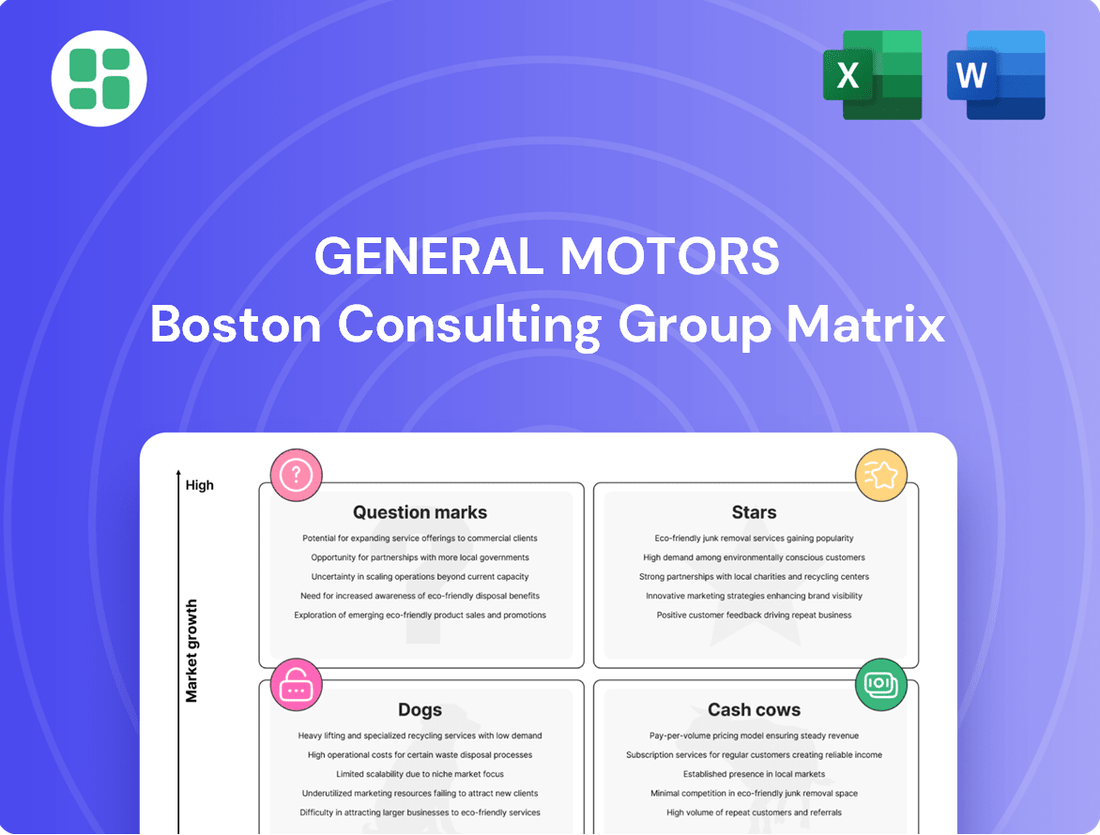

General Motors Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Motors Bundle

General Motors' BCG Matrix reveals a dynamic portfolio of vehicles, with established Cash Cows like the Chevrolet Silverado driving consistent revenue while emerging electric vehicles represent potential Stars or Question Marks. Understanding this balance is crucial for future success.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Chevrolet Equinox EV is a cornerstone of General Motors' electric vehicle strategy, aiming for broad market appeal with its competitive pricing and substantial driving range. This model is instrumental in driving GM's EV sales volume, significantly contributing to the company's expanding EV market share throughout 2024 and into early 2025.

The Cadillac LYRIQ stands as General Motors' premium electric vehicle offering, highlighting the company's commitment to the luxury EV market. Its performance has been noteworthy, with Cadillac capturing a significant share of the luxury EV market in the second quarter of 2025.

This model exemplifies GM's advanced Ultium battery architecture and sophisticated design, appealing to a discerning, affluent customer base. The LYRIQ contributes to increased profitability for GM within the rapidly expanding electric vehicle sector.

