Goldman Sachs Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldman Sachs Group Bundle

Unlock the strategic core of Goldman Sachs Group with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver exceptional value propositions across diverse markets. This detailed analysis is essential for anyone seeking to understand the drivers of their sustained success.

Dive into the intricate details of Goldman Sachs Group's operational framework. Our Business Model Canvas breaks down their revenue streams, cost structure, and key resources, offering a clear roadmap to their market dominance. Get your copy today to gain unparalleled strategic insights.

Partnerships

Goldman Sachs cultivates robust strategic alliances with major global corporations, serving as their go-to advisor for intricate financial maneuvers like mergers, acquisitions, and divestitures. These collaborations are fundamental to winning lucrative investment banking mandates and sustaining market leadership.

In 2024, Goldman Sachs continued to leverage these deep-rooted relationships, advising on significant cross-border M&A deals that underscored their advisory prowess. The firm's capacity to deliver integrated financial solutions across diverse industries solidifies these enduring partnerships, often built over many years.

Goldman Sachs actively collaborates with a diverse range of financial institutions, including commercial banks, private equity firms, and hedge funds. These partnerships are instrumental for co-lending arrangements, participating in syndicated deals, and engaging in joint investment ventures.

These strategic alliances significantly expand Goldman Sachs' operational reach and its capacity to execute large-scale transactions. By sharing risks and tapping into broader capital pools, the firm enhances its ability to serve clients in complex financial markets.

This collaborative approach is particularly vital for the Global Markets and Asset & Wealth Management divisions. For instance, in 2023, Goldman Sachs participated in numerous syndicated loan facilities, demonstrating the ongoing importance of these partnerships in facilitating significant financial activities.

Goldman Sachs partners with technology and data providers to bolster its trading platforms and analytical capabilities. These collaborations are crucial for maintaining a competitive edge in financial technology, driving efficiency through AI-powered tools, and ensuring robust cybersecurity.

Regulatory Bodies and Industry Associations

Goldman Sachs actively engages with regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) to ensure adherence to global financial regulations. This partnership is vital for maintaining operational integrity and navigating complex compliance requirements across its diverse business lines.

Through participation in industry associations such as the Securities Industry and Financial Markets Association (SIFMA), Goldman Sachs contributes to the development of market best practices and policy recommendations. For instance, in 2024, SIFMA continued to advocate for clear and consistent regulatory frameworks, which directly impacts how firms like Goldman Sachs operate and manage risk.

- Regulatory Compliance: Goldman Sachs' engagement ensures it meets stringent capital requirements, such as those under Basel III, which are continuously updated to reflect market conditions and systemic risk. As of Q1 2025, the firm reported a Common Equity Tier 1 (CET1) ratio of 14.5%, well above regulatory minimums.

- Market Influence: Proactive dialogue with regulators and industry groups helps shape financial policy, mitigating risks and fostering a stable operating environment. This collaboration is essential for adapting to evolving market dynamics and technological advancements in financial services.

- License to Operate: Maintaining strong relationships with regulatory authorities globally is fundamental to Goldman Sachs’ ability to conduct business and serve its clients across various jurisdictions.

Co-investors and Fund LPs

Goldman Sachs actively collaborates with a diverse range of co-investors and Limited Partners (LPs) across its Asset & Wealth Management division. These crucial relationships fuel the capital for its private equity, real estate, and credit funds, enabling the management of extensive asset portfolios. For instance, as of the first quarter of 2024, Goldman Sachs reported significant inflows into its alternative investment strategies, underscoring the importance of these LP relationships.

The firm's ability to attract and retain these sophisticated investors is paramount to expanding its alternative investment business. These LPs, which include pension funds, sovereign wealth funds, and endowments, provide not only capital but also strategic insights. In 2023, Goldman Sachs’ AUM in alternatives reached substantial figures, demonstrating the success of these partnerships.

- Co-investor Capital Infusion: LPs provide essential capital, allowing Goldman Sachs to deploy significant investments in private markets.

- Diversified LP Base: The firm partners with institutional investors globally, broadening its capital sources and investment reach.

- Strategic Alignment: Partnerships with LPs often involve co-investment opportunities, aligning interests and fostering long-term relationships.

- Growth Engine for Alternatives: The success and growth of Goldman Sachs' alternative investment strategies are directly tied to its ability to secure and maintain strong LP commitments.

Goldman Sachs' Key Partnerships are multifaceted, encompassing major global corporations for investment banking, financial institutions for co-lending, and technology providers for platform enhancement. These alliances are critical for market leadership, risk sharing, and technological advancement.

In 2024, the firm's engagement with Limited Partners (LPs) in its Asset & Wealth Management division proved vital, fueling capital for alternative investments. This symbiotic relationship, also involving co-investors, is a primary driver for the expansion of its alternative asset business, with AUM in alternatives showing consistent growth through 2023 and into early 2024.

| Partner Type | Purpose | 2024 Impact/Data Point |

|---|---|---|

| Global Corporations | M&A advisory, investment banking mandates | Advised on significant cross-border M&A deals |

| Financial Institutions | Co-lending, syndicated deals, joint ventures | Facilitated numerous syndicated loan facilities |

| Technology Providers | Trading platforms, analytics, AI tools | Enhanced AI-powered tools for trading efficiency |

| Limited Partners (LPs) & Co-investors | Capital for alternative investments (PE, Real Estate, Credit) | Significant inflows into alternative strategies in Q1 2024 |

| Regulatory Bodies & Industry Associations | Compliance, market best practices, policy input | Maintained CET1 ratio of 14.5% (Q1 2025), above regulatory minimums |

What is included in the product

A comprehensive overview of Goldman Sachs' business model, detailing its diverse client base, global reach, and multifaceted service offerings across investment banking, trading, asset management, and consumer banking.

