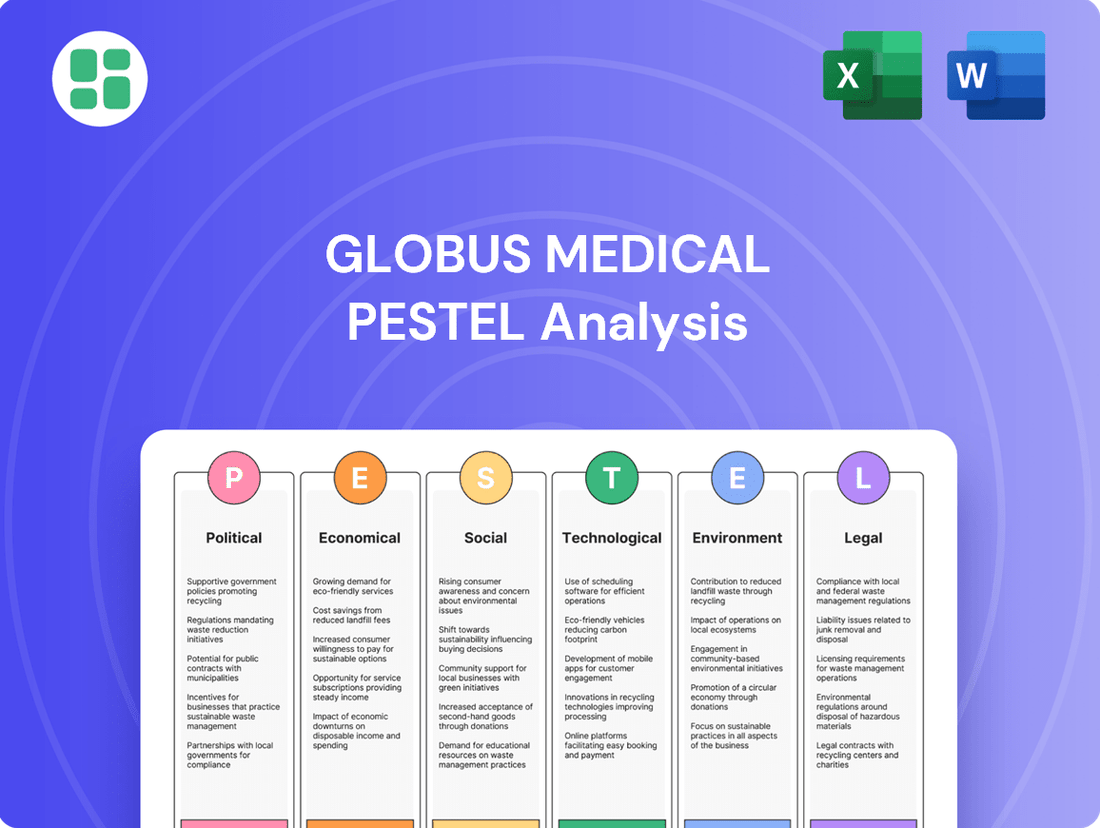

Globus Medical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globus Medical Bundle

Gain a competitive edge with our comprehensive PESTLE Analysis of Globus Medical. Understand the intricate interplay of political, economic, social, technological, legal, and environmental factors that are shaping its future. This expertly crafted analysis provides actionable intelligence to inform your strategic decisions. Download the full version now and unlock critical insights for market success.

Political factors

Government healthcare spending and reimbursement policies are critical for Globus Medical. Fluctuations in these budgets and changes in how spinal and orthopedic procedures are paid for directly affect demand and profitability. For instance, if governments decide to cover more advanced surgical technologies, it could significantly boost Globus Medical's sales. Conversely, stricter reimbursement rules might restrict market access and revenue streams.

The global push for cost-effectiveness in healthcare systems is a major factor. This trend pressures medical device companies like Globus Medical to clearly demonstrate the value their products bring. In 2024, many healthcare systems are scrutinizing device costs, seeking evidence of improved patient outcomes and reduced overall healthcare expenditures to justify reimbursement.

Globus Medical navigates a landscape shaped by stringent medical device regulations, notably the FDA's oversight in the United States and the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) in Europe. These frameworks directly impact product design, the timeline for market introduction, and overall operational expenditures.

The company must invest heavily to adhere to evolving standards, such as the FDA's adoption of ISO 13485 and the forthcoming EU AI Act. Proactive management of these requirements is crucial, as delays in compliance can significantly postpone new product launches, affecting revenue streams and market competitiveness.

