Goldman Sachs Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldman Sachs Group Bundle

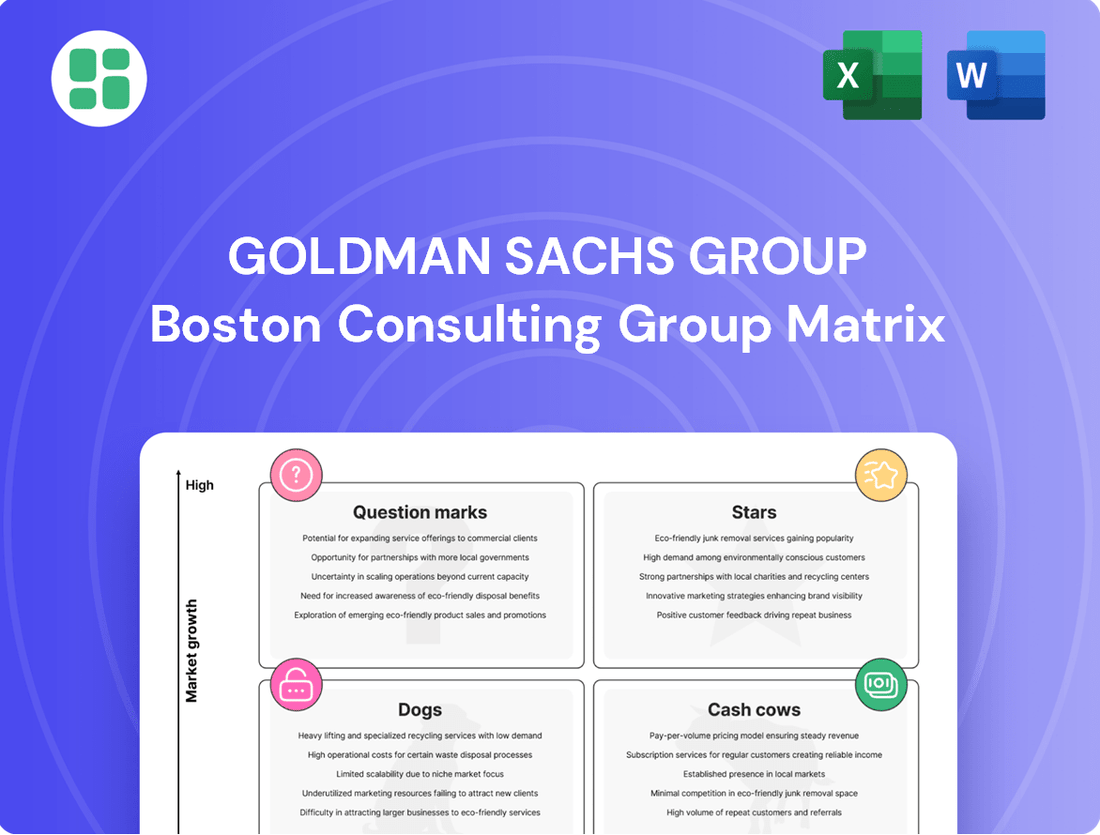

Curious about Goldman Sachs' strategic product portfolio? Our BCG Matrix preview highlights their key market positions, but to truly unlock their growth potential, you need the full picture.

Dive into the complete BCG Matrix to understand which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, and gain data-backed recommendations for optimizing their investments. Purchase the full report to receive a detailed breakdown and a clear roadmap for strategic decision-making.

Stars

Goldman Sachs' Equities and FICC financing operations within its Global Banking & Markets division are standout performers. In Q1 2025, these areas achieved record net revenues, underscoring their substantial market share and impressive growth trajectory for the firm.

The equities business saw record net revenues, fueled by robust activity in financing and derivatives. Simultaneously, FICC also delivered strong results, with net revenues boosted by increased income from mortgages and structured lending, marking a significant contribution to the firm's overall financial health.

Goldman Sachs is aggressively building out its digital asset capabilities, focusing on tokenization and crypto lending to cater to growing client interest. The firm's proprietary Digital Asset Platform, GS DAP®, is central to this, enabling real-time digitization and management of various assets.

This strategic push into digital assets positions Goldman Sachs in a high-growth sector. By investing heavily in GS DAP® and related initiatives, the firm aims to capture a significant market share and redefine traditional finance through enhanced digital infrastructure.