This model highlights Goldman Sachs' strategic focus on leveraging its expertise and global network to deliver integrated financial solutions and drive value for its stakeholders.

The Goldman Sachs Group Business Model Canvas acts as a pain point reliever by providing a structured, one-page snapshot that clarifies complex financial operations, enabling faster identification of inefficiencies.

It streamlines strategic alignment and communication, relieving the pain of dispersed information and fostering a shared understanding of how Goldman Sachs delivers value.

Activities

Investment Banking Advisory is a cornerstone for Goldman Sachs, focusing on expert guidance for mergers, acquisitions, corporate defense, and restructuring. They aim to facilitate complex strategic decisions for clients, leveraging their vast industry insights and global network to secure favorable outcomes.

In 2024, Goldman Sachs continued its strong performance in M&A advisory. For instance, they advised on several high-profile transactions, solidifying their reputation as a top-tier advisor in the global market. Their advisory services are critical for clients navigating significant corporate events.

Goldman Sachs operates actively across global markets, trading and selling a wide array of financial products including fixed income, currencies, commodities, and equities. This core activity involves providing crucial market-making services and liquidity to institutional clients, ensuring efficient trade execution.

In 2024, the firm's Global Markets division demonstrated robust performance, with equities trading revenues reaching $6.6 billion for the first nine months. This segment, along with strong results in Financing Group, which includes FICC financing, significantly bolsters the company's overall net revenues, highlighting its essential role in Goldman Sachs' business model.

Goldman Sachs' Asset and Wealth Management division is a cornerstone, actively managing a broad spectrum of assets for both institutional and individual clients. This includes sophisticated investment solutions spanning traditional asset classes and a growing focus on alternatives, demonstrating a commitment to diverse client needs.

Key activities involve meticulous portfolio construction and rigorous risk management, all while providing expert client advisory services. The firm’s strategic objective is clear: to drive continued growth in its assets under supervision and to secure consistent fee-based inflows, ensuring a stable revenue stream.

As of the first quarter of 2024, Goldman Sachs reported assets under supervision reaching $2.8 trillion, a significant figure underscoring the scale of their operations. Fee-based income from this segment was robust, reflecting the success of their advisory and management strategies.

Financial Research and Analysis

Goldman Sachs Group's core activities heavily involve conducting deep financial research and analysis across a wide array of industries, global markets, and prevailing economic trends. This rigorous examination forms the bedrock of their advisory services and strategic recommendations.

This in-depth research directly fuels the firm's proprietary trading strategies and underpins its investment recommendations, offering clients a distinct advantage. For instance, in 2024, Goldman Sachs analysts covered over 2,000 companies globally, producing thousands of research reports.

The firm's capacity to generate unique, data-driven insights serves as a significant competitive differentiator in the financial services landscape. This commitment to intellectual capital allows them to anticipate market shifts and identify opportunities others may miss.

- Deep Dive Research: Covering diverse sectors and economic indicators to identify trends and risks.

- Client Insights: Providing actionable intelligence to inform client investment decisions.

- Trading Strategy Support: Informing the firm's own market positioning and execution.

- Investment Recommendations: Developing data-backed suggestions for asset allocation and specific investments.

Technology Development and Innovation

Goldman Sachs significantly invests in technology to sharpen its competitive edge. This includes a strong focus on artificial intelligence and advanced data analytics, aiming to boost how efficiently they operate and create novel financial offerings. By integrating the latest tech, they enhance client experiences and drive overall productivity across their operations.

In 2024, the firm continued its commitment to technological advancement. For instance, their Marcus by Goldman Sachs platform leverages AI for personalized banking experiences. Furthermore, their ongoing investments in cloud infrastructure and cybersecurity are vital for supporting new product launches and ensuring data integrity.

- AI Integration: Goldman Sachs is actively deploying AI and machine learning across various functions, from risk management to algorithmic trading, aiming for smarter decision-making and operational efficiencies.

- Data Analytics: The firm utilizes sophisticated data analytics to understand market trends, personalize client interactions, and develop data-driven investment strategies.

- Platform Modernization: Continuous investment in updating and modernizing their technology platforms ensures scalability, security, and the ability to rapidly deploy new financial products and services.

- Cybersecurity: Robust cybersecurity measures are a key activity, protecting client data and the firm's infrastructure from evolving threats in the digital landscape.

Goldman Sachs' Consumer & Wealth Management segment is dedicated to serving individual clients, offering a range of banking and investment solutions. This includes managing wealth for affluent and high-net-worth individuals, as well as providing digital banking services through its Marcus platform.

In 2024, the firm continued to focus on expanding its digital offerings and enhancing client relationships within this segment. The Marcus platform, for example, saw continued development aimed at providing seamless digital experiences and personalized financial products.

The key activities involve acquiring and retaining clients through tailored financial advice, digital tools, and competitive product offerings. A significant focus is placed on leveraging technology to scale client acquisition and deepen engagement, thereby driving growth in deposits and assets under supervision.

