Globus Medical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globus Medical Bundle

Globus Medical operates in a dynamic orthopedic market, facing moderate threats from new entrants and substitutes, while buyer power and supplier bargaining power present key considerations. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Globus Medical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Globus Medical's reliance on specialized, medical-grade materials like titanium and PEEK for its implants and robotic systems means it must source from a select group of suppliers. These suppliers often possess unique manufacturing capabilities and adhere to rigorous quality control and regulatory standards, such as those set by the FDA for medical devices.

The limited number of manufacturers capable of consistently producing these high-quality, specialized materials to medical device specifications grants these suppliers considerable bargaining power. For instance, in 2023, the global market for medical-grade titanium was valued at approximately $10.5 billion, with a concentrated supply chain for the specific alloys and forms Globus Medical requires.

Suppliers possessing proprietary technology and intellectual property, especially for advanced components in areas like robotic surgery, significantly bolster their bargaining power. Globus Medical's reliance on such specialized suppliers for systems like ExcelsiusGPS means these suppliers can dictate terms more effectively. For instance, in 2023, the medical device industry saw continued consolidation among key component manufacturers, further concentrating power in the hands of a few technologically advanced suppliers.

The medical device sector's rigorous regulatory landscape significantly bolsters supplier bargaining power. Suppliers must adhere to stringent certifications like ISO 13485 and FDA regulations, a costly and complex process. This compliance acts as a substantial barrier to entry, limiting the number of qualified vendors and thus concentrating power among established, certified suppliers.

Supply Chain Disruptions

The medical device sector, which includes companies like Globus Medical, is quite vulnerable to global supply chain disruptions. For instance, the COVID-19 pandemic significantly impacted lead times and increased costs for many manufacturers. This forced companies to seek out alternative suppliers, a move that naturally bolsters the bargaining power of those alternative suppliers.

These disruptions can lead to several challenges for companies like Globus Medical:

- Increased Material Costs: Shortages of critical components, such as specialized alloys or electronic parts, can drive up prices. For example, in early 2024, reports indicated significant price increases for certain rare earth metals crucial for medical imaging equipment due to geopolitical tensions.

- Extended Lead Times: A lack of available raw materials or manufacturing capacity from suppliers can delay production schedules, impacting product availability and revenue.

- Need for Redundant Sourcing: To mitigate risk, companies often need to invest in qualifying and maintaining relationships with multiple suppliers, which can add complexity and cost to procurement processes.

Strategic Partnerships and Vertical Integration

To counter the bargaining power of suppliers, Globus Medical could forge strategic partnerships with key component providers, potentially securing more favorable terms and stable supply chains. These alliances might involve shared R&D or co-marketing efforts, solidifying relationships beyond simple transactional exchanges.

Furthermore, exploring selective vertical integration offers another avenue to reduce supplier dependency. By bringing the production of critical components in-house, Globus Medical can gain greater control over costs, quality, and lead times. For instance, if a specific surgical implant material represents a significant cost driver and is subject to price volatility, producing it internally could offer substantial savings and operational resilience.

- Strategic Partnerships: Long-term contracts or collaborative agreements with suppliers to ensure supply stability and potentially better pricing.

- Vertical Integration: In-house production of key components to reduce reliance on external suppliers and improve cost management.

- Supplier Diversification: Cultivating relationships with multiple suppliers for critical inputs to avoid over-reliance on any single entity.

Globus Medical faces significant supplier bargaining power due to its need for specialized, high-quality materials like titanium and PEEK, which are sourced from a limited number of qualified manufacturers. These suppliers often possess proprietary technology and navigate complex regulatory hurdles, such as FDA compliance and ISO 13485 certification, further concentrating their influence.

The medical device industry's reliance on advanced components and the stringent quality requirements create a concentrated supplier base. For instance, the market for medical-grade titanium, a key material for implants, was valued at approximately $10.5 billion in 2023, with a supply chain that is particularly specialized for medical applications.

