Globus Medical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globus Medical Bundle

Curious about Globus Medical's product portfolio performance? Our BCG Matrix preview highlights key areas, but to truly unlock strategic advantage, you need the full picture. Understand which innovations are poised for growth and which require a second look.

Don't just guess where to invest; know. The complete Globus Medical BCG Matrix provides a granular breakdown of their Stars, Cash Cows, Dogs, and Question Marks, equipping you with actionable insights for optimized resource allocation and future planning. Purchase the full report for a definitive roadmap to market leadership.

Stars

Globus Medical's robotic and enabling technologies, exemplified by the ExcelsiusGPS system, are positioned in the burgeoning robotic surgery market, which is expected to hit $1.41 billion by 2025, growing at an impressive 17.5% annual rate. This segment is a key driver of the company's growth strategy.

The company recently achieved a record number of enabling technology placements, underscoring robust market acceptance and its leading position in this technological frontier. This momentum indicates strong demand for its innovative surgical solutions.

While Q1 2025 saw some temporary slowdowns due to deal finalization, Globus Medical remains optimistic, focusing on converting its existing pipeline of these advanced systems to drive future performance and solidify its market share.

Following the NuVasive merger, Globus Medical's U.S. Spine business is a true star. As of late 2024, the company holds a commanding 25% market share in the global spine arena, matching Medtronic's position.

This core segment is firing on all cylinders, achieving its best quarterly revenue since the 2023 merger in the second quarter of 2025. This consistent, strong performance highlights the U.S. Spine business as a major revenue driver for Globus Medical.

Globus Medical's advanced materials science products, like their porous PEEK interbody spacers, represent a significant investment in innovation. These materials are designed to mimic bone's natural porosity, promoting better fusion and potentially reducing revision rates. This focus on cutting-edge technology is crucial in the competitive spinal implant market.

Minimally Invasive Surgical (MIS) Tools

The increasing adoption of Minimally Invasive Surgical (MIS) techniques is a key factor fueling revenue growth within the spinal implants market. These methods simplify procedures and shorten recovery periods for patients. Globus Medical is well-positioned to capitalize on this trend with its extensive range of MIS tools and solutions, notably those incorporating robotic navigation.

Globus Medical's strategic focus on integrated procedural solutions not only addresses the rising demand for MIS but also enhances surgical precision. This comprehensive approach solidifies their leadership in this rapidly advancing surgical field.

- Market Growth: The global MIS spinal surgery market was valued at approximately $7.5 billion in 2023 and is projected to reach over $12 billion by 2030, growing at a CAGR of around 7%.

- Globus Medical's Offering: Globus Medical provides a broad portfolio of MIS instruments, implants, and navigation systems designed to improve patient outcomes and surgeon efficiency.

- Robotic Integration: The company's investment in robotic-assisted surgery, like the Excelsius3D, further strengthens its MIS capabilities, offering enhanced visualization and control.

- Competitive Advantage: By offering end-to-end solutions for MIS procedures, Globus Medical differentiates itself and captures a larger share of this high-growth market segment.

Integrated Surgical Platforms

Globus Medical is pushing the boundaries by merging robotic and other advanced technologies into complete surgical systems. This integration is designed to make surgeries more precise and improve patient results. For instance, their ExcelsiusGPS system, now with even better navigation features, exemplifies this forward-thinking approach.

These all-in-one surgical solutions are a significant growth driver for Globus Medical. Hospitals are increasingly looking for sophisticated and efficient ways to perform procedures, making these integrated platforms highly desirable. This focus on a complete surgical treatment pathway allows Globus Medical to secure a strong position in this high-value market segment.

- Market Growth: The surgical robotics market, a key component of integrated platforms, was valued at approximately $7.5 billion in 2023 and is projected to reach over $17 billion by 2030, indicating substantial growth potential.

- Product Innovation: Globus Medical's ExcelsiusGPS system, a prime example of their integrated platforms, has seen continuous enhancements, including expanded navigation capabilities, which directly address the demand for advanced surgical tools.

