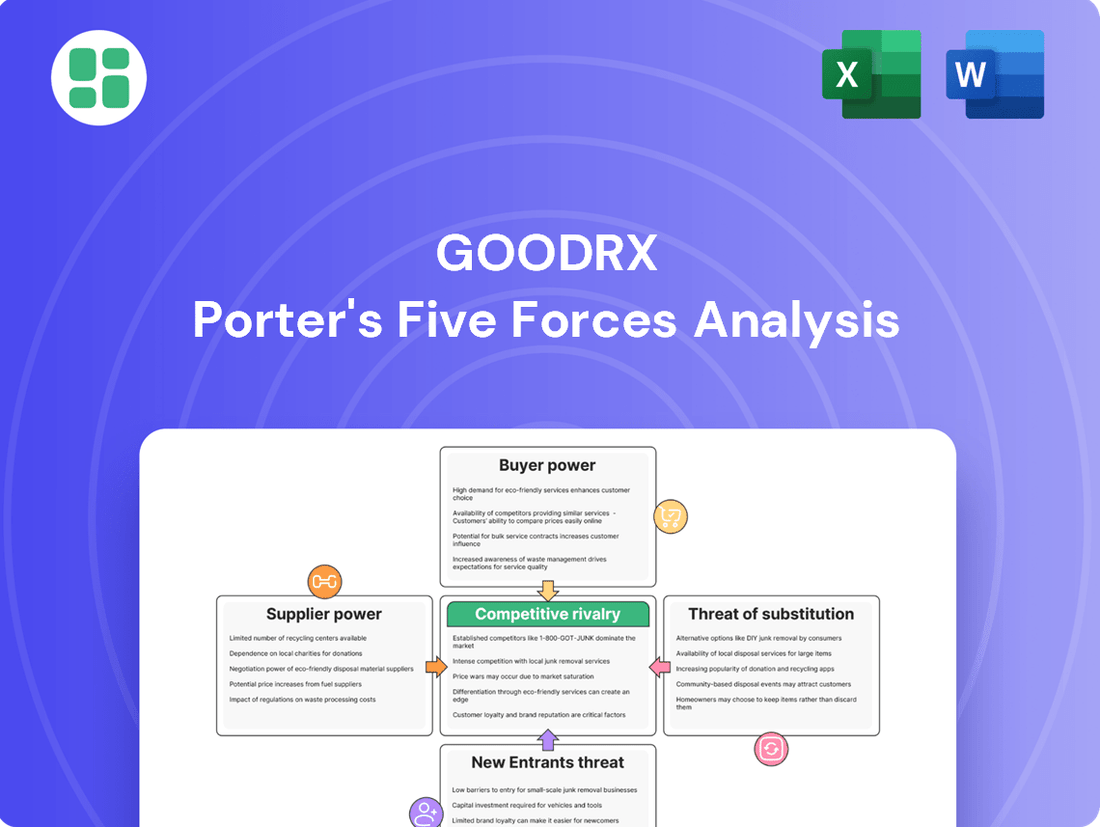

GoodRx navigates a complex landscape shaped by intense rivalry and the significant power of buyers. Understanding these forces is crucial for grasping its market position.

The full analysis reveals the real forces shaping GoodRx’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Pharmacies represent a key supplier group for GoodRx, as they dispense the medications and accept the discount codes. Historically, GoodRx navigated these relationships primarily through Pharmacy Benefit Managers (PBMs). This reliance on intermediaries can sometimes limit direct control over pricing and terms.

However, GoodRx is actively working to diversify its supplier relationships. The launch of GoodRx Community Link in June 2025 is a significant step, enabling independent pharmacies to contract directly with GoodRx. This move is designed to provide these smaller pharmacies with more stable pricing and improved profit margins, potentially strengthening GoodRx's position by offering more attractive terms to a wider network of dispensing partners.

Pharmacy Benefit Managers (PBMs) wield considerable power as intermediaries, negotiating drug prices and reimbursement rates between manufacturers, insurers, and pharmacies. GoodRx's Integrated Savings Program (ISP) relies on partnerships with major PBMs such as Caremark and Express Scripts, demonstrating their crucial role.