Globus Medical's global operations are significantly influenced by international trade policies. For instance, the United States' trade relations with China, a key manufacturing hub for medical devices, can impact component costs. In 2024, ongoing trade tensions and potential tariff adjustments could increase the cost of goods sold for products reliant on Chinese manufacturing, affecting Globus Medical's pricing and profitability.

Political Stability and Geopolitical Risks

Political instability in key international markets can significantly disrupt Globus Medical's operations, supply chains, and sales channels. For instance, the ongoing geopolitical tensions in Eastern Europe have led to supply chain disruptions for many medical device manufacturers, impacting the availability of raw materials and finished goods.

Geopolitical tensions, conflicts, or shifts in government priorities can directly impact healthcare infrastructure development and foreign investment. Countries facing political uncertainty may reduce spending on new medical technologies or favor domestic suppliers, posing risks to Globus Medical's international expansion and revenue generation.

- Global Political Instability: As of early 2024, numerous regions are experiencing heightened political instability, affecting trade agreements and market access for companies like Globus Medical.

- Healthcare Spending Shifts: Government budget reallocations due to political priorities, such as defense spending increases in some nations, can lead to reduced investment in healthcare infrastructure, impacting demand for medical devices.

- Trade Policy Uncertainty: Evolving trade policies and tariffs between major economic blocs can create unpredictable cost structures and market entry barriers for Globus Medical's global operations.

Healthcare Reform Initiatives

Broader healthcare reform initiatives, focusing on cost containment and quality improvement, present a dual-edged sword for medical device manufacturers like Globus Medical. For instance, the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, with its ongoing implementation and adjustments through 2024 and into 2025, continues to shape reimbursement models. While reforms aiming to expand access could potentially increase patient volumes for procedures utilizing Globus Medical's spinal implants and surgical tools, they simultaneously introduce downward pressure on pricing.

Changes in procurement models, driven by value-based purchasing and bundled payment systems, are also a significant consideration. These shifts, evident in ongoing policy discussions and pilot programs throughout 2024, can alter how hospitals and healthcare systems acquire medical devices. Manufacturers must adapt to demonstrating not just product efficacy but also cost-effectiveness and improved patient outcomes to secure contracts.

- Cost Containment Pressures: Reforms often target reducing overall healthcare spending, which can translate to lower reimbursement rates for medical devices.

- Quality Metrics: Increased emphasis on quality outcomes may require manufacturers to invest further in research and development to prove the long-term value of their products.

- Access Expansion: Initiatives to broaden insurance coverage could lead to a larger patient base, potentially boosting demand for elective procedures.

- Reimbursement Model Shifts: The move towards bundled payments and value-based care necessitates demonstrating cost-effectiveness and patient benefit beyond the device itself.

Government healthcare spending and reimbursement policies are critical for Globus Medical, directly influencing demand and profitability. In 2024, many healthcare systems are scrutinizing device costs, seeking evidence of improved patient outcomes to justify reimbursement. For instance, the ongoing implementation of MACRA continues to shape reimbursement models, potentially boosting patient volumes while simultaneously introducing downward pressure on pricing.

Stringent medical device regulations, such as the FDA's oversight and the EU's MDR, directly impact product design and market introduction timelines. Adherence to evolving standards, like ISO 13485, requires significant investment, as compliance delays can postpone new product launches. International trade policies and geopolitical instability also pose risks, affecting component costs and market access.

The global push for cost-effectiveness pressures medical device companies to demonstrate value. This trend, coupled with shifts towards value-based purchasing and bundled payments, necessitates proving not just product efficacy but also cost-effectiveness and improved patient outcomes to secure contracts.

| Factor | Impact on Globus Medical | 2024/2025 Relevance |

| Government Healthcare Spending | Directly affects demand and profitability. | Budget reallocations can reduce healthcare infrastructure investment. |

| Reimbursement Policies | Influences pricing and market access. | MACRA implementation continues to shape reimbursement models. |

| Regulatory Compliance | Impacts product launch timelines and operational costs. | Adherence to FDA and EU MDR/IVDR is crucial. |

| Trade Policies | Affects component costs and profitability. | Trade tensions and tariffs can increase the cost of goods sold. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Globus Medical's operations and strategic decisions.

It provides a comprehensive overview for stakeholders to identify potential challenges and growth avenues within the medical device industry.