- Competitive Positioning: By offering comprehensive, technology-driven surgical solutions, Globus Medical aims to capture a premium share of the market, differentiating itself from competitors who may offer standalone technologies.

- Hospital Adoption: The drive for improved surgical efficiency and patient outcomes fuels hospital investment in integrated platforms, with many healthcare systems prioritizing these advanced systems to remain competitive and enhance care quality.

Globus Medical's U.S. Spine business, particularly following the NuVasive merger, is a clear star performer. By late 2024, the company had secured a substantial 25% market share in the global spine sector, matching industry leader Medtronic. This segment demonstrated impressive momentum, achieving its strongest quarterly revenue in Q2 2025 since the merger, solidifying its role as a primary revenue engine.

The company's advanced materials, like porous PEEK interbody spacers, are designed to mimic bone, promoting fusion and potentially reducing revisions. This innovation directly supports the growing demand for Minimally Invasive Surgery (MIS) techniques, which simplify procedures and speed patient recovery. Globus Medical's comprehensive MIS offerings, including robotic navigation, position it strongly within this expanding market.

Globus Medical's integrated procedural solutions, combining robotic and advanced technologies, are also stars. The ExcelsiusGPS system, with its enhanced navigation, exemplifies this strategy, making surgeries more precise and improving patient outcomes. This focus on all-in-one surgical platforms is a key growth driver, appealing to hospitals seeking efficiency and advanced care.

| Segment | BCG Category | Key Differentiators | Market Position (Late 2024) | Growth Drivers |

| U.S. Spine Business | Star | Strong post-merger integration, extensive product portfolio, market leadership | 25% Global Spine Market Share | MIS adoption, robotic integration, procedural solutions |

| Robotic & Enabling Technologies | Star | ExcelsiusGPS system, advanced navigation, integrated surgical platforms | Emerging leader in robotic surgery market | Increasing demand for surgical precision, hospital investment in advanced technology |

| Advanced Materials Science | Star | Porous PEEK implants, bone-mimicking technology | Key player in spinal implant innovation | Focus on improved fusion rates, reducing revision surgeries |