These PBM relationships, however, are not without friction. Allegations in late 2024 of GoodRx conspiring with PBMs to suppress pharmacy reimbursements underscore the PBMs' significant leverage and the potential for contentious negotiations, impacting GoodRx's operational dynamics.

Pharmaceutical manufacturers hold significant bargaining power with GoodRx, especially within the Pharma Manufacturer Solutions segment. This segment, which saw a substantial 32% year-over-year increase in Q2 2025, relies on manufacturers agreeing to 'buy down' the prices of their brand-name drugs for consumers. This arrangement, while beneficial for GoodRx's service offerings and revenue, places manufacturers in a strong position to dictate terms, as GoodRx’s growth in this area is directly tied to their participation and pricing strategies.

Technology and Data Providers

GoodRx's reliance on technology and data providers highlights a significant bargaining power for these suppliers. The company's core function, providing real-time drug pricing information from tens of thousands of pharmacies, necessitates robust data feeds and sophisticated technological infrastructure.

The accuracy and breadth of this data are paramount to GoodRx's value proposition. While specific supplier relationships are not publicly detailed, the ability to aggregate information from over 70,000 pharmacies indicates a complex and potentially concentrated network of data sources. This reliance means that disruptions or unfavorable terms from key technology and data providers could directly impact GoodRx's operational capabilities and competitive standing.

- Data Aggregation: GoodRx aggregates pricing data from over 70,000 pharmacies, underscoring the need for reliable and extensive data feeds.

- Technological Dependence: The platform's functionality is intrinsically tied to the technology and data infrastructure provided by third parties.

- Supplier Leverage: Companies that provide critical data or technology infrastructure to GoodRx could wield significant bargaining power due to the essential nature of their services.

Healthcare Providers and Telehealth Professionals

GoodRx's telehealth platform, GoodRx Care, depends heavily on the availability and quality of healthcare providers and telehealth professionals. The bargaining power of these suppliers can influence GoodRx's operational costs and the perceived value of its services. In 2024, the demand for telehealth services continued to grow, increasing the leverage of qualified medical professionals in negotiating terms and compensation.

The reliance on these professionals is a key factor in GoodRx's strategy to diversify revenue beyond its core prescription discount business. For instance, GoodRx Care offers services like prescription refills and treatment for common conditions, directly utilizing these medical experts. This diversification is crucial for long-term growth and resilience.

- Provider Dependency: GoodRx Care's success hinges on its network of licensed healthcare providers, including doctors and nurse practitioners.

- Quality and Availability Impact: The caliber and accessibility of these professionals directly affect the quality of care and patient satisfaction, influencing GoodRx's brand reputation.

- Revenue Diversification: Telehealth services represent a significant avenue for GoodRx to broaden its income streams, moving beyond its established prescription savings model.

- Market Dynamics (2024): The increasing demand for virtual healthcare in 2024 likely strengthened the bargaining position of in-demand telehealth specialists.

Pharmacies and Pharmacy Benefit Managers (PBMs) are key suppliers for GoodRx, with PBMs holding significant leverage due to their role in negotiating drug prices and reimbursement rates.

In 2024, allegations of GoodRx colluding with PBMs to suppress reimbursements highlighted the PBMs' substantial influence and the potential for difficult negotiations.

Pharmaceutical manufacturers also possess strong bargaining power, particularly in the Pharma Manufacturer Solutions segment, where GoodRx's revenue growth depends on their agreement to reduce brand-name drug prices.