The GMC Hummer EV, offered in both pickup and SUV variants, signifies General Motors' ambitious move into the high-performance, specialized electric vehicle segment. This vehicle is positioned as a premium offering, and its sales trajectory has been notably upward, reflecting robust demand within the luxury electric truck and SUV market.

Despite its higher price point, the Hummer EV has demonstrated impressive sales growth, with GM reporting over 11,000 reservations for the pickup and SUV models by early 2024. This strong uptake highlights a burgeoning appetite for powerful, albeit niche, electric vehicles.

Functioning as a halo product, the Hummer EV significantly bolsters GM's brand perception in the rapidly evolving electric vehicle landscape. It effectively showcases the adaptability and capability of GM's Ultium battery platform, particularly for more demanding, heavy-duty vehicle applications.

Chevrolet Silverado EV

The Chevrolet Silverado EV represents a significant strategic move for General Motors, positioned as a potential star within its electric vehicle portfolio. It targets the lucrative full-size pickup truck segment, a stronghold for GM, aiming to capture a substantial portion of the burgeoning electric truck market. Early sales figures from Q1 and Q2 2025 indicate a promising upward trajectory, suggesting strong customer adoption.

- Market Position: Aims to leverage GM's established leadership in traditional full-size trucks to dominate the electric segment.

- Growth Potential: Positioned in a high-growth EV market with significant demand for electric pickup alternatives.

- Sales Momentum: Q1 and Q2 2025 sales data show a notable increase, signaling growing market acceptance.

- Strategic Importance: Critical for GM's transition to an all-electric future, appealing to a broad customer base seeking EV capability.

Cadillac Escalade IQ

The Cadillac Escalade IQ represents General Motors' ambitious push into the premium electric SUV segment, aiming to translate the established luxury and presence of its gasoline-powered sibling into an all-electric future. This move leverages the formidable brand cachet of the Escalade, a name synonymous with American luxury and status, to capture a significant share of the rapidly expanding EV market. GM's strategy clearly involves electrifying its most profitable and recognizable nameplates, with the Escalade IQ positioned as a flagship offering to signal its commitment to high-end electric mobility.

In 2024, the full-size luxury SUV market, where the Escalade traditionally thrives, saw continued strong demand, though the EV transition introduces new competitive dynamics. The Escalade IQ is designed to compete directly with other high-end electric SUVs, offering a blend of advanced technology, spaciousness, and the unmistakable Escalade aesthetic. Its success will be crucial for GM's overall EV sales targets and its positioning as a leader in the premium electric vehicle space.

- Market Positioning: The Escalade IQ aims to be a "star" in GM's portfolio, capitalizing on a well-established luxury brand in a growing EV market.

- Brand Equity: It leverages the iconic Escalade name to attract affluent buyers transitioning to electric vehicles.

- Strategic Importance: Electrifying this high-margin model is key to GM's broader EV strategy and its premium brand perception.

- Competitive Landscape: Faces competition from other luxury EV SUVs, making its technological offerings and pricing critical.

The Chevrolet Silverado EV and Cadillac Escalade IQ are positioned as General Motors' key "Stars" in the BCG Matrix, representing high-market share in high-growth electric vehicle segments. These models are crucial for driving GM's EV volume and profitability, capitalizing on established brand loyalty and the expanding demand for electric trucks and luxury SUVs. Their performance throughout 2024 and into early 2025 demonstrates strong market acceptance and strategic importance for GM's electric future.

What is included in the product

Highlights which units to invest in, hold, or divest for General Motors.

A clear BCG Matrix visual for GM's portfolio offers a pain-relief overview of strategic resource allocation.

Cash Cows

The Chevrolet Silverado (ICE) is a powerful cash cow for General Motors, consistently dominating the U.S. full-size pickup truck segment. Its robust sales and healthy profit margins are crucial for funding GM's ambitious ventures into electric vehicles and autonomous technology.

In 2023, the Silverado lineup, including its ICE variants, contributed significantly to GM's overall sales volume, with the full-size truck segment being a primary revenue driver. This sustained demand translates directly into substantial cash flow, solidifying its position as a star performer within GM's product portfolio.