Goldman Sachs' Asset & Wealth Management division is a clear Star, demonstrating robust growth. In Q1 2025, assets under supervision hit a record $3.17 trillion, building on $3.14 trillion in 2024. This expansion is fueled by consistent net inflows and a strategic emphasis on bespoke solutions for Ultra-High Net Worth individuals.

The firm's commitment to innovation and scale in serving UHNW clients underpins its Star status. Management fees have seen an increase, reflecting the value and breadth of services offered. This segment is crucial for Goldman Sachs' continued leadership in the competitive wealth management landscape.

Alternative Investments within Asset & Wealth Management

Goldman Sachs is aggressively expanding its alternative investments division, a key growth area. The firm raised a substantial $72 billion in 2024 and has set an ambitious target of $225 billion in gross inflows by the year's end, highlighting a significant market push.

This strategic focus is driven by the high growth potential inherent in alternative assets, with Goldman Sachs actively scaling its flagship fund offerings. The firm aims to capture a larger market share by penetrating both institutional and wealth management channels.

As a top-five global alternative asset manager, Goldman Sachs leverages its established position to capitalize on the expanding alternative investment landscape. This segment represents a critical component of their overall asset and wealth management strategy.

- 2024 Gross Inflows Target: $225 billion

- 2024 Capital Raised: $72 billion

- Market Position: Top-five global alternative asset manager

- Strategic Focus: Scaling flagship funds, penetrating institutional and wealth channels

Specialized M&A Advisory in High-Growth Sectors

Goldman Sachs Group continues to be a dominant force in M&A advisory, even as overall investment banking revenues experienced a dip in the first quarter of 2025. The firm's strategic emphasis on high-growth sectors such as technology, consumer goods, and healthcare, especially those fueled by artificial intelligence advancements, highlights its strength in specialized advisory services. This focus on capability-enhancing transactions and a pivot towards growth-oriented markets positions Goldman Sachs' specialized advisory within these areas as a high-growth, high-market-share segment, mirroring the characteristics of a Stars quadrant in the BCG Matrix.

In Q1 2025, Goldman Sachs reported a notable presence in M&A deals within the technology sector, with AI-driven transactions contributing significantly to their advisory pipeline. For instance, the firm advised on several key acquisitions in the AI software and hardware space, demonstrating their deep sector expertise. This strategic alignment with burgeoning industries underscores their ability to capture market share through specialized knowledge and execution capabilities.

- Technology Sector Strength: Goldman Sachs advised on a significant portion of tech M&A in early 2025, particularly in AI-related sub-sectors.

- Growth Focus: The firm's advisory revenue in consumer and healthcare M&A also showed resilience, driven by strategic, capability-enhancing deals.

- Market Position: This specialization in high-growth sectors allows Goldman Sachs to maintain a strong market share, akin to a Star in the BCG Matrix.

Goldman Sachs' Asset & Wealth Management division, particularly its alternative investments arm, is a clear Star. In 2024, the firm raised $72 billion and is targeting $225 billion in gross inflows by the end of the year, solidifying its position as a top-five global alternative asset manager. This segment is experiencing high growth and commands significant market share.

The firm's equities and FICC financing operations also shine as Stars. In Q1 2025, these areas achieved record net revenues, demonstrating robust client activity and strong market penetration. The equities business benefited from financing and derivatives, while FICC saw gains from mortgages and structured lending.

Goldman Sachs' M&A advisory, especially in technology and AI-driven sectors, is performing like a Star. The firm's strategic focus on high-growth areas and its advisory role in key AI acquisitions in early 2025 highlight its specialized expertise and ability to capture market share in these burgeoning markets.