This supplier power can lead to increased material costs and extended lead times for Globus Medical, as seen with global supply chain disruptions impacting critical component availability. To mitigate this, strategic partnerships and selective vertical integration are key strategies.

| Strategy | Description | Potential Impact on Supplier Power |

|---|---|---|

| Strategic Partnerships | Long-term agreements with key suppliers. | Can stabilize supply and potentially improve pricing by fostering collaboration. |

| Vertical Integration | In-house production of critical components. | Reduces reliance on external suppliers, offering greater control over costs and lead times. |

| Supplier Diversification | Developing relationships with multiple qualified suppliers. | Minimizes dependence on any single supplier, increasing negotiation leverage. |

What is included in the product

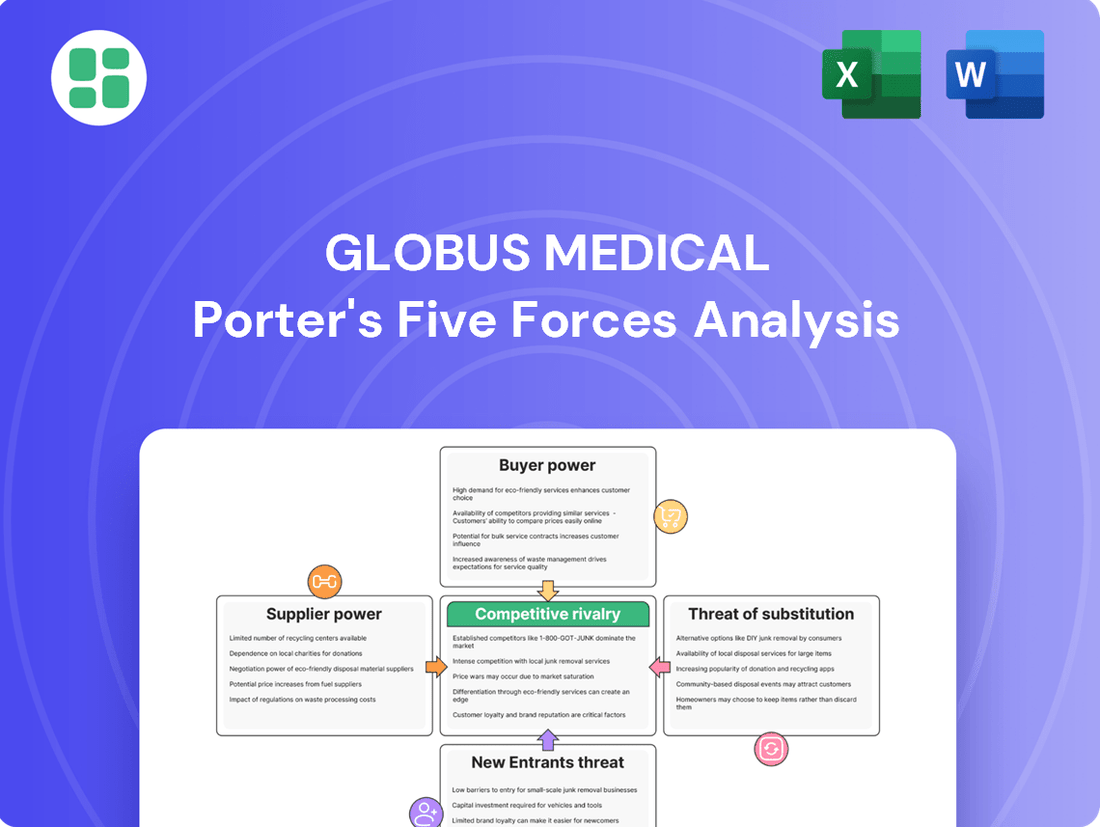

This analysis dissects the competitive landscape for Globus Medical by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the medical device industry.

Effortlessly identify and address competitive threats with a visual representation of Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Globus Medical's primary customers, including large hospitals and integrated healthcare networks, often consolidate their purchasing power through group purchasing organizations (GPOs). In 2024, GPOs continued to wield significant influence, negotiating bulk discounts that can pressure medical device manufacturers like Globus Medical on pricing. This consolidation allows these entities to demand favorable contract terms due to the substantial volumes they represent.

