General Motors Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Motors Bundle

Unlock the strategic blueprint behind General Motors's success with our comprehensive Business Model Canvas. Discover how GM innovates in vehicle design, manages its vast supplier network, and reaches diverse customer segments. This detailed analysis is your key to understanding their competitive edge.

Partnerships

General Motors' supplier network is a cornerstone of its operations, providing everything from steel and aluminum to sophisticated EV battery components. In 2024, GM continued to deepen these relationships, recognizing that robust collaboration with Tier 1 suppliers is essential for both traditional vehicle production and its ambitious EV rollout. This network is vital for ensuring a steady flow of high-quality parts and materials, directly impacting production efficiency and vehicle quality.

GM's commitment to sustainable sourcing is evident in its participation in initiatives like the First Movers Coalition. This partnership approach with suppliers aims to decarbonize heavy industry and transportation. By working closely with suppliers on environmental goals, GM not only strengthens its supply chain resilience but also aligns with broader sustainability objectives, a critical factor for long-term business success and investor confidence in 2024.

General Motors' (GM) strategic alliance with LG Energy Solution, known as Ultium Cells, represents a cornerstone partnership for its electric vehicle (EV) ambitions. This joint venture is critical for the in-house production of advanced EV battery cells, supporting both pouch and prismatic cell designs.

The collaboration with LG Energy Solution is designed to bolster GM's battery supply chain resilience and drive down costs for upcoming EV models. By optimizing battery technology for enhanced range and performance, GM aims to solidify its competitive position in the rapidly evolving EV market.

In 2024, GM continued to expand its Ultium Cells manufacturing capacity, with plans for multiple U.S. plants. For instance, the joint venture's facility in Warren, Ohio, was a significant contributor to GM's EV battery production goals, underscoring the tangible impact of this partnership.

General Motors (GM) actively collaborates with technology providers and research institutions to accelerate its autonomous driving (AD) development. While GM's subsidiary Cruise faced significant operational adjustments in 2024, including scaling back robotaxi services in certain cities, the underlying partnerships remain crucial for advancing the technology. These collaborations are essential for refining sensor technology, artificial intelligence, and mapping capabilities, aiming to integrate these advancements into future GM vehicles.

Charging Infrastructure Alliances

General Motors is forging key partnerships in charging infrastructure to bolster its electric vehicle (EV) strategy. A significant move involves alliances with major charging network providers, aiming to expand access for GM EV owners. For instance, GM has announced plans to adopt the North American Charging Standard (NACS), a move that will grant its customers access to a vast network of charging stations.

This integration is crucial for alleviating range anxiety and improving the overall ownership experience for GM's burgeoning EV lineup. By partnering with these networks, GM is effectively extending its reach and making EV charging more convenient, a critical factor for widespread consumer adoption. This strategy is particularly important as GM aims to significantly increase its EV sales in the coming years.

- NACS Integration: GM's adoption of the NACS standard opens up access to a substantial number of charging points across North America, enhancing convenience for EV owners.

- Expanded Network Access: Partnerships with charging providers aim to provide GM EV owners with a more robust and reliable charging experience, reducing barriers to EV adoption.

- Customer Convenience: By securing access to a broader charging infrastructure, GM is directly addressing customer concerns about charging availability and ease of use.

Strategic Marketing and Creative Agencies

General Motors (GM) strategically partners with a diverse array of marketing and creative agencies to craft compelling brand narratives and product communications. These collaborations are crucial for developing innovative campaigns that resonate with various customer demographics.

- Key Agencies: GM works with firms such as Anomaly, Mother, Preacher, 72andSunny, MediaMonks, Omnicom Precision Marketing Group, and Dentsu.

- Creative Output: These partnerships focus on generating breakthrough creative content and ensuring the effective delivery of GM's brand and product messaging.

- Strategic Alignment: The agency relationships are designed to align with GM's evolving marketing strategies and its commitment to innovation, particularly in areas like electric vehicles.

General Motors' key partnerships are vital for its electric vehicle (EV) transition and autonomous driving (AD) development. The collaboration with LG Energy Solution for Ultium Cells is central to its battery strategy, with multiple U.S. plants operational or planned as of 2024. GM also partners with technology providers and research institutions to advance AD capabilities, despite operational shifts at its subsidiary Cruise in 2024.

Furthermore, GM is expanding its charging infrastructure through alliances with major network providers, including its adoption of the North American Charging Standard (NACS). This move, significant in 2024, aims to enhance customer convenience and reduce range anxiety for its growing EV lineup. The company also engages diverse marketing and creative agencies to refine its brand messaging and product communications.

