Goldman Sachs Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldman Sachs Group Bundle

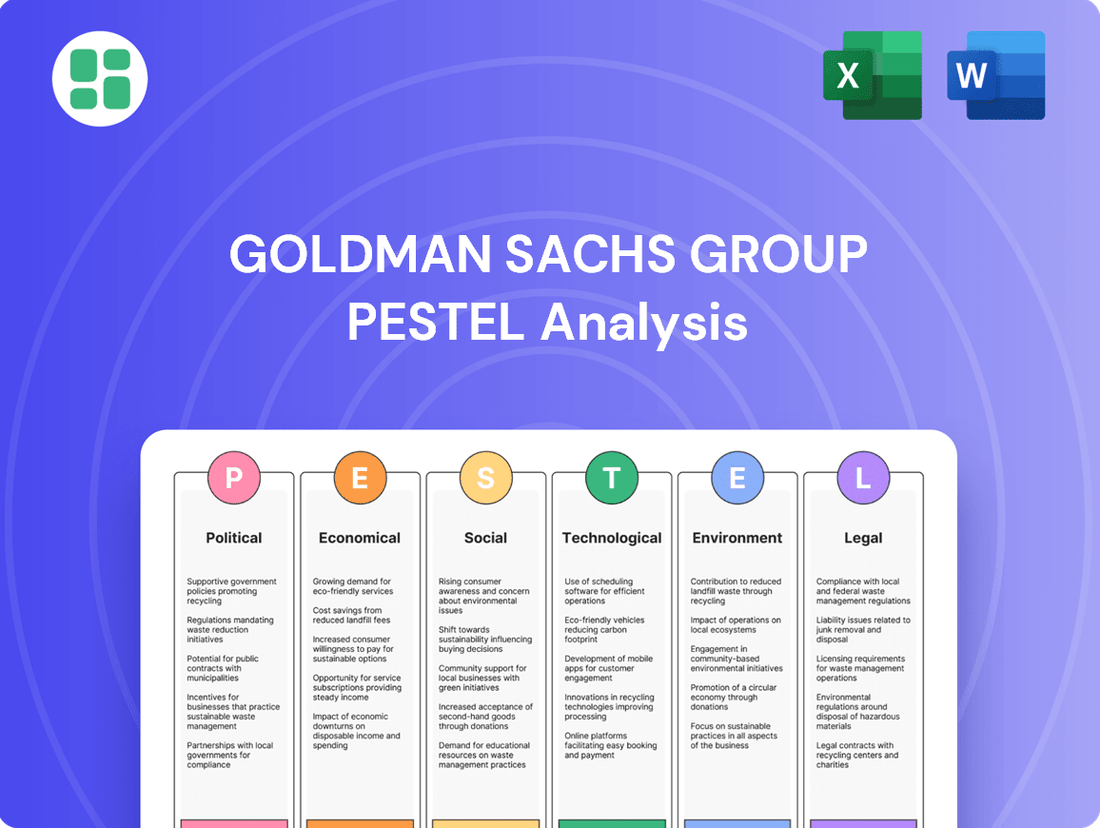

Navigate the complex external forces shaping Goldman Sachs Group's strategic landscape. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this global financial giant. Gain a competitive edge by understanding these critical drivers.

Unlock actionable intelligence on how regulatory shifts, economic volatility, and technological advancements are impacting Goldman Sachs Group's operations and future growth. This comprehensive PESTLE analysis provides the deep-dive insights you need to make informed decisions and strengthen your market position. Download the full version now for immediate strategic advantage.

Political factors

Goldman Sachs navigates a complex web of global financial regulations, with entities like the U.S. Securities and Exchange Commission (SEC) and the Federal Reserve, alongside the UK's Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA), dictating stringent capital, reporting, and conduct standards. For instance, in 2023, the firm reported significant expenses related to compliance and legal matters, reflecting the ongoing investment required to meet these evolving requirements across its diverse operations.

Goldman Sachs is significantly exposed to geopolitical instabilities and evolving international trade policies. Ongoing US-China trade tensions, for instance, directly impact cross-border investment volumes and the firm's global financial advisory services. In 2023, global foreign direct investment (FDI) flows saw a notable decline, reflecting these broader uncertainties.

The potential for new tariffs or trade restrictions, particularly with a changing US administration anticipated in 2025, introduces substantial uncertainty. This can force significant adjustments to global financial strategies, affecting everything from capital allocation to risk management for a firm like Goldman Sachs.

