GoodRx Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

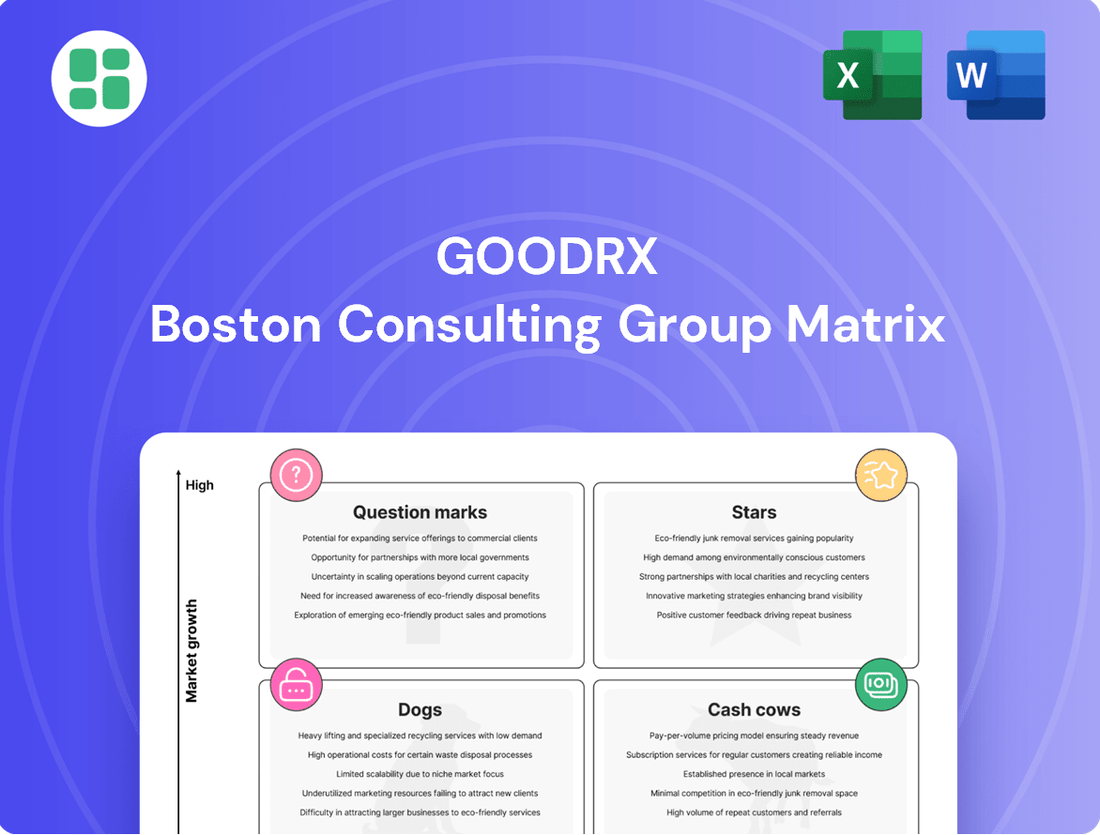

GoodRx's BCG Matrix highlights its diverse product portfolio, categorizing each into Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. Understanding these placements is crucial for effective resource allocation and strategic planning.

Dive deeper into GoodRx's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Pharma Manufacturer Solutions segment is a shining Star for GoodRx, exhibiting robust growth. In Q2 2025, this segment saw an impressive 32% year-over-year revenue increase, and projections indicate a full-year 2025 growth rate of at least 30%.

This performance solidifies GoodRx's high market share within the specialized area of linking drug makers with patients seeking affordability. The market itself is expanding due to a growing need for better drug access and patient assistance initiatives.

GoodRx's strategic investments in this segment underscore its commitment to leveraging this high-growth opportunity for sustained profitability and market dominance in the coming years.

GoodRx is strategically expanding its integrated savings program to encompass brand medications, actively forging direct-to-consumer relationships with pharmaceutical companies. This move aims to unlock deeper discounts for consumers and capitalize on GoodRx's substantial user base and market presence.