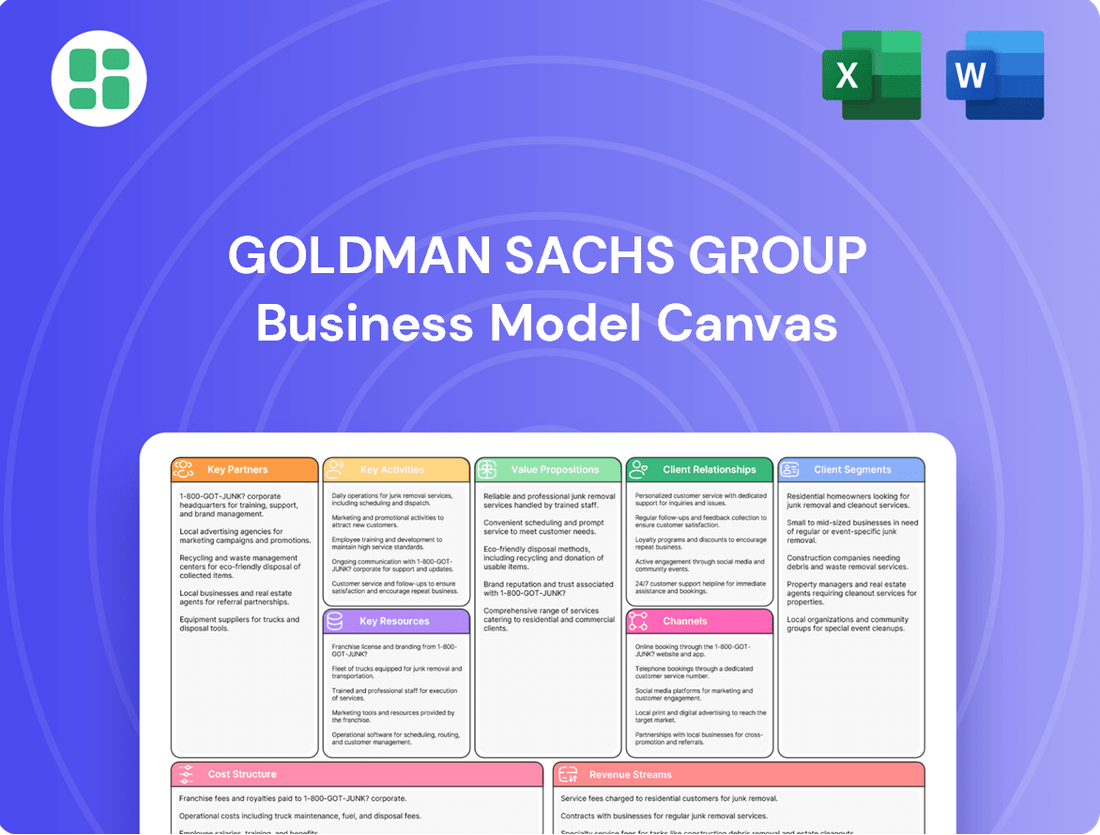

Delivered as Displayed

Business Model Canvas

The Goldman Sachs Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a transparent look at the comprehensive analysis. This isn't a sample or a mockup; it's a direct representation of the complete file, ensuring you know exactly what you're acquiring. Once your order is processed, you'll gain full access to this entire, professionally structured Business Model Canvas, ready for your immediate use.

Resources

Goldman Sachs' most critical resource is its highly skilled and experienced human capital. This includes investment bankers, traders, asset managers, and technology specialists who drive the firm's operations and client services.

The firm's reputation and success are fundamentally built on the intellectual capital, deep client relationships, and specialized expertise of its employees. In 2023, Goldman Sachs reported approximately 43,000 employees globally, highlighting the scale of its human capital investment.

Goldman Sachs Group's substantial financial capital and robust liquidity are critical for its global operations. This capital base, exceeding $100 billion in total equity as of early 2024, underpins its extensive lending, trading, and investment activities, enabling the firm to manage risk and seize market opportunities.

Maintaining strong capital ratios, such as a Common Equity Tier 1 (CET1) ratio consistently above regulatory minimums, is a testament to Goldman Sachs' financial health. For instance, its CET1 ratio stood at approximately 14% at the end of 2023, providing a significant buffer against potential economic downturns and supporting its growth initiatives.

Goldman Sachs' extensive global network, spanning over 30 offices worldwide, is a cornerstone of its business model. This expansive reach allows the firm to cultivate deep relationships with a diverse international clientele, facilitating seamless cross-border transactions and access to varied markets.

The firm's brand reputation, built on decades of perceived excellence and integrity, acts as a powerful intangible asset. This trust is critical in attracting and retaining high-net-worth individuals and institutional clients, particularly in complex financial dealings. For example, in 2023, Goldman Sachs reported significant revenue from its Global Banking & Markets segment, underscoring the value of its client relationships and global presence.

Proprietary Technology and Data Platforms

Goldman Sachs leverages advanced proprietary technology, including sophisticated trading systems and data analytics platforms, as a core resource. This technological backbone is essential for their efficient operations, robust risk management, and the development of cutting-edge digital client solutions. Cybersecurity infrastructure is also a critical component, safeguarding their extensive data assets.

The firm's commitment to ongoing investment in artificial intelligence and other emerging technologies underscores their strategic focus on innovation. For instance, in 2024, Goldman Sachs continued to enhance its cloud infrastructure and data capabilities, aiming to drive greater efficiency and provide more personalized client experiences. These investments are vital for maintaining a competitive edge in the rapidly evolving financial landscape.

- Trading Systems: High-frequency trading platforms and algorithmic execution capabilities.

- Data Analytics: Advanced platforms for market analysis, risk assessment, and client insights.

- Cybersecurity: Robust infrastructure to protect sensitive financial data and client information.

- AI Investment: Ongoing development and integration of artificial intelligence for operational efficiency and new product offerings.