Healthcare reimbursement policies and the growing imperative for hospitals to manage expenses directly impact how medical device purchases are made. This environment forces companies like Globus Medical to prove not only clinical efficacy but also economic value, often leading to price negotiations and tighter profit margins.

Surgeons' strong historical preference for specific medical devices, like those from Globus Medical, can be a significant driver of demand. However, hospital procurement departments are increasingly flexing their muscles, prioritizing cost-effectiveness and standardized offerings. This creates a delicate balance for Globus Medical, needing to satisfy both the clinical desire for cutting-edge technology and the financial imperative for value.

For instance, in 2024, many hospital systems are implementing stricter value-based purchasing programs, directly impacting their willingness to pay premiums for niche or unproven technologies. Globus Medical's success hinges on demonstrating not just clinical superiority but also a clear return on investment for these institutions, potentially through bundled pricing or long-term cost savings.

Availability of Competing Products

The orthopedic and spinal implant market is quite crowded, with numerous significant companies offering a wide array of products. This competitive landscape means customers, like hospitals and surgeons, have plenty of choices when selecting implants.

The presence of clinically similar devices from rival manufacturers directly enhances customer bargaining power. This forces companies such as Globus Medical to actively seek ways to stand out, whether through groundbreaking innovation, superior customer service, or competitive pricing strategies.

For instance, in 2023, the global orthopedic implants market was valued at approximately $60 billion, with significant contributions from spinal implants. This large market size indicates a robust competitive environment.

- High Market Competition: Numerous established players offer comparable orthopedic and spinal implant solutions.

- Customer Choice: Hospitals and surgeons can readily switch between suppliers due to the availability of equivalent products.

- Pressure on Pricing and Innovation: Competitors’ offerings compel Globus Medical to maintain competitive pricing and invest in R&D to differentiate.

- Impact on Profit Margins: Increased customer bargaining power can lead to pressure on Globus Medical's profit margins if differentiation is not effectively achieved.

Shift to Ambulatory Surgery Centers (ASCs)

The increasing shift of orthopedic and spinal procedures from hospitals to Ambulatory Surgery Centers (ASCs) significantly amplifies customer bargaining power. ASCs, driven by cost efficiency and faster patient throughput, are more sensitive to device pricing.

This trend pressures medical device manufacturers like Globus Medical to offer more competitive pricing, especially for products that streamline procedures and reduce overall treatment costs. For instance, in 2024, ASCs continued to gain market share in outpatient orthopedic surgeries, with some estimates suggesting they handle over 50% of certain elective procedures.

- Increased Price Sensitivity: ASCs aim for lower overall costs per procedure compared to hospitals, directly impacting device price negotiations.

- Focus on Efficiency: Products that reduce surgery time or simplify patient recovery are favored, giving ASCs leverage in selecting vendors.

- Volume Purchasing Power: As ASCs consolidate or grow in number, their collective purchasing power increases, allowing them to demand better terms.

- Market Share Dynamics: The growing prevalence of ASCs in performing orthopedic procedures means device companies must cater to their specific economic and operational needs to maintain market access.

Globus Medical faces considerable customer bargaining power due to the consolidation of purchasing through Group Purchasing Organizations (GPOs), which leverage volume for discounts. In 2024, these organizations continued to be key negotiators, pushing for favorable pricing from medical device manufacturers.