A concise PESTLE analysis for Globus Medical, highlighting key external factors that directly address and alleviate pain points in the medical device market, such as regulatory hurdles and competitive pressures.

Economic factors

Global healthcare expenditure is a significant driver for companies like Globus Medical. In 2023, worldwide health spending reached an estimated $10 trillion, a figure projected to continue its upward trajectory, driven by aging populations and advancements in medical technology. This overall growth is particularly beneficial for the orthopedic and spinal care sectors, directly impacting Globus Medical's market potential.

Economic downturns can present challenges, however. During periods of economic contraction, healthcare providers might postpone or reduce spending on high-cost medical equipment, and patients could delay elective procedures. For instance, a global recession could see a dip in capital expenditure budgets for hospitals, affecting sales cycles for complex surgical systems. Conversely, robust economic growth typically translates to increased disposable income and greater public and private investment in healthcare services and technologies.

Changes in reimbursement rates from both public and private insurers for spinal implants and robotic surgeries significantly impact Globus Medical. For instance, Medicare's Outpatient Prospective Payment System (OPPS) updates, which took effect January 1, 2024, introduced new payment adjustments for certain surgical procedures. A decline in these reimbursement rates can directly affect the profitability of procedures utilizing Globus Medical's advanced technologies.

Hospitals and surgeons may respond to reduced reimbursement by seeking less expensive alternatives to Globus Medical's offerings or postponing capital expenditures on new robotic systems. This trend was evident in some sectors in 2023, where payers tightened coverage for elective procedures, leading to a cautious approach by healthcare providers concerning high-cost technologies.

Rising inflation in 2024 and projected into 2025 directly impacts Globus Medical's operational costs. For instance, the Producer Price Index (PPI) for medical equipment manufacturing has seen upward pressure, potentially increasing the cost of raw materials like titanium and specialized plastics. This necessitates careful inventory management and strategic sourcing to mitigate these rising expenses.

Globus Medical must navigate the challenge of passing these increased costs onto customers. In a competitive medical device market, significant price hikes can deter sales. The company's ability to maintain or improve its profit margins will hinge on its efficiency in managing its supply chain and its pricing strategies throughout 2024 and into 2025.

Interest Rates and Access to Capital

Interest rate fluctuations directly influence Globus Medical's cost of capital, impacting its ability to fund research and development, pursue strategic acquisitions, or expand its operational footprint. For instance, if the Federal Reserve maintains a higher interest rate policy through 2024 and into 2025, borrowing costs for new projects or refinancing existing debt will increase, potentially squeezing profit margins.

Higher interest rates can also dampen demand from healthcare providers. Hospitals and health systems facing increased borrowing costs for their own capital expenditures might delay or scale back investments in expensive technologies like robotic surgery systems and advanced surgical instruments offered by Globus Medical. This could lead to slower adoption rates and a more cautious approach to purchasing new equipment, directly affecting Globus Medical's sales pipeline.

- Federal Funds Rate: As of mid-2024, the Federal Funds Rate target range remained elevated, impacting borrowing costs across the economy. Projections for 2025 suggest potential shifts depending on inflation data and economic growth.

- Corporate Bond Yields: Yields on corporate bonds, relevant for companies like Globus Medical issuing debt, have also reflected the higher interest rate environment, increasing the cost of accessing capital markets.

- Hospital Capital Spending: Healthcare systems' capital expenditure budgets are often sensitive to financing costs, with higher interest rates potentially leading to a slowdown in the procurement of high-ticket medical devices.

Currency Exchange Rate Volatility

Globus Medical, as a global player, faces significant exposure to currency exchange rate volatility, directly impacting its international sales and overall earnings. Fluctuations in currency values can create unpredictable swings in reported financial results.

A strengthening US dollar, for instance, can diminish the value of revenue earned in foreign currencies when those amounts are translated back into dollars. This can lead to lower reported international revenues and negatively affect the company's financial performance and future earnings guidance.

For example, in the first quarter of 2024, Globus Medical reported that foreign currency headwinds had a modest negative impact on its revenue, though the exact percentage was not substantial enough to drastically alter overall growth trends. However, continued dollar strength through 2024 and into 2025 could present a more pronounced challenge.

- Global Operations: Globus Medical operates in numerous countries, exposing it to a range of currency exchange rates.

- Revenue Translation: International sales revenue must be converted to USD, making it sensitive to the dollar's strength or weakness.

- Earnings Impact: A stronger USD can reduce the reported value of foreign earnings, potentially impacting profitability metrics.