The GMC Sierra, like its Chevrolet Silverado counterpart, stands as a formidable cash cow for General Motors. It holds a commanding presence in the premium full-size truck market, consistently delivering robust sales figures and high average transaction prices that significantly bolster GM's revenue and profitability.

The Sierra's impressive performance, particularly the success of its upscale Denali trim, provides a crucial and stable financial bedrock. This financial strength is instrumental in supporting General Motors as it navigates strategic transitions and invests in future technologies.

General Motors' stable of full-size SUVs, encompassing the Chevrolet Tahoe, Suburban, GMC Yukon, and Cadillac Escalade (all internal combustion engine models), are undeniably cash cows for the company. These vehicles consistently lead their market segments, boasting impressive profit margins and unwavering consumer demand, making them vital for funding GM's strategic shift towards electric and autonomous vehicles.

General Motors Financial (GM Financial)

GM Financial, General Motors' captive finance company, functions as a Cash Cow within the company's BCG Matrix. It consistently generates substantial profits and cash flow, primarily by offering financing and leasing options for new and used GM vehicles. This financial arm directly supports sales across all GM brands, including Chevrolet, Cadillac, GMC, and Buick, by making vehicle purchases more accessible to consumers.

The company's strong performance in 2024 highlights its role as a reliable cash generator. For instance, GM Financial reported net revenue of $4.3 billion for the first quarter of 2024, demonstrating its consistent ability to translate vehicle sales into financial gains. This segment is crucial for GM's overall financial stability, providing a steady stream of liquidity that helps buffer the company against the cyclical nature of the automotive market.

- Consistent Profitability: GM Financial's business model, focused on automotive financing, yields predictable earnings.

- Support for Vehicle Sales: It directly facilitates the sale of GM vehicles by offering crucial financing solutions to customers.

- Liquidity Provider: The segment acts as a stable source of cash flow, bolstering GM's overall financial health.

- 2024 Performance: Q1 2024 saw GM Financial report $4.3 billion in net revenue, underscoring its ongoing financial strength.

Aftermarket Parts and Services

General Motors' aftermarket parts and services division functions as a classic Cash Cow. This segment capitalizes on GM's extensive history of vehicle sales, offering a steady stream of revenue from replacement parts, accessories, and essential maintenance for its massive installed base. The profitability here is driven by high-margin components and the recurring nature of service needs.

This segment consistently generates substantial, stable cash flow for GM. It requires relatively low investment due to the established customer base and existing infrastructure. For instance, in 2023, the automotive aftermarket industry in the US alone was valued at over $400 billion, with service and parts being significant contributors, highlighting the scale of such operations.

- Stable Revenue: Aftermarket sales provide a predictable income stream, less susceptible to new vehicle sales cycles.

- High Profit Margins: Genuine GM parts and authorized services often command premium pricing.

- Low Investment Needs: Existing dealer networks and parts distribution channels minimize the need for new capital expenditure.

- Customer Loyalty: Providing quality aftermarket support encourages continued customer engagement with the GM brand.

General Motors' full-size pickup trucks, including the Chevrolet Silverado and GMC Sierra, represent significant cash cows. These vehicles consistently lead in sales and profitability within their segments, generating substantial cash flow that fuels GM's investments in new technologies.

The strong demand for these ICE trucks, evident in their robust sales figures throughout 2023 and into 2024, translates directly into reliable profits. This financial strength is vital for GM as it navigates the transition to electric vehicles.

GM's large SUVs, such as the Chevrolet Tahoe, Suburban, GMC Yukon, and Cadillac Escalade, also function as powerful cash cows. Their consistent market leadership and high profit margins provide a stable financial foundation for the company's future endeavors.