GoodRx's operational efficiency is further impacted by its reliance on technology and data providers, whose services are critical for aggregating pricing information from over 70,000 pharmacies.

| Supplier Group | Key Relationships | Bargaining Power Factors | Impact on GoodRx |

| Pharmacies | Direct contracts, Independent pharmacies | Dispensing medications, Accepting discount codes | Influences network reach and operational costs |

| PBMs | Caremark, Express Scripts | Negotiating drug prices, Reimbursement rates | Significant leverage, Potential for contentious negotiations |

| Pharma Manufacturers | Pharma Manufacturer Solutions segment | Setting terms for price buy-downs | Directly impacts revenue and service offerings |

| Technology & Data Providers | Data aggregation from 70,000+ pharmacies | Providing critical data feeds and infrastructure | Essential for core functionality, potential disruption risk |

| Healthcare Providers | GoodRx Care platform | Availability and quality of medical professionals | Affects operational costs and service value, market dynamics in 2024 increased provider leverage |

What is included in the product

This analysis dissects GoodRx's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the prescription drug discount market.

Instantly understand competitive pressures and identify opportunities to reduce costs for consumers.

Customers Bargaining Power

Consumers using GoodRx are often highly price-sensitive, frequently uninsured, underinsured, or dealing with substantial deductibles. This financial pressure compels them to actively search for the most affordable prescription options available.

A GoodRx survey conducted in June 2025 revealed that a significant 67% of Americans reported prescription costs as a burden, directly fueling the demand for discount and savings solutions like those offered by the platform.

Customers possess significant bargaining power due to the wide array of prescription savings alternatives available. Platforms like Blink Health, SingleCare, and RxSaver directly compete with GoodRx, offering similar discount services. This abundance of substitutes means consumers can readily switch to find the best prices, thereby pressuring GoodRx to maintain competitive offerings.

GoodRx's fundamental offering is price transparency, giving consumers the power to see drug costs at different pharmacies. This access to information directly strengthens the bargaining power of customers, as they can easily identify and select the most cost-effective prescriptions.

Low Switching Costs

The bargaining power of customers is significantly amplified by low switching costs. For consumers seeking prescription drug discounts, moving from GoodRx to a competitor's platform or a different discount card is often as simple as performing another online search. This minimal friction means GoodRx faces constant pressure to maintain its value proposition.

This ease of transition directly impacts GoodRx's ability to retain users. To counter this, GoodRx must continuously provide compelling pricing, a seamless user interface, and reliable access to savings. Failing to do so risks customers migrating to platforms that offer a slightly better deal or a more intuitive experience.

- Low Switching Costs: Customers can easily switch between discount providers with minimal effort.

- Competitive Pressure: GoodRx must consistently offer competitive pricing and a superior user experience to retain its customer base.

- User Retention: The ease of switching necessitates a strong focus on customer loyalty and satisfaction.

Influence of Insurance Coverage

The bargaining power of customers is significantly shaped by the influence of insurance coverage. For individuals with health insurance, the extent of their plan and their Pharmacy Benefit Manager (PBM) arrangements directly impacts how much they rely on services like GoodRx. While GoodRx is designed to work alongside insurance, robust coverage can diminish the perceived necessity of discount cards for some consumers, thereby increasing their bargaining power.

In 2024, the landscape of prescription drug costs continues to be a major concern for consumers. For instance, a significant portion of Americans face challenges with prescription affordability. A report from the Kaiser Family Foundation in early 2024 indicated that approximately 30% of adults reported difficulty affording their prescription medications, highlighting the ongoing need for cost-saving solutions. This statistic underscores the potential leverage customers have when seeking the best prices, whether through insurance or discount platforms.

- Insurance Impact: Comprehensive health insurance and PBM plans can reduce a customer's direct out-of-pocket costs, potentially lessening their need for third-party discount services.

- Perceived Value: When insurance provides substantial coverage or favorable pricing, the added value of a discount card like GoodRx may be perceived as lower, giving customers more leverage to negotiate or seek alternatives.

- Market Dynamics: The presence of multiple insurance providers and PBMs creates a competitive environment where customers, armed with information about their benefits, can exert greater influence on pricing and service expectations.

- Affordability Concerns: Despite insurance, a notable percentage of individuals still struggle with medication costs, making them highly sensitive to price and more likely to utilize any available savings, thus influencing the demand for discount platforms.