- Guidance Sensitivity: Future financial guidance issued by the company can be significantly influenced by anticipated currency movements.

Global economic health directly influences healthcare spending, with the World Health Organization estimating global health expenditure to reach $10 trillion in 2023, a figure expected to rise. This growth benefits companies like Globus Medical, which operates in the expanding orthopedic and spinal care markets. However, economic downturns can lead to reduced capital expenditure by hospitals and delayed elective procedures, impacting sales cycles for high-cost medical equipment.

Inflationary pressures in 2024 and projected into 2025 are increasing operational costs for Globus Medical, particularly for raw materials like titanium. The company must strategically manage its supply chain and pricing to mitigate these rising expenses without deterring customers in a competitive market. Furthermore, fluctuating interest rates, with the Federal Funds Rate remaining elevated in mid-2024, affect Globus Medical's cost of capital and can dampen demand from healthcare providers facing higher borrowing costs for their own investments.

Currency exchange rate volatility poses a significant risk for Globus Medical's international sales. A strengthening US dollar, for instance, can diminish the value of revenue earned in foreign currencies when translated back into dollars, potentially impacting reported financial results and future earnings guidance. This was noted as a modest negative impact in Q1 2024, but continued dollar strength through 2024-2025 could present a more pronounced challenge.

Same Document Delivered

Globus Medical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Globus Medical's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Globus Medical.

The content and structure shown in the preview is the same document you’ll download after payment, providing a deep dive into the strategic landscape for Globus Medical.

Sociological factors

The world's population is getting older, and this is a major trend for companies like Globus Medical. By 2023, over 770 million people were aged 65 and above, a number projected to reach 1.5 billion by 2050. This aging demographic directly fuels demand for spinal solutions as older individuals are more prone to conditions like degenerative disc disease and spinal stenosis.

As people age, the wear and tear on their spines increases, leading to a higher incidence of spinal disorders. This means a greater need for advanced medical devices such as spinal fixation systems, interbody fusion devices, and motion preservation technologies. Globus Medical is well-positioned to capitalize on this demographic shift by offering innovative products to address these growing orthopedic needs.

There's a significant shift in healthcare towards minimally invasive procedures, driven by patient demand for quicker recovery and less discomfort, alongside surgeon preference for enhanced precision. This trend is a major sociological factor influencing the medical device industry.

Globus Medical is well-positioned to capitalize on this, as their investment in advanced implants and robotic-assisted surgery directly supports these minimally invasive approaches. For instance, the global minimally invasive surgical instruments market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating strong market validation for this preference.

Public and medical community awareness of surgical robotics is steadily growing, a key factor influencing the adoption of advanced technologies. As more successful procedures are performed and their benefits become widely known, the demand for robotic-assisted surgeries is expected to rise. This increased acceptance directly translates to greater market penetration for companies like Globus Medical, whose ExcelsiusGPS® system is at the forefront of this innovation.

The increasing acceptance of robotic surgery is supported by data showing a significant rise in the number of procedures performed. For instance, by the end of 2023, the global market for surgical robotics was projected to reach over $12 billion, with a compound annual growth rate (CAGR) of more than 15% anticipated through 2030. This upward trend indicates a strong societal and professional embrace of these technologies, directly benefiting companies like Globus Medical.

Lifestyle Factors and Health Consciousness

Modern lifestyles, characterized by prolonged sitting and reduced physical activity, are unfortunately leading to an increase in spinal and musculoskeletal issues. This rise in conditions like back pain and joint problems directly translates into a greater demand for medical solutions. For instance, reports indicate a significant uptick in individuals seeking treatment for chronic back pain, a key area for Globus Medical.

This growing awareness of health, often termed health consciousness, is a powerful driver. People are more proactive about addressing their physical well-being and are more willing to invest in treatments that can improve their quality of life. This proactive approach means patients are often seeking interventions earlier in the progression of their conditions, expanding the market for specialized orthopedic and spine care products.

- Increased prevalence of sedentary jobs: A significant portion of the global workforce now engages in desk-bound roles, contributing to inactivity.

- Rising obesity rates: Global obesity levels continue to climb, placing additional stress on the musculoskeletal system. For example, the World Health Organization reported in 2022 that over 1 billion people worldwide were living with obesity.

- Growing demand for preventative care: Individuals are increasingly seeking solutions to manage or prevent musculoskeletal pain before it becomes severe.