The increasing prevalence of Ambulatory Surgery Centers (ASCs) for orthopedic procedures also heightens customer leverage. These centers prioritize cost-efficiency and faster patient turnover, making them highly sensitive to device pricing and demanding competitive offers from suppliers like Globus Medical.

| Factor | Impact on Globus Medical | 2024 Relevance |

|---|---|---|

| GPO Consolidation | Increased price negotiation leverage for customers | Continued strong influence on procurement terms |

| ASC Shift | Greater demand for cost-effective devices | ASCs performing over 50% of certain elective orthopedic procedures |

| Market Competition | Customers have numerous equivalent product options | Forces differentiation through innovation or pricing |

What You See Is What You Get

Globus Medical Porter's Five Forces Analysis

This preview showcases the complete Globus Medical Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the medical device industry. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The musculoskeletal and spinal implant market is intensely competitive, with established global giants like Medtronic, DePuy Synthes (a Johnson & Johnson company), Stryker, and Zimmer Biomet holding significant sway. These major players leverage vast resources, comprehensive product lines, and deep market penetration, creating formidable competition for Globus Medical.

Competitive rivalry in the orthopedic and spine market is intensely fueled by relentless innovation, especially in areas like robotic-assisted surgery. Globus Medical has established a strong position with its ExcelsiusGPS system, a testament to this drive.

Competitors are also pouring significant resources into cutting-edge technologies such as advanced robotics, 3D printing, and artificial intelligence. For instance, Intuitive Surgical, a major player in surgical robotics, reported revenue of $7.2 billion in 2023, highlighting the substantial investment in this sector.

This rapid technological evolution demands continuous and substantial research and development investment from companies like Globus Medical to not only keep pace but also to maintain a distinct competitive advantage. Failure to innovate can quickly lead to a loss of market share.

The medical device industry, particularly in the spine segment, has seen substantial consolidation. A prime example is Globus Medical’s merger with NuVasive, which officially closed in September 2023. This union created a formidable player in the market.

This wave of mergers and acquisitions significantly alters the competitive landscape. By combining forces, companies like the new Globus Medical entity gain greater market share, broader product portfolios, and enhanced research and development capabilities, thereby intensifying rivalry among all industry participants.

Product Differentiation and Clinical Outcomes

Companies in the medical device sector, including those in spine surgery like Globus Medical, actively compete by differentiating their products. This differentiation often hinges on demonstrating superior clinical outcomes, enhancing surgical precision, and ultimately improving a patient's quality of life. For instance, Globus Medical's investment in innovative implants and robotic surgical systems is a clear strategy to offer distinct advantages over competitors.

However, the competitive landscape is dynamic. Rivals are constantly introducing new products and publishing clinical data to challenge existing market positions and capture market share. This relentless innovation cycle means that any perceived advantage gained through product differentiation can be short-lived. For example, in 2023, the global spine surgery market was valued at approximately $10.5 billion, with significant portions driven by technological advancements and product innovation, highlighting the intensity of this competition.

- Product Innovation: Companies focus on developing next-generation implants and surgical technologies.

- Clinical Evidence: Demonstrating improved patient outcomes through robust clinical trials is a key differentiator.

- Robotic Surgery: The adoption and advancement of robotic platforms are central to competitive strategies.

- Market Share Dynamics: Continuous product introductions aim to disrupt and capture market share from incumbents.

Sales Force Effectiveness and Surgeon Relationships

Competitive rivalry in the medical device sector, particularly for companies like Globus Medical, is intensely driven by sales force effectiveness and the cultivation of surgeon relationships. Success hinges on a sales team's ability to engage, educate, and support surgeons, directly impacting product adoption and market share.

Companies invest heavily in training, clinical support, and direct interaction to foster surgeon loyalty. This focus is paramount, as surgeon preference is a key determinant in the selection of implants and surgical techniques. For instance, in 2024, the global orthopedic devices market was valued at approximately $55 billion, highlighting the significant financial stakes involved in capturing surgeon preference.

- Surgeon Loyalty: Direct engagement and robust clinical support are critical for securing and maintaining surgeon loyalty, a key driver of sales in the orthopedic sector.

- Market Penetration: Effective sales force execution directly correlates with a company's ability to penetrate the market and gain widespread adoption of its innovative medical technologies.

- Competitive Landscape: The high value of the orthopedic devices market, estimated at over $55 billion in 2024, intensifies rivalry as firms vie for surgeon endorsement and market dominance.