Intellectual Property and Research

Goldman Sachs' proprietary research and sophisticated financial models are core intellectual property assets. These are crucial for their advisory services and investment strategies, offering a competitive edge. The firm's extensive market insights, developed through dedicated research teams, are a fundamental part of its value proposition.

In 2024, Goldman Sachs continued to invest heavily in its research infrastructure. The firm's analysts produce thousands of reports annually, covering global markets and industries. This deep dive into data and trends allows them to identify opportunities and risks for clients, solidifying their reputation for intellectual capital.

- Proprietary Research: Goldman Sachs' teams generate unique market analysis and economic forecasts.

- Financial Models: Advanced valuation and risk assessment tools are developed in-house.

- Market Insights: The firm provides data-driven perspectives on global economic trends.

- Thought Leadership: Research output positions Goldman Sachs as an authority in financial services.

Goldman Sachs' key resources also encompass its extensive global network and strong brand reputation. The firm's over 30 offices worldwide facilitate deep client relationships and cross-border transactions. This global presence, combined with a reputation for integrity, attracts high-net-worth and institutional clients, driving significant revenue. In 2023, the Global Banking & Markets segment demonstrated the value of these relationships.

Value Propositions

Goldman Sachs provides top-tier advisory and execution services, especially for intricate financial deals within investment banking. Clients gain from the firm's profound industry insights, expansive global network, and the capacity to manage massive transactions flawlessly and discreetly, leading to superior strategic and financial results.

The firm's commitment to excellence is evident in its consistent leadership in M&A advisory rankings. For instance, in 2023, Goldman Sachs advised on a significant portion of announced global M&A deals, underscoring its pivotal role in facilitating major corporate transformations and strategic consolidations.

Goldman Sachs offers unparalleled access to global capital markets, enabling clients to raise funds through both equity and debt issuances. This is crucial for corporations aiming for expansion and governments managing their finances. In 2024, the firm continued to be a leading underwriter for IPOs and debt offerings worldwide, reflecting its deep market penetration.

The firm's strength lies in its extensive global markets franchise, facilitating efficient trading across diverse asset classes like equities, fixed income, currencies, and commodities. This broad reach allows institutional investors to optimize their portfolios effectively. Goldman Sachs' trading revenues in the first half of 2024 demonstrated the continued importance of this capability for its clients.

Goldman Sachs offers sophisticated investment solutions for its asset and wealth management clients, meticulously tailored to individual risk appetites and financial objectives. This encompasses providing access to exclusive alternative investments, a key differentiator in the market.

These bespoke strategies are designed to achieve superior risk-adjusted returns, a testament to the firm's deep market expertise. For instance, by the end of the first quarter of 2024, Goldman Sachs reported record assets under supervision, underscoring the trust and efficacy of their investment approaches.

Risk Management Expertise

Goldman Sachs' risk management expertise is a cornerstone of its value proposition, enabling clients to effectively navigate complex and volatile market conditions. This deep understanding of financial risk translates into tailored solutions designed to protect and enhance client portfolios.

The firm provides a comprehensive suite of services, including sophisticated hedging strategies and derivative products, to help clients manage a wide array of financial exposures. For instance, in 2024, the firm's Global Markets division continued to be a significant contributor, with its risk management capabilities underpinning client activity across various asset classes.

Strategic asset allocation advice, another facet of this expertise, helps clients build resilient portfolios capable of withstanding economic uncertainties. This proactive approach ensures clients are better positioned to achieve their long-term financial objectives, offering a crucial layer of stability.

- Hedging and Derivatives: Offering advanced tools to mitigate market risks.

- Strategic Asset Allocation: Providing guidance for portfolio stability and growth.

- Client Protection: Ensuring financial security in uncertain economic climates.

- Market Navigation: Assisting clients in understanding and managing financial exposures.

Trusted Partnership and Insights

Clients view Goldman Sachs as a steadfast ally, relying on its sharp market insights and strategic advice to navigate financial complexities. The firm’s commitment to client success, exemplified by its ‘One Goldman Sachs’ approach, cultivates lasting relationships built on mutual trust.

This partnership is crucial, as demonstrated by Goldman Sachs' significant role in advising on major transactions. For instance, in 2024, the firm was a leading advisor on a substantial number of M&A deals globally, underscoring its trusted position in the market.

- Market Intelligence: Providing forward-looking analysis to anticipate trends.

- Strategic Guidance: Offering tailored advice for complex financial objectives.

- Long-Term Commitment: Fostering enduring client relationships through consistent support.

- Proactive Solutions: Developing innovative strategies to address evolving market needs.

Goldman Sachs' value proposition centers on delivering expert advisory and execution for complex financial transactions, leveraging deep industry knowledge and a vast global network. Clients benefit from the firm's ability to manage large-scale deals discreetly, ensuring optimal strategic and financial outcomes.

The firm provides unparalleled access to global capital markets for both equity and debt financing, crucial for corporate expansion and governmental fiscal management. In 2024, Goldman Sachs maintained its position as a premier underwriter for IPOs and debt offerings, reflecting its extensive market reach.

Furthermore, Goldman Sachs offers sophisticated investment management solutions, meticulously tailored to individual client needs and risk profiles, including access to exclusive alternative investments. This commitment to bespoke strategies aims for superior risk-adjusted returns, as evidenced by record assets under supervision by Q1 2024.

| Value Proposition | Key Offerings | Client Benefit |

| Investment Banking Advisory | M&A, Capital Raising, Restructuring | Strategic growth, optimal capital structure |

| Global Markets Trading | Equities, Fixed Income, Currencies, Commodities | Efficient portfolio management, liquidity |

| Asset & Wealth Management | Bespoke investment strategies, Alternative Investments | Tailored returns, wealth preservation |

| Risk Management | Hedging, Derivatives, Strategic Allocation | Portfolio protection, navigating volatility |

Customer Relationships

Goldman Sachs cultivates high-touch, personalized relationships through dedicated relationship managers and specialized teams. This approach ensures bespoke advice and tailored solutions for complex financial needs of corporations, governments, and ultra-high-net-worth individuals.