The bargaining power of GoodRx's customers is substantial, driven by their price sensitivity and the readily available alternatives for prescription savings. With a significant portion of Americans finding prescription costs burdensome, as indicated by a June 2025 GoodRx survey where 67% reported this issue, consumers actively seek the best deals. The ease with which customers can switch between platforms like Blink Health or SingleCare, due to low switching costs, forces GoodRx to maintain competitive pricing and a superior user experience to retain its user base.

| Factor | Description | Impact on GoodRx |

| Price Sensitivity | Many users are uninsured, underinsured, or have high deductibles, making them highly focused on cost. | Increases demand for discount services but also intensifies price competition. |

| Availability of Alternatives | Numerous competing platforms offer similar prescription discount services. | Lowers customer loyalty and requires GoodRx to constantly innovate and offer value. |

| Low Switching Costs | Consumers can easily move between discount providers with minimal effort. | Exerts continuous pressure on GoodRx to maintain competitive pricing and user experience. |

| Information Access | GoodRx provides price transparency across pharmacies, empowering consumers. | Strengthens customer ability to find the lowest prices, increasing their leverage. |

Same Document Delivered

GoodRx Porter's Five Forces Analysis

This preview showcases the complete GoodRx Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the prescription drug pricing landscape. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

GoodRx faces a crowded landscape with numerous direct competitors offering similar prescription discount services. Platforms like Blink Health, SingleCare, RxSaver, and WellRx are all vying for the same customer base, creating a highly competitive environment.

Blink Health, in particular, stands out as a formidable rival, demonstrating significant revenue figures that underscore the intensity of the competition for market share within the prescription savings sector.

Major retail pharmacy chains such as CVS Health, Walgreens Boots Alliance, Costco Pharmacy, and Walmart Pharmacy exert significant competitive pressure. These giants possess vast retail footprints and frequently deploy proprietary loyalty programs and discount strategies to retain and attract customers, as seen in their ongoing efforts to capture market share in the prescription drug sector.

Their substantial scale and established customer bases allow these large players to negotiate favorable terms with pharmaceutical manufacturers and insurers, thereby influencing pricing and product availability. For instance, in 2023, Walmart Pharmacy continued its strategy of offering low-cost generics, further intensifying price competition within the industry.

The competitive landscape for prescription drug savings is intensifying with the emergence of tech giants and online pharmacies. Companies like Amazon Pharmacy and Capsule are leveraging their digital prowess and robust logistics networks to offer convenient medication access and delivery, directly challenging established discount models.

These new entrants are not just offering competitive pricing but also enhanced user experiences through seamless online platforms and home delivery services. For instance, Amazon Pharmacy reported significant growth in prescription volume in 2024, driven by its Prime membership integration and focus on convenience.

PBMs and Health Insurers

Pharmacy Benefit Managers (PBMs) and health insurers present a significant competitive threat to GoodRx. Major players like Express Scripts, OptumRx, and Cigna manage their own drug benefit programs, directly challenging GoodRx's discount services for individuals with insurance coverage. This dynamic creates a crowded marketplace where various organizations are actively seeking to manage and reduce prescription drug expenses.

These integrated PBMs and insurers can leverage their existing member base and negotiating power to offer competitive, or even superior, discount programs. For instance, OptumRx, a subsidiary of UnitedHealth Group, managed over $150 billion in drug spending in 2023, demonstrating the scale of their operations and their capacity to influence pricing.

- Direct Competition: PBMs and health insurers offer their own prescription discount programs, often integrated into existing health plans.

- Scale and Negotiation Power: Large PBMs can negotiate lower prices with manufacturers due to their substantial volume, directly impacting GoodRx's value proposition.

- Customer Loyalty: Insured individuals may prefer to use their insurer's or PBM's affiliated discount programs for convenience and potential additional benefits.

Market Saturation and Declining Active Users

The prescription discount sector is becoming increasingly crowded, making it harder for companies like GoodRx to stand out and grow. This saturation intensifies rivalry among existing players.

GoodRx has experienced difficulties, including a significant 14% decrease in its monthly active users during the second quarter of 2025. This decline is partly attributed to shifts within the retail pharmacy sector, which directly impacts GoodRx's user base.