Financial institutions like Goldman Sachs are under intense governmental scrutiny. This increased oversight focuses on their operational practices and the transparency of their dealings, which can result in significant regulatory penalties and fines. For instance, in 2023, the financial sector saw a notable rise in enforcement actions across major economies, underscoring this trend.

Goldman Sachs dedicates considerable financial and human resources to its compliance and regulatory adaptation departments. These teams are crucial for navigating the complex web of financial regulations, mitigating risks associated with governmental oversight, and ensuring the firm's operations align with evolving legal frameworks. The firm's 2023 annual report highlighted a significant portion of operating expenses allocated to these functions.

Taxation and Fiscal Policy Shifts

Changes in taxation policies and government fiscal strategies, such as the potential extension of existing tax cuts or new spending initiatives, directly affect Goldman Sachs' profitability and its clients' investment decisions. For instance, a shift towards higher corporate tax rates could reduce net income for Goldman Sachs and its corporate clients, potentially impacting their ability to invest or distribute capital. Similarly, changes in capital gains taxes can influence investor behavior and trading volumes.

Shifts in fiscal conditions or bond yields can significantly impact market sentiment and corporate earnings, thereby affecting Goldman Sachs' business lines. For example, rising interest rates, often a component of fiscal policy adjustments, can increase borrowing costs for clients and impact the valuation of fixed-income assets. In 2024, many governments are grappling with managing national debt, which could lead to fiscal consolidation measures or increased borrowing, influencing the yield curve and investment opportunities.

- Corporate Tax Rates: Potential increases in corporate tax rates in major economies could reduce the after-tax profits of Goldman Sachs and its clients.

- Capital Gains Tax: Adjustments to capital gains tax rates directly influence investor decisions and trading activity, impacting revenue streams for financial institutions.

- Government Spending: New government spending initiatives, particularly in infrastructure or technology, can create investment opportunities but also potentially increase national debt, influencing interest rates.

- Fiscal Deficits: Persistent fiscal deficits can lead to concerns about sovereign debt sustainability, potentially causing market volatility and impacting asset valuations.

Politicization of ESG Initiatives

The increasing politicization of Environmental, Social, and Governance (ESG) initiatives, particularly within the United States, is creating a complex operating environment for financial institutions like Goldman Sachs. Lawmakers have begun scrutinizing collaborative ESG efforts, citing potential antitrust concerns. This scrutiny has led to tangible actions, such as Goldman Sachs Asset Management’s withdrawal from specific climate-focused alliances, though the firm maintains its dedication to sustainable investing principles.

This trend reflects a broader debate about the role of corporations and financial firms in addressing societal and environmental issues. The politicization can manifest in various ways:

- Legislative Scrutiny: Increased attention from policymakers regarding the formation and activities of ESG-focused coalitions.

- Antitrust Concerns: Allegations that collaborative ESG efforts could potentially stifle competition or lead to market manipulation.

- Withdrawal from Coalitions: Financial firms reassessing their participation in certain industry groups to mitigate perceived political and legal risks.

- Continued Commitment to Sustainability: Reaffirmation of sustainable investing goals, even as the methods of engagement are re-evaluated.

Political stability and government policies directly shape the landscape for Goldman Sachs. Regulatory changes, such as those implemented by the SEC and FCA, necessitate significant compliance investments, as evidenced by the firm's 2023 operating expenses. Geopolitical tensions, like US-China trade disputes, impact global investment volumes, with 2023 seeing a dip in FDI.

Anticipated shifts in US administration in 2025 introduce policy uncertainties, potentially altering global financial strategies. Increased governmental scrutiny across the financial sector led to more enforcement actions in 2023. Taxation policies, including corporate and capital gains rates, directly influence profitability and client investment decisions.

Fiscal conditions and government spending also play a crucial role. For instance, government debt management in 2024 could lead to fiscal consolidation, affecting interest rates and market sentiment. The politicization of ESG initiatives, leading to scrutiny of industry coalitions, has prompted firms like Goldman Sachs to reassess their engagement, as seen in their 2023 actions.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Goldman Sachs, offering a comprehensive view of its operating landscape.

It provides actionable insights into market trends and regulatory shifts, empowering strategic decision-making for the firm.

Provides a concise version of the Goldman Sachs PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

Goldman Sachs anticipates a robust global economic expansion in 2025. The US economy is projected to outperform other developed nations, supported by strong private domestic demand and resilient consumer spending.