Goldman Sachs prioritizes building enduring strategic partnerships, acting as a steadfast financial ally through market fluctuations. This commitment ensures they evolve alongside client needs, fostering loyalty and a consistent revenue stream.

Goldman Sachs cultivates deep client connections through exclusive events, like its annual Global Markets Forum, which in 2024 brought together over 1,000 institutional investors and corporate leaders. These gatherings facilitate crucial networking and direct engagement with the firm’s senior leadership and market strategists.

The firm also disseminates proprietary research and analysis, offering clients unparalleled market insights. In 2024, Goldman Sachs published thousands of research reports and hosted webinars featuring economists and analysts, ensuring clients are well-informed on evolving economic landscapes and investment opportunities.

These initiatives are designed to reinforce Goldman Sachs's reputation as a premier source of financial intelligence and strategic guidance. By providing access to expert perspectives and networking, the firm strengthens its client relationships and positions itself as an indispensable partner in navigating complex markets.

Digital Platforms and Tools

Goldman Sachs enhances client relationships through sophisticated digital platforms, offering seamless access to research, portfolio updates, and transaction execution. These tools are designed to complement personalized advisory services, providing clients with greater control and convenience.

In 2024, the firm continued to invest in its digital infrastructure, aiming to deliver a superior client experience. For instance, its wealth management digital offerings saw increased adoption, with a significant percentage of clients actively utilizing online portals for portfolio monitoring and financial planning.

- Enhanced Digital Access: Clients benefit from secure, 24/7 access to a comprehensive suite of digital tools for managing investments and accessing market insights.

- Efficiency and Convenience: Digital platforms streamline transaction processes and provide real-time data, improving operational efficiency for both clients and the firm.

- Data-Driven Insights: Advanced analytics and personalized content are delivered through these channels, empowering clients with actionable information.

- Security and Trust: Goldman Sachs prioritizes robust security measures across its digital platforms to safeguard client data and maintain trust.

Solution-Oriented Engagement

Goldman Sachs cultivates customer relationships through a deeply solution-oriented approach, focusing on understanding and resolving clients' most critical financial challenges. This proactive engagement fosters trust and demonstrates a commitment to tangible value creation.

The firm emphasizes collaborative strategy development, working closely with clients to craft innovative and effective financial solutions. This partnership model ensures that client needs are met with tailored and impactful outcomes.

- Solution-Oriented Approach: Goldman Sachs prioritizes understanding and addressing clients' core financial pain points.

- Collaborative Strategy Development: The firm partners with clients to co-create innovative and effective financial strategies.

- Tangible Value Delivery: The focus remains on providing solutions that yield measurable positive results for clients.

- Capital Solutions Group: The establishment of this group exemplifies the firm's dedication to offering bespoke capital-raising and strategic advisory services, as seen in their advisory roles for significant 2024 transactions.

Goldman Sachs fosters deep, long-term relationships by acting as a strategic financial partner, offering bespoke advice and tailored solutions. This high-touch approach is supported by proprietary research and exclusive client events, such as the 2024 Global Markets Forum, which convened over 1,000 leaders.

The firm also leverages sophisticated digital platforms for enhanced client experience, providing 24/7 access to market insights and portfolio management tools. In 2024, digital wealth management offerings saw increased client adoption, streamlining access to financial planning and portfolio updates.

Goldman Sachs's solution-oriented approach focuses on resolving critical financial challenges through collaborative strategy development. This commitment is exemplified by their Capital Solutions Group, actively advising on significant 2024 transactions, underscoring their dedication to tangible value creation.

| Key Relationship Aspect | Description | 2024 Relevance |

| Personalized Advisory | Dedicated relationship managers and specialized teams provide tailored financial advice. | Essential for navigating complex needs of corporations and ultra-high-net-worth individuals. |

| Strategic Partnerships | Acting as a steadfast financial ally through market fluctuations. | Fosters loyalty and consistent revenue by evolving alongside client needs. |

| Exclusive Engagement | Client events like the Global Markets Forum facilitate networking and direct interaction. | In 2024, over 1,000 institutional investors and corporate leaders attended, fostering direct engagement. |

| Proprietary Insights | Dissemination of research reports and webinars offering market intelligence. | Thousands of reports published in 2024 kept clients informed on economic landscapes. |

| Digital Platforms | Seamless access to research, portfolio updates, and transaction execution. | Increased adoption of digital wealth management tools in 2024 enhanced client control and convenience. |

Channels

Direct sales and relationship managers form Goldman Sachs' core channel, fostering deep client connections. This high-touch model, essential for managing complex financial needs, saw the firm serve over 13,000 institutional clients and 1.6 million consumer clients as of Q1 2024.

These teams provide personalized service, crucial for retaining high-value clients and delivering tailored solutions. This direct engagement allows for a nuanced understanding of market demands and client objectives, driving revenue and client loyalty.

Goldman Sachs maintains a significant global office network, spanning over 30 countries and employing tens of thousands of professionals. This extensive reach, with key hubs in New York, London, and Hong Kong, allows the firm to offer integrated services to a diverse international client base, from corporations to governments.