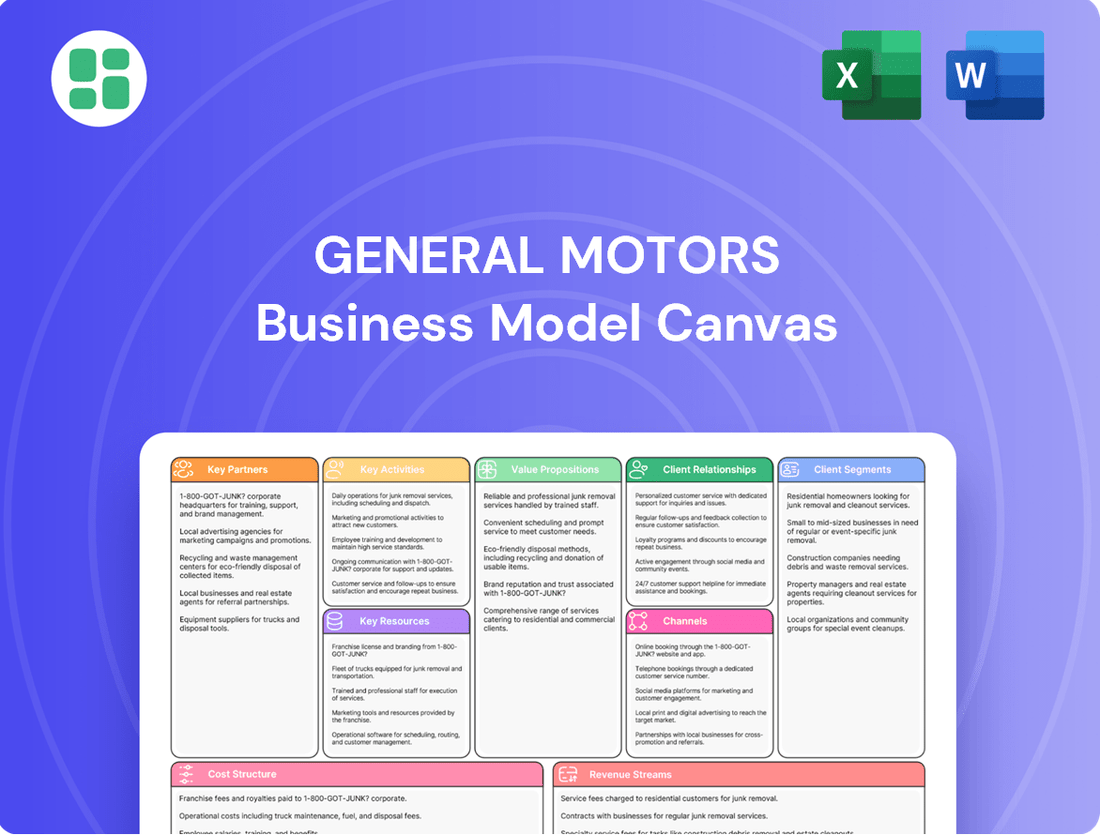

What is included in the product

A comprehensive, pre-written business model tailored to General Motors' strategy, covering customer segments, value propositions, and revenue streams in detail.

Reflects the real-world operations and plans of GM, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

The General Motors Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of their complex operations, enabling swift identification of inefficiencies and opportunities for improvement.

It streamlines strategic planning by condensing GM's vast business into a digestible, one-page snapshot, thereby alleviating the pain of information overload and fostering clearer decision-making.

Activities

General Motors' primary activities revolve around the comprehensive design, engineering, and manufacturing of a diverse vehicle lineup. This includes traditional gasoline-powered cars, trucks, and SUVs, alongside a significant and growing investment in electric vehicles (EVs) under its core brands: Chevrolet, Buick, GMC, and Cadillac.

The company oversees the entire product development process, from initial concept ideation through to final assembly. In 2023, GM reported delivering approximately 1.9 million vehicles in the U.S., with a notable increase in their EV sales, which more than doubled compared to 2022, reaching over 75,000 units.

General Motors dedicates substantial resources to research and development, with a strong focus on electric vehicle technology, next-generation battery chemistries, and autonomous driving capabilities. This commitment is evident in their aggressive product pipeline, aiming to introduce a wide array of new EV models by 2025.

GM's R&D efforts also extend to enhancing safety through advanced driver-assistance systems (ADAS) and the development of vehicle-to-everything (V2X) communication. These initiatives underscore their strategy to lead in future mobility solutions.

General Motors orchestrates a broad range of global sales and marketing efforts to connect with customers worldwide. This involves crafting targeted campaigns for its diverse brand portfolio, overseeing an extensive network of dealerships, and enhancing digital retail capabilities for online transactions and customer interaction.

In 2024, GM's commitment to digital sales is evident, with a significant portion of vehicle research and purchasing decisions influenced by online platforms. The company continues to invest in its omnichannel strategy, aiming to provide a seamless experience from initial online browsing to final vehicle delivery, reflecting evolving consumer preferences.

Automotive Financing and Related Services

General Motors Financial (GM Financial) is central to GM's strategy, offering a full suite of automotive financing options. This includes retail loans and leases designed to make purchasing GM vehicles more accessible, directly supporting sales volumes and customer acquisition.

GM Financial's role extends beyond simple transactions; it acts as a key enabler of customer loyalty by providing a seamless, integrated financial experience. This captive finance arm is crucial for driving repeat business and fostering stronger relationships with GM brand owners.

- Retail Financing: GM Financial provided approximately $37.5 billion in net financing receivables in 2023, a significant portion of which supports retail sales of new and used GM vehicles.

- Leasing Programs: The company actively manages lease portfolios, offering competitive terms that encourage new vehicle adoption and provide flexible ownership options for consumers.

- Commercial Financing: Beyond retail, GM Financial also offers financing solutions for dealerships and commercial fleets, supporting the broader automotive ecosystem.

- Portfolio Growth: As of December 31, 2023, GM Financial's total net financing receivables stood at $117.9 billion, underscoring its substantial impact on GM's overall revenue and market presence.

Sustainable Operations and Supply Chain Management

General Motors prioritizes sustainable operations and supply chain management, aiming for carbon neutrality across its global operations by 2040. This involves actively engaging its Tier 1 suppliers to commit to sustainability initiatives and reduce their environmental impact.

Key activities include driving down greenhouse gas emissions throughout the value chain and securing renewable electricity for its manufacturing facilities. For instance, in 2023, GM announced plans to source 100% renewable electricity for its U.S. facilities by 2025, a significant step towards its broader carbon neutrality goals.

- Supplier Engagement: GM collaborates with suppliers to set and achieve sustainability targets, fostering a collective approach to environmental responsibility.

- Emissions Reduction: The company focuses on reducing Scope 1, 2, and 3 emissions, with a particular emphasis on the supply chain's carbon footprint.

- Renewable Energy Procurement: GM is actively increasing its use of renewable energy sources for its operations, aiming for 100% renewable electricity globally.

General Motors' key activities encompass the entire lifecycle of vehicle creation, from initial design and engineering to manufacturing and global sales. This includes a strong emphasis on developing electric vehicles (EVs) and autonomous driving technology, as seen in their substantial R&D investments. GM also leverages GM Financial to provide crucial financing solutions, bolstering sales and customer loyalty.