The competitive rivalry within the musculoskeletal and spinal implant market is fierce, characterized by a constant battle for market share through innovation and strategic alliances. Established giants like Medtronic, Johnson & Johnson (DePuy Synthes), Stryker, and Zimmer Biomet possess significant resources and broad product portfolios, creating a challenging environment for Globus Medical.

This intense competition is further amplified by a rapid pace of technological advancement, particularly in areas like robotic-assisted surgery. Globus Medical's ExcelsiusGPS system exemplifies this focus on innovation. Competitors are also heavily investing in robotics, 3D printing, and AI; for instance, Intuitive Surgical's 2023 revenue of $7.2 billion underscores the substantial financial commitment in surgical robotics. The market's value, with the global spine surgery market reaching approximately $10.5 billion in 2023, highlights the stakes involved in this innovation race.

The sales force and surgeon relationships are critical battlegrounds. Companies invest heavily in training and support to foster surgeon loyalty, as surgeon preference directly influences product adoption. The over $55 billion valuation of the global orthopedic devices market in 2024 underscores the importance of these relationships in capturing market share and achieving dominance.

| Key Competitor | 2023 Revenue (Approximate) | Key Focus Areas |

| Medtronic | $23.4 billion | Spine, Robotics, Innovation |

| Johnson & Johnson (DePuy Synthes) | $15.2 billion (Medical Devices Segment) | Spine, Hip, Knee, Robotics |

| Stryker | $20.5 billion | Orthopedics, MedSurg, Neurotechnology |

| Zimmer Biomet | $7.0 billion | Joint Replacement, Spine, Trauma |

SSubstitutes Threaten

For certain spinal disorders, non-surgical treatments like physical therapy, pain medication, injections, and lifestyle changes can act as viable substitutes for surgical implants. These alternatives are frequently chosen for less severe conditions or as initial treatment steps, thereby lessening the immediate demand for Globus Medical's offerings.

Advancements in surgical techniques, particularly in minimally invasive spine surgery, can sometimes reduce the need for extensive implant use or traditional fixation. For instance, regenerative medicine approaches are gaining traction, potentially offering alternatives to fusion and hardware in certain spinal conditions.

While Globus Medical offers robust minimally invasive solutions, some procedures might evolve to rely less on permanent implants. For example, advancements in bio-absorbable materials or entirely new therapeutic modalities could emerge, posing a subtle substitution threat to traditional implant-based procedures that Globus Medical currently serves.

The rise of biological and regenerative therapies, including stem cell treatments and advanced tissue regeneration, poses a significant long-term threat to traditional spinal implants. These innovative approaches aim to repair or regenerate damaged spinal tissues directly, potentially bypassing the need for mechanical implants altogether.

While still in developmental stages, the success of these biological solutions could fundamentally alter the spinal surgery market. For instance, advancements in regenerative medicine are showing promise in preclinical studies for disc regeneration, a core area for spinal implant manufacturers.

Alternative Device Technologies

While Globus Medical is a leader in surgical implants and robotic systems, the threat of substitutes is present. Alternative medical device technologies or approaches, such as advanced bracing, external support systems, or novel diagnostic tools that can prevent or delay the need for surgical intervention, represent indirect substitutes. These can reduce the demand for Globus Medical's core offerings by addressing patient conditions differently.

For instance, in the orthopedic market, innovations in non-surgical pain management or regenerative medicine could potentially reduce the number of patients requiring implants. In 2023, the global orthopedic bracing and support market was valued at approximately $5.8 billion and is projected to grow, indicating a significant alternative pathway for patient care.

The development of less invasive surgical techniques or improved physical therapy protocols could also serve as substitutes. These alternatives might offer comparable outcomes to surgical procedures, thereby diminishing the perceived necessity of implants and robotic assistance for certain patient populations. The increasing focus on preventative care and early diagnosis further amplifies this threat, as it aims to manage conditions before they escalate to a stage requiring surgical intervention.