Goldman Sachs leverages proprietary digital platforms, such as its online client portals and mobile apps, to provide a seamless experience for accessing market data, research, and executing trades. These platforms are crucial for delivering services efficiently and enhancing client engagement.

In 2024, the firm continued to invest heavily in its digital infrastructure, recognizing digitalization as a core strategic imperative. This focus aims to streamline operations and offer clients enhanced capabilities for account management and real-time market access.

Industry Conferences and Forums

Goldman Sachs actively participates in and hosts numerous industry conferences and forums. These events are crucial for client engagement, allowing them to showcase expertise and build relationships. For instance, their Global Markets Forum provides a platform for discussing key economic and market trends with clients and industry leaders.

These gatherings are vital for thought leadership, enabling Goldman Sachs to disseminate its research and market outlook. By presenting at these events, they reinforce their position as a leading financial institution. In 2024, the firm continued this tradition, with executives speaking at major financial industry gatherings, sharing insights on global economic prospects and investment strategies.

Furthermore, these conferences serve as a significant channel for business development and networking. They offer opportunities to connect with potential clients and partners, fostering new business opportunities. Goldman Sachs leverages these forums to stay informed about emerging market trends and competitive landscapes.

- Client Engagement: Direct interaction with existing and potential clients to understand needs and strengthen relationships.

- Thought Leadership: Dissemination of research, market analysis, and strategic insights to establish expertise.

- Business Development: Networking opportunities to identify and cultivate new business leads and partnerships.

- Market Intelligence: Gathering information on industry trends, competitor activities, and emerging opportunities.

Strategic Marketing and Publications

Goldman Sachs employs strategic marketing and a robust publications arm as key channels. These efforts disseminate the firm's intellectual capital, including in-depth research reports, market analyses, and forward-looking outlooks, directly to its target audience of financially literate professionals and investors.

These publications are crucial for establishing thought leadership and communicating Goldman Sachs' expertise. For instance, their 2024 Global Investment Outlook reports, released in early 2024, provided detailed analyses of macroeconomic trends, asset class performance, and strategic investment recommendations, reaching millions of decision-makers globally.

The firm’s content strategy focuses on delivering actionable insights and data-driven perspectives.

- Thought Leadership: Publications like the 2024 "Big Ideas" report highlight emerging investment themes and technological advancements.

- Client Engagement: Targeted marketing campaigns and exclusive research access foster deeper relationships with institutional and high-net-worth clients.

- Brand Building: Consistent, high-quality content reinforces Goldman Sachs' reputation as a premier financial services provider.

- Market Influence: Extensive research reports influence market sentiment and investment strategies across the financial industry.

Goldman Sachs utilizes a multi-faceted channel strategy, combining direct client relationships with digital platforms and strategic marketing. This approach ensures broad reach while maintaining personalized engagement for diverse client needs.

The firm's extensive global presence, with offices in over 30 countries, facilitates integrated services for international clients. Proprietary digital platforms enhance client experience by providing seamless access to market data and trading capabilities.

In 2024, continued investment in digital infrastructure underscores its strategic importance for operational efficiency and client empowerment. Industry conferences and publications serve as crucial avenues for thought leadership and business development.

| Channel Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Direct Sales & Relationship Managers | Personalized service, complex needs management | Serving >13,000 institutional & 1.6M consumer clients (Q1 2024) |

| Digital Platforms | Online portals, mobile apps for market access, trading | Continued investment in infrastructure |

| Global Office Network | Integrated services across 30+ countries | Hubs in New York, London, Hong Kong |

| Industry Events & Publications | Thought leadership, client engagement, business development | 2024 Global Investment Outlook reports, "Big Ideas" |

Customer Segments

Goldman Sachs serves large corporations and multinational enterprises, offering sophisticated financial advisory, capital raising, and risk management solutions. These clients, across diverse sectors, often engage Goldman Sachs for complex mergers, acquisitions, and global expansion initiatives, representing a core revenue stream for the firm.

In 2024, investment banking fees, heavily influenced by large corporate transactions, remained a significant contributor to Goldman Sachs' revenue, demonstrating the continued reliance of major global businesses on their expertise for strategic financial maneuvers.

Goldman Sachs caters to a wide array of financial institutions, including commercial banks, investment banks, hedge funds, and asset managers. These entities rely on Goldman Sachs for critical services such as securities trading, prime brokerage, and sophisticated investment management solutions.

In 2024, Goldman Sachs continued to be a significant player in facilitating trading and providing liquidity for these institutional clients. The firm's global reach and deep market expertise enable these financial institutions to navigate complex markets and execute large-scale transactions efficiently.

Governments and public sector entities represent a crucial customer segment for Goldman Sachs, seeking sophisticated financial solutions for national and municipal needs. These clients, including sovereign governments and various public agencies, rely on Goldman Sachs for expertise in debt issuance, public finance advisory, and managing large-scale infrastructure financing. For instance, in 2024, governments globally continued to navigate complex fiscal landscapes, with many issuing bonds to fund public works and manage national debt. Goldman Sachs' role extends to providing strategic advice on economic development initiatives and capital markets access.

High-Net-Worth and Ultra-High-Net-Worth Individuals

Goldman Sachs' Asset & Wealth Management division is a key pillar, specifically serving high-net-worth and ultra-high-net-worth individuals and families. These clients are looking for tailored solutions to manage and expand their significant wealth. The division offers comprehensive services including personalized wealth management, expert investment advisory, and sophisticated private banking. As of the first quarter of 2024, client assets under supervision in wealth management stood at an impressive $1.6 trillion, underscoring the scale of this segment.