The company's commitment to sustainability is a core activity, aiming for carbon neutrality by 2040 through supply chain engagement and renewable energy adoption. In 2023, GM delivered approximately 1.9 million vehicles in the U.S., with EV sales more than doubling to over 75,000 units, highlighting their strategic shift.

| Key Activity | Description | 2023 Data/Focus |

|---|---|---|

| Vehicle Design & Manufacturing | Designing, engineering, and producing a diverse vehicle portfolio, including EVs. | Delivered ~1.9 million vehicles in the U.S. |

| Research & Development | Investing in EV technology, battery advancements, and autonomous driving. | Aggressive EV model pipeline by 2025. |

| Sales & Marketing | Global sales, dealership network management, and digital retail enhancement. | Increased focus on omnichannel strategy and online purchasing. |

| Financial Services | Providing automotive financing through GM Financial. | Net financing receivables of $117.9 billion as of Dec 31, 2023. |

| Sustainability Initiatives | Reducing emissions and increasing renewable energy use. | Aiming for 100% renewable electricity for U.S. facilities by 2025. |

Full Document Unlocks After Purchase

Business Model Canvas

The General Motors Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain. Once your order is complete, you'll have full access to this same, professionally structured Business Model Canvas, ready for your strategic insights and planning.

Resources

General Motors operates a vast global network of manufacturing and assembly plants, crucial for producing its wide range of vehicles. In 2024, GM continued its strategic pivot, with a significant portion of its manufacturing footprint being actively converted for electric vehicle (EV) production to meet escalating market demand.

This transformation is key to GM's future, aiming to solidify its position in the burgeoning EV market. The company's investment in these plant upgrades underscores its commitment to a sustainable automotive future.

General Motors' intellectual property, particularly patents covering its Ultium battery platform, advanced driver-assistance systems, and autonomous vehicle technology, is a cornerstone of its business model. This proprietary technology is not just a collection of patents; it's the engine driving GM's competitive edge in the rapidly changing automotive landscape. For instance, in 2023, GM continued to invest heavily in R&D for these areas, aiming to solidify its position in the electric and autonomous vehicle markets.

General Motors leverages a robust portfolio of iconic automotive brands like Chevrolet, Cadillac, GMC, and Buick. Each brand possesses substantial equity and appeals to distinct consumer segments, fostering strong customer loyalty and driving market share. This brand strength is a critical asset, underpinning GM's sales performance and market position.

Skilled Workforce and R&D Talent

General Motors' (GM) skilled workforce, including engineers, designers, and manufacturing specialists, is a cornerstone of its operational prowess and innovation. This talent pool is crucial for developing cutting-edge automotive technologies and ensuring efficient production processes.

GM's commitment to research and development (R&D) talent fuels its transition to an all-electric and software-defined vehicle future. The company actively invests in programs designed to upskill its employees, preparing them for the evolving demands of the automotive industry. For instance, GM announced in 2023 plans to invest $7 billion in EV and AV production in Michigan, creating thousands of jobs that will require advanced skills.

- Engineering and Design Expertise: GM relies on a deep bench of engineers and designers to conceptualize and create next-generation vehicles, particularly in the EV and autonomous driving sectors.

- Manufacturing Specialists: Skilled technicians and specialists are essential for the efficient and high-quality production of complex automotive components and vehicles.

- R&D Talent: The company's R&D teams are vital for driving innovation in battery technology, software development, and advanced driver-assistance systems (ADAS).

- Continuous Training and Development: GM's ongoing investment in employee training and development programs ensures its workforce remains adept at handling new manufacturing techniques and technological advancements, such as those needed for its Ultium battery platform.

Substantial Financial Capital and Investment Capacity

General Motors leverages substantial financial capital, including robust revenue streams from vehicle sales and its GM Financial arm, to fuel its strategic initiatives. This financial strength underpins its significant investment capacity, crucial for navigating the evolving automotive landscape.

The company has demonstrated this capacity through substantial commitments to future technologies. For instance, GM has pledged tens of billions of dollars towards the development and production of electric vehicles (EVs) and advanced battery manufacturing, a critical component of its long-term growth strategy.

- Capital Allocation: Billions dedicated to EV and autonomous vehicle (AV) development.

- Revenue Streams: Significant income from vehicle sales and GM Financial services.

- Investment Focus: Prioritizing battery manufacturing and next-generation mobility solutions.

- Strategic Capacity: Financial resources to support long-term transformation and market positioning.

General Motors' key resources also include its extensive network of suppliers, providing critical components for vehicle manufacturing. GM's strategic partnerships with battery suppliers, for example, are vital for securing the raw materials and advanced cells needed for its EV push. In 2024, GM continued to strengthen these relationships to ensure supply chain stability.

The company's intellectual property, particularly patents covering its Ultium battery platform, advanced driver-assistance systems, and autonomous vehicle technology, is a cornerstone of its business model. This proprietary technology is not just a collection of patents; it's the engine driving GM's competitive edge in the rapidly changing automotive landscape. For instance, in 2023, GM continued to invest heavily in R&D for these areas, aiming to solidify its position in the electric and autonomous vehicle markets.

GM's commitment to research and development (R&D) talent fuels its transition to an all-electric and software-defined vehicle future. The company actively invests in programs designed to upskill its employees, preparing them for the evolving demands of the automotive industry. For instance, GM announced in 2023 plans to invest $7 billion in EV and AV production in Michigan, creating thousands of jobs that will require advanced skills.