- Focus on active lifestyles: Despite sedentary trends, there's a concurrent movement towards fitness and wellness, which can still lead to sports-related injuries requiring medical intervention.

Patient Expectations and Quality of Life Improvements

Patients today have significantly higher expectations for surgical results, anticipating quicker recoveries and a marked improvement in their overall quality of life. This trend directly influences the medical device market, pushing for advancements that deliver tangible benefits.

Globus Medical is well-positioned to capitalize on this by developing innovative products and technologies aimed at enhancing surgical precision and effectiveness. For instance, their focus on minimally invasive techniques and advanced implant materials directly addresses the desire for less pain and faster healing.

- Enhanced Patient Outcomes: A growing number of patients are seeking surgical solutions that not only correct a condition but also restore or improve their functional capabilities and daily living.

- Demand for Minimally Invasive Procedures: Patient preference is shifting towards procedures that involve smaller incisions, leading to reduced scarring, less post-operative pain, and shorter hospital stays.

- Focus on Quality of Life: Beyond just a successful surgery, patients are increasingly prioritizing long-term improvements in mobility, comfort, and the ability to return to their normal activities.

Sociological factors significantly shape the demand for Globus Medical's offerings. The aging global population, with over 770 million people aged 65 and above in 2023, is a primary driver for spinal solutions due to increased prevalence of age-related conditions.

Furthermore, a growing preference for minimally invasive procedures, supported by the global minimally invasive surgical instruments market valued at approximately $30 billion in 2023, aligns with Globus Medical's technological investments in advanced implants and robotic surgery.

Modern lifestyles, marked by sedentary work and rising obesity rates (over 1 billion people globally living with obesity in 2022), contribute to a higher incidence of musculoskeletal issues, thereby increasing the need for orthopedic interventions.

Patients' heightened expectations for improved quality of life and faster recovery times also fuel demand for innovative solutions that enhance surgical precision and patient outcomes.

Technological factors

Globus Medical is heavily influenced by ongoing advancements in surgical robotics and artificial intelligence. These technologies are crucial for their strategy, aiming to boost surgical accuracy and patient outcomes.

The company's focus on integrating AI and robotic systems into their offerings, like the Excelsius3D surgical platform, directly addresses the market's demand for minimally invasive and more precise procedures. This technological edge is key to their competitive positioning.

In 2024, the surgical robotics market is projected to reach $13.9 billion, with AI integration being a significant growth factor. Globus Medical's investment in these areas, including their 2023 acquisition of Outpatient Imaging for $50 million to bolster their AI capabilities, positions them to capture a share of this expanding market.

Advancements in biomaterials science are revolutionizing musculoskeletal implants. Progress in areas like porous structures and sophisticated alloys is leading to implants that are not only more compatible with the human body but also significantly more durable and effective. This directly enhances patient outcomes and implant longevity.

Globus Medical is actively leveraging these material science breakthroughs. Their commitment to developing innovative implant designs and utilizing advanced materials, such as porous PEEK, is a key differentiator. This focus directly contributes to superior product performance, solidifying their position as a market leader in the orthopedic sector.

The increasing adoption of 3D printing in healthcare is a significant technological factor. This allows for the creation of patient-specific implants and surgical guides, leading to improved accuracy and better patient outcomes. For Globus Medical, this means a greater ability to offer customized solutions.

This trend towards personalized medicine, driven by technologies like 3D printing, opens up substantial market opportunities. Globus Medical can leverage these advancements to develop tailored products, potentially expanding its portfolio and catering to a growing demand for individualized medical treatments.

Data Analytics and Digital Health Integration

The increasing use of data analytics and digital health platforms presents significant opportunities for Globus Medical. These technologies can streamline pre-operative planning, offer real-time intra-operative guidance, and improve post-operative patient monitoring. By integrating these advancements, Globus Medical can optimize surgical workflows and provide enhanced clinical support.

Globus Medical can harness these digital tools to gather valuable real-world evidence, substantiating the efficacy of its innovative products. For instance, the global digital health market was projected to reach over $600 billion by 2024, indicating a strong trend toward data-driven healthcare solutions. This trend allows companies like Globus Medical to demonstrate clear value propositions to healthcare providers.

- Enhanced Surgical Planning: Digital imaging and analytics allow for more precise pre-operative simulations, reducing operating time and improving patient outcomes.

- Intra-operative Guidance: Real-time data feeds can guide surgeons during procedures, leading to greater accuracy and potentially fewer complications.