These discerning clients entrust Goldman Sachs with preserving and growing their substantial fortunes through a range of specialized services. The firm's approach focuses on understanding individual financial goals and risk appetites to craft bespoke strategies. This includes access to exclusive investment opportunities and sophisticated estate planning advice.

- Client Focus: High-net-worth and ultra-high-net-worth individuals and families.

- Services Offered: Personalized wealth management, investment advisory, private banking.

- Asset Under Supervision: Approximately $1.6 trillion in wealth management client assets (Q1 2024).

- Client Needs: Asset preservation, wealth growth, exclusive investment access, estate planning.

Institutional Investors

Institutional investors, a cornerstone of Goldman Sachs' client base, encompass entities like pension funds, university endowments, and charitable foundations. These sophisticated investors seek comprehensive asset management services, access to alternative investments, and highly customized portfolio solutions. In 2024, Goldman Sachs continued to leverage its deep market expertise and broad product suite to meet the complex needs of these significant capital allocators.

Goldman Sachs' appeal to institutional investors stems from its capacity to deliver a wide array of investment products and strategies, from traditional equities and fixed income to more complex alternative assets. This diversity allows institutions to effectively diversify their holdings and pursue specific return objectives. For instance, many large pension funds actively seek out private equity and real estate opportunities, areas where Goldman Sachs has a strong presence.

- Asset Management: Providing discretionary and non-discretionary investment management services.

- Alternative Investments: Offering access to private equity, hedge funds, and real estate.

- Tailored Portfolio Solutions: Designing customized investment strategies to meet specific client mandates and risk profiles.

Goldman Sachs serves a diverse array of institutional investors, including pension funds, endowments, and sovereign wealth funds. These clients require sophisticated asset management, access to alternative investments, and tailored portfolio construction to meet their long-term financial objectives. In 2024, the firm's ability to provide deep market insights and a broad spectrum of investment products remained critical for these large capital allocators.

The firm also caters to a significant segment of high-net-worth and ultra-high-net-worth individuals and families through its wealth management division. These clients seek personalized financial planning, investment advisory, and private banking services to preserve and grow their substantial assets. As of Q1 2024, Goldman Sachs managed $1.6 trillion in wealth management client assets, highlighting the scale and importance of this customer base.

| Customer Segment | Key Needs | 2024 Relevance |

| Institutional Investors | Asset management, alternative investments, portfolio customization | Continued demand for sophisticated strategies and market access. |

| High-Net-Worth Individuals & Families | Personalized wealth management, investment advisory, private banking | $1.6 trillion in wealth management AUM (Q1 2024) underscores significant client trust and asset base. |

Cost Structure

Employee compensation and benefits represent Goldman Sachs' most significant expense, a direct consequence of its need for top-tier financial expertise across investment banking, trading, and asset management. In 2023, compensation and benefits expenses amounted to $23.1 billion, a substantial portion of its total operating expenses, underscoring the value placed on its human capital.

Goldman Sachs invests heavily in technology and infrastructure, a significant portion of its cost structure. These expenditures cover everything from the physical data centers that house their operations to the sophisticated trading platforms and custom software they develop.

In 2024, the firm's commitment to technological advancement is evident. For instance, a substantial portion of their operational budget is dedicated to enhancing cybersecurity measures, a critical component in protecting client data and maintaining market trust. Furthermore, ongoing investments in artificial intelligence and machine learning are crucial for maintaining a competitive edge and driving innovation across all business lines.

Goldman Sachs faces significant costs for regulatory compliance and legal matters, a crucial element of its business model. In 2024, the financial services industry continued to navigate a complex web of global regulations, demanding substantial investments in legal counsel, dedicated compliance staff, and sophisticated risk management technology. These expenses are not merely operational overhead but are vital for maintaining licenses and avoiding costly penalties.

Adherence to these ever-changing rules is paramount. For instance, the ongoing focus on capital requirements and consumer protection regulations necessitates continuous adaptation and expenditure. Goldman Sachs, like its peers, allocates considerable resources to ensure it meets these stringent demands, reflecting the critical nature of regulatory scrutiny in the financial sector.

Marketing and Business Development

Goldman Sachs dedicates significant resources to marketing and business development to foster client acquisition and retention. These expenditures encompass a range of activities designed to enhance brand visibility and engagement. For instance, in the first quarter of 2024, the company reported total operating expenses of $12.1 billion, a portion of which directly supports these crucial growth initiatives.

The firm's investment in these areas is strategic, focusing on building and maintaining strong client relationships. This often involves hosting exclusive client events and producing insightful market publications that position Goldman Sachs as a thought leader.

- Client Events: Targeted events to engage high-net-worth individuals and institutional clients.

- Publications: Research reports and market analysis distributed to clients and the broader financial community.

- Branding Initiatives: Advertising and public relations efforts to reinforce Goldman Sachs' reputation and market standing.

- Digital Marketing: Online advertising and content marketing to reach a wider audience and attract new business.

Occupancy and Administrative Expenses

Goldman Sachs' cost structure is significantly impacted by occupancy and administrative expenses, reflecting its global operational footprint. The firm manages a vast network of offices and facilities worldwide, leading to substantial costs for rent, utilities, and ongoing maintenance. In 2023, Goldman Sachs reported total operating expenses of $36.9 billion, a portion of which is directly attributable to these physical and administrative necessities.

To address these costs, Goldman Sachs has implemented initiatives aimed at optimizing its organizational footprint. These efforts are designed to streamline operations and reduce overhead. For instance, the firm has been strategically consolidating certain office spaces and investing in technology to enhance remote work capabilities, thereby managing the direct impact of real estate and associated administrative burdens.