What is included in the product

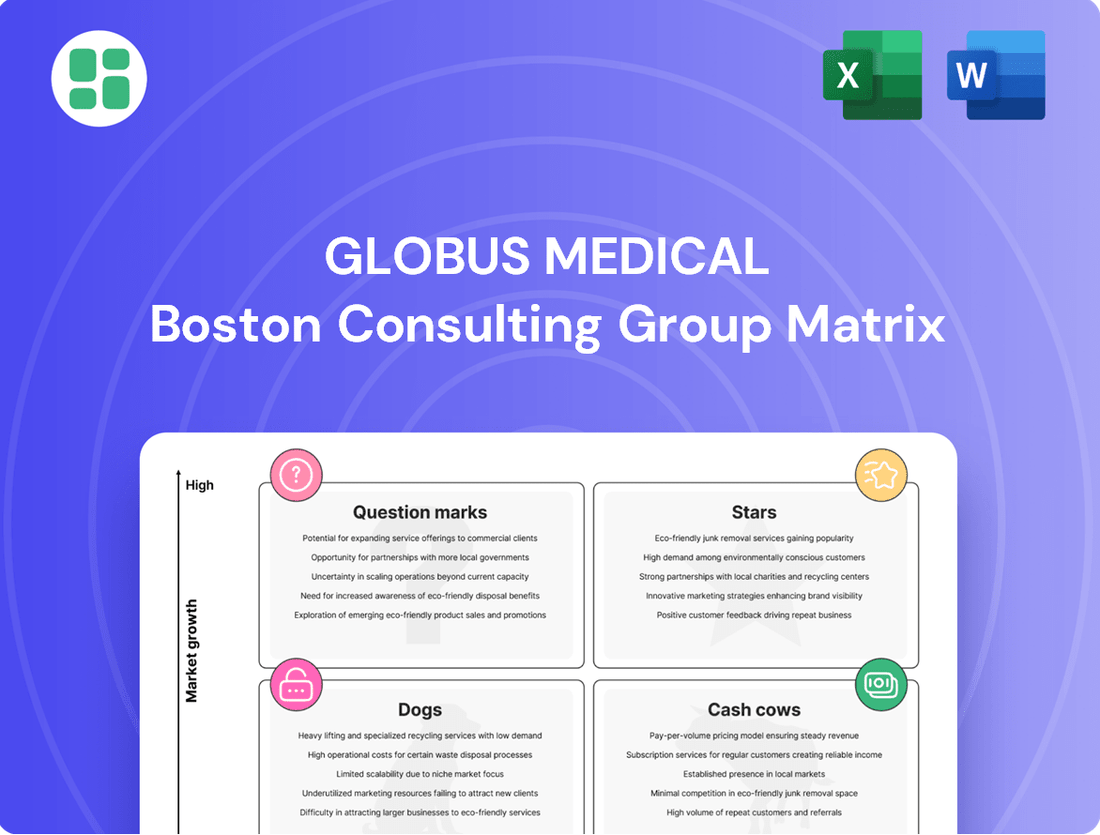

The Globus Medical BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Globus Medical's BCG Matrix offers a clear visual of their product portfolio, simplifying strategic decisions and reducing the pain of resource allocation.

Cash Cows

Globus Medical's core spinal fixation and fusion systems are its established Cash Cows. These products have long enjoyed a significant market share, built on strong surgeon loyalty and a track record of reliable clinical performance.

While the market for these foundational spinal solutions may not be experiencing explosive growth, their widespread adoption and consistent demand ensure a steady and substantial cash flow for the company. This stability allows Globus Medical to fund investments in newer, higher-growth areas.

In 2023, for instance, Globus Medical reported total revenue of $2.4 billion, with their Musculoskeletal Solutions segment, which includes spinal products, contributing significantly. This segment’s performance underscores the enduring strength of their core offerings.

Globus Medical's established motion preservation devices, such as their spinal disc replacements, are key players in the company's portfolio. These products are designed to treat degenerative disc disease and other spinal conditions, offering patients a way to maintain mobility.

In the mature spinal implant market, these devices benefit from a strong reputation and proven clinical outcomes, likely securing a significant market share. For instance, the global spinal fusion devices market, a related segment, was valued at approximately $9.5 billion in 2023 and is projected to grow, indicating the demand for such solutions.

These established products are considered cash cows for Globus Medical, generating substantial and consistent revenue. Their mature status means lower R&D investment compared to newer technologies, contributing significantly to the company's profitability and funding growth in other areas.

Globus Medical's biomaterials portfolio, supporting musculoskeletal procedures, is likely a stable cash cow. These products are crucial for spinal and orthopedic surgeries, guaranteeing consistent demand and reliable cash flow. The segment benefits from a well-established portfolio and supply chains, requiring minimal growth investments.

Legacy Spinal Implant Product Lines

Globus Medical's legacy spinal implant product lines, while not the latest innovations, have likely cemented their position as cash cows. These established offerings benefit from strong surgeon loyalty and widespread adoption, contributing to a significant market share within the broader spinal sector.

These mature products typically demand less aggressive marketing investment compared to newer technologies. This allows them to generate substantial cash flow with high profit margins, underscoring their role as reliable revenue generators for the company.

- High Market Share: These legacy products have captured a substantial portion of the spinal implant market due to their long history and proven performance.

- Reduced Investment Needs: Lower marketing and R&D expenditures compared to growth products translate into higher profitability.

- Consistent Cash Generation: They provide a steady stream of cash that can be reinvested in other areas of the business, such as funding the company's Stars or Question Marks.

Comprehensive Traditional Spinal Solutions

Globus Medical's Comprehensive Traditional Spinal Solutions represent its established cash cow. These products have a long history in the market, generating consistent revenue that fuels the company's growth initiatives.

This strong financial foundation allows Globus Medical to allocate resources effectively, particularly towards its innovative offerings. The steady demand for these traditional solutions underscores their market penetration and reliability as a revenue stream.