General Motors leverages substantial financial capital, including robust revenue streams from vehicle sales and its GM Financial arm, to fuel its strategic initiatives. This financial strength underpins its significant investment capacity, crucial for navigating the evolving automotive landscape. For instance, GM has pledged tens of billions of dollars towards the development and production of electric vehicles (EVs) and advanced battery manufacturing, a critical component of its long-term growth strategy.

| Key Resource | Description | 2024 Focus/Fact |

| Manufacturing Facilities | Global network of plants for vehicle production. | Active conversion for EV production. |

| Intellectual Property | Patents for Ultium battery, ADAS, AV tech. | Continued heavy R&D investment in 2023. |

| Skilled Workforce | Engineers, designers, manufacturing specialists. | Upskilling for EV and software-defined vehicles. |

| Financial Capital | Revenue from sales and GM Financial. | Tens of billions pledged for EV and battery manufacturing. |

Value Propositions

General Motors (GM) boasts a broad vehicle lineup, encompassing everything from familiar gasoline engines to a growing range of electric vehicles (EVs). This extensive selection ensures they can meet a wide array of customer demands and preferences across various market segments.

GM's commitment to innovation means customers benefit from cutting-edge design and technology. For instance, in 2024, GM is heavily investing in its Ultium EV platform, aiming to launch multiple new electric models, further diversifying its offerings and appealing to a growing eco-conscious market.

This diverse and innovative approach allows GM to cater to different budgets and needs, from entry-level commuters to performance-oriented trucks and luxury SUVs. The company's strategy in 2024 focuses on making EVs more accessible, broadening their appeal beyond early adopters.

General Motors is solidifying its position as an electric vehicle (EV) technology leader, driven by its versatile Ultium battery platform. This modular architecture underpins a growing lineup of EVs, from trucks to luxury vehicles, promising competitive range and performance.

GM's aggressive product rollout strategy is key to its value proposition. By introducing a wide array of new electric models, the company aims to capture a significant share of the burgeoning EV market and make electric mobility more accessible to a broader audience.

In 2024, GM's commitment to electrification is evident in its planned launches and ongoing investments. The company has stated its intention to have over 30 EV models globally by the end of 2025, with a substantial portion of these arriving in 2024, showcasing their dedication to this technological shift.

General Motors' advanced safety and connected vehicle features, including Super Cruise and OnStar, significantly elevate the driving experience by offering hands-free driving capabilities and robust emergency assistance. These technologies provide tangible value through enhanced safety and convenience, setting GM vehicles apart in the market.

By 2024, GM had equipped over 4 million vehicles with Super Cruise, demonstrating strong customer adoption of its hands-free driving technology. OnStar services further bolster this value proposition, offering real-time diagnostics, stolen vehicle assistance, and remote access, all contributing to a safer and more connected journey for drivers.

Reliable and Accessible Automotive Financing

Through GM Financial, General Motors offers customers a streamlined path to vehicle ownership with flexible and competitive financing solutions. This integration makes purchasing a GM vehicle more accessible and fosters greater customer satisfaction. In 2023, GM Financial reported total assets of $122.4 billion, demonstrating its significant capacity to support vehicle sales.

This in-house financing arm simplifies the entire buying experience, from initial selection to securing a loan, directly enhancing customer loyalty. GM Financial's commitment to providing tailored financing options contributes to a smoother transaction, ultimately boosting repeat business.

GM Financial's value proposition is further solidified by its ability to offer diverse financing products, including retail loans and leases, catering to a wide range of customer needs and credit profiles. This comprehensive approach ensures that more potential buyers can drive away in a new GM vehicle.

- Accessible Financing: GM Financial provides flexible and competitive loan and lease options.

- Simplified Purchase: Integrated financial services streamline the vehicle buying process.

- Enhanced Loyalty: A smooth financing experience boosts customer satisfaction and encourages repeat business.

- Financial Strength: GM Financial's substantial asset base ($122.4 billion in 2023) underpins its ability to finance sales.

Commitment to Sustainability and a Zero-Emissions Future

General Motors' commitment to a zero-emissions, all-electric future resonates strongly with consumers and stakeholders prioritizing environmental responsibility. This vision is backed by tangible actions, such as GM's stated goal to be carbon neutral across its global products, facilities, and supply chain by 2040.

The company is actively investing in renewable energy sources and sustainable manufacturing processes. For instance, GM announced plans to power all its U.S. manufacturing plants with 100% renewable energy by 2025, a significant step towards its broader sustainability objectives.

- Zero-Emissions Vision: Appeals to environmentally conscious consumers and investors.

- Carbon Neutrality Goal: Aiming for carbon neutrality by 2040 across products, facilities, and supply chain.

- Renewable Energy Investment: Targeting 100% renewable energy for U.S. plants by 2025.

- Sustainable Manufacturing: Focus on responsible product development and manufacturing practices.

General Motors offers a broad vehicle portfolio, from traditional gasoline-powered cars to an expanding range of electric vehicles (EVs), ensuring a wide appeal. Their focus on innovation, particularly with the Ultium EV platform, is central to their 2024 strategy, aiming to make EVs more accessible and diverse.

Advanced safety and connectivity features like Super Cruise and OnStar significantly enhance the driving experience, providing hands-free driving and robust assistance. By 2024, over 4 million vehicles were equipped with Super Cruise, highlighting customer adoption of these valuable technologies.

GM Financial simplifies vehicle acquisition through competitive financing, making ownership more accessible and fostering customer loyalty. With $122.4 billion in total assets reported in 2023, GM Financial demonstrates substantial capacity to support sales.

GM's commitment to a zero-emissions future, targeting carbon neutrality by 2040 and powering U.S. plants with 100% renewable energy by 2025, appeals to environmentally conscious consumers.

| Value Proposition | Description | Key Data/Facts (as of 2024 or latest available) |

|---|---|---|

| Diverse Vehicle Lineup | Offering a wide range of gasoline and electric vehicles to meet varied customer needs. | Growing portfolio of EVs underpinned by the Ultium platform. |

| Technological Innovation | Focus on advanced features like Super Cruise and the Ultium EV platform for enhanced driving and sustainability. | Over 4 million vehicles equipped with Super Cruise by 2024. |

| Accessible Financing | Streamlined and competitive financing options through GM Financial. | GM Financial reported $122.4 billion in total assets in 2023. |

| Sustainability Commitment | Vision for a zero-emissions future and carbon neutrality. | Targeting 100% renewable energy for U.S. plants by 2025; carbon neutral by 2040. |

Customer Relationships

General Motors cultivates robust relationships with its extensive network of independent dealerships, viewing them as vital partners. This support includes comprehensive training programs and specialized tools designed to empower dealers in delivering outstanding customer service and sales experiences.