This initiative is particularly focused on capturing a larger share of the burgeoning cash-pay market for brand-name drugs. By offering enhanced savings, GoodRx positions itself as a frontrunner in this high-growth segment, which is increasingly important as more consumers opt for out-of-pocket payment options.

In 2024, the pharmaceutical market continued to see a significant portion of sales occurring outside of traditional insurance channels, highlighting the opportunity for direct-to-consumer savings programs. GoodRx's strategy directly addresses this trend, aiming to become a primary destination for affordable brand-name prescriptions.

GoodRx is strategically positioning itself as the premier consumer-centric digital healthcare hub, aiming to bring together a wide array of services. This ambitious vision places the platform squarely in the Star category within the dynamic digital health sector, a market increasingly favoring consolidated and integrated offerings.

The company's ongoing development and integration of new services underscore its dedication to securing and maintaining a dominant, high-growth trajectory in the long term. For instance, in 2023, GoodRx reported a 7% increase in total revenue to $779 million, showcasing continued expansion in a competitive landscape.

Partnerships with Healthcare Professionals (HCPs)

GoodRx's partnerships with healthcare professionals (HCPs) are a cornerstone of its business, positioning it as a significant player in the digital health landscape. In 2024, over 1 million HCPs utilized the GoodRx platform, a testament to its widespread adoption and utility in helping patients access affordable medications. This strong engagement with prescribers is vital for influencing prescription decisions and driving medication adherence.

The company's substantial market share within the HCP engagement sector highlights its critical role in the prescription fulfillment ecosystem. This high adoption rate directly translates to increased prescription volume for pharmaceutical companies and greater access to savings for patients.

Looking ahead, GoodRx is strategically investing in this area, with plans for an expanded HCP product slated for 2026. This forward-looking development signals GoodRx's commitment to further solidifying its position and enhancing its offerings for healthcare providers.

- HCP Platform Usage: Over 1 million healthcare professionals used GoodRx in 2024.

- Market Position: Strong market share in HCP engagement, crucial for prescription volume.

- Future Development: Expanded HCP product planned for 2026, indicating continued investment.

- Impact: Facilitates patient access to affordable medications and drives prescription volume.

Market Penetration in High-Demand Therapeutic Areas

GoodRx is actively pursuing market penetration in high-demand therapeutic areas by forging partnerships with drug manufacturers. This strategy focuses on medications like GLP-1s, which are crucial for managing diabetes and weight loss. The demand for these drugs has surged, with prescription fills doubling in 2024 alone.

By concentrating on these high-growth segments where cost is a significant barrier for many patients, GoodRx is solidifying its position as a key facilitator of access to essential treatments. This approach is instrumental in growing its market share within these rapidly expanding therapeutic categories.

- GLP-1 Prescription Fills: Doubled in 2024, highlighting intense demand.

- Partnerships: Collaborations with manufacturers are central to offering discounts.

- Therapeutic Focus: Emphasis on high-demand areas like diabetes and weight loss.

- Market Position: Aiming to be a leader in providing affordable access to critical medications.

The Pharma Manufacturer Solutions segment is a shining Star for GoodRx, exhibiting robust growth. In Q2 2025, this segment saw an impressive 32% year-over-year revenue increase, and projections indicate a full-year 2025 growth rate of at least 30%. This performance solidifies GoodRx's high market share within the specialized area of linking drug makers with patients seeking affordability. GoodRx is strategically expanding its integrated savings program to encompass brand medications, actively forging direct-to-consumer relationships with pharmaceutical companies, aiming to unlock deeper discounts for consumers and capitalize on GoodRx's substantial user base and market presence.

GoodRx's partnerships with healthcare professionals (HCPs) are a cornerstone of its business, positioning it as a significant player in the digital health landscape. In 2024, over 1 million HCPs utilized the GoodRx platform, a testament to its widespread adoption and utility in helping patients access affordable medications. This strong engagement with prescribers is vital for influencing prescription decisions and driving medication adherence. GoodRx is strategically positioning itself as the premier consumer-centric digital healthcare hub, aiming to bring together a wide array of services, placing the platform squarely in the Star category within the dynamic digital health sector.