The digital asset strategy, centered around GS DAP®, positions Goldman Sachs for future growth in a high-potential sector. By investing in tokenization and crypto lending, the firm aims to lead in this evolving financial landscape, indicating Star-like potential.

| Business Segment | BCG Matrix Quadrant | Key Performance Indicators (Q1 2025 & 2024 Data) | Strategic Rationale |

|---|---|---|---|

| Asset & Wealth Management (Alternatives) | Star | $72 billion raised in 2024; Target $225 billion gross inflows by year-end 2024; Top-five global alternative asset manager | High growth potential, significant market share, scaling flagship funds |

| Global Banking & Markets (Equities & FICC Financing) | Star | Record net revenues in Q1 2025; Robust activity in financing and derivatives (Equities); Increased income from mortgages and structured lending (FICC) | Strong market share, impressive growth trajectory, significant contribution to firm's health |

| Investment Banking (M&A Advisory - Tech/AI) | Star | Notable presence in tech M&A in Q1 2025, especially AI-driven deals; Resilience in consumer and healthcare M&A | Specialized expertise in high-growth sectors, strategic alignment with burgeoning industries |

| Digital Assets | Star (Emerging) | Aggressive build-out of capabilities; Focus on tokenization and crypto lending; GS DAP® platform development | High-growth sector potential, capturing market share, redefining traditional finance |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

It provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertainty in investment decisions.

Cash Cows

Goldman Sachs' core investment banking advisory, particularly in merger and acquisition (M&A) services, has long been a cornerstone of its business. For over twenty years, the firm has consistently ranked at the top for M&A advisory revenue globally, demonstrating a deeply entrenched market position.

Despite a revenue decline in Q1 2025, this segment represents a mature, high-market-share business. The firm's extensive client relationships and deep expertise solidify its ability to generate consistent cash flow over the long term, acting as a stable revenue engine.

Goldman Sachs' Global Markets division features prime brokerage and established trading desks as significant cash cows. These mature businesses, operating across diverse asset classes, consistently deliver high-volume revenue thanks to the firm's extensive client base and robust infrastructure.

In 2024, for instance, Goldman Sachs reported strong performance in its Global Markets segment, driven by client activity in equities and fixed income, currencies, and commodities. This stability, coupled with a high market share, solidifies these operations as reliable profit generators requiring minimal incremental growth investment.

Goldman Sachs' traditional institutional asset management, encompassing mutual funds and similar products, is a prime example of a cash cow. This segment thrives on consistent management fees derived from substantial, long-term client assets. As of the first quarter of 2024, Goldman Sachs reported record assets under supervision (AUS) of $2.7 trillion, with a significant portion attributed to its asset management division, underscoring its stability and scale.

The mature nature of this business means it doesn't demand the same level of aggressive reinvestment as growth-oriented areas. This allows it to generate substantial and predictable cash flow, which can then be strategically deployed to fund other initiatives within the firm, such as expanding into new markets or investing in technology. The enduring client relationships and established infrastructure further solidify its role as a reliable cash generator.

Debt Underwriting Services

Debt underwriting, especially for asset-backed and investment-grade deals, has been a robust performer for Goldman Sachs. This segment has consistently boosted Investment Banking revenues, even during periods when advisory services saw a dip. This resilience points to a mature market where Goldman Sachs commands a substantial presence, generating steady fee income.

Goldman Sachs's established leadership in underwriting diverse debt issuances underscores its role as a dependable cash cow. For instance, in 2024, the firm participated in numerous significant debt offerings across various sectors, reflecting its deep market penetration and client trust.

- Strong Fee Generation: Debt underwriting services contribute a significant and stable stream of fees to Goldman Sachs's revenue, particularly in the investment-grade and asset-backed markets.

- Market Leadership: The firm's consistent ranking among top debt underwriters highlights its strong market share and the maturity of this business segment.

- Resilience: This service area has demonstrated resilience, providing consistent revenue even when other Investment Banking divisions experience fluctuations, as seen in 2024 performance data.

Private Banking and Lending within AWM

Goldman Sachs' private banking and lending operations within Asset & Wealth Management are a significant cash cow for the firm. In 2024, this segment delivered a robust 12% revenue increase, reaching $2.9 billion.

This growth is underpinned by a loyal base of high-net-worth clients, who generate predictable, fee-based income. The recurring nature of these revenues, coupled with lending opportunities, solidifies its position as a reliable profit generator for Goldman Sachs.

- Segment: Private Banking and Lending (Asset & Wealth Management)

- 2024 Revenue: $2.9 billion

- 2024 Revenue Growth: 12%

- Key Drivers: High-net-worth client base, fee-based income, lending activities

Goldman Sachs' established businesses, like investment banking advisory and global markets, function as cash cows. These mature segments boast high market share and generate consistent revenue streams, requiring less investment for growth. For instance, the firm's consistent top ranking in M&A advisory over two decades highlights its stable, profit-generating position.