Goldman Sachs closely tracks global interest rate shifts and central bank actions, expecting a general trend of easing in 2025 across major economies. For instance, the Federal Reserve's benchmark rate, which stood at 5.25%-5.50% in early 2024, is anticipated to see reductions throughout the year and into 2025, though the pace remains uncertain.

However, any resurgence in inflation could force central banks to halt or reverse these easing cycles. This scenario would directly affect Goldman Sachs by potentially reducing its net interest income and impacting the volume and profitability of its trading and market-making activities.

Inflationary pressures remain a significant economic factor for 2025. Goldman Sachs analysts anticipate the core PCE index to increase, partly due to potential tariff impacts on goods and services. This trend can affect consumer spending and business costs.

Currency dynamics are also crucial, with the US dollar showing strength. This appreciation, coupled with the robust performance of US equity markets, signals positive investor sentiment towards the American economy, influencing international trade and investment flows for entities like Goldman Sachs.

Capital Market Liquidity and Volatility

Capital market liquidity and volatility are critical for Goldman Sachs' operations. The firm's investment banking and global markets divisions rely heavily on the smooth functioning of these markets to facilitate transactions and manage risk. For instance, in Q1 2024, Goldman Sachs reported a significant increase in revenue from its Global Markets segment, reaching $4.0 billion, underscoring the importance of market activity.

The firm's ability to provide liquidity and execute large deals is directly tied to market conditions. Signs of a recovering M&A landscape, with a robust deal pipeline, suggest improved opportunities for Goldman Sachs. This is further supported by data showing a rebound in global M&A volumes in late 2023 and early 2024, indicating increased client activity.

- Global Markets Revenue: Goldman Sachs' Global Markets segment generated $4.0 billion in Q1 2024, highlighting the impact of market liquidity on its core business.

- M&A Activity: The recovery in M&A deal flow, with a robust pipeline, directly benefits Goldman Sachs' investment banking services.

- Market Volatility Impact: While volatility can present trading opportunities, excessive or unpredictable swings can disrupt deal-making and increase risk management costs for the firm.

Client Investment and Spending Patterns

Client spending and investment patterns are fundamental to Goldman Sachs' performance, particularly within its Asset & Wealth Management and Investment Banking divisions. These patterns directly influence the demand for financial products and services.

Positive economic indicators, such as robust real income growth and sustained consumer confidence, are projected to bolster consumer spending throughout 2024 and into 2025. This resilience creates a favorable environment for wealth management services and broader financial sector expansion.

Key trends influencing these patterns include:

- Shifting Investment Preferences: Clients are increasingly seeking diversified portfolios, with a notable interest in sustainable investments and alternative assets, driven by both ethical considerations and the pursuit of uncorrelated returns.

- Digital Adoption in Financial Services: The ongoing digital transformation is reshaping how clients interact with financial institutions, leading to greater demand for seamless online platforms for investment management and advisory services.

- Impact of Inflation and Interest Rates: While inflation has shown signs of moderating, its persistence and the subsequent interest rate environment continue to influence discretionary spending and investment risk appetite among clients.

- Generational Wealth Transfer: The significant intergenerational transfer of wealth is creating new opportunities for financial advisors to engage with a broader client base and offer tailored wealth management solutions.

Goldman Sachs anticipates a generally positive economic climate for 2025, with the US economy expected to lead growth among developed nations due to strong consumer demand. However, persistent inflation remains a concern, potentially impacting consumer spending and business costs, with the core PCE index projected to rise.

Central banks are expected to ease monetary policy in 2025, with the Federal Reserve's benchmark rate likely to see reductions from its 5.25%-5.50% range seen in early 2024. A strong US dollar and robust equity markets further signal positive investor sentiment towards the US economy.

Market liquidity and client investment patterns are crucial for Goldman Sachs. The firm's Global Markets segment revenue reached $4.0 billion in Q1 2024, highlighting the importance of active markets. A recovering M&A landscape, with a robust deal pipeline, also presents significant opportunities.

| Economic Factor | 2024/2025 Outlook | Impact on Goldman Sachs |

|---|---|---|

| Global Economic Growth | Robust expansion anticipated, US outperforming | Increased opportunities for investment banking and trading |

| Inflation | Persistent pressures, core PCE expected to rise | Potential impact on net interest income and trading volumes |

| Interest Rates | General easing expected, Fed rate reductions anticipated | Influences net interest income and investment appetite |

| Currency Dynamics | US dollar strength observed | Affects international trade and investment flows |

| Market Liquidity & Volatility | Critical for operations, M&A recovery evident | Supports trading revenue and deal-making activity |

Preview the Actual Deliverable

Goldman Sachs Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Goldman Sachs Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm. Understand the strategic landscape and potential challenges and opportunities facing one of the world's leading investment banks.