Dealer input is actively sought and integrated into GM's strategic planning, particularly in areas like sales process refinement and enhancing the overall customer journey. For instance, feedback from the dealer network was instrumental in the development and ongoing improvement of GM's Digital Retail Platform, aiming to streamline the car buying process.

In 2024, GM continued to invest in dealer support initiatives, recognizing that a well-equipped and motivated dealer network is fundamental to achieving sales targets and customer satisfaction. This focus on dealer enablement is a cornerstone of GM's strategy to maintain a competitive edge in the automotive market.

General Motors leverages OnStar to foster personalized connected services, transforming it into a robust e-commerce platform. This strategic move allows GM to offer customers tailored experiences, including access to diverse subscription plans, real-time vehicle diagnostics, and essential safety services. In 2024, OnStar continued to integrate more deeply, aiming to enhance customer loyalty and unlock new revenue streams through these specialized offerings.

General Motors is significantly boosting customer relationships via its digital engagement strategy, notably through its comprehensive Digital Retail Platform. This platform empowers customers to effortlessly browse vehicles, customize financing options, and even begin the purchasing process entirely online, offering unparalleled convenience and a modern shopping journey.

In 2024, GM's focus on digital retail is a strategic move to capture a larger share of the online car buying market. This enhanced digital presence is designed to increase customer interaction and loyalty by providing a transparent and user-friendly experience from initial research to final sale.

Building Brand Loyalty and Retention

General Motors (GM) cultivates deep customer relationships to drive brand loyalty and retention, a cornerstone of its business model. The company consistently earns accolades, such as being recognized for the highest overall manufacturer loyalty in recent years, demonstrating the effectiveness of its customer-centric approach.

GM's strategy hinges on delivering a superior ownership experience. This involves not only offering high-quality vehicles across its diverse brand portfolio but also providing exceptional customer service throughout the vehicle's lifecycle, from purchase to after-sales support.

- High-Quality Products: GM's commitment to vehicle quality is a primary driver of repeat business and positive word-of-mouth referrals.

- Exceptional Customer Service: Investments in dealership service training and customer support initiatives aim to resolve issues efficiently and build trust.

- Diverse Portfolio: Offering a wide range of vehicles, from trucks and SUVs to electric vehicles like the Chevrolet Bolt EV and Cadillac Lyriq, caters to varied customer needs and encourages brand switching within GM.

- Loyalty Programs: While not explicitly detailed for the canvas, GM often employs loyalty incentives and personalized offers to reward repeat customers and encourage continued engagement.

Customer Care and After-Sales Support

General Motors prioritizes a robust customer care and after-sales support system, encompassing comprehensive warranty services, scheduled maintenance, and the assurance of genuine parts availability. This focus is fundamental to fostering enduring customer satisfaction and ensuring a positive ownership experience throughout a vehicle's lifespan.

- Warranty Services: GM offers extensive warranty coverage, with many new vehicles including a 3-year/36,000-mile limited bumper-to-bumper warranty and a 5-year/60,000-mile powertrain warranty as of early 2024.

- Maintenance Programs: To support vehicle longevity and performance, GM provides recommended maintenance schedules and often includes complimentary scheduled maintenance for the first year or a set mileage on select new models.

- Genuine Parts: Ensuring the availability of genuine GM parts is crucial for maintaining vehicle integrity and performance, with a vast network supporting repairs and replacements globally.

- Customer Support Channels: GM utilizes a multi-channel approach for customer support, including dedicated phone lines, online portals, and dealership service centers to address inquiries and service needs promptly.

General Motors fosters strong customer relationships through its integrated digital platforms and personalized services, aiming to enhance loyalty and drive repeat business. The company's commitment to a superior ownership experience, backed by quality products and comprehensive after-sales support, is central to its strategy.

In 2024, GM continued to leverage OnStar as a key touchpoint for personalized connected services and e-commerce, offering tailored experiences and unlocking new revenue streams. The ongoing investment in dealer support and digital retail initiatives underscores GM's focus on providing a seamless and convenient customer journey from online browsing to final purchase.

GM's customer loyalty is further reinforced by its diverse vehicle portfolio, catering to a wide range of consumer needs, and its dedication to exceptional customer service across all touchpoints. This customer-centric approach has consistently positioned GM favorably in industry loyalty rankings.

GM's customer care strategy emphasizes comprehensive warranty services, readily available genuine parts, and accessible support channels to ensure long-term satisfaction and vehicle performance. For instance, new vehicle warranties typically include bumper-to-bumper and powertrain coverage, providing significant peace of mind to owners.

| Customer Relationship Strategy | Key Initiatives | 2024 Focus/Data |

|---|---|---|

| Dealer Network Engagement | Training, specialized tools, feedback integration | Continued investment in dealer enablement for sales and service excellence. |

| Connected Services & E-commerce | OnStar platform utilization | Deepening OnStar integration for personalized services, subscriptions, and diagnostics. |

| Digital Retail Experience | Digital Retail Platform | Enhancing online browsing, customization, and purchasing for convenience and transparency. |

| Product Quality & Ownership Experience | High-quality vehicles, after-sales support | Maintaining brand loyalty through superior vehicle performance and lifecycle support. |

Channels

General Motors' primary channel remains its vast global network of franchised dealerships, serving as the crucial touchpoint for both vehicle sales and after-sales service. These physical locations are where customers engage directly with sales experts, experience vehicles through test drives, and access essential maintenance and parts.

In 2024, GM continued to leverage this extensive dealership infrastructure, which is fundamental to its customer relationship management and brand presence worldwide. This network is not just about selling cars; it's about providing a comprehensive customer experience that includes ongoing support and service.