Traditional institutional asset management and debt underwriting also serve as reliable cash cows. With substantial assets under supervision and strong participation in debt offerings, these areas provide predictable fee income. The private banking and lending segment, showing a 12% revenue increase to $2.9 billion in 2024, further exemplifies this stable, high-revenue generation.

| Business Segment | Role in BCG Matrix | Key Financial Indicators (2024/Q1 2024) | Supporting Data |

|---|---|---|---|

| Investment Banking Advisory (M&A) | Cash Cow | High Market Share, Consistent Revenue | Top-ranked globally for over 20 years. |

| Global Markets (Prime Brokerage, Trading) | Cash Cow | Strong Client Activity, Robust Infrastructure | Strong performance driven by equities and FICC in 2024. |

| Institutional Asset Management | Cash Cow | Substantial Assets Under Supervision, Fee-Based Income | Record AUS of $2.7 trillion as of Q1 2024. |

| Debt Underwriting | Cash Cow | Steady Fee Income, Market Leadership | Consistent contributor to Investment Banking revenue in 2024. |

| Private Banking & Lending | Cash Cow | High-Net-Worth Client Base, Lending Opportunities | 2024 Revenue: $2.9 billion (12% growth). |

Delivered as Shown

Goldman Sachs Group BCG Matrix

The Goldman Sachs Group BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional, ready-to-use strategic analysis. You can confidently use this preview as a direct representation of the comprehensive BCG Matrix report that will be yours to edit, print, or present. This ensures complete transparency and immediate utility for your business planning needs.

Dogs

Marcus by Goldman Sachs' legacy consumer lending operations, particularly those involving significant losses and increased loan loss provisions, firmly place it in the 'Dog' quadrant of the BCG Matrix. The firm's decision to scale back substantial parts of this business underscores its poor performance and limited growth potential.

The potential early termination of the Apple Card partnership, which was a cornerstone of Marcus's consumer lending strategy, further solidifies its 'Dog' status. This indicates a low market share within a segment that is either experiencing slow growth or outright decline, tying up valuable resources with minimal returns.

Goldman Sachs is actively working to shed non-core, underperforming principal investments, with a target completion date of 2026. This strategic move is designed to unlock capital previously tied up in these legacy assets. These investments, characterized by low growth and low market share, no longer align with the firm's forward-looking strategies.

By divesting these assets, Goldman Sachs aims to streamline its overall portfolio. This process allows for the reallocation of freed-up capital towards areas with greater growth potential and strategic relevance. For instance, in 2023, the firm reported a decrease in its principal investments portfolio, signaling a deliberate shift in capital allocation priorities.

Certain niche, low-volume trading desks within Goldman Sachs' Global Markets division, particularly within FICC or Equities, might represent the Dogs in the BCG Matrix. These desks often struggle with low market share and limited growth prospects. For example, a desk focusing on a specific, illiquid derivative might see minimal trading activity.

These segments could be characterized by intense competition or declining investor interest, resulting in negligible revenue generation. If these desks consistently fail to generate profits and instead consume valuable resources, they are prime candidates for the Dog classification. In 2024, such desks might be re-evaluated for their strategic fit and potential for divestment or restructuring.

Underperforming Advisory Sub-segments

Within Goldman Sachs' Investment Banking division, while the overall performance might be robust, specific advisory areas could be lagging. For instance, a particular sector advisory might be seeing reduced deal flow or lower fee generation due to intense competition or unfavorable market dynamics. If these underperforming segments consistently contribute less to net revenues and show no immediate signs of recovery, they could be candidates for strategic review.

These underperforming sub-segments, when viewed through a BCG matrix lens, would likely fall into the 'Dogs' category. This classification signifies low market share and low growth prospects within their respective advisory niches. For example, if a specific M&A advisory service, perhaps focused on a niche industry that has seen a significant contraction in deal volume throughout 2024, consistently generates less than 5% of the total Investment Banking revenue and its market growth projection is negative, it would fit this profile. Goldman Sachs regularly assesses its business lines, and such segments would warrant a deep dive into their cost structures and potential for turnaround or divestment.

- Low Market Share: Advisory services in niche sectors might hold a market share below 3% in 2024, significantly trailing competitors.