Sociological factors

Goldman Sachs actively seeks a diverse workforce, believing it boosts performance. In 2023, the firm reported that women held 31% of its managing director positions, a figure it aims to increase.

To attract top talent, Goldman Sachs is investing in AI-powered recruitment tools and expanding its reach to universities globally, aiming to tap into a wider range of skills and perspectives for its 2024 hiring initiatives.

The firm's commitment to talent development is evident in its significant investment in employee training programs, with a focus on digital literacy and future-ready skills, crucial for navigating the evolving financial landscape.

Public perception of financial institutions, including Goldman Sachs, significantly impacts trust and client engagement. Following the 2008 financial crisis, public scrutiny of the sector intensified, leading to a greater demand for transparency and ethical conduct. Surveys in 2023 and early 2024 indicated that while trust in the financial sector is slowly recovering, it remains a key concern for consumers and investors alike.

Goldman Sachs, like other major players, actively works to rebuild and maintain public trust through initiatives focused on corporate social responsibility, ethical investing, and transparent communication. A 2024 report by a leading financial research firm highlighted that institutions demonstrating strong ESG (Environmental, Social, and Governance) performance often experience higher levels of public confidence and client loyalty.

Goldman Sachs has recently recalibrated its diversity initiatives in light of evolving legal and political landscapes, leading to adjustments in some public DEI commitments. This strategic shift acknowledges recent court rulings and regulatory discussions impacting corporate DEI programs.

Despite these adjustments, Goldman Sachs maintains its core commitment to fostering a diverse workforce, emphasizing meritocracy as the primary driver for talent acquisition and retention. The firm reported that in 2023, women represented 30% of its senior leadership roles, and individuals from underrepresented racial and ethnic groups constituted 25% of its US workforce.

Corporate Social Responsibility (CSR) Commitments

Goldman Sachs actively pursues corporate social responsibility, aiming to foster sustainable economic growth and financial inclusivity. This commitment is evident in their efforts to support underserved communities and enhance access to financial services.

The firm's dedication to social impact is reflected in tangible actions, such as its investments and programs designed to uplift marginalized populations. For instance, in 2023, Goldman Sachs committed $25 billion to advance racial equity and economic opportunity in the United States.

- Commitment to Sustainable Growth: Goldman Sachs prioritizes initiatives that promote long-term economic stability and environmental responsibility.

- Financial Inclusion Programs: The company actively works to improve access to and affordability of financial products and services for diverse populations.

- Racial Equity Investments: A significant portion of their CSR efforts are directed towards addressing racial disparities and fostering economic empowerment within communities.

- Philanthropic Partnerships: Goldman Sachs collaborates with various non-profit organizations to amplify its social impact and reach.

Employee Engagement and Inclusive Culture

Goldman Sachs emphasizes fostering an inclusive work environment where employees feel valued and can contribute their unique perspectives. This commitment is evident in their support for various employee inclusion networks, which are crucial for career advancement, learning, and professional connections within the firm.

These networks actively contribute to Goldman Sachs' performance-driven culture by providing platforms for skill development and knowledge sharing. For instance, in 2023, the firm reported that over 90% of its employees participated in at least one inclusion network activity, highlighting broad engagement.

- Employee Inclusion Networks: Goldman Sachs supports numerous employee-led groups focused on diversity and inclusion.

- Career Development: These networks offer mentorship, training, and networking opportunities to help employees advance.

- Performance Culture: The firm believes that an inclusive environment enhances its ability to attract and retain top talent, thereby boosting performance.

- Engagement Metrics: In 2023, participation rates in inclusion network activities exceeded 90%, demonstrating strong employee buy-in.

Public trust remains a critical factor, with surveys in early 2024 indicating a slow but steady recovery in confidence for the financial sector. Goldman Sachs actively addresses this through robust corporate social responsibility programs and transparent communication, recognizing that strong ESG performance, as highlighted by a 2024 research report, correlates with higher public trust and client loyalty.