- Occupancy Costs: Rent, utilities, and maintenance for global office infrastructure.

- Administrative Expenses: Includes professional services, travel, and general overhead.

- Optimization Program: Initiatives to streamline the organizational footprint and reduce associated costs.

Employee compensation remains the largest cost driver for Goldman Sachs, reflecting its reliance on highly skilled professionals. In 2023, this category alone accounted for $23.1 billion of its expenses, highlighting the premium placed on talent in the financial services sector.

Technology and infrastructure are critical investments, encompassing everything from trading platforms to cybersecurity. For 2024, significant budget allocations are directed towards AI and machine learning to maintain a competitive edge.

Regulatory compliance and legal expenses are substantial, necessitated by the intricate global financial landscape. These costs are vital for maintaining operational licenses and avoiding penalties, with ongoing adaptation to capital and consumer protection rules.

Marketing and business development are key to client acquisition and retention, with a portion of the $12.1 billion in Q1 2024 operating expenses dedicated to these growth initiatives.

Occupancy and administrative costs are also significant due to Goldman Sachs' global presence, with ongoing efforts to optimize its office footprint and reduce overhead.

| Expense Category | 2023 Actual ($B) | Focus in 2024 |

|---|---|---|

| Compensation & Benefits | 23.1 | Talent acquisition and retention |

| Technology & Infrastructure | N/A (Significant Investment) | AI, ML, Cybersecurity |

| Regulatory & Legal | N/A (Ongoing Costs) | Compliance with evolving regulations |

| Marketing & Business Development | N/A (Portion of OpEx) | Client engagement and brand building |

| Occupancy & Administrative | N/A (Portion of OpEx) | Office footprint optimization |

Revenue Streams

Goldman Sachs generates substantial revenue from investment banking fees. These include advisory fees for mergers and acquisitions (M&A) and underwriting fees from issuing new stocks and bonds. The firm's success in these areas directly correlates with the volume and value of transactions it facilitates. In 2024, Goldman Sachs reported robust growth in its investment banking division, with total fees reaching $9.5 billion, a notable increase from the previous year.

Goldman Sachs generates substantial revenue from trading activities across global markets. This includes buying and selling fixed income securities, currencies, commodities (FICC), and equities. They act as market makers, facilitating trades for clients, and also engage in proprietary trading, using their own capital.

This revenue stream is known for its volatility, as it's directly tied to market conditions. However, it remains a significant contributor to the firm's overall performance. For instance, in 2024, Goldman Sachs reported record net revenues in equities and FICC financing, underscoring the importance of these trading operations.

Goldman Sachs generates recurring revenue through management and other fees from its Asset & Wealth Management division. These fees are earned on assets under supervision, covering services like investment portfolio management and wealth advisory.

This segment has demonstrated consistent growth, with assets under supervision reaching $2.9 trillion by the end of the first quarter of 2024. This highlights the division's increasing scale and the steady income stream derived from its client relationships.

Net Interest Income

Goldman Sachs generates net interest income primarily from the spread between the interest it earns on its assets and the interest it pays on its liabilities. This core banking function underpins its lending and financing operations, acting as a foundational revenue stream.

For the first quarter of 2024, Goldman Sachs reported net interest income of $2.0 billion. This figure demonstrates the ongoing importance of this revenue source, even as the firm diversifies its offerings.

- Interest on Loans and Securities: Goldman Sachs earns interest from a diverse portfolio of loans and investment securities it holds.

- Interest on Deposits and Borrowings: The firm pays interest on customer deposits and funds raised through various borrowing mechanisms.

- Net Interest Margin: The difference between interest earned and interest paid, after accounting for any associated costs, contributes to profitability.

- Impact of Interest Rates: Fluctuations in benchmark interest rates significantly influence the size of net interest income.

Private Banking and Lending

Goldman Sachs generates significant revenue from its private banking and lending operations. This includes providing loans and credit solutions to high-net-worth individuals and corporations, earning income through interest and various fees.

In 2024, private banking and lending net revenues achieved record highs, underscoring the segment's growing importance to the firm's overall financial performance. This growth reflects increased client demand for sophisticated lending products and advisory services.

- Interest Income: Earned on loans extended to private clients and corporate entities.

- Fees: Generated from various lending solutions, including structuring, origination, and servicing fees.

- Record 2024 Performance: Private banking and lending net revenues reached unprecedented levels during the year.

Goldman Sachs' revenue streams are diverse, encompassing investment banking, trading, asset management, and lending activities. The firm leverages its global reach and expertise to serve a broad client base, from individuals to large corporations.

| Revenue Stream | Description | 2024 Data (Illustrative) |

| Investment Banking | Advisory and underwriting fees for M&A and capital markets. | $9.5 billion in fees. |

| Global Markets Trading | Revenue from trading fixed income, currencies, commodities, and equities. | Record net revenues in equities and FICC financing. |

| Asset & Wealth Management | Management and performance fees on assets under supervision. | $2.9 trillion in assets under supervision (Q1 2024). |

| Net Interest Income | Spread between interest earned on assets and paid on liabilities. | $2.0 billion (Q1 2024). |

| Private Banking & Lending | Interest and fees from loans and credit solutions to high-net-worth clients. | Record net revenues achieved in 2024. |

Business Model Canvas Data Sources

The Goldman Sachs Group Business Model Canvas is built upon a foundation of extensive financial disclosures, proprietary market research, and internal strategic assessments. These diverse data sources ensure that every aspect of the canvas, from revenue streams to cost structures, is grounded in empirical evidence and informed strategic thinking.