- Post-operative Monitoring: Integrated platforms enable continuous patient data collection, facilitating early detection of issues and personalized recovery plans.

- Real-World Evidence Generation: Data analytics can be used to collect and analyze clinical data, supporting product development and market adoption.

Cybersecurity in Medical Devices and Data

As medical devices increasingly connect to digital networks and integrate with broader healthcare systems, cybersecurity emerges as a paramount technological consideration for companies like Globus Medical. The growing reliance on interconnectedness, while offering efficiency gains, also expands the attack surface for potential cyber threats, necessitating significant investment in protective measures.

Globus Medical must prioritize robust cybersecurity protocols to safeguard sensitive patient data and ensure the uninterrupted, secure functionality of its medical devices. This commitment is crucial not only for regulatory compliance, such as HIPAA in the United States, but also for maintaining the confidence of healthcare providers and patients alike. For instance, a 2024 report indicated that healthcare data breaches cost an average of $10.93 million, highlighting the financial and reputational risks involved.

- Increased Connectivity Risks: The proliferation of internet-connected medical devices (IoMT) creates new vulnerabilities.

- Regulatory Compliance: Adherence to data protection laws like HIPAA and GDPR is non-negotiable.

- Patient Safety and Data Integrity: Cybersecurity failures can directly impact patient care and compromise sensitive health information.

- Industry Investment Trends: Cybersecurity spending in the healthcare sector is projected to grow significantly, with some estimates reaching over $125 billion globally by 2025, underscoring its importance.

Technological advancements are reshaping the medical device landscape, with surgical robotics and AI integration at the forefront. Globus Medical is strategically investing in these areas, exemplified by its Excelsius3D platform, to enhance surgical precision and patient outcomes. The global surgical robotics market was expected to reach $13.9 billion in 2024, with AI being a key driver.

Innovations in biomaterials science are leading to more compatible and durable musculoskeletal implants. Globus Medical leverages these breakthroughs, utilizing materials like porous PEEK, to improve product performance and patient recovery. The increasing adoption of 3D printing further enables the creation of patient-specific implants, aligning with the trend toward personalized medicine.

Digital health platforms and data analytics offer significant opportunities for optimizing surgical workflows and patient monitoring. Globus Medical can utilize these tools to gather real-world evidence, supporting product development. The digital health market was projected to exceed $600 billion by 2024, highlighting the value of data-driven healthcare solutions.

As medical devices become more connected, cybersecurity is a critical concern, with healthcare data breaches costing an average of $10.93 million in 2024. Globus Medical must invest in robust security protocols to protect patient data and ensure device integrity, a growing trend as global cybersecurity spending in healthcare is projected to surpass $125 billion by 2025.

| Technology Area | Impact on Globus Medical | Market Data/Trend |

|---|---|---|

| Surgical Robotics & AI | Enhanced precision, improved patient outcomes, competitive advantage | Surgical robotics market projected at $13.9 billion in 2024; AI integration is a key growth factor. |

| Biomaterials Science | Development of superior, more compatible implants; improved product performance | Advancements in porous structures and alloys for enhanced durability and biocompatibility. |

| 3D Printing | Creation of patient-specific implants and surgical guides; personalized medicine | Facilitates customized solutions, catering to growing demand for individualized treatments. |

| Digital Health & Data Analytics | Optimized surgical planning, real-time guidance, post-operative monitoring; real-world evidence | Digital health market projected over $600 billion by 2024; supports value proposition demonstration. |

| Cybersecurity | Protection of patient data, ensuring device integrity and regulatory compliance | Healthcare data breaches averaged $10.93 million in 2024; cybersecurity spending in healthcare to exceed $125 billion by 2025. |

Legal factors

Globus Medical navigates a complex web of global medical device regulations, including the U.S. Food and Drug Administration's Quality Management System Regulation (QMSR), which now aligns with the ISO 13485 standard, and the European Union's Medical Device Regulation (MDR). These frameworks are critical for ensuring product safety and efficacy.

Failure to adhere to these evolving standards can result in severe consequences. For instance, in 2023, the FDA issued over 3,000 warning letters to medical device manufacturers for various compliance issues, underscoring the strict enforcement environment. Such non-compliance can lead to substantial fines, restricted market access, and costly product recalls, directly impacting Globus Medical's operational continuity and financial performance.

Globus Medical operates under strict product liability laws, meaning any defects in its surgical implants or instruments that cause patient harm could lead to costly lawsuits. For instance, the medical device industry has seen significant settlements in product liability cases, underscoring the financial exposure. The company must maintain rigorous quality control and robust legal defense strategies to mitigate these risks.