GoodRx is actively pursuing market penetration in high-demand therapeutic areas by forging partnerships with drug manufacturers, focusing on medications like GLP-1s. The demand for these drugs has surged, with prescription fills doubling in 2024 alone. By concentrating on these high-growth segments where cost is a significant barrier for many patients, GoodRx is solidifying its position as a key facilitator of access to essential treatments.

| Segment | Growth Rate (YoY) | Key Driver | 2024 Metric | Future Outlook |

| Pharma Manufacturer Solutions | 32% (Q2 2025) | Linking drug makers with patients | N/A | Projected 30%+ full-year 2025 growth |

| Digital Health Hub (HCP Engagement) | N/A | Consolidated services, HCP partnerships | 1M+ HCPs used platform in 2024 | Expanded HCP product in 2026 |

| High-Demand Therapeutics (e.g., GLP-1s) | N/A | Partnerships for affordable access | Prescription fills doubled in 2024 | Continued focus on access in growing categories |

What is included in the product

The GoodRx BCG Matrix offers tailored analysis of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework highlights which units to invest in, hold, or divest based on market share and growth potential.

GoodRx's BCG Matrix offers a clear, visual overview of its business units, simplifying complex strategic decisions.

Cash Cows

The Core Prescription Discount Card and Coupon Service is GoodRx's bedrock, boasting a commanding presence in prescription savings with access to over 70,000 pharmacies.

Despite a minor dip in prescription transaction revenue in Q2 2025, this segment remains a significant cash generator. Its established brand and loyal user base mean it requires minimal promotional spending to maintain its strong performance.

GoodRx's existing pharmacy network is a significant asset, acting as a cash cow within its business model. This mature network, encompassing major chains and independent pharmacies nationwide, ensures widespread consumer access to discounted medications. This established infrastructure provides a consistent and reliable revenue stream, as the heavy lifting of network development is largely complete.

GoodRx boasts a substantial and loyal consumer base, with nearly 30 million unique users in 2024. This extensive reach translates into strong brand recognition within the prescription savings market.

The company's established presence ensures consistent user engagement and a steady flow of transactions. This reliability in revenue generation means GoodRx can allocate fewer resources to marketing efforts compared to emerging products.

Advertising and Marketing Revenue from Pharmacies

Advertising and marketing revenue from pharmacies represents a strong Cash Cow for GoodRx. The company's substantial user base and high transaction volume allow it to charge significant fees to pharmacies. These pharmacies, in turn, benefit from the increased foot traffic and prescription fills generated by GoodRx users.

This revenue stream is a testament to GoodRx's dominant market share and its well-established platform. Because it already holds a strong position, maintaining this revenue requires relatively low investment in growth initiatives.

- High Market Share: GoodRx leverages its established platform and large user base to attract pharmacy advertising.

- Pharmacy Benefits: Pharmacies pay for placement and advertising to gain visibility and drive prescription fills from GoodRx users.

- Low Growth Investment: As a Cash Cow, this segment requires minimal investment to sustain its strong revenue generation.

- Revenue Driver: In 2023, GoodRx reported total revenue of $779 million, with its largest segment being prescription segments, which includes advertising and marketing fees from pharmacies.

Basic Subscription Offerings (e.g., GoodRx Gold)

The GoodRx Gold subscription, while facing overall revenue headwinds from partnership shifts, stands as a prime example of a cash cow within the company's BCG matrix. This mature offering continues to deliver consistent, recurring revenue from a dedicated user base prioritizing significant prescription savings.

Despite limited new growth potential in this particular segment, GoodRx Gold reliably generates steady cash flow. This makes it a valuable asset to be "milked" for its ongoing financial contributions, supporting other areas of the business.

- Recurring Revenue: GoodRx Gold provides a stable stream of income from its loyal subscriber base.

- Mature Offering: While growth is limited, its established position ensures consistent cash generation.