General Motors is significantly enhancing its Online Digital Retail Platform, enabling customers to research, customize, secure financing, and purchase vehicles entirely from home. This digital avenue works alongside the traditional dealership model and is being rolled out across more GM brands.

In 2024, GM reported that a substantial portion of its sales funnel, including lead generation and vehicle configuration, is now happening online, indicating a strong shift in customer behavior towards digital engagement. This platform is crucial for reaching a wider customer base and streamlining the purchase process.

GM Financial Services acts as a crucial revenue stream and a key partner in General Motors' value proposition, directly facilitating vehicle sales by offering competitive financing and leasing solutions. This captive finance arm enhances customer accessibility to GM vehicles, driving higher sales volumes.

In 2023, GM Financial reported total revenue of $10.3 billion, a significant portion of which is directly tied to enabling vehicle purchases for GM customers. The company's robust portfolio, including loans and leases, directly supports the affordability of Chevrolet, Cadillac, GMC, and Buick vehicles, reinforcing GM's market position.

Direct-to-Fleet and Commercial Sales

General Motors leverages direct sales channels to cater specifically to commercial and fleet customers, which encompasses a broad range of entities from small businesses to large corporations and government agencies. This approach allows for tailored solutions and dedicated support for these crucial market segments.

The company has invested in specialized sales teams and product lines designed to meet the unique demands of fleet operations. A prime example of this strategy is BrightDrop, GM's business dedicated to electric delivery vehicles and logistics solutions, which operates on a direct-to-customer model.

In 2023, General Motors reported significant growth in its fleet and commercial sales, with retail deliveries to commercial customers increasing by 14% year-over-year. This segment is vital for the company's overall revenue, with fleet sales often representing a substantial portion of total vehicle volume.

- Dedicated Commercial Sales Force: GM employs specialized sales professionals focused on understanding and serving the needs of fleet operators.

- BrightDrop for Electrification: This subsidiary offers electric vans and related services, directly targeting the commercial delivery market.

- Fleet-Specific Product Offerings: GM provides vehicles and configurations optimized for commercial use, including robust chassis and specialized upfitting options.

- Growth in Commercial Deliveries: In 2023, GM saw a 14% increase in retail deliveries to commercial customers, highlighting the strength of this sales channel.

Connected Vehicle Technology and In-Vehicle Apps

Connected vehicle technology, including in-vehicle apps, serves as a crucial channel for General Motors to deliver ongoing value and revenue streams. Through services like OnStar, GM directly engages customers with subscription-based features, essential software updates, and convenient e-commerce capabilities, extending the relationship beyond the initial sale.

This continuous engagement fosters customer loyalty and provides a platform for recurring revenue. For instance, in the first quarter of 2024, General Motors reported that its connected services segment, which includes OnStar, contributed significantly to its financial performance, with a substantial portion of new vehicles equipped with these advanced features.

- Subscription Services: OnStar and similar connected services offer monthly subscriptions for safety, security, and convenience features, creating predictable revenue.

- Over-the-Air (OTA) Updates: GM utilizes this channel to deliver software updates, improving vehicle performance, adding new functionalities, and addressing potential issues remotely.

- E-commerce Integration: In-vehicle apps allow for direct purchasing of goods and services, from booking appointments to ordering food, generating transaction-based revenue.

- Data Monetization: Anonymized vehicle data, with customer consent, can be leveraged for market insights and potential partnerships, creating additional value.

General Motors utilizes a multi-channel strategy, blending physical dealerships with robust digital platforms to reach diverse customer segments. This approach ensures broad market coverage and caters to evolving consumer preferences for both in-person and online interactions.

The company's extensive dealership network remains a cornerstone, complemented by its growing online retail capabilities which facilitate a seamless digital purchasing experience. GM Financial also plays a vital role by providing accessible financing, directly supporting sales across all channels.

Furthermore, GM employs direct sales for commercial and fleet clients, offering tailored solutions, and leverages connected vehicle technology for ongoing customer engagement and revenue generation through subscription services.

| Channel | Description | 2023/2024 Data Point |

|---|---|---|

| Dealership Network | Physical locations for sales, service, and customer interaction. | GM's primary sales and service touchpoint globally. |

| Online Digital Retail Platform | Enables online research, customization, financing, and purchase. | Significant portion of lead generation and vehicle configuration occurs online. |

| GM Financial Services | Captive finance arm offering loans and leases to facilitate vehicle sales. | Total revenue of $10.3 billion in 2023, directly supporting vehicle affordability. |

| Direct Sales (Commercial/Fleet) | Tailored solutions for businesses, corporations, and government agencies. | 14% year-over-year increase in retail deliveries to commercial customers in 2023. |

| Connected Vehicle Technology | In-vehicle apps, OnStar, OTA updates for ongoing engagement and revenue. | Connected services contribute significantly to financial performance in Q1 2024. |

Customer Segments

General Motors (GM) caters to a wide range of individual consumers, from budget-conscious families to luxury seekers. For instance, in 2024, Chevrolet continued to be a strong contender for families and young professionals, offering a diverse lineup of SUVs and trucks. Cadillac, on the other hand, appeals to younger luxury buyers drawn to its advanced technology and premium features.

Commercial and fleet operators represent a substantial customer base for General Motors, encompassing businesses that rely on vehicles for logistics, construction, and various service industries. These customers prioritize vehicle durability, practical utility, and a favorable total cost of ownership, frequently resulting in significant bulk purchases of GM vehicles.

For instance, in 2024, GM's commercial vehicle sales continued to show strength, particularly in segments like full-size vans and heavy-duty trucks, which are essential for many fleet operations. The company's focus on providing reliable and efficient vehicles tailored to business needs underpins its strategy to capture a larger share of this lucrative market.

General Motors actively engages government and institutional buyers, supplying a diverse range of vehicles for critical public services. These clients, including federal, state, and local agencies, often require specialized configurations for law enforcement, emergency response, and fleet operations.