Protecting its intellectual property is paramount for Globus Medical, given its reliance on innovative technologies. The company invests heavily in securing patents for its designs and surgical techniques, a common practice in the medtech sector where R&D spending is substantial. In 2023, Globus Medical reported significant investment in R&D, a portion of which is allocated to IP protection and enforcement to prevent competitors from infringing on its technological advancements.

Globus Medical operates under stringent anti-kickback and anti-bribery regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA), which are critical for its dealings with healthcare professionals and institutions globally. These laws prohibit offering or accepting anything of value to influence decisions, a key area for medical device companies. Failure to comply can lead to substantial financial penalties and legal repercussions, impacting the company's operational integrity and market standing.

Data Privacy and Security Regulations

The increasing digitalization of healthcare, particularly with AI-driven surgical planning and robotic systems, places significant emphasis on data privacy and security. Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe mandate stringent protocols for handling sensitive patient information. Globus Medical must ensure its innovative products and internal operational systems are fully compliant with these evolving data privacy laws to mitigate the risk of substantial fines, which can reach millions of dollars, and to preserve the trust of patients and healthcare providers.

Compliance with these regulations is not merely a legal obligation but a critical component of maintaining brand reputation and market access. For instance, a data breach could lead to significant reputational damage and loss of business, impacting Globus Medical's ability to secure new partnerships and retain existing customers in the highly competitive medical device sector.

- HIPAA fines can reach up to $1.5 million per violation category per year.

- GDPR violations can incur penalties of up to 4% of annual global revenue or €20 million, whichever is higher.

- Globus Medical's commitment to data security is paramount for maintaining patient trust and regulatory adherence.

- Adherence to data privacy laws is crucial for the successful integration of AI and digital technologies in surgical solutions.

Mergers & Acquisitions and Antitrust Laws

Globus Medical's growth strategy, heavily reliant on mergers and acquisitions, faces significant legal hurdles under antitrust laws. The proposed acquisition of NuVasive, valued at approximately $3.1 billion, is a prime example requiring thorough review by regulatory bodies like the Federal Trade Commission (FTC) in the United States and similar authorities internationally. These reviews assess whether the combined entity would unduly stifle competition within the musculoskeletal device market.

Antitrust compliance is not merely a procedural step; it's a critical determinant of strategic success. Failure to satisfy these regulations can lead to substantial delays, costly divestitures, or even the outright blocking of deals, as seen in other sectors where large mergers faced significant antitrust challenges in 2024. For Globus Medical, navigating these legal complexities ensures its ability to integrate new technologies and expand its market presence without facing punitive actions or market exclusion.

- Regulatory Scrutiny: The $3.1 billion NuVasive acquisition is under intense antitrust review, impacting Globus Medical's market expansion plans.

- Competition Impact: Regulators assess if the merger creates anti-competitive conditions in the musculoskeletal sector, a common concern for large M&A deals in 2024.

- Strategic Risk: Non-compliance or adverse rulings can delay or derail growth, potentially forcing asset sales or the termination of key strategic initiatives.

Globus Medical must navigate a stringent regulatory landscape, including evolving FDA QMSR aligning with ISO 13485 and EU MDR, to ensure product safety and market access. Non-compliance, as evidenced by thousands of FDA warning letters in 2023, can lead to significant fines and recalls.

Environmental factors

Globus Medical's operations, from manufacturing to its global supply chain, rely on diverse raw materials and significant energy consumption. The growing emphasis on environmental responsibility means the company must actively manage its resource use, minimize waste generation, and consider sourcing from suppliers committed to ecological stewardship to lessen its environmental impact.

For instance, in 2023, the medical device industry, including companies like Globus Medical, faced increased scrutiny regarding its carbon footprint. Data from industry reports indicate that companies are investing more in energy-efficient manufacturing technologies, with projections suggesting a 15% increase in such investments by 2025 as companies strive to meet sustainability targets and reduce operational costs.

The disposal of medical devices, including implants and surgical instruments, presents significant environmental hurdles. These items often contain complex materials and can pose biohazard risks, necessitating careful handling and disposal protocols.

Globus Medical must assess the full lifecycle impact of its products. This includes exploring avenues for recycling, reprocessing, or implementing environmentally responsible disposal methods to mitigate ecological damage.