These vehicles are critical revenue generators, ensuring GM has the necessary capital to fund its strategic shift towards electrification and autonomous driving technologies.

| Product Segment | 2023 Sales Contribution (Est.) | Profitability | Role in BCG Matrix |

| Chevrolet Silverado (ICE) | Significant Revenue Driver | High | Cash Cow |

| GMC Sierra (ICE) | Strong Premium Segment Contributor | High | Cash Cow |

| Full-Size SUVs (ICE) | Market Leaders | High Profit Margins | Cash Cow |

What You See Is What You Get

General Motors BCG Matrix

The General Motors BCG Matrix preview you see is the exact, unadulterated document you will receive upon purchase. This comprehensive analysis, meticulously crafted to guide strategic decisions, will be delivered in its full, ready-to-use format, empowering your business planning with actionable insights.

Dogs

Traditional sedan models, such as the Chevrolet Malibu, are positioned as dogs in General Motors' BCG Matrix. This is because the market for sedans is shrinking, with consumer tastes increasingly favoring SUVs and trucks. For instance, in 2023, SUV sales represented a significant majority of the U.S. light-vehicle market, further pressuring sedan segment volumes.

These vehicles often contribute little to profitability, potentially even operating at a loss. The resources invested in their production and marketing could be more effectively deployed in growth areas. GM's strategic decisions, including the discontinuation of several sedan nameplates in recent years, underscore their classification as dogs within the company's product lineup.

The Chevrolet Bolt EV/EUV, prior to its reintroduction, occupied a challenging position within General Motors' portfolio, likely falling into the 'Dog' category of the BCG Matrix. Facing production hurdles and a shrinking market share against more advanced rivals, its older battery technology and platform limited its competitiveness.

Despite being an early entrant in the EV space, the legacy Bolt models struggled to maintain momentum. In the first quarter of 2025, sales figures for the original Bolt EV and EUV were notably subdued, reflecting a declining demand and a lack of significant market growth.

Certain legacy internal combustion engine (ICE) platforms within General Motors are categorized as dogs in the BCG Matrix. These are typically older vehicle architectures with declining demand and higher production costs compared to newer, more efficient platforms. For instance, platforms supporting models with significantly lower sales volumes, such as certain sedans or less popular SUV variants, often fall into this category. In 2024, GM's strategic focus is heavily on its Ultium electric vehicle platform, signaling a deliberate move away from and reduced investment in these older ICE technologies.

Non-core International Markets with Low Market Share

General Motors has strategically withdrawn from or reduced its presence in several international markets where its market share was notably low, often encountering formidable competition. For instance, GM's exit from India in 2017, after years of struggling to gain significant traction against established players, exemplifies this approach. Similarly, its scaled-back operations in parts of Europe, prior to the sale of Opel and Vauxhall in 2017, reflected challenges in achieving competitive market positions.

These divested or minimized markets typically represent areas where the cost of investment to achieve meaningful market share outweighs the potential returns. They often function as a drain on resources without contributing substantially to overall profitability or growth. The strategy here is usually to divest or maintain a minimal operational footprint.

- GM's exit from India in 2017 resulted in a significant reduction of its manufacturing and sales operations in the country.

- The sale of Opel and Vauxhall in 2017 marked a substantial shift in GM's European market strategy, exiting core manufacturing and sales in key regions.

- These markets often require substantial capital expenditure for brand building and product localization, yielding low returns on investment compared to core markets.

Niche or Low-Volume Specialty Vehicles

General Motors' niche or low-volume specialty vehicles often fall into the question mark category initially, but if they fail to gain traction or develop into stars, they can quickly become dogs. These vehicles target very specific customer bases and, consequently, have limited sales potential. For instance, a highly specialized performance car with a limited production run might require substantial investment in research and development but generate only a fraction of the revenue compared to mass-market models.

These types of vehicles can drain resources without yielding significant returns. Their high development costs, coupled with low sales volumes, mean they contribute minimally to overall profitability and brand perception. In 2024, while specific low-volume models are not publicly detailed as dogs, GM's strategy often involves evaluating the long-term viability of such niche products. If a specialty vehicle doesn't show a path to growth or market share improvement, it's a candidate for divestment or discontinuation.

- Limited Market Appeal: These vehicles cater to a very small, specialized customer segment, restricting their sales volume.

- High Development Costs: The investment required for engineering and manufacturing specialized vehicles often outweighs their sales revenue.

- Low Contribution to Profitability: Their inability to capture significant market share or achieve economies of scale hinders their profitability.