- Market Saturation: The prescription discount market is reaching a point where there are many similar offerings, limiting opportunities for substantial new growth.

- Declining Active Users: GoodRx reported a 14% drop in monthly active users in Q2 2025, signaling user engagement challenges.

- Pharmacy Landscape Changes: Evolving strategies and operations by retail pharmacies have contributed to GoodRx's user base decline.

- Intensified Competition: The combination of saturation and user engagement issues heightens the competitive pressure on GoodRx.

GoodRx operates in a highly competitive environment, facing pressure from direct rivals, large retail pharmacy chains, and emerging tech players. This intense rivalry is further exacerbated by the actions of Pharmacy Benefit Managers (PBMs) and health insurers who offer their own discount programs, directly competing for the same market share.

The market is saturated with numerous prescription savings platforms, including Blink Health, SingleCare, and RxSaver, all vying for consumer attention. Major retail pharmacies like CVS and Walgreens also leverage their extensive networks and loyalty programs to retain customers, as seen in their continued focus on low-cost generics in 2023.

New entrants such as Amazon Pharmacy are disrupting the space with convenient online services and home delivery, reporting significant growth in prescription volume in 2024. This broad competitive pressure, coupled with GoodRx's reported 14% decline in monthly active users in Q2 2025, underscores the challenging landscape.

| Competitor Type | Key Players | Impact on GoodRx |

|---|---|---|

| Direct Competitors | Blink Health, SingleCare, RxSaver | Fragmented market share, price wars |

| Retail Pharmacy Chains | CVS Health, Walgreens, Walmart Pharmacy | Leverage existing customer base, proprietary programs |

| Tech/Online Pharmacies | Amazon Pharmacy, Capsule | Convenience, digital-first approach, home delivery |

| PBMs & Insurers | Express Scripts, OptumRx, Cigna | Integrated discount programs, scale, negotiating power |

SSubstitutes Threaten

For many consumers, traditional health insurance plans and the benefits negotiated by Pharmacy Benefit Managers (PBMs) represent the most significant substitutes for GoodRx's prescription savings services. When insurance coverage is robust and cost-effective, the appeal and necessity of discount cards naturally decrease.

In 2023, the average annual premium for employer-sponsored family health coverage in the US reached $24,000, with employees paying an average of $6,500. This significant employer subsidy, coupled with PBMs' negotiated discounts, can make out-of-pocket prescription costs manageable for many insured individuals, thereby reducing their reliance on GoodRx.

Drug manufacturers offer their own co-pay assistance programs, especially for high-cost brand-name drugs. These programs can directly reduce a patient's out-of-pocket expenses, potentially making them more attractive than using third-party discount platforms. For instance, in 2023, pharmaceutical companies spent billions on patient assistance programs, with a significant portion allocated to co-pay coupons, directly impacting the competitive landscape for discount aggregators.

The growing prevalence of direct-to-consumer (DTC) online pharmacies and mail-order services presents a significant threat of substitution for traditional brick-and-mortar pharmacies. These digital alternatives, like Amazon Pharmacy or Capsule, offer a convenient, often subscription-based, and transparent pricing model that directly competes with the services GoodRx provides through its discount cards. For instance, by mid-2024, several major online pharmacies reported significant year-over-year growth in prescription fulfillment, indicating a clear shift in consumer preference towards these more accessible channels.

Over-the-Counter (OTC) Medications and Lifestyle Changes

The threat of substitutes for prescription drugs, and by extension services like GoodRx that help manage their cost, is significant. Consumers facing high out-of-pocket expenses often explore alternatives, including over-the-counter (OTC) medications, dietary supplements, or even lifestyle adjustments to manage their health conditions. This can mean substituting prescription treatments with less effective but cheaper options, or simply foregoing treatment altogether.

The financial pressure is real. In 2025, a substantial 42% of Americans reported making changes to their medication regimen due to cost concerns. These changes often involve:

- Opting for over-the-counter medications or supplements as a less expensive alternative to prescription drugs.