- Stagnant or Declining Growth: Projections for these specific advisory areas might indicate a negative growth rate for 2024-2025, contrasting with the broader Investment Banking sector's expansion.

- Reduced Revenue Contribution: These segments could be contributing less than 5% to the overall Investment Banking net revenues, indicating a lack of significant impact.

- Strategic Re-evaluation: Goldman Sachs would typically analyze the cost-to-serve and potential for repositioning or exiting these 'Dog' segments to reallocate resources to more promising areas.

Small Business Lending (Legacy)

Goldman Sachs Bank USA’s small business lending represented a minuscule portion of its balance sheet, less than 0.1% at the close of 2022. This suggests a very limited market share and potentially slow growth in this segment for the entire organization.

Despite community reinvestment efforts, if direct small business lending isn't a strategic growth area, its minimal contribution could classify it as a 'Dog' within a BCG matrix framework. For context, total small business lending in the US reached approximately $772 billion in 2023, highlighting the scale of the market Goldman Sachs' legacy segment was not significantly tapping into.

- Low Market Share: Less than 0.1% of Goldman Sachs Bank USA's balance sheet in 2022.

- Potential for Low Growth: Indicative of limited strategic focus or success in this area.

- BCG Classification: Likely categorized as a 'Dog' due to minimal contribution and growth prospects.

Segments like Marcus by Goldman Sachs' legacy consumer lending, certain niche trading desks, and underperforming advisory areas within Investment Banking are classified as 'Dogs' in Goldman Sachs' BCG Matrix. These are characterized by low market share and low growth prospects, often requiring significant resources with minimal returns.

The firm's strategy involves divesting or restructuring these underperforming assets to unlock capital for more promising ventures. For example, principal investments with low growth and market share are targeted for completion by 2026.

The limited contribution of small business lending, representing less than 0.1% of Goldman Sachs Bank USA's balance sheet in 2022, also places it in the 'Dog' category, indicating a lack of significant market penetration and growth potential.

These 'Dog' segments, such as specific advisory services with less than 3% market share in 2024 and negative growth projections, are regularly assessed for their strategic fit and potential for divestment.

| Business Segment | BCG Classification | Key Characteristics | Relevant Data/Notes |

| Marcus Legacy Consumer Lending | Dog | Low market share, significant losses, increased loan loss provisions | Potential early termination of Apple Card partnership |

| Niche Trading Desks (e.g., FICC, Equities) | Dog | Low market share, limited growth prospects, minimal revenue generation | Re-evaluation for strategic fit in 2024 |

| Underperforming Investment Banking Advisory Areas | Dog | Low market share in niche sectors (e.g., <3% in 2024), stagnant or declining growth (e.g., negative growth 2024-2025) | Contributing <5% to total IB revenue |

| Small Business Lending (Goldman Sachs Bank USA) | Dog | Minimal balance sheet contribution (<0.1% in 2022), limited strategic focus | US small business lending market approx. $772 billion in 2023 |

Question Marks

Goldman Sachs' Platform Solutions, encompassing transaction banking, demonstrated resilience in Q1 2025, with profitability improving. While net revenues saw a slight year-over-year dip, the segment's focus on institutional clients and new offerings like real-time payments signals strong future growth potential.

This area is a classic question mark in the BCG matrix, possessing high growth prospects but currently holding a relatively low market share. Continued strategic investment is crucial for Platform Solutions to capture significant market traction and achieve economies of scale in its transaction banking services.

Goldman Sachs is strategically exploring new digital asset offerings, including crypto lending, contingent on regulatory approvals. This move aligns with their broader digital asset strategy, aiming to tap into a rapidly evolving market.

While the crypto lending space represents a high-growth opportunity, Goldman Sachs' current market share in these specific nascent offerings is likely minimal. The firm is in the early stages of developing its presence in this sector.

These initiatives demand substantial investment to build market share and capitalize on future growth potential. For context, global crypto lending volumes, while volatile, saw significant activity in 2024, with platforms facilitating billions in loans, underscoring the market's untapped potential.

Goldman Sachs' Platform Solutions segment, which includes ventures like its digital asset platform in partnership with Tradeweb, falls into the Question Marks category of the BCG Matrix. These initiatives are strategic bets on high-growth fintech areas, aiming to capture future market share. For instance, Tradeweb reported a 9% increase in revenue to $1.3 billion in 2023, highlighting the growth potential in digital trading infrastructure.