- Advanced Bracing and External Support Systems: These offer non-surgical alternatives for managing orthopedic conditions, potentially delaying or eliminating the need for implants.

- Novel Diagnostic and Preventative Tools: Early detection and intervention through new diagnostic technologies can mitigate the progression of diseases, reducing the patient pool requiring surgical solutions.

- Regenerative Medicine and Non-Surgical Therapies: Advancements in these fields present alternative treatment pathways that could compete with traditional implant-based solutions.

- Improved Physical Therapy and Rehabilitation: Enhanced non-surgical treatment protocols can offer comparable outcomes to surgery for some conditions, acting as a substitute for invasive procedures.

Patient-Specific Solutions and Custom Implants

The increasing availability of patient-specific solutions and custom 3D-printed implants presents a potential substitute threat to traditional, mass-produced medical devices. As these personalized options become more accessible and cost-efficient, they could erode the market share for standard implants.

For instance, advancements in additive manufacturing allow for the creation of implants precisely tailored to an individual's anatomy, potentially offering superior fit and outcomes. This innovation could steer demand away from generic, off-the-shelf products.

Companies focusing on custom solutions may gain traction if they can demonstrate clear clinical advantages or comparable pricing to standard implants. This trend highlights the evolving landscape where personalization challenges mass production models.

Globus Medical, for example, has been investing in its 3D printing capabilities, indicating an awareness of this shift. The market for 3D-printed orthopedic implants is projected to grow significantly, with some estimates suggesting it could reach billions in the coming years, underscoring the competitive pressure from these specialized solutions.

The threat of substitutes for Globus Medical primarily stems from non-surgical treatments and emerging regenerative therapies. For less severe spinal conditions, physical therapy, medications, and injections offer alternatives that bypass the need for surgical implants. Furthermore, advancements in biological and regenerative medicine, such as stem cell treatments, aim to repair tissue directly, potentially eliminating the requirement for mechanical hardware altogether.

The orthopedic bracing and support market, valued at approximately $5.8 billion in 2023, represents a significant alternative pathway for patient care, potentially delaying or preventing the need for implants. Additionally, custom 3D-printed implants are gaining traction, offering personalized solutions that could challenge traditional mass-produced devices. Globus Medical's investment in 3D printing capabilities acknowledges this evolving competitive landscape.

| Substitute Category | Description | Market Relevance (2023-2024 Data) | Potential Impact on Globus Medical |

|---|---|---|---|

| Non-Surgical Treatments | Physical therapy, pain management, injections | Significant patient adoption for mild to moderate conditions | Reduces immediate demand for implants |

| Regenerative Medicine | Stem cells, tissue regeneration | Growing research and early clinical trials | Long-term threat to fusion and hardware |

| Orthopedic Bracing & Support | External support systems | Market valued at ~$5.8 billion in 2023 | Delays or prevents need for surgical intervention |

| Custom 3D-Printed Implants | Patient-specific anatomical solutions | Increasing accessibility and clinical trials | Challenges mass-produced implant market share |

Entrants Threaten

Entry into the medical device sector, particularly in sophisticated areas like musculoskeletal and robotic technologies, demands significant upfront investment in research and development. For instance, developing a new surgical robot can easily cost hundreds of millions of dollars before it even reaches the market.

New players encounter substantial financial obstacles to innovate and protect their intellectual property. This high cost of entry acts as a formidable barrier, deterring many potential competitors from entering the market.

Stringent regulatory approval processes, such as the U.S. Food and Drug Administration (FDA) clearance for medical devices, present a significant hurdle for new entrants in the orthopedic industry. These processes are lengthy, complex, and expensive, requiring extensive testing and clinical trials that can span several years and demand substantial financial investment.

Globus Medical benefits from its well-established brand reputation and strong, long-standing relationships with surgeons. These deep connections are difficult for new entrants to replicate, as trust and proven clinical performance are paramount in the medical device sector.