- Cash Flow Generation: The subscription acts as a reliable source of funds to support the company's operations and investments.

- Strategic Importance: Its cash cow status allows GoodRx to allocate resources to high-growth potential areas.

GoodRx's core prescription discount card and coupon service, along with its advertising and marketing revenue from pharmacies, firmly represent its Cash Cows. These segments benefit from a high market share and a substantial, loyal user base of nearly 30 million unique users in 2024, requiring minimal new investment to maintain their strong revenue generation.

The GoodRx Gold subscription also functions as a cash cow, providing consistent, recurring revenue from a dedicated user base. Despite limited growth potential, its established position ensures reliable cash flow, supporting other business areas.

| Segment | Market Share | Growth Potential | Revenue Contribution (2023) | Investment Required |

|---|---|---|---|---|

| Prescription Discount & Coupon Service | High | Low | Largest Segment (part of $779M total revenue) | Low |

| Pharmacy Advertising & Marketing | High | Low | Significant | Low |

| GoodRx Gold Subscription | Moderate | Low | Consistent Recurring Revenue | Low |

What You’re Viewing Is Included

GoodRx BCG Matrix

The BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase, ensuring complete transparency and immediate utility. This comprehensive analysis, detailing GoodRx's strategic positioning within the pharmaceutical and healthcare landscape, is ready for immediate integration into your business planning. You can confidently expect the same high-quality, data-driven insights that are crucial for understanding market dynamics and competitive advantages. Once purchased, this report will be directly accessible, enabling you to leverage its strategic framework without delay.

Dogs

The discontinuation of programs like the Kroger Savings Club directly impacted GoodRx's subscription revenue, leading to a notable decline in that specific segment. These initiatives represent past ventures that no longer contribute significantly to the company's overall revenue or market share.

The bankruptcy of significant retail partners, such as Rite Aid, has created a direct impact on GoodRx's integrated savings program. This has resulted in an estimated $35-40 million loss in projected revenue for the program in 2025.

This segment of the ISP, specifically linked to the shrinking presence of retail pharmacies, is characterized by low growth and low market share. Consequently, it acts as a drain on resources, primarily due to forces outside of GoodRx's direct control.

Underperforming niche telehealth verticals within GoodRx's portfolio would likely represent services that have struggled to gain meaningful user adoption or market share. These could be specialized offerings that haven't resonated with consumers or faced intense competition, leading to low revenue generation relative to the investment. For example, a niche mental health platform or a specialized chronic condition management service that hasn't met user acquisition targets would fit here.

These underperforming areas are essentially consuming valuable resources, such as development costs and marketing spend, without yielding significant returns. In 2023, GoodRx's overall revenue grew by 3% to $770 million, but specific telehealth initiatives that aren't contributing to this growth would be a concern. Identifying these underperformers is crucial for strategic resource allocation, potentially leading to decisions about divesting or significantly revamping these services.

Legacy or Outdated Platform Features with Low Engagement

Legacy or outdated platform features with low engagement represent GoodRx's potential Dogs in the BCG Matrix. These are functionalities that users rarely interact with, showing minimal engagement metrics. For instance, if a specific tool within the app, like a seldom-used prescription price comparison for a niche medication category, has seen less than 0.5% of active users engage with it in the last quarter, it falls into this category. Such features often continue to incur maintenance expenses, such as server upkeep or software updates, without generating significant user value or contributing to market share growth.

- Low User Interaction: Features with less than 1% daily active user engagement.

- High Maintenance Costs: Ongoing expenses for features that don't drive revenue or user growth.

- No Strategic Value: Elements that do not differentiate GoodRx or attract new customer segments.

- Potential for Discontinuation: These features may be candidates for removal to reallocate resources.

Segments with High Competition and No Clear Differentiation

Segments with High Competition and No Clear Differentiation, often found in the prescription discount market, represent areas where GoodRx faces a crowded field of similar providers. These are sub-segments where it's tough to stand out. Think of numerous smaller discount card companies offering very similar services without a truly unique selling point. These "Dogs" in the BCG matrix struggle to gain traction or make substantial profits because they don't offer anything distinct to consumers.