These partnerships require significant investment to develop and scale, with their ultimate market position and profitability yet to be determined. Goldman Sachs is actively investing in these areas to drive innovation and expand its offerings in the digital economy. The success of these ventures hinges on market adoption and their ability to generate substantial returns, potentially transitioning them into Stars in the future.

Geographic Expansion in Emerging Markets

Geographic expansion into emerging markets represents a classic Question Mark for Goldman Sachs. These regions, while boasting high growth potential, often have lower existing market share for the firm. For example, while Goldman Sachs has a strong foothold in developed economies, its presence in many sub-Saharan African or Southeast Asian financial markets is still developing. This necessitates significant investment in local talent, regulatory navigation, and building brand recognition to capture market share.

The high growth trajectory of many emerging economies, such as India's projected GDP growth of 6.5% in 2024 and Indonesia's 5.2%, presents a compelling case for investment. However, these markets also come with inherent risks, including political instability, currency fluctuations, and evolving regulatory landscapes. Goldman Sachs' strategy here would involve carefully selecting specific markets and committing substantial capital to build out its capabilities, aiming to transform these Question Marks into Stars.

The success of this strategy hinges on Goldman Sachs' ability to leverage its global expertise while adapting to local nuances. Key considerations include:

- Market Selection: Identifying emerging markets with favorable regulatory environments and strong economic fundamentals.

- Investment Allocation: Committing significant capital for infrastructure, technology, and local talent acquisition.

- Risk Mitigation: Developing strategies to manage political, economic, and currency-related risks.

- Partnerships: Collaborating with local institutions to accelerate market penetration and understanding.

AI-driven Financial Solutions and Tools

Goldman Sachs views AI as a major growth driver, investing heavily in its development and deployment. The firm's commitment to AI-driven financial solutions places it in a dynamic, high-potential market segment.

While Goldman Sachs is a leader in financial services, its market share in highly specialized, cutting-edge AI applications may currently be modest compared to dedicated technology firms. This positions these AI initiatives as potential Stars or Question Marks within the BCG framework, requiring substantial investment and market development.

The firm's strategic focus on AI is evident in its ongoing research and development efforts, aiming to create innovative tools for trading, risk management, and client services. For instance, in 2023, Goldman Sachs reported significant investments in AI and machine learning capabilities, underscoring their belief in its transformative power for the financial sector.

- AI Development: Goldman Sachs is actively developing AI-powered platforms for enhanced data analysis and predictive modeling.

- Market Potential: The market for AI-driven financial solutions is projected for substantial growth, with estimates suggesting it could reach hundreds of billions of dollars globally by the end of the decade.

- Strategic Investment: The company's R&D spending in AI reflects a strategic bet on these solutions becoming a significant revenue stream.

- Competitive Landscape: While Goldman Sachs is a financial giant, specialized fintech companies focused solely on AI may currently hold a larger share in niche AI applications.

Goldman Sachs' foray into digital assets, including potential crypto lending, represents a classic Question Mark. This area offers high growth potential but currently has a limited market share for the firm, requiring significant investment to build traction.

The firm's strategic partnerships, like the one with Tradeweb for its digital asset platform, also fall into this category. These ventures are positioned in high-growth fintech sectors, aiming to capture future market share, but their ultimate success and profitability are yet to be fully realized.

Emerging market expansion is another key Question Mark, with high growth prospects but a current low market share for Goldman Sachs. Significant investment is needed to navigate local regulations and build brand presence.

Goldman Sachs' significant investments in Artificial Intelligence (AI) also place it in the Question Mark quadrant. While the AI market for financial solutions is expanding rapidly, the firm's share in specialized AI applications is still developing, necessitating continued capital allocation.

| Category | Market Growth | Market Share | Strategic Implication |

| Platform Solutions (Digital Assets) | High | Low | Invest for growth, aim to increase market share. |

| Emerging Markets Expansion | High | Low | Strategic investment to build presence and capture share. |

| AI in Financial Services | High | Developing | Continued R&D and deployment to establish leadership. |

BCG Matrix Data Sources

Our BCG Matrix is built upon a robust foundation of financial disclosures, market research reports, and competitive intelligence to provide a comprehensive strategic overview.