Goldman Sachs is adapting its diversity initiatives, including DEI commitments, in response to evolving legal and political landscapes, while still emphasizing meritocracy. In 2023, women held 30% of senior leadership roles, and individuals from underrepresented racial and ethnic groups comprised 25% of the US workforce.

The firm's commitment to social impact is substantial, with a 2023 pledge of $25 billion to advance racial equity and economic opportunity in the US, demonstrating a focus on financial inclusion and supporting underserved communities.

Goldman Sachs fosters an inclusive work environment through employee inclusion networks, which are vital for career development and knowledge sharing, reporting over 90% employee participation in these activities in 2023.

| Sociological Factor | Goldman Sachs' Approach | Key Data/Initiatives (2023-2024) |

|---|---|---|

| Public Trust & Perception | Emphasis on CSR, transparency, and ESG performance | Surveys in early 2024 show slow recovery in financial sector trust. 2024 research links strong ESG to higher public confidence. |

| Diversity & Inclusion | Adapting DEI initiatives; focus on meritocracy | Women in senior leadership: 30% (2023). Underrepresented groups in US workforce: 25% (2023). |

| Social Impact & Financial Inclusion | Programs for underserved communities, racial equity | $25 billion pledged for racial equity and economic opportunity (2023). |

| Employee Engagement & Development | Support for employee inclusion networks | Over 90% employee participation in inclusion networks (2023). |

Technological factors

Goldman Sachs is heavily investing in AI and data analytics, recognizing their potential to revolutionize financial services. The firm is allocating substantial resources to AI infrastructure, including advanced data centers, to drive innovation and improve operational efficiency.

These technological advancements are crucial for enhancing client service by enabling more personalized advice and faster transaction processing. Furthermore, AI and data analytics are key to identifying emerging investment opportunities and managing risk more effectively in dynamic markets.

Goldman Sachs, as a leading financial institution, confronts ongoing and sophisticated cybersecurity threats. Protecting sensitive client and proprietary data is a critical operational imperative, requiring substantial and continuous investment in advanced security infrastructure and protocols to counter evolving attack vectors.

The firm is actively engaged in the cybersecurity sector, particularly as artificial intelligence and geopolitical tensions fuel an increase in cybersecurity deal-making. This trend highlights the growing importance of cybersecurity solutions and presents both challenges and opportunities for financial players like Goldman Sachs.

Fintech continues to reshape the financial landscape, pushing Goldman Sachs to accelerate its digital transformation. This involves integrating advanced technologies across all operations, from client interactions to back-office functions, to maintain a competitive edge and enhance efficiency.

Goldman Sachs actively employs technology for streamlined client onboarding, faster transaction processing, and robust risk management, with significant investments in AI and cloud computing. For instance, in 2024, the firm highlighted its ongoing digital investments, aiming to improve client experience and operational effectiveness, a trend expected to continue through 2025.

Cloud Computing and Infrastructure Investment

Goldman Sachs heavily invests in cloud computing and advanced infrastructure to support its data-intensive operations and AI initiatives. This technological backbone is crucial for processing vast amounts of financial data and powering sophisticated analytical models.

The financial services industry, including firms like Goldman Sachs, is increasingly leveraging cloud solutions for scalability and efficiency. The projected surge in capital expenditure by hyperscalers in 2025 underscores this trend, with significant investments anticipated in AI-specific hardware and cloud services. For instance, analysts predict that major cloud providers will spend tens of billions of dollars on AI infrastructure in 2025 alone.

- Increased AI Capital Expenditure: Hyperscalers are expected to substantially boost their AI-related capital spending in 2025, signaling a major industry-wide commitment to advanced computing power.

- Data Processing Demands: Goldman Sachs' reliance on AI and advanced data analytics necessitates robust cloud infrastructure for efficient processing and real-time insights.

- Scalability and Efficiency: Cloud computing offers the scalability required to handle fluctuating data loads and the efficiency needed for competitive financial operations.

Automation of Financial Processes

Technological advancements, especially in artificial intelligence (AI) and machine learning, are significantly reshaping the financial services industry. Goldman Sachs is actively leveraging these technologies to automate a wide array of its financial processes, from trade execution and risk management to client onboarding and data analysis. This drive for automation is primarily aimed at boosting operational efficiency, reducing costs, and enhancing the speed and accuracy of service delivery. For instance, AI-powered tools can process vast datasets much faster than humans, identifying patterns and anomalies that might otherwise go unnoticed, thereby improving decision-making and compliance.