For instance, in 2024, GM secured significant contracts, such as supplying police pursuit vehicles to numerous police departments across the United States, demonstrating their commitment to this segment. These institutional purchases are characterized by rigorous procurement processes, demanding adherence to specific safety standards, performance metrics, and often, sustainability goals.

Ride-Sharing and Autonomous Mobility Providers

General Motors, through its significant investment in autonomous driving technology via Cruise, is strategically targeting ride-sharing companies and emerging mobility service providers. This customer segment is crucial for deploying scalable, efficient, and safe autonomous vehicle solutions tailored for the complexities of urban transportation.

GM envisions these providers as key adopters of its autonomous fleet technology, enabling them to offer new transportation services. The focus is on creating a future where autonomous vehicles are integrated seamlessly into existing urban mobility networks, enhancing accessibility and reducing congestion.

- Target Market Focus: Ride-sharing platforms and future mobility service operators seeking to integrate autonomous capabilities into their fleets.

- Value Proposition: Providing a safe, reliable, and cost-effective autonomous driving system that can be scaled for commercial ride-hailing operations.

- Key Partnerships: Collaborations with existing ride-sharing giants and new entrants in the mobility-as-a-service sector are essential for market penetration.

- Revenue Streams: Potential revenue from fleet sales, licensing of autonomous technology, and service agreements with mobility providers.

Environmentally Conscious and Tech-Savvy Buyers

General Motors is increasingly catering to a segment of buyers who deeply value environmental responsibility and cutting-edge technology. This group is actively seeking out solutions that align with their sustainability goals and embrace the latest advancements in automotive innovation.

GM's strategy directly addresses this by heavily promoting its expanding portfolio of electric vehicles (EVs), such as the Chevrolet Bolt EV and GMC Hummer EV, which represent a significant shift towards zero-emission transportation. Furthermore, the company is integrating advanced connected car features and over-the-air software updates, appealing to the tech-savvy nature of these consumers.

- Growing EV Market Share: In 2024, the global EV market is projected to continue its robust growth, with GM aiming to capture a significant portion of this expanding segment.

- Consumer Demand for Sustainability: Surveys consistently show a rising preference among consumers for environmentally friendly products, with a willingness to pay a premium for EVs.

- Connected Car Adoption: The adoption of connected car technologies is accelerating, with a large percentage of new vehicle buyers expecting advanced infotainment and driver-assistance systems.

- GM's EV Investment: GM has committed billions of dollars to EV development and battery manufacturing, signaling a long-term focus on this environmentally conscious and tech-forward customer base.

General Motors' customer segments are diverse, ranging from individual consumers seeking reliable transportation to large commercial fleets and government entities. The company also targets forward-thinking buyers prioritizing sustainability and advanced technology, particularly through its electric vehicle offerings.

Cost Structure

Manufacturing and production expenses represent the largest portion of General Motors' cost structure. These costs encompass everything from the steel and aluminum that form the car's body to the complex electronic components and the skilled labor on the assembly line. GM's commitment to electric vehicles means substantial capital is also being allocated to retooling factories for EV production, a significant investment in their future manufacturing capabilities.

General Motors dedicates significant resources to research and development, a crucial element of its business model. In 2023 alone, GM reported R&D expenses of $10.5 billion, underscoring its commitment to innovation.

These investments are heavily weighted towards future-facing technologies like electric vehicles, advanced battery chemistries, and autonomous driving systems. This focus is essential for GM to maintain its competitive edge in a rapidly evolving automotive landscape.

General Motors dedicates substantial resources to its sales, marketing, and distribution efforts. This includes significant spending on advertising across its diverse brand portfolio, such as Chevrolet, GMC, and Cadillac, to drive consumer demand. In 2024, GM's marketing spend is expected to remain robust, reflecting the competitive automotive landscape and the introduction of new models.

Dealer incentives play a crucial role in motivating dealerships to push GM vehicles, representing another major cost component. Furthermore, the logistics involved in distributing vehicles from manufacturing plants to dealerships nationwide and globally are complex and costly, encompassing transportation and inventory management.

GM is actively investing in digital platforms and analytics to streamline and optimize these expenditures. The goal is to enhance the efficiency of marketing campaigns, improve customer targeting, and make the distribution network more responsive, aiming for a better return on investment for these essential business functions.

Capital Expenditures and Infrastructure Development

General Motors (GM) incurs substantial capital expenditures to support its strategic shift towards electric vehicles (EVs). These investments are crucial for modernizing existing manufacturing facilities and building new ones, particularly for battery cell production. For instance, GM announced plans to invest billions in its Ultium battery technology and manufacturing capabilities, aiming to produce millions of EVs annually.

The company's commitment to infrastructure development extends to charging solutions. GM is investing in building out a robust charging network to alleviate range anxiety for EV owners. These significant, long-term capital outlays are fundamental to GM's transition from traditional internal combustion engines to a predominantly electric future.

- Manufacturing Modernization: Significant investments in upgrading and retooling assembly plants for EV production.

- Battery Cell Manufacturing: Expansion of Ultium battery production facilities, including joint ventures.

- Charging Infrastructure: Development and support for public and home charging solutions.

Labor and Employee-Related Costs

General Motors' cost structure is significantly influenced by its substantial labor expenses. These encompass wages, comprehensive benefits packages, and costs associated with union contracts for its vast global workforce, making them a critical component of operational expenditures.

In 2024, GM continued to manage these significant labor commitments. For instance, the company's U.S. hourly workforce, largely represented by the United Auto Workers (UAW), is covered by agreements that include provisions for wages, healthcare, and pensions. These agreements are a major driver of the company's cost of goods sold and overall operating expenses.

- Wages and Salaries: Direct compensation for GM's employees across manufacturing, R&D, and administrative functions.

- Employee Benefits: Includes healthcare, retirement plans (pensions and 401k contributions), and other welfare programs.

- Union Agreements: Costs dictated by collective bargaining agreements, often including wage escalators, job security provisions, and specific benefit structures.