- Rationing medication doses to make prescriptions last longer.

- Delaying prescription refills to spread out costs.

- Stopping medication entirely when costs become prohibitive.

These behaviors directly impact the demand for prescription medications and highlight a critical vulnerability for companies operating within the pharmaceutical access ecosystem.

Generic Drug Programs and Hospital Charity Programs

The threat of substitutes for GoodRx is significant, particularly from generic drug programs and hospital charity initiatives. Many employers, healthcare systems, and pharmacies now offer their own free or heavily discounted generic drug programs, directly competing with GoodRx's core offering.

Furthermore, pharmaceutical companies and hospitals often have charity programs designed to assist patients who struggle with medication costs. These programs act as direct substitutes, bypassing the need for discount card services like GoodRx for a segment of the population. For instance, in 2024, many major health systems expanded their patient assistance programs, aiming to reduce out-of-pocket expenses for uninsured or underinsured individuals.

- Employer-Sponsored Generic Programs: Many large employers now negotiate directly with pharmacies to offer generics at cost or with minimal markups for their employees.

- Hospital Charity Care: Hospitals provide financial assistance and free medications to eligible low-income patients, reducing reliance on third-party discount services.

- Pharmaceutical Manufacturer Patient Assistance Programs (PAPs): These programs offer free or discounted brand-name and generic drugs directly to eligible patients, especially those facing high co-pays or lacking insurance.

- Direct Pharmacy Discount Programs: Some pharmacies, particularly independent ones or those within large retail chains, have their own loyalty programs or discount tiers that can rival GoodRx pricing for certain generics.

The threat of substitutes for GoodRx is substantial, stemming from various sources that offer alternative ways for consumers to manage prescription costs. Traditional health insurance and PBMs, with their negotiated discounts, can make GoodRx less necessary. In 2023, the average annual premium for employer-sponsored family health coverage was $24,000, with employees paying $6,500, highlighting the impact of employer subsidies.

Manufacturer co-pay assistance programs, especially for expensive brand-name drugs, also serve as direct substitutes. Pharmaceutical companies invested billions in these programs in 2023, directly competing with discount platforms. Furthermore, the rise of online pharmacies and DTC services offers convenience and transparent pricing, with many reporting significant growth in prescription fulfillment by mid-2024.

| Substitute Type | Description | Impact on GoodRx | Example Data Point |

|---|---|---|---|

| Health Insurance/PBMs | Negotiated discounts and coverage plans | Reduces need for discount cards | Avg. 2023 family premium: $24,000 |

| Manufacturer PAPs | Co-pay assistance for brand drugs | Directly competes for high-cost meds | Billions spent by pharma in 2023 |

| Online/DTC Pharmacies | Convenient, subscription-based models | Offers alternative fulfillment channels | Significant growth reported by mid-2024 |

| Generic Programs/Charity | Employer/hospital discounts, charity care | Bypasses third-party discounts | Expansion of health system assistance in 2024 |

Entrants Threaten

GoodRx's established brand recognition and extensive network effects present a significant barrier to new entrants. As an early mover, GoodRx has cultivated strong trust among consumers, a crucial element in the healthcare sector. This is reinforced by its vast network, encompassing over 70,000 pharmacy partnerships, a scale that would be incredibly challenging and costly for newcomers to replicate. For instance, in 2023, GoodRx reported approximately 17 million monthly active users, highlighting the depth of its consumer engagement.

The U.S. healthcare system presents a formidable challenge for new entrants due to its intricate web of regulations, especially concerning prescription drug pricing and the operations of Pharmacy Benefit Managers (PBMs). Navigating this complex environment, which includes continuous examination of PBM activities and the possibility of evolving policies, acts as a substantial barrier.

Launching a robust platform like GoodRx, which aggregates pricing from numerous pharmacies and offers integrated telehealth services, demands significant upfront capital. This isn't just about building an app; it involves establishing extensive data networks and cultivating relationships across the pharmaceutical industry.