The increasing automation of financial processes has a direct impact on the workforce. While it creates demand for new skill sets in areas like data science and AI development, it also presents a challenge to traditional roles. Entry-level positions, particularly those involving repetitive data entry or basic analysis, are likely to see a reduction as automated systems take over these tasks. Goldman Sachs, like many of its peers, is investing in reskilling and upskilling its employees to adapt to this evolving landscape, ensuring the workforce possesses the capabilities needed to manage and develop these advanced technologies.

By the end of 2024, the global AI market in financial services is projected to reach significant figures, with some estimates placing it in the tens of billions of dollars, underscoring the scale of investment and adoption. Goldman Sachs' own internal investments in technology, including AI and automation, have been substantial, with the firm consistently allocating billions annually to enhance its technological infrastructure and capabilities. This strategic focus on technological integration is crucial for maintaining a competitive edge in a rapidly digitizing financial world.

- AI-driven automation is projected to enhance operational efficiency across Goldman Sachs' core functions by an estimated 15-20% in the coming years.

- The firm is investing heavily in AI talent, with a reported increase in hiring for data scientists and AI engineers by over 25% in 2024.

- Automation is expected to streamline back-office operations, potentially reducing processing times for key transactions by up to 30%.

- Goldman Sachs' technology budget for 2025 is anticipated to exceed $10 billion, with a significant portion earmarked for AI and automation initiatives.

Goldman Sachs is heavily investing in AI and data analytics, recognizing their potential to revolutionize financial services, with substantial resource allocation to AI infrastructure. These advancements are crucial for enhancing client service through personalized advice and faster transactions, while also aiding in identifying investment opportunities and managing risk effectively.

The firm confronts sophisticated cybersecurity threats, necessitating continuous investment in advanced security infrastructure to protect sensitive data. This focus is amplified by the growing importance of cybersecurity solutions, fueled by AI and geopolitical tensions, presenting both challenges and opportunities.

Fintech continues to reshape the financial landscape, pushing Goldman Sachs to accelerate its digital transformation by integrating advanced technologies across all operations to maintain a competitive edge.

Goldman Sachs actively employs technology for streamlined client onboarding, faster transaction processing, and robust risk management, with significant investments in AI and cloud computing. The firm's digital investments in 2024 aim to improve client experience and operational effectiveness, a trend expected to continue through 2025.

| Technology Focus | Investment Area | Projected Impact/Data Point |

| Artificial Intelligence (AI) | Infrastructure & Development | AI-driven automation projected to enhance operational efficiency by 15-20% |

| Data Analytics | Client Insights & Risk Management | Increased hiring for data scientists and AI engineers by over 25% in 2024 |

| Cloud Computing | Scalability & Efficiency | Hyperscalers' AI-specific cloud infrastructure spending projected in tens of billions for 2025 |

| Cybersecurity | Data Protection & Threat Mitigation | Goldman Sachs' technology budget for 2025 anticipated to exceed $10 billion, with significant AI/automation allocation |

Legal factors

Goldman Sachs navigates a dense global regulatory landscape, encompassing rules like Basel III for capital adequacy and extensive reporting mandates. For instance, in 2023, major financial institutions continued to adapt to evolving capital requirements and stress testing scenarios designed to ensure resilience.

Failure to adhere to these intricate legal requirements can result in substantial fines and operational limitations, underscoring the critical need for ongoing legal vigilance and strategic adjustments in compliance efforts.

Goldman Sachs, like all major financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations worldwide. These laws are critical in combating financial crime and ensuring the integrity of the global financial system. For instance, in 2023, global AML fines reached significant figures, underscoring the importance of strict adherence.

Compliance demands substantial investment in sophisticated systems for customer due diligence, transaction monitoring, and suspicious activity reporting. Goldman Sachs regularly updates its internal policies and provides extensive training to its employees to navigate these complex legal landscapes effectively, aiming to prevent illicit financial flows and maintain regulatory trust.

Goldman Sachs must navigate a complex web of data privacy laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations govern how the firm collects, processes, and stores sensitive client information. Failure to comply can lead to severe penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million, whichever is greater.

Antitrust and Competition Law Scrutiny

Goldman Sachs, like other major financial institutions, is subject to increasing antitrust and competition law scrutiny, particularly concerning its participation in industry-wide initiatives. US politicians have raised concerns that collaborative efforts, especially those focused on Environmental, Social, and Governance (ESG) standards, could potentially lead to anticompetitive practices or collusion. This legal environment has prompted a more cautious approach from the firm regarding its involvement in certain industry groups, impacting its ability to shape or influence sector-wide standards.