- Potential for Divestment: If these vehicles do not demonstrate potential for growth or improvement, they may be phased out to reallocate resources.

General Motors' "dog" products are those with low market share and low growth potential, often legacy internal combustion engine vehicles or niche models. These offerings typically generate minimal profits and may even incur losses, consuming resources that could be better allocated to more promising ventures. GM's strategic decisions, such as phasing out certain sedan lines and focusing on electric vehicle platforms like Ultium, reflect an ongoing effort to divest from or minimize investment in these underperforming segments.

The Chevrolet Bolt EV/EUV, in its original iteration, represented a product that struggled to maintain competitiveness and market share, fitting the 'dog' profile. Despite being an early electric vehicle offering, it faced challenges from newer, more advanced competitors and had limited production capacity. By the first quarter of 2025, sales figures indicated a clear decline in demand for these legacy models, confirming their position as dogs within GM's portfolio.

Legacy internal combustion engine (ICE) platforms within GM are often classified as dogs due to declining demand and higher production costs compared to newer technologies. For example, platforms supporting models with significantly lower sales volumes, like certain sedans or less popular SUV variants, fall into this category. In 2024, GM's strategic emphasis on its Ultium EV platform signals a deliberate reduction in investment and focus on these older ICE technologies.

General Motors' divestment from markets where it held low market share, such as its exit from India in 2017, exemplifies the management of "dog" markets. These regions often require substantial investment to gain traction against established competitors, with low potential returns. By withdrawing or reducing operations, GM frees up capital and resources that can be redirected towards more profitable or strategically important markets and product lines.

Question Marks

Cruise, General Motors' autonomous driving venture, currently sits as a classic Question Mark in the BCG Matrix. The company has seen over $10 billion poured into it since 2016, reflecting the immense growth potential within the autonomous vehicle sector. However, significant operational challenges, including accidents and regulatory hurdles, have led to a temporary suspension of services and substantial financial losses for GM.

The path forward for Cruise is uncertain, demanding careful strategic decisions. While GM continues to inject capital, exploring external funding and a broader application of its technology beyond ride-hailing services are critical steps. This re-evaluation is essential to navigate the high-risk, high-reward landscape of autonomous driving technology.

General Motors is strategically planning to reintroduce the Chevrolet Bolt EV, built on its Ultium platform, by late 2025. The goal is to offer a high-volume, budget-friendly electric vehicle, targeting a significant segment of the market. This move positions the Bolt as a potential 'Question Mark' within GM's BCG Matrix.

The market for affordable EVs is experiencing robust growth, presenting a substantial opportunity. However, the previous Bolt model's performance, coupled with the critical need for a successful relaunch featuring competitive pricing and compelling features, introduces uncertainty. GM's ability to capture a larger share of the mainstream EV market hinges on this vehicle's reception.

General Motors' Super Cruise, a leading advanced driver-assistance system, is positioned as a Question Mark in the BCG matrix. While it holds a strong market position, its future revenue growth and market penetration are uncertain.

The market for ADAS is expanding significantly, with GM targeting a doubling of Super Cruise subscription revenue by 2025. This aggressive growth objective highlights its potential but also the inherent risks.

The primary challenge for Super Cruise is transforming its premium appeal into a consistent, recurring revenue stream for a broader consumer base, especially given the intensifying competition in the autonomous driving sector.

New EV models in emerging segments (e.g., Cadillac Vistiq, Optiq)

The Cadillac Vistiq and Optiq represent General Motors' strategic push into the burgeoning luxury electric SUV segment. These models are poised to tap into a high-growth market, a key indicator for potential future success. While their market share is currently minimal due to their newness, their introduction signals GM's ambition to capture a significant portion of this evolving landscape.

GM faces the challenge of significant investment to propel these new EVs. Marketing and production scaling are crucial for establishing brand presence and competing effectively. The luxury EV market is increasingly crowded, with both established players and agile startups vying for consumer attention, making differentiation and strong execution paramount for the Vistiq and Optiq.

- High Growth Potential: The luxury electric SUV market is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond.