In 2024, the prescription discount market continues to be highly fragmented. While GoodRx has established a strong brand, many smaller players operate with minimal differentiation. For instance, a significant portion of the market consists of providers who simply offer a discount card with no additional value-added services or specialized focus. This lack of unique value proposition makes it difficult for these offerings to capture or retain market share against more established or innovative solutions.

- Market Saturation: The prescription discount industry sees numerous small players offering basic discount cards, leading to intense competition.

- Lack of Differentiation: Many competitors in these segments fail to provide a unique value proposition or competitive advantage.

- Struggling Growth: These undifferentiated offerings often find it challenging to increase their market share or achieve significant profitability.

- Consumer Choice Overload: Consumers are presented with many similar options, making it harder for less distinct services to gain recognition.

GoodRx's "Dogs" in the BCG Matrix likely encompass legacy platform features with low user engagement and niche telehealth verticals that haven't gained traction. These segments, like outdated tools with minimal interaction or specialized health services struggling for adoption, consume resources without contributing significantly to growth or market share. For example, features used by less than 0.5% of active users in a quarter, or telehealth offerings with low user acquisition targets, fall into this category.

The company also faces "Dogs" in highly competitive, undifferentiated segments of the prescription discount market. These are areas where numerous small providers offer similar basic discount cards, making it hard for any single entity to stand out. In 2024, this market saturation means many smaller players struggle to gain or retain market share due to a lack of unique value propositions.

These underperforming areas, such as the ISP segment linked to the shrinking presence of retail pharmacies, are characterized by low growth and low market share. The bankruptcy of partners like Rite Aid, for instance, projected a $35-40 million revenue loss for GoodRx's integrated savings program in 2025, highlighting the challenges in these "Dog" categories.

The discontinuation of programs like the Kroger Savings Club also illustrates how past ventures can become "Dogs" if they no longer contribute significantly to revenue or market share, acting as drains on resources without yielding returns.

Question Marks

GoodRx Care's telehealth services, offering virtual consultations, are positioned within a booming U.S. telehealth market. This sector is expected to see substantial growth, with projections indicating a Compound Annual Growth Rate (CAGR) that could reach impressive levels by 2030, reflecting increasing consumer adoption and technological advancements.

While these virtual health offerings hold significant growth potential and meet a clear demand for accessible healthcare, GoodRx's current market share in the overall telehealth space is relatively modest. This contrasts with its established, dominant position in prescription savings, suggesting an opportunity for expansion and increased penetration.

GoodRx's new condition-specific subscription services, like those for erectile dysfunction and planned expansions into weight loss and hair loss, represent a strategic move into high-demand therapeutic areas. These services are currently in their nascent stages, meaning they have a low market share within the broader prescription drug market.

However, their focus on significant unmet needs positions them as potential future Stars in the GoodRx BCG Matrix. This means they require substantial investment to capture market share and achieve growth. For instance, the telehealth market, which these services tap into, saw significant growth, with some estimates suggesting a compound annual growth rate of over 20% in the years leading up to 2024.

GoodRx's new e-commerce platform for over-the-counter (OTC) medications, launched in October 2024 with Opill, marks a strategic move into a burgeoning market. This initiative positions GoodRx to capture a share of the rapidly expanding direct-to-consumer health product sales, which are projected to reach $130 billion in the US by 2027, according to industry reports.

As a new entrant, this OTC e-commerce solution is currently a question mark for GoodRx. While it taps into a high-growth area, its market share within the broader OTC space is minimal, requiring significant investment to build brand recognition and customer adoption. This early stage necessitates careful observation of its development and competitive response.

Integration into Electronic Health Records (EHR) and Digital Workflows

GoodRx is actively pursuing integration of its prescription pricing tools directly into Electronic Health Records (EHR) and broader digital clinical workflows. This move aims to enhance provider efficiency by embedding cost transparency at the point of care, potentially improving patient adherence and reducing out-of-pocket expenses. While this represents a significant strategic direction for GoodRx, targeting a rapidly growing segment of digital health solutions, it's important to note that this initiative is still in its nascent stages of development and market adoption for the company.