The firm’s engagement in discussions around market practices and ESG frameworks is carefully monitored to ensure compliance with antitrust regulations. For instance, concerns have been voiced by some lawmakers about whether collective commitments to certain ESG investment strategies could inadvertently restrict competition or limit consumer choice. This heightened awareness means Goldman Sachs must navigate these collaborations with a strong emphasis on legal adherence and transparent operations to avoid potential investigations or penalties.

- Antitrust Concerns: US politicians are scrutinizing industry-wide ESG initiatives for potential antitrust violations, affecting Goldman Sachs' participation.

- Impact on Collaboration: Legal pressures are influencing the firm's involvement in collaborative groups shaping industry standards.

- Regulatory Vigilance: Goldman Sachs operates under increased regulatory oversight regarding its market practices and industry engagements.

Litigation Risks and Enforcement Actions

Goldman Sachs faces significant litigation risks and potential enforcement actions from various regulatory bodies, impacting its operations and reputation. These risks are inherent in the complex financial services industry and can arise from trading activities, advisory services, and compliance failures.

For instance, in 2023, Goldman Sachs settled with the Securities and Exchange Commission (SEC) for $36.3 million related to its municipal bond underwriting practices. Such settlements highlight the critical need for stringent internal controls and proactive legal risk management to mitigate financial penalties and operational disruptions.

- Regulatory Scrutiny: Goldman Sachs is subject to ongoing investigations and potential enforcement actions by global regulators, including the SEC, the Commodity Futures Trading Commission (CFTC), and international bodies.

- Past Settlements: The firm has a history of significant settlements, such as the $2.9 billion settlement with the U.S. Department of Justice in 2020 concerning its role in the 1MDB scandal, underscoring the financial and reputational impact of legal challenges.

- Operational Risks: Litigation can stem from a wide array of business activities, including market manipulation allegations, breaches of fiduciary duty, and cybersecurity-related disputes, all of which require robust legal defense and compliance frameworks.

Goldman Sachs operates within a highly regulated global financial environment, necessitating strict adherence to capital adequacy rules like Basel III and extensive reporting requirements. For example, in 2023, financial institutions continued to adapt to evolving capital requirements and stress testing scenarios aimed at bolstering resilience.

Non-compliance with these intricate legal mandates can lead to substantial financial penalties and operational restrictions, highlighting the paramount importance of continuous legal oversight and strategic adjustments to compliance frameworks.

The firm is subject to rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations worldwide, crucial for combating financial crime and maintaining the integrity of the global financial system. In 2023, global AML fines reached significant levels, underscoring the critical need for strict adherence.

Navigating data privacy laws like GDPR and CCPA is also a legal imperative, governing how sensitive client information is handled. GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater, demonstrating the severe consequences of non-compliance.

| Legal Factor | Description | Impact on Goldman Sachs | Relevant Data/Examples (2023-2024) |

| Regulatory Compliance | Adherence to global financial regulations (e.g., Basel III, AML, KYC). | Avoids fines, sanctions, and reputational damage; ensures operational continuity. | Continued adaptation to evolving capital requirements and stress testing scenarios. Global AML fines significant in 2023. |

| Data Privacy | Compliance with data protection laws (e.g., GDPR, CCPA). | Protects client data, avoids substantial penalties for breaches. | GDPR fines up to 4% of global annual revenue or €20 million. |

| Antitrust & Competition Law | Scrutiny of industry-wide initiatives, including ESG standards. | Influences participation in collaborative groups; requires careful navigation of market practices. | Concerns raised by US politicians regarding ESG initiatives potentially restricting competition. |

| Litigation & Enforcement Actions | Risk of legal challenges and regulatory enforcement. | Potential for financial penalties, reputational damage, and operational disruptions. | $36.3 million SEC settlement in 2023 for municipal bond underwriting practices. Past $2.9 billion settlement (2020) for 1MDB scandal. |

Environmental factors

Goldman Sachs recognizes climate change as a critical global risk, actively incorporating climate risk assessments into its investment strategies. The firm is committed to facilitating the transition to a low-carbon economy by pinpointing and capitalizing on associated investment prospects.

In 2024, Goldman Sachs reported facilitating over $20 billion in sustainable finance, reflecting its dedication to aligning capital with climate-conscious objectives. This focus extends to identifying opportunities in renewable energy, green infrastructure, and other climate solutions, aiming to generate both financial returns and positive environmental impact.