Gaining the confidence of surgeons and healthcare providers requires years of consistent product quality and dedicated support, a significant barrier for newcomers. For instance, in 2024, the medical device industry continued to emphasize surgeon training and feedback loops, areas where incumbents like Globus Medical have a distinct advantage.

New companies face immense challenges in building the necessary sales and distribution networks, which are critical for reaching a broad customer base. This infrastructure is costly and time-consuming to develop, further deterring potential entrants.

Intellectual Property and Patent Protection

The medical device sector, including companies like Globus Medical, is heavily guarded by intellectual property and patents. Established companies possess vast patent portfolios covering everything from device design and material composition to innovative surgical methods. This creates a significant barrier for newcomers aiming to launch genuinely novel products, as they risk patent infringement or face substantial licensing fees.

For instance, in 2023, the medical device industry saw continued robust patent activity, with companies actively seeking protection for advancements in areas like robotics, AI-driven diagnostics, and minimally invasive surgical tools. Globus Medical itself holds numerous patents related to its spine and orthopedic implant technologies, underscoring the importance of R&D and IP for competitive advantage.

- Patent Landscape: Existing players like Globus Medical have extensive patent portfolios protecting designs, materials, and surgical techniques.

- Barrier to Entry: New entrants face challenges in introducing novel products without infringing on existing patents or incurring high licensing costs.

- R&D Investment: The need for significant investment in research and development to create non-infringing innovations or acquire necessary licenses is a key hurdle.

Capital Requirements for Manufacturing and Distribution

Beyond the substantial investment in research and development, new entrants in the medical device sector, like Globus Medical, face immense capital hurdles for specialized manufacturing. These facilities demand precision engineering, sterile environments, and advanced quality control systems, often costing tens to hundreds of millions of dollars.

Establishing a robust global distribution network is another significant capital drain. This involves setting up warehouses, logistics, sales teams, and regulatory compliance infrastructure in numerous countries, creating a formidable financial barrier to entry for potential competitors.

The sheer scale and infrastructure required to compete effectively in the medical device market, especially in areas like spine and trauma where Globus Medical operates, present a high financial barrier. For instance, building out a sales force and distribution channels comparable to established players can easily require an initial investment exceeding $100 million.

- Manufacturing Facilities: Specialized cleanrooms and advanced machinery for producing orthopedic implants can cost upwards of $50 million.

- Quality Control Systems: Implementing rigorous FDA-compliant quality management systems and testing equipment adds significant capital expenditure.

- Global Distribution Network: Establishing logistics, warehousing, and sales infrastructure across key markets can necessitate an initial outlay of over $100 million.

- Regulatory Compliance: Navigating diverse international regulatory approvals for medical devices requires substantial financial resources and expertise.

The threat of new entrants for Globus Medical is relatively low due to the substantial capital requirements for research, development, and specialized manufacturing. For example, developing a new orthopedic implant system can cost tens of millions of dollars. Furthermore, navigating the complex and lengthy regulatory approval processes, such as FDA clearance which can take years and millions in testing, presents a significant barrier.

Established relationships with surgeons and a strong brand reputation, built over years of consistent product quality and support, are difficult for new companies to replicate. In 2024, the emphasis on surgeon training and feedback loops further solidified these incumbent advantages. The extensive patent portfolios held by companies like Globus Medical, covering device designs and surgical methods, also deter new entrants who risk infringement or costly licensing.

| Barrier Type | Estimated Cost/Timeframe | Impact on New Entrants |

| R&D and Product Development | $50M - $200M+ | High capital requirement for innovation |

| Regulatory Approval (e.g., FDA) | 2-7 years, $1M - $10M+ | Lengthy and expensive compliance process |

| Sales & Distribution Network | $50M - $150M+ | Significant investment to build market reach |

| Intellectual Property (Patents) | Varies (licensing/infringement risk) | Limits ability to introduce novel, non-infringing products |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Globus Medical leverages data from company annual reports, SEC filings, and industry-specific market research reports. We also incorporate insights from financial analyst reports and trade publications to gain a comprehensive understanding of the competitive landscape.