The potential impact of this integration is substantial, as it seeks to address a critical need for cost-effective prescription management within the healthcare system. By embedding GoodRx's capabilities into existing provider workflows, the company is positioning itself to capture a share of the expanding digital health market, which saw significant investment and growth in 2023 and is projected to continue its upward trajectory through 2024. This strategic push aligns with broader industry trends toward value-based care and improved patient financial engagement.

- EHR Integration: GoodRx is developing partnerships and technical solutions to embed its pricing information and savings tools directly within EHR systems used by physicians and pharmacists.

- Workflow Enhancement: The goal is to streamline the prescription process for providers, allowing them to easily present cost-saving options to patients without disrupting their existing clinical routines.

- Market Penetration: While this is a high-growth area, GoodRx's penetration in this specific niche is still in its early phases, indicating significant future potential and ongoing development efforts.

- Patient Access Focus: This strategy is designed to improve patient access to affordable medications by providing real-time cost information and savings opportunities directly within the care setting.

Expansion into Broader Healthcare Services

GoodRx's ambition to evolve into a holistic digital healthcare hub positions its expansion into broader services as a potential star in the BCG matrix. These ventures, while targeting high-growth sectors, are currently in nascent stages with minimal market penetration. Significant capital infusion will be necessary to nurture these initiatives and establish a strong foothold.

For instance, exploring areas like chronic disease management platforms or specialized virtual care services aligns with their mission. These require substantial R&D and marketing to gain traction. As of early 2024, GoodRx reported a 10% year-over-year increase in its telehealth business, indicating a growing, albeit still developing, market presence for its digital health offerings.

- Targeting High-Growth Niches: Expansion into areas like mental health support or personalized wellness programs taps into rapidly expanding digital health markets.

- Low Initial Market Share: These new service lines, while promising, begin with a small percentage of the overall addressable market, necessitating aggressive growth strategies.

- Significant Investment Required: Building out the infrastructure, technology, and user acquisition for these broader services demands substantial financial commitment, potentially impacting short-term profitability.

- Potential for Future Stars: Successful development and scaling of these broader services could transform them into significant revenue drivers for GoodRx in the coming years.

GoodRx's new e-commerce platform for over-the-counter (OTC) medications, including the October 2024 launch with Opill, represents a strategic move into a high-growth market. This initiative aims to capture a share of the rapidly expanding direct-to-consumer health product sales, projected to reach $130 billion in the US by 2027. As a new entrant, this OTC e-commerce solution is currently a question mark, requiring significant investment to build brand recognition and customer adoption in a market where its share is minimal.

GoodRx's integration of prescription savings tools into Electronic Health Records (EHR) is another question mark. This strategy targets a growing segment of digital health solutions aimed at improving provider efficiency and patient access to affordable medications. Despite the potential impact and alignment with value-based care trends, this initiative is still in its early stages of development and market adoption as of 2024.

The company's expansion into broader digital health services, such as chronic disease management platforms, also falls into the question mark category. These ventures, while targeting high-growth sectors, have minimal market penetration and require substantial investment for R&D and marketing. GoodRx reported a 10% year-over-year increase in its telehealth business in early 2024, indicating nascent but growing traction in these new areas.

These question mark initiatives, including the OTC e-commerce platform and EHR integration, represent areas with high growth potential but currently low market share for GoodRx. They require significant investment to establish a foothold and gain traction, making their future success uncertain but potentially very rewarding if they mature into Stars.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| OTC E-commerce Platform | High (US market projected $130B by 2027) | Minimal | High | Question Mark |

| EHR Integration | High (growing digital health solutions) | Nascent | High | Question Mark |

| Broader Digital Health Services | High (e.g., telehealth, chronic disease management) | Low (e.g., 10% YoY telehealth growth early 2024) | Substantial | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages extensive data from public company filings, market research reports, and industry-specific databases to accurately assess market share and growth potential.