- Training and Development: Investments in upskilling the workforce, particularly for new technologies like electric vehicles and autonomous driving.

General Motors' cost structure is heavily weighted towards manufacturing and production, encompassing raw materials, components, and assembly line labor. Significant investments in research and development, particularly for electric vehicles and autonomous technology, also represent a major cost. Furthermore, substantial spending on sales, marketing, distribution, and dealer incentives is crucial for market penetration and brand visibility.

| Cost Category | Description | 2023/2024 Impact |

|---|---|---|

| Manufacturing & Production | Raw materials, components, assembly, labor | Largest portion; retooling for EVs a major investment. |

| Research & Development | New technologies (EVs, autonomous driving), battery tech | $10.5 billion in 2023; crucial for future competitiveness. |

| Sales, Marketing & Distribution | Advertising, dealer incentives, logistics | Robust spending expected in 2024; essential for demand generation. |

| Labor Expenses | Wages, benefits, union contracts | Significant component of COGS and operating expenses, managed via UAW agreements. |

| Capital Expenditures | EV/battery plant upgrades, charging infrastructure | Billions invested in Ultium technology and manufacturing expansion. |

Revenue Streams

General Motors' core revenue generation hinges on the sale of new vehicles. This encompasses a wide range of models, from traditional gasoline-powered cars and trucks to the growing segment of electric vehicles (EVs). The company markets these vehicles under its well-established brands: Chevrolet, Cadillac, GMC, and Buick.

These sales are primarily conducted through a wholesale model, where GM sells vehicles to its extensive network of dealerships. Additionally, GM also generates revenue from direct sales to large fleet customers, such as rental car companies and government agencies. In 2023, General Motors reported total automotive revenue of $161.9 billion, with vehicle sales forming the vast majority of this figure.

General Motors Financial, the company's captive finance arm, is a crucial revenue generator. It provides retail financing, leasing, and commercial lending for GM vehicles, directly supporting sales and creating a consistent income stream from interest and lease payments.

In 2024, GM Financial's net revenue was approximately $12.8 billion, with a significant portion derived from its financing and leasing operations. This segment not only boosts vehicle sales by offering accessible purchasing options but also contributes substantially to GM's overall profitability through interest income and residual value management on leases.

General Motors (GM) generates significant revenue from selling genuine parts and accessories, catering to both new vehicle owners and those seeking replacements or upgrades. This segment is crucial for maintaining customer loyalty and providing a consistent income stream beyond the initial vehicle purchase.

Furthermore, GM leverages its extensive dealership network to offer a wide array of aftermarket services, including routine maintenance, repairs, and specialized diagnostics. In 2023, GM's service and parts revenue demonstrated resilience, contributing substantially to the company's overall financial performance, underscoring the enduring value of post-sale customer engagement.

Connected Services and Software Subscriptions

General Motors is increasingly leveraging connected services and software subscriptions as a significant revenue driver. This segment includes offerings through its OnStar brand, providing safety, security, navigation, and infotainment features to customers.

The company is actively working to grow this recurring revenue by expanding its subscription-based services. A key focus area is the integration of advanced driver-assistance systems, such as Super Cruise, with subscription models. Additionally, GM is exploring in-vehicle e-commerce opportunities, allowing drivers to purchase goods and services directly from their vehicles.

- OnStar Subscriptions: Safety, security, and convenience features offered on a recurring basis.

- Super Cruise Subscriptions: Access to GM's hands-free driving technology for compatible vehicles.

- In-Vehicle E-commerce: Future revenue streams from integrated shopping and service platforms within the vehicle.

Commercial and Mobility Solutions

General Motors generates revenue from specialized commercial vehicle sales, notably through its BrightDrop brand, which focuses on electric last-mile delivery solutions. This segment is crucial for diversifying GM's income streams beyond traditional consumer vehicles.

Future revenue is anticipated from the scaling of Cruise's autonomous driving technology, particularly in ride-hailing services. This represents a significant growth opportunity as the company aims to commercialize its self-driving capabilities.

- BrightDrop's electric delivery vans and related services

- Revenue from Cruise's autonomous ride-hailing operations

- Potential for future mobility-as-a-service offerings

Beyond vehicle sales, GM Financial, the company's captive finance arm, is a significant revenue generator. In 2023, this segment contributed substantially to GM's overall financial performance by providing retail financing, leasing, and commercial lending for GM vehicles, generating income from interest and lease payments.

Parts and service revenue, including genuine parts, accessories, and aftermarket services like maintenance and repairs, also form a vital income stream. This segment supports customer loyalty and provides consistent revenue beyond the initial vehicle purchase, as evidenced by its substantial contribution to GM's 2023 financial results.

Emerging revenue streams include connected services and software subscriptions, such as OnStar and Super Cruise, offering recurring income. GM is actively expanding these offerings, aiming to integrate in-vehicle e-commerce and further monetize its digital platforms.

Specialized commercial sales, particularly through BrightDrop's electric delivery solutions, and the future commercialization of Cruise's autonomous driving technology in ride-hailing services represent key diversification and growth avenues for GM.

| Revenue Stream | Primary Source | 2023/2024 Data Point |

|---|---|---|

| New Vehicle Sales | Chevrolet, Cadillac, GMC, Buick | $161.9 billion (Total Automotive Revenue 2023) |

| Financial Services | GM Financial (financing, leasing) | ~$12.8 billion (GM Financial Net Revenue 2024) |

| Parts & Service | Genuine parts, accessories, repairs, maintenance | Substantial contribution to 2023 financial performance |

| Connected Services & Software | OnStar, Super Cruise subscriptions | Growing recurring revenue focus |

| Commercial & Future Mobility | BrightDrop, Cruise autonomous services | Diversification and growth opportunities |

Business Model Canvas Data Sources

The General Motors Business Model Canvas is built upon extensive market research, internal financial disclosures, and competitive analysis. These data sources ensure each component, from value propositions to revenue streams, is grounded in current industry realities and strategic objectives.