- Established Market Presence: Decades of experience in providing traditional spinal implants and instruments.

- Consistent Revenue Generation: These products contribute significantly to Globus Medical's overall sales, acting as a stable financial backbone.

- Foundation for Investment: Profits from these mature product lines are crucial for funding research and development in areas like robotics and biologics.

Globus Medical's established spinal fixation and fusion systems are prime examples of its cash cows. These products have a long-standing reputation for reliability and surgeon loyalty, ensuring consistent demand in a mature market. Their significant market share, built over years of performance, translates into a steady and substantial cash flow for the company.

The consistent revenue generated by these mature product lines is vital for funding innovation in newer, higher-growth areas. For instance, the global spinal fusion devices market, a segment where these cash cows operate, was valued at approximately $9.5 billion in 2023, highlighting the enduring demand for such solutions.

These products benefit from reduced investment needs in marketing and R&D compared to emerging technologies. This allows them to contribute significantly to Globus Medical's profitability, acting as a stable financial backbone that supports strategic investments across the business.

| Product Category | Market Position | Revenue Contribution | Investment Needs |

| Spinal Fixation & Fusion Systems | High Market Share, Established | Consistent & Substantial | Low |

| Motion Preservation Devices | Strong Reputation, Proven Outcomes | Steady | Moderate |

| Biomaterials Portfolio | Crucial Support, Consistent Demand | Reliable Cash Flow | Minimal |

| Legacy Spinal Implant Lines | Widespread Adoption, Surgeon Loyalty | Significant | Reduced |

Delivered as Shown

Globus Medical BCG Matrix

The Globus Medical BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no demo content, and no need for further editing—just a ready-to-use, professionally formatted strategic analysis. You can confidently use this preview as a direct representation of the valuable insights you'll gain.

Dogs

Globus Medical's older, undifferentiated spinal implants likely reside in the Dogs quadrant of the BCG Matrix. These products, while potentially having a long history, probably face significant price pressure and struggle to stand out in a crowded, mature market segment. Their market share is likely modest, generating minimal profits and tying up valuable resources that could be better allocated to more promising areas of the business.

Globus Medical's third-party biologic sales are positioned as a potential cash trap within their BCG matrix. The company has signaled a planned reduction in these sales, citing anticipated shifts in the reimbursement environment for wound care products, beginning in Q1 2025.

This strategic move indicates that this particular segment, likely a minor contributor to their total revenue, is experiencing headwinds such as unfavorable market dynamics or declining profitability. Persisting with significant investment in this area would be ill-advised, as it offers limited growth prospects and diminishing returns.

Globus Medical's portfolio may include certain products or older product lines that haven't gained significant traction in specific international markets or specialized geographic niches. These could represent areas where the company has a limited presence or faces strong local competition.

Such segments often fall into the 'Dogs' category of the BCG Matrix, characterized by low market growth and a small market share. For instance, a legacy spine implant system might have strong adoption in North America but struggle to gain a foothold in emerging Asian markets due to regulatory hurdles or different surgical preferences.

The strategic decision for these 'Dog' products involves a careful assessment of their potential for expansion. If market research in 2024 indicates that the cost of entering new geographies outweighs the potential revenue, or if competitive pressures are too intense, Globus Medical might consider de-emphasizing these products to reallocate resources to more promising areas of its business.

Discontinued or Phased-Out Product Lines

Globus Medical, like many forward-thinking medical device companies, actively manages its product lifecycle. Products that are no longer competitive due to advancements in technology or have reached the end of their market relevance are strategically phased out. These discontinued or phased-out product lines are a natural part of maintaining a cutting-edge portfolio.

These older products, while potentially still requiring some customer support, typically contribute very little to new revenue streams. Their continued presence can divert valuable resources, such as research and development focus or sales team attention, away from newer, more promising innovations. For instance, a product line that was popular a decade ago might now be superseded by significantly more effective or efficient technologies, making its continued promotion a less strategic use of company capital.

- Product Obsolescence: Older implant designs or instrumentation that are technically surpassed by newer, more advanced offerings.