GoodRx’s market capitalization, which stood at approximately $2.7 billion as of mid-2024, underscores the substantial financial resources needed to achieve and maintain its current scale. This financial muscle deters potential new entrants who may lack the deep pockets required to compete effectively.

Data and Technology Expertise

New entrants face a significant hurdle in replicating GoodRx's data and technology expertise. Developing the sophisticated data aggregation capabilities and proprietary algorithms necessary to provide accurate, real-time prescription pricing information requires substantial investment and time. GoodRx's decade-plus experience in this specialized field has allowed them to build a robust technological infrastructure and a deep understanding of the market, creating a formidable barrier to entry.

Consider the following points regarding this barrier:

- Data Aggregation Complexity: Effectively collecting and standardizing pricing data from numerous pharmacies and manufacturers is a complex, ongoing process.

- Proprietary Algorithm Development: The accuracy and real-time nature of GoodRx's pricing information rely on sophisticated, continuously refined algorithms.

- Established Infrastructure: GoodRx has invested heavily in building and maintaining the technology backbone required for its operations.

- Market Experience: Over ten years of operation has provided GoodRx with invaluable insights into data nuances and user behavior, which are difficult for newcomers to replicate quickly.

Existing Relationships with Key Stakeholders

GoodRx has built strong, long-term connections with crucial players like pharmacies, pharmacy benefit managers (PBMs), and drug makers. For a new competitor to enter, establishing this same level of trust and seamless integration into the intricate healthcare network would be a significant hurdle. This includes navigating potentially complex regulatory and legal landscapes that established players already understand.

These existing relationships act as a substantial barrier. For instance, a new entrant would need to secure contracts and favorable terms with numerous pharmacy chains, a process that can be lengthy and costly. GoodRx's established network means it can often negotiate better rates or offer more comprehensive services, making it difficult for newcomers to compete on price or convenience.

- Established Pharmacy Partnerships: GoodRx has agreements with thousands of pharmacies across the US, providing a wide reach for its discount programs.

- PBM Integration: While facing some headwinds, GoodRx has historically worked with PBMs to facilitate prescription savings, a complex integration for new entrants.

- Manufacturer Relationships: Building rapport and securing access to manufacturer-provided savings programs is vital and takes time to cultivate.

- Navigating Ecosystem Complexity: The healthcare system's intricate web of regulations and stakeholder interests presents a steep learning curve and potential legal challenges for new entrants.

The threat of new entrants for GoodRx is relatively low, primarily due to the substantial barriers to entry in the prescription discount and telehealth market. GoodRx's established brand, extensive pharmacy network of over 70,000 locations, and complex data aggregation capabilities represent significant hurdles for newcomers. The intricate U.S. healthcare regulatory landscape and the high capital investment required to build a comparable platform further deter potential competitors.

GoodRx's market capitalization, around $2.7 billion in mid-2024, illustrates the financial scale needed to compete. Replicating their decade of experience in data and algorithm development is a formidable challenge. For instance, maintaining the accuracy of real-time pricing across numerous pharmacies requires sophisticated, continuously updated technology, a significant ongoing investment.

| Barrier Type | Description | GoodRx Advantage |

|---|---|---|

| Brand Recognition & Network Effects | Building consumer trust and a wide pharmacy network is crucial. | Established trust and over 70,000 pharmacy partnerships. |

| Capital Requirements | Significant upfront investment for platform development and data infrastructure. | Market cap of ~$2.7 billion (mid-2024) indicates substantial financial resources. |

| Data & Technology Expertise | Complex data aggregation and proprietary algorithms are key differentiators. | Over 10 years of experience in developing sophisticated pricing data and algorithms. |

| Regulatory Complexity | Navigating U.S. healthcare regulations, especially around drug pricing. | Established understanding and experience with the intricate healthcare ecosystem. |

Porter's Five Forces Analysis Data Sources

Our GoodRx Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including company financial statements, investor relations reports, and industry-specific market research. We also incorporate data from regulatory filings and analyses from leading financial news outlets to ensure a comprehensive understanding of the competitive landscape.