The healthcare industry's waste is substantial; in 2023, the US generated an estimated 14.5 million tons of medical waste, with a growing emphasis on reducing landfill dependence and increasing recycling rates for non-hazardous components.

Globus Medical's manufacturing and operational activities inherently lead to energy consumption and carbon emissions. As global environmental awareness grows, the company will likely face mounting pressure to transition towards renewable energy sources and enhance its energy efficiency.

This pressure could translate into concrete actions such as setting ambitious carbon emission reduction targets, aligning with international climate goals. For instance, in 2023, the medical device industry, as a whole, has seen increased scrutiny regarding its environmental impact, with many companies exploring ways to reduce their operational footprint by 2024 and beyond.

Regulatory Compliance for Environmental Standards

Globus Medical must strictly adhere to environmental regulations concerning manufacturing emissions, waste disposal, and chemical usage. Failure to comply can result in significant financial penalties, operational disruptions, and damage to its public image. For instance, in 2024, the medical device industry faced increased scrutiny over its carbon footprint, with some regions implementing stricter emission controls that could affect manufacturing costs.

Staying ahead of these evolving standards is paramount. Companies like Globus Medical are expected to invest in cleaner technologies and sustainable practices. For example, the European Union's Green Deal initiatives continue to push for more stringent environmental reporting and waste reduction targets, impacting global supply chains and manufacturing processes throughout 2024 and into 2025.

Key areas of focus for Globus Medical's environmental compliance include:

- Emissions Control: Implementing technologies to reduce air and water pollutants from manufacturing facilities.

- Waste Management: Developing robust systems for the responsible disposal and recycling of medical waste and manufacturing byproducts.

- Chemical Usage: Ensuring safe handling and disposal of chemicals used in production, adhering to regulations like REACH in Europe.

- Energy Efficiency: Investing in energy-saving measures to reduce the company's overall environmental impact and operational costs.

Climate Change Impact on Operations

Globus Medical, like many in the medical device sector, faces potential operational disruptions from climate change. Extreme weather events, such as severe storms or floods, could impact manufacturing facilities or logistics, delaying product delivery. For instance, the increasing frequency of such events globally in 2024 poses a tangible risk to supply chain stability.

Resource scarcity, another facet of climate change, might affect the availability and cost of raw materials used in medical device production. Companies are increasingly evaluating their environmental footprint and implementing strategies to build resilience against these broader climate impacts. This proactive approach is crucial for maintaining business continuity and ensuring consistent product availability for healthcare providers.

- Supply Chain Vulnerability: Extreme weather events in 2024 have already demonstrated the fragility of global supply chains, a risk directly applicable to Globus Medical's material sourcing and product distribution.

- Operational Continuity: The need to assess and mitigate climate-related risks is paramount for ensuring uninterrupted manufacturing and delivery of critical medical devices.

- Resource Management: Potential scarcity of key materials due to climate shifts necessitates robust resource management and diversification strategies for sustained operations.

Globus Medical must navigate stringent environmental regulations, with compliance impacting manufacturing costs and operational practices. The medical device industry, in 2023, saw a 15% projected increase in investments towards energy-efficient technologies by 2025, driven by sustainability goals.

The disposal of medical devices presents a significant challenge, as the US generated approximately 14.5 million tons of medical waste in 2023, with a growing focus on reducing landfill reliance.

Climate change poses risks to Globus Medical's supply chain and operations through extreme weather events, as evidenced by global supply chain disruptions in 2024.

Resource scarcity due to climate shifts also necessitates robust management and diversification of raw material sourcing.

| Environmental Factor | Impact on Globus Medical | 2024/2025 Data/Trend |

|---|---|---|

| Regulatory Compliance | Increased operational costs, need for cleaner technologies | Stricter emission controls in some regions impacting manufacturing costs; EU Green Deal pushing for enhanced environmental reporting. |

| Waste Management | Need for responsible disposal and recycling of medical and manufacturing waste | Focus on reducing landfill dependence and increasing recycling rates for non-hazardous medical components. |

| Climate Change Risks | Supply chain disruptions from extreme weather, potential resource scarcity | Increasing frequency of extreme weather events impacting global supply chains in 2024. |

| Energy Efficiency & Renewables | Pressure to reduce carbon footprint and operational costs | Projected 15% increase in investments in energy-efficient manufacturing technologies by 2025 within the medical device industry. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Globus Medical is built upon a comprehensive review of data from leading market research firms, government regulatory bodies, and reputable financial news outlets. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors influencing the medical device industry.