- Market Saturation: Product categories where competition is intense and growth potential for older generations is minimal.

- Resource Allocation: Products requiring ongoing support but generating negligible new sales, thus representing a drain on resources.

- Strategic Portfolio Refresh: The deliberate phasing out of older items to make way for and focus on next-generation technologies.

Products Facing Intense Commoditization

In the medical device sector, certain standard implants and instruments can become commoditized, intensifying price wars and shrinking profit margins. If Globus Medical has products in this category without unique selling points, they would likely have a small market share and contribute little to the company's growth.

These commoditized products generally need minimal investment. However, their continued existence might not fit with Globus Medical's focus on high innovation. For instance, in 2024, the spine implant market, while growing, saw increased competition in more standard offerings, potentially impacting margins for companies with less differentiated portfolios in this segment.

- Low Market Share: Products that have become commoditized often struggle to maintain a significant market presence against numerous competitors offering similar items.

- Low Growth Rate: As differentiation fades, the growth potential for these products typically stagnates, as demand is driven by price rather than innovation.

- Low Profitability: Intense price competition inherent in commoditized markets leads to reduced profit margins, making these offerings less attractive financially.

- Minimal Investment Required: Due to their mature and standardized nature, these products usually require little in the way of research and development or marketing investment.

Globus Medical's older, undifferentiated spinal implants likely reside in the Dogs quadrant of the BCG Matrix. These products, while potentially having a long history, probably face significant price pressure and struggle to stand out in a crowded, mature market segment. Their market share is likely modest, generating minimal profits and tying up valuable resources that could be better allocated to more promising areas of the business.

Globus Medical's portfolio may include certain products or older product lines that haven't gained significant traction in specific international markets or specialized geographic niches. These could represent areas where the company has a limited presence or faces strong local competition.

These older products, while potentially still requiring some customer support, typically contribute very little to new revenue streams. Their continued presence can divert valuable resources, such as research and development focus or sales team attention, away from newer, more promising innovations. For instance, a product line that was popular a decade ago might now be superseded by significantly more effective or efficient technologies, making its continued promotion a less strategic use of company capital.

In the medical device sector, certain standard implants and instruments can become commoditized, intensifying price wars and shrinking profit margins. If Globus Medical has products in this category without unique selling points, they would likely have a small market share and contribute little to the company's growth. For example, in 2024, the spine implant market saw increased competition in more standard offerings, potentially impacting margins for companies with less differentiated portfolios in this segment.

Question Marks

Globus Medical's acquisition of Nevro in Q2 2025 for $250 million positions them within the burgeoning neuromodulation market, specifically spinal cord stimulation. This move diversifies their portfolio beyond their established musculoskeletal offerings.

The Nevro segment, while representing a high-growth opportunity, currently occupies a nascent market share for Globus Medical. This places it in the Question Mark category of the BCG Matrix, demanding careful strategic consideration and significant investment to nurture its potential.

To elevate Nevro from a Question Mark to a Star, Globus Medical must channel substantial resources into integrating Nevro's technology and scaling its market presence. This investment is crucial for achieving competitive parity and ultimately capturing a dominant position in the spinal cord stimulation market.

Globus Medical's recent product launches, such as the Cohere ALIF spacer and Modulus ALIF blades in 2024, alongside DuraPro with Navigation in early 2025, represent significant investments in the high-growth spinal implant market. These innovations are positioned in segments experiencing robust expansion, with the global spinal fusion devices market projected to reach approximately $11.5 billion by 2025, growing at a CAGR of around 5.5%.

Despite the promising market dynamics, these new products currently possess a low market share as they are new entrants. This places them squarely in the Question Mark category of the BCG Matrix. For instance, the ALIF spacer market, while growing, is competitive, and capturing share requires substantial effort.

To transition these products from Question Marks to Stars, Globus Medical must allocate significant resources towards aggressive marketing, sales force expansion, and clinical education. Failure to achieve rapid market penetration and build brand recognition could see these promising innovations stagnate and potentially decline into the Dog category, as seen with other specialized medical devices that fail to gain traction against established competitors.