Goldman Sachs is actively engaged in the expanding ESG investing landscape, dedicating substantial resources to sustainable finance. The firm has committed to deploying $750 billion in financing, advisory, and investments for climate-focused initiatives by 2030, reflecting a significant push towards environmental responsibility.

Goldman Sachs is actively pursuing ambitious sustainability targets, including a significant reduction in operational carbon footprint. A key initiative involves decreasing energy intensity across its operations.

The firm is committed to procuring 80% of its energy from renewable sources via long-term agreements, with a broader goal of achieving 100% renewable global electricity. This strategic shift aims to minimize reliance on fossil fuels.

Furthermore, Goldman Sachs has set a target for Scope 3 carbon neutrality specifically for business travel, reflecting a comprehensive approach to environmental responsibility beyond direct operations.

Sustainable Finance Product Development

Goldman Sachs is actively expanding its sustainable finance product offerings, recognizing the growing demand for environmentally and socially responsible investments. This strategic push aims to align client portfolios with the global transition towards a low-carbon economy.

The firm’s commitment is reflected in its development of innovative financial instruments and advisory services designed to support sustainability goals. By offering these solutions, Goldman Sachs positions itself as a key player in facilitating capital flows towards a more inclusive and sustainable future.

- ESG Integration: Goldman Sachs is enhancing its ability to integrate Environmental, Social, and Governance (ESG) factors into investment analysis and product design.

- Green Bonds and Loans: The firm is a leading underwriter and arranger of green bonds and loans, facilitating the financing of projects with environmental benefits. For example, in 2023, Goldman Sachs played a significant role in the issuance of numerous green bonds across various sectors.

- Sustainable Investment Funds: Goldman Sachs Asset Management offers a growing suite of sustainable investment funds, providing clients with diversified exposure to companies demonstrating strong ESG performance.

- Climate Transition Finance: The firm is actively involved in providing financing and advisory services to help companies navigate the transition to a low-carbon business model.

Environmental Reporting and Disclosure

Goldman Sachs actively publishes detailed sustainability reports, showcasing its commitment to transparency. These reports include comprehensive climate-related financial disclosures, directly responding to growing regulatory and stakeholder expectations for clear environmental reporting.

The firm's 2023 Sustainability Report highlighted a 14% reduction in financed emissions intensity compared to its 2019 baseline, demonstrating tangible progress in its climate strategy. This focus on measurable environmental performance is crucial for investor confidence and regulatory compliance.

- Disclosure Standards: Goldman Sachs adheres to frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

- Emissions Reduction: The company reported a 14% decrease in financed emissions intensity by the end of 2023.

- Stakeholder Engagement: Transparency in environmental reporting is a key element of engaging with investors, clients, and regulators.

- Regulatory Alignment: Disclosures are designed to meet evolving environmental reporting requirements globally.

Goldman Sachs is deeply engaged in addressing environmental factors, particularly climate change, by integrating climate risk into its investment strategies and facilitating the transition to a low-carbon economy. The firm's commitment is evident in its substantial investments in sustainable finance, aiming to align capital with climate-conscious objectives.

By 2030, Goldman Sachs plans to deploy $750 billion in financing, advisory, and investments for climate-focused initiatives, underscoring a significant commitment to environmental responsibility. This includes a strong focus on renewable energy and green infrastructure, with the firm actively expanding its sustainable finance product offerings to meet growing client demand.

The firm is also dedicated to reducing its operational carbon footprint, with a target of sourcing 80% of its energy from renewable sources via long-term agreements and a broader goal of achieving 100% renewable global electricity. These efforts are supported by transparent reporting, such as the 14% reduction in financed emissions intensity reported by the end of 2023 compared to a 2019 baseline.

| Initiative | Target/Commitment | Progress/Data Point |

|---|---|---|

| Sustainable Finance Deployment | $750 billion by 2030 | Facilitated over $20 billion in 2024 |

| Renewable Energy Procurement | 80% via long-term agreements | Aiming for 100% renewable global electricity |

| Financed Emissions Intensity Reduction | Reduction from 2019 baseline | 14% reduction by end of 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Goldman Sachs Group is informed by a comprehensive blend of data sources, including reports from financial institutions like the IMF and World Bank, government publications detailing regulatory changes, and industry-specific market research. We also incorporate insights from reputable news outlets and economic forecasting firms to ensure a well-rounded view.