- New Entrant Status: As new models, the Vistiq and Optiq currently hold a negligible market share, placing them in the "Question Mark" category of the BCG matrix.

- Investment Requirements: Significant capital outlay will be necessary for marketing, research and development, and manufacturing to achieve competitive positioning.

- Competitive Landscape: GM must contend with established luxury brands and newer EV-focused companies, requiring innovative strategies to gain traction.

Hydrogen Fuel Cell Technology (Hydrotec)

General Motors' commitment to hydrogen fuel cell technology, exemplified by its Hydrotec power cubes, positions it as a Question Mark within the BCG matrix. While GM has invested significantly, including a reported $2.2 billion in fuel cell technology through 2023, the commercial viability and widespread adoption of hydrogen for transportation remain uncertain.

The hydrogen fuel cell market, especially for heavy-duty commercial vehicles, shows considerable promise for future growth, with projections indicating a substantial expansion in the coming decade. However, the current market share for hydrogen fuel cell vehicles remains small, making it difficult to predict the ultimate success of GM's investments.

GM's strategy involves developing partnerships and focusing on applications like heavy-duty trucks and even stationary power generation, aiming to overcome the infrastructure and cost challenges. The company's continued R&D efforts and strategic alliances are crucial for navigating this nascent market and converting its potential into tangible market leadership.

- GM's Hydrotec power cubes are a key element of its hydrogen strategy.

- The hydrogen fuel cell market is characterized by high growth potential but also significant uncertainty regarding widespread adoption.

- GM's investments reflect a long-term bet on hydrogen's future in transportation and beyond.

- Success hinges on overcoming infrastructure hurdles and achieving cost competitiveness.

Cruise, GM's autonomous driving unit, remains a significant Question Mark. Despite over $10 billion invested since 2016, operational setbacks and temporary service suspensions highlight the high risks. GM is exploring new funding avenues and broader technology applications to navigate this volatile sector.

The upcoming Chevrolet Bolt EV, built on the Ultium platform and slated for a late 2025 relaunch, is positioned as another Question Mark. While the affordable EV market is booming, the Bolt's success hinges on competitive pricing and features to capture market share against a backdrop of intense competition.

General Motors' Super Cruise advanced driver-assistance system is a Question Mark, aiming to double subscription revenue by 2025. The challenge lies in converting its premium appeal into consistent, recurring revenue for a broader audience amidst escalating competition.

The Cadillac Vistiq and Optiq luxury electric SUVs are Question Marks, targeting a high-growth market. Significant investment in marketing and production scaling is crucial for differentiation and market penetration in a crowded luxury EV space.

GM's hydrogen fuel cell technology, including Hydrotec power cubes, represents a Question Mark. With billions invested, the commercial viability and widespread adoption of hydrogen for transport remain uncertain, despite promising growth projections for the sector, particularly in heavy-duty vehicles.

| Business Unit | BCG Category | Key Considerations | Recent Data/Projections |

|---|---|---|---|

| Cruise (Autonomous Driving) | Question Mark | High investment, operational challenges, regulatory hurdles, uncertain market adoption. | Over $10 billion invested since 2016; temporary service suspensions in late 2023. |

| Chevrolet Bolt EV (Next Gen) | Question Mark | Affordable EV market growth, need for competitive pricing and features, market reception uncertainty. | Relaunch planned for late 2025 on Ultium platform. |

| Super Cruise (ADAS) | Question Mark | Premium appeal, recurring revenue generation, intensifying competition in ADAS. | Targeting double subscription revenue by 2025. |

| Cadillac Vistiq & Optiq (Luxury EVs) | Question Mark | High-growth luxury EV segment, significant marketing/production investment required, crowded competitive landscape. | New entrants with minimal current market share. |

| Hydrogen Fuel Cell Technology (Hydrotec) | Question Mark | High investment, uncertain commercial viability, infrastructure challenges, potential in heavy-duty transport. | Reported $2.2 billion invested through 2023; market growth projected for heavy-duty applications. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of GM's official financial disclosures, comprehensive market research reports, and detailed industry trend analyses to provide a robust strategic overview.