Globus Medical, while a powerhouse in spine solutions, is actively developing its orthopedic trauma and joint reconstruction segments. These areas represent significant growth opportunities within the expansive musculoskeletal market. For instance, the global orthopedic trauma market was valued at approximately $8.5 billion in 2023 and is projected to grow, indicating substantial demand.

Although these segments might currently hold a smaller market share compared to Globus Medical's leading spine business, their strategic importance is undeniable. Continued investment in research, development, and market penetration is key to unlocking their full potential in these competitive fields, aiming to capture a larger slice of the projected $12 billion global orthopedic market by 2028.

International Market Expansion in Nascent Regions

Globus Medical might identify nascent regions as potential Stars or Question Marks within its international market expansion strategy. While overall international sales saw robust growth in 2024, a Q1 2025 dip in international net sales, attributed partly to distributor order timing, highlights the inherent volatility in some overseas markets. This suggests that while established international markets are performing well, newer or less developed regions could represent significant future growth opportunities where Globus Medical currently holds a low market share.

These emerging markets demand careful strategic planning and focused investment to unlock their potential. For instance, if a specific nascent region demonstrates rapidly increasing healthcare spending and a growing demand for advanced orthopedic solutions, it could be classified as a Question Mark. Globus Medical would need to invest heavily to build brand awareness and distribution networks.

- Nascent Regions as Potential Stars: High growth potential, low current market share for Globus Medical.

- Q1 2025 International Sales Dip: Indicative of timing issues rather than fundamental market weakness in some overseas areas.

- 2024 International Sales Growth: Demonstrates overall positive traction in global markets.

- Strategic Investment Required: Targeted efforts are crucial to capitalize on growth prospects in less established international markets.

Next-Generation AI-driven Surgical Planning Tools

Globus Medical's ExcelsiusGPS platform already integrates advanced navigation, but the company's exploration of next-generation AI-driven surgical planning tools places it squarely in the question mark category of the BCG matrix. This segment of the robotic surgery market is experiencing rapid evolution, with AI poised to revolutionize pre-operative planning by offering predictive analytics and personalized surgical approaches. For instance, the global AI in healthcare market was valued at approximately $15.7 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the immense growth potential and the significant investment required to capture market share.

These nascent AI planning tools, while holding high growth potential, are still in their early stages of development or commercialization for Globus Medical. They represent a significant investment in research and development to refine algorithms, ensure clinical validation, and achieve regulatory approval. The success of these tools hinges on their ability to demonstrate tangible improvements in surgical outcomes, such as reduced operating times or enhanced precision, thereby justifying the substantial capital outlay needed to compete in this dynamic space.

- High Growth Potential: The AI in surgery market is expanding rapidly, with AI-driven planning tools expected to become standard.

- Significant Investment Required: Developing and commercializing cutting-edge AI planning requires substantial R&D funding and market penetration efforts.

- Unproven Long-Term Viability: While promising, these tools need to prove their sustained clinical efficacy and market adoption to secure long-term success.

- Competitive Landscape: Globus Medical faces competition from established players and innovative startups investing heavily in AI-powered surgical solutions.

Globus Medical's acquisition of Nevro, along with new product launches in spinal implants, places them in the Question Mark category of the BCG Matrix. These ventures represent high-growth opportunities but currently hold low market share, demanding significant investment for market penetration and competitive positioning.

The company’s exploration of AI-driven surgical planning tools also falls into the Question Mark quadrant. This segment of the robotic surgery market is rapidly evolving, requiring substantial R&D to refine algorithms and achieve clinical validation, with success hinging on demonstrating improved surgical outcomes.

Emerging international markets, despite overall positive global sales growth in 2024, present potential Question Marks. A Q1 2025 dip in international sales highlights the volatility in some overseas markets, necessitating strategic planning and focused investment to build brand awareness and distribution networks.

To transition these Question Marks into Stars, Globus Medical must allocate substantial resources towards marketing, sales expansion, and clinical education. Failure to gain rapid market traction could lead to these innovations stagnating.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.